Market overview

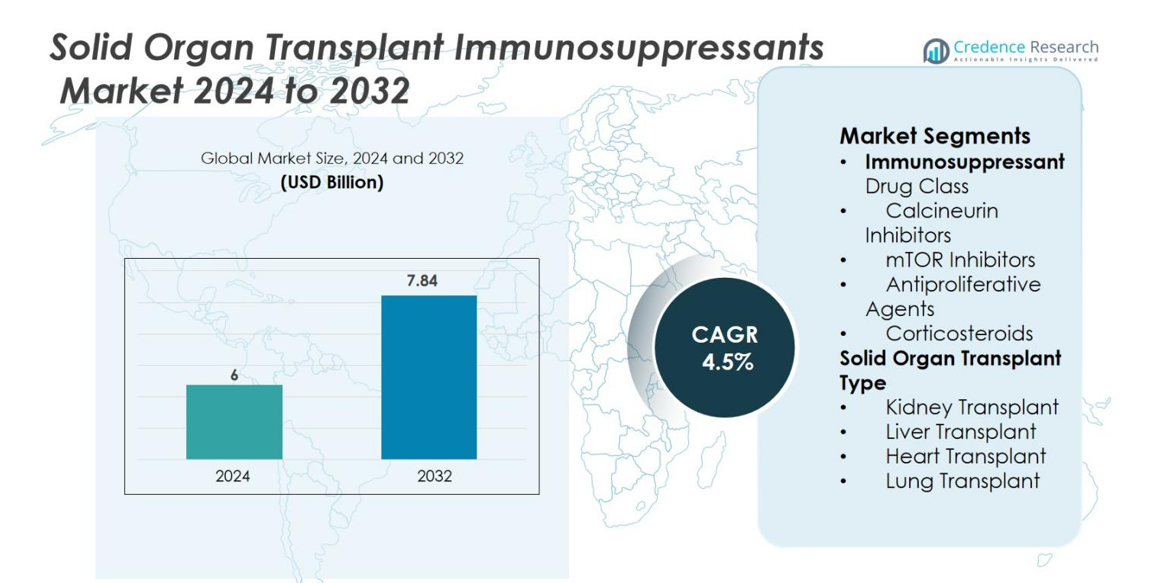

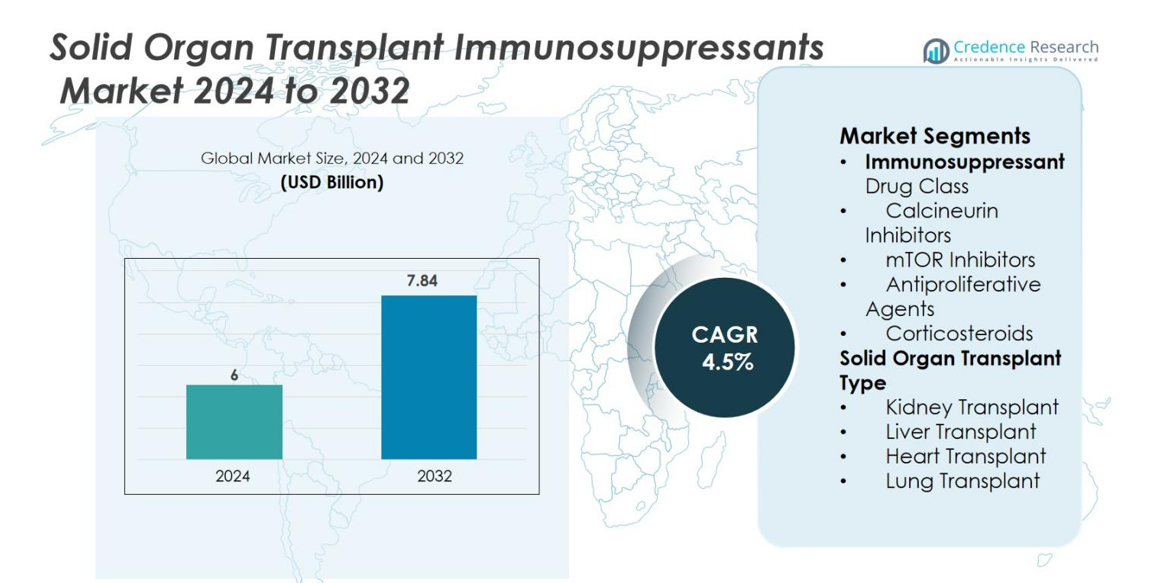

The Solid Organ Transplant Immunosuppressants market size was valued at USD 6 billion in 2024 and is anticipated to reach USD 7.84 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Organ Transplant Immunosuppressants Market Size 2024 |

USD 6 billion |

| Solid Organ Transplant Immunosuppressants Market, CAGR |

4.5% |

| Solid Organ Transplant Immunosuppressants Market Size 2032 |

USD 7.84 billion |

The Solid Organ Transplant Immunosuppressants market is driven by major players such as Astellas Pharma Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Pfizer Inc., Bristol-Myers Squibb Company, Sanofi, Veloxis Pharmaceuticals, Inc., Takeda Pharmaceutical Company, Accord Healthcare, and Lupin Limited. These companies maintain strong competitive positions through diversified immunosuppressant portfolios, continuous R&D investment, and strategic collaborations aimed at improving long-term graft survival and reducing treatment toxicity. North America leads the global market with over 40% share, supported by high transplant volumes, advanced clinical infrastructure, and strong adoption of innovative therapies. Europe follows with roughly 30% share, benefiting from robust organ donation systems and well-established post-transplant care frameworks.

Market Insights

- The Solid Organ Transplant Immunosuppressants market was valued at USD 6 billion in 2024 and is projected to reach USD 7.84 billion by 2032, registering a CAGR of 4.5%.

- Market growth is driven by rising global transplant volumes, increasing prevalence of chronic kidney and liver diseases, and continuous advancements in immunosuppressive drug formulations that enhance graft survival and reduce toxicity.

- Key trends include expanding adoption of personalized immunosuppression, biomarker-based monitoring, the growing use of biologics, and development of extended-release and targeted therapies.

