Market Overview

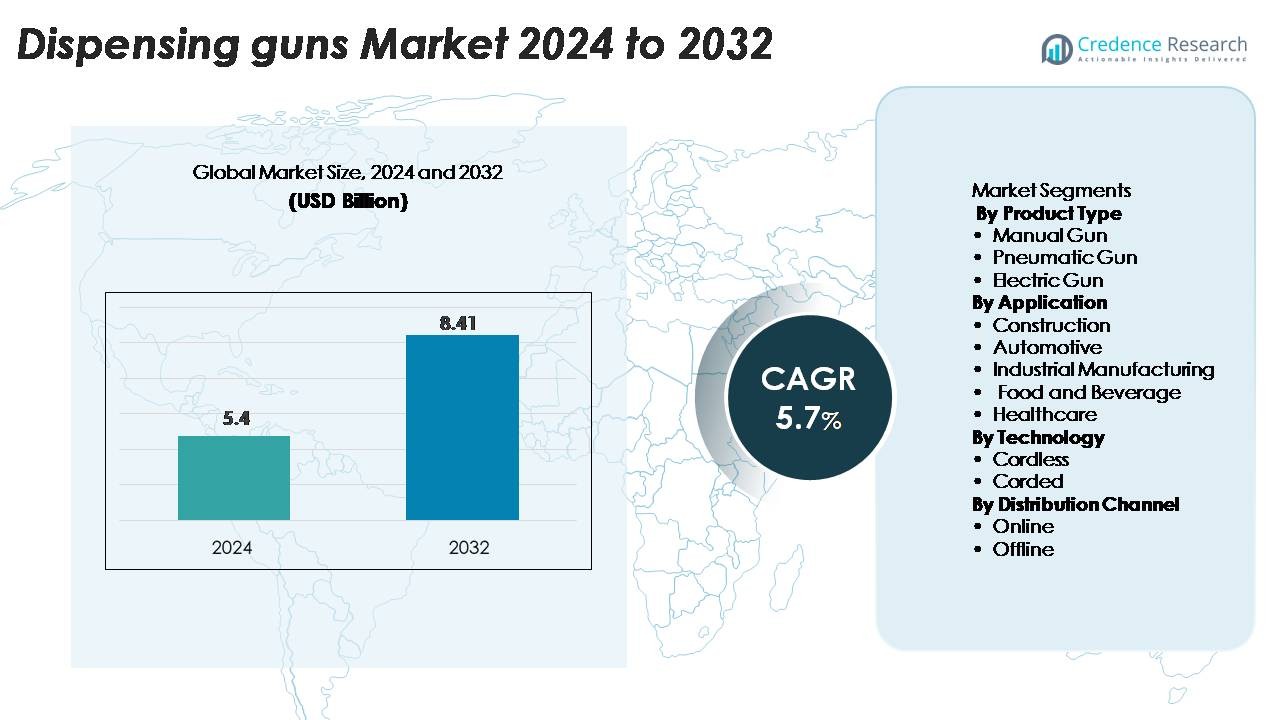

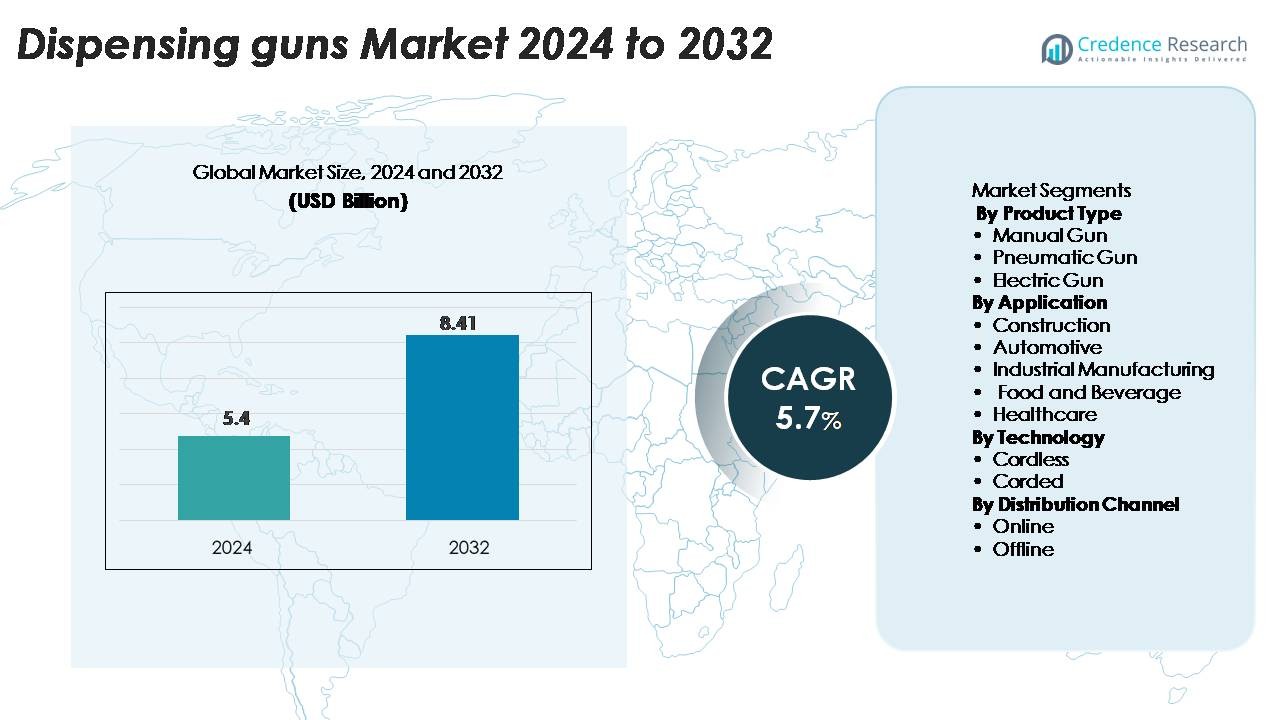

The Dispensing Guns Market size was valued at USD 5.4 billion in 2024 and is projected to reach USD 8.41 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dispensing Guns Market Size 2024 |

USD 5.4 Billion |

| Dispensing Guns Market, CAGR |

5.7% |

| Dispensing Guns Market Size 2032 |

USD 8.41 Billion |

The global dispensing guns market is dominated by key players such as Nordson Corporation, Sulzer Ltd., Henkel AG & Co. KGaA, 3M Company, and Illinois Tool Works Inc. These companies lead through robust product portfolios, technological advancements, and global distribution networks. Nordson and Sulzer focus on high-precision pneumatic and electric systems for industrial applications, while Henkel and 3M emphasize adhesive integration for construction and automotive use. North America remains the leading region, holding a 36% market share, driven by advanced manufacturing infrastructure and innovation in cordless dispensing systems. Strategic collaborations and regional expansion continue to shape competition, enhancing overall market consolidation and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dispensing Guns Market size was valued at USD 5.4 billion in 2024 and is projected to reach USD 8.41 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- Growing adoption in construction and automotive industries drives demand for pneumatic and electric dispensing guns, supported by increased use of adhesives and sealants for precision bonding.

- Technological advancements such as cordless designs, digital pressure control, and ergonomic models enhance efficiency and user convenience, fueling market expansion.

- The market is competitive, with key players like Nordson Corporation, Sulzer Ltd., Henkel AG & Co. KGaA, and 3M Company focusing on innovation, automation, and strategic partnerships to strengthen global presence.

- North America leads with a 36% share, followed by Europe at 28% and Asia-Pacific at 25%, while the pneumatic gun segment dominates with 42% market share, reflecting its precision and industrial reliability.

