Market overview

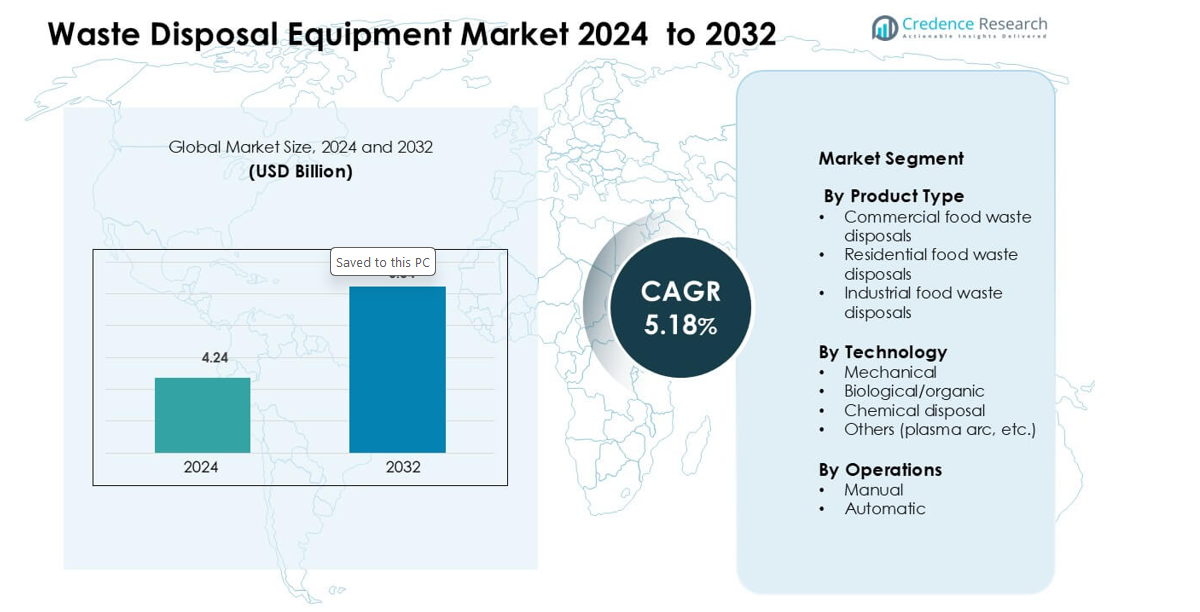

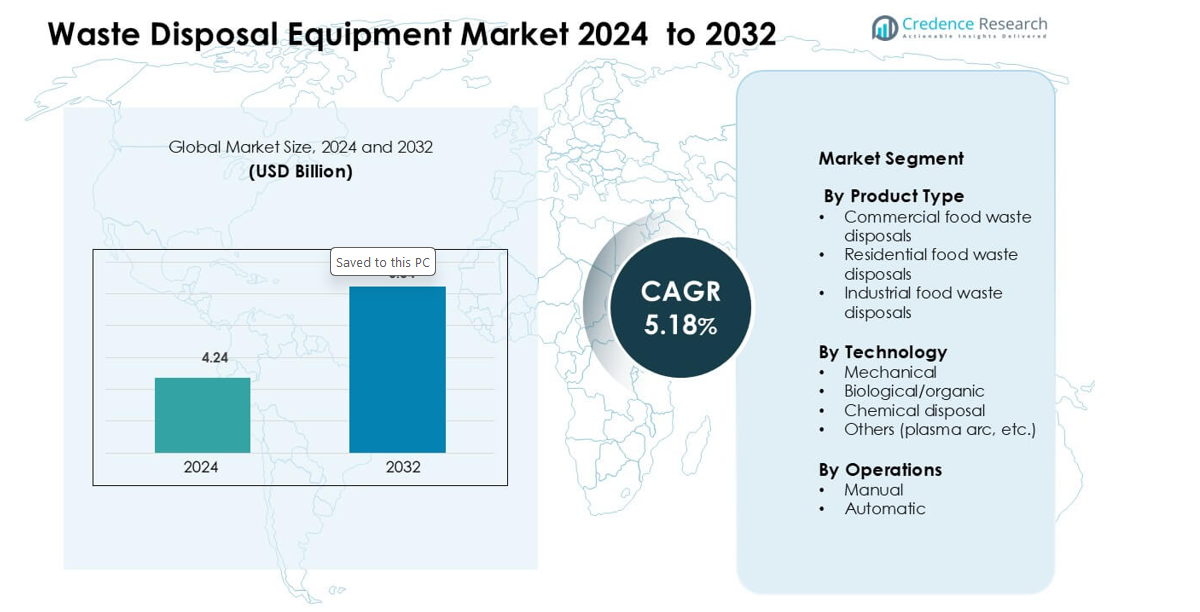

Waste Disposal Equipment Market was valued at USD 4.24 billion in 2024 and is anticipated to reach USD 6.34 billion by 2032, growing at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste Disposal Equipment Market Size 2024 |

