Market Overview

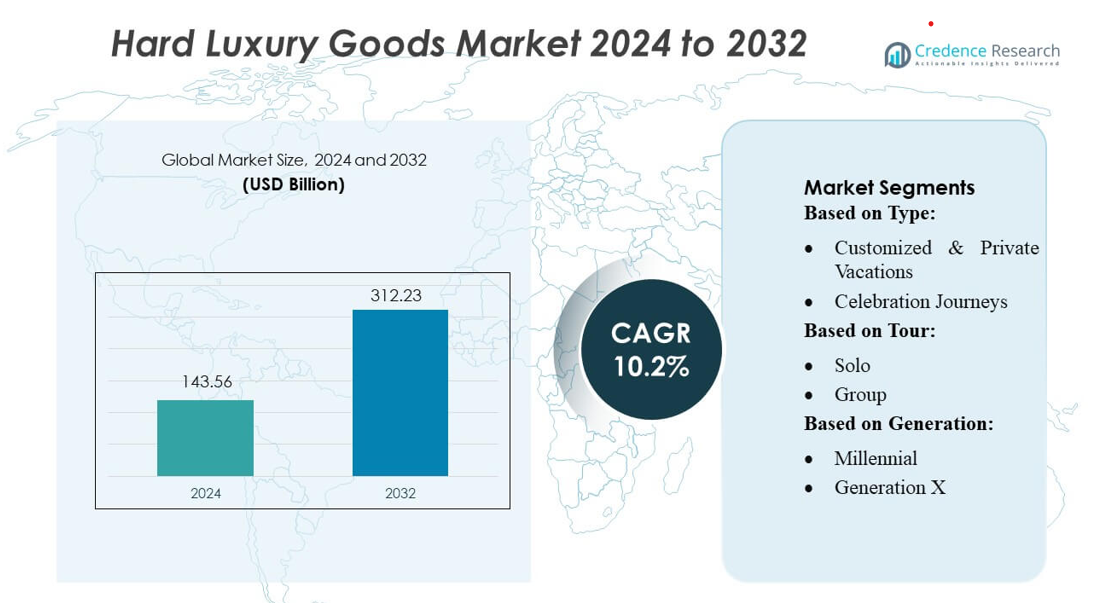

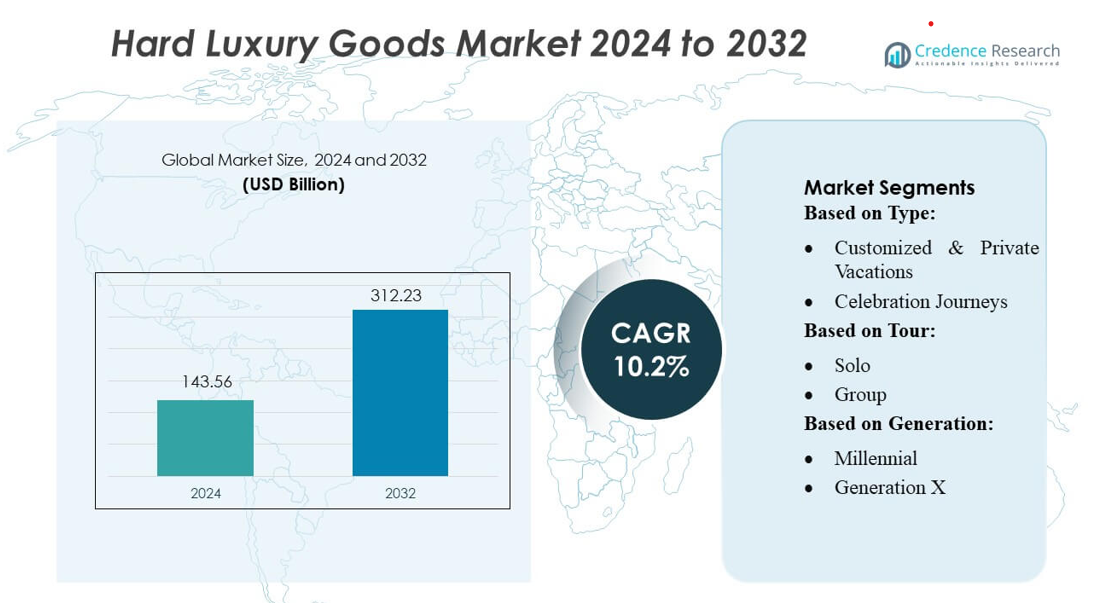

Hard Luxury Goods Market size was valued USD 143.56 billion in 2024 and is anticipated to reach USD 312.23 billion by 2032, at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hard Luxury Goods Market Size 2024 |

USD 143.56 billion |

| Hard Luxury Goods Market, CAGR |

10.2% |

| Hard Luxury Goods Market Size 2032 |

USD 312.23 billion |

The Hard Luxury Goods Market is shaped by the strategic presence of leading global maisons, with companies such as LVMH Group, Chanel LTD, Hermès International S.A., Kering SA, Burberry Group PLC, Prada S.p.A, L’Oréal S.A., Estée Lauder Companies Inc., Coty Inc., and Shiseido Company Limited driving innovation across fine jewelry, premium watches, and high-end accessories. These players compete through craftsmanship excellence, selective distribution, and expansion of experiential boutiques. Asia-Pacific emerges as the leading region, commanding exactly 36% of the global market share, supported by rising wealth creation, strong demand for investment-grade luxury items, and rapid growth in luxury retail infrastructure.

Market Insights

- The Hard Luxury Goods Market was valued at USD 143.56 billion in 2024 and is projected to reach USD 312.23 billion by 2032, registering a CAGR of 10.2%, supported by rising global wealth and growing demand for premium jewelry and luxury watches.

- Market growth is driven by increasing appetite for investment-grade gemstones, high-end timepieces, and limited-edition craftsmanship, reinforced by digital authentication systems and expansion of certified pre-owned luxury channels.

- Key trends include the rise of experiential boutiques, personalized luxury services, ethical sourcing of precious materials, and stronger omnichannel integration across flagship stores and digital platforms.

- Competitive intensity remains high as leading maisons strengthen brand equity through selective distribution, vertical integration, and curated heritage-led collections, while emerging players adopt digital-first retail strategies to capture younger luxury consumers.

