Market Overview

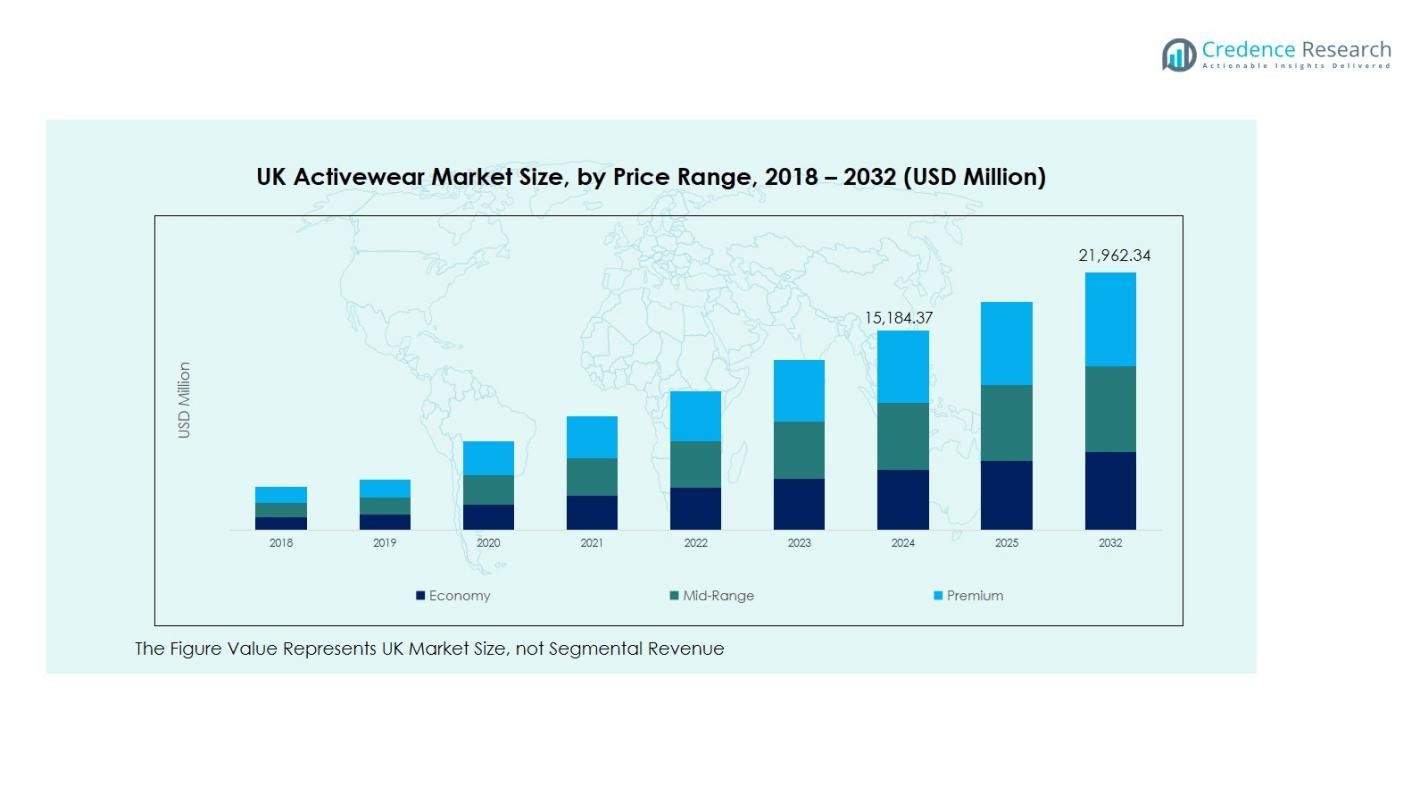

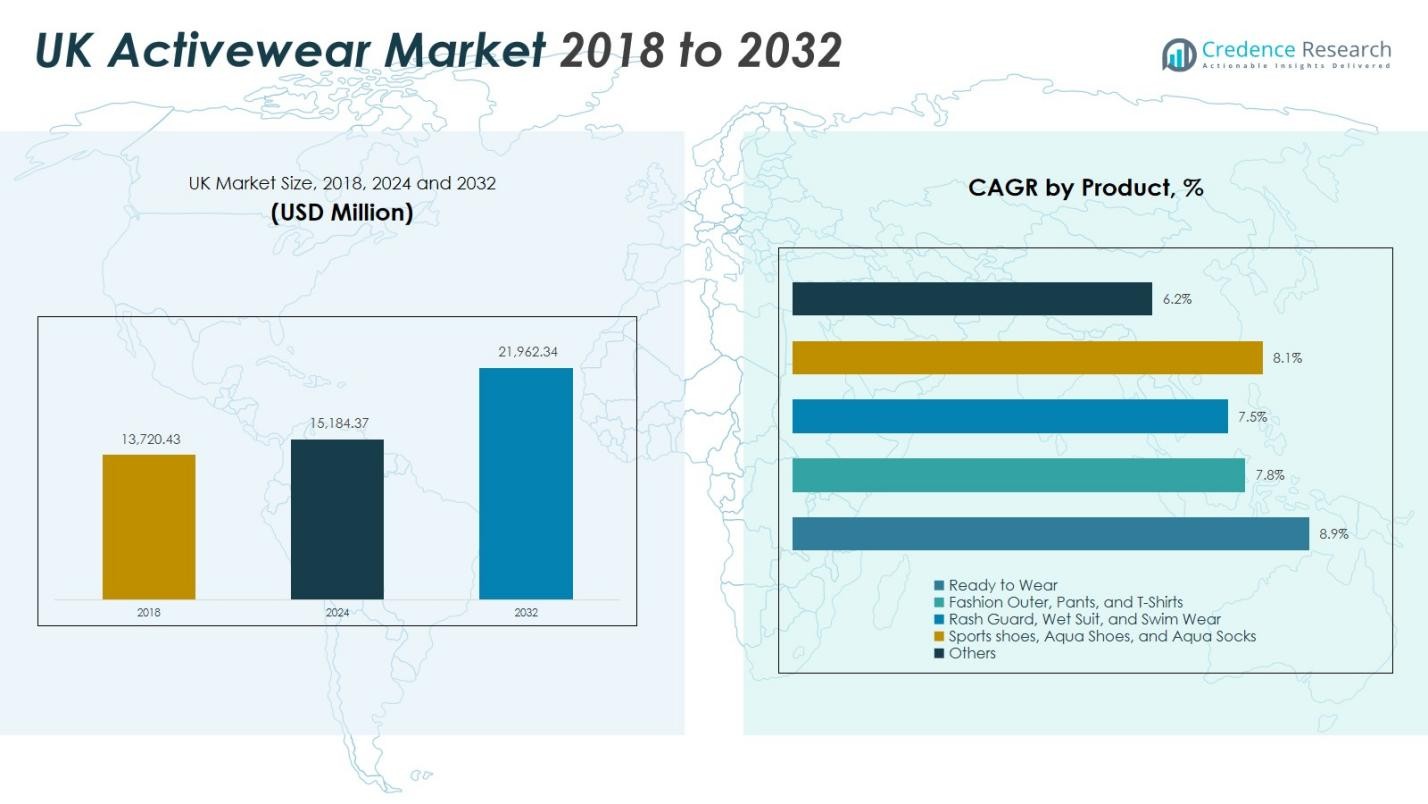

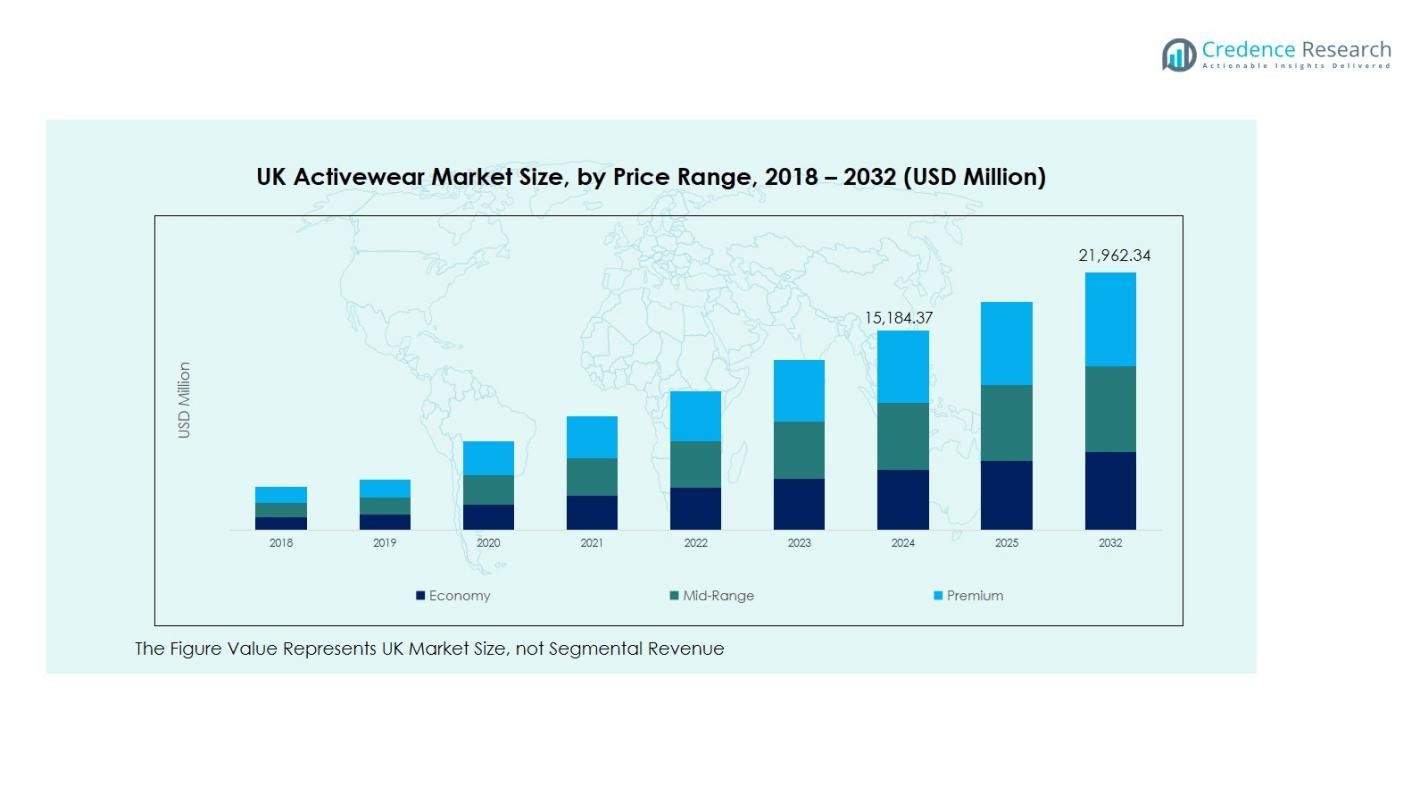

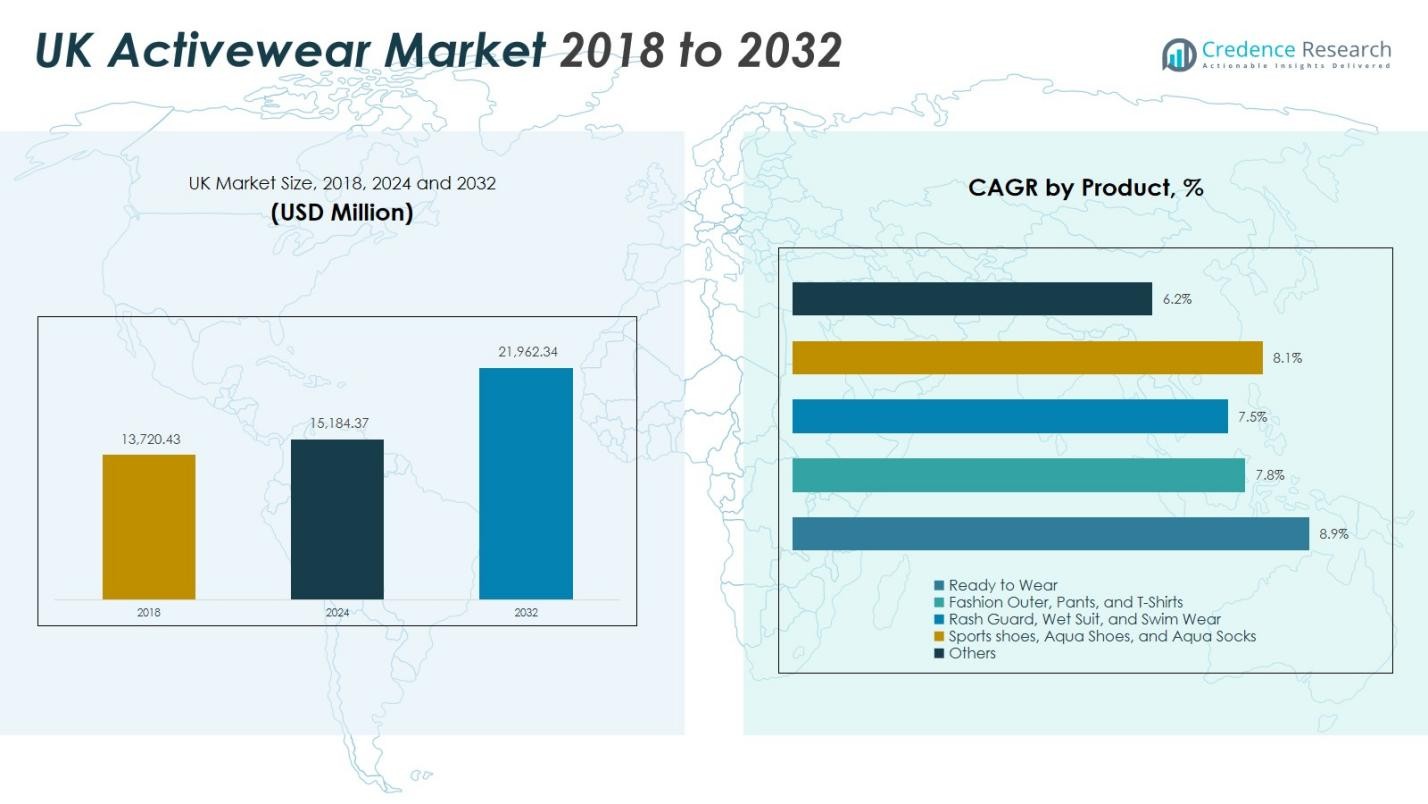

The UK Activewear Market was valued at USD 13,720.43 Million in 2018, increased to USD 15,184.37 Million in 2024, and is anticipated to reach USD 21,962.34 Million by 2032, growing at a CAGR of 4.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K Activewear Market Size 2024 |

USD 15,184.37 Million |

| U.K Activewear Market, CAGR |

4.72% |

| U.K Activewear Market Size 2032 |

USD 21,962.34 Million |

The UK Activewear Market is dominated by key players such as Nike Inc., Adidas AG, Puma SE, Under Armour, Gymshark, and Sweaty Betty, who lead the market through their innovative products, strong brand recognition, and extensive distribution networks. These companies are at the forefront of catering to the growing demand for versatile and performance-oriented activewear, with a strong focus on athleisure and eco-friendly materials. England is the largest regional market, commanding 55% of the market share in 2024, driven by its robust urban population, fitness culture, and widespread adoption of e-commerce. Scotland follows with 15%, where outdoor activities like hiking and cycling drive demand for durable activewear. Wales holds 10% of the market, with increasing participation in sports and fitness activities. Northern Ireland contributes 7%, showing steady growth due to the rise in fitness awareness. The South West and South East regions of England together account for 13% of the market.

