Market overview

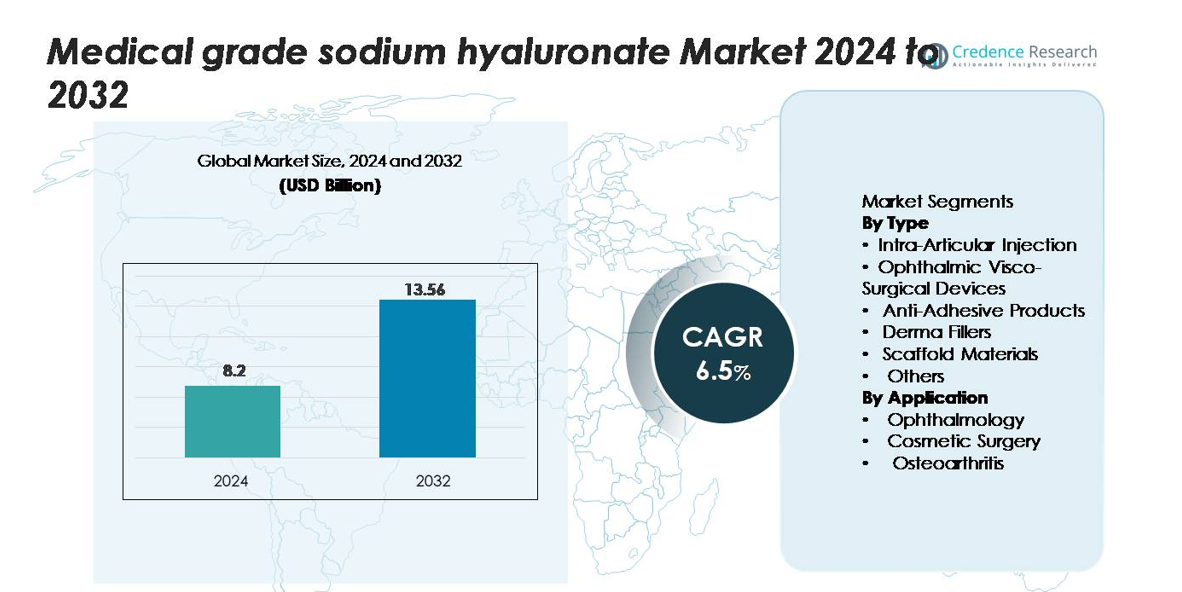

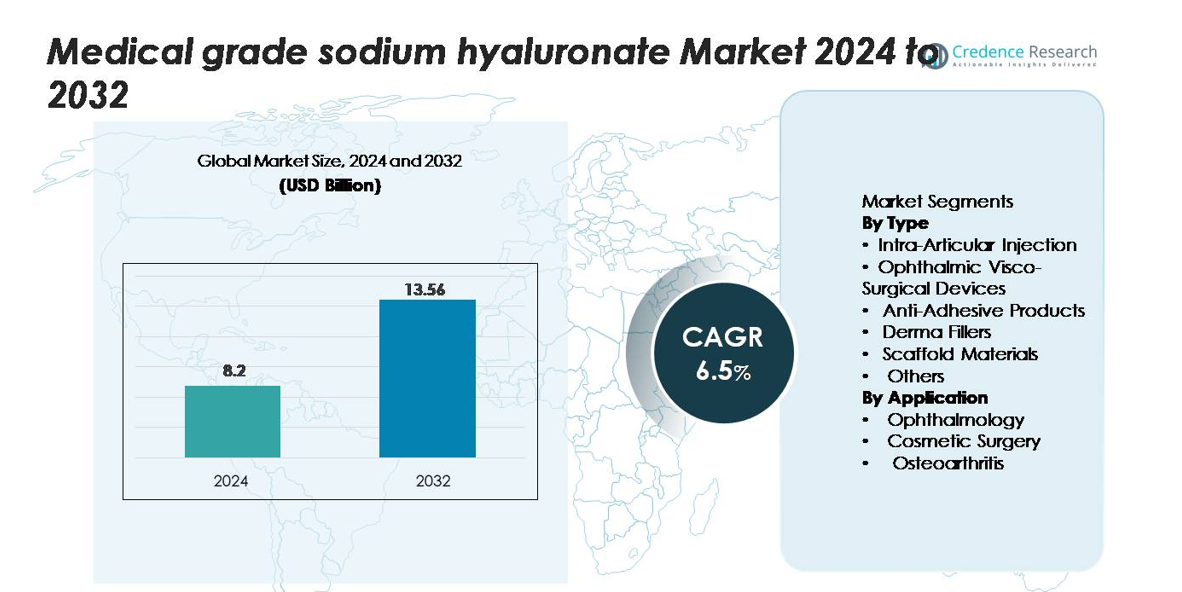

The Medical Grade Sodium Hyaluronate market was valued at USD 8.2 billion in 2024 and is anticipated to reach USD 13.56 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Grade Sodium Hyaluronate Market Size 2024 |

USD 8.2 billion |

| Medical Grade Sodium Hyaluronate Market, CAGR |

6.5% |

| Medical Grade Sodium Hyaluronate Market Size 2032 |

USD 13.56 billion |

The medical grade sodium hyaluronate market is led by established pharmaceutical and biotechnology companies that supply products for orthopedic, ophthalmic, and cosmetic use. Major players focus on high-purity formulations, long-lasting injectables, and strong clinical validation to maintain a competitive edge. Strategic partnerships with hospitals, aesthetic clinics, and surgical centers expand product reach, while ongoing R&D supports new applications in drug delivery, tissue repair, and anti-adhesion therapy. North America remains the leading region with nearly 38% market share, driven by high procedure volumes in osteoarthritis and cataract surgery. Asia Pacific follows as the fastest-growing region due to expanding cosmetic treatments and improving healthcare access.

Market Insights

- The medical grade sodium hyaluronate market reached USD 8.2 billion in 2024 and is projected to hit USD 13.56 billion by 2032, growing at a 6.5% CAGR during the forecast period.

- Demand rises due to increasing osteoarthritis cases, expanding cataract surgeries, and rapid uptake of minimally invasive cosmetic fillers, making intra-articular injections the dominant segment with the highest share.

- A key trend is the shift toward long-lasting, high-purity formulations for better therapeutic outcomes in orthopedic, ophthalmic, and aesthetic procedures, supported by growing clinical approvals and improved product durability.

