Market Overview

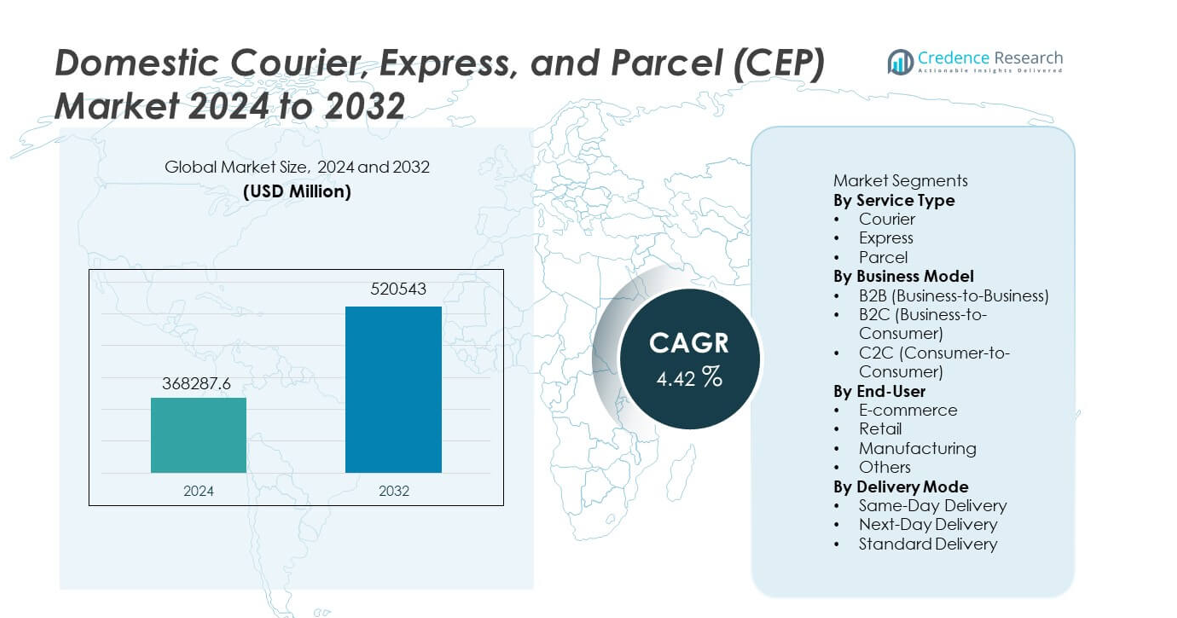

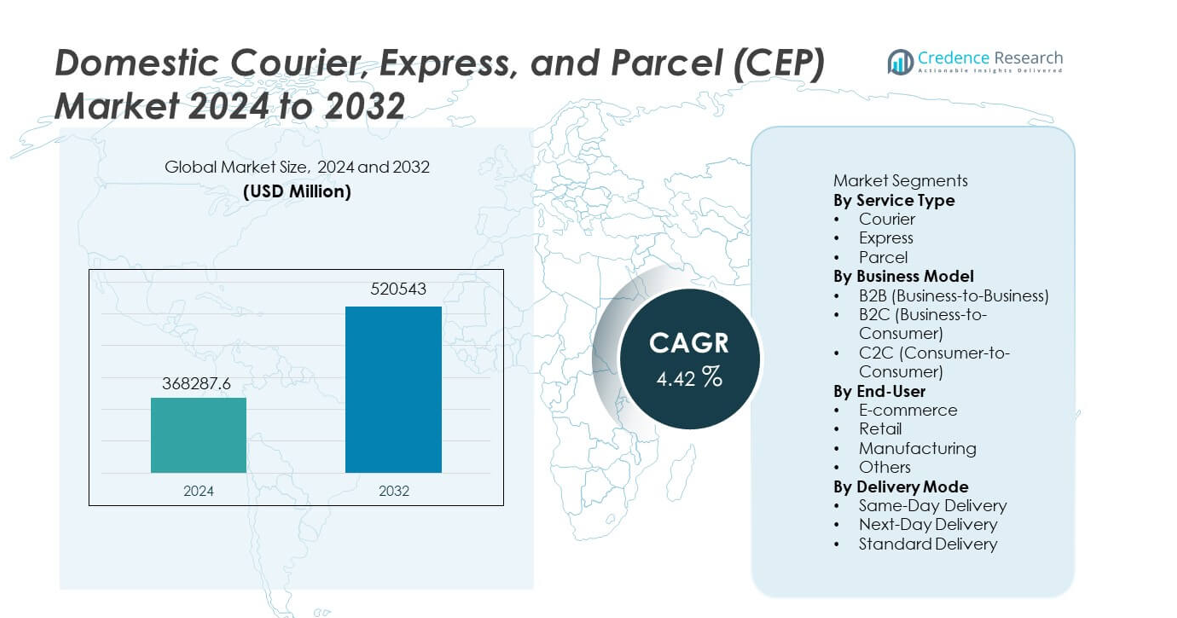

The Domestic Courier, Express, and Parcel (CEP) Market reached USD 368,287.6 million in 2024 and is projected to grow to USD 520,543 million by 2032, registering a CAGR of 4.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Domestic Courier, Express, and Parcel (CEP) Market Size 2024 |