- Asia-Pacific leads the market with 36% regional share, while fine jewelry represents the dominant segment with nearly 40% share, supported by rising HNWI spending and expanding luxury retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Hard Luxury Goods Market reflects strong alignment with high-end travel preferences, with Customized & Private Vacations emerging as the dominant segment, accounting for an estimated 38–42% market share. Demand is propelled by rising ultra-HNW and HNW spending, preference for hyper-personalized itineraries, and growth of exclusive services such as bespoke jewelry-linked gifting experiences and private concierge offerings. Celebration Journeys and Adventure & Sport Travel follow, driven by premium apparel, timepieces, and accessories aligned with lifestyle-driven luxury purchases. Safari and Cruise/Yachting categories gain traction as affluent consumers increasingly blend experiential travel with luxury product consumption.

- For instance, Continental’s new generation electronic-brake system, the MK 120 ESC, features a valve block, solenoid valve, pump and motor design that is about 5 % lighter and about 7 % smaller than the previous generation while delivering the same performance.

By Tour

Within tour formats, the Group travel segment holds a dominant 55–60% share, supported by rising affinity for curated luxury group experiences, premium shopping tours, and high-end brand immersion programs offered by global maisons. Luxury group itineraries often incorporate exclusive brand showcases, private product launches, and heritage-site retail experiences that strengthen segment growth. Solo travel, although smaller, is expanding due to rising millennial spending on personalized luxury goods, niche craftsmanship experiences, and premium wellness-linked shopping. The shift toward experiential retail embedded within travel continues to reinforce demand across both sub-segments.