- Competition strengthens with global manufacturers investing in R&D, cross-linked filler innovation, and expanded hospital partnerships, though high treatment costs and uneven reimbursement remain major restraints.

- North America leads with nearly 38% share, supported by high procedure volumes, while Asia Pacific is the fastest-growing, driven by cosmetic demand and expanding healthcare capacity; Europe maintains strong presence in ophthalmic and orthopedic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Intra-articular injection holds the largest market share within medical grade sodium hyaluronate. Orthopedic clinics use these injections to restore joint lubrication, reduce pain, and delay knee replacement surgery. Growing osteoarthritis cases among elderly and overweight populations increase treatment demand. Clinicians prefer high-purity hyaluronate for its longer residence time and biocompatibility, supporting repeat procedures. Ophthalmic visco-surgical devices also show strong growth, driven by rising cataract and refractive surgeries. Surgeons value sodium hyaluronate’s viscoelastic properties, which protect corneal tissue and maintain chamber depth during lens implantation. Derma fillers form another fast-growing segment due to increased adoption of non-surgical cosmetic procedures. Aesthetic clinics use cross-linked hyaluronate gels for wrinkle reduction, lip enhancement, and facial contouring. Product improvements offering longer effects and better hydration support wider consumer acceptance. Anti-adhesive products and scaffold materials find use in postoperative care and tissue engineering, supported by research in regenerative medicine. The others segment includes niche medical applications where biocompatibility and moisture retention are essential.

- For instance, Fidia Farmaceutici’s Hyalgan is supplied in 2.0 mL syringes containing 20 mg of sodium hyaluronate and is administered once weekly for three injections, with clinical data showing measurable improvement in knee flexion within 30 days of treatment.

