Market Overview:

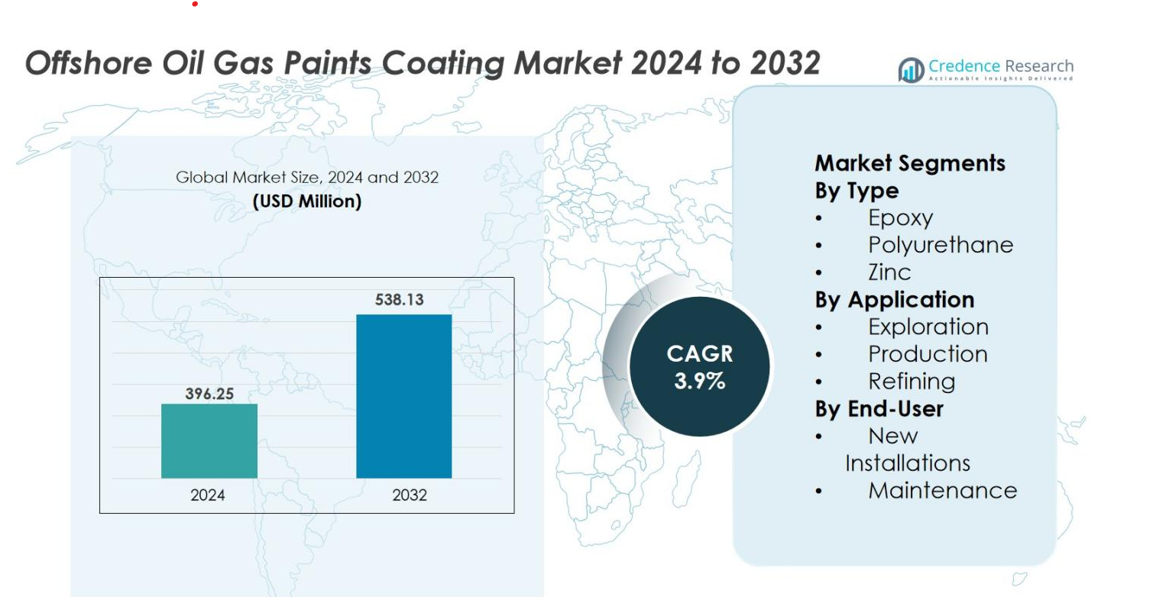

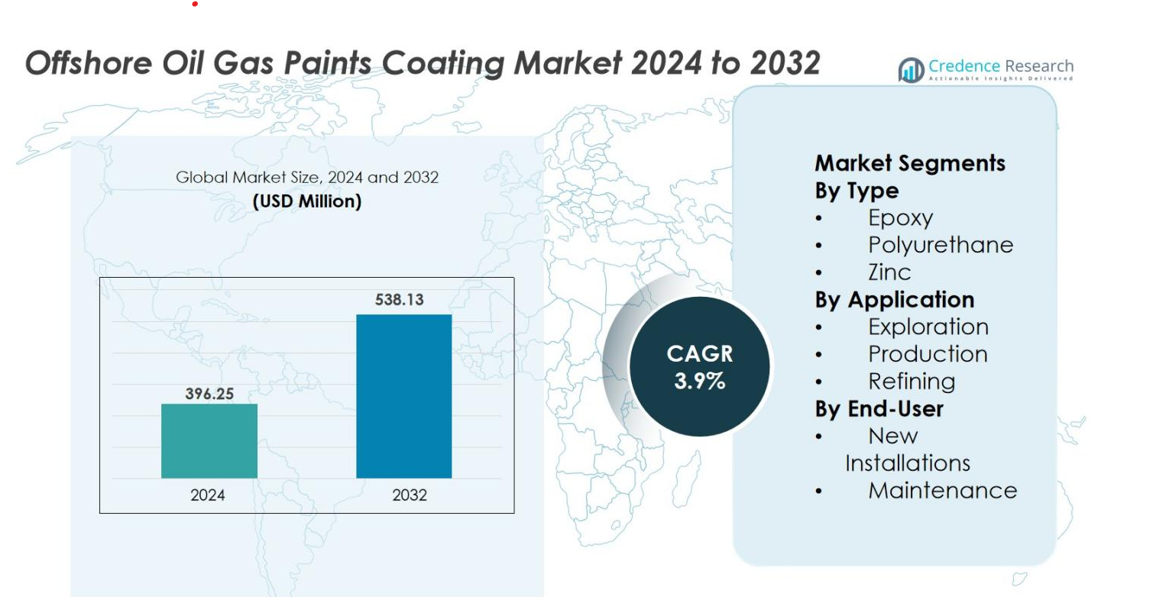

The Offshore Oil & Gas Paints & Coatings market size was valued at USD 396.25 million in 2024 and is anticipated to reach USD 538.13 million by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Oil & Gas Paints and Coatings Market Size 2024 |

