Market Overview

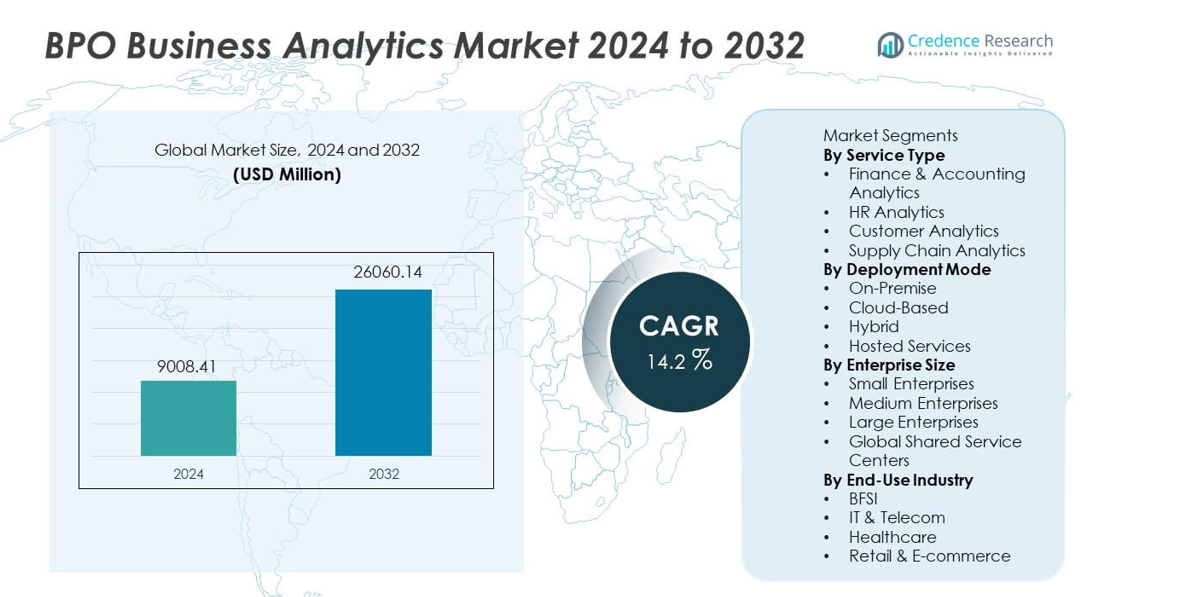

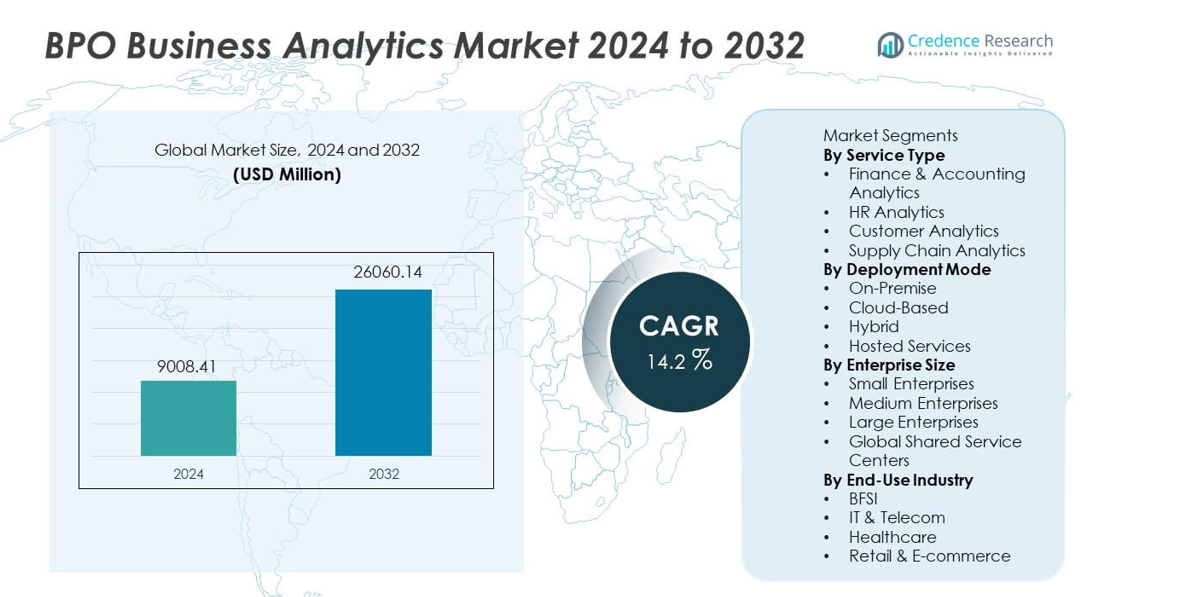

The BPO Business Analytics market reached USD 9,008.41 million in 2024 and is projected to hit USD 26,060.14 million by 2032, growing at a CAGR of 14.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| BPO Business Analytics Market Size 2024 |