By Application

Osteoarthritis dominates the application landscape with the highest market share. Sodium hyaluronate injections support joint cushioning and mobility in patients who seek non-surgical relief. Demand grows due to the rising geriatric population and increased sports-related joint injuries. Clinicians favor viscosupplementation as it offers reduced side effects compared to oral anti-inflammatory drugs. Ophthalmology remains another key application, supported by expanding access to eye surgeries and adoption of premium intraocular lenses. The compound’s protective and lubricating properties help reduce intraoperative complications.

Cosmetic surgery shows rapid growth as consumers increasingly choose minimally invasive aesthetic treatments. Hyaluronate fillers provide natural-looking results with short recovery time, encouraging use in dermatology and medical spas. Social media influence and rising disposable incomes boost facial aesthetics demand across age groups. Manufacturers focus on advanced gel structures that improve lift capacity and durability. The application of sodium hyaluronate in skin rejuvenation and anti-aging procedures supports strong future potential for this segment.

- For instance, Anika Therapeutics’ Monovisc delivers a single 4.0 mL intra-articular injection containing 88 mg of non-avian sodium hyaluronate, with documented clinical trials showing measurable improvement in WOMAC pain scores within 14 days.

Key Growth Drivers

Rising Prevalence of Osteoarthritis and Joint Disorders

The growing number of osteoarthritis patients stands as a major driver for medical grade sodium hyaluronate. Age-related cartilage degeneration, obesity, and increased sports-related injuries continue to push the demand for viscosupplementation. Physicians use sodium hyaluronate injections to restore joint lubrication, reduce friction, and improve mobility, making it a preferred non-surgical treatment for early- to mid-stage arthritis. Patients also favor these injections due to quick recovery time and fewer systemic side effects compared to oral pain medication. As healthcare systems focus on delaying knee replacement surgeries, demand for intra-articular injections continues to rise. Expanding geriatric populations in regions such as North America, Europe, and Asia further strengthen the market outlook. The development of longer-lasting and high-viscosity formulations enhances clinical effectiveness, encouraging repeat procedures and wider adoption in orthopedic centers.

- For instance, Anika Therapeutics’ Orthovisc delivers a 2.0 mL injection containing 30 mg of ultra-pure, high-molecular-weight sodium hyaluronate, with clinical studies reporting measurable improvement in knee pain within 28 days of administration.

Growing Use in Ophthalmic Surgeries and Advanced Eye Care

Sodium hyaluronate plays a crucial role in cataract, glaucoma, and refractive surgeries, where surgeons rely on its viscoelastic properties to protect delicate ocular tissues. Rising cases of age-related vision loss and increased access to advanced ophthalmic procedures contribute to market expansion. The growing number of ambulatory surgical centers and adoption of premium intraocular lenses also create strong demand for viscoelastic agents. Developing nations are investing in eye care infrastructure, improving availability of cataract treatments for rural and low-income populations. Surgeons prefer high-purity, medical grade hyaluronate due to better patient outcomes, reduced intraoperative trauma, and faster healing. Ongoing product innovations involving better clarity and improved rheological properties continue to support market penetration across private hospitals and specialty clinics.

- For instance, Bausch & Lomb’s Amvisc Plus provides a 0.8 mL dose at a concentration of 16 mg/mL (1.6%) sodium hyaluronate with a molecular weight of approximately 1.6 million Da, helping maintain a stable anterior chamber during phacoemulsification and reducing endothelial cell loss.

Growing Demand for Non-Surgical Cosmetic Enhancements

The increasing popularity of minimally invasive cosmetic procedures boosts the use of hyaluronate-based dermal fillers. Consumers seek natural anti-aging solutions for wrinkle reduction, skin hydration, and facial contouring. These fillers offer quick results, reversible effects, and short recovery periods, leading to strong acceptance among younger and aging populations. Social media influence and rising disposable incomes further drive aesthetic procedures across developed and emerging markets. Dermatology clinics prefer advanced cross-linked gel fillers that provide increased lift capacity and improved durability. Manufacturers continue to introduce differentiated filler grades targeted for lips, cheeks, and under-eye correction, helping expand product portfolios. As more men enter the cosmetic aesthetics segment and preventive skincare trends rise, dermal filler demand remains strong, supporting long-term market growth.

