Market overview

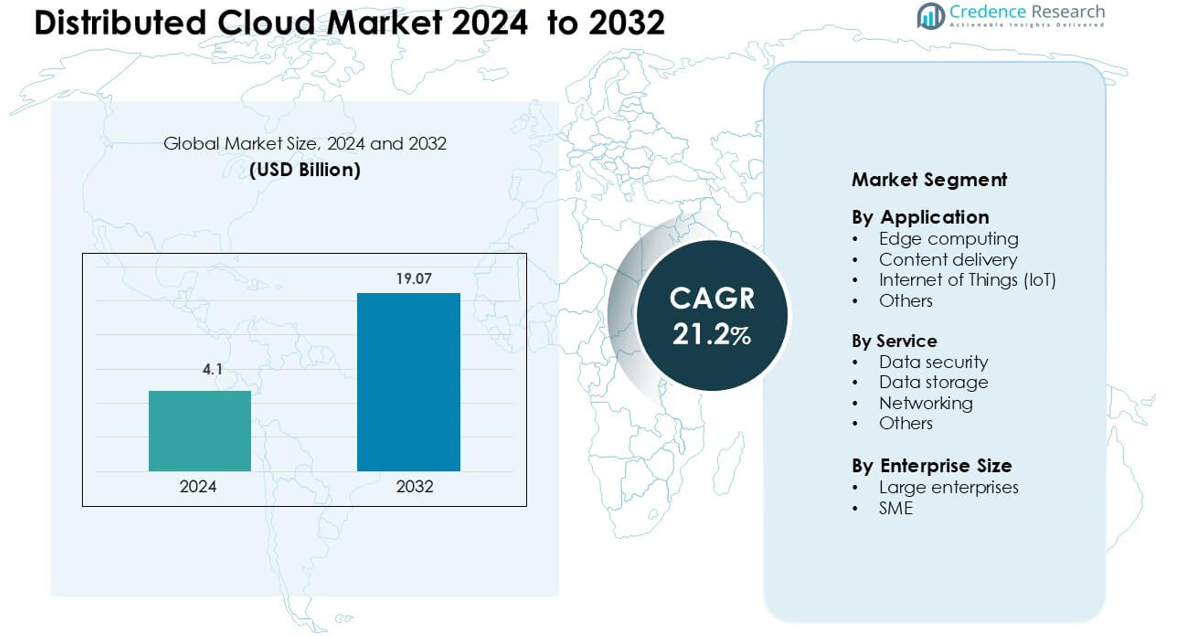

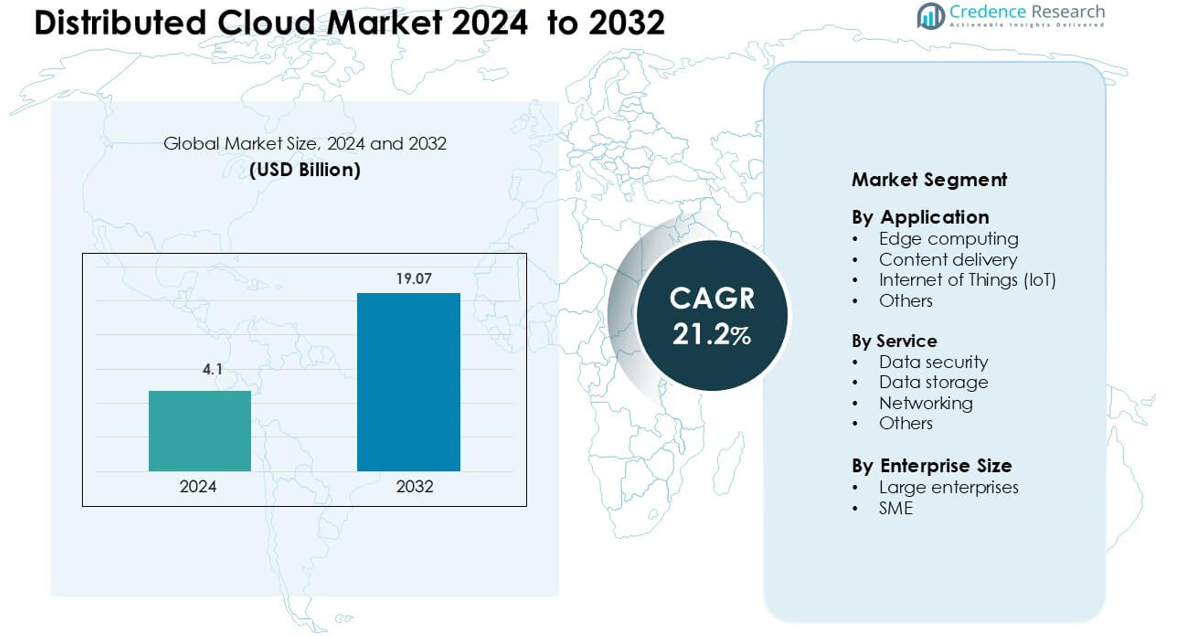

Distributed Cloud Market was valued at USD 4.1 billion in 2024 and is anticipated to reach USD 19.07 billion by 2032, growing at a CAGR of 21.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distributed Cloud Market Size 2024 |

