Market Overview

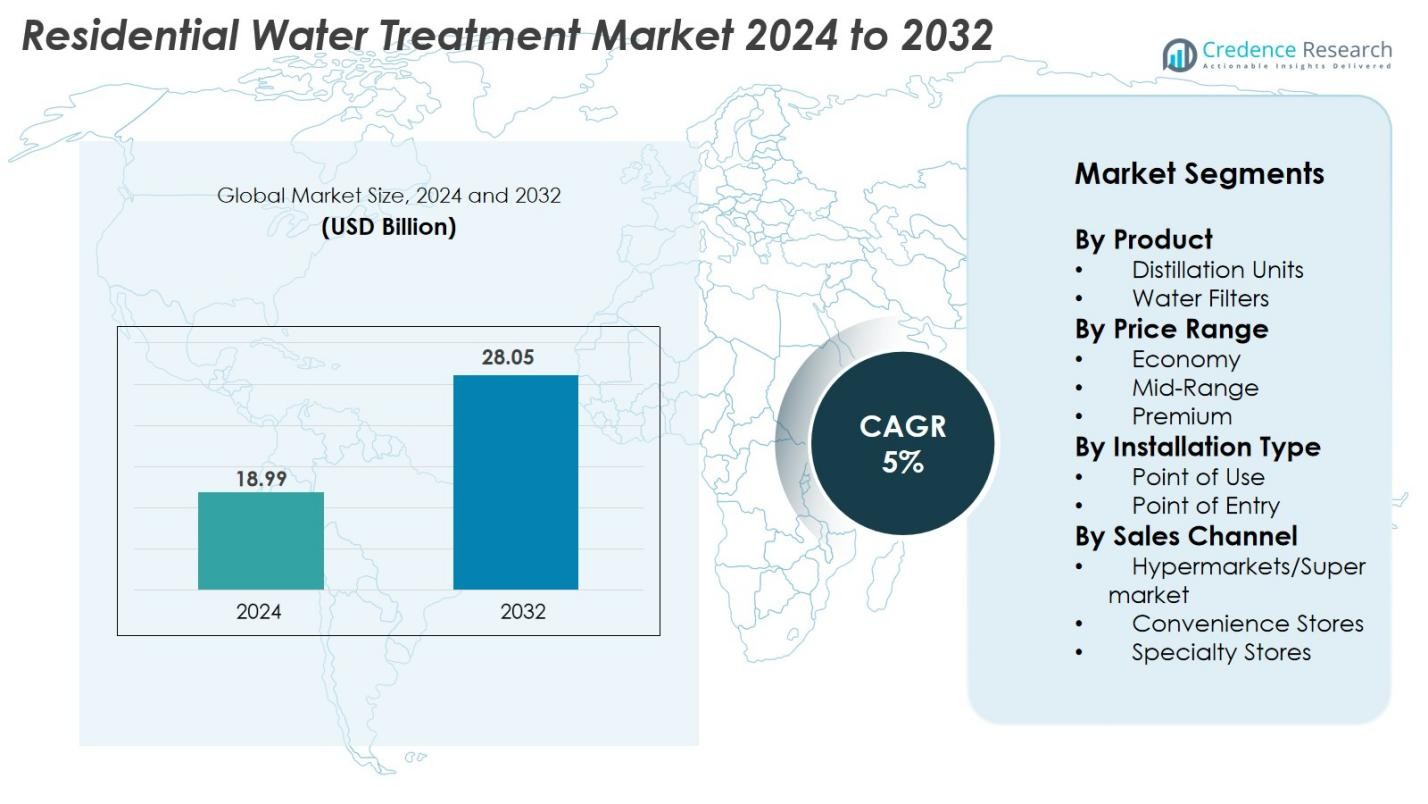

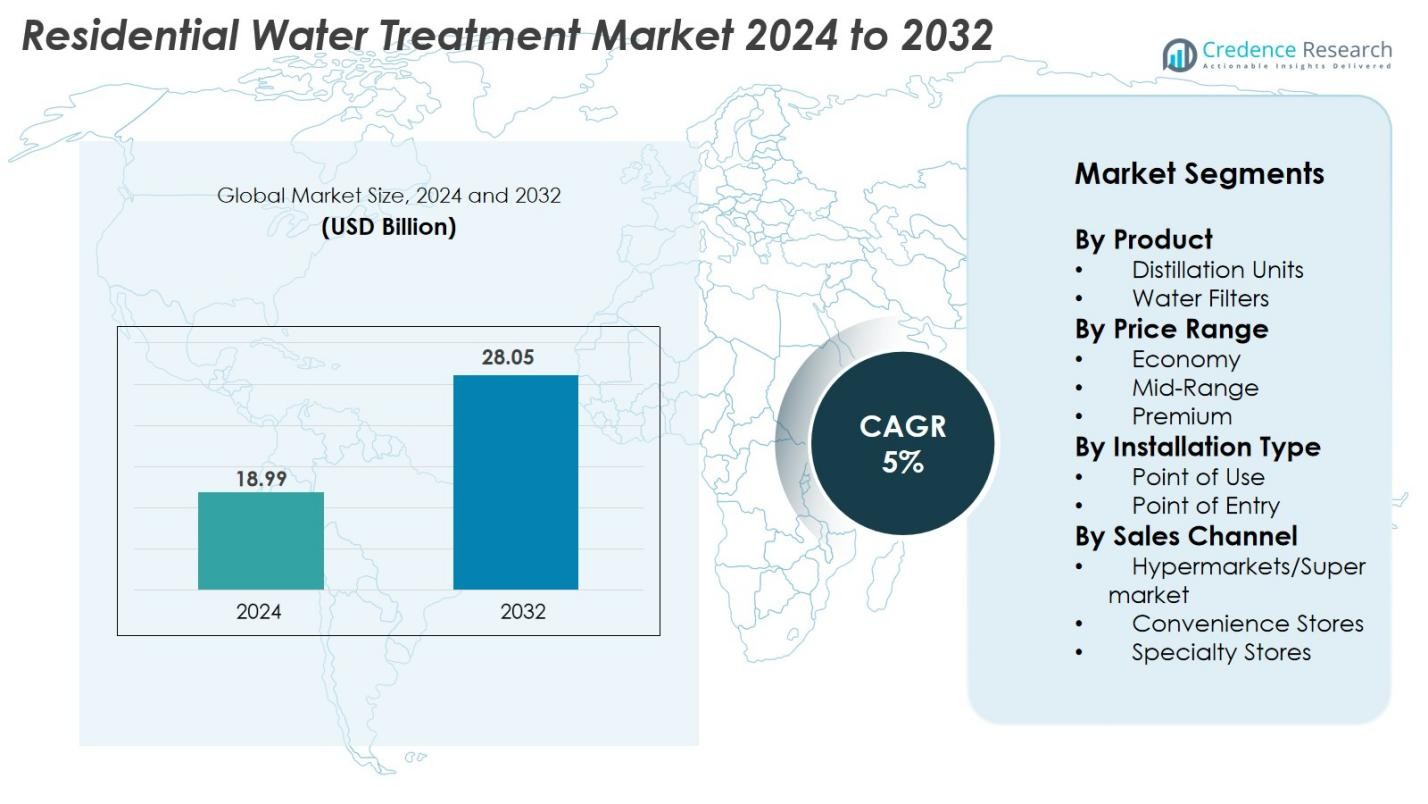

Residential Water Treatment Market size was valued at USD 18.99 Billion in 2024 and is anticipated to reach USD 28.05 Billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Water Treatment Market Size 2024 |

USD 18.99 Billion |

| Residential Water Treatment Market, CAGR |

5% |

| Residential Water Treatment Market Size 2032 |

USD 28.05 Billion |

Residential Water Treatment Market is driven by strong participation from leading players such as A.O. Smith Corporation, Kent Supreme, Eureka Forbes, Panasonic, Aquasana, GE Appliances, 3M, Waterwise Inc., Everpure, and Aqua Care. These companies focus on advanced RO, UV, and multi-stage filtration technologies, supported by expanding product portfolios and strong distribution networks. North America leads the market with a 34.2% share in 2024, followed by Asia-Pacific with 29.8%, reflecting rapid urbanization and rising health awareness. Europe holds a 27.6% share, driven by strict water-quality standards and growing adoption of eco-friendly purification solutions across households.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Water Treatment Market was valued at USD 18.99 Billion in 2024 and is projected to reach USD 28.05 Billion by 2032, registering a CAGR of 5%.

- Growing consumer awareness of contaminants, aging municipal pipelines, and rising health concerns are driving strong adoption of RO, UV, and multi-stage filtration systems across residential households.

- Key trends include the rising demand for smart, connected purifiers, water-efficient RO systems, and compact, space-saving filtration units tailored for urban living environments.

- Leading players such as A.O. Smith Corporation, Eureka Forbes, Panasonic, Kent Supreme, GE Appliances, and 3M strengthen market growth through product innovation, expanded retail networks, and service-focused strategies.

- Regionally, North America leads with a 34.2% share, followed by Asia-Pacific at 29.8% and Europe at 27.6%, while water filters dominate product segmentation with a 62.4% share in 2024.

