Market Overview

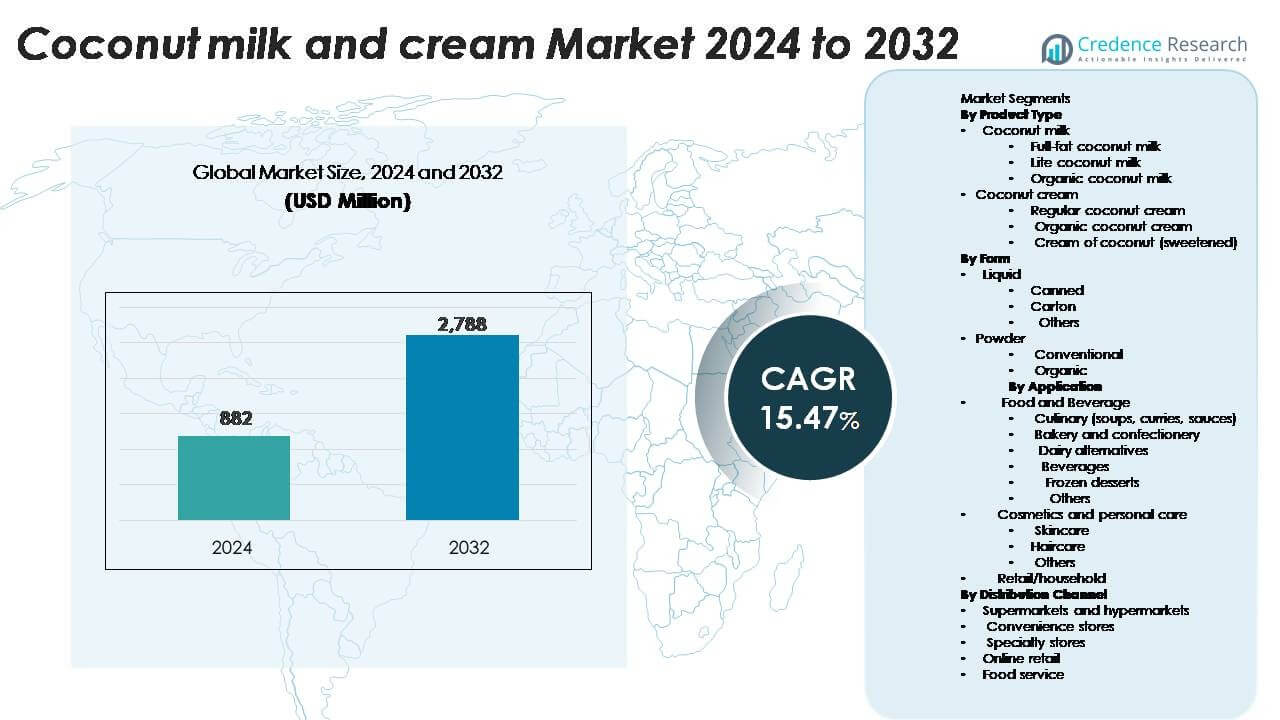

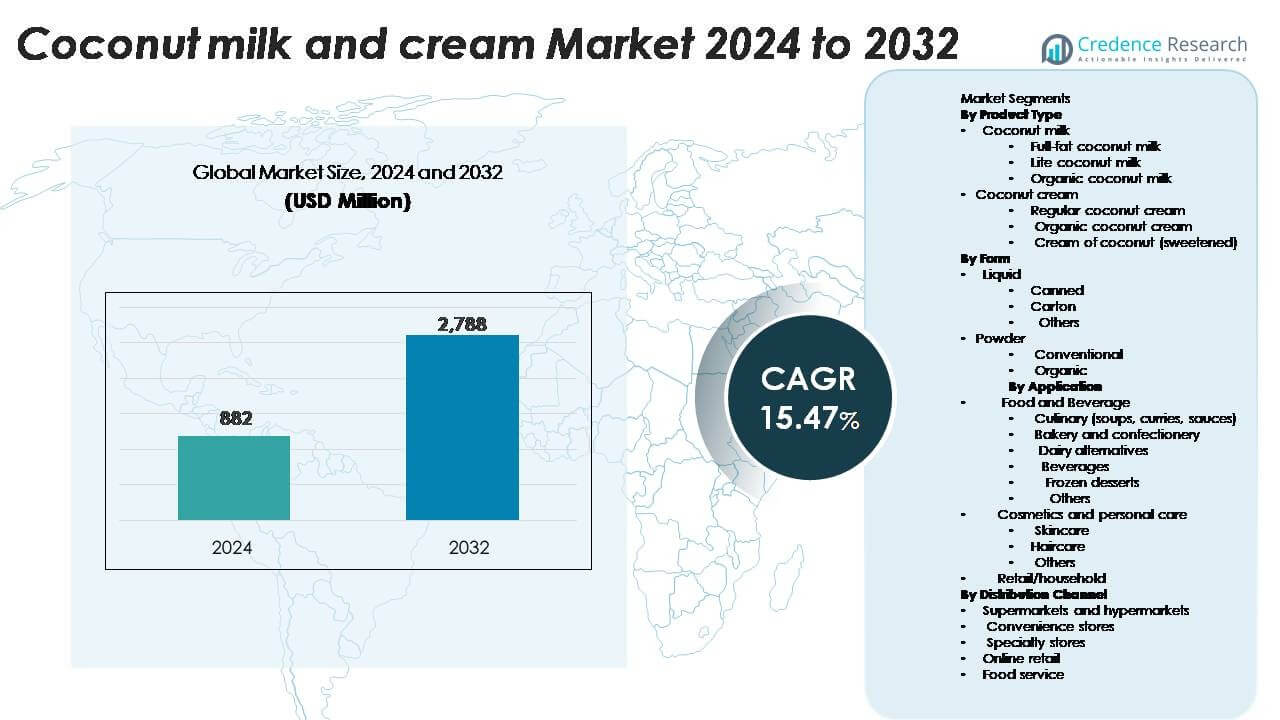

The coconut milk and cream market size was valued at USD 882 million in 2024 and is projected to reach USD 2,788 million by 2032, growing at a CAGR of 15.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coconut Milk and Cream Market Size 2024 |

USD 882 million |

| Coconut Milk and Cream Market, CAGR |

15.47% |

| Coconut Milk and Cream Market Size 2032 |

USD 2,788 million |

Danone, Nestlé, Goya Foods, Thai Coconut, and Vita Coco are among the leading companies in the coconut milk and cream market, competing through clean-label formulations, flavored beverages, organic variants, and strong retail presence. These players expand distribution across supermarkets, cafés, and online channels, while investing in sustainable sourcing from major coconut-producing nations. Asia-Pacific remains the dominant region with 38% market share, supported by large production capacity and strong domestic consumption in packaged foods and culinary applications. North America and Europe follow, driven by rising demand for plant-based beverages and dairy alternatives. Leading brands focus on innovation in barista-style coconut milk, powdered mixes, desserts, and fortified beverages to maintain competitive advantage in both household and foodservice segments.

Market Insights

- The coconut milk and cream market was valued at USD 882 million in 2024 and is set to reach USD 2,788 million by 2032, growing at a CAGR of 15.47% during the forecast period.

- Rising demand for plant-based, lactose-free, and clean-label products drives growth, as consumers shift from dairy to natural alternatives used in beverages, curries, bakery, desserts, and ready-to-eat foods.