USD 4.1 billion |

| Distributed Cloud Market, CAGR |

21.2% |

| Distributed Cloud Market Size 2032 |

USD 19.07 billion |

The distributed cloud market is led by major players such as Amazon Web Services, Microsoft Corporation, Google LLC (Alphabet Inc.), IBM Corporation, Oracle Corporation, VMware, F5, Wind River Systems, Teradata, and Cubbit Srl. These companies dominate through extensive global cloud infrastructure, advanced data management capabilities, and continuous innovation in edge and hybrid cloud technologies. Strategic alliances with telecom providers and AI-driven automation tools further strengthen their competitive positioning. Geographically, North America leads the distributed cloud market with a 38% share in 2024, driven by robust digital infrastructure, widespread enterprise adoption, and strong regulatory frameworks supporting data security and localization.

Market Insights

- The Distributed Cloud Market was valued at USD 4.1 billion in 2024 and is projected to reach USD 19.07 billion by 2032, growing at a CAGR of 21.2% during the forecast period.

- Key drivers include rising demand for low-latency computing, rapid digital transformation, and increased adoption of multi-cloud and hybrid IT models across industries.

- Emerging trends highlight the integration of edge computing, AI-driven automation, and industry-specific distributed cloud solutions enhancing scalability and compliance.

- The market is moderately consolidated, with major players such as Amazon Web Services, Microsoft, Google, IBM, and Oracle dominating, while regional firms like Cubbit Srl and Wind River Systems strengthen niche innovation.

- North America leads with a 38% share, followed by Europe at 28% and Asia Pacific at 24%; by application, edge computing accounts for over 40% of the market due to growing real-time data processing needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The edge computing segment dominates the distributed cloud market, accounting for over 40% of the total share in 2024. This dominance is driven by the growing demand for low-latency data processing and real-time analytics across industries such as manufacturing, telecommunications, and autonomous mobility. Distributed cloud infrastructure enables efficient workload distribution and data localization, enhancing performance and compliance. The surge in 5G deployment and AI-powered edge applications further accelerates adoption, as enterprises seek scalable, secure, and responsive computing environments close to end users.

- For instance, Microsoft operates over 150 edge sites across more than 50 countries, providing sub-30 ms latency to more than 80% of its global audience, illustrating scalable global reach.

By Service

Data storage is the leading service segment, capturing nearly 38% of the distributed cloud market share. Its growth is propelled by the exponential rise in unstructured data from IoT devices, social media, and enterprise applications. Organizations are increasingly adopting distributed storage models to ensure data redundancy, faster retrieval, and regulatory compliance. The integration of hybrid and multi-cloud strategies supports business continuity and cost optimization. Moreover, advancements in distributed databases and object storage systems enable enhanced scalability and accessibility, reinforcing data storage as the cornerstone of distributed cloud services.

- For instance, Amazon S3 supports individual objects up to 5 TB in size and stores more than 350 trillion objects globally.

By Enterprise Size

Large enterprises hold the dominant position in the distributed cloud market, representing approximately 65% of the share in 2024. Their strong adoption is attributed to the need for advanced IT infrastructure, robust data governance, and compliance management across global operations. Large organizations leverage distributed cloud models to optimize workload placement, enhance resilience, and reduce latency for mission-critical applications. Meanwhile, SMEs are gradually increasing adoption due to the availability of cost-efficient, managed distributed cloud services that simplify deployment and scalability without extensive in-house IT resources.

Key Growth Drivers

Rising Demand for Low-Latency and Real-Time Data Processing

The increasing adoption of latency-sensitive applications such as autonomous vehicles, remote healthcare, and industrial automation is propelling the demand for distributed cloud solutions. These architectures enable data processing closer to the source, minimizing latency and improving real-time responsiveness. With the proliferation of IoT devices and 5G networks, enterprises are prioritizing distributed infrastructures to enhance user experience and operational efficiency. The ability to deliver instant analytics and support mission-critical workloads at the edge positions distributed cloud systems as a strategic enabler of digital transformation across industries.

- For instance, Azure Cosmos DB’s Service Level Agreement (SLA) specifically guarantees less than 10 ms for both point-reads and point-writes at the 99th percentile for single-region accounts with direct connectivity.

