Market Overview

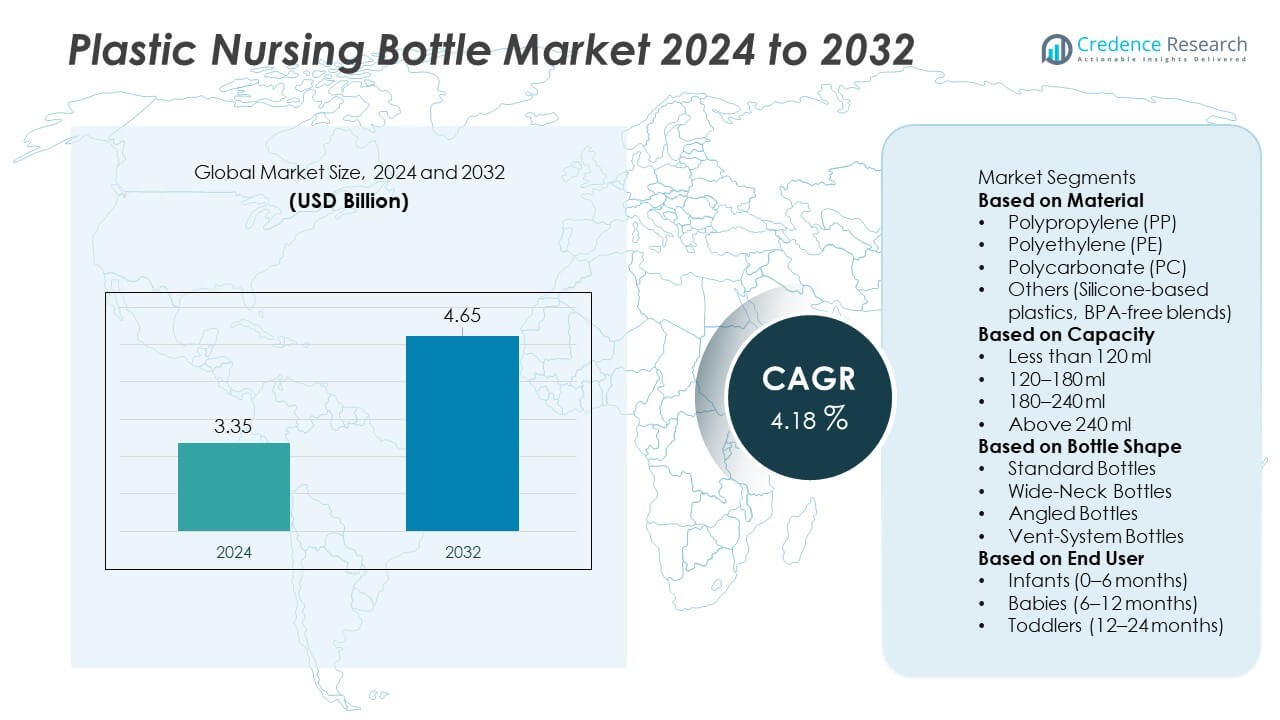

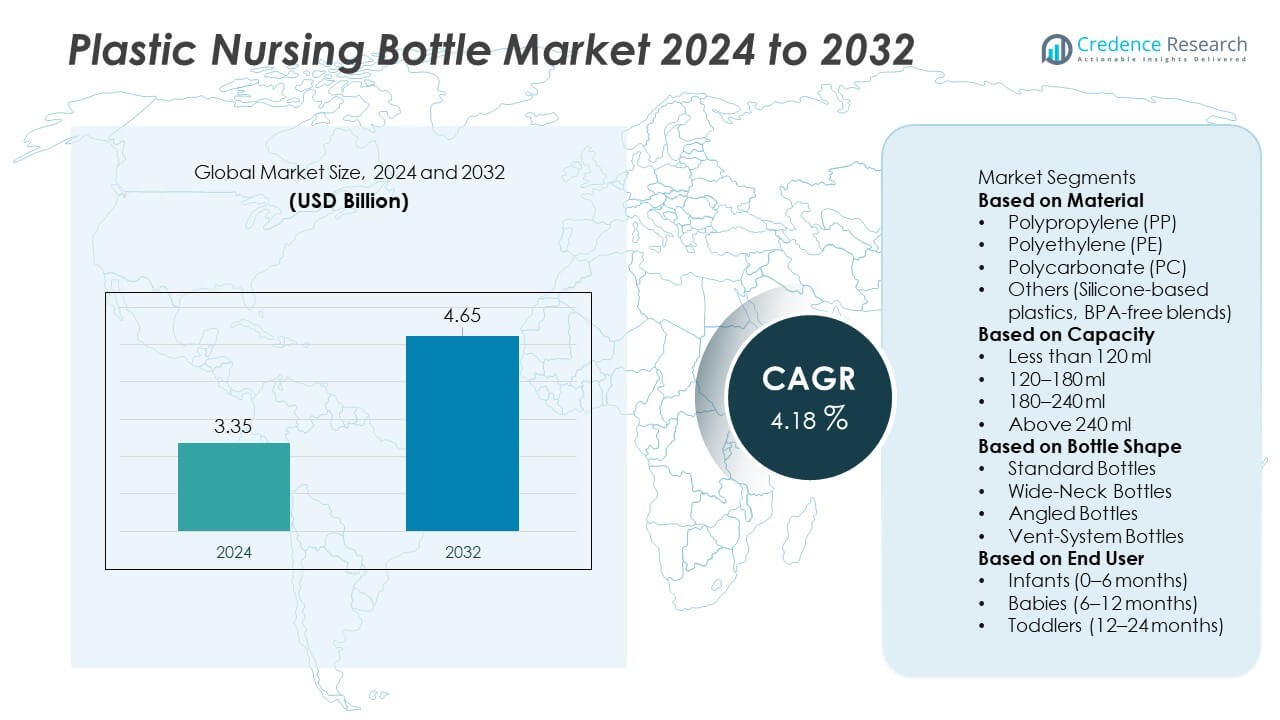

The Plastic Nursing Bottle market was valued at USD 3.35 billion in 2024 and is expected to reach USD 4.65 billion by 2032, expanding at a CAGR of 4.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Nursing Bottle Market Size 2024 |

USD 3.35 Billion |

| Plastic Nursing Bottle Market, CAGR |

4.18% |

| Plastic Nursing Bottle Market Size 2032 |

USD 4.65 Million |

Top players in the Plastic Nursing Bottle market include Philips Avent, Pigeon Corporation, Dr. Brown’s, Medela AG, Tommee Tippee, Chicco, MAM Babyartikel, Comotomo, NUK, and Lansinoh Laboratories, each focusing on BPA-free materials, ergonomic shapes, and anti-colic technologies to strengthen product differentiation. These companies expand portfolios with wide-neck and vent-system designs to meet rising safety and convenience demands. Regionally, North America leads with a 38% share, driven by strong awareness of infant health standards and high adoption of premium bottles. Europe follows with a 32% share, supported by strict regulations and a rapid shift toward chemical-safe feeding solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plastic Nursing Bottle market reached USD 3.35 billion in 2024 and is set to grow at a CAGR of 4.18%, driven by rising adoption of BPA-free and ergonomic bottle designs.

- Demand increases due to strong focus on infant safety, which boosts the use of PP material holding a 46% share, along with growing preference for 180–240 ml bottles that lead the capacity segment with a 52% share.

- Wide-neck bottles dominate with a 41% share, supported by trends favoring easy cleaning, anti-colic systems, and improved hygiene.

- Competition intensifies as brands like Philips Avent, Pigeon, and Dr. Brown’s expand portfolios with vent-system designs, while cost-pressure and plastic safety concerns act as key restraints.

- North America leads the market with a 38% share, followed by Europe at 32%, while Asia Pacific holds a 24% share, driven by rising baby-care spending and strong online retail penetration.