Market Insights

Market Insights

-

- The UK Activewear Market was valued at USD 15,184.37 million in 2024 and is projected to grow at a CAGR of 4.72% through 2032 reaching USD 21,962.34 million.

- The growing popularity of athleisure and health‑and‑fitness awareness are key market drivers, boosting demand across segments such as ready‑to‑wear which holds a 40% share and polyester fabric at 35%.

- Sustainability and technological integration in activewear are major trends, with synthetic materials dominating at 60% share and natural materials gaining traction among eco‑conscious consumers

- Leading companies such as Nike Inc., Adidas AG, Puma SE, Under Armour, Gymshark and Sweaty Betty dominate the market by leveraging global branding, innovation, and e‑commerce channels.

- On the regional front, England commands 55% of the UK market, followed by Scotland at 15%, Wales at 10%, Northern Ireland at 7%, and the South West & South East England combined at 13%, while price sensitivity and rising costs present significant restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Ready to Wear segment is the dominant sub-segment in the UK Activewear Market, commanding the largest share of 40% in 2024. This segment’s strong performance is driven by the increasing consumer demand for versatile, stylish, and functional activewear suitable for both athletic and casual use. The growing popularity of athleisure, alongside the trend of wearing activewear for daily activities, supports the growth of this segment. Fashion Outer, Pants, and T-Shirts also hold significant market share, while Sports Shoes and Aqua Shoes are increasingly popular in fitness and water sports categories.

-

- For instance, London-based fitness brand 1Rebel launched its 1R Collection featuring seamless and sweat-wicking designs that cater to high-intensity workouts and everyday use, reflecting this demand for multifunctional activewear.

By Fabric

Polyester leads the fabric segment, with a share of 35% in 2024, driven by its durability, moisture-wicking properties, and cost-effectiveness. The material is widely preferred for its ability to handle intense physical activity and maintain comfort. Spandex follows as a key fabric, capturing 25% of the market share, favored for its flexibility and stretchability in activewear. Nylon and Neoprene also experience substantial demand, primarily for swimwear and wetsuits, while Cotton remains popular for casual, comfortable apparel, especially in the Ready to Wear category.

-

- For instance, India’s Reliance Industries, a major polyester producer, supplies high-strength recycled polyester fibers widely used in outdoor and industrial apparel, supporting sustainable production initiatives.

By Material

The Synthetic material segment dominates the UK Activewear Market with a significant share of 60% in 2024. Synthetic materials, such as polyester and spandex, are favored for their strength, flexibility, and moisture-wicking capabilities, making them ideal for activewear. The demand for Natural materials, such as cotton, continues to rise, with a focus on sustainability and eco-conscious production. However, synthetic materials still dominate due to their performance advantages and lower cost, which ensures their preference among both consumers and manufacturers in the activewear industry.

Key Growth Drivers

Rising Popularity of Athleisure

The growing trend of athleisure is a significant driver of the UK Activewear Market. Consumers increasingly prefer activewear that combines comfort, style, and functionality for everyday wear, not just for exercise. This shift is seen across various age groups and demographics, fueled by the desire for clothing that supports both fitness and social occasions. As a result, brands are focusing on creating versatile designs that can transition from gym to street, driving the demand for activewear in the fashion-forward athleisure space.

-

- For instance, Adidas pushes the boundary with its Boost midsole technology in running shoes, providing energy return and comfort that appeal to consumers looking for performance and style in their athleisure wear.

Health and Fitness Awareness

Increased health and fitness awareness has fueled the demand for activewear in the UK. As more consumers adopt healthier lifestyles, the need for specialized clothing tailored to physical activities continues to rise. The growing popularity of fitness activities such as running, yoga, and cycling has led to increased consumption of activewear products, particularly those that enhance performance, provide comfort, and support recovery. This health-focused trend will continue to boost market growth as more individuals prioritize wellness and fitness in their daily routines.

-

- For instance, Nike offers gym trainers with Flyknit uppers and Nike React foam cushioning designed to enhance performance and comfort during high-intensity workouts, supporting stability and energy return.