Expansion of Multi-Cloud and Hybrid IT Strategies

Organizations are increasingly shifting from traditional centralized cloud models to distributed cloud environments to achieve greater flexibility and control. The growing complexity of enterprise data management and regulatory compliance requirements drives this shift. Distributed cloud systems facilitate workload placement across multiple cloud and on-premises environments while maintaining unified governance and security. This approach allows enterprises to leverage the best features of public and private clouds, optimize costs, and ensure business continuity. The trend toward hybrid IT infrastructure continues to accelerate market growth globally.

- For instance, Google Anthos supports over 30 hardware, software and system-integration partners enabling enterprises to deploy workloads across on-premises and public clouds seamlessly.

Growing Emphasis on Data Sovereignty and Compliance

Regulatory frameworks emphasizing data localization and privacy, such as GDPR and regional data protection laws, are fueling the adoption of distributed cloud models. These systems allow organizations to store and process data within specific geographic boundaries, ensuring compliance with local regulations. By deploying cloud services closer to end users, companies reduce data transfer risks and enhance security oversight. This capability is particularly critical for sectors like finance, healthcare, and government, where data sovereignty is a top priority. As global data governance standards tighten, distributed cloud deployment becomes a preferred choice for regulated enterprises.

Key Trends & Opportunities

Integration of Edge and AI-Driven Cloud Infrastructure

The convergence of distributed cloud with edge computing and artificial intelligence presents a major growth opportunity. Organizations are leveraging AI-powered edge analytics to process and interpret data locally, enabling faster decision-making and reduced network dependency. This integration supports emerging use cases in predictive maintenance, smart cities, and autonomous systems. Cloud providers are increasingly deploying micro data centers and AI-optimized hardware at edge nodes to enhance scalability and performance. The growing synergy between AI, IoT, and distributed cloud ecosystems is expected to redefine enterprise computing and drive innovation across multiple verticals.

- For instance, AWS Wavelength Zones allow developers to deploy applications in carrier 5G networks, co-located with edge infrastructure, offering ultra-low latency user experiences in edge gaming and AR/VR use-cases.

Expansion of Industry-Specific Distributed Cloud Solutions

Cloud service providers are developing industry-tailored distributed cloud frameworks to address the unique needs of verticals such as manufacturing, healthcare, retail, and telecommunications. These customized solutions offer optimized latency, enhanced data protection, and domain-specific compliance support. For instance, distributed healthcare clouds facilitate secure patient data exchange, while retail clouds enable real-time inventory and demand analytics. The growing adoption of verticalized cloud ecosystems creates new monetization avenues for providers and supports enterprises in achieving faster digital transformation. This trend underscores the market’s shift toward specialization and localized service delivery.

- For instance, ZStack Healthcare Industry Solutions supported over 600 VMware-to-ZStack migrations across hospitals and enabled elastic bare-metal GPU virtualization for PACS and medical AI workloads.

Key Challenges

Complexity in Network and Infrastructure Management

Managing a distributed cloud environment presents significant operational challenges due to its geographically dispersed nature. Coordinating data consistency, workload balancing, and security across multiple nodes requires advanced orchestration tools and skilled personnel. Integration with legacy IT systems further complicates deployment, often leading to interoperability issues and increased maintenance costs. Moreover, ensuring seamless connectivity between public and private infrastructures demands robust network optimization strategies. Enterprises must invest in automation, unified management platforms, and continuous monitoring to overcome these complexities and fully leverage distributed cloud benefits.

Data Security and Privacy Concerns

Despite offering localized control, distributed cloud systems expose organizations to new security vulnerabilities. The decentralized structure increases the attack surface, making it harder to enforce consistent security policies across all environments. Data transfer between nodes can lead to exposure risks if encryption and access controls are inadequately implemented. Additionally, compliance management becomes challenging when handling cross-border data operations. Cybersecurity threats such as ransomware and edge-based attacks further intensify these concerns. To mitigate risks, enterprises need to adopt zero-trust security models, advanced encryption standards, and automated compliance monitoring frameworks.

Regional Analysis

North America

North America holds the largest share of the distributed cloud market, accounting for over 38% in 2024. The region’s leadership is driven by advanced cloud infrastructure, strong presence of major providers such as Amazon Web Services, Microsoft, and Google Cloud, and rapid adoption of edge computing solutions. Enterprises across sectors like BFSI, healthcare, and retail are leveraging distributed cloud models to enhance data localization and performance. Additionally, government initiatives supporting data security and digital transformation continue to strengthen market growth, with the U.S. serving as the key contributor.

Europe

Europe represents nearly 28% of the global distributed cloud market, supported by stringent data protection laws such as GDPR and rising investments in sovereign cloud initiatives. Countries like Germany, the U.K., and France are at the forefront, emphasizing secure, compliant, and energy-efficient cloud infrastructure. The demand for localized data processing in public administration, financial services, and manufacturing sectors accelerates adoption. Collaboration between European cloud providers and hyperscalers to build region-specific distributed networks also fosters growth. The region’s focus on digital resilience and data autonomy positions it as a strategic market for expansion.