USD 368,287.6 million |

| Domestic Courier, Express, and Parcel (CEP) Market, CAGR |

4.42% |

| Domestic Courier, Express, and Parcel (CEP) Market Size 2032 |

USD 520,543 million |

Top players in the Domestic Courier, Express, and Parcel (CEP) market include DHL, FedEx, UPS, USPS, Royal Mail, Japan Post, SF Express, YTO Express, Blue Dart Express, and Aramex, all of which focus on strengthening last-mile delivery, expanding automated sorting capabilities, and improving real-time tracking systems to meet rising parcel volumes. These companies enhance competitiveness through digital platforms, flexible delivery options, and partnerships with major e-commerce retailers. Asia Pacific leads the market with a 35% share, driven by strong online retail growth and dense urban demand, while North America and Europe follow due to advanced logistics infrastructure and high adoption of express delivery services.

Market Insights

- The Domestic CEP market reached USD 368,287.6 million in 2024 and will grow at a CAGR of 4.42% through 2032.

- Key drivers include rising online shopping volumes and demand for faster home deliveries, with the parcel segment leading at 57% due to frequent small-package shipments.

- Major trends highlight automation in sorting, AI-based routing, and contactless delivery innovations, while Asia Pacific holds the largest regional share at 35%, driven by rapid digital retail growth.

- Competitive activity intensifies as leading players invest in last-mile infrastructure, electric fleets, and digital tracking platforms to enhance reliability and efficiency.

- Market restraints include high last-mile delivery costs and capacity challenges during peak seasons, while the B2C segment maintains dominance with a 62% share, supported by strong e-commerce penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

The parcel segment dominates this category with a 57% share, driven by rapid growth in e-commerce shipments, increased home deliveries, and rising adoption of subscription-based retail models. Parcels account for the largest volume due to frequent small-package orders across fashion, electronics, personal care, and household goods. Express services follow as customers demand faster delivery options and same-day fulfillment. Courier services maintain steady demand for time-sensitive business documents and high-value deliveries. Expanding last-mile infrastructure and rising consumer expectations for speed and reliability continue to reinforce the leadership of the parcel segment.

- For instance, DHL is a major logistics provider which delivers well over a billion parcels annually, supported by an extensive global network of operational facilities and a significant fleet of vehicles for pick-up and delivery.

By Business Model

The B2C segment leads the business model category with a 62% share, supported by strong online shopping activity and growing demand for fast and affordable home delivery services. Retailers rely heavily on CEP partners to manage high-volume, multi-location shipments. The B2B segment follows, driven by industrial supply chains, spare parts distribution, and inter-company logistics. The C2C segment grows steadily with higher use of peer-to-peer selling platforms and online marketplaces. The dominance of B2C remains firmly anchored in rising digital commerce, efficient last-mile networks, and flexible delivery options.

- For instance, Amazon Logistics managed 5,900 million parcel deliveries in 2023 across its B2C network covering more than 21 countries.

By End-User

E-commerce holds the largest share at 48%, reflecting strong reliance on efficient parcel networks to handle high-frequency, low-weight shipments. Increasing online penetration, promotional sales events, and diverse product categories fuel consistent volume growth. Retail follows as stores restock frequently and support omnichannel operations such as click-and-collect and store-to-home delivery. Manufacturing relies on CEP services for time-critical components and spare parts, maintaining steady demand. The “Others” category expands with growing use by healthcare, financial services, and small businesses. E-commerce remains the dominant force due to continuous digital adoption and evolving customer delivery expectations.

Key Growth Driver

Expansion of E-Commerce and Digital Retail

The rapid rise of online shopping drives significant growth in the Domestic CEP market as retailers depend on reliable parcel networks to fulfill frequent and diverse customer orders. Increasing smartphone usage, digital payment adoption, and aggressive discounting by e-commerce platforms boost shipment volumes. Consumers expect faster and more flexible delivery options, prompting logistics providers to upgrade last-mile infrastructure and expand distribution centers. Seasonal sales events and subscription-based purchases further elevate demand. This sustained surge in online retail strengthens the long-term growth outlook for domestic courier, express, and parcel services.