USD 396.25 million |

| Offshore Oil & Gas Paints and Coatings Market, CAGR |

3.9% |

| Offshore Oil & Gas Paints and Coatings Market Size 2032 |

USD 538.13 million |

The Offshore Oil & Gas Paints & Coatings market is led by key players such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin‑Williams Company, Hempel A/S, Jotun Group, Kansai Paint Co., Ltd., RPM International Inc., and Chugoku Marine Paints, Ltd.. These companies leverage global reach, strong technical capabilities and extensive product portfolios. The dominant region is Asia‑Pacific, which holds approximately 37.2% of the market share, driven by escalating offshore exploration and production. North America and Europe follow, with mature infrastructure and stringent regulatory demands fueling regional competition.

Market Insights

- The Offshore Oil & Gas Paints & Coatings market size was valued at USD 396.25 million in 2024 and is anticipated to reach USD 538.13 million by 2032, growing at a CAGR of 3.9% during the forecast period.

- The market is driven by the increasing demand for protective coatings due to growing offshore exploration and production activities, stricter environmental regulations, and the need for asset longevity and reduced maintenance costs.

- Key trends include the rise of eco‑friendly coatings, smart coatings with antifouling properties, and the rapid expansion of offshore oil and gas production in emerging markets like Asia‑Pacific and the Middle East.

- The competitive landscape features key players such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin‑Williams Company, Hempel A/S, and Jotun Group, who dominate with their extensive product portfolios and strong regional presence.

- North America holds around 28–29% of the market share, with Asia‑Pacific leading at over 37%, driven by offshore production growth in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Offshore Oil & Gas Paints & Coatings market is primarily segmented into Epoxy, Polyurethane, and Zinc coatings. Among these, Epoxy coatings dominate the market, accounting for 45% of the total market share. Their superior corrosion resistance and durability in harsh marine environments make them the preferred choice. The dominance of Epoxy coatings is driven by their ability to withstand the extreme conditions encountered in offshore oil and gas operations. Their widespread use in exploration, production, and refining applications further contributes to their market leadership, with growing demand for long-lasting and high-performance coatings.

- For instance, a field‑study evaluating 11 coating systems in offshore exposure found that barrier‑type epoxy coatings exhibited an under‑film creep (rust propagation) of up to 11.3 mm after six years on an operating ship site, compared with 7.6 mm at a stationary coastal site.

By Application

The Offshore Oil & Gas Paints & Coatings market is also segmented by application into Exploration, Production, and Refining. The Production application holds the largest share, making up 55% of the market. This is driven by the significant number of offshore production facilities requiring specialized coatings to protect against corrosion and harsh environmental conditions. The growth of offshore production projects globally fuels the demand for coatings in this segment. Coatings used in production applications are essential for both new installations and maintenance, further increasing the demand for high-performance coatings.

- For instance, produced water injection systems require robust internal coating protection epoxy-based systems rated for produced water, brines, and industrial process water applications are critical for pipeline longevity, with tanks and piping designed to resist hot water exposures up to 82°C.

By End-User

The end-user segmentation of the Offshore Oil & Gas Paints & Coatings market includes New Installations and Maintenance. The Maintenance sub-segment leads the market, representing 60% of the market share. Maintenance coatings are crucial for protecting and refurbishing offshore platforms and rigs, as they are exposed to harsh marine environments. The increasing focus on asset integrity management and the rising costs associated with downtime further drive the demand for high-quality maintenance coatings, making it the dominant sub-segment in the market.

Key Growth Drivers

Growing Offshore Exploration and Production Activities

The expansion of offshore oil and gas operations is fueling demand for high‑performance paints and coatings. As industry players venture into deeper waters and more remote locations, the need for protective coatings that withstand saltwater, UV exposure, high pressure, and corrosive environments becomes critical. Specifically, coatings help extend asset life and minimize downtime for rigs, platforms, and subsea equipment. This surge in upstream investment, therefore, directly drives the market for specialized coatings tailored to offshore conditions.