USD 4.24 billion |

| Waste Disposal Equipment Market, CAGR |

5.18% |

| Waste Disposal Equipment Market Size 2032 |

USD 6.34 billion |

The waste disposal equipment market is led by prominent players such as Emerson Electric, InSinkErator, GE Appliances, KitchenAid, SUEZ Recycling and Recovery, Ecoverse, EcoSafe, Biogreen, Teka, and Moen. These companies compete through innovation in automation, energy efficiency, and sustainable waste processing technologies. Emerson Electric and InSinkErator maintain strong leadership in commercial and residential disposal systems, while SUEZ and Ecoverse emphasize eco-friendly and recycling-integrated solutions. Regionally, North America dominates the global market, accounting for approximately 35% of total market share, driven by stringent waste management regulations, advanced infrastructure, and widespread adoption of smart, high-performance disposal equipment across both residential and industrial sectors.

Market Insights

- The global waste disposal equipment market was valued at USD 4.24 billion in 2024 and is projected to grow at a CAGR of 5.18% from 2025 to 2032, driven by rising demand for efficient and sustainable waste management systems.

- Increasing government regulations on landfill reduction and environmental protection are major market drivers, encouraging adoption of automated and energy-efficient disposal technologies across residential, commercial, and industrial sectors.

- Key market trends include the integration of IoT and smart automation, expansion of decentralized waste treatment systems, and growing investment in eco-friendly and circular waste management solutions.

- The competitive landscape features leading players such as Emerson Electric, InSinkErator, GE Appliances, and SUEZ Recycling and Recovery, focusing on product innovation, sustainability, and regional expansion.

- North America leads the market with 35% share, followed by Europe at 30% and Asia-Pacific at 25%, while the commercial disposal segment dominates with nearly 50% market share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The commercial food waste disposal segment dominates the waste disposal equipment market, accounting for an estimated 45–50% market share. Its leadership stems from the rising adoption of large-capacity, energy-efficient disposers in hotels, restaurants, and catering facilities. Increasing regulatory emphasis on sustainable waste management and hygiene in the food service industry further boosts demand. Additionally, the integration of smart monitoring systems and odor control technologies enhances operational efficiency, making commercial disposals a preferred choice over residential and industrial variants. Rapid urbanization and growth in the hospitality sector continue to reinforce this dominance.

- For instance, in SinkErator’s commercial-grade disposer model SS-1000 features a 10 HP motor specifically designed for continuous operation in large kitchens, enabling high-volume waste processing

By Technology

The mechanical disposal segment leads the market with around 55–60% share, driven by its reliability, cost-effectiveness, and ease of installation. Mechanical disposers are widely used across residential and commercial applications due to their robust performance and low maintenance requirements. Technological advancements, such as noise reduction mechanisms and corrosion-resistant grinding components, have expanded their appeal. While biological and chemical disposal systems are gaining traction in eco-friendly waste treatment, mechanical units remain the dominant choice for quick, large-scale waste processing in high-volume food operations.

- For instance, in SinkErator’s SS-1000 commercial disposer is built around a 10-horsepower induction motor that runs at 1,725 RPM and is specified for continuous feed operation in stadium and large-venue kitchens; the product specification highlights its 10 HP motor and enclosed design for moisture protection.

By Operations

The automatic operation segment holds the dominant position with nearly 60% market share, supported by the growing trend toward automation and smart kitchen solutions. Automatic waste disposers offer hands-free operation, enhanced safety, and improved hygiene, aligning with the rising preference for efficient, user-friendly systems in both residential and commercial settings. Integration with sensors, timers, and Internet of Things (IoT) technologies enhances precision and convenience. The increasing labor cost and emphasis on operational efficiency in foodservice establishments further accelerate the shift from manual to automatic waste disposal systems.

Key Growth Drivers

Rising Focus on Sustainable Waste Management

The growing emphasis on sustainability and circular economy principles is a major driver of the waste disposal equipment market. Governments and regulatory bodies are enforcing stringent waste management and landfill reduction policies, encouraging industries and municipalities to adopt advanced disposal systems. Businesses across foodservice, healthcare, and manufacturing sectors are increasingly investing in efficient disposal technologies to minimize environmental impact and comply with waste segregation norms. The rising consumer awareness regarding eco-friendly waste handling also boosts demand for energy-efficient and low-emission equipment. Additionally, initiatives promoting composting and waste-to-energy conversion are fueling innovation in biological and mechanical disposal systems.

- For instance, Divert, Inc. has processed more than 2.3 billion pounds of food waste since its launch in 2007 across its facilities.

