Market Overview

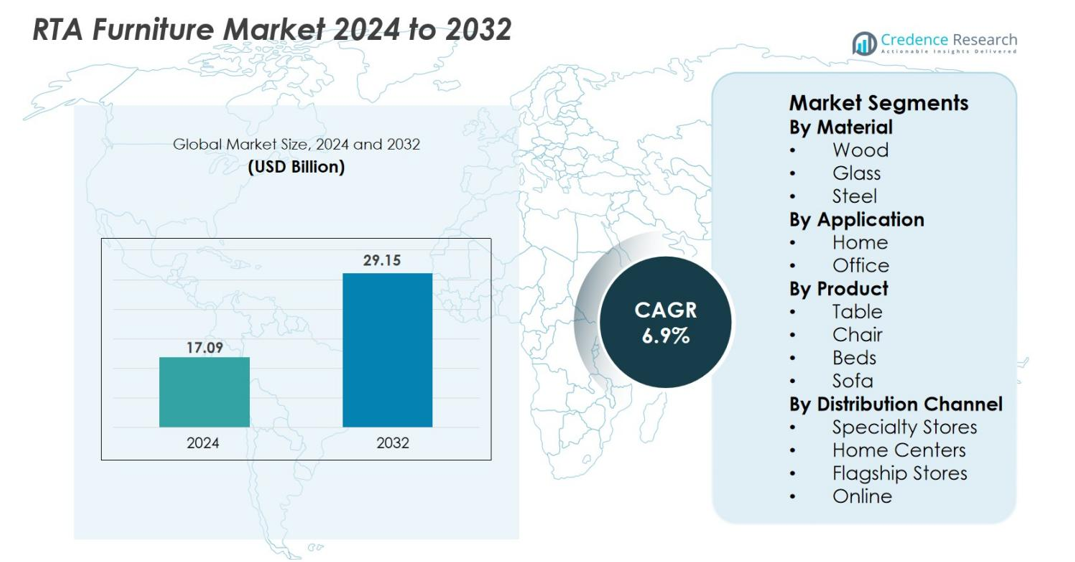

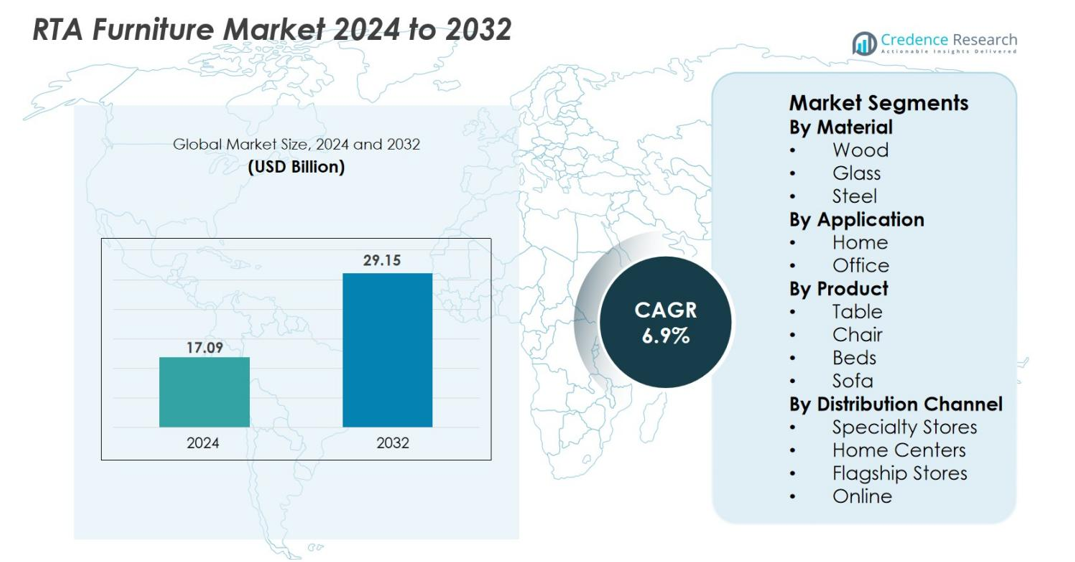

RTA Furniture market size was valued at USD 17.09 Billion in 2024 and is anticipated to reach USD 29.15 Billion by 2032, at a CAGR of 6.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RTA Furniture market Size 2024 |

USD 17.09 Billion |

| RTA Furniture market, CAGR |

6.9% |

| RTA Furniture market Size 2032 |

USD 29.15 Billion |

The RTA Furniture market is anchored by leading players such as Inter IKEA Systems B.V., Dorel Industries Inc., Morris Home Furniture, Steinhoff International, Tvilum A/S, Simplicity Sofas, Home Reserve, Whalen Furniture, Fabritec (EUROSTYLE) and Bush Home, each leveraging large‑scale logistics, global sourcing and e‑commerce strategies. The Asia Pacific region leads with a 39.8% share, followed closely by North America at 38.61%, while Europe holds a considerable portion with around 15.5% share. These regions anchor the market’s geographic spine and drive innovation diffusion and consumer adoption trends.

