Market overview

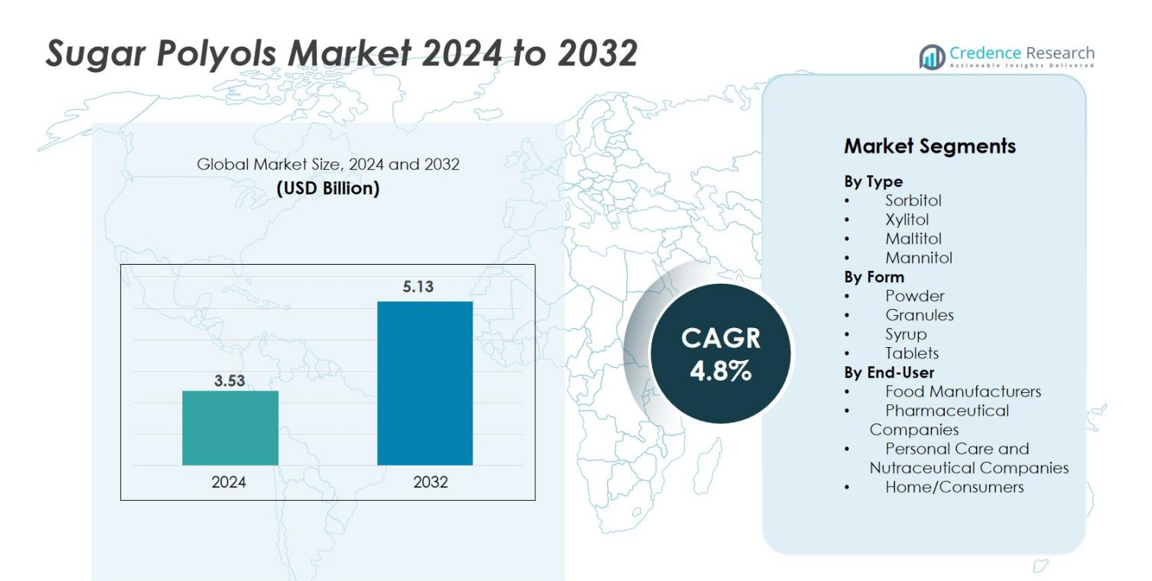

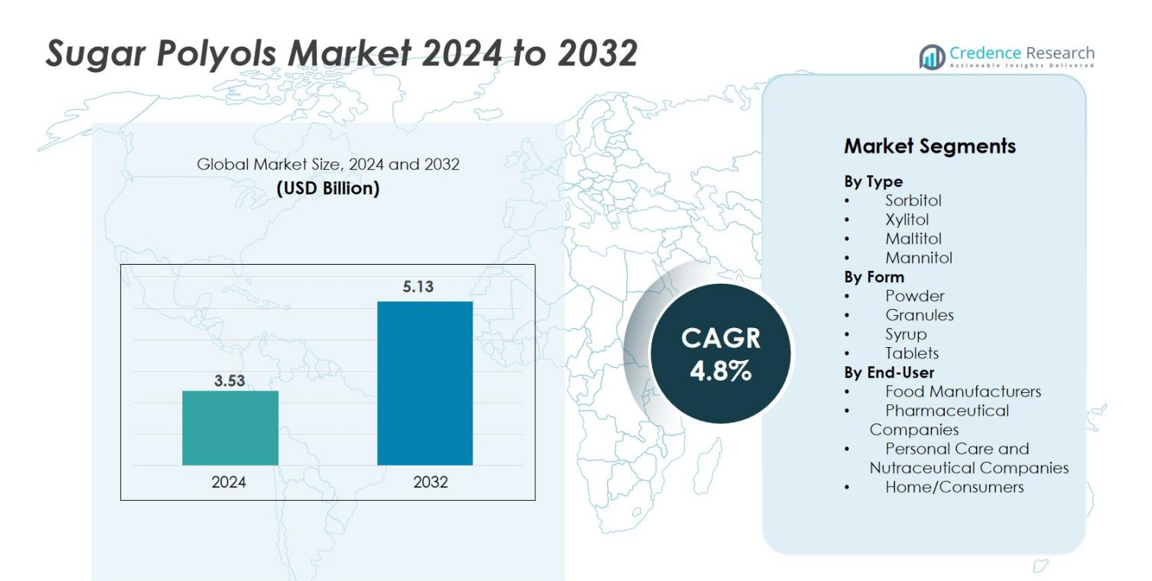

The Sugar Polyols Market size was valued at USD 3.53 billion in 2024 and is anticipated to reach USD 5.13 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sugar Polyols Market Size 2024 |

USD 3.53 billion |

| Sugar Polyols Market, CAGR |

4.8% |

| Sugar Polyols Market Size 2032 |

USD 5.13 billion |

The Sugar Polyols Market is led by established global players such as Cargill, Inc., Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Frères, Tate & Lyle PLC and BENEO GmbH. These companies command significant market presence through expansive production capacity and diversified product lines. Regionally, the strongest share stands in the Asia‑Pacific region at approximately 40.2%, driven by rising manufacturing and consumer demand. Europe and North America follow, each capturing substantial portions of the market due to mature food and pharmaceutical sectors and sustained reformulation efforts.