Key Trends & Opportunities

Shift Toward Biocompatible and Long-Lasting Formulations

A key trend shaping the market is the shift toward more durable and cross-linked sodium hyaluronate formulations, offering extended therapeutic benefits. In osteoarthritis, injectable products with longer residence time are gaining traction, reducing the frequency of treatments and improving patient satisfaction. In cosmetic applications, hybrid fillers combine hyaluronate with bioactive ingredients to promote collagen regeneration and enhanced hydration. The rise of regenerative medicine creates opportunities for sodium hyaluronate in tissue repair, scaffold development, and wound healing applications. Manufacturers also invest in high-purity biotechnology-based production to ensure safety, consistency, and enhanced clinical outcomes.

- For instance, Allergan’s Juvéderm Volift uses Vycross technology with a 17.5 mg/mL hyaluronic acid concentration and demonstrated measurable wrinkle improvement lasting up to 420 days in multicenter patient trials.

Widening Applications in Post-Surgical Care and Drug Delivery

Medical grade sodium hyaluronate sees expanding use in anti-adhesive products for postoperative healing, where it creates a barrier between tissues to prevent adhesion formation. Hospitals adopt these solutions in abdominal, gynecological, and orthopedic surgeries to reduce complications and recovery time. In parallel, research into drug delivery systems positions hyaluronate as a carrier for targeted therapies, especially in ophthalmology and oncology. Hydrogels incorporating hyaluronate can support sustained release of active molecules, improving treatment precision. These expanding applications open new commercial opportunities beyond traditional viscosupplementation and fillers.

- For instance, Ferring Pharmaceuticals’ DURASEAL Xact sealant delivers 2.0 mL of hydrogel composed of polyethylene glycol and sodium hyaluronate, forming a protective layer that polymerizes within 30 seconds to minimize postoperative tissue binding.

Key Challenges

High Treatment Costs and Limited Patient Affordability

Premium sodium hyaluronate products and injectable therapies carry high costs, limiting accessibility for low-income populations. In several countries, lack of reimbursement coverage makes viscosupplementation and dermal filler treatments cost-prohibitive. Cosmetic applications remain largely out-of-pocket expenses, restricting adoption among price-sensitive consumers. In developing regions, limited awareness and inadequate healthcare infrastructure further slow market penetration. Manufacturers face pressure to balance innovation with cost-efficient production to remain competitive.

Regulatory Approval Barriers and Product Safety Concerns

Medical grade sodium hyaluronate products must comply with strict regulatory standards, making approval timelines long and costly. Variations in regulatory requirements across the U.S., Europe, and Asia complicate global product launches. Safety concerns arise from improper handling, low-quality fillers, or unauthorized aesthetic procedures, which can lead to adverse effects and damage market trust. To maintain credibility, manufacturers must ensure strong clinical evidence, quality control, and physician training. These regulatory complexities and safety risks remain critical challenges for market participants.

Regional Analysis

North America

North America leads the medical grade sodium hyaluronate market with the largest share, driven by high adoption of viscosupplementation and advanced ophthalmic procedures. Strong presence of specialty hospitals, favorable reimbursement for osteoarthritis treatment, and rising demand for dermal fillers support regional dominance. The United States records the highest consumption due to its aging population and high awareness of minimally invasive therapies. Extensive use of premium viscoelastic agents in cataract surgeries also contributes to growth. Strategic product launches and FDA-approved formulations help manufacturers strengthen their position, keeping North America ahead of other regions in market share and revenue.

Europe

Europe holds a significant market share with strong demand for ophthalmic visco-surgical devices and intra-articular injections. Countries such as Germany, France, Italy, and the UK have well-established healthcare systems supporting access to advanced orthopedic and ophthalmic care. Increasing uptake of dermal fillers in medical spas and dermatology clinics further accelerates demand. The region benefits from widespread awareness of anti-aging treatments and growing preference for non-surgical options. Manufacturers focus on regulatory-compliant, high-purity formulations, improving market credibility. Rising geriatric population and joint degeneration cases ensure sustained consumption, keeping Europe among the leading revenue contributors.

