Market overview

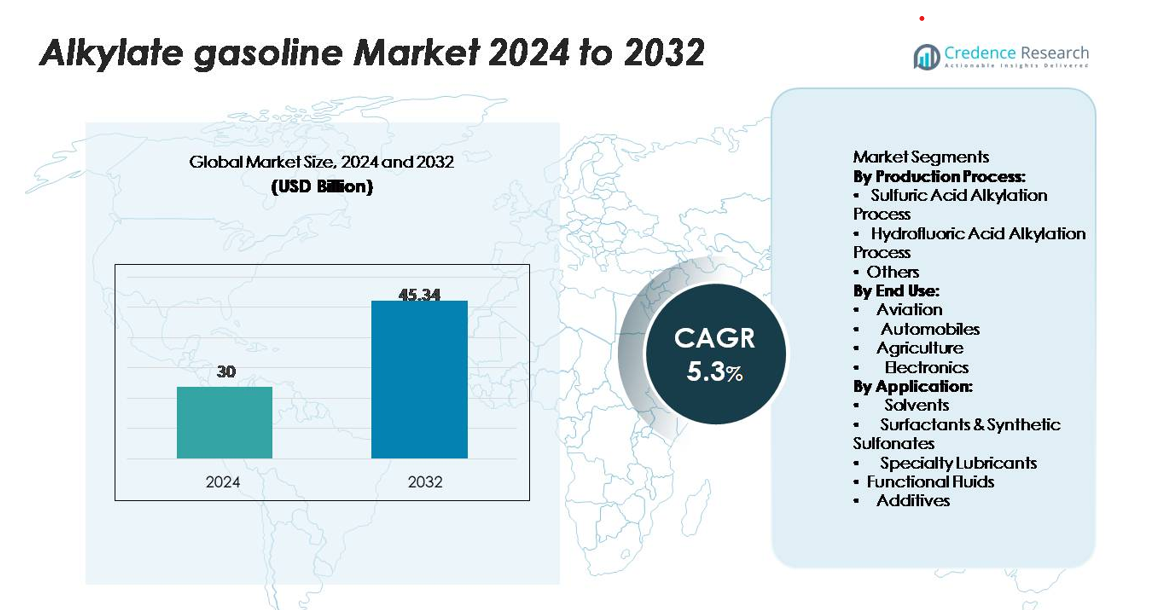

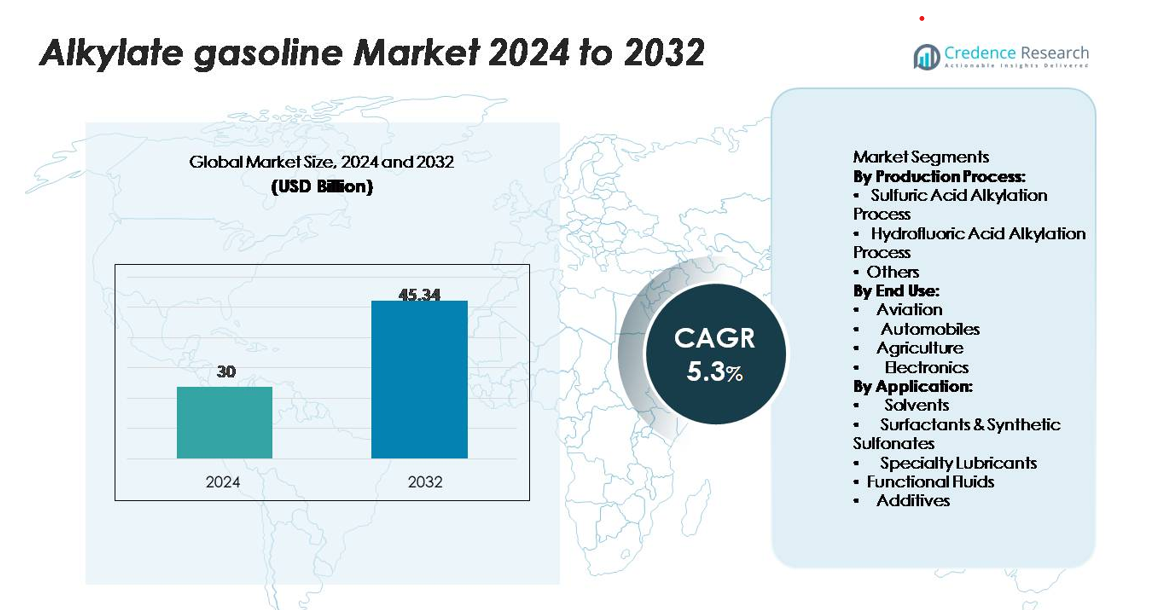

The global alkylate gasoline market was valued at USD 30 billion in 2024 and is projected to reach USD 45.34 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alkylate Gasoline Market Size 2024 |

USD 30 billion |

| Alkylate Gasoline Market, CAGR |

5.3% |

| Alkylate Gasoline Market Size 2032 |

USD 45.34 billion |

The global alkylate gasoline market features several established players that shape competitive dynamics through advanced refining capabilities and strong global networks. Leading companies include Neste Oyj, Warter Fuels, Preem, Haltermann, Aspen, Hercutec Chemie, Gulf Pro Fuels, Lukoil, Royal Dutch Shell plc, and BP plc. These suppliers focus on producing high-purity alkylate with low aromatics, low sulfur, and high octane levels that meet strict international fuel standards. These companies leverage strong refining capability, global logistics and regulatory compliance to compete effectively. Regionally, Europe leads the market with approximately 35% share, driven by stringent emission standards and high adoption of cleaner‑burning fuels

Market Insights

- The market stood at USD 30 billion in 2024 and is projected to reach USD 45.34 billion by 2032, reflecting a CAGR of 5.3%.

- Strong demand from the automotive sector, combined with stricter fuel‑emission regulations, drives growth. The dominance of the automobile end‑use segment (≈52% share) further supports expansion.

- A key trend lies in the shift toward sulfur‑ and aromatics‑free alkylate gasoline, along with capacity upgrades and new process technologies like solid‑acid alkylation. Europe leads regionally with about 35% share, followed by North America (~30%) and Asia‑Pacific (~25%).

- In terms of competitive dynamics, the market features consolidated major refiners partnering with technology licensors and expanding globally; high entry barriers maintain incumbent advantages.

