Market Overview

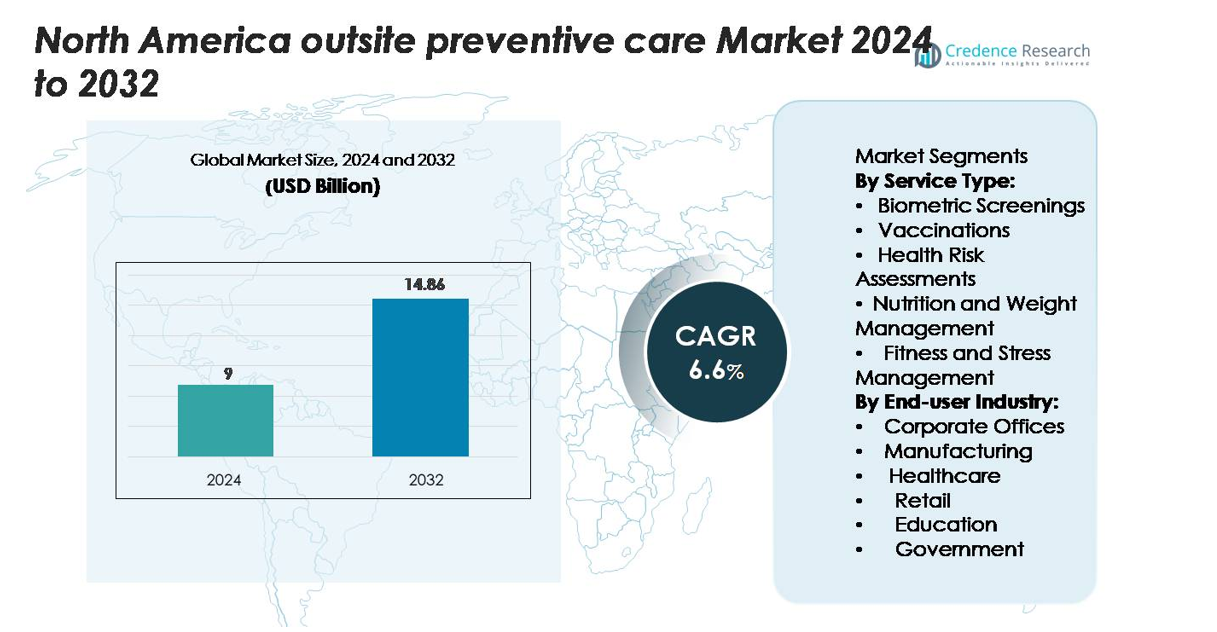

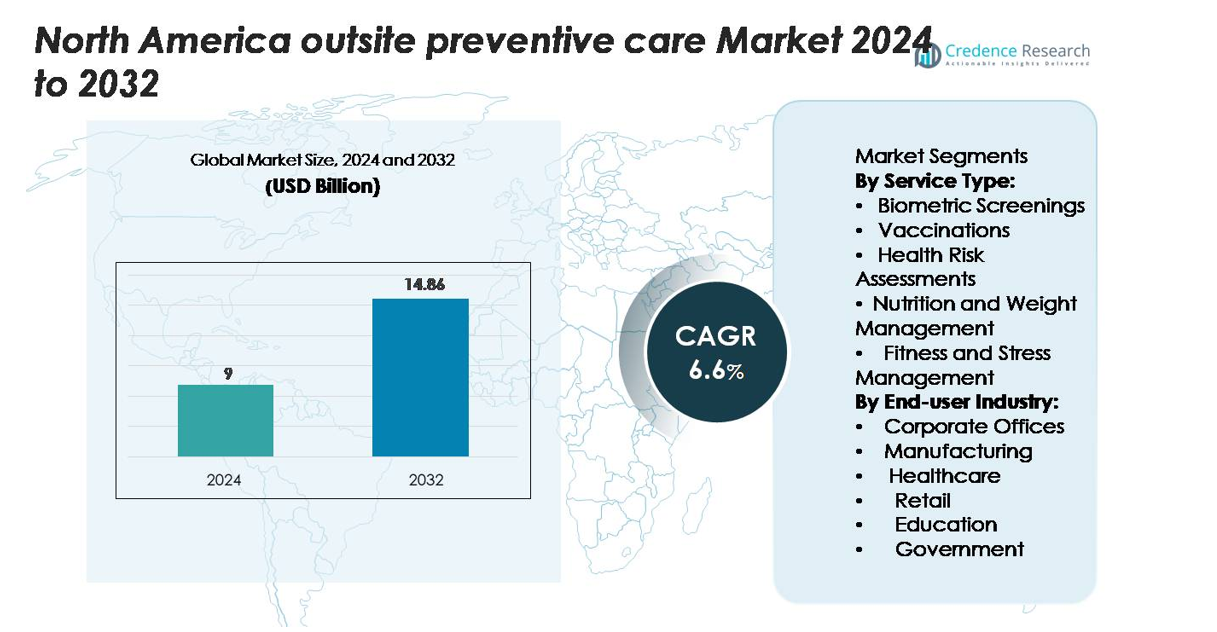

North America onsite preventive care market reached USD 9 Billion in 2024. The market is projected to touch USD 14.86 Billion by 2032, driven by steady adoption of workplace wellness programs. The sector is expected to grow at a 6.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Outside Preventive Care Market Size 2024 |

USD 9 Billion |

| North America Outside Preventive Care Market, CAGR |

6.6% |

| North America Outside Preventive Care Market Size 2032 |

USD 14.86 Billion |

Leading providers in the North America onsite preventive care market focus on biometric screenings, mental-health programs, wellness coaching, and integrated onsite clinic services for large employers. Top vendors strengthen their presence through data-driven platforms, hybrid care models, and scalable workforce-health solutions that support chronic-disease prevention and productivity improvement. The United States leads the regional market with a 78% share, supported by strong employer investment and widespread adoption of onsite wellness infrastructure. Canada follows with expanding uptake in corporate and public-sector organizations, while Mexico shows early growth driven by large manufacturing clusters.

Market Insights

- The North America onsite preventive care market reached USD 9 Billion in 2024 and is set to hit USD 14.86 Billion by 2032 at a 6.6% CAGR.

- Rising employer focus on early-risk detection drives strong demand for biometric screenings, which lead the service type segment with a 38% share.

- Digital wellness tools, hybrid onsite-virtual care models, and mental-health programs shape major market trends, increasing participation and program scalability.

- Competition intensifies as major providers expand integrated onsite clinics, analytics platforms, and injury-prevention services across corporate, manufacturing, and healthcare sectors.

- The United States dominates with a 78% regional share, followed by Canada at 19%, while Mexico holds 3%, supported by growth in industrial hubs and multinational workplaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Biometric screenings hold the dominant position with a 38% share, driven by strong employer demand for early-risk detection and baseline health data. Companies rely on these screenings to track chronic-disease indicators and reduce expensive emergency claims. Vaccinations grow as firms target infection-control programs, while health risk assessments support personalized wellness planning. Nutrition and weight management gain traction in workplaces with high metabolic-risk profiles. Fitness and stress-management services expand as employers address burnout and mental-health needs. Rising insurance incentives and onsite clinical integration continue to strengthen adoption across all service lines.

- For instance, Johnson & Johnson reports that its “Healthy & Me” platform logged over 75 billion steps via digital trackers across its global employee base, and achieved a tobacco-use reduction from ~12 % to between 3 – 4 % after integrating biometric and risk-assessment programs.