- The competitive landscape features major players such as Astellas, Novartis, Roche, Pfizer, Bristol-Myers Squibb, Sanofi, and Veloxis, with generics manufacturers like Accord and Lupin strengthening price competitiveness; calcineurin inhibitors hold over 40% segment share.

- Regionally, North America leads with 40%+ share, followed by Europe at 30%, Asia-Pacific at 20% as the fastest-growing region, while Latin America and Middle East & Africa collectively account for the remainder.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

Immunosuppressant Drug Class

Calcineurin inhibitors account for the largest share of the Solid Organ Transplant Immunosuppressants market, representing over 40% of total revenue. Their dominance is driven by strong clinical efficacy in preventing acute rejection across kidney, liver, and heart transplants. mTOR inhibitors continue to grow steadily due to their favorable safety profile and reduced nephrotoxicity, while antiproliferative agents maintain consistent adoption as part of combination regimens. Corticosteroids remain essential for induction and early post-transplant therapy, though long-term use is declining due to side-effect concerns.

- For instance, a retrospective single-center cohort of 150 kidney transplant patients converted from calcineurin inhibitors to the mTOR inhibitor Sirolimus showed that creatinine clearance improved from 50.9 mL/min ± 20.7 at conversion to 52.9 mL/min ± 20.8 at 24 months after conversion.

Solid Organ Transplant Type

Kidney transplants constitute the leading segment, capturing more than 55% of market demand due to the high global prevalence of chronic kidney disease and expanding transplantation volumes. Liver transplants follow with strong uptake supported by improved surgical outcomes and rising cases of end-stage liver disease. Heart and lung transplants contribute a smaller yet steadily increasing share, driven by enhanced survival rates and improving access to advanced immunosuppressant regimens, which collectively support sustained market expansion.