- Feed‑stock price volatility and operational risks from acid‑based alkylation (safety, environmental compliance) act as major restraints, limiting quick scalability and increasing cost pressures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Production Process:

The sulfuric acid alkylation process dominates the market with a 46% share due to its efficiency and widespread adoption in refineries. This process offers high octane output and flexibility in feedstock usage, making it suitable for large-scale gasoline blending. Hydrofluoric acid alkylation holds a smaller share but is preferred in regions requiring ultra-low sulfur fuels. Technological upgrades and safety improvements in acid handling further drive growth. The “Others” category, including solid acid and ionic liquid alkylation, is emerging due to environmental and safety advantages, presenting opportunities for future adoption.

- For instance, ExxonMobil’s Baytown refinery operates a sulfuric acid alkylation unit with a total capacity of approximately 44,500 barrels per day (BPD), producing high-octane blending components at reaction temperatures around 5–10 °C and acid concentrations near 93% H₂SO₄.

By End Use:

Automobiles represent the largest end-use segment with a 52% market share, fueled by global gasoline consumption growth and rising vehicle ownership. High-octane alkylate gasoline improves engine efficiency, reduces knocking, and meets emission standards, driving adoption in passenger and commercial vehicles. Aviation fuels hold a significant niche share due to stringent performance requirements, while agriculture and electronics applications benefit from specialized blends. Expanding urbanization, fleet modernization, and government incentives for cleaner fuels underpin demand, encouraging refiners to optimize production for automotive-grade alkylates.