Market Insights

- The RTA Furniture market size was valued at USD 17.09 billion in 2024 and is expected to reach USD 29.15 billion by 2032, at a CAGR of 6.9% during the forecast period.

- Urbanization and shrinking living spaces are key drivers, as consumers increasingly demand space-efficient, easy-to-assemble furniture for smaller homes.

- Sustainability is a significant trend, with eco-friendly materials and recyclable packaging gaining traction among consumers and manufacturers.

- Intense competition is seen among top players such as Inter IKEA, Dorel Industries, and Tvilum, with regional players also gaining ground on price and design innovation.

- The Asia Pacific region leads with a 39.8% share, followed by North America at 38.61%, while Europe captures 15.5%, reflecting the demand for RTA furniture across varied living conditions globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Material

In the global RTA furniture market, the Wood material sub‑segment dominates, commanding a 56.9 % share in 2024. Wood’s leadership is driven by its strong aesthetic appeal, durability, and growing consumer preference for sustainable materials such as FSC‑certified timber and reclaimed wood. Manufacturers capitalize on wood’s versatility across tables, chairs, beds, and sofas, and its natural image aligns with the rising demand for eco‑friendly home furnishings. Glass and Steel materials are smaller in share and face challenges such as higher costs or less warm aesthetics, which constrain broader uptake.

- For instance, Ashley Furniture Industries operates one of the largest wood furniture production capacities globally, running more than 30 manufacturing and distribution facilities and processing over 1,500,000 wooden furniture units annually across its RTA and non-RTA categories.

By Application

Within application segments, the Home (residential) category is the dominant sub‑segment, representing 61.56 % of the RTA furniture market in 2024. The strong residential share is propelled by urbanization, smaller living units, and increased DIY furniture assembly among homeowners. This drives demand for easy‑to‑assemble, space‑efficient furnishings with appealing designs at budget‑friendly price points. The Office (commercial) segment remains smaller, as its demand depends on business refurbishment cycles and generally prefers full‑service furniture rather than self‑assembly models.

- For instance, Wayfair reported approximately 40 million orders delivered in total across all product categories for the full year 2024, a figure which is widely understood to include a significant portion of RTA (Ready-To-Assemble) items such as shelving units, beds, and storage systems.

By Product

In the product segmentation, the Chair & Sofa group leads with a 34.2 % share in 2024. The dominance of chairs and sofas reflects the growing consumption of modular living‑room furniture, the rise of compact urban homes, and work‑from-home trends that elevate seating requirements. These items offer high value per piece and benefit from flat‑pack logistics inherent in the RTA model. Tables, Beds, and Sofa segments trail behind, as they either require larger packaging or less frequent replacement cycles, reducing their relative share.

Key Growth Drivers

Urbanisation and Shrinking Living Spaces

Rapid urbanisation coupled with diminishing living space, especially in metropolitan areas, is driving strong demand for the ready‑to‑assemble (RTA) furniture market. As households shift into smaller apartments and multi‑family homes, consumers increasingly seek compact, flat‑pack furniture that fits constrained floor plans while offering style and functionality. Manufacturers respond with modular designs and elevated aesthetics that maximise value within limited space. This transformation in living formats underpins a major growth driver, enabling RTA furniture to capture a growing share of furniture replacement and new‑home fit‑out demand.

- For instance, IKEA’s “BOAXEL” and “PLATSA” modular storage systems were engineered as flexible, customizable solutions designed specifically to maximize storage potential in small homes and challenging spaces, such as those with sloping ceilings or under staircases.

Rise of E‑commerce and Direct‑to‑Consumer Models

The growth of e‑commerce channels and direct‑to‑consumer (D2C) business models significantly fuels the RTA furniture market. Online platforms simplify discovery, allow comparison of design and price, and facilitate logistics of flat‑pack shipping and home delivery. Consumers now embrace the convenience of browsing digital catalogues and receiving products in compact packaging. This streamlined purchase path aligns perfectly with the self‑assembly format of RTA furniture, accelerating adoption across younger and tech‑savvy segments and enabling broader geographic reach for manufacturers and brands.

- For instance, IKEA recorded over 3.8 billion online visits in FY2023, with more than 150 million orders processed through its e-commerce channel, many of which included RTA products optimized for parcel delivery.