Asia Pacific

Asia Pacific accounts for approximately 24% of the distributed cloud market and is the fastest-growing regional segment. The expansion of 5G networks, booming e-commerce ecosystem, and increasing cloud adoption among SMEs drive market acceleration. China, Japan, India, and South Korea are key growth engines, with rising demand for low-latency applications in manufacturing, telecom, and smart city projects. Government-backed digital transformation programs and local data sovereignty regulations further encourage distributed cloud deployment. As regional enterprises modernize their IT infrastructure, Asia Pacific is expected to register the highest CAGR during the forecast period.

Latin America

Latin America holds a smaller but rapidly expanding share of about 6% in the global distributed cloud market. Growth is primarily driven by increasing enterprise cloud adoption, digital banking penetration, and government-led data localization policies. Countries such as Brazil, Mexico, and Chile are witnessing a surge in demand for hybrid and distributed cloud frameworks that support remote operations and data compliance. The emergence of regional data centers by global cloud providers is improving accessibility and performance. Continued investments in connectivity and regulatory alignment are expected to boost market penetration in the coming years.

Middle East & Africa

The Middle East & Africa region represents nearly 4% of the distributed cloud market, with strong momentum in the Gulf Cooperation Council (GCC) countries. Nations such as the UAE and Saudi Arabia are investing heavily in digital infrastructure to support smart governance, fintech, and AI-driven public services. The region’s growing focus on data sovereignty and local data center expansion underpins demand for distributed cloud models. In Africa, improving broadband access and rising cloud-based enterprise adoption contribute to steady growth. Strategic partnerships between governments and hyperscale providers are fostering cloud localization and innovation.

Market Segmentations

By Application

- Edge computing

- Content delivery

- Internet of Things (IoT)

- Others

By Service

- Data security

- Data storage

- Networking

- Others

By Enterprise Size

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the distributed cloud market is characterized by the strong presence of global technology giants and emerging innovators focusing on edge computing, data security, and hybrid cloud integration. Leading players such as Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, and Oracle Corporation dominate the market through extensive cloud infrastructure, advanced analytics capabilities, and strategic global partnerships. These companies are expanding their distributed cloud networks to support regional data compliance and low-latency service delivery. Meanwhile, firms like VMware, F5, and Wind River Systems are enhancing their portfolios with virtualization, networking, and edge management solutions. European providers such as Cubbit Srl are contributing to decentralized storage innovations, while Teradata focuses on distributed data analytics. The market is witnessing rising collaboration between hyperscalers and telecom operators to integrate 5G-enabled edge networks, underscoring a competitive shift toward interoperability, data sovereignty, and AI-driven automation across distributed cloud ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amazon Web Services, Inc. (U.S.)

- IBM Corporation (U.S.)

- F5, Inc. (U.S.)

- Oracle Corporation (U.S.)

- Cubbit Srl (Italy)

- VMware, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Wind River Systems, Inc. (U.S.)

- Alphabet, Inc. (Google LLC) (U.S.)

- Teradata (U.S.)

Recent Developments

- In October 2025, IBM Corporation (U.S.) IBM partnered with Bharti Airtel to power the new Airtel Cloud platform and expand distributed hybrid cloud services in India. The deal includes building two new multizone regions in Mumbai and Chennai, spreading infrastructure across multiple sites to improve resilience and meet data residency rules.

- In December 2024, IBM Corporation (U.S.) IBM announced the deprecation of IBM Cloud Object Storage for IBM Cloud Satellite, its distributed cloud platform. From December 2024, the Satellite object storage option enters a phased retirement, pushing customers toward alternative storage architectures while IBM continues positioning Satellite as a managed distributed cloud for regulated and edge workloads

Report Coverage

The research report offers an in-depth analysis based on Application, Service, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The distributed cloud market will experience strong growth as enterprises prioritize low-latency and data-localized computing.

- Integration of AI and machine learning will enhance automation, scalability, and predictive cloud management.

- Edge computing will continue to dominate applications, supporting real-time analytics and IoT ecosystems.

- Hybrid and multi-cloud adoption will expand as businesses seek flexibility and cost optimization.

- Data sovereignty regulations will drive demand for region-specific and compliant cloud deployments.

- Telecom operators will play a key role through 5G-enabled edge cloud infrastructure partnerships.

- Industry-specific cloud solutions will emerge across healthcare, manufacturing, and financial services.

- Advancements in security and encryption will strengthen trust in distributed cloud architectures.

- SMEs will increasingly adopt managed distributed cloud services for scalability and operational efficiency.

- Global providers will expand investments in localized data centers to enhance performance and reliability.