- For instance, The Pemex Deer Park refinery operates an alkylation unit as part of its refining process, which contributes to the production of high-purity motor fuels, such as gasoline, diesel, and jet fuel.

By Application:

Solvents are the dominant application segment with a 38% share, supported by alkylate gasoline’s clean-burning and high-octane properties. Surfactants and synthetic sulfonates, specialty lubricants, functional fluids, and additives segments benefit from its chemical stability and low aromatics content. Industrial adoption in chemical manufacturing, coatings, and lubrication industries drives market expansion. Companies focus on producing high-purity alkylates for performance-critical applications. Increasing regulatory emphasis on environmental compliance and low-emission products fuels demand across all applications, positioning solvents as the primary growth driver in the alkylate gasoline market.

Key Growth Drivers

Rising Demand for Cleaner Fuels

Global regulatory frameworks and environmental policies are accelerating the adoption of low-emission fuels, driving alkylate gasoline demand. The fuel’s high-octane, low-sulfur, and low-aromatic characteristics make it an ideal blending component for gasoline, reducing harmful emissions and improving engine performance. For instance, refiners in North America and Europe are upgrading alkylation units to comply with stringent emission standards while meeting increasing consumer demand for environmentally friendly fuels. Growth in urban transportation, expanding vehicle fleets, and adoption of modern internal combustion engines further stimulate market expansion. Additionally, government incentives for cleaner fuels and green refinery initiatives create opportunities for producers to scale production and diversify into high-performance fuel blends, reinforcing alkylate gasoline’s strategic role in sustainable energy portfolios.

- For instance, Next Wave Energy Partners LP’s Project Traveler facility achieved commercial operations in March 2024 and produces an alkylate feedstock marketed as “Optimate” with a road octane rating of 0, a Reid Vapor Pressure of 3.5 psia, and a sulfur content of five parts per million or less.

Technological Advancements in Alkylation Processes

Innovations in sulfuric acid and hydrofluoric acid alkylation processes enhance operational efficiency and product yield, supporting market growth. Modern catalytic systems, improved process controls, and safety enhancements reduce environmental risks and optimize feedstock utilization. For instance, TotalEnergies and ExxonMobil have implemented advanced sulfuric acid alkylation units capable of handling heavier olefins while minimizing waste generation. Solid acid and ionic liquid-based alkylation technologies are also emerging, offering eco-friendly alternatives with reduced chemical hazards. These advancements allow refiners to produce high-purity, high-octane gasoline while complying with evolving regulatory requirements. Continuous R&D in process intensification and modular unit designs further expands adoption in both established and emerging markets.

- For instance, ExxonMobil’s ALKEMAX™ sulfuric acid alkylation units support a single‑reactor capacity of up to 12 000 barrels per day, using auto‑refrigeration to reduce compressor load and power usage.

Expansion of Transportation and Industrial Sectors

Growing vehicle ownership, urbanization, and industrialization across Asia Pacific, North America, and the Middle East are major growth drivers. Alkylate gasoline is increasingly used in passenger cars, commercial vehicles, and aviation fuel blends due to its superior combustion characteristics. For instance, Asia Pacific refiners are scaling alkylation capacities to meet rising demand from automotive and industrial fuel markets. Industrial applications, including solvents, specialty lubricants, and functional fluids, further support consumption. Infrastructure expansion, government incentives for cleaner energy, and rising fuel consumption in developing economies provide sustainable growth opportunities for market participants. Companies investing in capacity enhancement and geographic expansion strengthen their competitive position.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Fuels

Refiners are increasingly adopting eco-friendly alkylation technologies to produce low-aromatic, high-octane gasoline. This trend aligns with global carbon reduction goals and government mandates on cleaner fuels. For instance, firms are integrating solid acid and ionic liquid alkylation units to minimize hazardous byproducts and enhance energy efficiency. Expansion of low-emission vehicle fleets and rising environmental awareness among consumers create significant opportunities for refined fuel markets. Additionally, cross-industry collaboration between oil companies and chemical manufacturers accelerates the development of specialty applications in solvents, surfactants, and additives, driving diversified revenue streams.