Rapid Urbanization and Infrastructure Development

The accelerated pace of urbanization, coupled with expanding commercial infrastructure, has significantly increased waste generation worldwide. This trend propels the demand for high-performance disposal systems in residential complexes, shopping centers, restaurants, and public facilities. Governments in emerging economies are investing in modern waste management infrastructure to address the growing burden on urban sanitation systems. The surge in quick-service restaurants, catering services, and hospitality establishments further drives adoption of large-capacity, automatic waste disposers. Moreover, technological improvements in grinding mechanisms, odor control, and compact designs enhance user convenience, supporting wider market penetration in both developed and developing regions.

- For instance, a regulatory/industry source states India currently generates over 62 million metric tons of municipal solid waste annually, of which only about 43 million metric tons is collected and roughly 12 million metric tons treated, leaving more than 31 million metric tons untreated demonstrating the pressing need for disposal infrastructure.

Integration of Automation and Smart Technologies

Technological innovation is transforming waste disposal equipment into intelligent, connected systems. The integration of automation, sensors, and Internet of Things (IoT) technologies allows real-time monitoring, predictive maintenance, and energy optimization. These advancements enhance operational efficiency while reducing manual intervention and downtime. Smart disposers with load-sensing and self-cleaning features are gaining popularity in commercial kitchens and industrial facilities. Additionally, the rising adoption of AI-enabled waste sorting and monitoring solutions is improving processing accuracy and waste recovery rates. This technological shift aligns with global trends toward smart homes and sustainable infrastructure, making automation a key catalyst for market growth.

Key Trends and Opportunities

Growth of Decentralized and On-Site Waste Processing Solutions

A prominent trend shaping the waste disposal equipment market is the transition toward decentralized waste management. On-site waste treatment systems are increasingly deployed in commercial kitchens, institutions, and residential complexes to reduce transportation costs and landfill dependency. These systems enable localized processing, such as composting and bio-digestion, which supports circular waste management models. Manufacturers are introducing compact, energy-efficient, and odor-controlled on-site units tailored to small and mid-scale applications. The growing acceptance of decentralized solutions also creates opportunities for service-based models, including waste collection, recycling, and equipment maintenance partnerships.

- For instance, a shopping mall in India implemented an on-site organic-waste-converter system that composted 220 kg per day of food-court kitchen waste, diverting that volume from municipal collection.

Expansion of the Circular Economy and Resource Recovery Initiatives

The global shift toward circular economy principles presents substantial opportunities for the waste disposal equipment market. Industries are focusing on resource recovery, converting food and organic waste into valuable by-products such as compost, biogas, and animal feed. This has stimulated demand for advanced disposal and treatment technologies that support waste segregation and material reuse. Governments and corporations are collaborating to promote sustainable production cycles and reduce greenhouse gas emissions from waste. Equipment manufacturers are responding by developing modular, scalable systems compatible with recycling and bioconversion processes, further aligning with global sustainability targets.

- For instance, in Korea 54 public treatment facilities handling food/organic waste produce about 126,400 tonnes per year of compost and animal-feed product from the input of food-waste streams.

Key Challenges

High Initial Investment and Maintenance Costs

One of the primary challenges in the waste disposal equipment market is the high capital expenditure associated with installation and maintenance. Advanced systems with automation, odor control, and biological processing capabilities require substantial upfront investment, limiting adoption among small businesses and residential users. Additionally, ongoing maintenance and replacement of mechanical components add to operational costs. These financial constraints are particularly evident in developing economies, where budget limitations and lack of financing options restrict market penetration. Manufacturers are addressing this challenge by offering leasing models and cost-efficient product variants, though affordability remains a major barrier.

Limited Awareness and Technical Expertise

Despite technological advancements, limited user awareness and lack of technical expertise hinder the effective deployment of waste disposal systems. Many small-scale commercial establishments and households remain unaware of proper disposal practices and equipment handling requirements. Moreover, inadequate training and after-sales support often result in inefficient operation and equipment downtime. In some regions, insufficient regulatory enforcement further reduces the incentive for adopting advanced disposal technologies. To overcome this challenge, stakeholders must focus on education, capacity building, and standardized training programs that encourage correct usage, maintenance, and waste segregation practices for optimal equipment performance.

Regional Analysis

North America

North America holds a market share of around 35%, driven by stringent waste management regulations and high adoption of advanced disposal technologies. The United States leads regional growth with strong implementation of sustainability initiatives and large-scale commercial applications in hospitality and foodservice sectors. Technological innovation, coupled with consumer preference for automated and energy-efficient systems, further supports market expansion. Additionally, the presence of major manufacturers and robust municipal waste handling infrastructure enhances product penetration. Government incentives for eco-friendly waste processing and growing awareness of landfill reduction continue to reinforce North America’s market dominance.

