Market Overview:

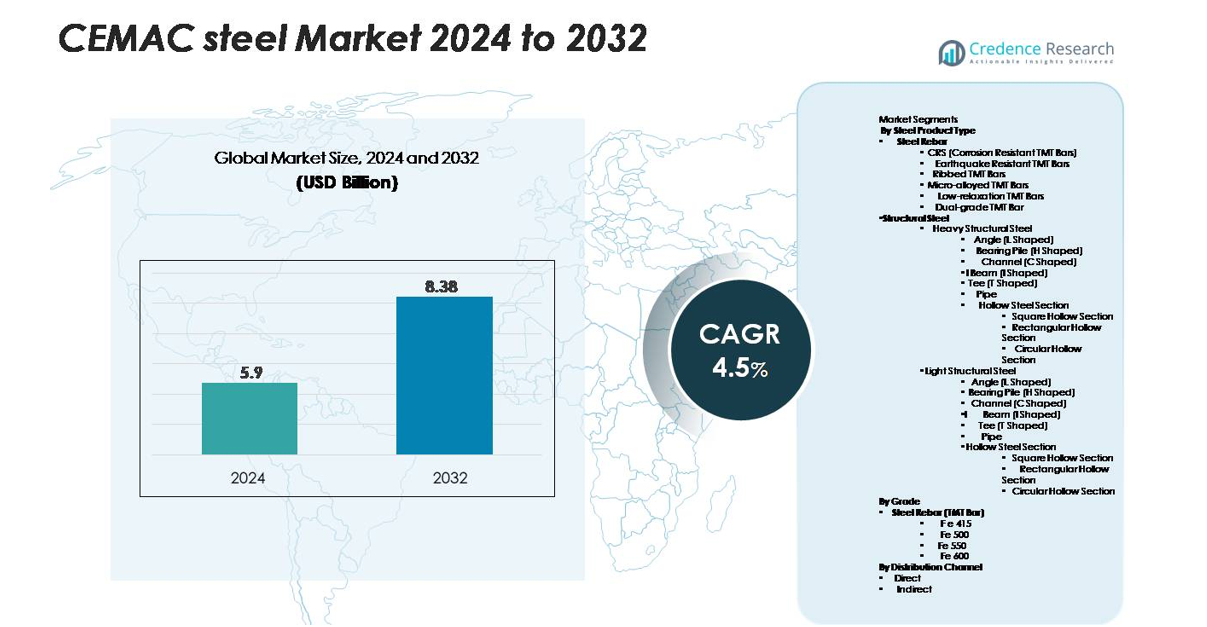

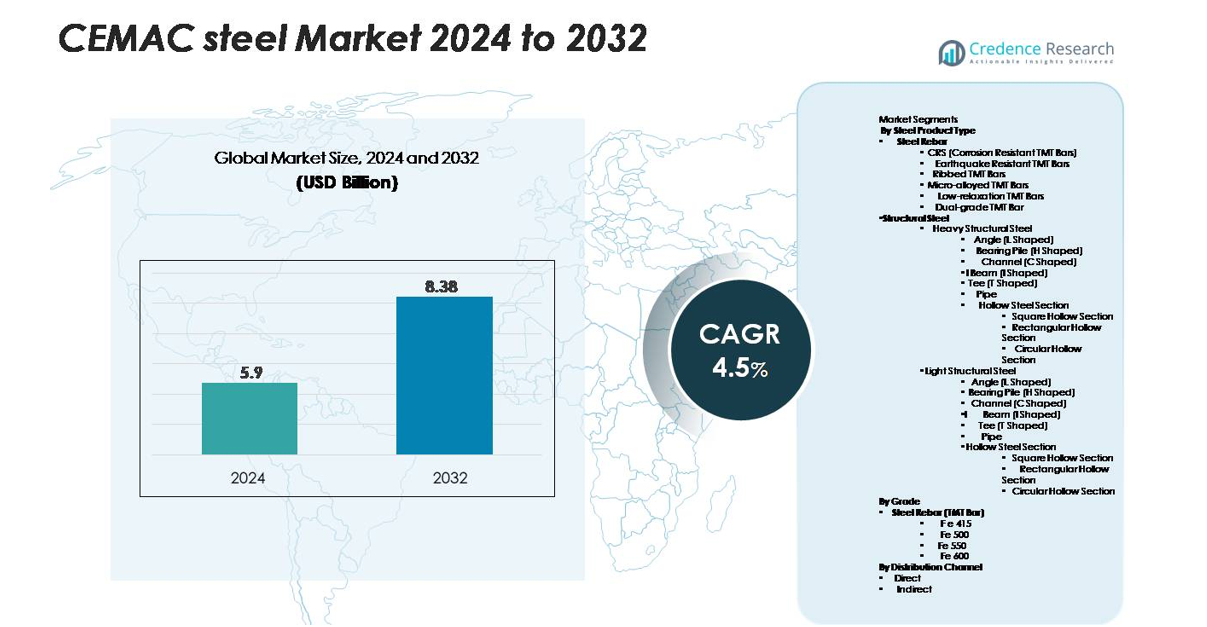

CEMAC steel market size was valued at USD 5.9 billion in 2024 and is anticipated to reach USD 8.38 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CEMAC Steel Market Size 2024 |

USD 5.9 billion |

| CEMAC Steel Market, CAGR |

4.5% |

| CEMAC Steel Market Size 2032 |

USD 8.38 billion |

Cameroon leads the CEMAC steel market with a 40% share, supported by advanced distribution networks and steady infrastructure spending. Major suppliers include international steel manufacturers, regional importers, and local service centers that provide value-added processing such as cutting, bending, and welding for construction and industrial customers. Leading distributors maintain warehouse stocks of TMT bars, beams, pipes, and hollow sections to meet government and private project demand. These suppliers compete on pricing, delivery reliability, and credit support for contractors. Increasing direct procurement by infrastructure developers and oil-linked industries further strengthens the position of well-organized steel importers and processors across the region.

Market Insights

- The CEMAC steel market was valued at USD 5.9 billion in 2024 and is projected to reach USD 8.38 billion by 2032, growing at a CAGR of 4.5%, driven by rising infrastructure and construction demand.

- Steel Rebar, particularly Fe 500 grade, dominates the product segment, while structural steel sections gain traction in industrial and transport projects, reflecting strong demand for durable construction materials.