Market Segmentation Analysis:

By Product Type

The pneumatic gun segment holds the largest market share of 42% in the dispensing guns market. Its dominance is driven by high precision, consistent pressure control, and suitability for industrial and automotive applications. Pneumatic guns are widely adopted in assembly lines and manufacturing facilities where uniform material flow is critical. Manual guns maintain steady demand due to their affordability and use in small-scale construction and DIY projects, while electric guns gain traction for their user-friendly operation and compatibility with advanced adhesive materials.

- For instance, Nordson Corporation’s UltimusPlus™ pneumatic dispensing system delivers precise time-pressure control and supports appropriate air input pressures, ensuring consistent flow in automated assembly lines.

By Application

The construction segment accounts for 38% of the market share, making it the leading application area. The growth stems from increasing use of sealants, adhesives, and bonding agents in residential and commercial projects. Dispensing guns are essential for accurate material application in structural joints, flooring, and insulation work. The automotive sector also shows robust adoption, driven by lightweight assembly and surface finishing requirements. Industrial manufacturing continues expanding its use, focusing on automation-based adhesive dispensing to enhance production efficiency and reduce material waste.

- For instance, 3M’s Scotch-Weld™ DP8407NS structural adhesive is applied through a precision dispensing gun, achieving tensile shear strength of 28 MPa on aluminum substrates, ensuring durability in structural joints.

By Technology

Cordless dispensing guns dominate the market with a 57% share, supported by flexibility, mobility, and ease of use across multiple work environments. They are increasingly preferred in construction and repair operations where access to power sources is limited. The integration of lithium-ion batteries and brushless motors enhances power efficiency and runtime, improving operator convenience. Corded variants retain relevance in continuous-use industrial settings, offering uninterrupted operation and higher torque output. The demand shift toward cordless technology reflects the growing trend of ergonomic, portable, and battery-powered dispensing solutions.

Key Growth Drivers

Rising Adoption in Construction and Automotive Applications

The expanding use of adhesives and sealants in construction and automotive industries drives the dispensing guns market. Growing infrastructure projects and increasing demand for efficient bonding tools in vehicle assembly boost product adoption. Pneumatic and electric dispensing guns enhance precision, minimize material waste, and improve workflow efficiency in both sectors. The rise in lightweight vehicle designs and modular construction further supports demand for advanced dispensing systems. Manufacturers are investing in multi-component dispensing solutions to handle diverse materials, ensuring higher accuracy and operational speed in industrial processes.

- For instance, Nordson Corporation offers pneumatic dispense valves, such as the Nordson EFD 736HPA-NV Series, that operate at up to 2,500 psi (172 bar) and are designed to handle extremely viscous materials like greases and silicones, catering to both infrastructure and vehicle assembly applications.

Technological Advancements in Dispensing Systems

Continuous innovation in dispensing technology is a major growth catalyst. Electric and cordless dispensing guns integrated with brushless motors, lithium-ion batteries, and digital pressure control systems improve performance and reliability. Automated dispensing systems are gaining traction in industrial manufacturing for accurate adhesive application. These advancements reduce operator fatigue, enhance consistency, and enable real-time process monitoring. Companies focus on ergonomic design and smart connectivity features, supporting integration into Industry 4.0 frameworks. The trend toward automation and energy efficiency further strengthens market penetration across end-use sectors.

- For instance, Nordson Corporation’s Ultimus I-II benchtop dispensers allow time adjustment to as fine as 0.0001 seconds, with the Ultimus I model supporting air pressure regulation from 0 to 100 psi (0-7 bar) for general fluids, and the Ultimus II model offering 0-15 psi (0-1 bar) for greater control with low-viscosity fluids.

Growing Demand for Efficient Material Handling Solutions

The shift toward precision-based manufacturing processes increases the need for efficient material dispensing equipment. Dispensing guns play a key role in achieving uniform application of sealants, resins, and adhesives across industrial operations. Growing emphasis on productivity, safety, and waste reduction supports their adoption. The healthcare and food industries are also witnessing increased use due to stringent hygiene and quality control standards. Manufacturers are developing lightweight, easy-to-clean models with adjustable flow rates to cater to diverse operational requirements. This demand for controlled material handling fosters sustained market growth.