USD 9,008.41 million |

| BPO Business Analytics Market, CAGR |

14.2% |

| BPO Business Analytics Market Size 2032 |

USD 26,060.14 million |

The BPO Business Analytics market includes major players such as Accenture, IBM, TCS, Wipro, Genpact, Infosys, Capgemini, Cognizant, EXL Service, and HCL Technologies, all of which invest in AI-enabled platforms, cloud-based analytics, and automation to support data-driven outsourcing models. These companies enhance service depth by offering predictive insights, workflow optimization, and domain-specific analytics solutions across BFSI, telecom, retail, and healthcare. Asia Pacific leads the market with a 29% share, driven by strong outsourcing ecosystems and skilled analytics talent. North America follows with 36%, while Europe holds 27%, supported by mature digital adoption and rising demand for compliance-focused analytics.

Market Insights

- The BPO Business Analytics market reached USD 9,008.41 million in 2024 and will reach USD 26,060.14 million by 2032 at a CAGR of 14.2%, driven by rising demand for outsourced analytics solutions.

- Strong demand for insight-driven operations fuels growth, with Customer Analytics holding 38% share as enterprises prioritize customer experience optimization and real-time decision support.

- Key trends include wider adoption of AI, automation, and cloud-based analytics platforms, enabling faster reporting and predictive modeling across global BPO delivery centers.

- Competition intensifies as Accenture, IBM, TCS, Wipro, Genpact, and Infosys expand AI-enabled services, while data security and talent shortages remain major restraints across the BPO Business Analytics landscape.

- Asia Pacific leads with 29% share, followed by North America at 36% and Europe at 27%, driven by strong outsourcing growth, cloud adoption, and increased investment in digital transformation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Customer Analytics leads the BPO Business Analytics market with a 38% share, driven by rising demand for insight-driven customer engagement and retention strategies. Businesses use advanced analytics to evaluate sentiment, behavior, and service quality across multi-channel interactions. Finance & Accounting Analytics follows as companies seek improved accuracy in forecasting, compliance, and cost optimization. HR Analytics gains traction as organizations adopt data-driven workforce planning and performance tracking. Supply Chain Analytics grows steadily due to higher demand for real-time visibility and risk mitigation. The strong shift toward personalized customer experience continues to reinforce leadership of Customer Analytics.

- For instance, Accenture enhanced its SynOps platform with automation modules that use integrated AI models for improved client interaction analysis and streamlined workflow decisions.

By Deployment Mode

Cloud-Based deployment dominates the market with a 52% share, supported by rapid adoption of scalable, cost-efficient analytics platforms across global BPO operations. Cloud systems allow real-time data access, faster integration, and improved collaboration across distributed service centers. Hybrid deployment follows as enterprises balance security needs with cloud flexibility. On-Premise remains relevant in data-sensitive sectors such as BFSI and healthcare, while Hosted Services expand due to simplified maintenance and outsourcing benefits. Increasing digital transformation initiatives and rising use of AI-powered analytics platforms continue to strengthen Cloud-Based adoption.

- For instance, TCS deployed its Daezmo cloud analytics suite for large enterprises, enabling processing of vast amounts of structured and unstructured data.

By Enterprise Size

Large Enterprises hold the leading position with a 57% share, driven by high-volume data processing needs and strong investments in advanced analytics outsourcing. These organizations prioritize operational efficiency, cost reduction, and insight-driven decision-making across global functions. Global Shared Service Centers follow as multinational firms centralize analytics operations to improve standardization and governance. Medium Enterprises adopt analytics to enhance growth planning and customer insights, while Small Enterprises benefit from cloud-based BPO analytics with lower entry costs. The scale, data complexity, and global footprint of Large Enterprises continue to support their dominant share.

Key Growth Drivers

Rising Adoption of Data-Driven Decision-Making

Organizations rely on analytics to enhance efficiency, forecast performance, and improve customer outcomes, which drives strong demand for BPO business analytics services. Companies outsource analytics to access specialized expertise, advanced tools, and faster insights without expanding internal teams. Growth in real-time reporting and predictive modeling strengthens adoption across finance, customer operations, and HR functions. Businesses aim to reduce operational risks and improve accuracy, pushing analytics deeper into core processes. Increasing use of dashboards and automated insights supports broader integration across global service centers.