- Adoption of high-strength, corrosion-resistant TMT bars and hollow sections is increasing, supported by modular construction trends, urban housing projects, and coastal infrastructure development.

- Competitive landscape features international suppliers, regional distributors, and local service centers; Cameroon holds 40% market share, followed by Gabon 18%, Congo 15%, Chad 12%, CAR 8%, and Equatorial Guinea 7%, highlighting regional concentration.

- Market restraints include reliance on imported raw materials, production constraints, and skilled workforce shortages, which challenge timely supply and project execution, particularly for small-scale contractors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Steel Product Type

Steel Rebar holds the dominant share in the CEMAC steel market due to its extensive use in residential and commercial construction. CRS, earthquake-resistant, and ribbed TMT bars see steady demand as builders focus on structural durability and corrosion prevention in coastal and humid regions. The growing shift toward micro-alloyed and low-relaxation TMT bars also supports higher strength-to-weight ratios, reducing steel consumption in large projects. Structural steel, including heavy and light sections such as I-beams, channels, pipes, and hollow sections, remains essential for bridges, industrial plants, and transportation projects, sustaining long-term demand.

- For instance, Tata Steel’s micro-alloyed TMT bars incorporate niobium and vanadium additives, raising tensile strength beyond 550 MPa and extending fatigue life in reinforced concrete structures.