Cost Efficiency through Flat‑Pack Logistics and DIY Assembly

A fundamental strategic advantage of RTA furniture lies in its flat‑pack logistics and do‑it‑yourself (DIY) assembly model, which reduce manufacturing, shipping and delivery costs. By shipping disassembled components and shifting assembly to the consumer, manufacturers cut overheads and offer more competitive pricing than traditional pre‑assembled furniture. This cost efficiency resonates strongly across value‑seeking buyers and large‑scale residential fit‑outs. As cost pressures continue in global markets, this driver empowers RTA furniture companies to sustain margins while widening accessibility to a broader consumer base.

Key Trends & Opportunities

Sustainability and Eco‑Material Adoption

Sustainability is emerging as a significant opportunity within the RTA furniture market. Consumers and regulators increasingly demand eco‑friendly materials, recyclable packaging and low‑VOC finishes. Manufacturers respond by integrating recycled wood, sustainable forests certified timber and modular designs that reduce waste. This trend presents an opportunity to differentiate on brand purpose, capture environmentally conscious buyer segments and justify premium pricing for “green” furniture lines. By aligning product design with sustainability narratives, RTA furniture companies can expand into new value tiers and secure long‑term brand loyalty.

- For instance, HNI Corporation reduces Volatile Organic Compound (VOC) emissions by employing sustainable finishing processes, including converting major product lines to powder coat paint systems which contain zero VOCs. This initiative is part of a broader sustainability strategy that contributed to the corporation lowering its absolute combined Scope 1 and 2 GHG emissions by 64% through actions like sourcing 100% renewable electricity.

Customization, Modular Design and Smart Home Integration

Customization and modular furniture design are rapidly gaining traction in the RTA furniture market. Consumers seek pieces that adapt to evolving lifestyles—such as work‑from‑home arrangements, multi‑purpose rooms and flexible living formats. RTA offerings increasingly incorporate modular components, configurable layouts and smart‑home compatibility. This shift opens up value‑added opportunities: brands can upsell interfaces for connectivity, modular add‑ons and bespoke finishes. The ability to offer tailored products at accessible price points positions RTA furniture as not just economical but as lifestyle‑enabling, unlocking new market segments and premium margins.

- For instance, Lovesac’s Sactionals—built on modular bases and sides—exceed 20 million possible configurations, with the company producing more than 1.5 million modular pieces annually to support customizable seating layouts.

Key Challenges

Complex Assembly Perception and Consumer Experience Risks

One of the main challenges facing the RTA furniture market is consumer concern over assembly complexity, missing hardware and perceived durability. Although cost‑effective, if assembly isn’t intuitive or parts are missing, satisfaction suffers, which may hinder repeat purchases. Some buyers still prefer pre‑assembled furniture for convenience. To overcome this challenge, manufacturers must invest in user‑friendly instructions, simplified hardware kits and high‑quality components to ensure that the DIY promise does not undermine the customer experience or brand reputation.

Raw Material Volatility and Global Supply Chain Disruptions

The RTA furniture industry also contends with material cost volatility and supply chain disruptions. Fluctuating prices of wood, metal and engineered board materials compress margins. Meanwhile, global logistics delays, tariff changes and freight cost spikes hamper flat‑pack delivery efficiency. These pressures particularly impact companies operating at scale or serving multiple regions. Addressing this challenge demands that manufacturers build agile sourcing networks, lean inventory models and resilient logistics frameworks to maintain price competitiveness while safeguarding profitability.

Regional Analysis

Asia Pacific

The Asia Pacific region captured a market share of 39.8% in the RTA Furniture market in 2024. Rapid urban migration, smaller dwelling footprints, and escalating demand for compact, low‑cost furnishings propel this dominance. Manufacturers intensify focus on DIY‑friendly, flat‑pack models to appeal to the region’s younger, mobile workforce. Online penetration and mobile‑first retail strategies further amplify adoption. Partnerships with local logistics networks enable timely delivery in emerging urban centres, sustaining high growth momentum as residential and hybrid‑use settings evolve across the region.

North America

In North America, the RTA Furniture market accounted for a share of 38.61% in 2024. High consumer affinity for convenient, self‑assembled furniture and strong e‑commerce penetration drive regional strength. Urban‑dwelling millennials and Gen Z favour stylish, affordable flat‑pack solutions suited to smaller apartments or rental living. Major brands invest in direct‑to‑consumer channels and leverage advanced logistics to shorten delivery times. Meanwhile, sustainability credentials and modular living trends enhance product appeal, enabling RTA furniture to gain deeper shelf‑space and market share in both home and office settings.

