Market Overview

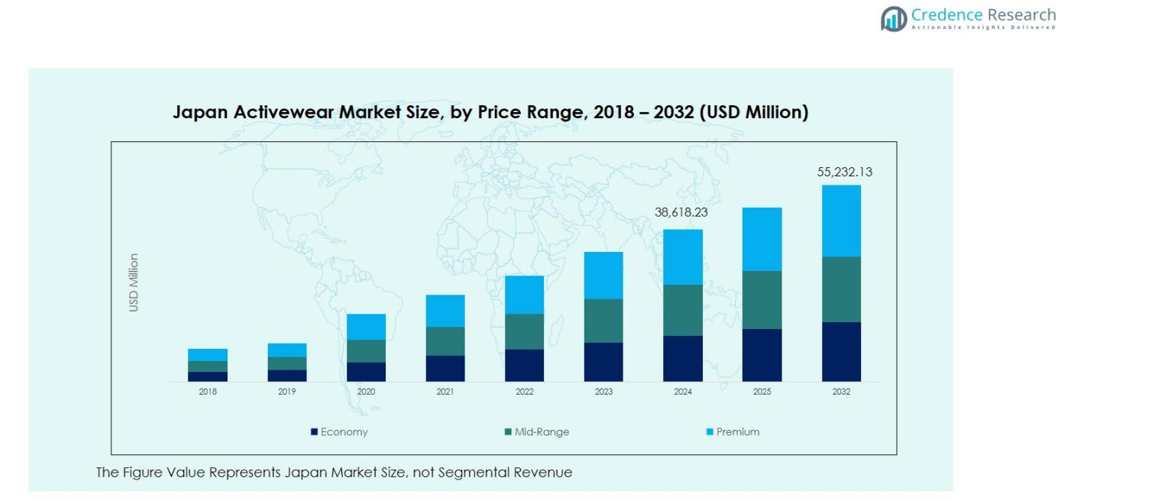

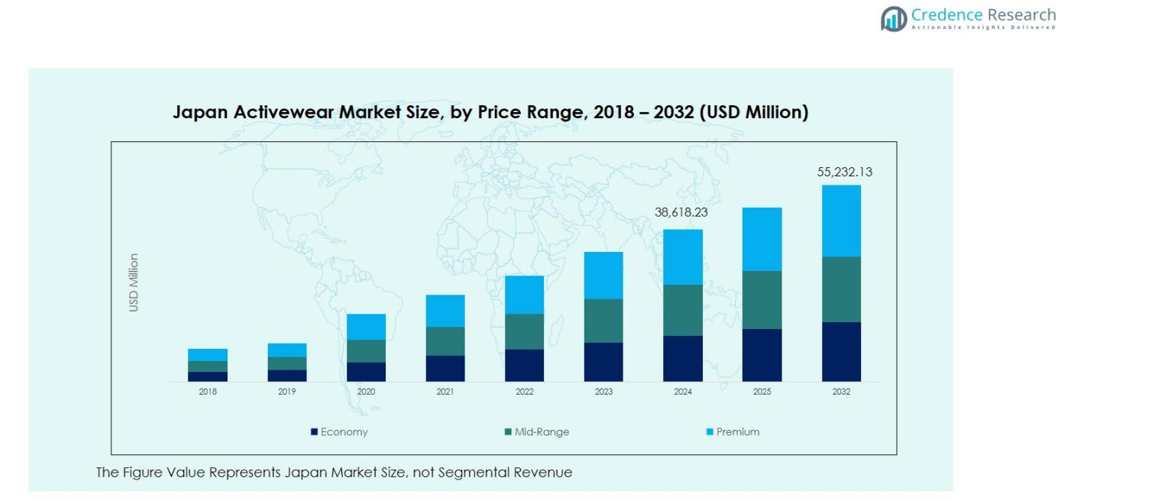

The Japan Activewear Market was valued at USD 33,085.75 Million in 2018, USD 38,618.23 Million in 2024, and is projected to reach USD 55,232.13 Million by 2032, growing at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Activewear Market Size 2024 |