- For instance, IBM’s Watson-powered analytics engine processes vast amounts of data using sophisticated AI algorithms, helping enterprises improve decision accuracy across customer and finance operations.

Expansion of Digital Transformation Across Enterprises

Enterprises accelerate digital transformation to streamline processes and modernize operations, boosting demand for outsourced analytics support. BPO providers deliver AI-enabled platforms, automated workflows, and cloud-based data solutions that improve efficiency and decision speed. Adoption rises in industries facing high data complexity, such as BFSI, telecom, and retail. As companies scale digital programs, they require continuous optimization and analytics-driven insights. This transition strengthens the role of BPO analytics in large transformation initiatives and long-term strategic planning.

- For instance, Cognizant’s AI-led digital operations incorporate a range of solutions and platforms, such as the Cognizant Neuro IT Operations platform and the Operations Intelligence Platform for Oil & Gas, which continuously ingest, correlate, and analyze data streams in different formats to identify patterns, predict outcomes, and provide deep operational intelligence across global transformation projects.

Growing Need for Customer Experience Optimization

Customer experience becomes a key competitive priority, increasing the need for analytics-driven insights in outsourced support operations. BPO providers use sentiment analysis, behavior tracking, and predictive modeling to help companies improve retention and engagement. Rising use of omni-channel communication creates complex data streams that require specialized analytics capabilities. Demand rises across retail, telecom, travel, and financial services. As organizations shift toward personalized service models, customer analytics becomes central to improving satisfaction and lifetime value.

Key Trends & Opportunities

Increased Integration of AI and Automation in Analytics Delivery

AI, machine learning, and automation strengthen the capabilities of BPO analytics providers by enabling faster insight generation, anomaly detection, and outcome prediction. Automated workflows reduce manual reporting time and improve accuracy across finance, HR, and customer operations. These technologies offer major opportunities for providers as demand grows for real-time and predictive intelligence. Enterprises adopt AI-driven tools to reduce costs and enhance service quality. Continuous improvements in generative AI and natural language processing expand application potential across industries.

- For instance, Infosys’ AI platform, Topaz, helps clients accelerate decision cycles across customer and finance functions. The platform transforms customer service processes for clients and delivers significant productivity gains.

Rising Demand for Cloud-Based Platforms and Scalable Data Solutions

Cloud-based analytics platforms gain strong traction due to their flexibility, lower upfront costs, and ability to support global service delivery models. Enterprises use cloud solutions to centralize data, improve collaboration, and accelerate deployment of analytics tools. This trend creates opportunities for BPO providers offering managed cloud analytics services with advanced security and integration capabilities. Growing use of hybrid and multi-cloud environments also expands demand for scalable solutions. As digital ecosystems grow, cloud adoption will remain a major driver of outsourced analytics.

- For instance, Capgemini’s cloud data framework orchestrates enterprise workloads across multi-cloud setups, enabling stable analytics delivery at scale. Capgemini offers solutions that use cloud-native tools and automation to manage services consistently, supporting a wide variety of business needs and enabling rapid development of new services.

Key Challenges

Data Security and Compliance Concerns

Handling sensitive financial, customer, and operational data creates major challenges for BPO analytics providers. Companies demand strict compliance with global regulations, including GDPR, HIPAA, and sector-specific data protection rules. Any data breach or compliance gap can affect trust and disrupt outsourcing relationships. Providers must invest heavily in encryption, access control, and secure cloud infrastructure. Rising data volumes increase the complexity of managing privacy and security across distributed delivery centers.

Shortage of Skilled Analytics Professionals

The market faces talent constraints as demand grows for skilled data analysts, data scientists, and AI specialists. BPO providers struggle to scale advanced analytics services without strong talent pipelines. Skill shortages increase training costs, slow project execution, and limit service expansion. Competition for experienced professionals remains high across industries. Providers must invest in continuous learning programs, automation tools, and AI-enabled platforms to overcome capability gaps and maintain service quality.

Regional Analysis

North America

North America holds a 36% share of the BPO Business Analytics market, driven by strong adoption of advanced analytics across finance, retail, healthcare, and telecom sectors. Enterprises invest in outsourcing to enhance decision-making, automate reporting, and improve customer engagement. The U.S. leads due to its mature digital ecosystem and widespread use of AI-enabled analytics tools. Rising demand for cloud-based platforms and predictive insights strengthens growth across shared service centers. Increased focus on operational efficiency and compliance also supports sustained adoption of outsourced analytics across regional enterprises.