- For instance, in a published “State of the Art” review, a duplex system of thermally sprayed aluminium (TSA) plus a three‑layer paint coating on offshore oil & gas structures was estimated to have a time to first maintenance between 7 and 23 years in extreme offshore environments.

Stringent Regulatory and Safety Requirements

Regulation and safety protocols in offshore environments are becoming ever stricter, compelling operators to adopt coatings with enhanced performance and environmental compliance. Coatings must now often meet low‑VOC standards, anti‑fouling requirements, and increased durability obligations under harsh marine conditions. The combination of regulatory pressure and the imperative to maintain structural integrity drives market players to invest in advanced formulations, boosting overall market growth.

- For instance, MARPOL Annex VI Regulation 15 requires oil tankers and vessel operators to develop approved VOC Management Plans, with systems that minimize volatile organic compound emissions during loading, transit, and unloading operations through vapor recovery units, closed loading systems, and pressure-vacuum valve installations, subjecting non-compliant vessels to port state detention or fines.

Intent to Extend Asset Life and Reduce Maintenance Costs

Operators in the offshore oil & gas sector increasingly recognize that maintenance and repair contribute significantly to total lifecycle costs. By applying advanced protective coatings, they can lengthen service intervals, reduce corrosion‑related failures, and minimize unplanned downtime. This economic rationale prompts greater uptake of premium coatings solutions and supports market expansion. The shift from initial installation towards long‑term asset management thus serves as a major growth driver.

Key Trends & Opportunities

Advancement of Eco‑friendly and Smart Coating Technologies

One of the prominent trends in the offshore paints and coatings space is the rise of eco‑friendly products and smart coatings. Manufacturers are developing formulations with antifouling properties, embedded sensors for corrosion monitoring, and low environmental impact. These innovations present clear opportunities: operators are willing to pay for solutions that deliver longer life, lower maintenance, and regulatory compliance. As sustainability becomes a board‑level agenda, coatings that align with these demands will gain traction.

- For instance, researchers developed a smart coating composed of an epoxy/PVDF matrix embedded with ZIF‑8 nanosensors, capable of detecting onset of corrosion in steel structures.

Rapid Growth of Emerging Offshore Markets in Asia‑Pacific and Middle East

Emerging regions such as Asia‑Pacific and the Middle East represent strong opportunities for coatings manufacturers. These regions are witnessing accelerated offshore exploration and production activity, combined with offshore infrastructure upgrades and investments. As local operators partner with global suppliers and regulatory regimes mature, demand for both new installations and maintenance coatings rises. Companies positioning early in these markets can secure significant growth avenues.

- For instance, Jotun has introduced high-performance protective coatings for offshore structures and oil and gas facilities across Asia-Pacific, including solvent-borne systems designed to meet stricter environmental and performance requirements for marine and offshore assets.

Key Challenges

High Costs and Price Sensitivity in the Supply Chain

Advanced offshore coatings often command higher prices due to specialized raw materials, performance requirements, and certification demands. Smaller operators or contractors in cost-sensitive regions may delay or opt for lower-grade alternatives, limiting uptake. Additionally, fluctuating oil prices can constrain investment in upstream infrastructure, indirectly impacting coatings demand. This cost barrier poses a tangible challenge to market expansion. Moreover, in emerging markets with budget constraints, the preference for cost-effective solutions is more pronounced, creating further pressure on suppliers to balance performance with affordability.

Long Approval Cycles and Technological Barriers

In offshore applications, coatings must undergo extensive testing, qualification, and certification before deployment in critical assets. These long approval cycles slow time-to-market for innovation. Also, harsh offshore environments demand coatings that can perform under extreme conditions (e.g., deep water, strong currents, extreme temperatures), which increases R&D complexity and risk. This combination of technical barriers and regulatory oversight can hinder rapid commercialization of new solutions. Furthermore, the lack of standardized qualification procedures across regions adds to complexity, causing delays and increasing costs for manufacturers looking to scale globally.

Regional Analysis

North America

North America holds a significant portion of the market, with the region’s share of 29%. The United States in particular drives demand through its mature offshore production infrastructure, deep‑water platforms and stringent regulatory regime that compels high performance coatings. Maintenance and retrofit activity on aging rigs and platforms further sustain demand. As offshore operators aim to extend asset life and comply with environmental standards, North America remains a key market for premium marine and corrosion‑resistant coatings.