- For instance, long-term survival analysis of liver transplant recipients showed mean estimated graft survival of 20.90 years in the U.S. and 20.38 years in the U.K. in recent studies.

Key Growth Drivers

Rising Global Transplant Volumes

The growing number of solid organ transplant procedures worldwide remains a primary driver of the immunosuppressants market. Increasing incidences of chronic kidney disease, liver cirrhosis, heart failure, and pulmonary disorders are significantly expanding the pool of eligible transplant candidates. Improvements in surgical techniques, expanded donor availability through living and deceased donation, and better organ preservation methods have also contributed to rising transplant success rates. As more patients survive the perioperative period, the long-term need for effective immunosuppressive regimens continues to escalate. Additionally, the aging population and higher prevalence of lifestyle-related diseases are further accelerating transplant activity, creating sustained demand for advanced immunosuppressant therapies.

- For instance, global transplant volumes reached approximately 172,409 organs in 2023, with an average of around one transplant every 3 minutes.

Advancements in Drug Formulations and Therapeutic Protocols

Innovations in immunosuppressive drug design and delivery play a vital role in market expansion. Newer formulations aim to minimize toxicity, reduce dosing frequency, and improve patient adherence, which is a critical factor for preventing graft rejection. The development of extended-release versions, targeted therapies, and agents with improved safety profiles is driving broader adoption across organ types. Personalized medicine approaches, such as pharmacogenomic-guided dosing and biomarker-driven monitoring, are improving therapeutic precision and reducing adverse events. These advancements enable clinicians to tailor regimens more effectively, supporting better long-term graft survival and increasing reliance on modern immunosuppressant combinations.

- For instance, CYP3A5 genotyping allowed dose adjustments where CYP3A5 expressors required tacrolimus starting doses of up to 0.3 mg/kg/day, compared with a standard starting dose of 0.15 mg/kg/day in non-expressors (poor metabolizers) to reach target trough levels.

Expanding Access to Transplant Care in Emerging Markets

Rapid improvements in healthcare infrastructure and increasing healthcare expenditure in emerging economies are significantly enhancing access to organ transplantation. Countries in Asia-Pacific, Latin America, and the Middle East are investing in transplant centers, specialized surgical programs, and post-transplant care facilities. Greater availability of reimbursement programs, government initiatives promoting organ donation, and rising awareness of transplantation as a viable treatment option are supporting higher procedure volumes. Pharmaceutical companies are also expanding their presence in these regions by offering cost-effective drug variants and strengthening distribution networks. As more patients in these markets gain access to advanced therapies, demand for immunosuppressants is expected to grow steadily.

Key Trends & Opportunities

Shift Toward Personalized and Minimization Protocols

A major trend shaping the market is the growing shift toward personalized immunosuppressive strategies and minimization protocols designed to reduce long-term medication burden. Advances in genetic testing, immune profiling, and biomarker-based monitoring are enabling clinicians to fine-tune dosing and identify early signs of rejection with greater accuracy. This movement toward individualized regimens reduces toxicity, enhances graft longevity, and increases patient quality of life. At the same time, research is accelerating in precision therapies that selectively target immune pathways, opening opportunities for next-generation agents with improved safety. This trend presents significant commercial potential for companies investing in innovative, patient-tailored drug solutions.

- For instance, a randomized controlled trial with genotype-guided dosing found that in kidney transplant recipients, the CYP3A5 expressers required a starting dose of 0.12 ± 0.03 mg/kg/day of tacrolimus, compared with 0.09 ± 0.03 mg/kg/day in non-expressers to reach similar trough levels.

Biologics and Novel Therapeutic Classes Gaining Momentum

The growing interest in biologics and alternative therapeutic classes represents a substantial opportunity for market expansion. Monoclonal antibodies, co-stimulation blockers, and cell-based therapies are gaining traction as adjuncts or alternatives to traditional immunosuppressants. These agents offer targeted mechanisms of action, reducing the need for broad-spectrum immunosuppression and lowering the risk of infections or malignancies. As clinical trials demonstrate favorable outcomes, biologics are increasingly being incorporated into induction and maintenance protocols. Pharmaceutical companies are focusing on pipeline development in this area, aiming to capture unmet needs related to tolerance induction, chronic rejection prevention, and long-term graft preservation.