- For instance, India Post has the largest postal network in the world, with over one hundred and sixty thousand post offices nationwide, which has recently undergone a massive digital transformation to improve parcel services.

Advancements in Last-Mile Delivery Solutions

Technological advancements in routing optimization, real-time tracking, and automated sorting systems enhance speed and reliability in last-mile delivery operations. Logistics providers invest in electric vehicles, micro-fulfillment centers, and smart lockers to improve efficiency and reduce operational costs. Urbanization increases delivery density, creating opportunities for faster distribution. Delivery innovations such as crowdsourced fleets and contactless services also support customer convenience. These advancements help CEP providers manage rising volumes while maintaining high service standards, strengthening their competitive positioning in the domestic market.

- For instance, UPS has a global fleet with many thousands of alternative fuel and advanced technology vehicles which it continues to deploy across its worldwide delivery routes.

Growth of SMEs and Consumer-to-Consumer Shipments

A growing number of small and medium enterprises rely on CEP networks to reach customers across regions with fast and cost-effective delivery options. The rise of online marketplaces enables individual sellers and home-based businesses to participate in national commerce, increasing C2C shipment volumes. Flexible pricing models, digital booking platforms, and improved pickup services support wider adoption. SMEs benefit from better access to shipping infrastructure without needing in-house logistics capabilities. This expanding user base contributes significantly to overall market growth.

Key Trend and Opportunity

Increasing Adoption of Automation and AI in Logistics

Automation and AI reshape domestic CEP operations by improving sorting accuracy, reducing manual labor, and optimizing vehicle routing. AI-powered forecasting helps providers predict demand spikes and allocate resources efficiently. Automation in hubs accelerates parcel throughput, supporting next-day and same-day delivery commitments. As companies digitize operations, opportunities emerge for advanced tracking tools, automated customer communication, and predictive maintenance for fleets. These technologies enable cost reductions and service improvements, unlocking new efficiencies and competitive advantages for CEP players.

- For instance, SF Express deployed extensive robotic automation in its sorting centers and processed a substantial volume of parcels in supported by AI-driven routing.

Expansion of Sustainable and Green Delivery Models

Sustainability initiatives create strong opportunities as logistics companies adopt electric delivery vehicles, low-emission fleets, and eco-friendly packaging. Urban regulations encouraging green mobility accelerate this transition. Consumers increasingly prefer brands aligned with environmental responsibility, prompting CEP providers to integrate carbon-neutral shipping options and energy-efficient operations. Investments in renewable-powered warehouses and optimized routing help reduce carbon footprints. As sustainability becomes a competitive differentiator, companies capable of delivering greener services gain market share and stronger customer loyalty.

- For instance, Royal Mail deployed thousands of electric vans and operated all of its delivery offices using renewable power.

Key Challenge

Rising Operational Costs in Last-Mile Delivery

Last-mile delivery remains the costliest part of logistics due to fuel expenses, labor shortages, and complex urban delivery environments. Traffic congestion and dispersed delivery points increase time and resource requirements. Providers must balance speed, affordability, and profitability as consumer expectations tighten. Maintaining service reliability during peak seasons further strains operational budgets. Without effective route optimization and infrastructure upgrades, rising costs weaken margins and hinder scalability. Managing these pressures is critical for sustained performance in the Domestic CEP market.

Capacity Strain from High Delivery Volumes

Rapid growth in parcel volumes often overwhelms sorting hubs, transportation networks, and last-mile teams, especially during peak periods. Limited warehouse space and outdated logistics infrastructure create bottlenecks that delay deliveries. Sudden surges from e-commerce events can exceed capacity, reducing efficiency and service quality. CEP providers must invest continuously in automation, fleet expansion, and workforce training to keep pace with rising demand. Failure to scale infrastructure effectively can lead to customer dissatisfaction and lost business opportunities.

Regional Analysis

North America

North America holds a market share of 29%, driven by strong e-commerce penetration, mature retail networks, and high demand for fast home deliveries. Major CEP providers invest in automation, advanced tracking systems, and last-mile delivery innovations to meet rising expectations for same-day and next-day services. Growth in subscription commerce and cross-state shipping further strengthens market activity. The region also benefits from well-developed logistics infrastructure and widespread digital adoption. Increasing B2C parcel volumes and expanding fulfillment centers continue to support the region’s competitive position in the Domestic CEP market.