By Grade

Fe 500 dominates the TMT bar segment due to its balance of strength, ductility, and affordability for mass housing and infrastructure construction. Higher-grade bars such as Fe 550 and Fe 600 gain traction in high-rise buildings and industrial structures requiring enhanced load-bearing capacity. In structural steel, ASTM A36 and ASTM A572 remain widely used for beams, columns, and welded frames because of their weldability and tensile strength. Growing adoption of EN 10025, BS 4360, and JIS G3101 in industrial and marine applications further supports compliance with international engineering standards across import-linked projects.

- For instance, JSW Steel’s Fe 500D TMT bars deliver a minimum yield strength of 500 MPa and elongation of 16%, meeting seismic zone requirements for multi-storey buildings.

By Distribution Channel

The direct distribution channel leads the CEMAC steel market, driven by bulk procurement from construction companies, government contractors, and industrial project developers. Manufacturers and large distributors supply TMT bars, structural sections, and hollow profiles directly to project sites, reducing logistics costs and ensuring uninterrupted material flow. The indirect channel, comprising retail outlets and local dealers, remains important for small-scale builders and individual housing projects. Expansion of infrastructure development and public-private partnerships encourages direct long-term contracts, strengthening supplier-buyer relationships and supporting competitive pricing across the region.

Key Growth Drivers

Large-Scale Infrastructure and Housing Development

Infrastructure modernization remains the primary growth driver for the CEMAC steel market. Governments invest in highways, bridges, rail expansions, seaports, and power transmission networks to improve trade movement and industrial productivity. Public–private partnerships further accelerate steel procurement for airports, logistics parks, and energy pipelines. Rising urbanization increases demand for housing complexes, commercial buildings, hospitals, and educational institutions, driving consumption of TMT bars, structural sections, and hollow steel profiles. Affordable housing programs and road rehabilitation projects in Cameroon, Gabon, and Congo create steady steel rebar demand. At the same time, developers favor corrosion-resistant and earthquake-resistant grades to improve safety in coastal and high-risk zones. The construction sector’s reliance on steel as a core structural material ensures consistent market growth as regional development plans scale up.

- For instance, ArcelorMittal produces corrosion-resistant TMT bars, such as the Fe 500D grade, which are engineered with a minimum 500 MPa yield strength and are designed to offer reduced chloride penetration, making them suitable for infrastructure in humid coastal areas.

Growth of Mining, Oil, and Industrial Manufacturing

CEMAC economies rely heavily on mining, petroleum production, and mineral processing, which require heavy structures, pipelines, storage tanks, and equipment frames built with structural steel. Steel demand rises for rigs, refineries, industrial sheds, conveyors, and port terminals handling oil and mineral exports. Expansion of cement plants, agro-processing units, chemical facilities, and fabrication workshops also contributes to higher consumption of beams, channels, and square or circular hollow sections. Equipment manufacturers use steel for machinery, heavy vehicles, and fabrication components, strengthening direct procurement channels. Government efforts to diversify economies beyond crude exports encourage industrial clusters and special economic zones, creating long-term visibility for steel suppliers. As industries automate and scale operations, stronger and high-grade steel remains essential to support higher load-bearing capacity and longer durability.

- For instance, Tenaris supplies high-strength, API 5L-grade steel pipes, such as API 5L X65 (which has a minimum tensile strength of 535 MPa) or X70 (minimum tensile strength of 635 MPa), for offshore crude transport systems globally.

Investments in Transport and Cross-Border Trade Corridors

Regional trade corridors drive steel consumption for road expansion, truck terminals, and logistics infrastructure. Projects linking Cameroon, Chad, the Central African Republic, and Gabon improve movement of goods and mining outputs. Bridge construction and roadway improvements require structural steel, rebar, and hollow profiles for pillars, retaining walls, and support systems. Port modernization in Douala, Kribi, and Libreville increases steel demand for warehouses, cranes, and marine structures exposed to corrosion. Cross-border rail development further supports procurement of steel sleepers, beams, and welded frames. International funding agencies and development banks support many of these projects, ensuring guaranteed material flow and large-volume orders. As trade and transport networks improve, industrial investors gain confidence, which leads to construction of new factories, storage facilities, and processing hubs, ensuring structural steel remains indispensable for long-term economic expansion.