By End-user Industry

Corporate offices lead the market with a 42% share, supported by large employee bases and high investment in wellness infrastructure. Employers seek lower absenteeism and stronger productivity through routine onsite care programs. Manufacturing sites adopt preventive services to reduce workplace injuries and support shift-based health access. Healthcare facilities expand use to manage workforce fatigue and compliance needs. Retail and education sectors adopt flexible onsite models for dispersed staff. Government agencies show steady growth as wellness budgets strengthen across federal and state institutions.

- For instance, ABB incorporates ergonomic design and human factors analysis into its industrial solutions, such as control room designs and automation systems, to help improve safety and operator well-being in factory and process environments.

Key Growth Drivers

Rising Employer Focus on Workforce Health and Productivity

Employers across North America now prioritize preventive care to reduce rising healthcare costs and improve long-term employee performance. Many organizations report increased chronic-disease risks among workers, which strengthens demand for onsite screenings, coaching, and early-intervention programs. Companies adopt these services to cut absenteeism, boost workforce energy, and maintain operational continuity. Preventive care also supports better morale, reduced staff turnover, and improved job satisfaction in high-stress environments. Large corporations integrate onsite clinics to enhance employee accessibility and reduce time spent on offsite medical visits. As employers link wellness outcomes with performance metrics, investment in preventive programs grows further. This shift helps organizations build a resilient and healthier workforce while gaining measurable gains in productivity.

- For instance, IBM reported that its digital wellness and preventive-care program processed more than 2,000,000 individual health-engagement records in a single year, enabling early identification of metabolic and cardiovascular risks across employee groups

Expansion of Insurance Incentives and Value-Based Care Models

Insurance providers now encourage companies to use onsite preventive services through premium discounts and improved coverage for early-risk detection programs. Value-based care models reward employers for lowering long-term healthcare claims, making preventive services financially attractive. Insurers view biometric screenings, risk assessments, and vaccination drives as essential tools to minimize costly emergency events and chronic-disease complications. Many companies receive structured incentives for adopting health coaching and lifestyle-management programs. As insurers shift toward preventive cost control, demand for onsite solutions strengthens in both small and large organizations. This trend accelerates adoption across industries that face heavy medical claims or high-risk employee groups. Growing collaboration between payers and workplace clinics continues to push preventive adoption forward.

- For instance, Omada Health—partnered with Cigna, Kaiser Permanente, and other major insurers—reported enrolling more than 1,000,000 members in its preventive-care and chronic-management programs, with digital biomarkers recorded in high-resolution intervals to support insurer reimbursement models.

Growth of Mental Health, Stress Management, and Lifestyle Programs

The surge in mental-health concerns and workplace burnout strongly drives adoption of onsite preventive services. Employers see rising cases of stress, anxiety, and fatigue, especially in corporate, manufacturing, and healthcare environments. This shift increases the need for onsite counseling, resilience training, stress-management programs, and fitness initiatives. Organizations adopt holistic wellness models that integrate physical and mental well-being to support long-term employee stability. Hybrid work models also push demand for flexible preventive programs that target lifestyle issues such as poor sleep, weight imbalance, and low physical activity. Companies invest in these programs to strengthen emotional health, organizational culture, and workforce engagement. As mental health becomes a strategic business priority, preventive service providers expand offerings to include mindfulness coaching, ergonomic evaluations, and personalized wellness plans that improve daily functioning.

Key Trends & Opportunities

Technology-Enabled Preventive Care and Data-Driven Health Insights

Digital tools now enhance onsite preventive care by enabling real-time health monitoring, automated risk classification, and personalized intervention plans. Wearables, mobile apps, and AI-based analytics help companies identify early health risks and tailor wellness strategies to specific employee groups. Providers integrate digital dashboards to track biometric data and engagement also strengthens onsite models by offering hybrid care options that combine virtual and physical trends, helping employers measure program outcomes and refine future investments. Telehealth expansion services. This integration creates opportunities for continuous monitoring, higher program participation, and greater accessibility for remote or shift-based employees. As technology adoption grows, onsite preventive care becomes more scalable and cost-effective for organizations of all sizes.