USD 38,618.23 Million |

| Japan Activewear Market, CAGR |

4.57% |

| Japan Activewear Market Size 2032 |

USD 55,232.13 Million |

The Japan Activewear Market is dominated by leading companies such as ASICS Corporation, Onitsuka Tiger, Uniqlo (UNIQLO MOVE), Mizuno Corporation, and Descente Ltd., each contributing to the market’s robust growth. ASICS and Mizuno are renowned for their performance-oriented activewear, while Uniqlo’s versatile and affordable athleisure range appeals to a broad consumer base. Onitsuka Tiger focuses on blending fashion with functionality, catering to both active and casual wear markets. Eastern Japan holds the largest share of the market, 60%, driven by major metropolitan areas like Tokyo and Yokohama, where fitness and athleisure adoption is high. Western Japan follows with 25% of the market share, with a strong demand for outdoor sports and fitness apparel. These regions drive the overall market growth through increasing health-consciousness and the growing popularity of active lifestyles.

Market Insights

- The Japan Activewear Market was valued at USD 38,618.23 Million in 2024 and is forecast to reach USD 55,232.13 Million by 2032 at a CAGR of 4.57%.

- Growth is driven by increasing health and fitness consciousness among consumers and the rise in athleisure adoption, with the ready‑to‑wear product segment holding 35 % market share.

- A major trend involves sustainability and eco‑friendly materials, while synthetic fabrics dominate 70 % of the material segment and polyester accounts for 40 % of the fabric segment.

- Market dynamics see major brands such as ASICS Corporation, Onitsuka Tiger, UNIQLO MOVE, Mizuno Corporation and Descente Ltd. emphasizing product innovation and omni‑channel retailing, yet intense competition and price sensitivity pose challenges.

- Regionally, Eastern Japan commands approximately 60 % market share, Western Japan around 25 %, with smaller shares in Northern (10 %) and Southern (5 %) Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Japan Activewear Market is segmented into several product types, with “Ready to Wear” being the dominant sub-segment, holding a significant share due to its convenience and increasing consumer demand for everyday activewear. This sub-segment accounts for 35% of the market, driven by the rising popularity of athleisure and activewear in daily life. Fashion Outer, Pants, and T-shirts follow closely, supported by consumer preference for stylish yet functional clothing. Rash Guard, Wet Suit, and Swim Wear are also growing, especially due to the country’s strong outdoor and water sports culture. Sports Shoes, Aqua Shoes, and Aqua Socks complete the segment with a growing share, fueled by the rising health and fitness trend in Japan.

- For instance, ASICS, for example, unveiled its TOKYO Collection with MEGABLAST™ and SONICBLAST™ running shoes equipped with advanced foam technologies, catering to urban runners seeking comfort and style.

By Fabric

Polyester is the dominant fabric in the Japan Activewear Market, holding the largest share at 40%. The material’s durability, moisture-wicking properties, and affordability contribute to its widespread use in activewear. Nylon follows, making up 25% of the fabric market, known for its strength and lightweight nature, ideal for sports clothing. Neoprene and Polypropylene, though smaller in share, are essential for specialized activewear like wet suits. Spandex, contributing to 15%, is favored for its flexibility in performance wear, while Cotton holds a traditional appeal, especially in casual wear, at 10%. Other fabrics are gaining traction in niche segments.

- For instance, Teijin Frontier Co., Ltd. produces advanced polyester fibers like DELTAPEAK®, used in professional rugby uniforms for their exceptional stretch, resilience, and shape retention.

By Material

The Japan Activewear Market is largely driven by synthetic materials, which dominate the market with a share of 70%. Synthetic materials like polyester and spandex offer superior durability, moisture control, and flexibility, making them highly desirable in activewear. Natural materials, while representing 30% of the market, are favored for their breathability and eco-friendly attributes. However, synthetic materials continue to be the go-to choice for performance-based apparel, driven by their ability to withstand wear and provide comfort during physical activity. The demand for natural materials is growing, particularly among eco-conscious consumers seeking sustainable alternatives.

Key Growth Drivers

Increasing Health and Fitness Consciousness

A significant growth driver for the Japan Activewear Market is the increasing focus on health and fitness. With a growing emphasis on physical wellness, more consumers are adopting active lifestyles, which has led to heightened demand for comfortable and functional activewear. As Japan experiences a shift toward regular exercise, including gym workouts, yoga, and running, the need for high-performance apparel is growing. This trend is supported by a rise in health-focused campaigns and the integration of fitness into daily routines, which is expected to drive market expansion in the coming years.