Europe

Europe accounts for a market share of 27%, supported by dense urban populations, strong regulatory frameworks, and advanced logistics networks. The region experiences steady demand across e-commerce, manufacturing, and retail sectors, with parcel shipments growing due to high consumer reliance on online shopping. Sustainability initiatives drive investment in electric delivery fleets and carbon-neutral solutions. Cross-border domestic-style operations within the EU further enhance parcel flows. The region’s focus on service reliability, automation, and green logistics supports continued growth and maintains Europe as a key market for CEP services.

Asia Pacific

Asia Pacific leads the market with a market share of 35%, driven by rapid urbanization, expanding digital commerce, and rising middle-class consumption. Countries such as China, India, Japan, and South Korea generate high parcel volumes due to large e-commerce ecosystems and increasing B2C shipments. Investments in last-mile delivery, smart warehouses, and automated sorting hubs accelerate efficiency. The region’s strong manufacturing base supports robust B2B and industrial shipments. Government support for logistics modernization and digital payment adoption further strengthens Asia Pacific’s leadership in the Domestic CEP market.

Latin America

Latin America holds a market share of 6%, supported by steady e-commerce expansion and growing demand for reliable parcel delivery across urban centers. Markets such as Brazil, Mexico, and Argentina show rising B2C activity driven by improved digital infrastructure and greater online retail participation. CEP providers invest in last-mile networks and regional distribution centers to overcome geographic and infrastructural challenges. While growth is gradual, increasing smartphone usage and enhanced payment systems support long-term expansion. Economic development initiatives further contribute to strengthening the logistics ecosystem.

Middle East & Africa

The Middle East & Africa region represents a market share of 3%, driven by rising e-commerce adoption and investments in logistics hubs, particularly in the UAE, Saudi Arabia, and South Africa. Growing consumer demand for faster delivery options and expansion of online retail platforms fuel parcel volume growth. Infrastructure improvements, free-trade zones, and urban development projects support logistics efficiency. However, market expansion is moderated by geographic diversity and uneven digital adoption. Continued investment in transportation networks and fulfillment centers is key to supporting long-term growth in the region.

Market Segmentations:

By Service Type

By Business Model

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Consumer-to-Consumer)

By End-User

- E-commerce

- Retail

- Manufacturing

- Others

By Delivery Mode

- Same-Day Delivery

- Next-Day Delivery

- Standard Delivery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes DHL, FedEx, UPS, USPS, Royal Mail, Japan Post, SF Express, YTO Express, Blue Dart Express, and Aramex. These companies compete by expanding delivery networks, improving last-mile efficiency, and leveraging technology for real-time tracking and automated sorting. Growing parcel volumes from e-commerce push providers to enhance capacity and adopt flexible delivery models such as same-day and contactless services. Strategic partnerships with online retailers strengthen market positioning, while investments in electric vehicles and sustainable logistics address environmental goals. Regional players gain traction through localized service capabilities and competitive pricing. As consumer expectations for speed and reliability intensify, companies focus on digital platforms, route optimization, and diversified service offerings to maintain an edge in the Domestic CEP market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DHL

- FedEx

- UPS

- USPS (United States Postal Service)

- Royal Mail

- Japan Post

- SF Express

- YTO Express

- Blue Dart Express

- Aramex

Recent Developments

- In August 2024, J&T Express launched a new parcel delivery service called J&T SPEED in Saudi Arabia, marking a significant expansion of its offerings in the Middle Eastern logistics market.

- In February 2024, Emirates Post Group, rebranded as 7X, unveiled EMX, a new subsidiary dedicated to reshaping the courier, express, and parcel (CEP) industry in the UAE. Leveraging cutting-edge technologies, EMX aims to deliver unparalleled logistics solutions, prioritizing speed, reliability, and customer-centric services.

- In April 2023, Interroll launched the High Performance Conveyor Platform (HPP) specifically designed for the demanding courier, express, and parcel (CEP) market

Report Coverage

The research report offers an in-depth analysis based on Service Type, Business Model, End-User, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for domestic CEP services will rise as e-commerce penetration continues to grow.

- Same-day and next-day delivery options will expand as consumers expect faster fulfillment.

- Automation in sorting hubs and AI-powered routing will improve delivery efficiency.

- Electric and green delivery fleets will gain adoption as sustainability becomes a priority.

- Investments in last-mile infrastructure will increase to manage higher parcel volumes.

- Retailers and logistics firms will deepen partnerships to streamline delivery networks.

- Digital tracking and real-time visibility tools will become standard across all service tiers.

- Subscription commerce and recurring deliveries will contribute to consistent shipment growth.

- Regional logistics startups will gain traction with specialized and hyperlocal delivery models.

- Continued urbanization will drive higher delivery density, supporting optimized service routes.