Market Segmentation Analysis

By Product

The Residential Water Treatment Market by product is dominated by water filters, accounting for 62.4% of the market share in 2024. Their wide adoption is driven by increasing consumer awareness of contaminants such as chlorine, lead, and microbial impurities. Households prefer filtration systems for their affordability, ease of installation, and compatibility with various water sources. Distillation units hold a smaller share but continue to attract users seeking high-purity output for specific health needs. The growing emphasis on safe drinking water and rising urban water quality concerns accelerate demand for advanced multi-stage filtration technologies.

- For instance, A. O. Smith’s X8 Green RO system integrates an 8-stage purification process and features a mineralizer cartridge rated for 6,000 liters, ensuring extended filtration life.

By Price Range

In the price range segment, mid-range solutions lead the Residential Water Treatment Market with a 48.7% market share in 2024, supported by strong consumer preference for balanced affordability and performance. Mid-range products offer enhanced purification technologies, better durability, and wider brand availability, making them the most attractive choice for middle-income households. Economy systems remain popular in emerging markets, while premium products gain traction among high-income consumers seeking smart, connected, and high-efficiency purification systems. Rising disposable incomes and growing adoption of household water safety solutions continue to drive mid-range segment dominance.

- For instance, Kent RO’s Grand Plus model incorporates an RO+UV+UF purification framework with a storage capacity of 8 liters and a purification rate of 20 liters per hour, ensuring continuous supply for family households.

By Installation Type

By installation type, point-of-use (POU) systems dominate the Residential Water Treatment Market with a 67.1% market share in 2024, driven by their convenience, lower cost, and targeted purification at consumption points such as kitchen sinks. POU systems, including countertop, under-sink, and faucet-mounted units, are preferred for daily drinking and cooking requirements. Point-of-entry (POE) systems are gaining momentum among larger households seeking whole-home filtration for bathing, laundry, and appliance protection. Increasing water contamination levels, rising household awareness, and expanding urban populations reinforce the strong demand for POU solutions.

Key Growth Drivers

Rising Concerns Over Drinking Water Quality

Growing concerns about deteriorating water quality remain one of the strongest drivers of the Residential Water Treatment market. Increasing contamination from industrial discharge, aging municipal pipelines, agricultural runoff, and high TDS levels in groundwater has made households more dependent on home-based purification systems. Consumers are increasingly aware of risks related to microbial pathogens, heavy metals, chlorine, and emerging contaminants, strengthening the need for advanced systems such as RO, UV, and multi-stage filtration units. Government testing reports and rising media coverage of water quality incidents further influence consumer behavior. In rapidly urbanizing regions, water scarcity and the reliance on tanker or borewell supplies also heighten demand for purification units. The growing preference for convenient, point-of-use systems and the shift toward regular filter-replacement cycles contribute to market expansion. As health consciousness rises globally, reliable home water treatment solutions are becoming essential, supporting long-term market growth.

- For instance, Culligan’s Aquasential Reverse Osmosis system uses a five-stage purification module and delivers up to 189 liters of purified water per day, suitable for households with high consumption.

Increasing Adoption of Smart and Connected Water Purification Technologies

The adoption of smart water purification systems is accelerating as consumers shift toward technologically advanced home appliances. Modern residential water treatment devices now integrate IoT-based monitoring, app-controlled operations, digital indicators, and automated filter replacement alerts, improving user convenience and system reliability. These features ensure optimal performance while reducing maintenance uncertainty for households. Smart RO and UV systems, supported by Wi-Fi connectivity and AI-driven diagnostics, are becoming popular in premium and mid-range segments. Manufacturers are investing in innovation to offer energy-efficient purification, water recovery optimization, and enhanced real-time tracking of water quality parameters. Growing consumer preference for smart home ecosystems further strengthens this trend. As brands expand product portfolios with intelligent purification tools, the market benefits from rising demand for high-tech, feature-rich, and user-friendly water treatment solutions, particularly in urban households with busy lifestyles and higher disposable incomes.

Rising Urbanization and Expansion of Middle-Class Households

Rapid urbanization and the expansion of middle-income households significantly drive the Residential Water Treatment market. Urban regions often face inconsistent water supply quality due to infrastructure limitations, compelling households to rely on purification systems as a necessity rather than a lifestyle choice. The growing number of nuclear families and rising residential construction activity create strong replacement and first-time installation opportunities. Increasing disposable incomes enable households to upgrade from basic filtration units to more advanced RO, UV, and multi-stage systems. Additionally, the rise of packaged drinking water costs encourages consumers to switch to home purification solutions. The market also benefits from rising homeownership, improved living standards, and government-led initiatives promoting access to safe drinking water. As urban populations grow globally, the adoption of reliable household water treatment systems is expected to increase steadily, supporting sustained market expansion.