Market Insights

- The Sugar Polyols Market reached USD 3.53 billion in 2024 and is projected to grow at a CAGR of 4.8% through the forecast period.

- Rising consumer demand for low‑calorie and sugar‑free products is pushing the use of sorbitol, xylitol and maltitol; segment‑wise, the sorbitol type holds around 40% share, and the powder form holds about 45% share.

- The Asia Pacific region dominates with roughly 38% market share; manufacturers are also creating sugar polyols for pharmaceuticals and personal‑care applications to exploit emerging opportunities.

- Key players including Cargill, Roquette Frères, ADM and Tate & Lyle strengthen their positions via global manufacturing scale, sustainable sourcing and product innovation, intensifying competition.

- High cost of polyols compared to traditional sugars and growing competition from alternative sweeteners (such as stevia and monk fruit) may limit growth in some segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Sugar Polyols market is primarily segmented by type, with Sorbitol leading the market share. Sorbitol dominates due to its widespread use in the food and beverage industry as a low-calorie sweetener, holding around 40% of the market share. Other notable segments include Xylitol, which is gaining traction in oral care products, and Maltitol, which is popular in sugar-free confectioneries. The increasing demand for low-calorie and diabetic-friendly products drives the growth of these sub-segments, as consumers seek healthier alternatives to traditional sugars.

- For instance, Roquette Frères has highlighted its Sorbitol’s wide application in sugar-free gums and confectioneries, benefiting from Sorbitol’s ability to retain moisture and provide a soft mouthfeel in diabetic-friendly protein bars made without added sugars

By Form

Sugar Polyols are available in various forms, including powder, granules, syrup, and tablets. The powder form holds the largest market share at approximately 45%, driven by its ease of use in food and pharmaceutical applications. Syrups are also popular, particularly in processed foods and beverages, owing to their versatility and ability to provide moisture retention. Granules and tablets, while smaller segments, continue to grow due to their demand in consumer products such as sugar substitutes and nutritional supplements.

- For instance, syrups containing sorbitol are popular in processed foods and beverages for their moisture retention and texture-improving properties, making them ideal for sugar-free confectionery and bakery products.

By End-User

The end-user segments of the Sugar Polyols market include food manufacturers, pharmaceutical companies, personal care and nutraceutical companies, and home/consumers. Food manufacturers account for the largest share, approximately 50%, as they increasingly incorporate sugar polyols in sugar-free and low-calorie products. Pharmaceutical companies follow, driven by the demand for polyols in medicines, especially in diabetic treatments. The personal care and nutraceutical sectors are expanding rapidly, owing to the rising trend of sugar substitutes in health and wellness products, further enhancing market growth.

Key Growth Drivers

Rising Demand for Low-Calorie and Sugar-Free Products

One of the primary drivers of growth in the Sugar Polyols Market is the increasing consumer preference for low-calorie and sugar-free alternatives. As health awareness rises, consumers are becoming more conscious of sugar consumption, particularly in the context of obesity, diabetes, and other lifestyle-related diseases. Sugar polyols such as Sorbitol, Xylitol, and Maltitol are being increasingly used as sweeteners in food and beverage products to offer the taste of sugar without the associated calories. The growing demand for low-sugar and sugar-free products in the food and beverage industry, especially in confectionery, dairy, and soft drinks, is expected to fuel the market’s expansion.

- For instance, Cargill produces special grades of sorbitol used extensively in sugar-free gums and diabetic-friendly desserts, offering sweetness without raising blood sugar levels.

Health and Wellness Trends Driving Market Expansion

The growing emphasis on health and wellness, particularly among millennials and health-conscious consumers, is another significant growth driver for the Sugar Polyols Market. As consumers seek healthier lifestyles, there is a rising demand for products that provide nutritional benefits without compromising on taste. Sugar polyols, which are often used as functional ingredients in food, beverages, and dietary supplements, are gaining traction due to their ability to improve blood sugar control, support weight management, and reduce dental issues. This trend is supported by the rise in health and wellness-focused food and beverage offerings such as low-calorie, gluten-free, and diabetic-friendly products.