- For instance, Honeywell UOP reports that its commercial ISOALKY™ ionic-liquid alkylation unit, commissioned at Chevron’s Salt Lake City refinery, produces alkylate with a Research Octane Number above 98, operates at significantly lower acid consumption than traditional sulfuric systems, and eliminates handling of hazardous HF or H₂SO₄.

Integration of Advanced Refinery Technologies

The incorporation of digital monitoring, predictive maintenance, and automation in alkylation units is reshaping production efficiency. Companies like ExxonMobil and TotalEnergies employ smart sensors and process optimization software to enhance yield, reduce downtime, and ensure product quality. Modular and compact alkylation units facilitate deployment in space-constrained refineries and urban industrial zones. These technological adoptions reduce operational risks, improve environmental compliance, and lower production costs. The trend opens avenues for investment in retrofitting existing facilities and developing next-generation refineries capable of producing high-performance alkylate gasoline.

- For instance, ExxonMobil licenses its ALKEMAX™ sulfuric acid alkylation technology, which is a real, widely used product known for its efficiency and reliability.

Key Challenges

High Operational and Safety Risks

Handling sulfuric acid and hydrofluoric acid in alkylation processes poses significant safety and environmental challenges. Accidental leaks or improper storage can result in severe hazards, making compliance with safety standards and rigorous training mandatory. Refineries must invest heavily in protective infrastructure, emergency response systems, and waste neutralization technologies. These high operational costs can limit small and mid-sized producers from scaling alkylation capacities. Additionally, stringent regulatory scrutiny in regions like North America and Europe increases capital expenditures and operational complexity, affecting profit margins and market entry strategies.

Volatility in Raw Material Supply and Costs

Alkylate gasoline production depends on feedstocks such as olefins and isobutane, whose prices fluctuate due to crude oil and natural gas market dynamics. Supply chain disruptions, geopolitical tensions, and refining capacity constraints can lead to sudden cost increases, impacting profitability. For instance, olefin scarcity in regions with limited refining infrastructure may delay alkylation unit output. Producers must implement strategic sourcing, long-term contracts, and process optimization to mitigate volatility. Persistent raw material cost fluctuations and regional supply inconsistencies remain a major challenge for consistent production and market stability.

Regional Analysis

North America

North America holds approximately 30% of the global alkylate gasoline market share, driven by strong refining infrastructure and high gasoline demand. The region benefits from stringent emission standards and a mature automotive sector that values high‑octane, low‑aromatic fuel blends. Increased investment in alkylation units and capacity upgrades support growth, while rising demand in aerospace and specialty fuel applications further expands the market. Producers exploit stable feedstock supplies and regulatory alignment to deepen regional penetration.

Europe

Europe commands the largest regional share at around 35%, supported by aggressive carbon‑emission regulations and mandated cleaner fuel use. Refiners in Germany, France, and the UK increasingly use alkylate gasoline as a blending component to satisfy Euro‑6 and other standards. The expanding high‑performance vehicle market, coupled with chemical industry demand for low‑aromatic solvents, sustains growth. Investments in safer alkylation technologies and capacity expansion strengthen Europe’s leading position.

Asia Pacific

Asia Pacific captures roughly 25% of market share and offers the fastest growth trajectory, thanks to rapid industrialization, rising vehicle ownership, and expanding aviation sectors. Countries such as China, India and Japan increase gasoline consumption and demand for cleaner fuel components. Refiners capitalize on feedstock availability and supportive government policies aimed at lowering emissions. Capacity additions in the region aim to meet both domestic and export‑oriented alkylate gasoline demand.

Latin America

Latin America accounts for about 6% of global share, with increasing refinery upgrades and adoption of cleaner gasoline blends helping to grow the market. Growth in the automotive and agricultural sectors combined with moderate regulatory pressure for fuel quality improvement drive regional demand. Though infrastructure and feedstock constraints limit scale, strategic investments and partnerships are unlocking incremental growth opportunities in Brazil and Argentina.