- For instance, Nike’s Gyakusou collection, developed in collaboration with Tokyo-based runners, emphasizes functional running apparel designed for real training needs, blending performance with local design insight.

Rise in Athleisure Adoption

The growing popularity of athleisure, where activewear is worn not only for sports but as everyday casual wear, is a major growth driver in the Japan Activewear Market. The trend is particularly popular among millennials and younger generations who prioritize comfort and versatility in their wardrobe. Activewear is no longer confined to gyms or sports activities but is increasingly being seen as fashionable and suitable for various occasions. This shift is propelling demand for stylish, multifunctional, and comfortable clothing, contributing significantly to market growth.

- For instance, Asics launched its MetaRun campaign featuring advanced material science with adaptive stability and lightweight cushioning, appealing to consumers valuing innovation and functionality.

Technological Advancements in Activewear

Advancements in fabric technology and innovation in activewear design are boosting the Japan Activewear Market. Smart fabrics with moisture-wicking, temperature-regulating, and antimicrobial properties are increasingly incorporated into products, improving comfort and performance. Additionally, the development of lightweight, durable, and flexible materials enhances the overall functionality of activewear. These technological innovations cater to the evolving needs of athletes and fitness enthusiasts, further accelerating the demand for high-quality and performance-enhancing activewear in the market.

Key Trends & Opportunities

Sustainability in Activewear

Sustainability is an emerging trend in the Japan Activewear Market, with consumers increasingly seeking eco-friendly options. Brands are responding by adopting sustainable practices such as using recycled materials, organic fabrics, and reducing carbon footprints in manufacturing. The growing awareness around environmental issues has led to a shift towards eco-conscious purchasing behaviors. This trend opens opportunities for companies to innovate and expand their product lines with sustainable, high-performance activewear. Consumers are more likely to support brands that align with their values regarding sustainability, presenting a significant growth opportunity.

- For instance, Mizuno launched the Wave Neo running shoes made with recycled polyester and plant-derived materials, balancing the product’s carbon impact through afforestation efforts.

Expansion of Online Retail Channels

The shift to online shopping is another significant trend shaping the Japan Activewear Market. With the rise of e-commerce platforms, consumers now have easier access to a wider variety of activewear brands and styles. The convenience of online shopping, coupled with enhanced delivery options and seamless return policies, is driving sales. The growth of online retail presents opportunities for brands to reach a broader audience, improve customer engagement, and offer personalized shopping experiences through virtual fitting rooms or customized recommendations, positioning e-commerce as a key growth channel.

- For instance, transcosmos Inc. and BBF, Inc. entered a strategic alliance to help overseas apparel brands launch and optimize their online infrastructure for the Japanese market, providing localized services that have streamlined e-commerce engagement and international brand entry.

Key Challenges

Intense Market Competition

One of the primary challenges in the Japan Activewear Market is the intense competition among local and international brands. With many players vying for market share, brands are under constant pressure to differentiate themselves through innovative designs, high-quality products, and competitive pricing. This fierce competition, particularly from established global brands, makes it difficult for new entrants to establish a foothold in the market. To remain competitive, brands must invest heavily in marketing and product development, which can drive up operational costs.

Price Sensitivity Among Consumers

Price sensitivity remains a challenge in the Japan Activewear Market, particularly in the mid-range and economy segments. While premium products continue to perform well, many consumers are seeking more affordable options due to economic uncertainties and rising living costs. This trend is pushing brands to balance product quality with cost-effectiveness to cater to price-sensitive buyers. As the demand for reasonably priced activewear rises, brands must find innovative ways to offer value while maintaining profitability, making cost management a key challenge in the market.

Regional Analysis

Eastern Japan

Eastern Japan holds a dominant share of the Japan Activewear Market, accounting for around 60% of the total market. This region includes major urban areas such as Tokyo, Yokohama, and Chiba, where demand for activewear is high due to the large population of fitness-conscious consumers. The trend of adopting active lifestyles, coupled with the popularity of athleisure, is particularly strong in these metropolitan areas. Furthermore, the strong presence of major retail chains and e-commerce platforms contributes to the region’s leading position. The growth is also driven by technological advancements in activewear products, catering to the needs of urban dwellers.