- Product innovation strengthens market expansion, with launches of barista-style milk, flavored beverages, powdered mixes, low-sugar variants, and organic coconut products. Asia-Pacific dominates production and consumption due to strong culinary use and export strength.

- The competitive landscape includes Danone, Nestlé, Goya Foods, Thai Coconut, and Vita Coco, focusing on sustainable sourcing, recyclable packaging, and fortified beverages. Private labels gain ground through affordable pricing in retail.

- Asia-Pacific leads with 38% regional share, followed by North America and Europe. In segment share, coconut milk holds the largest portion, while liquid canned formats remain the preferred choice for households and foodservice.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Coconut milk leads the product type segment and accounts for the largest share due to its wide use in soups, sauces, curries, bakery items, and plant-based beverages. Full-fat coconut milk holds the dominant position as food manufacturers and household users prefer its richer flavor and creamier texture. Demand rises across Asian cuisine, vegan diets, and dairy-free formulations. Lite and organic coconut milk grow steadily, supported by health-focused consumers and clean-label trends. Coconut cream also expands in bakery fillings, confectionery, desserts, and ready-to-eat products, with sweetened cream of coconut gaining traction in cocktails and frozen beverages.

- For instance, Thai Coconut Public Company Limited manufactures canned full-fat coconut milk, with one product line (‘Real Thai’ brand) having a fat content of 17 grams per 90 ml serving, which is approximately 18.8 grams per 100ml.

