Market overview

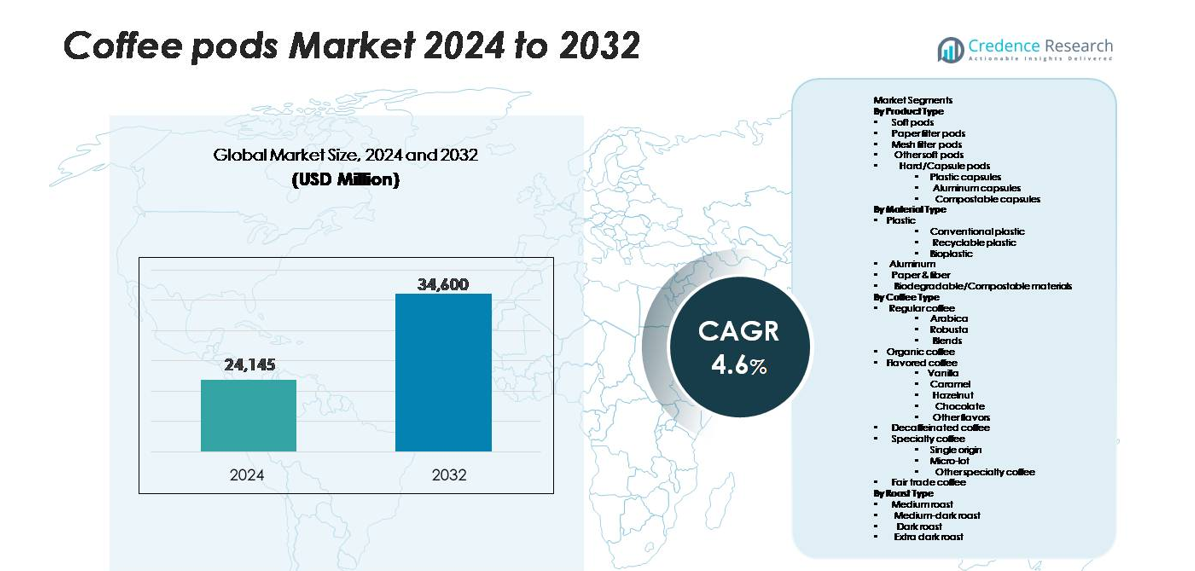

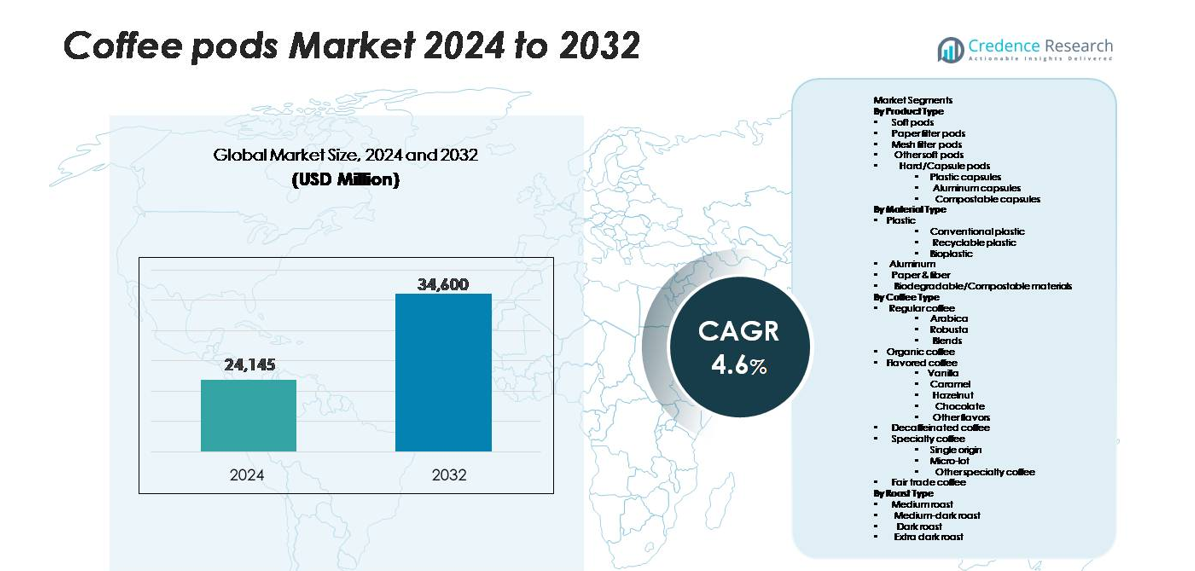

The coffee pods market size was valued at USD 24,145 million in 2024 and is projected to reach USD 34,600 million by 2032, registering a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Pods Market Size 2024 |