Europe

The European region held a significant share of the RTA Furniture market in 2024, 15.5%. Mature housing markets and high awareness of ergonomics and sustainability catalyse demand for ready‑to‑assemble furniture. Consumers favour sleek, adaptable designs that align with modern interiors and smaller living spaces. Regulatory emphasis on circular economy practices and certified sustainable woods boosts product differentiation. Brands respond via modular components, downloadable assembly guides, and online marketplaces, enabling RTA furniture to maintain robust share and steady growth within a design‑conscious clientele.

Latin America

In Latin America, the RTA Furniture market’s share was 4.3% in 2024 but demonstrates notable growth potential. Urbanisation and rising home ownership among younger demographics drive an increased appetite for cost‑effective, easy‑to‑install furniture. Flat‑pack logistics reduce shipping and warehousing costs, making RTA solutions particularly appealing in emerging Latin markets. E‑commerce expansion into secondary and tertiary cities further supports uptake. As consumers seek multi‑functional furnishings for hybrid living spaces, manufacturers tailor products accordingly to capture share and future volume expansion in the region.

Middle East & Africa

The Middle East & Africa region, while currently representing 2.9% of the global RTA Furniture market, is gaining traction. A surge in housing developments, high proportions of expatriate and transient populations, and increased preference for flexible interiors drive adoption of RTA furniture. Urban high‑rise living and rental‑friendly furniture models align well with the flat‑pack self‑assembly format. Digital retail platforms and organised distribution channels expand reach into previously underserved markets. As affordability and convenience become paramount, RTA manufacturers are well-positioned to capture incremental share in this dynamic region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Material

By Application

By Product

By Distribution Channel

- Specialty Stores

- Home Centers

- Flagship Stores

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis: The global RTA furniture market is spearheaded by key players such as Inter IKEA Systems B.V., Dorel Industries Inc., Morris Home Furniture, Steinhoff International, Tvilum A/S, Simplicity Sofas, Home Reserve, Whalen Furniture, Fabritec (EUROSTYLE) and Bush Home. These companies are driving the market through strong brand recognition, extensive flat‑pack logistics capabilities and direct‑to‑consumer channels. They invest in efficient supply‑chain operations, sustainable material sourcing and e‑commerce platforms to meet evolving consumer preferences. Market competition remains moderate in concentration, with the top five manufacturers holding approximately 30 % of the market and a wide field of regional players competing on price, design innovation and speed to market.

Key Player Analysis

- Simplicity Sofas

- Whalen Furniture

- Tvilum A/S

- Home Reserve

- Fabritec (EUROSTYLE)

- Dorel Industries

- Bush Home

- Inter IKEA Systems B.V.

- Morris Home Furniture

- Steinhoff International

Recent Developments

- In April 2025, IKEA launched India’s first “Plan & Order Point” in East Bengaluru (740 sq m), offering personalized consultation, planning and installation for its RTA furniture portfolio.

- In February 2025, Rhenus Group inaugurated IKEA’s first fully-outsourced Customer Distribution Centre in Gurugram, India, supporting its RTA furniture logistics and last-mile delivery.

- In March 2024, Ashley Furniture Industries (via its affiliate Ashley Home, Inc.) signed an agreement to acquire Resident Home Inc., a leading digital-retailer and wholesaler of mattresses and bedding accessories.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The expansion of e‑commerce and direct‑to‑consumer channels will accelerate the global reach of RTA furniture, making such products accessible in smaller cities and emerging markets.

- Urbanisation and shrinking living spaces will continue to boost demand for modular, flat‑pack furniture solutions designed for compact homes.

- Growing consumer emphasis on sustainability and eco‑friendly materials will drive manufacturers to adopt certified timber, recycled boards and greener packaging.

- Customisable designs and modular product families will gain popularity, enabling consumers to tailor pieces to flexible living spaces and evolving needs.

- Integration of augmented reality (AR), virtual reality (VR) and online visualization tools will enhance the shopping experience and reduce purchase hesitation.

- The shift to remote and hybrid work models will stimulate demand for affordable, easy‑to‑assemble office‑at‑home furniture, expanding the application base beyond residential living rooms.

- Brands will increasingly adopt direct shipping, regional micro‑fulfilment hubs and lean supply chains to deliver flat‑pack furniture faster and more cost‑efficiently.

- Rising raw material volatility and logistics complexity will push players to diversify sourcing, invest in alternative materials and digitalise supply‑chain resilience.

- Smaller manufacturers and regional players will find niche opportunities by specialising in design‑centric, premium or regional‑culture‑inspired RTA furniture offerings.

- Strategic partnerships, acquisitions and collaborations (for instance furniture‑tech players with AR/visualisation firms) will reshape market structure and provide competitive advantage among key players.