Key Trends & Opportunities

Growing Shift Toward Eco-Friendly and High-Efficiency Purification Systems

A major trend shaping the Residential Water Treatment market is the rising demand for eco-friendly purification systems designed to reduce water wastage, energy consumption, and plastic dependency. Consumers are becoming increasingly environmentally conscious, driving interest in RO systems with water recovery mechanisms, zero-water-waste technologies, and advanced filtration media made from biodegradable or long-lasting materials. Manufacturers are responding by introducing water-efficient models and filters with extended lifespans, minimizing replacement frequency. The shift toward sustainable purification aligns with broader global initiatives promoting water conservation and green household appliances. Opportunities emerge for brands offering recyclable filter cartridges, solar-powered purification, and systems designed to reduce operational footprints. As environmental regulations tighten and consumers prioritize sustainability, companies innovating eco-friendly purification technologies will gain a competitive advantage in premium and mid-range residential segments.

- For instance, Coway’s CHP-18 series water purifiers (e.g., Villaem II) utilize an RO membrane with a lifespan of approximately 24 months (or 18–24 months for some compatible filters) rather than a specific total liter capacity for the filter itself.

Rising Demand for Portable, Modular, and Compact Water Treatment Solutions

The increasing popularity of compact and portable water treatment solutions presents a strong opportunity within the residential market. As more households move into smaller urban apartments, demand grows for lightweight, space-saving devices such as faucet filters, countertop purifiers, gravity-based units, and modular under-sink systems. These solutions appeal to renters, frequent movers, and students due to their ease of installation and affordability. The trend is further strengthened by lifestyle mobility, the rising prevalence of shared living spaces, and the need for convenient purification options without permanent plumbing changes. Manufacturers are focusing on modular designs that allow users to customize filtration levels, portability, and water flow configurations. The surge in online retail has also expanded access to compact purification products. This trend offers significant growth opportunities in emerging markets and urban centers where space limitations and mobility influence consumer purchasing behavior.

- For instance, Brita’s basic faucet filtration system processes up to 378 liters before cartridge replacement and requires no tools for installation, making it ideal for mobile and rental households.

Key Challenges

High Maintenance Costs and Frequent Filter Replacements

One of the major challenges affecting the Residential Water Treatment market is the high maintenance cost associated with advanced purification systems, particularly RO and UV units. Frequent filter replacements, servicing requirements, and membrane cleaning add to the total cost of ownership, discouraging budget-conscious consumers. In many regions, lack of standardized service networks and dependence on third-party technicians further complicate maintenance reliability. Households often delay servicing due to cost concerns, reducing system efficiency and lifespan. Additionally, low-cost counterfeit filters available in unorganized markets pose safety and durability risks. For manufacturers, maintaining consistent after-sales service quality remains difficult across diverse geographies. Addressing this challenge requires affordable subscription-based maintenance models, long-life filters, and improved service infrastructure.

Variability in Water Quality and Lack of Consumer Awareness

The Residential Water Treatment market also faces challenges due to highly variable water quality across regions, making it difficult for consumers to select the most suitable purification technology. Many households lack awareness of specific contaminants in their water supply, leading to improper product choices or underutilization of system features. Misconceptions about RO wastage, UV effectiveness, and general maintenance further hinder adoption. In rural or price-sensitive markets, reliance on traditional boiling or basic filters reduces the uptake of advanced systems. Additionally, inconsistent municipal water testing and lack of standardization in water quality reporting limit consumer understanding. To overcome this challenge, manufacturers must invest in awareness campaigns, water testing services, and educational tools that guide consumers toward appropriate purification technologies.

Regional Analysis

North America

North America leads the Residential Water Treatment Market with a 34.2% market share in 2024, driven by heightened awareness of water contamination issues, aging pipeline infrastructure, and widespread adoption of advanced purification technologies. Consumers prefer RO, UV, and multi-stage systems supported by strong product availability and high disposable incomes. The U.S. dominates regional demand due to stringent water safety regulations and frequent municipal quality concerns. Growth is further fueled by the rising adoption of smart, connected purifiers and subscription-based filter replacement models. Canada follows with increasing uptake of energy-efficient and eco-friendly home filtration solutions.