- For instance, in the original BENEFIT trial (standard criteria donor kidneys), belatacept therapy showed a mean estimated GFR of approximately 70 mL/min/1.73 m² at year 7, compared with approximately 45 mL/min/1.73 m² in the cyclosporine arm. In the BENEFIT-EXT trial (extended criteria donor kidneys), the mean estimated GFR for belatacept was approximately 54 mL/min/1.73 m², versus approximately 35 mL/min/1.73 m² for cyclosporine at year 7. In both studies, these results demonstrate significantly improved long-term renal function with belatacept therapy compared to cyclosporine.

Key Challenges

Adverse Effects and Long-Term Safety Concerns

Despite their clinical importance, immunosuppressants present significant challenges due to their long-term safety profiles. Calcineurin inhibitors and corticosteroids are associated with nephrotoxicity, metabolic complications, hypertension, and heightened infection risk. These adverse effects often compromise patient adherence, jeopardizing graft survival and leading to costly post-transplant complications. The chronic nature of immunosuppressive therapy means patients face lifelong exposure, amplifying concerns around cumulative toxicity. Regulatory scrutiny around drug safety is tightening, requiring companies to invest heavily in risk mitigation strategies, monitoring tools, and safer alternatives, which increases development complexity and costs.

High Treatment Costs and Reimbursement Limitations

The high cost of lifelong immunosuppressive therapy remains a major barrier, particularly in low- and middle-income regions. Branded drugs, biologics, and novel agents are often expensive, limiting access for patients without comprehensive insurance coverage. Even in developed markets, reimbursement restrictions for newer therapies can delay adoption despite clinical benefits. Healthcare systems face increasing financial pressure due to rising transplant volumes and prolonged patient lifespans, prompting more stringent evaluations of cost-effectiveness. These economic constraints challenge pharmaceutical companies to balance innovation with affordability, while health providers must navigate complex coverage frameworks to ensure consistent patient access.

Regional Analysis

North America

North America dominates the Solid Organ Transplant Immunosuppressants market, accounting for over 40% of global revenue due to high transplant volumes, advanced healthcare infrastructure, and strong adoption of innovative therapies. The U.S. leads the region with well-established transplant centers, broad reimbursement coverage, and robust clinical research supporting new drug development. Rising prevalence of chronic kidney and liver diseases continues to drive demand, while ongoing improvements in donor registration and organ preservation strengthen procedure rates. Strategic collaborations between pharmaceutical companies and research institutions further support market expansion across North America.

Europe

Europe represents 30% of the global market, supported by high accessibility to transplant services, favorable government policies, and comprehensive post-transplant care frameworks. Countries such as Germany, France, Spain, and the U.K. lead in transplant procedures, underpinned by strong organ donation systems and advanced clinical capabilities. The region benefits from broad adoption of combination immunosuppressive regimens and increasing use of biologics. Rising incidence of end-stage organ failure, aging demographics, and improved survival outcomes continue to fuel market growth, while harmonized regulatory pathways promote consistent availability of innovative therapies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing 20% of the market and demonstrating strong expansion driven by growing healthcare investments and rising transplant volumes in China, India, Japan, and South Korea. Improved access to specialized transplant centers, expanding insurance coverage, and increasing organ donation awareness contribute to higher procedure rates. The region is experiencing rapid adoption of cost-effective immunosuppressant variants, supported by strong presence of generics manufacturers. As chronic disease burdens rise and governments promote transplantation programs, Asia-Pacific presents significant growth potential for both established and emerging immunosuppressant therapies.