Market Segmentation Analysis:

By Material

Polypropylene (PP) leads this segment with a 46% share due to strong durability and high heat resistance. Buyers prefer PP bottles because the material supports repeated sterilization and offers safe, BPA-free feeding. Polyethylene (PE) follows with growing adoption in low-cost bottles, while Polycarbonate (PC) holds a declining share due to regulatory concerns. Silicone-based and BPA-free blends record steady growth as parents shift toward premium, chemical-safe designs. Rising awareness of infant safety and advancements in medical-grade plastics continue to push PP ahead of other materials.

- For instance, Pigeon Corporation shifted major PC lines to BPA-free PP in 2018 after Japan’s regulation updates, converting 42 production molds to alternative materials.

By Capacity

The 180–240 ml segment dominates with a 52% share, driven by strong demand for bottles suitable for daily and long-duration feeding. This size fits standard feeding patterns and reduces frequent refills, increasing convenience for parents. Bottles below 120 ml serve newborn needs, while 120–180 ml options cater to mid-stage feeding. Above 240 ml bottles grow steadily among toddlers with higher intake requirements. The leading 180–240 ml range benefits from wide availability, compatibility with most nipple systems, and ergonomic designs that enhance ease of handling.

- For instance, NUK offers 150 ml bottles tailored for newborns (0-6 months) and slightly older infants to help with the transition to independent drinking, and larger capacity bottles, such as 260 ml, cater to growing toddlers with higher intake requirements as part of its general product strategy.

By Bottle Shape

Wide-neck bottles hold the largest 41% share due to easy cleaning, better hygiene, and improved milk flow. Parents also prefer wide-neck designs for a comfortable grip and strong compatibility with anti-colic nipples. Standard bottles remain relevant for affordability, while angled bottles help reduce air intake during feeding. Vent-system bottles gain traction as anti-colic awareness grows. The wide-neck segment maintains its leadership as both premium and mid-range brands focus on offering wide-mouth designs that support fast filling and efficient maintenance.

Key Growth Drivers

Rising Focus on Infant Health and Safety

Demand grows as parents prioritize safe and non-toxic feeding solutions. Manufacturers shift toward BPA-free plastics, medical-grade materials, and enhanced sterilization compatibility. Strong awareness of chemical exposure drives rapid adoption of PP and silicone-based bottles. Healthcare professionals also recommend safer materials, increasing consumer confidence. Growth accelerates as brands highlight testing standards, product certifications, and durability. This shift toward high-safety feeding products continues to strengthen market expansion across both premium and mass-market categories.

- For instance, Comotomo uses medical-grade silicone certified under USP Class VI, which requires passing six biocompatibility and toxicity evaluations to meet hospital-grade safety standards.

Growing Preference for Convenient and Ergonomic Bottle Designs

Parents seek bottles that support easy handling, quick cleaning, and reduced feeding discomfort. Wide-neck and vent-system designs gain strong traction due to better hygiene and improved milk flow. User-friendly shapes and anti-colic mechanisms also enhance daily feeding efficiency. Manufacturers invest in ergonomic structures, heat-resistant plastics, and compatibility with multiple nipple types. Convenience-driven buying behavior pushes companies to refine bottle design, boosting demand across all baby age groups. This preference for comfort and functionality continues to support long-term market growth.

- For instance, Tommee Tippee’s Closer to Nature wide-neck bottles feature a compact, ergonomic shape designed to be comfortable for both parents and babies to hold, and they have an easy-latch, breast-like nipple to encourage natural feeding. The wide neck also makes the bottles easier to clean and fill.

Expansion of Online Retail and Premium Baby Care Brands

Digital platforms drive strong sales growth by offering wider choices, transparent reviews, and discounts. Online channels increase visibility for premium brands featuring advanced plastic materials and anti-colic features. Parents prefer e-commerce for easy comparison of sizes, shapes, and safety certifications. Subscription models for feeding essentials also gain momentum. Growth rises as baby-care brands invest in online campaigns, product demos, and influencer partnerships. This shift toward digital buying accelerates adoption of innovative bottle designs and expands reach in emerging markets.