By Form:

Liquid products dominate the market as canned and carton variants are widely used in foodservice and household cooking. Canned coconut milk has the highest share because it offers longer shelf life and consistent quality for soups, curries, and packaged foods. Carton-based options expand in retail due to convenience and easy pouring formats. Powdered coconut milk grows in bakery mixes, ready-to-drink beverages, vending machines, and travel-friendly applications. Organic and conventional powders attract nutrition-focused consumers seeking lactose-free and gluten-free options. The shift toward instant drinks and dehydrated mixes strengthens demand for powdered formats.

- For instance, Cocomi Bio Organic produces spray-dried coconut milk powder packaged in oxygen-sealed pouches to maintain product stability for up to 18 months without refrigeration. This is achieved by reducing the moisture content to typical low industry levels (around 2.5-3.0%, sometimes lower for premium products) during the spray-drying process.

By Application:

Food and beverage remain the primary application and contribute the largest revenue share. Culinary use dominates as coconut milk and cream are common ingredients in soups, curries, sauces, and restaurant dishes across Asia, Europe, and North America. Bakery, desserts, dairy alternatives, and flavored beverages expand usage in plant-based formulations and premium recipes. Frozen desserts such as vegan ice creams and sorbets increase market adoption. Cosmetics and personal care form a growing segment, with coconut cream used in skincare and haircare for moisturizing and strengthening benefits. Retail consumption also rises due to rising home cooking and premium packaged products.

Key Growth Drivers

Rising Demand for Plant-Based and Lactose-Free Food Products

The global shift toward plant-based and lactose-free diets steadily increases the adoption of coconut milk and cream across retail, foodservice, and packaged foods. Health-focused consumers prefer dairy alternatives that are lactose-free, gluten-free, and cholesterol-free, while still offering a creamy mouthfeel. Coconut milk supports vegan, flexitarian, and clean-label trends, which encourages companies to launch coconut-based yogurts, coffee creamers, cheeses, ice creams, and ready-to-drink beverages. Supermarkets and cafés expand product lines as coconut beverages replace dairy in coffee and smoothies. Organic and non-GMO certifications attract premium shoppers seeking natural fats and sustainable ingredients. These advantages strengthen penetration across developed and emerging markets, positioning coconut milk as a mainstream dairy substitute.

- · For instance, Starbucks introduced coconut-milk beverages across its U.S. network in 2015. At the end of its fiscal year 2015, the company had approximately 12,123 U.S. stores (out of over 23,000 stores globally at the time), demonstrating large-scale foodservice adoption of plant-based dairy substitutes. The company later expanded coconut-milk menu items and other plant-based options into Canada and Europe.

Growing Use in Processed and Ready-to-Eat Foods

The expansion of processed and ready-to-eat products drives strong consumption of coconut derivatives. Food manufacturers prefer coconut milk for its ability to enhance texture, improve flavor, and maintain stability in frozen, canned, and shelf-stable formats. Coconut cream is used in confectionery fillings, sauces, soups, bakery mixes, cocktails, and frozen desserts. Ready-to-cook meal kits featuring Thai, Indonesian, and Indian cuisines boost sales in retail. International restaurant chains also adopt coconut-based ingredients in fusion menus, expanding consumption beyond traditional markets. E-commerce platforms accelerate household usage by supplying canned, powdered, and carton-based variants. Ongoing product innovation from food brands continues to build momentum across the global value chain.

- For instance, Nestlé’s “MAGGI Coconut Milk Powder” is sold in pack sizes ranging from 25 g to 1 kg, and the company confirms sourcing from more than 6,600 coconut-farming families in Sri Lanka, demonstrating industrial-scale integration of coconut ingredients into processed foods.

Expansion of Non-Food Applications

Non-food sectors such as cosmetics and personal care create steady demand for coconut milk and cream. Skincare and haircare companies add coconut extracts to shampoos, conditioners, masks, soaps, lotions, and serums due to moisturizing, soothing, and antimicrobial benefits. Clean-beauty trends replace chemical-based emulsifiers with natural alternatives, increasing the use of coconut derivatives in vegan and paraben-free products. Personal grooming brands market coconut milk as a deep-nourishing ingredient for dry, damaged, or sensitive skin. Wellness centers and spas incorporate coconut-based creams in aromatherapy and massage therapies. As these applications expand beyond seasonal demand in food, suppliers gain diversified revenue streams and wider global presence.

Key Trends & Opportunities

Product Innovation and Premiumization

Manufacturers invest in premium coconut formulations such as flavored beverages, barista-grade milk for coffee, keto-friendly desserts, and fortified drinks containing added protein, vitamins, or minerals. Powdered coconut milk grows in instant mixes, meal kits, vending machines, and travel-friendly packs. Organic, non-GMO, and sustainably sourced products attract high-value consumers. Companies also develop low-fat or low-sugar variants for diabetic and weight-management customers. Recyclable cartons, BPA-free cans, and clean labeling help brands gain consumer trust. These innovations expand coconut usage from occasional cooking to daily consumption in beverages, breakfast foods, and retail snacks.

