Market Overview

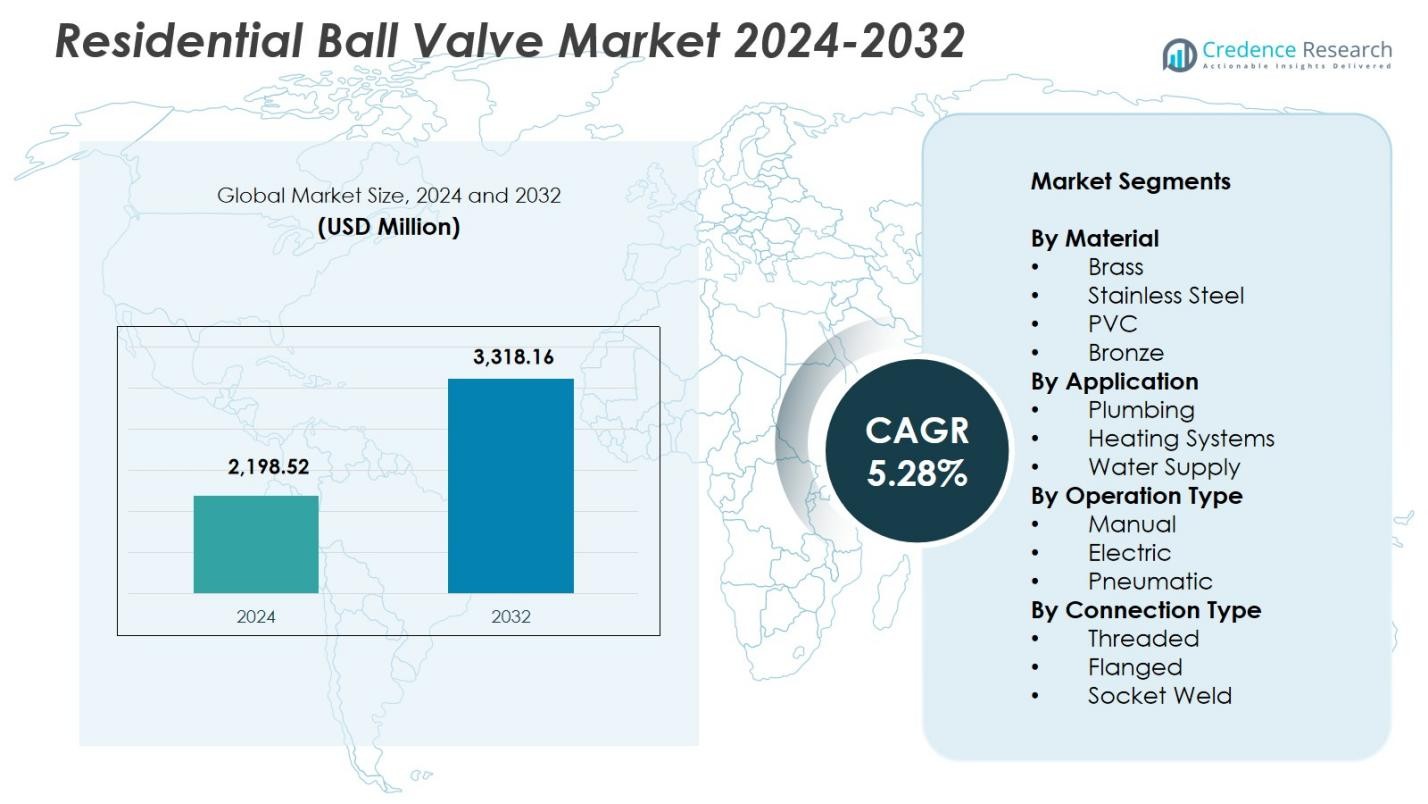

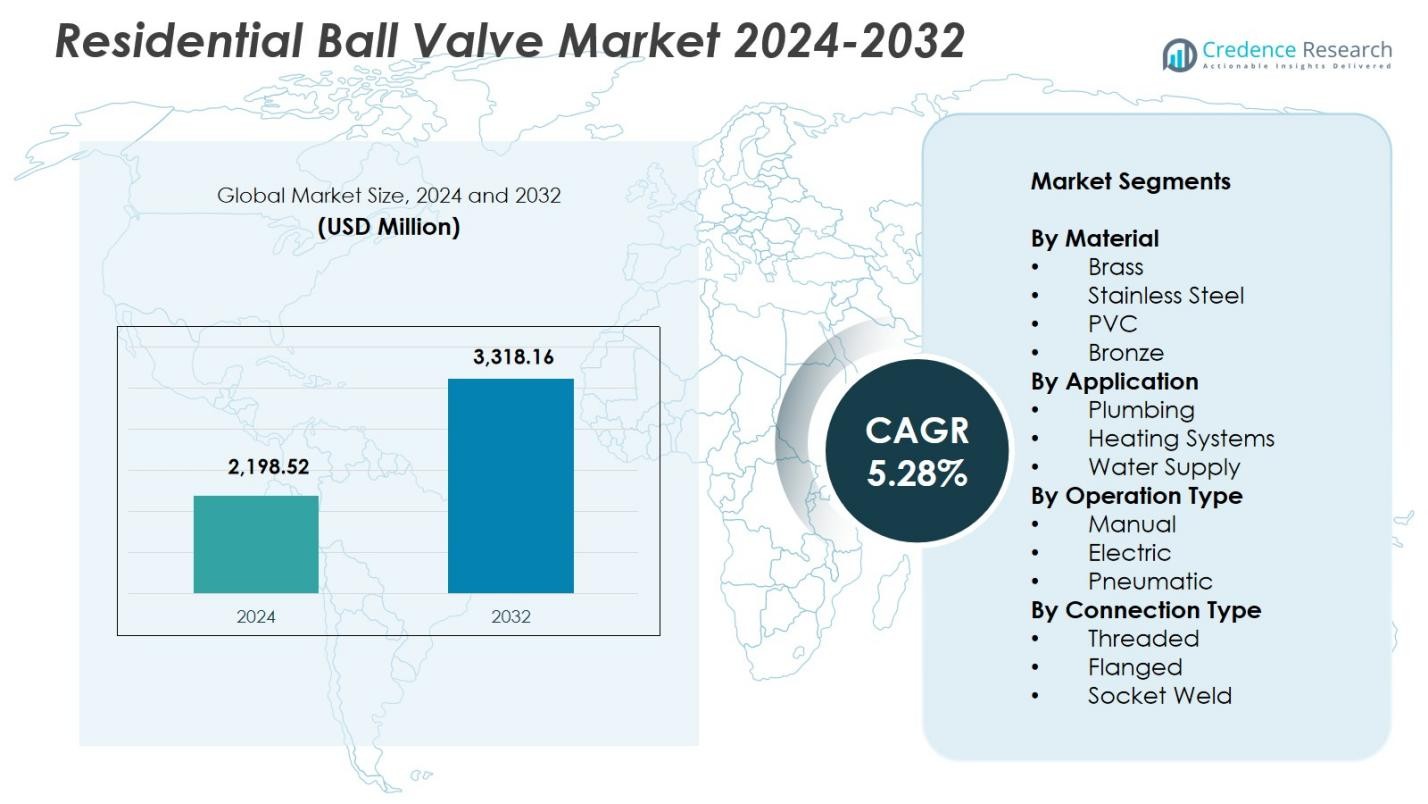

Residential Ball Valve Market size was valued at USD 2,198.52 Million in 2024 and is anticipated to reach USD 3,318.16 Million by 2032, at a CAGR of 5.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Ball Valve Market Size 2024 |

USD 2,198.52 Million |

| Residential Ball Valve Market, CAGR |

5.28% |

| Residential Ball Valve Market Size 2032 |

USD 3,318.16 Million |

Residential Ball Valve Market features leading players such as Honeywell International, Emerson Electric, Watts Water Technologies, Mueller Water Products, NIBCO, AVK Holding, KITZ Corporation, Valmet Flow Control, and Pentair, all of whom strengthen market presence through advanced product portfolios and strong distribution networks. These companies focus on durable, lead-free, and corrosion-resistant valve technologies that support expanding residential plumbing and smart-home applications. Regionally, North America leads the market with a 33.4% share in 2024, driven by strict plumbing standards and high renovation activity, while Asia-Pacific follows with a 29.7% share, supported by rapid urbanization and large-scale residential construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Residential Ball Valve Market is valued at USD 2,198.52 Million in 2024 and will reach USD 3,318.16 Million by 2032, growing at a CAGR of 5.28%.

- Rising residential construction, renovation activities, and demand for durable plumbing components drive market growth, with brass material leading at 44.6% share and plumbing applications dominating at 52.3%.