Key Trends & Opportunities

Shift Toward Eco-Friendly and BPA-Free Plastic Alternatives

Parents increasingly choose BPA-free, phthalate-free, and eco-safe plastics to minimize health risks. This trend boosts demand for Tritan, medical-grade PP, and silicone-based blends. Manufacturers also explore recycled plastics and bio-based materials to align with sustainability goals. Premium brands highlight environmental certifications to attract conscious parents. This shift creates opportunities for companies to invest in green materials, safer chemical compositions, and recyclable packaging. The move toward sustainable feeding solutions positions the category for long-term innovation and competitive differentiation.

- For instance, Chicco uses materials like BPA-free polypropylene or premium borosilicate glass in its feeding bottles, which are rigorously tested by third-party labs and meet high safety standards for infant use, such as those established by the FDA and EFSA, confirming their safety for repeated use.

Growing Adoption of Anti-Colic and Vent-System Technologies

Anti-colic bottles gain popularity as modern designs help reduce air intake and feeding discomfort. Parents value vent-systems, angled shapes, and controlled-flow nipples that support smoother feeding. Manufacturers introduce advanced airflow regulation, leak-proof structures, and easy-clean components to improve usability. Demand rises as healthcare experts emphasize colic reduction and digestive comfort for infants. Companies that integrate innovative vent mechanisms and ergonomic structures see strong growth opportunities. This trend also pushes premiumization across the plastic nursing bottle category.

- For instance, Dr. Brown’s internal vent tube is engineered for airflow separation, which creates positive-pressure flow similar to breastfeeding. The unique design channels air from the nipple collar to the back of the bottle, preventing it from mixing with the milk or formula.

Key Challenges

Concerns Over Plastic Safety and Chemical Exposure

Some parents remain cautious about plastic-based feeding products due to long-standing concerns over chemical leaching. Despite BPA-free advancements, skepticism persists, especially among buyers leaning toward glass or stainless-steel alternatives. Regulatory updates also require frequent material testing, increasing production costs. These concerns challenge mass-market brands relying on traditional plastic formulas. Manufacturers must invest in safer blends, stronger certifications, and clear communication to maintain consumer trust. Limited awareness in emerging markets further adds complexity to overcoming perception barriers.

Intense Competition from Low-Cost and Alternative Feeding Products

The market faces heavy competition from low-priced bottles produced by local manufacturers, which affects premium brand margins. Cheaper alternatives often lack advanced designs or safety features but still attract price-sensitive buyers. Glass bottles, stainless-steel models, and hybrid materials also offer strong alternatives. This competition pressures companies to innovate while keeping costs manageable. Brand differentiation becomes difficult when many products appear similar in shape and functionality. Sustaining growth requires investment in features, durability, and targeted marketing strategies.

Regional Analysis

North America

North America holds a 38% share due to strong demand for BPA-free, premium-quality nursing bottles supported by high awareness of infant safety. Parents prefer wide-neck, vent-system, and ergonomic designs that reduce feeding discomfort and improve hygiene. Major brands focus on compliance with strict safety standards, boosting product trust. E-commerce adoption also drives steady sales growth as buyers compare materials, certifications, and features with ease. Continued preference for durable PP and silicone-based bottles strengthens the region’s leadership position.

Europe

Europe accounts for a 32% share, driven by strong regulatory oversight and rising preference for chemical-safe feeding products. Parents adopt PP, Tritan, and advanced vent-system bottles due to strict BPA and phthalate limits across the region. Premium brands gain traction as consumers seek ergonomic shapes and high-durability materials. Sustainability awareness also influences buying behavior, boosting interest in eco-safe plastic blends. Retailers expand their offerings through online and specialty baby-care channels, strengthening market penetration in key countries such as Germany, France, and the UK.