E-commerce Growth and Digital Transformation

The expansion of e-commerce and digital channels has significantly impacted the UK Activewear Market. With the rise of online shopping, consumers are now able to access a wider variety of activewear products from global and local brands. Online platforms offer convenience, personalized shopping experiences, and access to international markets, driving increased sales. E-commerce has also allowed brands to capitalize on data analytics to better understand consumer preferences and tailor their offerings, further stimulating demand and supporting growth in the activewear sector.

Key Trends & Opportunities

Sustainability and Eco-friendly Materials

Sustainability is becoming a major trend in the UK Activewear Market as consumers and brands alike focus on reducing environmental impact. There is a growing preference for eco-friendly materials, such as organic cotton, recycled polyester, and biodegradable fabrics. Brands are increasingly adopting sustainable practices, including eco-conscious manufacturing processes and offering products made from recycled or natural materials. This trend presents a significant opportunity for companies to differentiate themselves in a competitive market while appealing to environmentally conscious consumers.

-

- For instance, TALA manufactures its SkinLuxe and DayFlex collections using at least 50% sustainable fibres, with their seamless factories powered by solar panels featuring on-site water recycling systems that clean and reuse water in the dyeing process.

Technological Integration in Activewear

The integration of technology into activewear is transforming the market with innovative products that offer added functionality. Smart fabrics and wearables that track performance metrics such as heart rate, calories burned, or muscle activity are gaining traction. Additionally, advancements in fabric technology, such as moisture-wicking materials and temperature-regulating fabrics, are improving performance and comfort. This trend offers opportunities for brands to develop more sophisticated products and cater to fitness enthusiasts looking for high-tech activewear solutions that enhance their workouts and daily activities.

-

- For instance, Hexoskin Smart Shirts incorporate three embedded cardiac sensors and dual-channel respiratory sensors that capture 1-lead ECG data at 256 Hz, enabling real-time monitoring of heart rate and breathing patterns with up to 36 hours of continuous data collection.

Key Challenges

Price Sensitivity and Economic Uncertainty

One of the key challenges facing the UK Activewear Market is price sensitivity among consumers, exacerbated by economic uncertainty. The rising cost of raw materials, production, and logistics has led to increased prices for activewear products. While premium products remain popular, many consumers are now more cautious about their spending, opting for lower-cost alternatives. This challenge forces brands to balance quality with affordability while remaining competitive in a market increasingly driven by value-conscious buyers.

Intense Market Competition

The UK Activewear Market faces intense competition from both established global players and emerging local brands. This competitive pressure makes it difficult for companies to differentiate themselves solely based on product offerings. To remain competitive, brands need to innovate continuously, focusing on unique designs, high-quality fabrics, or additional features like smart technology. Moreover, smaller players must find ways to effectively compete with major brands with larger marketing budgets and established consumer loyalty.

Regional Analysis

England

England dominates the UK Activewear Market, accounting for the largest share of 55% in 2024. The region benefits from a high concentration of urban areas, with London serving as a major fashion and fitness hub. The growing trend of athleisure, combined with a strong fitness culture, has driven the demand for activewear, particularly in metropolitan areas. Additionally, England’s expansive e-commerce infrastructure and widespread digital adoption have contributed to increased sales. The demand for high-performance and stylish activewear continues to be fueled by health-conscious consumers across the region, ensuring sustained market growth.

Scotland

Scotland holds a significant share of 15% in the UK Activewear Market in 2024. The region’s active lifestyle, particularly in outdoor sports such as hiking, cycling, and running, drives the demand for durable and performance-focused activewear. As a result, activewear brands offering specialized gear for these activities experience strong sales. Moreover, Scotland’s growing trend towards fitness and wellness, paired with the increased adoption of e-commerce, is contributing to the market’s growth. The demand for high-quality, sustainable activewear is particularly notable, with Scottish consumers leaning towards eco-conscious options.