- · For instance, Danone, which is committed to sustainable packaging solutions, offers an organic coconut milk beverage that contains 0 grams of plant protein per 240 ml serving. The company uses various types of packaging, including cartons, many of which are designed to be BPA-free and recyclable, across its wide range of plant-based products.

Growth in Foodservice and Retail Distribution

Foodservice expansion plays a key role in market growth as cafés, bakeries, and restaurant chains include coconut-based beverages, bakery fillings, and desserts on their menus. Online retail platforms boost direct-to-consumer sales with subscription packs and bulk delivery options. Supermarkets widen shelf space for dairy alternatives, coconut drinks, and frozen desserts. Private labels launch competitively priced products, increasing accessibility in developing markets. Rising home cooking and cross-cultural cuisine adoption further drive retail demand for canned, carton, and powdered coconut formats, especially in urban households.

- · For instance, Thai Coconut Public Company Limited supplies ultra-high-temperature (UHT) coconut milk with an 18-month ambient shelf life to foodservice outlets, using a sterilization system that heats the product to temperatures typically around 137-145°C for a few seconds (e.g., 4 seconds) to preserve flavor and microbial safety.

Key Challenges

Price Fluctuations and Supply Dependence

The industry relies heavily on tropical regions such as Indonesia, India, the Philippines, and Sri Lanka for raw coconuts. Climate change, seasonal variations, cyclones, and pest attacks can disrupt yields, resulting in unstable supply and cost escalation. Import duties, packaging material costs, and freight charges add further price pressure. Smaller producers struggle to compete with large multinational brands that secure long-term sourcing contracts. These factors create price volatility in retail, reducing affordability in price-sensitive markets and potentially slowing adoption in lower-income regions.

Competition from Other Plant-Based Alternatives

Coconut milk competes with almond, soy, oat, cashew, and pea-based alternatives that target similar consumer segments. Many of these substitutes offer functional advantages—such as higher protein (soy, pea) or smoother coffee foam (oat). Food and beverage companies also explore sunflower and rice bases for allergen-friendly, nut-free formulations. As plant-based competition intensifies, coconut-based brands must differentiate through clean labels, organic sourcing, fortified nutrition, or blended products. Continuous innovation becomes essential to defend market share in a rapidly expanding dairy-alternative landscape.

Regional Analysis

North America

North America holds a significant share (23%) in the coconut milk and cream market, led by strong demand for plant-based dairy alternatives and clean-label food products. The United States dominates regional revenue, supported by large retail networks and wide availability across supermarkets, cafés, and online platforms. Coconut milk is frequently used in vegan beverages, bakery items, sauces, and ready-to-eat meals. Rising consumer preference for lactose-free and gluten-free diets pushes product adoption in households and foodservice. Private label launches, flavored beverages, and dairy-free ice creams strengthen market presence. Canada also contributes to steady growth through specialty retail and premium imports.

Europe

Europe accounts for a notable market share (22%) due to strong vegan culture, clean-label preferences, and high adoption of ethnic and fusion cuisines. The United Kingdom, Germany, France, and the Netherlands lead consumption across beverages, culinary dishes, bakery, and dairy alternatives. Retailers expand coconut milk offerings alongside almond, oat, and soy beverages, boosting category visibility. Growing use in foodservice chains, coffee shops, and ready-to-eat foods enhances demand. Premium organic and sustainably sourced coconut products gain popularity in Western Europe, while Eastern Europe shows rising interest driven by urban consumers and online retail growth.

Asia-Pacific

Asia-Pacific holds the largest market share (38%) and remains the fastest-growing region. Countries such as Thailand, Indonesia, the Philippines, India, China, and Vietnam are both major producers and high-volume consumers. Coconut milk and cream form essential ingredients in traditional cooking, packaged foods, confectionery, and foodservice. Expanding manufacturing capacity, lower raw material costs, and strong domestic consumption contribute to regional leadership. Export growth to Europe and North America supports large-scale production. Rising demand for organic and processed coconut products also boosts retail expansion. Increasing shelf-ready packaging and export-oriented processing further reinforce dominance.