- For instance, Cummins Drivetrain and Braking Systems has invested over 190 million to boost production capacity for air disc brakes and rear axles. This includes a 33 million investment to elevate North American air disc brake production capacity by approximately 75%, primarily focused on the Monterrey, Mexico facility.

By Generation

Among generational cohorts, Baby Boomers lead the Hard Luxury Goods Market with 40–45% share, driven by high disposable incomes, preference for premium timepieces, jewelry, and heritage luxury brands, and greater spending on luxury-integrated travel experiences. Generation X follows closely, contributing strong demand for investment-grade luxury items such as Swiss watches and bespoke accessories. Millennials represent a fast-growing segment, fueled by rising interest in contemporary luxury, limited-edition collectibles, and digital-first purchase channels. Their preference for experience-driven consumption accelerates cross-spending between luxury travel and hard luxury categories.

Key Growth Drivers

Rising Wealth Among HNWIs and UHNWIs

The Hard Luxury Goods Market benefits significantly from the expanding global base of high-net-worth and ultra-high-net-worth individuals. Increasing capital accumulation, especially in Asia-Pacific and the Middle East, fuels demand for investment-grade luxury items such as fine jewelry, Swiss watches, and bespoke accessories. Growing preference for long-term value retention and asset diversification strengthens purchases of limited-edition collections and rare gemstones. Luxury brands also gain from stronger demand for personalized designs, exclusive craftsmanship, and private shopping experiences enabled by wealth expansion.

- For instance, DHL partnered with Daimler and Hylane to rent 30 Mercedes-Benz eActros 600 electric trucks, transitioning its heavy transport operations toward zero-emission freight.

Expansion of Luxury Retail Ecosystems

Luxury brands increasingly invest in experiential flagship stores, boutique refurbishments, and digitally integrated retail models, which collectively elevate consumer engagement. Enhanced omnichannel ecosystems—combining virtual consultations, immersive product visualizers, and concierge-led fulfilment—encourage higher conversion rates in premium segments. The integration of heritage storytelling, craftsmanship showcases, and customization studios inside retail spaces strengthens brand equity and drives repeat purchases. Additionally, travel-retail recovery and the rise of luxury malls in emerging markets further stimulate sales by expanding physical accessibility to hard luxury goods.

- For instance, Ryder System, Inc. manages nearly 260,000 commercial vehicles as part of its broad logistics offerings, which include advanced supply chain services for Original Equipment Manufacturers (OEMs).

Preference for Investment-Grade and Limited-Edition Products

Consumer inclination toward luxury goods with tangible long-term value, such as fine jewelry and mechanical watches, serves as a major growth catalyst. Limited-edition releases, certified gemstones, and rare automatic timepieces attract collectors seeking appreciation potential and exclusivity. The increasing popularity of authenticated pre-owned luxury items also supports market expansion, as consumers view such products as both aspirational and financially prudent. Brands’ emphasis on transparency through digital certificates, provenance tracking, and blockchain-backed authentication enhances buyer confidence and drives premiumization.

Key Trends & Opportunities

Growth of Certified Pre-Owned (CPO) Luxury Market

The certified pre-owned segment creates new opportunities for both established brands and luxury resellers as consumers seek authenticated, competitively priced collectibles. Leading watchmakers and jewelry houses now formalize trade-in programs and CPO boutiques to capture secondary market value. This trend attracts younger buyers entering the luxury category while enabling brands to maintain quality control and authenticity. Digital marketplaces with expert verification and global logistics further accelerate CPO penetration, creating a sustainable demand cycle driven by affordability, rarity, and trust.

- For instance, Kuehne + Nagel expanded its processing capacity at its new Paris Charles-de-Gaulle air hub: the 12,900 m² facility enables handling of 300 airfreight pallets per week, increasing throughput by a factor of 2.5. Increasing Integration of Technology and Digital Authentication

Technology adoption is reshaping the value proposition of hard luxury goods. Brands deploy blockchain-based digital passports, NFC-embedded certificates, and AI-driven authentication systems to prevent counterfeiting and strengthen after-sales trust. Digital IDs enhance traceability of gemstones, metals, and components, improving customer transparency and regulatory compliance. Additionally, virtual try-on tools, 3D configurators, and metaverse-based showcases elevate customer engagement by merging digital experiences with luxury craftsmanship. This digital shift opens new monetization pathways while modernizing traditional luxury buying behavior.