USD 24,145 million |

| Coffee Pods Market, CAGR |

4.6% |

| Coffee Pods Market Size 2032 |

USD 34,600 million |

The Coffee Pods market is dominated by major companies such as Costa Coffee, Peet’s Coffee, Tim Hortons, JDE Peet’s, Illycaffè S.p.A., Starbucks Corporation, Keurig Dr Pepper Inc., Caffè Nero, Nestlé S.A., and The Kraft Heinz Company. These brands compete through machine-compatible capsules, premium blends, and expanding flavored and specialty pod lines. Europe leads the market with 42% share, supported by strong café culture, early adoption of capsule machines, and growing demand for aluminum and compostable pods. North America follows with 34% share, driven by subscription models, large retail distribution, and increasing home consumption of premium single-serve beverages.

Market Insights

- The Coffee Pods market was valued at USD 24,145 million in 2024 and is projected to reach USD 34,600 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- Rising demand for single-serve convenience, premium coffee culture, and café-style beverages at home drives strong consumption. Capsule machines reduce brewing time, provide portion control, and support flavored, specialty, and barista-style drinks, boosting repeat pod purchases in retail and online channels.

- Premiumization and sustainability shape market trends as brands launch organic, fair-trade, single-origin, and compostable capsule formats. Younger consumers prefer flavored capsules such as hazelnut, caramel, chocolate, and vanilla, supporting high repeat sales.

- The competitive landscape includes Starbucks, Nestlé, Keurig Dr Pepper, JDE Peet’s, Costa Coffee, and others focusing on recyclable and compostable pods, subscription models, and machine compatibility to secure market share.

- Europe leads with 42% share, followed by North America at 34%, while hard/capsule pods dominate the product segment with 76% share. Price sensitivity and plastic waste concerns remain major restraints, encouraging a shift toward eco-friendly and budget capsule formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Hard/capsule pods lead the product type segment with nearly 76% market share, driven by strong adoption of single-serve brewing systems and growing compatibility across premium coffee machines. Plastic and aluminum capsule formats remain widely used due to airtight sealing and long shelf life, while compostable capsules gain momentum as brands respond to waste regulations and eco-conscious consumers. Soft pods, including paper and mesh filters, attract budget buyers and hotel chains, but premiumization trends keep capsule demand high in supermarkets, e-commerce platforms, and subscription services. Rising flavored capsule launches further strengthen category dominance.

- For instance, Nespresso’s Original Line machines extract at a calibrated pressure of 19 bar, and its aluminum capsules are engineered to maintain aroma stability for up to 12 months of sealed storage, demonstrating the technological advantage of capsule-based systems.

By Material Type

Plastic-based pods dominate the material segment with around 60% share, supported by mass production, lightweight structure, and strong sealing performance. Conventional plastic leads in volume, but recyclable plastic and bioplastics continue to gain traction as regulations target single-use waste. Aluminum pods grow as premium brands use airtight designs to preserve aroma and freshness, while paper and fiber pods appeal to environmentally conscious buyers who prefer biodegradable formats. Compostable materials remain the fastest-growing category as companies adopt plant-based polymers and industrial composting standards to reduce landfill pressure and improve brand sustainability perception.

- For instance, Lavazza’s compostable Eco Caps are produced with a plant-based biopolymer that completely decomposes in industrial composting facilities within 180 days according to EN 13432 certification standards, while maintaining capsule structure and extraction integrity during brewing.