- Smart-home expansion boosts adoption of electric and automated valves, while long-life, corrosion-resistant materials and leak-prevention technologies shape emerging market trends.

- Major players such as Honeywell, Emerson, Watts Water Technologies, and NIBCO expand presence through advanced product portfolios and strong distribution networks, with manual valves holding 61.7% share.

- North America leads with 33.4% share, followed by Asia-Pacific at 29.7% and Europe at 28.1%, driven by strong housing development, modernization of plumbing systems, and rising preference for reliable water-control solutions.

Market Segmentation Analysis:

By Material

The Residential Ball Valve Market by material is dominated by Brass, holding 44.6% share in 2024, driven by its superior corrosion resistance, high durability, and suitability for residential plumbing networks. Brass valves ensure long service life, leak prevention, and compatibility with diverse pipe materials, supporting their strong adoption in new housing installations and renovation projects. Stainless steel follows due to its strength in high-pressure environments, while PVC gains traction for cost-effective, lightweight applications. Bronze remains relevant in specialized systems requiring enhanced performance stability, but brass continues to lead due to reliability and widespread residential acceptance.

- For instance, Pegler manufactures WRAS-approved brass ball valves for potable water in UK homes, ensuring durability in heating and general plumbing. NIBCO supplies bronze ball valves rated at 200 psi for residential hot/cold water and gas shut-off, offering stability in multi-purpose systems.

By Application

Within the application segment, Plumbing leads the Residential Ball Valve Market with 52.3% share in 2024, supported by rising residential construction, water distribution upgrades, and the need for reliable shut-off mechanisms. Plumbing systems demand valves with consistent performance, ease of operation, and resistance to corrosion, which strengthens the segment’s leadership. Heating systems contribute steadily as smart HVAC technologies expand, while water supply networks adopt durable valves for maintaining pressure integrity. However, the plumbing segment maintains dominance due to its critical role in every household’s water flow management and continuous replacement demand in aging residential infrastructure.

- For instance, Kirloskar offers 3-piece floating ball valves in sizes from 15 mm to 100 mm with screwed, socket weld, or flanged ends, designed for residential water works and building construction to enable easy maintenance without pipe removal.

By Operation Type

The operation type segment is led by Manual ball valves, capturing 61.7% share in 2024, largely due to their affordability, simple installation, and reliability in everyday residential applications. Manual valves offer effortless shut-off control, low maintenance requirements, and compatibility with various pipe layouts, making them universally preferred by homeowners and contractors. Electric valves are gaining traction with the rise in smart home automation, while pneumatic types see niche use in systems requiring controlled actuation. Despite technological shifts, manual operation continues to dominate due to cost efficiency and suitability across standard residential plumbing and heating systems.

Key Growth Drivers

Rising Residential Construction and Renovation Activities

Growing residential construction and renovation projects strongly drive the Residential Ball Valve Market, as new plumbing and water supply systems require reliable flow control components. Expanding urban housing, refurbishment of aging infrastructure, and government incentives for home improvement boost the demand for durable valves across all material categories. Increasing consumer preference for high-quality fixtures and the need to comply with modern plumbing standards further accelerate adoption. As building activities intensify across emerging and developed regions, demand for efficient, corrosion-resistant, and long-life ball valves continues to strengthen.

- For instance, NIBCO’s T-585-66-LF two-piece bronze ball valve, with a 600 psi non-shock cold working pressure rating, supports hot and cold water systems in residential construction by delivering water for human consumption.

Increasing Focus on Water Efficiency and Leakage Reduction

Greater emphasis on water conservation reinforces market growth as households and utilities adopt valves that minimize leakage and improve distribution efficiency. Residential ball valves play a critical role in reducing water loss through enhanced sealing mechanisms and high operational reliability. Rising awareness about sustainable water usage, stricter municipal regulations, and the adoption of smart metering solutions increase the requirement for robust shut-off valves. As water stress intensifies in many regions, homeowners prioritize high-performance valves that ensure flow accuracy and reduce unnecessary consumption.

- For instance, Astral Pipes offers the Compact True Union Ball Valve, designed for residential plumbing with low-torque operation and double union ends that enable easy removal and servicing to prevent leaks.