- For instance, Fitbit has reported analyzing over 22 billion hours of sleep-tracking data, which directly supports the development of advanced preventive-care features such as its Sleep Profile classification system.

Growing Adoption of Integrated Onsite Clinics and Multi-Specialty Wellness Centers

Organizations increasingly establish integrated onsite clinics that combine medical care, mental-health support, lifestyle programs, vaccinations, and chronic-disease counseling under one roof. These multi-specialty centers improve convenience and encourage higher employee participation in preventive programs. Employers view integrated models as long-term investments that reduce external medical dependence and improve early detection of health issues. Providers also expand services to include nutrition counseling, physiotherapy, stress management, and ergonomic assessments. This ecosystem creates significant growth opportunities for vendors offering full-service platforms and coordinated care models. Companies with large or dispersed workforces adopt multi-service centers to ensure consistent care delivery and strong workforce engagement. The rise of integrated wellness ecosystems positions onsite preventive care as a core element of future corporate health strategies.

- For instance, Premise Health serves millions of members at over 800 wellness centers, demonstrating strong utilization of multi-service clinic models.

Opportunity in High-Risk Industries Seeking Injury Prevention and Workforce Stability

Manufacturing, logistics, retail, and healthcare sectors show rising interest in onsite preventive care due to high injury rates, shift fatigue, and ergonomic risks. These industries need continuous monitoring of physical strain, musculoskeletal health, and metabolic conditions. Providers offer targeted programs such as ergonomic training, strength-building sessions, injury-prevention workshops, and onsite physiotherapy to reduce workplace accidents. Companies use these services to protect productivity, extend employee longevity, and reduce workers’ compensation claims. This demand opens strong opportunities for preventive care vendors specializing in occupational health. As workforce shortages rise in physically demanding industries, employers strengthen preventive programs to retain skilled workers and maintain consistent operational output.

Key Challenges

High Implementation Costs and Limited Adoption Among Small Enterprises

While large corporations invest in onsite preventive care, small and mid-sized organizations struggle with high upfront costs. Setting up onsite clinics, hiring specialized staff, and maintaining equipment often exceeds the budgets of smaller employers. Many rely on basic wellness initiatives instead of structured preventive programs. Limited space, resource constraints, and low economies of scale also slow adoption. Providers attempt to offer modular or shared onsite services, but coverage gaps remain. The cost barrier restricts market expansion and reduces access for millions of small-business employees. Without strong financial incentives or subsidized models, adoption in smaller companies will continue to grow at a slower pace, creating disparities in preventive care access across the workforce.

Low Employee Engagement and Privacy Concerns in Preventive Programs

Despite employer investments, many employees hesitate to participate in onsite health programs due to privacy concerns and fear of data misuse. Workers worry about biometric data being shared with employers or insurers, which lowers engagement rates in screenings and risk assessments. Some employees also show low interest in wellness activities due to time constraints, lack of awareness, or perceived stigma around mental-health participation. These issues limit the effectiveness of preventive programs and reduce measurable outcomes. Providers must invest in strong data-privacy frameworks, transparent communication, and personalized engagement tools to build trust. Without addressing these concerns, participation levels may stagnate and weaken long-term program impact.

Regional Analysis

United States

The United States dominates the North America onsite preventive care market with a 78% share, supported by strong employer spending on wellness, chronic-disease management, and mental-health programs. Large corporations adopt onsite clinics to reduce medical claims and increase workforce productivity. High prevalence of obesity, stress, and lifestyle-related risks strengthens demand for biometric screenings, vaccinations, and structured health assessments. U.S. businesses also lead in integrating digital tools, telehealth, and data-driven wellness platforms into workplace environments. Expanding insurance incentives, regulatory focus on preventive care, and rising workforce health awareness continue to reinforce the country’s leadership position.