Key Trends & Opportunities

Rising Use of High-Strength and Corrosion-Resistant Steel

Demand shifts toward high-strength TMT bars and structural steel grades that support lighter construction and longer lifespan. Builders prefer Fe 500 and Fe 550 for reinforced concrete structures to reduce steel usage without compromising load capacity. Coastal and humid regions adopt corrosion-resistant TMT bars and galvanized hollow sections to minimize maintenance in bridges, marine ports, and storage tanks. Lightweight hollow sections gain popularity in modular construction, prefabricated buildings, and industrial frames due to easier handling and faster installation. As safety regulations strengthen, engineering standards encourage adoption of ASTM-based grades, opening opportunities for suppliers offering certified materials. This trend also benefits manufacturers positioned to supply premium steel to contractors working on large infrastructure and industrial projects.

- For instance, JSPL’s Fe 550D TMT bars provide a minimum tensile strength of 600 MPa, enabling reduction in bar diameter while maintaining structural stability in multistorey buildings.

Expansion of Steel Distribution Networks and Local Processing

Growth in direct procurement and warehouse-based supply chains supports reliable material availability for contractors and industrial users. Steel service centers cut, bend, and customize beams, channels, and rebar to match project specifications, reducing fabrication time on-site. Local manufacturing of hollow sections and rebars creates opportunities for steel mills to expand capacity, while downstream fabrication units serve automotive, agricultural machinery, and equipment manufacturers. Increasing dealer networks in cities and small towns supports distribution for small residential builders. Investments in rolling mills and coating units also encourage import substitution, lowering dependency on foreign steel shipments. The shift toward local processing presents long-term revenue prospects for steel producers and service providers targeting construction and industrial clients.

- For instance, Tosyali Algeria is commissioning a new galvanizing line with a coating capacity of 400,000 tons annually, which is expected to be fully operational in 2025. This facility is designed to reduce Algeria’s need for imported coated steel for industrial and commercial projects.

Key Challenges

Reliance on Imported Raw Materials and Production Constraints

The CEMAC steel market faces challenges due to limited domestic raw material supply and dependence on imported billets, scrap, and finished steel products. Currency fluctuations and high logistics costs increase procurement expenses and affect pricing stability, especially for small contractors. Port congestion and transport delays disrupt delivery timelines and cause project slowdowns. Limited smelting and rolling capacity also restrict local output, leading to higher reliance on external suppliers. Small fabrication units struggle with inconsistent power supply and high operational costs, reducing competitiveness against imported materials. Addressing these constraints requires investment in local steel plants, energy infrastructure, and mining-to-metal supply chains to improve production efficiency.

Skilled Workforce Gaps and Project Delays

Shortage of skilled welders, fabricators, structural engineers, and project technicians remains a critical challenge. In large infrastructure projects, mistakes in steel cutting, welding, or installation increase rework and material wastage. Smaller contractors rely on manual labor rather than advanced machinery, slowing construction timelines and reducing structural precision. Limited access to training programs also restricts adoption of high-grade steel and new construction technologies. Project delays caused by funding issues, regulatory approvals, and procurement bottlenecks further affect steel demand cycles. Improving technical training, certification programs, and on-site mechanization can help contractors deliver better-quality steel construction and reduce inefficiencies.