Middle East & Africa (MEA)

The MEA region holds around 4% of the global market share as refiners respond to expanding petrochemical capacity and rising domestic fuel consumption. Emerging economies in the Middle East leverage low‑cost hydrocarbon resources to invest in alkylation units and integrate them into broader refining complexes. Africa’s growth remains nascent but presents potential as fuel standards tighten and infrastructure improves. Challenges include feedstock logistics and regulatory consistency across countries.

Market Segmentations:

By Production Process:

- Sulfuric Acid Alkylation Process

- Hydrofluoric Acid Alkylation Process

- Others

By End Use:

- Aviation

- Automobiles

- Agriculture

- Electronics

By Application:

- Solvents

- Surfactants & Synthetic Sulfonates

- Specialty Lubricants

- Functional Fluids

- Additives

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global alkylate gasoline market features a blend of major integrated refiners and specialised technology providers that shape market dynamics. Leading global oil companies — such as ExxonMobil Corporation, Royal Dutch Shell plc and BP plc — leverage their downstream infrastructure, refining capacity and international footprint to maintain strong market positions. Meanwhile, smaller and regional players focus on niche applications and regional supply chains to capture growth in specific segments. Strategic initiatives—such as mergers and acquisitions, alliances with catalyst technology providers, capacity expansions and production efficiency upgrades—are common. Companies increasingly invest in low‑hazard alkylation technologies and digital monitoring systems to reduce costs, enhance safety and comply with tightening fuel regulations. As a result, market entry remains challenging due to high capital intensity, technical complexity and regulatory hurdles, enabling incumbents to sustain competitive advantage through scale, technological depth and supply‑chain integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shell

- Lukoil

- Neste

- Preem

- BP

- Aspen

- Gulf Pro Fuels

- Haltermann

- Hercutec Chemie

- Warter Fuels

Recent Developments

- In March 2024, Next Wave Energy Partners LP launched Project Traveler, an ethylene-to-alkylate production plant at its Pasadena, Texas, site near the Houston Ship Channel. The plant is now producing Optimate, a low-sulfur, high-octane, low-RVP alkylate with zero olefins. This product is marketed as a gasoline blending component to meet North America’s growing demand for cleaner-burning fuels.

- In February 2022, Lummus Technology announced that Shandong Yulong Petrochemical, a subsidiary of Nanshan Group, has selected its CDAlky technology for a new 400 KTA alkylation unit. This unit will be part of Shandong Yulong’s 20,000 KTA Refining and Petrochemical Integrated Project in Shandong Province, China.

- In January 2022, awarded Lummus Technology a contract to licence both CD Etherol® and CD Alky® technologies for its alkylation and MTBE units at its Perm refinery, enhancing alkylate and ether‑blend production.

Report Coverage

The research report offers an in-depth analysis based on Production process, End use, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth in demand for high‑octane, low‑aromatic fuel blends will expand usage of alkylate gasoline.

- Refiners will increasingly invest in modern alkylation technologies, including solid‑acid and ionic liquid catalysts, to improve yields and safety.

- Expansion of automotive and aviation sectors in emerging markets will create significant volume opportunities for alkylate fuel blends.

- Regulatory push for cleaner fuels and stricter emission standards will drive alkylate adoption as a key blending component.

- Growth in industrial applications such as solvents, surfactants, specialty lubricants and functional fluids will diversify alkylate market use.

- Refinery players with integrated feedstock access and downstream capabilities will solidify competitive advantage.

- Market expansion will shift geographically toward Asia Pacific, led by China and India, while mature regions remain stable.

- Infrastructure investment and technological retrofits will unlock capacity in regions with limited alkylation units.

- Feedstock volatility and acid‑based process risks will require supply‑chain stability and safer technology adoption.

- E‑mobility and alternative fuels will challenge gasoline demand, pushing alkylate producers to pivot toward specialty applications.