Europe

Europe commands a 27% share, supported by rising demand for analytics outsourcing across BFSI, manufacturing, and e-commerce sectors. Enterprises adopt business analytics to meet regulatory standards, reduce operational risks, and improve customer service outcomes. The region benefits from expanding digital transformation programs and increasing cloud adoption. Countries such as the U.K., Germany, and France drive demand due to large enterprise footprints and strong emphasis on data governance. Growing interest in automation and AI-driven insights supports ongoing expansion of the BPO analytics market across Europe.

Asia Pacific

Asia Pacific leads the market with a 29% share, driven by rapid growth in outsourcing hubs across India, the Philippines, and China. Enterprises in the region adopt analytics to enhance process efficiency and support global operations. Strong availability of skilled talent and expanding BPO infrastructure accelerate adoption of advanced analytics solutions. Rising digital adoption across BFSI, telecom, and retail sectors fuels further expansion. Cloud-based analytics platforms gain momentum as companies scale operations. Asia Pacific remains the fastest growing regional market due to increasing reliance on data-driven service delivery.

Latin America

Latin America holds a 5% share, supported by expanding outsourcing activity and rising adoption of analytics in customer service, retail, and financial services. Countries such as Brazil, Mexico, and Colombia strengthen demand due to growing digital transformation initiatives. Enterprises outsource analytics to reduce operational costs and improve service quality. Cloud adoption continues to expand, enabling wider access to scalable analytics tools. Despite slower growth compared to major regions, the market benefits from improving IT ecosystems and rising interest in data-driven business models.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by increasing investments in digital transformation and rising adoption of outsourced analytics among large enterprises. Gulf countries invest in advanced analytics to modernize operations across finance, telecom, and public services. South Africa and Kenya show growing traction in customer analytics and process optimization. Limited local expertise increases reliance on international BPO providers. As cloud adoption grows and enterprises seek efficiency gains, the region shows steady progress in outsourced analytics adoption.

Market Segmentations:

By Service Type

- Finance & Accounting Analytics

- HR Analytics

- Customer Analytics

- Supply Chain Analytics

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

- Hosted Services

By Enterprise Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

- Global Shared Service Centers

By End-Use Industry

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape features leading companies such as Accenture, IBM, TCS, Wipro, Genpact, Infosys, Capgemini, Cognizant, EXL Service, and HCL Technologies. These providers strengthen their position through advanced analytics platforms, AI-driven decision tools, and domain-focused outsourcing solutions. Firms expand service portfolios by integrating automation, predictive modeling, and cloud-based analytics to support global clients across BFSI, retail, telecom, and healthcare sectors. Strategic partnerships with technology vendors enhance delivery capabilities, while investments in talent development address rising demand for skilled analysts. Providers also focus on industry-specific analytics frameworks to improve business outcomes and operational efficiency. Growing competition encourages continuous innovation, faster deployment models, and scalable analytics architectures that support digital transformation across complex enterprise environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Accenture

- IBM Corporation

- Tata Consultancy Services (TCS)

- Wipro

- Genpact

- Infosys

- Capgemini

- Cognizant

- EXL Service

- HCL Technologies

Recent Developments

- In November 2025, Accenture invested in Alembic, an AI-powered causal marketing intelligence platform, to transform marketing measurement by providing real-time insights and AI-driven analysis of marketing campaign ROI.

- In 2025, Cognizant unveiled a partnership with Salesforce to offer a combined suite of customer- and operations-transformation services. This move bolsters its AI-augmented agents and real-time analytics for customer resolution

Report Coverage

The research report offers an in-depth analysis based on Service Type, Deployment Mode, Enterprise Size, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for outsourced analytics will rise as enterprises scale digital transformation.

- AI-driven automation will enhance reporting speed and reduce manual effort in analytics delivery.

- Cloud-based analytics adoption will expand across global service centers.

- Customer analytics will gain more importance as companies prioritize personalized engagement.

- Predictive and prescriptive analytics will become central to operational decision-making.

- BPO providers will invest in industry-specific analytics frameworks to improve outcomes.

- Data security requirements will drive stronger compliance-focused analytics solutions.

- Collaboration between technology vendors and BPO firms will accelerate innovation.

- Advanced workforce analytics will support smarter hiring and performance management.

- Emerging markets will adopt outsourced analytics faster as BPO ecosystems mature.