Market Overview

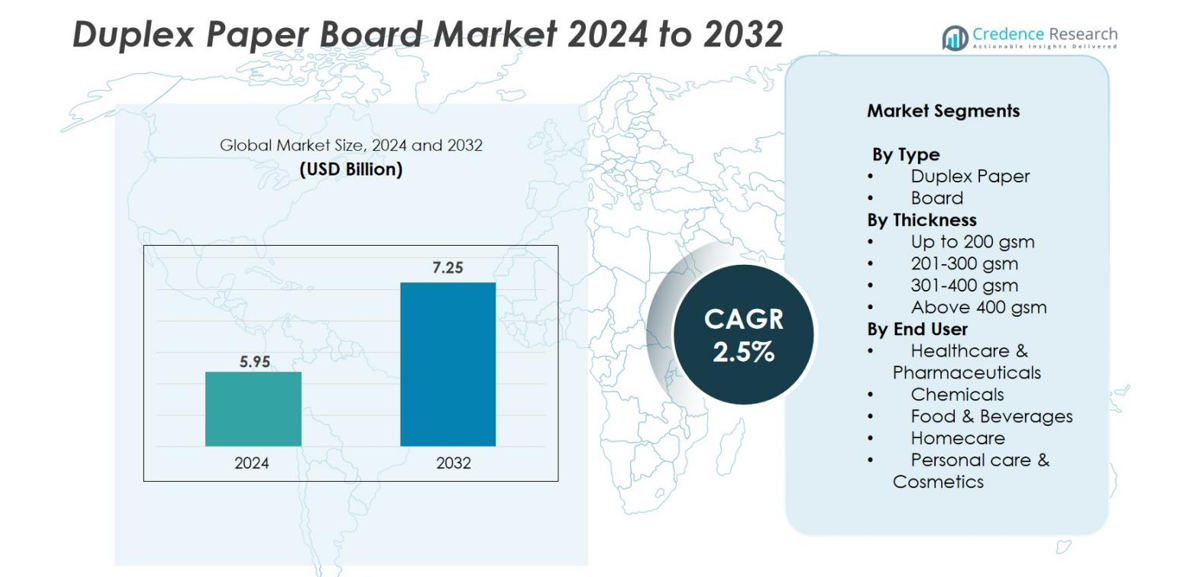

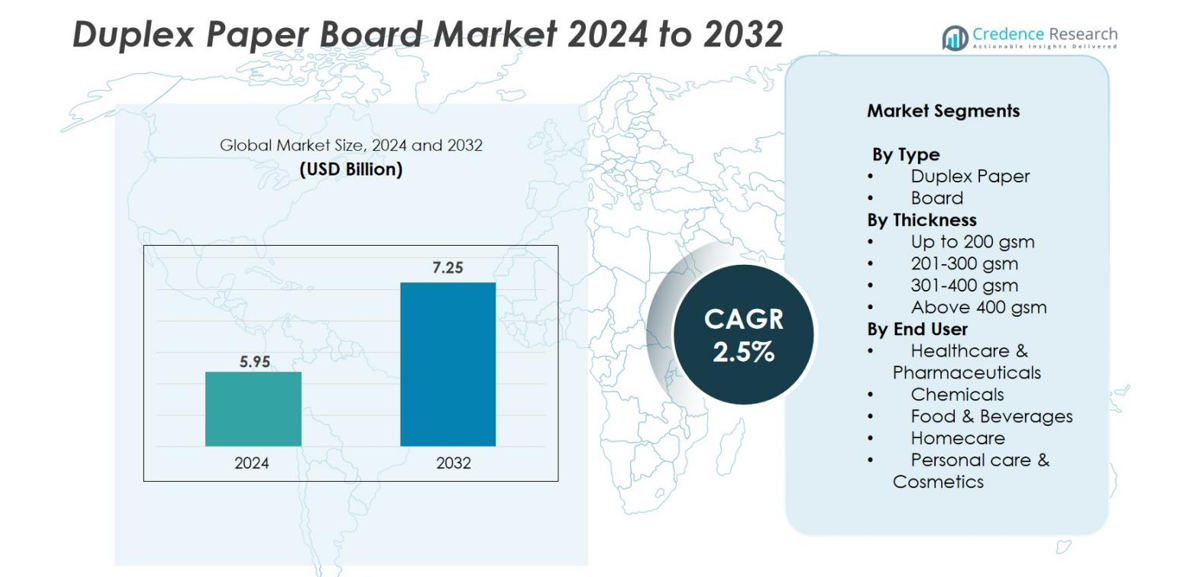

Duplex Paper Board market size was valued USD 5.95 Billion in 2024 and is anticipated to reach USD 7.25 Billion by 2032, at a CAGR of 2.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Duplex Paper Board Market Size 2024 |