Asia Pacific

Asia Pacific shows the fastest growth and continues gaining market share due to expanding healthcare infrastructure, rising cosmetic procedure volumes, and increasing cataract surgeries. China, Japan, South Korea, and India lead adoption, supported by large elderly populations and growing affordability of medical treatments. The region sees strong demand for sodium hyaluronate fillers as beauty awareness and preventive skincare increase. Hospitals and ophthalmic centers adopt viscoelastic agents for cataract surgery at a rapid pace. Domestic manufacturers also expand production capacity, making products more accessible. Government health programs and private investments drive further market penetration.

Latin America

Latin America holds a moderate market share, supported by rising adoption of dermal fillers and orthopedic treatments. Brazil and Mexico lead demand due to growing medical tourism, cosmetic surgery popularity, and improved access to private healthcare. Clinics increasingly use hyaluronate-based fillers for facial aesthetics, driven by social media influence and beauty trends. Ophthalmic product usage grows as cataract procedures rise among aging populations. However, limited reimbursement and uneven healthcare development restrict broader adoption. Growing awareness of minimally invasive therapies and entry of global brands create opportunities for future expansion.

Middle East & Africa

The Middle East & Africa account for a smaller share of the medical grade sodium hyaluronate market but show steady growth. The Gulf region experiences rising demand for aesthetic procedures and premium ophthalmic care due to high medical tourism and expanding private hospitals. Sodium hyaluronate injections gain traction in orthopedic clinics treating joint pain and mobility issues. In Africa, limited healthcare access and affordability challenges slow adoption, but urban hospitals increasingly perform cataract and cosmetic procedures. Increasing investment in specialized medical centers and entry of international manufacturers improve long-term growth prospects.

Market Segmentations:

By Type

- Intra-Articular Injection

- Ophthalmic Visco-Surgical Devices

- Anti-Adhesive Products

- Derma Fillers

- Scaffold Materials

- Others

By Application

- Ophthalmology

- Cosmetic Surgery

- Osteoarthritis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the medical grade sodium hyaluronate market features a mix of global pharmaceutical companies, biotechnology firms, and specialty manufacturers focused on orthopedic, ophthalmic, and aesthetic applications. Leading players compete through high-purity formulations, advanced cross-linking technologies, and longer-lasting injectable products. Many companies invest in clinical trials to expand regulatory approvals for viscosupplementation, cataract surgery support, and dermal fillers. Strategic partnerships with hospitals, dermatology clinics, and ambulatory surgical centers improve product reach. Expansion into emerging markets strengthens distribution networks and lowers treatment costs. Manufacturers also focus on biocompatible production methods and improved viscoelastic properties to enhance safety and patient outcomes. Continuous product innovation, growing application areas such as wound care and anti-adhesion agents, and rising investments in R&D ensure a competitive and evolving market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zimmer Biomet Holdings, Inc.

- LG Chem Ltd.

- Ferring Pharmaceuticals

- Galderma S.A.

- Seikagaku Corporation

- Bausch Health Companies Inc.

- Fidia Farmaceutici S.p.A.

- Bohus BioTech AB

- Anika Therapeutics, Inc.

- Allergan (AbbVie Inc.)

Recent Developments

- In January 2025, Galderma S.A. presented new real-world data on its injectable aesthetic portfolio (including hyaluronic acid fillers) at the IMCAS 2025 Congress, reinforcing its leadership in HA-based aesthetics.

- In July 2024, LG Chem Ltd. announced the launch of its single-injection cross-linked hyaluronic acid product “Synovian” (exported as “Hyruan ONE”) in China via partner Yifan Pharmaceutical

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for intra-articular injections will rise as osteoarthritis cases increase worldwide.

- Ophthalmic visco-surgical use will grow with more cataract and refractive surgeries.

- Dermal fillers will gain wider adoption due to rising interest in minimally invasive aesthetics.

- Product innovation will focus on long-lasting, high-viscosity and cross-linked formulations.

- Expanding applications in wound healing and anti-adhesion therapy will create new opportunities.

- Drug delivery systems using hyaluronate-based hydrogels will gain research and commercial attention.

- Manufacturers will strengthen global distribution through hospital and clinic partnerships.

- Growing medical tourism will boost adoption in Latin America, the Middle East, and Asia.

- Regulatory approvals for advanced formulations will support clinical trust and safety.

- Increased production capacity in emerging markets will improve affordability and access.