By Coffee Type

Regular coffee holds the largest share with over 58% market contribution, led by Arabica-dominant blends that offer balanced taste and wide consumer acceptance. Specialty coffee grows steadily as single-origin and micro-lot pods target premium buyers seeking traceability and unique flavor profiles. Flavored varieties such as vanilla, caramel, hazelnut, and chocolate attract younger consumers and boost repeat purchases in retail and online channels. Organic and fair-trade coffee pods benefit from ethical sourcing and clean-label trends, while decaffeinated options serve health-conscious or caffeine-sensitive users without sacrificing convenience.

Key Growth Drivers

Rising Demand for Single-Serve Convenience

Single-serve brewing systems drive strong demand for coffee pods because they offer speed, portion control, and flavor consistency. Urban households adopt capsule machines as busy lifestyles reduce time for traditional brewing. Offices, hotels, and cafés also use pod systems to reduce wastage and preparation errors. Manufacturers expand machine compatibility across major brands, which increases repeat pod purchases and builds subscription revenue. Retailers promote multipack deals and bundle offers, encouraging trial and retention. Growing interest in premium beverages at home boosts flavored, specialty, and barista-style pod sales. Strong marketing by global coffee chains supports adoption in developing markets.

- For instance, Nespresso’s Original Line machines operate at a calibrated extraction pressure of 19 bar, while Keurig’s K-Elite brews a full cup in roughly 60 seconds using an internal pump designed for consistent extraction flow, demonstrating the efficiency advantage that drives single-serve adoption in both households and commercial spaces.

Product Premiumization and Specialty Coffee Growth

Premiumization remains a major driver as more consumers seek café-quality taste at home. Brands introduce single-origin, micro-lot, and gourmet blends in capsule form, strengthening the premium segment. Specialty coffee pods allow users to experience roast variations and unique flavor notes without expensive equipment. Companies upgrade extraction technology to maintain aroma and crema. Barista-style capsules support milk-based beverages like cappuccino and latte. Subscription-based models and personalized flavor bundles increase loyalty. Growing consumer awareness of bean sourcing, roasting styles, and origin stories also drives demand for traceable and high-quality capsule coffee.

- For instance, illycaffè s new X-Caps system uses Hyperinfusion technology that ensures water meets the coffee at optimal pressure for superior aromatic extraction, producing a rich, full-bodied espresso with a dense, long-lasting crema, demonstrating how precision extraction drives premium capsule performance and flavor integrity. precision extraction drives premium capsule performance and flavor integrity.Top of Form

Sustainable and Compostable Packaging Demand

Environmental concerns accelerate innovation in compostable and recyclable pod formats. Governments impose waste reduction rules on single-use plastics, pushing brands to shift toward biodegradable and paper-based materials. Companies introduce plant-based polymers, aluminum recycling programs, and industrial composting solutions. Clear labeling and eco-certifications help brands earn buyer trust. Sustainability also appeals to younger consumers who prefer ethical and low-waste packaging. Retailers highlight eco-friendly pods in premium and organic product shelves, improving visibility. Partnerships with recycling organizations support collection programs, reducing landfill impact and improving brand reputation.

Key Trends & Opportunities

Growth of Online Subscriptions and Direct-to-Consumer Sales

Online platforms create major growth opportunities through recurring subscriptions and custom flavor bundles. Consumers prefer doorstep delivery, discounted refills, and machine-plus-pod combo offers. Brands use data analytics to track flavor preferences and push personalized recommendations. E-commerce also enables small roasters and specialty brands to reach a wider audience without large retail investments. Seasonal editions, trial packs, and loyalty rewards increase engagement. Social media marketing helps new flavors gain fast adoption, while QR-linked traceability programs boost transparency.

- For instance, the barcode stores specific extraction parameters such as cup size, temperature, rotational speed of water flow, infusion time, and flow rate, which the machine reads to brew each blend with optimal aroma and crema consistency.

Innovation in Flavor Profiles and Functional Coffee Pods

Flavored and functional pods expand rapidly as buyers seek indulgent or health-focused options. Manufacturers introduce dessert-inspired flavors such as caramel, chocolate, hazelnut, and vanilla. Some brands add functional ingredients like collagen, vitamins, probiotics, or adaptogens. Limited-edition and café-style varieties help differentiate premium product lines. In emerging markets, local flavor customization strengthens regional positioning. The rise of vegan and dairy-free preferences also encourages plant-based milk-compatible capsules. These innovations improve product diversity and support repeat purchases.