Rising Integration of Smart Home and Automated Systems

Growing smart-home adoption drives the market as consumers shift toward automated water control solutions. Electric and sensor-enabled ball valves allow remote monitoring, leak detection, and automated shut-off, making them essential for modern home automation ecosystems. Increasing connectivity through IoT platforms, enhanced safety features, and compatibility with home management apps strengthen demand. Builders and system integrators incorporate smart valves into advanced HVAC, irrigation, and plumbing systems, prompting manufacturers to expand electronically actuated product portfolios that enhance user control and operational efficiency.

Key Trends & Opportunities

Transition Toward Advanced Materials and Long-Life Valve Designs

A strong trend in the Residential Ball Valve Market is the shift toward materials offering superior durability, corrosion resistance, and performance stability. Manufacturers innovate with upgraded brass alloys, stainless steel variants, and engineered polymers to enhance service life and reduce maintenance frequency. The opportunity lies in developing eco-friendly and lead-free formulations to meet evolving safety standards. As consumers increasingly demand premium, long-lasting home fixtures, brands offering high-performance material solutions gain a competitive edge and expand their penetration in modern plumbing and heating applications.

- For instance, NIBCO offers the S-685-66-LF series lead-free brass ball valves featuring a full port design, blowout-proof stem, reinforced PTFE seats, and a stainless steel ball and stem rated for 600 psi non-shock cold working pressure, ideal for potable water plumbing in homes.

Expansion of Smart and Remote-Controlled Valve Solutions

Rapid adoption of smart residential technologies creates opportunities for advanced electric and IoT-enabled ball valves. Homeowners value remote shut-off capabilities, real-time leakage alerts, and integration with mobile applications, making digital valve systems attractive upgrades. Manufacturers explore partnerships with smart-home ecosystem providers to offer interoperable solutions that enhance convenience and safety. As insurance companies incentivize leak-prevention technologies and smart-home penetration rises globally, the market witnesses growing demand for connected valves that deliver predictive maintenance insights and automated water management.

- For instance, U.S. Solid’s smart motorized ball valve connects to Wi-Fi for app-based remote control, supports a maximum medium pressure of 1.0 MPa, and operates across a flow medium temperature range of 0°C to 90°C with an IP65 enclosure rating.

Key Challenges

Fluctuating Raw Material Prices and Manufacturing Costs

Volatility in prices of brass, stainless steel, and engineered polymers poses a significant challenge for valve manufacturers. Rising input costs directly impact production economics, making it difficult to maintain price stability across product ranges. Manufacturers face pressure to balance affordability with quality while navigating unpredictable global supply chains. Sudden fluctuations in metal availability or energy expenses strain margins and complicate long-term procurement planning, prompting companies to seek alternative materials, optimize manufacturing processes, and diversify sourcing strategies to protect profitability.

Infrastructure Variability and Installation Complexities

Diverse plumbing standards, inconsistent installation practices, and variations in residential infrastructure across regions create operational challenges. Manufacturers must design valves compatible with multiple pipe materials, pressure conditions, and regulatory requirements, increasing product complexity. Older homes may present installation constraints due to outdated layouts or space limitations, requiring adaptable valve configurations. These factors lead to higher installation costs, potential performance inconsistencies, and increased need for skilled technicians. Ensuring universal compatibility and simplifying integration remain key hurdles for widespread market adoption.

Regional Analysis

North America

North America holds a strong position in the Residential Ball Valve Market with a 33.4% share in 2024, supported by high standards in residential plumbing, strong renovation activity, and widespread adoption of durable brass and stainless-steel valves. The region benefits from stringent building codes that encourage the use of reliable shut-off systems and leak-prevention components. Expanding smart-home integration accelerates demand for electric and automated valves, particularly in the U.S. Growing investments in water-efficient infrastructure and replacement of aging plumbing networks further strengthen market growth across both newly constructed and refurbished residential properties.

Europe

Europe accounts for a 28.1% share in 2024 in the Residential Ball Valve Market, driven by advanced plumbing regulations, energy-efficient heating systems, and sustained demand for premium valve materials. Countries such as Germany, the U.K., and France prioritize safety compliance and long-life fixtures, boosting adoption of high-durability ball valves. The expansion of district heating networks and the modernization of older housing stock strengthen demand for manual and automated options. Rising awareness of water conservation and stringent standards for lead-free plumbing materials further increase market penetration across European households and renovation projects.