USD 5.95 Billion |

| Duplex Paper Board Market, CAGR |

2.5% |

| Duplex Paper Board Market Size 2032 |

USD 7.25 Billion |

The Duplex Paper Board market includes leading players such as Emami Paper Mills Ltd., International Paper Company, Stora Enso Oyj, Sappi Ltd, Kimberly-Clark Corp., and The West Coast Paper Mills Ltd. These companies focus on recycled duplex grades, premium coated boards, and lightweight carton solutions for food, cosmetics, healthcare, and e-commerce packaging. Asia Pacific remains the leading region with a 28% share, supported by rising packaged food demand and rapid retail expansion in India and China. Europe follows close behind with strong regulations favoring sustainable paper packaging. Producers invest in high-barrier coatings, digital printing, and automated finishing lines to meet the needs of branding-focused FMCG and pharmaceutical customers.

Market Insights

- The Duplex Paper Board market was valued at USD 5.95 Billion in 2024 and will reach USD 7.25 Billion by 2032 at a CAGR of 2.5%.

- Food and beverage packaging drives most demand, supported by rising use of folding cartons, cups, and bakery boxes. Duplex paper holds a 58% share by type due to high printability and cost efficiency.

- High-barrier coatings, digital printing, and lightweight recycled grades remain key trends as brands move toward sustainable packaging. Companies expand automated finishing lines for faster delivery.

- Price pressure is a major restraint, as volatile pulp and recycled fiber costs reduce margins for small mills. Competition from plastics and corrugated formats also challenges growth in heavy-duty packaging.

- Asia Pacific leads the market with 28% share, followed by North America at 31% and Europe at 29%. Food and FMCG brands in these regions use 201–300 gsm grades, which account for 42% share due to strength and printing quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Duplex Paper leads the Duplex Paper Board market with a 58% share in 2024. Duplex paper offers strong printability, surface smoothness, and cost efficiency, making it suitable for packaging, labeling, and disposable products. Board holds a smaller share but remains important in rigid packaging where high stiffness and durability are required. Manufacturers focus on recycled fiber content, lightweight options, and moisture resistance to support food and consumer goods applications. Growing e-commerce shipments and rising demand for protective packaging boost both segments, while duplex paper maintains dominance due to wide use in cartons and advertising materials.

- For instance, Edicon Paper Product in India manufactures premium recycled duplex boards like Iconic Ocean, which combine sustainable recycled fibers with high durability, meeting international packaging standards.

By Thickness

The 201–300 gsm category holds a dominant 42% share in 2024. This thickness range fits folding cartons for food, cosmetics, pharmaceuticals, and household products. It supports high-quality printing, die-cutting, and lamination, helping brands improve product appearance and shelf appeal. Up to 200 gsm is used for lightweight packaging and disposable products. Thicknesses of 301–400 gsm and above 400 gsm support heavy-duty packaging, industrial goods, and rigid cartons. Demand for 201–300 gsm continues to grow due to sustainability targets, recyclability, and low transport cost without compromising strength.

- For instance, Printex Transparent Packaging, which uses 201-300 gsm boards with hot and cold foil stamping to create shimmering metallic finishes for cosmetics cartons, enhancing shelf visibility.

By End User

Food & Beverages lead the market with a 34% share in 2024. Duplex paper boards are widely used in takeaway containers, bakery boxes, dairy cartons, frozen food packaging, and disposable cups. The material protects food from moisture and contamination while supporting strong graphics. Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Chemicals, and Homecare products also rely on duplex boards for labeling, blister card packaging, and hygienic storage. Food brands prefer recyclable and biodegradable packaging to meet regulations and consumer expectations, boosting demand for coated and uncoated duplex boards.

Key Growth Drivers

Growing Demand from Food and Beverage Packaging

Food and beverage brands use duplex paper board for cartons, trays, cups, and labels. The material protects items from moisture and light, helping maintain shelf life. Strong printability also supports branding and product visibility. Rising demand for ready-to-eat meals, bakery products, and packaged dairy increases consumption of coated boards. Governments encourage recyclable packaging and limit single-use plastics, pushing companies toward paper-based formats. Large FMCG brands expand adoption across frozen, dry, and fast-food segments. The growth of online food delivery further expands demand for lightweight and leak-resistant packaging. These factors keep food and beverage packaging the strongest volume driver.