Key Trends & Opportunities

Transition Toward Battery-Powered Cordless Models

Cordless dispensing guns are rapidly gaining popularity due to enhanced mobility and convenience. Advancements in battery technology, such as longer-lasting lithium-ion cells, enable extended operation and faster charging. These models are preferred for construction and maintenance activities where portability is essential. Companies are introducing smart battery indicators and variable-speed triggers to improve usability. The transition toward cordless systems aligns with the global shift toward user-centric, energy-efficient, and ergonomic tools, creating opportunities for manufacturers to expand their product portfolios and cater to professional contractors and industrial users alike.

- For instance, Makita’s 18V LXT® Cordless Grease Gun (model XPG01) delivers a maximum push force of 10,000 psi and dispenses at 10 ounces per minute (in auto-speed mode). This tool can be powered by a 5.0Ah lithium-ion battery, which charges fully in 45 minutes using a Makita Rapid Optimum Charger.

Increasing Integration of Smart and Automated Features

The incorporation of automation and digital control systems presents a major opportunity. Smart dispensing guns equipped with sensors, programmable controls, and IoT connectivity enable precise dosing and remote monitoring. These systems minimize human error, improve adhesive consistency, and support predictive maintenance. The trend is especially prominent in electronics and industrial manufacturing sectors that demand high repeatability and quality assurance. As industries embrace automation, companies offering intelligent and data-enabled dispensing solutions are likely to gain a competitive edge in global markets.

Sustainability and Lightweight Material Development

Manufacturers are focusing on sustainable materials and eco-friendly product designs to meet environmental standards. The adoption of recyclable plastics and lightweight metals reduces the carbon footprint and enhances tool ergonomics. Eco-conscious consumers and industries prefer durable, low-energy products that align with green manufacturing goals. Furthermore, the integration of biodegradable adhesives in compatible dispensing systems creates new opportunities in packaging and construction sectors. This sustainability-driven shift encourages innovation across the value chain, from product design to end-user applications.

Key Challenges

High Equipment Costs and Maintenance Requirements

The initial investment for advanced pneumatic and electric dispensing guns remains a major barrier for small and medium enterprises. High-end models with digital control, pressure regulation, and automated features involve significant costs. Regular calibration and maintenance further add to operational expenses. In sectors with tight budgets, manual alternatives are still preferred, limiting the adoption of advanced models. Manufacturers must balance pricing with technological benefits to attract wider market acceptance and encourage transition toward automated dispensing solutions.

Operational Limitations and Material Compatibility Issues

Dispensing guns often face challenges with material viscosity, curing times, and flow rate control, affecting precision and performance. Incompatible adhesive or sealant formulations can lead to clogging, leakage, or uneven application. These limitations hinder consistent outcomes in high-precision industries like electronics and medical devices. Additionally, operators require technical expertise to ensure proper setup and maintenance. Addressing compatibility through standardized designs, interchangeable components, and user training programs will be essential to overcome these operational challenges and ensure optimal performance across applications.

Regional Analysis

North America

North America leads the global dispensing guns market with a 36% share, driven by strong industrial infrastructure and widespread adoption in construction and automotive sectors. The United States accounts for the majority of demand, supported by advanced manufacturing standards and ongoing automation trends. Key players in the region focus on cordless and pneumatic variants for improved efficiency and ergonomics. Growing renovation activities and a surge in adhesive applications across production lines sustain regional growth. Robust e-commerce networks also enhance accessibility to professional-grade tools for both commercial and individual users.

Europe

Europe holds a 28% share of the dispensing guns market, supported by a mature construction industry and increasing demand for sustainable materials. Germany, France, and the U.K. drive market expansion through extensive use of adhesives in vehicle assembly and industrial production. The region’s strong emphasis on energy-efficient construction and lightweight materials further accelerates adoption. European manufacturers focus on automation and eco-friendly product designs aligned with regulatory standards. The growing transition toward electric and hybrid vehicles enhances the role of precision dispensing in adhesive bonding processes.