Asia-Pacific

Asia-Pacific leads in growth momentum and holds a 29.7% share in 2024, supported by rapid urbanization, large-scale residential construction, and expanding middle-class demand for reliable water flow systems. China and India drive consumption due to increasing housing development and growing awareness of plumbing reliability. The region’s shift toward modernized water distribution and heating solutions elevates demand for brass, PVC, and stainless-steel valves. Manufacturers benefit from strong local production capabilities, while rising adoption of smart-home technologies stimulates interest in electric and sensor-based valves across emerging urban clusters.

Latin America

Latin America captures a 5.6% share in 2024, driven by gradual improvements in residential infrastructure and increasing investments in water supply modernization. Brazil and Mexico lead demand as households upgrade plumbing networks to reduce leakage and enhance water efficiency. The market benefits from growing adoption of cost-effective PVC and brass valves, supported by expanding real estate development and government-backed housing projects. However, variations in building standards and economic fluctuations influence market stability. Rising consumer awareness of durable fixtures and steady construction activities strengthen long-term demand across key residential markets.

Middle East & Africa

The Middle East & Africa region holds a 3.2% share in 2024, shaped by rising urban housing projects, water scarcity concerns, and the need for reliable shut-off solutions in residential plumbing. Gulf countries drive demand through modern construction initiatives and preference for corrosion-resistant stainless-steel and brass valves suitable for extreme climatic conditions. Africa’s growth is supported by emerging residential developments and gradual improvements in water distribution networks. Despite affordability challenges in some markets, increasing infrastructure investment and adoption of efficient flow-control components contribute to steady market expansion in the region.

Market Segmentations:

By Material

- Brass

- Stainless Steel

- PVC

- Bronze

By Application

- Plumbing

- Heating Systems

- Water Supply

By Operation Type

- Manual

- Electric

- Pneumatic

By Connection Type

- Threaded

- Flanged

- Socket Weld

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Ball Valve Market features a diverse competitive landscape led by major players such as Honeywell International, Emerson Electric, Watts Water Technologies, Mueller Water Products, NIBCO, AVK Holding, KITZ Corporation, Valmet Flow Control, and Pentair. These companies strengthen their market presence through broad product portfolios, robust distribution networks, and continuous investment in advanced valve technologies. Manufacturers focus on developing durable, lead-free, and corrosion-resistant materials to meet evolving plumbing standards and rising consumer expectations for long-life residential fixtures. Strategic expansions into smart, electric, and remote-operated valve systems position leading brands to capture growing demand driven by smart-home adoption. Companies also prioritize partnerships with plumbing contractors, builders, and home-automation integrators to enhance market penetration. Additionally, sustained investments in manufacturing automation, quality certification, and sustainability initiatives support long-term competitiveness while enabling firms to address diverse regional requirements and regulatory frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc.

- Emerson Electric Co.

- Watts Water Technologies

- Mueller Water Products

- NIBCO Inc.

- AVK Holding A/S

- WATTS Valve Co.

- KITZ Corporation

- Valmet Flow Control (formerly Neles)

- Pentair plc

Recent Developments

- In December 2025 Watts Water Technologies, Inc. completed the acquisition of Saudi Cast, enhancing its manufacturing footprint in cast-iron and stainless-steel drainage and plumbing fittings.

- In July 2025 NIBCO Inc. introduced extended metal locking levers for its 585 and 595 ball-valve series to improve safety and longevity.

- In September 2025 Watts Water Technologies, Inc. launched a new line of 3-piece stainless-steel ball valves designed for high durability and broader application suitability.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Operation Type, Connection Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as residential construction and renovation activity continues to rise globally.

- Demand for durable, corrosion-resistant valve materials will strengthen as households prioritize long-life plumbing components.

- Smart and automated ball valves will gain wider acceptance with increasing adoption of home-automation technologies.

- Lead-free and eco-friendly valve designs will expand as regulatory bodies tighten safety and environmental standards.

- Manufacturers will integrate IoT features to enable leak detection, remote operation, and predictive maintenance.

- Energy-efficient heating and water management systems will drive stronger uptake of advanced valve configurations.

- Localized production capabilities will increase as companies work to reduce supply-chain risks and improve regional responsiveness.

- Digital distribution channels and e-commerce will play a larger role in product accessibility for homeowners and contractors.

- Partnerships between valve manufacturers and construction firms will intensify to support large-scale housing developments.

- Technological innovation and material advancements will shape next-generation valves with improved performance and user convenience.