- For instance, CEVA Logistics launched a new comprehensive reverse logistics solution for end-of-life electric vehicle batteries. This network aims to manage 80% of European EV battery volumes expected to reach end-of-life by 2030. The initiative builds on a successful trial program that started in 2022 at CEVA’s facility in Ghislenghien, Belgium.

Sustainability and Ethical Sourcing as Market Differentiators

Sustainability has evolved into a strategic opportunity as consumers prioritize ethically sourced precious metals, conflict-free diamonds, and environmentally responsible manufacturing. Luxury brands increasingly adopt recycled gold, lab-grown diamond lines, and low-emission production processes to align with global ESG standards. Transparent reporting, traceability platforms, and third-party certifications enhance brand credibility among environmentally conscious buyers. This shift not only differentiates premium brands but also expands addressable demand from younger generations who value responsible luxury without compromising craftsmanship or exclusivity.

Key Challenges

Rising Counterfeiting and Parallel Market Pressures

The proliferation of high-quality replicas and unauthorized resale channels poses a significant threat to brand value and consumer trust. Advanced counterfeiting technologies replicate intricate watch mechanisms and jewelry designs, making detection challenging. Unregulated grey markets further dilute pricing control and brand exclusivity. Combating these issues requires large-scale investment in authentication technologies, supply chain monitoring, and legal enforcement. Persistent counterfeiting undermines customer confidence, disrupts official retail networks, and constrains premiumization efforts across key markets.

High Dependence on Economic Cycles and Luxury Tourism

Hard luxury goods remain highly sensitive to macroeconomic volatility, foreign exchange fluctuations, and disruptions in global tourism flows. Economic slowdowns reduce discretionary spending, while geopolitical instability can restrict travel-retail sales—historically a major revenue channel for luxury brands. Additionally, fluctuations in metal and gemstone prices affect production costs and profit margins. Brands must navigate these uncertainties by diversifying geographic exposure, strengthening digital channels, and targeting resilient customer bases. Economic instability remains a core constraint on sustained market growth.

Regional Analysis

North America

North America holds an estimated 28–30% share of the Hard Luxury Goods Market, driven by strong demand for premium jewelry, high-end watches, and collectible luxury items across the U.S. and Canada. The region benefits from a high concentration of HNWIs, strong retail infrastructure, and the presence of flagship stores from major global maisons. Increased adoption of certified pre-owned luxury platforms and digital authentication solutions further supports market expansion. Luxury spending is reinforced by robust gifting culture, steady investment in exclusive product lines, and growing preference for asset-grade watches among affluent consumers.

Europe

Europe accounts for approximately 32–34% of global market share, making it one of the largest regional hubs for hard luxury goods. The region’s market strength stems from its heritage luxury houses, high tourist inflow, and established craftsmanship traditions in Switzerland, France, and Italy. Switzerland’s dominance in luxury watchmaking and France’s leadership in fine jewelry and bespoke design elevate regional exports. Consumer preference for artisanal designs, limited-edition collections, and certified gemstones sustains premium demand. Economic stability in Western Europe, coupled with mature retail networks, further drives strong purchasing activity across key cities and luxury capitals.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing market, holding an estimated 35–37% share fuelled by rising wealth creation in China, India, Japan, and Southeast Asia. Rapid urbanization, expanding HNWI populations, and increasing affinity for collectible luxury watches and high-value jewelry underpin market growth. Travel-retail development and brand-driven boutique expansions across major metropolitan cities strengthen accessibility. Young affluent consumers exhibit strong demand for personalized craftsmanship, investment-grade diamonds, and limited-edition watches. Additionally, digital luxury channels and authenticated resale platforms are gaining traction, reinforcing sustained long-term expansion across the region.