- For instance, large brands like Nestlé leverage duplex board packaging for dry foods and bakery products, benefiting from its excellent printability that helps create premium, visually appealing packaging with strong shelf presence, while also complying with environmental standards to reduce plastic use.

Expansion of E-Commerce and Consumer Goods

Online retail drives the need for sturdy, lightweight, and cost-effective packaging. Duplex paper board helps protect cosmetics, pharmaceuticals, household goods, and electronics during shipping. It offers smooth print surfaces for labels and brand designs. Retailers prefer recyclable and biodegradable packaging to meet sustainability goals and reduce plastic use. Growth of small and medium e-commerce sellers also increases demand for custom folding cartons and printed sleeves. Rapid order fulfillment encourages the use of machine-friendly boards designed for automatic cutting, folding, and gluing. These advantages make duplex board a preferred material across many product categories.

- For instance, Kraft back duplex board with a smooth white-coated front is widely used by cosmetic brands for sustainable packaging that supports embossing and foiling, enhancing the product’s shelf appeal while ensuring rigidity and protection during transit.

Rising Focus on Recyclable and Eco-Friendly Materials

Companies replace plastic trays and laminated cartons with recyclable paper-based solutions. Duplex board supports circular material use because it is made from recycled pulp. Governments introduce waste-management rules and extended producer responsibility programs. Cosmetics, homecare, and personal care brands shift to eco-friendly packaging to improve brand perception. Printer-friendly coated boards support fine graphics without using metallic films or plastic laminates. Many manufacturers invest in chlorine-free bleaching, water-based inks, and barrier coatings that improve grease and moisture resistance. These upgrades help meet sustainability goals while keeping production costs stable.

Key Trends & Opportunities

Adoption of High-Barrier and Specialty Coated Boards

Advanced coatings improve strength and barrier properties without plastic film. Water-based coatings resist grease, moisture, and heat, helping food packaging. Specialty grades support pharmaceutical blister cards and high-print applications. Brands use scented, embossed, and textured boards for premium goods. Anti-counterfeit printing and QR-based traceability open new uses in healthcare and cosmetics. These features provide strong growth opportunities for high-value grades within the market.

- For instance, Flint Group’s DecaCode water-based barrier coatings meet stringent food contact regulations while providing moisture, aroma, and gas barriers that extend shelf life and simplify recycling for bakery and produce packaging.

Growth of Automated Packaging and Digital Printing

Converters now use high-speed folding, lamination, and die-cutting lines. Machine-friendly duplex board reduces wastage and increases printing accuracy. Digital printing supports short-run and customized packaging for regional stores and e-commerce sellers. This trend helps small brands launch faster and reduce inventory costs. Automation also supports faster delivery cycles for FMCG companies. These advantages attract more manufacturers to upgrade production capacity.

- For instance, Britepak reported a 130% increase in output rates after upgrading to advanced folder-gluer machines capable of processing 80-104 boxes per minute, while reducing labor and floor space costs.

Key Challenges

Fluctuation in Raw Material and Energy Prices

Recycled fiber and pulp prices vary due to supply shortages and global trade issues. Energy costs add pressure to pulping, drying, and coating processes. Small mills face difficulties maintaining margins. Price instability affects contract stability with FMCG and pharmaceutical customers. This challenge slows expansion in developing markets and forces producers to invest in efficiency upgrades.

Competition from Alternative Packaging Materials

Rigid plastics, corrugated boxes, and flexible pouches compete with duplex board. Plastics offer high moisture resistance and longer shelf life for some goods. Corrugated formats support heavier loads in e-commerce. Flexible pouches reduce transport cost and storage space. Duplex board must continue improving barrier strength and performance to protect market share. Manufacturers respond by adding specialty coatings and premium finishes.

Regional Analysis

North America

North America holds 31% share in 2024. Food packaging, personal care items, and homecare goods drive demand for coated duplex boards. Large FMCG brands use recycled boards to meet sustainability laws in the U.S. and Canada. Growth of ready-to-eat meals and frozen food supports higher use in folding cartons. E-commerce shipments increase demand for protective packaging and printed sleeves. Producers invest in lightweight grades to reduce transport cost. Recycling infrastructure in major cities also supports steady raw material availability.