- For instance, Cargill introduced its Zerose™ erythritol in a range of sugar-free bakery and confectionery products, leveraging its low glycemic index and tooth-friendly benefits to meet consumers’ demand for healthier sweeteners.

Growing Demand in the Pharmaceutical Industry

The pharmaceutical industry’s increasing reliance on sugar polyols for formulating medications is another key growth driver. Sugar polyols are widely used in oral medications, particularly those designed for diabetic patients or people with metabolic disorders, due to their low glycemic index and non-cariogenic properties. Polyols such as Xylitol and Sorbitol are commonly used as excipients in syrups, tablets, and chewable medicines to improve patient compliance and enhance product stability. Additionally, polyols are used in formulations for laxatives and gastrointestinal health products.

Key Trends & Opportunities

Increasing Adoption of Natural and Plant-Based Sugar Polyols

A notable trend in the Sugar Polyols Market is the growing consumer preference for natural and plant-based sugar substitutes. Products such as Xylitol, derived from birch trees and corn, are gaining popularity as natural sweeteners in various food, beverage, and personal care applications. This shift towards plant-based ingredients aligns with the rising demand for clean-label, organic, and non-GMO products, as consumers become more focused on sustainability and natural ingredients. Manufacturers are responding to this trend by developing sugar polyols from renewable plant sources, offering a competitive edge in the market.

- For instance, Xylitol, extracted from birch trees and corn cobs, is widely used as a natural sweetener across food, beverage, and personal care industries

Expanding Application in Personal Care and Nutraceuticals

Sugar polyols are increasingly being used in the personal care and nutraceutical sectors, opening up new opportunities in these markets. In personal care, polyols such as Sorbitol and Xylitol are incorporated into products like toothpaste, mouthwash, and skin creams due to their moisturizing and non-cariogenic properties. In the nutraceutical industry, sugar polyols are used in dietary supplements, functional foods, and weight management products. The shift towards more natural and health-promoting ingredients is driving the adoption of sugar polyols, especially in products targeting health-conscious consumers. As the global demand for nutraceuticals continues to rise, particularly in regions like North America and Asia-Pacific, sugar polyols are well-positioned to meet the need for effective and safe ingredients in these rapidly growing industries.

- For instance, Colgate incorporates sorbitol as a humectant in its toothpaste formulations to maintain moisture and prevent drying, which helps preserve product stability and texture over time.

Key Challenges

Regulatory and Safety Concerns

One of the significant challenges facing the Sugar Polyols Market is the growing scrutiny over the safety and regulatory aspects of polyols in food and pharmaceuticals. While sugar polyols are generally regarded as safe by regulatory agencies such as the FDA, concerns regarding the overconsumption of polyols, particularly in large quantities, have led to some regulatory restrictions. Excessive intake of sugar polyols can cause gastrointestinal issues, such as bloating and diarrhea, which can affect consumer perception and demand. Regulatory bodies are increasingly focused on ensuring the safety of these ingredients, leading to potential challenges for manufacturers in terms of meeting stringent regulations and consumer safety standards.

Competition from Alternative Sweeteners

The Sugar Polyols Market faces stiff competition from other alternative sweeteners such as stevia, monk fruit, and artificial sweeteners like aspartame and sucralose. These alternatives are gaining popularity due to their natural origins, zero-calorie benefits, and enhanced sweetness profiles, posing a direct challenge to the growth of sugar polyols. While polyols offer benefits such as low glycemic impact and tooth-friendly properties, their relatively lower sweetness intensity compared to other sweeteners can limit their appeal in certain product formulations. Additionally, the price sensitivity of consumers and manufacturers may push them toward choosing lower-cost alternatives, further intensifying competition

Regional Analysis

North America

In 2024, the North America region held 20% of the global sugar polyols market share. The region’s growth is driven by strong demand for low‑sugar products and broad acceptance of polyols in food, pharmaceuticals and confectionery applications. Market expansion benefits from regulatory approvals and advanced manufacturing capacities. However, saturation in established markets and high competition from alternative sweeteners pose constraints. The U.S. remains a key contributor, supported by health‑aware consumers and well‑developed supply chains.

Europe

The Europe region accounted for 22% of the global sugar polyols market in 2024. Growth in Europe stems from stringent sugar‑reduction targets in food and beverage products and strong R&D investment in low‑calorie sweeteners. Several key players operate manufacturing bases here, enabling efficient supply. Nonetheless, slow economic growth in some countries and high production costs affect regional expansion pace. Regulatory clarity and consumer demand for “clean‑label” ingredients provide further impetus for uptake in this region.