Wales

Wales captures 10% of the UK Activewear Market share in 2024. The activewear market in Wales is driven by increasing participation in recreational activities, including rugby, walking, and fitness training. While the region has a smaller market size compared to England and Scotland, growing consumer interest in health and fitness is driving demand for high-performance activewear. E-commerce growth has also supported increased market penetration in the region. The Welsh preference for durable and comfortable activewear continues to create opportunities for brands that cater to both sports and lifestyle needs, contributing to market expansion.

Northern Ireland

Northern Ireland represents 7% of the UK Activewear Market in 2024. While the market size is smaller, the region has seen an uptick in health-conscious behaviors, especially among the younger demographic. There is growing demand for activewear that blends functionality and fashion, particularly in urban centers such as Belfast. The expansion of online shopping and a shift towards fitness activities are boosting sales, while local retailers offer increasing options for activewear products. Northern Ireland’s market growth remains steady, driven by consumer preferences for comfortable, stylish, and performance-oriented products.

South West and South East England

The South West and South East regions of England together contribute 13% to the UK Activewear Market in 2024. These regions have a strong consumer base focused on outdoor and leisure activities such as walking, hiking, and cycling. The demand for activewear products designed for these activities is robust, with an increasing preference for eco-friendly and sustainable options. The presence of major urban centers and strong retail networks also supports market growth. These regions benefit from both a strong local market and a rising trend in e-commerce, which further drives demand for activewear products.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swimwear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material

By Price Range

- Mid-Range

- Premium

- Economy

By Distribution Channel

By Region

- England

- Scotland

- Wales

- Northern Ireland

- South West and South East England

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Competitive Landscape

The UK Activewear Market is highly competitive, with major players such as Nike Inc., Adidas AG, Puma, Under Armour, Gymshark, and Sweaty Betty leading the market. These companies dominate the industry by offering a diverse range of products catering to both fitness enthusiasts and fashion-forward consumers. Nike and Adidas maintain significant market shares by capitalizing on their strong brand recognition, extensive distribution networks, and continual product innovation. Gymshark, a UK-based brand, has rapidly gained traction through its social media marketing strategies and focus on athleisure. The growing popularity of e-commerce has further intensified competition, with brands increasingly leveraging online platforms to reach a wider consumer base. Additionally, the trend toward sustainability has prompted many companies to adopt eco-friendly materials and production processes. Smaller, niche players are also emerging, focusing on specialized activewear for specific sports or outdoor activities, further diversifying the competitive landscape in the UK.

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Gymshark (UK-founded)

- Sweaty Betty (UK-based)

- Lululemon Athletica

- ASICS Corporation

- Reebok

- Fabletics

Recent Developments

- In April 2025, MP Activewear (part of The Hut Group) launched its range in-store at 20 UK Decathlon outlets, marking its first major physical‑retail partnership in the UK.

- In February 2024, Marks & Spencer announced that global sports‑brands Puma and Reebok would join its “The Sports Edit on M&S.com” platform in February–March to bolster its activewear lineup.

- In October 2025, Umbro linked with Australia’s Mertra for its first‑ever collaboration, announced 29 October 2025.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Price Range, Fabric, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Activewear Market is expected to continue its growth trajectory, driven by increasing consumer demand for versatile and functional clothing.

- Athleisure will remain a dominant trend, with more consumers opting for activewear suitable for both fitness and daily wear.

- The rise in health consciousness will continue to boost the demand for activewear, particularly for sports-specific apparel.

- E-commerce will play an increasingly important role in the distribution of activewear, as more consumers prefer the convenience of online shopping.

- The shift towards sustainable and eco-friendly materials will accelerate, with brands focusing on reducing their environmental footprint.

- Technological advancements in fabric, such as moisture-wicking and temperature-regulating materials, will drive innovation in activewear products.

- There will be a growing focus on personalized and custom-fit activewear, catering to individual preferences and body types.

- The youth demographic will remain a key driver of the market, with younger consumers placing greater emphasis on style and comfort.

- The expansion of fitness trends such as yoga, cycling, and running will fuel the demand for specialized activewear designed for these activities.

- Increased brand collaboration and partnerships, particularly in the athleisure sector, will lead to new product lines and expanded consumer reach.

Market Insights

Market Insights