Europe

Europe accounts for 29% share in 2024. Strict packaging waste regulations and single-use plastic bans push food and consumer goods producers toward coated boards. Germany, Italy, France, and the U.K. show strong use in bakery boxes, dairy cartons, and pharmaceutical packaging. Demand rises for high-barrier recycled grades that support frozen and chilled foods. Large converters expand digital printing and traceability features. Many mills use low-chemical pulping and water-based coatings to meet sustainability needs. Growing export of packaged foods also supports steady consumption across the region.

Asia Pacific

Asia Pacific holds 28% share in 2024. India, China, Vietnam, and Indonesia lead due to rising packaged food demand and expanding retail chains. Local converters produce cost-effective, recycled-grade duplex boards for FMCG, cosmetics, and household goods. E-commerce delivery growth adds demand for printed cartons and protective sleeves. Rapid urbanization boosts consumption of ready meals, bakery items, and beverages. Governments promote sustainable packaging to reduce plastic waste. Foreign packaging firms invest in automated board production facilities to meet regional supply gaps.

Latin America

Latin America holds 7% share in 2024. Brazil and Mexico remain key markets with growing packaged food consumption and cosmetic exports. Duplex boards replace plastic food trays and laminated cartons in bakeries and fast-food chains. Small and medium converters adopt digital printing to reduce production cost. Import dependency affects board pricing during currency fluctuations. Retail expansion and food delivery platforms help maintain steady consumption. Sustainability policies encourage packaging firms to shift toward recyclable boards and water-based coatings.

Middle East & Africa

Middle East & Africa account for 5% share in 2024. Growth comes from food service, pharmaceuticals, and household goods. Retail chains and hypermarkets boost demand for branded folding cartons. Import reliance increases price sensitivity in low-income markets. Gulf countries promote eco-friendly packaging to reduce plastic waste. Local mills upgrade coating systems to improve moisture resistance for dairy and bakery goods. Africa shows long-term potential due to population growth and rising urban consumption.

Market Segmentations

By Type

By Thickness

- Up to 200 gsm

- 201-300 gsm

- 301-400 gsm

- Above 400 gsm

By End User

- Healthcare & Pharmaceuticals

- Chemicals

- Food & Beverages

- Homecare

- Personal care & Cosmetics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Duplex Paper Board market remains moderately consolidated, with global and regional players competing on product quality, pricing, and supply reliability. Emami Paper Mills Ltd., International Paper Company, Hangzhou Gerson Paper Co. Ltd., and The West Coast Paper Mills Ltd. (SKG) maintain strong positions due to wide product portfolios and steady demand from packaging converters. Global manufacturers such as Sappi Ltd, Stora Enso Oyj, and Kimberly-Clark Corp. focus on premium coated grades, sustainable raw material sourcing, and lightweight alternatives to meet eco-compliance standards. El-Salam Paper Mills and Millennium Overseas support demand in emerging markets through cost-efficient manufacturing and flexible order sizes. Many producers invest in energy-efficient pulping, bulk waste recovery, and recycled fiber utilization to reduce operating costs. Partnerships with printing houses, FMCG brands, and corrugated box manufacturers enhance market presence. As sustainability and recyclability gain importance, product innovation and capacity expansion shape long-term competitive advantages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, N R Agarwal Industries revealed plans to set up a new 1,000 TPD board plant, with a significant investment.

- In April 2024, International Paper (US) agreed to acquire DS Smith plc (UK) in an all‑share deal valued at approx. US$7.2 billion, creating a major sustainable‐packaging platform including board products.

Report Coverage

The research report offers an in-depth analysis based on Type, Thickness, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as FMCG, electronics, and e-commerce sectors expand packaging needs.

- Lightweight and recycled duplex boards will gain stronger adoption due to sustainability rules.

- Manufacturers will invest in energy-efficient machinery and cost-saving pulping systems.

- Partnerships with corrugated box makers and converters will improve supply chain reach.

- Companies will increase exports to Africa, Southeast Asia, and Latin America.

- Digital printing and custom packaging trends will drive demand for high-brightness coated boards.

- Product innovation will focus on water-resistant and food-grade duplex boards.

- Capacity expansions and mill modernization will improve production stability.

- Strict waste management norms will push mills toward circular fiber and recovered paper use.

- Competition will intensify, encouraging price optimization, faster delivery, and superior quality control.