Europe

Europe accounts for a moderate share of the market, estimated at 20%. The region’s demand is propelled by North Sea offshore operations, subsea production systems and rigorous safety and environmental standards. European operators increasingly adopt advanced coating technologies to address challenges such as harsh offshore weather, high salinity and regulatory mandates for low‑VOC systems. The combination of mature infrastructure, replacement activity and regulatory pressure helps maintain Europe’s steady share in the offshore paints and coatings market.

Asia‑Pacific

Asia‑Pacific is currently the dominant region, commanding over 37% of the market share. Rapid growth in offshore oil and gas exploration and production across China, India, Indonesia and Southeast Asia drives robust demand for corrosion‑resistant coatings. Investments in deep‑water fields, LNG infrastructure and offshore platform deployment underpin this region’s strong performance. Manufacturers and coating specialists are increasingly focusing on Asia‑Pacific to capitalize on infrastructure growth, cost‑sensitive operators and localized supply opportunities.

Latin America

In Latin America, the market share is estimated at around 10%. Brazil’s extensive pre‑salt offshore developments and Argentina’s expanding offshore exploration business contribute significantly to the region’s demand for specialized coatings. The need for coating solutions that can withstand deepwater challenges, corrosive salt‑water environments and large FPSO hulls underscores the region’s niche but growing market. Local policy incentives and emerging supply‑chain capabilities make Latin America an attractive growth zone for coatings suppliers.

Middle East & Africa

The Middle East & Africa (MEA) region holds an estimated share of 10%. Offshore oilfield modernization programs in the Gulf, West Africa and the Red Sea are creating demand for advanced coatings capable of resisting high temperature, salinity and wave action. Investment in both new installations and maintenance across MEA’s oil & gas sector boosts coatings uptake. While the region remains somewhat volatile due to geopolitical and investment risks, the long‑term demand outlook for offshore coatings is positive.

Market Segmentations

By Type

By Application

- Exploration

- Production

- Refining

By End-User

- New Installations

- Maintenance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the offshore oil‑and‑gas paints and coatings market is characterized by a concentrated group of global players who leverage extensive product portfolios, advanced technology development, and strong regional presence to compete. Companies such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin‑Williams Company, Hempel A/S, Jotun Group, Kansai Paint Co., Ltd., RPM International Inc. and Chugoku Marine Paints, Ltd. dominate market share through their focus on high‑performance coatings tailored for offshore platforms, subsea installations and FPSOs. These players strengthen their competitive edge via strategic alliances, acquisitions, and investments in R&D to deliver corrosion‑resistant, low‑VOC and antifouling coatings. Regional players and niche manufacturers present smaller competitive threats, while the evolving regulatory landscape and demand for longer lifespan assets further intensify competition among established suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Birla Nu Pharma Ltd. signed an agreement to acquire Clean Coats India Private Limited, a specialty coatings company serving oil and gas sectors, aiming to strengthen its offshore oil & gas coatings capability.

- In September 2025, Jotun Group launched Hardtop XP II, a next‑generation topcoat designed for offshore oil & gas infrastructure, offering faster curing, enhanced durability and improved protection against UV and harsh marine conditions.

- In June 2025, Hempel A/S introduced Hempaguard NB, a silicone hull coating tailored for newbuild offshore vessels, enabling reduced downtime and improved fouling‑protection efficiency from day one.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing deep‑water and ultra‑deep‑water offshore projects will drive demand for advanced protective coatings.

- Focus on sustainability will push manufacturers to develop low‑VOC and eco‑friendly coating formulations.

- Integration of smart coating technologies, such as corrosion‑monitoring sensors, will create new value‑added product segments.

- Growing asset integrity and maintenance strategies in the offshore sector will favour coatings designed for refurbishment and lifecycle extension.

- Rising offshore activity in Asia‑Pacific, the Middle East and Latin America will open new regional growth opportunities for coatings suppliers.

- Mergers, acquisitions and strategic partnerships among leading coating companies will intensify competitive dynamics.

- Supply‑chain disruptions and raw‑material cost volatility will encourage the adoption of locally sourced materials and regional manufacturing hubs.

- Stringent regulatory standards for offshore operations will increase demand for high‑performance coatings that meet durability and safety requirements.

- The shift from new installations to maintenance and refurbishing of ageing offshore infrastructure will alter product demand patterns.

- Digitalization of asset‑management systems will support predictive maintenance and drive demand for coatings that align with digital monitoring frameworks.