Latin America

Latin America accounts for 7% of the market, driven by growing transplant activities in Brazil, Mexico, Argentina, and Colombia. Expanding public healthcare funding, improved organ donation initiatives, and increasing adoption of standardized transplant protocols support market growth. Brazil remains the regional leader due to its large patient population and well-developed national transplant program. However, access to advanced immunosuppressive therapies still varies across countries, influenced by economic disparities and uneven reimbursement structures. Despite these challenges, rising demand for kidney and liver transplants continues to create a steady need for cost-efficient immunosuppressant regimens.

Middle East & Africa

The Middle East & Africa region holds 5% of the global market, with growth concentrated in Saudi Arabia, the UAE, South Africa, and Egypt. Investments in transplant infrastructure, government-supported medical tourism, and expanding specialized centers are enhancing access to advanced treatments. Kidney transplants dominate regional procedures due to high rates of diabetes and hypertension. However, limited donor availability and inconsistent healthcare resources in several African countries constrain broader market expansion. Despite these challenges, increasing partnerships with international medical institutions and rising awareness of organ donation are gradually improving regional transplant outcomes.

Market Segmentations

By Immunosuppressant Drug Class

- Calcineurin Inhibitors

- mTOR Inhibitors

- Antiproliferative Agents

- Corticosteroids

By Solid Organ Transplant Type

- Kidney Transplant

- Liver Transplant

- Heart Transplant

- Lung Transplant

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Solid Organ Transplant Immunosuppressants market is shaped by a mix of global pharmaceutical leaders and emerging specialty drug manufacturers focused on long-term immunosuppression and transplant survival. Key players include Astellas Pharma Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Pfizer Inc., Bristol-Myers Squibb Company, Sanofi, Veloxis Pharmaceuticals, Inc., Takeda Pharmaceutical Company, Accord Healthcare, and Lupin Limited. These companies compete through extensive R&D investments, strong product portfolios, and strategic collaborations to develop safer, more effective therapies with reduced toxicity. Market competition is further influenced by patent expirations, increasing availability of generics, and growing demand for extended-release formulations and biologics. Leading firms are prioritizing personalized dosing strategies, next-generation immunomodulators, and improved monitoring technologies to strengthen their market positions. As transplantation volumes rise globally, these companies continue to expand their presence across developed and emerging markets, aiming to meet the increasing need for high-quality, cost-efficient immunosuppressant therapies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Tonix Pharmaceuticals Holding Corp. announced a collaboration with Massachusetts General Hospital to initiate a Phase 2 clinical trial of its dimeric Fc-modified anti-CD40L monoclonal antibody, TNX-1500, aimed at kidney transplant rejection prevention.

- In November 2025, Eledon Pharmaceuticals, Inc. reported that despite not achieving the primary endpoint in its Phase 2 BESTOW trial of tegoprubart, it plans to advance the candidate into Phase 3 for kidney transplant rejection prevention.

- In June 2025, Sanofi announced that its investigational agent Riliprubart earned U.S. orphan-drug designation for the treatment of antibody-mediated rejection in solid organ transplantation.

Report Coverage

The research report offers an in-depth analysis based on Immunosuppressant Drug Class, Solid Organ Transplant Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global transplant volumes continue to rise across major organ types.

- Advances in personalized immunosuppression will enable more precise dosing and improved long-term graft survival.

- New biologics and targeted therapies will gain wider adoption, reducing reliance on older high-toxicity drugs.

- Extended-release and improved-delivery formulations will enhance patient adherence and minimize adverse effects.

- Emerging markets will expand rapidly due to better healthcare infrastructure and increasing access to transplant procedures.

- Artificial intelligence and biomarker-driven monitoring will support earlier detection of rejection and optimized therapy adjustments.

- Pharmaceutical companies will intensify R&D efforts focused on reducing nephrotoxicity and metabolic complications.

- Competition will increase as generics manufacturers strengthen their presence with cost-efficient immunosuppressant options.

- Regulatory agencies will promote safer, innovation-driven formulations, influencing product development strategies.

- Collaborative clinical programs and global transplant networks will accelerate the introduction of next-generation immunosuppressive therapies.