- For instance, Nespresso introduced its Barista Creations line with flavor-infused capsules engineered for milk pairing, and the system’s Vertuo machines read a capsule barcode containing up to 400 encoded brewing parameters, including rotational speed of up to 7,000 rotations per minute and precise infusion timing, to create crema thickness comparable to café beverages, demonstrating how technology supports flavor innovation in pods.

Key Challenges

Environmental Impact and Waste Management Issues

Waste management remains one of the most persistent challenges. Many plastic capsules end up in landfills because waste collection systems are not designed for mixed-material pods. Recycling requires separation of coffee grounds, filters, and casings, making disposal complicated for consumers. Some regions lack industrial composting facilities to support biodegradable formats. Negative publicity around microplastics and single-use waste affects brand perception. Companies must invest in simple recycling programs, return-to-store drop-offs, or compostable materials to reduce criticism and meet regulatory pressure.

Price Sensitivity and Competition from Ground Coffee

Price remains a barrier, particularly in price-sensitive markets where traditional ground or instant coffee is cheaper. Pod systems require upfront machine cost plus recurring purchases, which limits adoption among low-income consumers. Local roasters and private-label brands intensify price competition with budget pods and refillable capsule solutions. Consumers who brew larger quantities also prefer ground coffee for cost efficiency. To overcome this challenge, brands use promotional packs, subscription discounts, and multi-brand machine compatibility to retain buyers and defend market share.

Regional Analysis

North America

North America holds 34% market share, driven by strong single-serve machine ownership, premium capsule adoption, and subscription-based sales. The U.S. leads due to high consumption of flavored and specialty pods, supported by wide retail distribution and compatibility across Keurig, Nespresso, and private-label systems. Consumers prefer convenience, consistent taste, and café-style beverages at home, which boosts repeat purchases. Brands expand recyclable and compostable capsule lines to meet sustainability expectations. Canada shows growing demand for organic, fair-trade, and aluminum-seal capsules in urban households. E-commerce platforms and direct-to-consumer models further accelerate market penetration across major metropolitan cities.

Europe

Europe commands 42% market share, making it the largest regional market. Rising preference for premium capsules, artisanal roasters, and espresso-based beverages drives consumption. Italy, France, Germany, and the UK lead due to strong café culture, high machine ownership, and early adoption of aluminum and compostable pods. Strict environmental regulations encourage brands to shift from traditional plastic toward biodegradable and recyclable materials. Private-label supermarket capsules gain traction by offering lower-cost alternatives with strong compatibility. Specialty coffee pods, fair-trade sourcing claims, and flavor diversification also support market expansion. Subscription models gain popularity among urban consumers seeking premium blends and single-origin varieties.

Asia Pacific

Asia Pacific holds 17% market share, with rapid growth fueled by rising urban incomes and café-style beverage trends at home. China, Japan, South Korea, and Australia lead adoption as consumers shift from instant coffee to capsule-based brewing. Premium imports, flavored pods, and milk-based capsule drinks support younger buyer segments. Retailers expand machine-plus-pod bundles, while e-commerce platforms increase access to international brands. Local roasters introduce region-specific flavors to build market differentiation. Growing café chains and hotel networks also support pod demand. Sustainability awareness increases interest in recyclable and compostable formats, particularly in Japan and Australia.

Latin America

Latin America accounts for 4% market share, supported by expanding middle-income households and rising interest in home coffee machines. Brazil, Mexico, and Argentina lead adoption as consumers seek café-quality beverages without high preparation time. Local roasters introduce capsule versions of regional beans, improving availability and flavor familiarity. Import tariffs and higher pod prices limit penetration in low-income groups, but multi-brand machine compatibility expands affordability. Retail chains and online marketplaces help smaller brands reach new customers. Compostable and paper-based formats attract environmentally conscious buyers, especially in urban regions where waste concerns are rising.