Asia Pacific

The Asia Pacific region dominated the sugar polyols market in 2024 with around 38% of global share. Rapid urbanization, rising disposable incomes and growing incidence of diabetes drive demand for sugar substitutes in countries like China and India. The region benefits from large-scale production capacity and increasing adoption across food, beverages and oral‑care products. Challenges include variability in regulatory frameworks and differences in product acceptance across markets. Overall, Asia Pacific presents the strongest growth potential globally.

Latin America

The Latin America region captured 10% share of the sugar polyols market in 2024. Growth is driven by increasing consumer health awareness and rising demand for sugar‑free and functional food products, particularly in Brazil and Mexico. Market progress is supported by local production enhancements and sourcing of polyols for confectionery and beverage industries. However, economic volatility and import‑cost pressures may limit expansion. Strategic partnerships and heightened product innovation can strengthen regional performance.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for 5% of the global sugar polyols market share in 2024. Growth is emerging thanks to rising health consciousness, expanding pharmaceutical markets and increased demand for low‑calorie sweeteners. Key opportunities arise in the Gulf Cooperation Council states with strong retail and food‑service sectors. Constraints include limited local production, high import dependence, and regulatory heterogeneity across countries. Effective regional strategies and localised formulations may enhance market uptake.

Market Segmentations

By Type

- Sorbitol

- Xylitol

- Maltitol

- Mannitol

By Form

- Powder

- Granules

- Syrup

- Tablets

By End-User

- Food Manufacturers

- Pharmaceutical Companies

- Personal Care and Nutraceutical Companies

- Home/Consumers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sugar Polyols Market features a concentrated group of major global ingredient‑players who drive innovation, scale and market reach. Companies like Cargill, Inc., The Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC and Roquette Frères hold strong positions due to broad portfolios, global manufacturing footprints and robust distribution channels. Many of these players pursue strategies such as capacity expansion, product‑portfolio diversification, strategic partnerships and acquisitions to maintain competitiveness. They also emphasise R&D to develop next‑generation polyols and sustainable sourcing to satisfy regulatory and consumer demand for healthier ingredients. Emerging regional players such as Gulshan Polyols Ltd and Shandong Bailong Chuangyuan further intensify competition by leveraging cost‑effective local manufacturing and regional supply chains. As a result, the market’s competitive dynamics are shaped by scale, technological capabilities, sustainability credentials and geographic reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill

- Roquette Freres

- Ingredion

- Gulshan Polyols Ltd

- Shandong Bailong Chuangyuan

- Tate & Lyle

- Archer Daniels Midland Company

- Tereos

- Nagase Viita

- BENEO

Recent Developments

- In October 2025, BASF SE formed a strategic collaboration with International Flavors & Fragrances Inc. (IFF) to accelerate innovation via enzyme and bio-based polymer systems (relevant to polyol / sugar-alcohol production-/application technologies).

- In 2025, Cargill finalized the acquisition of the remaining 50% stake in SJC Bioenergia, enhancing its presence in Brazil’s renewable energy market. This strategic move supports Cargill’s efforts to integrate bio-based feedstocks for polyol production, ensuring a sustainable supply chain.

- In January 2024, Cargill’s existing zero-calorie stevia sweetener, EverSweet®, received positive safety opinions from the European Food Safety Authority (EFSA) and the UK Food Standards Agency (FSA), paving the way for its commercial launch in these new markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sugar polyols market will expand with broader adoption across food, beverage and pharmaceutical applications.

- Sorbitol will continue as the dominant type segment, supporting about a quarter of industry value, while powder forms will remain preferred.

- Asia Pacific will solidify its leading regional position, contributing around 35‑40 % of global share, followed by Europe and North America.

- Manufacturers will increase investment in clean‑label and plant‑based polyol variants to meet consumer preference for natural ingredients.

- Tech innovations will improve production efficiency and reduce costs, enabling wider use in value‑sensitive markets.

- Growth in low‑calorie and sugar‑reduction regulation worldwide will accelerate product reformulation and drive polyol uptake.

- Expansion into oral‑care, personal care and nutraceuticals will open new revenue streams beyond traditional food sectors.

- Rising digestive‑tolerance formulations will help polyols overcome gastrointestinal side‑effect concerns and broaden appeal.

- Price competition from novelty sweeteners will press polyol producers to differentiate on function and safety.

- Emerging markets in Latin America and Africa will see above‑average growth as consumer health awareness and disposable incomes increase.