Western Japan

Western Japan, which includes cities like Osaka, Kyoto, and Kobe, contributes around 25% to the Japan Activewear Market. This region has seen a steady rise in activewear consumption, driven by the increasing popularity of outdoor activities and fitness centers. Additionally, Western Japan’s cultural inclination toward sports such as baseball, soccer, and basketball drives the demand for performance-oriented apparel. The growing focus on wellness and the rise of health-conscious consumers further fuel the activewear market. Retail outlets and online platforms in this region are expanding rapidly, providing greater access to activewear products.

Northern Japan

Northern Japan represents a smaller yet significant portion of the Japan Activewear Market, holding about 10% of the market share. The region, which includes Hokkaido and surrounding areas, sees moderate demand for activewear, primarily driven by cold-weather sports such as skiing and snowboarding. As outdoor sports gain popularity in these colder climates, there is an increased need for specialized activewear, including thermal wear and performance gear. The growth in this region is slower compared to the eastern and western regions, but it remains a crucial segment, especially with a growing awareness of fitness and wellness.

Southern Japan

Southern Japan, encompassing regions like Fukuoka, Okinawa, and the Kyushu islands, accounts for around 5% of the Japan Activewear Market. Although smaller in market share, the region has potential for growth due to an increasing interest in fitness and recreational activities. Warm climates in southern Japan promote outdoor sports and casual activewear usage, particularly for jogging, cycling, and yoga. The region’s demand for activewear is expected to rise as more consumers embrace healthier lifestyles. Additionally, growing online retail activity in the region further supports the market expansion in southern Japan.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

Competitive Landscape

Competitive landscape in the Japan Activewear Market is characterized by the presence of both global and local brands striving for market share. Key players such as ASICS Corporation, Onitsuka Tiger, Uniqlo (UNIQLO MOVE), Mizuno Corporation, and Descente Ltd. dominate the market with their strong product offerings and extensive retail networks. ASICS and Mizuno lead with a focus on performance-driven apparel, while Uniqlo’s athleisure line has gained significant traction due to its versatility and affordability. Local players like Descente Ltd. and Mont-bell also maintain a competitive edge by catering to specific consumer needs, such as outdoor and sports apparel. The market is highly competitive, with brands constantly innovating in product design, material technology, and customer experience. Additionally, e-commerce platforms play a crucial role in enhancing product accessibility and customer engagement, allowing these brands to reach a broader audience across Japan. Pricing strategies and regional preferences further influence the competitive dynamics within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, ASICS Corporation and Toyoda Gosei Co., Ltd. partnered to launch the “SKYHAND OG” sneaker using leather remnants from steering‑wheel production, available from 1 February 2025.

- In May 2025, Uniqlo (under Fast Retailing Co., Ltd.) launched a new tennis apparel collection, developed by designer Clare Waight Keller in collaboration with tennis legend Roger Federer.

- In June 2024, Mitsui & Co., Ltd. completed acquisition of BIGI HOLDINGS Co., Ltd. (including apparel brands such as MEN’S BIGI) as a wholly‑owned subsidiary.

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Activewear Market is expected to continue its growth trajectory, driven by increasing health and fitness awareness among consumers.

- The demand for athleisure will expand as more consumers incorporate activewear into their daily wardrobes.

- Technological innovations in fabric and garment design, such as moisture-wicking and temperature-regulating materials, will enhance product offerings.

- Sustainability will become a key focus, with more brands adopting eco-friendly materials and ethical production practices.

- The rise in online shopping will drive e-commerce sales, with brands investing in digital platforms and enhanced customer experiences.

- Activewear consumption will see growth across all age groups, with younger consumers leading the trend.

- Outdoor and performance-oriented apparel will grow in popularity, fueled by Japan’s strong outdoor sports culture.

- Regional preferences will continue to shape the product offerings, with specific demand for cold-weather and outdoor sports gear in northern and southern Japan.

- Brands will focus on expanding their presence in untapped markets, particularly in smaller regions with growing health and fitness trends.

- The introduction of smart activewear, integrating wearable technology for fitness tracking, will open new opportunities in the market.