Middle East & Africa

The Middle East & Africa region holds 3% market share, but demand grows due to rising coffee culture and premium lifestyle trends in the UAE, Saudi Arabia, South Africa, and Turkey. Hotels and commercial offices increasingly adopt capsule machines for consistent beverage quality. Premium imports and flavored capsules attract younger consumers. High machine cost and uneven retail access restrict adoption in several African markets. Online retail channels help bridge availability gaps and offer competitive pricing. Sustainability campaigns and aluminum recycling programs gain traction in major Gulf cities, supporting gradual adoption of eco-friendly capsule lines.

Market Segmentation

By Product Type

- Soft pods

- Paper filter pods

- Mesh filter pods

- Other soft pods

- Hard/Capsule pods

- Plastic capsules

- Aluminum capsules

- Compostable capsules

By Material Type

- Plastic

- Conventional plastic

- Recyclable plastic

- Bioplastic

- Aluminum

- Paper & fiber

- Biodegradable/Compostable materials

By Coffee Type

- Regular coffee

- Organic coffee

- Flavored coffee

- Vanilla

- Caramel

- Hazelnut

- Chocolate

- Other flavors

- Decaffeinated coffee

- Specialty coffee

- Single origin

- Micro-lot

- Other specialty coffee

- Fair trade coffee

By Roast Type

- Medium roast

- Medium-dark roast

- Dark roast

- Extra dark roast

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Coffee Pods market features a mix of global coffee chains, capsule system manufacturers, and private-label brands competing on flavor range, machine compatibility, and sustainable packaging. Leading players invest in aluminum and compostable pod formats to address regulatory pressure and improve brand perception. Companies expand premium single-origin and flavored varieties to capture younger consumers seeking café-style beverages at home. Strategic partnerships with machine manufacturers help secure recurring pod sales through closed-system platforms. E-commerce and subscription models strengthen customer retention, while supermarkets expand shelf space for private-label capsules to attract price-sensitive buyers. Regional roasters gain traction by offering locally sourced beans and artisanal blends in compatible capsule formats. Marketing campaigns focus on aroma retention, freshness, and barista-quality crema to differentiate products. Sustainability programs, such as recycling schemes and plant-based materials, continue to shape competitive strategies. Overall, innovation in flavor, machine integration, and eco-friendly packaging remains central to defending market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Costa Coffee

- Peet’s Coffee

- Tim Hortons

- JDE Peet’s

- Illycaffè S.p.A.

- Starbucks Corporation

- Keurig Dr Pepper Inc.

- Caffè Nero

- Nestlé S.A.

- The Kraft Heinz Company

Recent Developments

- In February 2024, JDE Peet’s announced that starting in September 2024 it will manufacture, distribute and sell Costa-branded aluminium coffee capsules in Great Britain under the L’OR Barista system.

- In April 2023, Starbucks partnered with Nespresso to launch the Nespresso | Starbucks Reserve™ Remix Blend capsule line in the U.S. and U.K., combining two origin coffees and premium extraction profiles.

- In August 2022, Tim Hortons introduced “Espresso Capsules” compatible with Nespresso Original Line machines in Canada, with varieties like Classic Lungo, Bold Espresso, Bright Espresso and Decaf.

Report Coverage

The research report offers an in-depth analysis based on Product type, Material type, Coffee type, Roast type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Coffee pods will see higher adoption as more households choose single-serve brewing for speed and consistency.

- Premium capsule lines with single-origin and specialty blends will expand in retail and e-commerce.

- Compostable and recyclable materials will replace conventional plastic in most new product launches.

- Capsule machines will become more affordable, increasing penetration in developing markets.

- Flavored pods such as vanilla, caramel, and hazelnut will gain strong repeat demand among younger consumers.

- Subscription models with personalized flavor bundles will boost brand loyalty and recurring sales.

- Hotels, offices, and cafés will adopt pod systems to reduce waste and improve beverage consistency.

- Regional roasters will introduce local bean varieties in machine-compatible formats to attract niche buyers.

- Energy-efficient and smart capsule machines will improve brewing control and reduce maintenance needs.

- Recycling partnerships and collection programs will expand as companies respond to sustainability regulations.