Latin America

Latin America captures a moderate market share (15%) driven by increasing consumption of plant-based beverages, bakery products, and ethnic cuisines. Brazil and Mexico lead demand as supermarkets and foodservice channels expand dairy-free offerings. Coconut milk becomes popular in smoothies, desserts, and confectionery items, while powdered variants gain traction in household cooking. Urban consumers show rising preference for lactose-free and natural ingredient-based products. Local brands and imported labels compete on pricing and quality, while online retail drives accessibility in developing cities. Wider adoption in cosmetics and personal care also contributes to steady regional growth.

Middle East & Africa

The Middle East & Africa hold a smaller (9%) yet expanding market share, supported by rising vegan diets, premium retail distribution, and demand for lactose-free beverages. The United Arab Emirates, Saudi Arabia, and South Africa lead consumption through supermarkets, hotels, and cafés offering coconut-based desserts and beverages. The growing expatriate population and adoption of Asian cuisine strengthen usage in foodservice. Powdered coconut milk gains popularity for longer shelf life in hot climates. Imports dominate the market, with international brands capturing most sales. Gradual expansion of health-food stores, e-commerce platforms, and specialty cafés supports ongoing regional growth.

Market Segmentations:

By Product Type

- Coconut milk

- Full-fat coconut milk

- Lite coconut milk

- Organic coconut milk

- Coconut cream

- Regular coconut cream

- Organic coconut cream

- Cream of coconut (sweetened)

By Form

- Liquid

- Powder

- Conventional

- Organic

- Others

By Application

- Food and Beverage

- Culinary (soups, curries, sauces)

- Bakery and confectionery

- Dairy alternatives

- Beverages

- Frozen desserts

- Others

- Cosmetics and personal care

- Retail/household

By Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Specialty stores

- Online retail

- Food service

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coconut milk and cream market features a mix of global food manufacturers, regional processors, and private label brands competing through product quality, sourcing capabilities, and distribution reach. Leading companies focus on expanding organic, non-GMO, and clean-label portfolios to meet rising consumer expectations. Innovation centers on flavored coconut beverages, barista-style milk, canned cooking formats, and powdered variants for instant mixes. Major players invest in sourcing partnerships with coconut-producing nations to ensure consistent supply and cost control, while private labels offer competitive pricing in supermarkets. Many brands strengthen visibility through vegan certifications, recyclable packaging, and fortified nutritional blends. Growth in online retail encourages companies to launch subscription packs and multipurpose family-size cartons. As plant-based competition intensifies from almond, oat, soy, and cashew products, coconut suppliers emphasize texture, taste, and culinary versatility. Strategic mergers, R&D investments, and foodservice collaborations continue to shape market positioning at global and regional levels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cocomi Bio Organic (Sri Lanka)

- Campbell Soup Company (U.S.)

- Nestlé S.A. (Netherlands)

- Thai Coconut Public Company Limited (Thailand)

- SunOpta Inc. (U.S.)

- McCormick & Company, Incorporated (U.S.)

- Danone S.A. (France)

- Goya Foods, Inc. (U.S.)

- Axelum Resources Corp. (Philippines)

- Sambu Group (Indonesia)

Recent Developments

- In February 2025, Whole Moon launched the first coconut milk made using whole coconut meat without creams or oils, distributed nationwide at Sprouts and select US retailers including ShopRite, Fairway and Central Markets. The innovation delivers complete protein profiles while maintaining premium positioning in the plant-based beverage segment

- In 2024, Dehusk launched as the Philippines’ first locally-produced fortified coconut milk, founded by actress Nadine Lustre and entrepreneur Christophe Bariou. The product is enriched with calcium and essential nutrients while emphasizing sustainable local production using abundant Philippine coconuts

- In April 2023, Atlante announced its plans to launch Organic Coconut products as a part of its Berry Sanders brand. The product is made from organic coconuts sourced from Thailand

Report Coverage

The research report offers an in-depth analysis based on Product type, From, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as plant-based eating becomes mainstream across global markets.

- Coconut milk will gain wider use in coffee shops and beverage chains as a dairy-free option.

- Food manufacturers will launch more vegan yogurts, ice creams, and ready-to-drink smoothies.

- Powdered coconut milk will expand in instant mixes, travel packs, and vending applications.

- Organic and clean-label claims will attract premium consumers in retail stores.

- E-commerce platforms will drive direct-to-home deliveries and subscription sales.

- Natural personal care brands will increase use of coconut milk in skincare and haircare.

- Companies will invest in sustainable sourcing and fair-trade certification programs.

- Private labels will expand shelf space in supermarkets with cost-competitive options.

- Blended plant-based beverages combining coconut with oat, almond, or pea will gain popularity.