Regional Analysis

Cameroon

Cameroon holds the dominant share of the CEMAC steel market, accounting for nearly 40% of total regional consumption. Large-scale infrastructure investments in highways, bridges, hydroelectric plants, and port modernization in Douala and Kribi drive high demand for structural steel and TMT bars. Rapid urbanization boosts residential and commercial construction, supporting steady rebar procurement. Industrial manufacturing, oil and gas logistics, and storage facilities also rely on heavy structural profiles and hollow sections. Import channels and distribution networks are more advanced in Cameroon than in other CEMAC markets, ensuring strong supply chain capability and continued dominance in steel consumption.

Gabon

Gabon contributes close to 18% of the CEMAC steel market, supported by oil refining, mining, and the expansion of industrial processing zones. Construction of free trade zones, logistics parks, and port facilities in Libreville and Port-Gentil increases steel usage for beams, piles, pipelines, and modular structures. Public housing programs and commercial real estate development sustain demand for corrosion-resistant TMT bars and galvanized hollow sections. The country relies significantly on imported billets and finished products, but steady industrial investments and government-backed infrastructure pipelines maintain consistent steel procurement throughout the year, strengthening Gabon’s share in the regional market.

Congo (Republic of Congo)

The Republic of Congo accounts for around 15% of regional steel demand, driven by oil terminals, storage infrastructure, road rehabilitation, and bridge construction. Projects in Pointe-Noire and Brazzaville utilize high-strength structural steel for industrial sheds, transportation facilities, and river crossings. Residential and commercial projects show a rising shift toward Fe 500 and Fe 550 rebar for durability and lower material usage. Although imports dominate supply, government incentives for industrial development and logistics corridors support steady consumption. Expansion of cement factories, power projects, and warehouses further sustains steel demand across heavy and light structural segments.

Chad

Chad represents nearly 12% of the CEMAC steel market, supported by highway development, oil production facilities, and growing urban housing needs. Investments in road networks connecting N’Djamena to neighboring trade routes create continuous demand for structural beams, channels, and rebar. Oil field infrastructure and pipeline upgrades use heavy structural steel and corrosion-resistant grades for harsh environmental conditions. Residential construction grows gradually, driven by population expansion and small-scale private projects. Although the steel supply chain depends heavily on imports, ongoing public works and logistics corridor development ensure stable procurement volume and strengthen Chad’s position in the regional market.

Central African Republic (CAR)

The Central African Republic holds a smaller share, contributing close to 8% of the CEMAC steel market. Steel demand mainly arises from road rehabilitation, bridge repairs, and reconstruction of public infrastructure. Urban housing projects and commercial buildings in Bangui rely on imported rebar and light structural sections through dealer networks. Limited manufacturing capacity and road connectivity challenges affect large-scale industrial consumption. However, international development funding and infrastructure rebuilding programs stimulate market activity, particularly for TMT bars and hollow sections. As logistics routes improve, CAR is expected to show gradual recovery in construction steel demand.

Equatorial Guinea

Equatorial Guinea accounts for nearly 7% of regional steel usage, driven by oil and gas processing, offshore logistics, and selective commercial construction. Port facilities, storage terminals, and industrial workshops rely on heavy structural steel and coated hollow sections for durability in coastal environments. The government focuses on social infrastructure such as hospitals, administrative buildings, and housing, sustaining rebar demand. Although large infrastructure spending has moderated, maintenance and modernization of oil-linked infrastructure continue to support consumption. The country depends mainly on imported steel, but port access ensures smooth distribution and stable procurement for ongoing industrial and civil construction needs.