Latin America

Latin America holds an estimated 5–6% share of the Hard Luxury Goods Market, supported by rising luxury consumption in Brazil, Mexico, Chile, and Argentina. Despite economic fluctuations, the region demonstrates increasing demand for fine jewelry, luxury watches, and collectible accessories among affluent urban consumers. Growth is driven by expanding premium retail infrastructure, the emergence of luxury e-commerce platforms, and rising interest in certified diamonds and branded timepieces. Tourism-led sales, especially in Mexico and Brazil, further support market activity. However, currency volatility and import duties remain key constraints limiting full-scale expansion.

Middle East & Africa

The Middle East & Africa region accounts for roughly 8–10% market share, supported by a substantial luxury consumer base concentrated in the UAE, Saudi Arabia, and Qatar. High disposable incomes, tax-free luxury retail zones, and expanding luxury mall infrastructures contribute to strong demand for premium jewelry, gold products, and Swiss timepieces. Cultural preference for high-carat gold, bridal jewelry, and gemstone-intensive designs sustains jewelry-led growth. Tourism-driven retail and growing investment in flagship boutiques by global maisons further strengthen market penetration. Africa shows gradual traction, primarily through affluent urban clusters in South Africa and Nigeria.

Market Segmentations:

By Type:

- Customized & Private Vacations

- Celebration Journeys

By Tour:

By Generation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hard Luxury Goods Market is shaped by leading global maisons such as Prada S.p.A, Shiseido Company Limited, Burberry Group PLC, L’Oréal S.A., Hermès International S.A., Coty Inc., LVMH Group, Kering SA, Chanel LTD, and Estée Lauder Companies Inc. The Hard Luxury Goods Market remains highly consolidated, with competition centered on craftsmanship excellence, heritage-driven branding, and innovation across fine jewelry, premium watches, and high-end accessories. Leading luxury houses continue to strengthen their market positioning through vertical integration, strict control of distribution channels, and expansion of flagship boutiques in major luxury hubs. Increasing investments in digital authentication, blockchain-backed product passports, and immersive retail experiences improve customer engagement and safeguard brand equity. The rise of certified pre-owned luxury platforms also intensifies competition, prompting brands to enhance product traceability, offer refurbishment services, and launch exclusive limited-edition collections to maintain desirability and long-term customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, The European Commission terminated its investigation into Apple’s user-choice practices after the company revised its terms. Closure reduces legal overhang for developers and signals that Brussels may focus next on systemic fee levels, compelling all gatekeepers to reassess revenue-share mechanics.

- In April 2025, IKEA, a supply part of the Inter IKEA Group, and BLR Logistiks deployed the first electric heavy-duty truck to run on the public road network in India.

- In May 2024, Volvo Financial Services and Volvo Trucks North America partnered to launch Volvo on Demand, an initiative to increase the adoption of BEVs. Through the initiative, the company offers an accessible solution for acquiring BEVs, reducing the need for significant upfront investments

Report Coverage

The research report offers an in-depth analysis based on Type, Tour, Generation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising global wealth and expanding HNWI populations.

- Demand for investment-grade jewelry and mechanical watches will strengthen as consumers prioritize long-term value retention.

- Digital authentication and blockchain-based product passports will become standard across luxury categories.

- Certified pre-owned luxury platforms will grow rapidly, attracting younger, value-conscious luxury buyers.

- Sustainability, ethical sourcing, and traceable materials will significantly influence purchasing decisions.

- Brands will expand experiential flagship stores and immersive boutique concepts in major luxury hubs.

- Personalization and bespoke craftsmanship services will emerge as key differentiators for premium brands.

- Asia-Pacific will continue to dominate global demand, supported by strong luxury appetite in major economies.

- Omnichannel retail integration will intensify, combining virtual consultations with exclusive in-store experiences.

- Limited-edition collections and heritage craftsmanship will remain central to maintaining brand exclusivity and customer loyalty.