Canada

Canada holds a 19% market share, driven by rising employer adoption of preventive services in corporate, manufacturing, and public-sector workplaces. Organizations focus on early detection of chronic illnesses and improved workforce well-being due to increasing healthcare utilization pressures. Demand grows for vaccinations, ergonomic programs, and mental-health support across offices and industrial sites. Canadian employers also invest in hybrid preventive models that combine onsite services with virtual wellness platforms. Government emphasis on public health and strong workplace-safety regulations further encourages preventive adoption. As workforce stress and chronic-disease risks increase, Canada expands its investment in structured onsite care solutions.

Mexico

Mexico accounts for a 3% share, reflecting early-stage adoption of onsite preventive care compared to the rest of North America. Large manufacturing plants and multinational corporations lead demand, focusing on injury prevention, fatigue management, and chronic-risk reduction. Employers in automotive, electronics, and logistics sectors introduce biometric screenings, nutrition guidance, and workplace fitness programs to enhance worker stability. Adoption remains slower among small and medium enterprises due to budget constraints. However, rising healthcare costs and growing awareness of preventive care benefits attract investment. Urban regions with expanding industrial activity show the strongest growth potential for onsite wellness programs.

Market Segmentations:

By Service Type:

- Biometric Screenings

- Vaccinations

- Health Risk Assessments

- Nutrition and Weight Management

- Fitness and Stress Management

By End-user Industry:

- Corporate Offices

- Manufacturing

- Healthcare

- Retail

- Education

- Government

By Geography

Competitive Landscape

The competitive landscape in the North America onsite preventive care market features a mix of specialized wellness providers, onsite clinic operators, occupational health companies, and digital health platforms. Leading players compete by expanding biometric screenings, mental-health support, lifestyle coaching, and integrated clinic services tailored to large corporate and industrial workforces. Vendors strengthen their position through data-driven wellness platforms, remote monitoring tools, and hybrid preventive models that combine onsite and virtual engagement. Companies focus on improving participation rates, enhancing personalized care plans, and delivering measurable reductions in healthcare claims. Strategic partnerships with insurers, technology firms, and large employers help providers scale programs across multiple worksites. As demand grows for mental-health solutions, ergonomic assessments, and chronic-risk management, companies broaden their offerings to cover physical, emotional, and lifestyle needs. Continuous innovation in analytics, telehealth integration, and outcome reporting remains essential for maintaining competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QuadMed (part of Quad/Graphics)

- Worksite Medical

- Medcor, Inc.

- Wellness Corporate Solutions

- Cigna Onsite Health, LLC

- Interactive Health

- TotalWellness Health

- Premise Health

- Marathon Health

- Concentra (a subsidiary of Select Medical)

Recent Developments

- In April 2025, Concentra announced the acquisition of Pivot Onsite Innovations, which operated over 200 workplace health clinics across more than 40 states.

- In 2023, the company Premise Health published an analysis across over 207,000 lives (26 employers/unions) showing marked increases in preventive/office visits and reductions in inpatient admissions through its employer-direct site care model.

- In 2024, its parent The Cigna Group announced a major divestment of its Medicare Advantage and supplemental businesses

Report Coverage

The research report offers an in-depth analysis based on Service type, End-User industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of integrated onsite clinics will rise as employers seek stronger preventive coverage.

- Mental-health and stress-management programs will expand across corporate and industrial workplaces.

- Digital wellness platforms and AI-based risk insights will guide more personalized preventive plans.

- Demand for biometric screenings and chronic-risk monitoring will increase due to workforce health needs.

- Hybrid onsite-virtual care models will gain traction and improve employee participation.

- Preventive programs in manufacturing and logistics sectors will grow as injury-prevention becomes a priority.

- Employers will invest more in nutrition, weight management, and lifestyle coaching services.

- Partnerships between insurers and onsite care providers will strengthen adoption rates.

- Small and mid-sized companies will adopt modular onsite wellness programs as costs decrease.

- Data privacy, compliance, and secure health-reporting systems will become central to market expansion.Top of FormBottom of Form