Asia Pacific

Asia Pacific holds a 24% share, supported by a large infant population and rising spending on modern baby-care products. Growing urbanization and online retail expansion accelerate adoption of PP and wide-neck designs. Middle-income families increasingly prefer bottles with anti-colic systems and heat-resistant materials. Local manufacturers offer cost-efficient options, while global brands expand distribution to capture fast-growing demand. Increased focus on hygiene and infant comfort drives premium product uptake, especially in China, India, Japan, and Southeast Asia.

Latin America

Latin America captures a 4% share, driven by growing awareness of infant health and gradual adoption of safer bottle materials. Consumers shift from basic plastic bottles to PP, Tritan, and vent-system designs that support easier cleaning and smoother feeding. Economic constraints sustain demand for affordable brands, yet premium options gain visibility through online marketplaces. Baby specialty stores and pharmacies expand product ranges across Brazil, Mexico, and Argentina. Rising education on colic prevention and sterilization practices continues to support steady market development.

Middle East & Africa

The Middle East & Africa region holds a 3% share, with growth fueled by increasing birth rates and rising awareness of safe feeding products. Urban families favor PP and wide-neck bottles for durability and hygiene convenience. Premium international brands grow in Gulf countries due to higher purchasing power and strong retail availability. In African markets, affordability drives adoption of basic PP bottles, while slow but rising interest in vent-system designs reflects improving awareness. Expanding online retail and better healthcare guidance support gradual market expansion.

Market Segmentations:

By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polycarbonate (PC)

- Others (Silicone-based plastics, BPA-free blends)

By Capacity

- Less than 120 ml

- 120–180 ml

- 180–240 ml

- Above 240 ml

By Bottle Shape

- Standard Bottles

- Wide-Neck Bottles

- Angled Bottles

- Vent-System Bottles

By End User

- Infants (0–6 months)

- Babies (6–12 months)

- Toddlers (12–24 months)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Philips Avent, Pigeon Corporation, Dr. Brown’s, Medela AG, Tommee Tippee, Chicco, MAM Babyartikel, Comotomo, NUK, and Lansinoh Laboratories, each strengthening their presence through product innovation and brand reliability. Companies focus on BPA-free plastics, ergonomic shapes, and anti-colic technologies to meet rising parent expectations. Leading brands expand portfolios with wide-neck, vent-system, and heat-resistant PP bottles to enhance feeding comfort and hygiene. Digital retail strategies support stronger market penetration as firms leverage online reviews, targeted ads, and subscription models. Many players also invest in advanced manufacturing processes to improve durability, reduce chemical risks, and comply with strict safety standards across regions. Premium brands differentiate through design, certification, and advanced airflow systems, while mass-market companies compete on affordability and wide distribution. This mix of innovation, material advancements, and competitive pricing shapes the market’s long-term growth trajectory.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, the awards organiser MadeForMums announced the winners for their annual awards, which included a category for breast- & bottle-feeding products.

- In March 2023, Ember Technologies, Inc. launched a temperature control technology-based baby bottle system in the U.S. The product is designed with a patented technology control platform that enables mothers to create a perfectly warm milk formula for their babies.

Report Coverage

The research report offers an in-depth analysis based on Material, Capacity, Bottle Shape, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as parents continue to prefer BPA-free, medical-grade plastic bottles.

- Anti-colic and vent-system technologies will gain stronger adoption across premium ranges.

- Manufacturers will focus on ergonomic shapes that improve grip and cleaning convenience.

- Online retail growth will boost visibility for global and emerging baby-care brands.

- Sustainable and recyclable plastic blends will gain traction as eco-awareness increases.

- Innovation in heat-resistant and long-lasting plastics will enhance product durability.

- Smart packaging and better sterilization indicators may enter mainstream product designs.

- Competition will intensify as local brands offer low-cost alternatives in developing regions.

- Partnerships with hospitals and maternity centers will expand brand trust and reach.

- Strong growth will continue in Asia Pacific as birth rates and disposable incomes increase.