Europe

Europe accounts for 27.6% of the Residential Water Treatment Market in 2024, supported by strict water-quality regulations and a strong environmental focus. Households in Western Europe, particularly Germany, France, and the U.K., increasingly adopt filtration systems to address hardness, microplastics, and chemical contaminants. Demand for eco-friendly purification technologies, including water-saving RO systems and recyclable filters, is growing steadily. Southern and Eastern Europe are witnessing rising adoption due to improving urban infrastructure and consumer awareness. The region’s emphasis on sustainability and premium home appliances continues to support the expansion of residential water purification systems.

Asia-Pacific

Asia-Pacific holds the largest growth momentum and captures 29.8% of the Residential Water Treatment Market in 2024, driven by rapid urbanization, varying water quality, and dependence on tanker and borewell sources. Countries such as India, China, and Indonesia show strong demand for RO and ultraviolet systems due to high TDS levels and microbial contamination. Expanding middle-class households and rising health consciousness further accelerate adoption. The region benefits from local manufacturing, competitive pricing, and wide retail distribution. Increasing government initiatives promoting safe drinking water and rising awareness of daily health risks continue to make Asia-Pacific the fastest-expanding market.

Latin America

Latin America holds a 5.8% market share in 2024, with demand driven by inconsistent municipal water supply and increasing household reliance on purification systems. Brazil and Mexico lead the region as urban populations grow and consumer awareness of waterborne illnesses rises. Households increasingly adopt POU systems such as countertop and under-sink filters for drinking and cooking needs. Economic constraints support steady demand for affordable and mid-range filtration solutions. Improvements in retail penetration and expansion of water quality testing services are further encouraging the uptake of household purification technologies across the region.

Middle East & Africa

The Middle East & Africa region accounts for 2.6% of the Residential Water Treatment Market in 2024, primarily driven by water scarcity, desalinated water use, and rising concerns over microbial impurities. Gulf nations such as the UAE and Saudi Arabia show strong adoption of advanced RO and activated carbon systems to improve taste and reduce salinity. In Africa, urban centers increasingly rely on filtration due to unreliable municipal supply and contamination risks. Affordability challenges slow adoption, but rising urbanization, growing awareness, and expanding access to retail distribution channels are gradually supporting market growth.

Market Segmentations

By Product

- Distillation Units

- Water Filters

By Price Range

- Economy

- Mid-Range

- Premium

By Installation Type

- Point of Use

- Point of Entry

By Sales Channel

- Hypermarkets/Supermarket

- Convenience Stores

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Residential Water Treatment Market is shaped by a mix of global brands and regional specialists focusing on advanced purification technologies, product reliability, and expanding distribution networks. Key players such as A.O. Smith Corporation, Kent Supreme, Eureka Forbes, Panasonic, Aquasana, GE Appliances, 3M, Waterwise Inc., Everpure, and Aqua Care concentrate on offering RO, UV, activated carbon, and multi-stage filtration systems tailored to diverse household needs. Companies increasingly invest in smart purification features, improved water recovery systems, and long-life filters to strengthen their market position. Strategic initiatives, including product innovation, partnerships with retail and online channels, and expansion into emerging markets, help brands broaden their consumer reach. Growing emphasis on eco-friendly materials and energy-efficient purification technologies also drives competitive differentiation. As consumer awareness rises and regulatory standards tighten, leading manufacturers continue to refine product quality, affordability, and after-sales service to maintain long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Eureka Forbes Ltd launched a new range of Aquaguard water purifiers featuring Longlife Nanopore Filter technology that provides a filter-life of up to 2 years for Indian homes.

- In 2024, Unilever announced the sale of its water-purification business Pureit to A. O. Smith Corporation, marking a significant portfolio shift in the residential purification segment.

Report Coverage

The research report offers an in-depth analysis based on Product, Price Range, Installation Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as households increasingly prioritize safe and reliable drinking water solutions.

- Adoption of smart and connected purification systems will accelerate, driven by rising demand for real-time monitoring and automated maintenance.

- Eco-friendly and water-efficient purification technologies will gain prominence as sustainability becomes a major consumer focus.

- Point-of-use systems will remain the preferred installation type due to convenience, affordability, and targeted purification benefits.

- Advanced RO and multi-stage filtration technologies will see wider usage in regions with high TDS and variable water quality.

- The rise of compact and modular purifiers will support adoption in urban apartments with limited space.

- Manufacturers will expand service subscription models, improving maintenance accessibility and long-term system performance.

- Growth opportunities will strengthen in emerging markets as awareness of water contamination and health risks increases.

- Digital retail channels will play a larger role, enhancing consumer reach and product availability.

- Innovations in long-life filters and low-maintenance designs will help reduce ownership costs and boost adoption.