Europe

Europe accounts for approximately 30% of the global waste disposal equipment market, supported by strict environmental directives such as the EU Waste Framework Directive. Countries like Germany, the UK, and France are at the forefront of adopting smart and sustainable waste management solutions. The region’s emphasis on circular economy practices and resource recovery encourages demand for mechanical and biological disposal systems. High public awareness, well-developed infrastructure, and government funding for green technologies further accelerate market growth. Ongoing innovation in odor control and low-energy equipment continues to strengthen Europe’s leadership in sustainable waste solutions.

Asia-Pacific

Asia-Pacific commands a market share of nearly 25% and is the fastest-growing region in the waste disposal equipment market. Rapid urbanization, industrial expansion, and increasing food waste volumes in China, India, and Japan drive significant demand for advanced disposal systems. Government initiatives to modernize waste management infrastructure and reduce landfill dependence are boosting adoption rates. Rising disposable incomes and expanding commercial foodservice sectors also contribute to market growth. Moreover, local manufacturers are offering cost-effective and compact disposal solutions suited to dense urban environments, reinforcing Asia-Pacific’s position as a high-potential growth hub.

Latin America

Latin America holds a market share of about 6–7%, supported by gradual improvements in waste collection and processing infrastructure. Brazil and Mexico are leading markets, with increasing public-private partnerships driving investments in sustainable waste management. The growing hospitality and food processing industries are spurring demand for commercial waste disposers. However, limited regulatory enforcement and budget constraints in several countries moderate overall growth. The rising focus on urban hygiene, coupled with awareness campaigns promoting responsible waste disposal, is expected to enhance market penetration and encourage adoption of modern disposal technologies across the region.

Middle East & Africa

The Middle East & Africa region captures nearly 5% of the global market, showing steady growth due to expanding urban populations and increasing waste generation. Gulf countries, including the UAE and Saudi Arabia, are investing in smart city projects and sustainable waste management systems to align with national environmental goals. Industrial diversification and rising hospitality sector activities drive demand for efficient disposal equipment. However, challenges such as limited infrastructure and high equipment costs restrain broader adoption. Ongoing government initiatives to improve sanitation standards and promote circular waste practices are expected to boost regional demand.

Market Segmentations

By Product Type

- Commercial food waste disposals

- Residential food waste disposals

- Industrial food waste disposals

By Technology

- Mechanical

- Biological/organic

- Chemical disposal

- Others (plasma arc, etc.)

By Operations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The waste disposal equipment market is highly competitive, featuring a mix of global corporations and regional manufacturers striving to expand their market presence through technological innovation and strategic collaborations. Key players such as Emerson Electric, InSinkErator, GE Appliances, and KitchenAid dominate the market with advanced, energy-efficient, and automated disposal solutions tailored for both commercial and residential applications. Companies like SUEZ Recycling and Recovery, Ecoverse, and EcoSafe focus on sustainability-driven technologies, emphasizing recycling integration and biological waste processing. Emerging firms such as Biogreen, Teka, and Moen are gaining traction by introducing compact, smart, and cost-effective disposal units for urban consumers. Strategic mergers, product diversification, and regional expansion remain central competitive strategies. Furthermore, investments in IoT-enabled systems and noise reduction technologies are reshaping product portfolios, while ongoing emphasis on eco-friendly operations and circular waste management continues to differentiate leading players in this evolving market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Appliances

- EcoSafe

- Moen

- Ecoverse

- KitchenAid

- SUEZ Recycling and Recovery

- Biogreen

- Teka

- Emerson Electric

- InSinkErator

Recent Developments

- In March 2025, Ecoverse partnered with Denali to introduce a mobile depackaging unit (for unsalable food waste) that can be deployed within 24 hours, advancing organics‑side equipment for waste diversion.

- In January 2025, SUEZ signed a share‑purchase agreement to acquire a majority stake in Italy’s Gruppo Ecosistem, enhancing its industrial‑waste‑recovery business and strengthening its equipment & recycling footprint in Italy

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Operations and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The waste disposal equipment market will experience steady growth driven by global emphasis on sustainable waste management practices.

- Automation and smart technologies will increasingly integrate into disposal systems, enhancing efficiency and reducing manual intervention.

- Demand for compact and energy-efficient equipment will rise in urban residential and commercial applications.

- Governments will strengthen regulations promoting recycling, composting, and waste-to-energy solutions.

- Manufacturers will focus on developing low-noise, odor-controlled, and sensor-based disposal units.

- Adoption of biological and organic waste treatment technologies will expand across foodservice and industrial sectors.

- Partnerships between technology providers and waste management companies will drive product innovation.

- Emerging economies in Asia-Pacific will witness significant growth due to rapid urbanization and infrastructure development.

- Leasing and service-based models will gain popularity to overcome high installation and maintenance costs.

- Sustainability-driven product design and circular economy integration will define the future direction of the market.