Asia-Pacific

Asia-Pacific commands a 25% market share and is projected to exhibit the fastest growth rate through 2032. China, Japan, India, and South Korea lead the demand, propelled by rapid urbanization, industrialization, and infrastructure development. Expanding automotive production and electronics manufacturing increase the need for precise dispensing solutions. Local manufacturers invest in cost-effective, high-performance products to meet domestic and export demands. The region benefits from favorable government initiatives supporting industrial automation and construction modernization. Growing online retail penetration further widens product accessibility across emerging markets.

Latin America

Latin America accounts for a 7% share of the dispensing guns market, with Brazil and Mexico serving as key contributors. The construction boom and industrial modernization initiatives fuel the regional demand. Increasing adoption of electric and pneumatic models in automotive assembly and repair workshops enhances operational efficiency. Government infrastructure investments and expanding manufacturing clusters strengthen long-term prospects. However, limited technical awareness and dependence on imports remain key barriers. Market players are focusing on affordable product lines to cater to small and medium-sized enterprises.

Middle East & Africa (MEA)

The Middle East & Africa region captures a 4% share of the global dispensing guns market. Demand is supported by growing infrastructure projects, particularly in the UAE, Saudi Arabia, and South Africa. Rising construction of residential, commercial, and industrial facilities drives adhesive and sealant consumption. The healthcare and oil & gas industries also utilize dispensing systems for precision applications. Ongoing diversification efforts and industrial growth initiatives under programs like Saudi Vision 2030 create opportunities for market expansion. Import-dependent supply chains and limited local manufacturing remain key challenges to overcome.

Market Segmentations:

By Product Type

- Manual Gun

- Pneumatic Gun

- Electric Gun

By Application

- Construction

- Automotive

- Industrial Manufacturing

- Food and Beverage

- Healthcare

By Technology

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dispensing guns market is highly competitive, with global and regional players focusing on technological innovation, product diversification, and strategic expansion. Leading companies such as Nordson Corporation, Sulzer Ltd., Henkel AG & Co. KGaA, 3M Company, and Illinois Tool Works Inc. dominate through extensive product portfolios and strong distribution networks. These firms invest in ergonomic design, automation integration, and cordless technology to meet evolving user demands. Emerging players emphasize cost-effective and sustainable solutions to penetrate developing markets. Collaborations with construction and automotive industries enhance product reach and application scope. Mergers, acquisitions, and partnerships remain key strategies to strengthen market position, improve R&D capabilities, and expand geographical presence across high-growth regions like Asia-Pacific and North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nordson Corporation

- METABO

- Irion

- Makita

- 3M

- Milwaukee Tool

- Henkel

- Albion Engineering

- PC Cox

- GreatStar

Recent Developments

- In November 2025, Nordson Corporation announced that its division Nordson EFD will showcase four “Mastering Micron-Level Assembly” fluid-dispensing demonstrations at the Compamed 2025 trade event.

- In April 2024, Metabo HPT launched a lineup of 10 new cordless tools and accessories as part of its MultiVolt™ system, highlighting cordless operation trends.

Report Coverage

The research report offers an in-depth analysis based on Product type,Application, Technology,Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dispensing guns will grow due to expanding construction and automotive applications.

- Cordless and battery-powered models will gain strong traction for flexibility and convenience.

- Automation and smart dispensing systems will improve accuracy and reduce material waste.

- Manufacturers will focus on lightweight and ergonomic designs to enhance operator comfort.

- Integration of IoT and data monitoring will optimize performance and predictive maintenance.

- Sustainable materials and eco-friendly adhesives will drive innovation in product development.

- Asia-Pacific will emerge as the fastest-growing regional market with industrial expansion.

- Strategic mergers and acquisitions will strengthen global supply and technology capabilities.

- Customizable dispensing systems will increase adoption in healthcare and electronics industries.

- Continuous R&D investment will improve precision, efficiency, and energy optimization across applications.