Market Segmentations:

By Steel Product Type

- Steel Rebar

- CRS (Corrosion Resistant TMT Bars)

- Earthquake Resistant TMT Bars

- Ribbed TMT Bars

- Micro-alloyed TMT Bars

- Low-relaxation TMT Bars

- Dual-grade TMT Bar

- Structural Steel

- Heavy Structural Steel

- Angle (L Shaped)

- Bearing Pile (H Shaped)

- Channel (C Shaped)

- I Beam (I Shaped)

- Tee (T Shaped)

- Pipe

- Hollow Steel Section

- Square Hollow Section

- Rectangular Hollow Section

- Circular Hollow Section

- Light Structural Steel

- Angle (L Shaped)

- Bearing Pile (H Shaped)

- Channel (C Shaped)

- I Beam (I Shaped)

- Tee (T Shaped)

- Pipe

- Hollow Steel Section

- Square Hollow Section

- Rectangular Hollow Section

- Circular Hollow Section

By Grade

- Steel Rebar (TMT Bar)

- Fe 415

- Fe 500

- Fe 550

- Fe 600

- Structural Steel

- ASTM A36

- ASTM A572

- ASTM A992

- ASTM A500

- EN 10025

- BS 4360

- JIS G3101

- DIN 17100

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The CEMAC steel market features a fragmented competitive landscape dominated by regional distributors, importers, fabrication workshops, and a limited number of steel processors. Most consumption relies on imported billets, TMT bars, and structural sections sourced from Asia, the Middle East, and Europe, creating strong competition among international suppliers targeting construction, infrastructure, and industrial clients. Local service centers offer value-added processing, including cutting, bending, welding, and fabrication, which helps contractors reduce on-site labor and project timelines. Competitive pricing, delivery reliability, and credit-based dealer networks remain key differentiators in the market. Large buyers, such as government contractors and industrial developers, prefer direct procurement contracts to secure consistent supply for long-term projects. Meanwhile, smaller residential builders rely on retail dealers and local stockists. As infrastructure spending expands, companies with warehouse networks, certified high-grade steel, and technical support services are positioned to strengthen regional presence and win larger project-based orders.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- METALCO

- African Foundries Limited

- LES ACIERIES DU CAMEROUN SARL

- Bangui Metal Fabricators

- Nippon Steel Corporation

- Good Time Steel

- Kankan Iron and Steel

- Lake Group

- Bimbo Steel Production

- Metafrique Group

Recent Developments

- In January 2025, LES ACIERIES DU CAMEROUN SARL Cameroonian government document lists the company (registration or certificate context), signalling active regulatory or administrative movement.

- In January 2025, JFE Steel Corporation announced the sale of its JGreeX green steel to JFE Shoji Pipe & Fitting Corporation (JKK). This marks a significant milestone as it is the first instance of a Japanese steel distributor offering JGreeX in the steel pipe sector. The collaboration with JKK will facilitate a sales system designed for small-lot shipments and rapid deliveries, allowing JFE Steel to effectively market and supply its green steel to a diverse customer base.

- In October 2024, JSW Group has signed a MoU with POSCO Group of Korea to develop an integrated steel plant in India, aiming an capacity of 5 million tonnes/annum initially. This partnership aims to improve India’s steel production capabilities while also exploring opportunities in battery materials and renewable energy sectors, particularly for electric vehicles. The partnership is expected to bolster economic ties and promote sustainable practices in the steel industry, marking a pivotal step in India’s industrial growth.

Report Coverage

The research report offers an in-depth analysis based on Steel product type, Grade, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-strength TMT bars will increase as infrastructure and high-rise construction expand.

- Steel processing plants will grow in the region to reduce dependence on imported billets and finished products.

- Adoption of corrosion-resistant and modular steel sections will increase in coastal and industrial zones.

- Distribution networks will modernize, with service centers offering custom cutting and fabrication for contractors.

- Local manufacturing of hollow steel sections and structural profiles will improve supply reliability and lower costs.

- Importers will form strategic partnerships with global mills to secure long-term contracts and competitive pricing.

- Public‑private partnerships in transport and trade corridors will drive large-volume steel procurement.

- Workshops and training programs will focus on welding, fabrication, and structural installation skills to boost project quality.

- Growth in industrial hubs and special economic zones will create sustained demand for structural steel and heavy profiles.

- Digital supply chain solutions and supplier portals will improve order tracking, stock visibility, and delivery timelines.