Market Overview

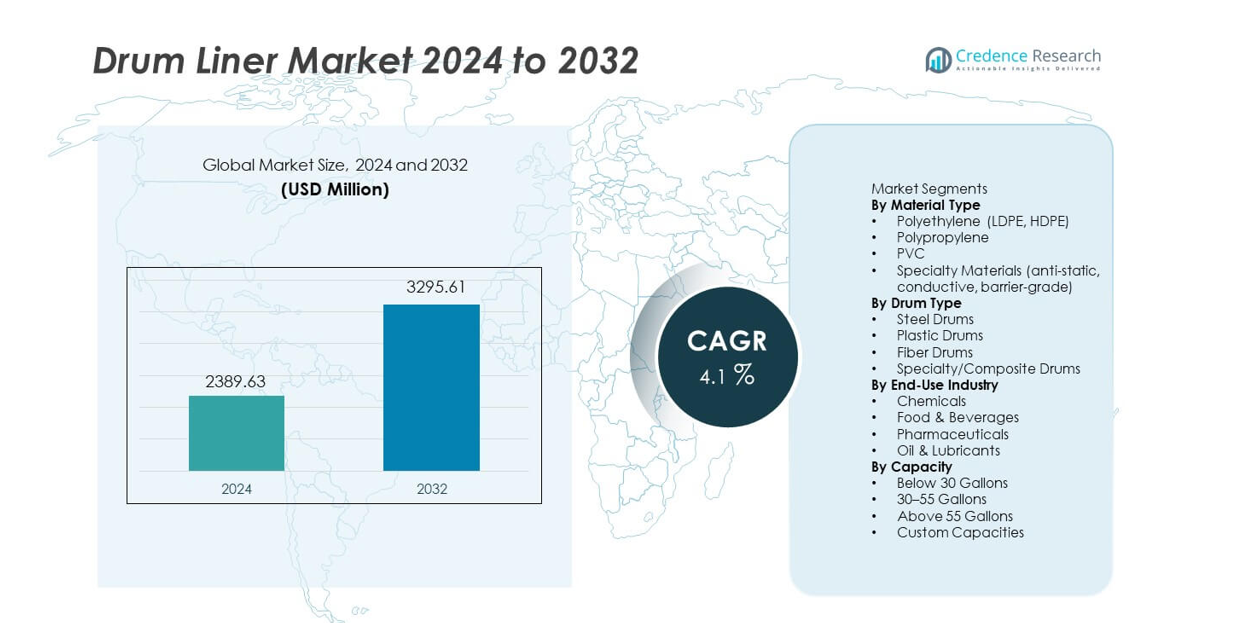

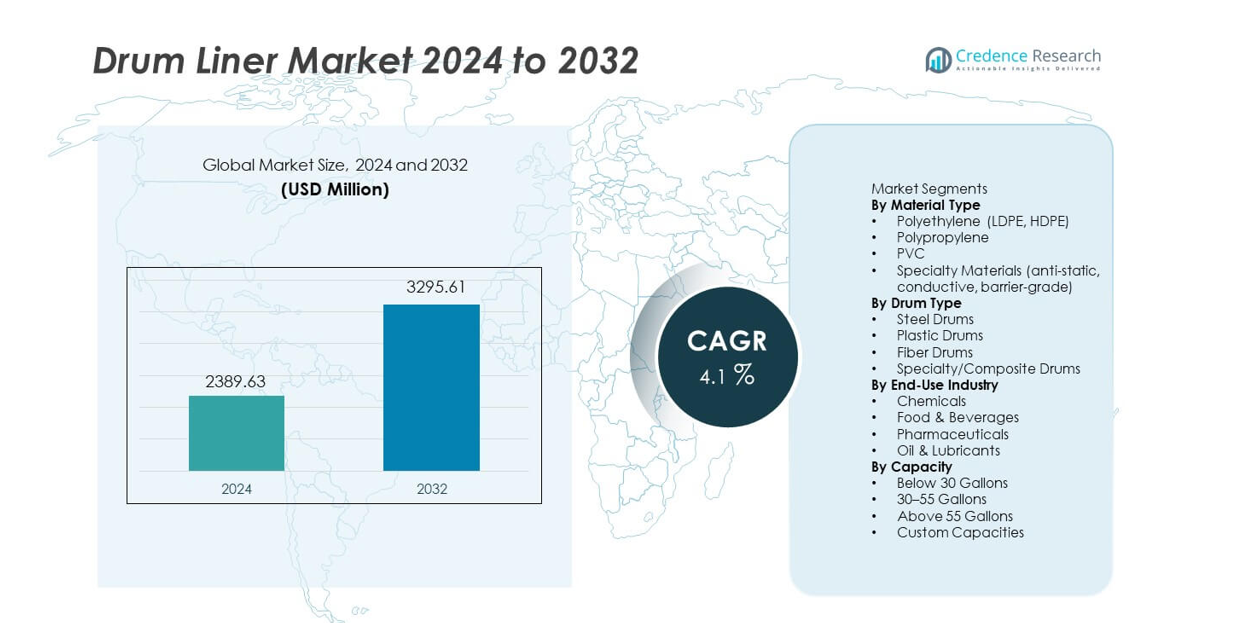

The Drum Liner market reached USD 2,389.63 million in 2024 and is expected to grow to USD 3,295.61 million by 2032, registering a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drum Liner Market Size 2024 |

USD 2,389.63 million |

| Drum Liner Market, CAGR |

4.1% |

| Drum Liner Market Size 2032 |

USD 3,295.61 million |

Top players in the Drum Liner market include Berry Global, C.L. Smith, International Plastics Inc., Multi-Pack Solutions, Anduro Manufacturing, Jokasafe, Polypak Packaging, Terdex, Dana Poly Inc., and Welton Rubber Company, each focusing on advanced polymer formulations, contamination control, and customized liner designs to meet strict industrial standards. These companies strengthen their position through high-performance polyethylene liners, specialty anti-static materials, and scalable production systems. North America leads the global market with a 33% share, supported by strong demand in chemicals, pharmaceuticals, and food processing. Europe follows with a 28% share, driven by sustainability rules and mature industrial networks. Asia Pacific holds a 27% share, reflecting rapid industrial expansion and rising export-oriented manufacturing.

Market Insights

- The Drum Liner market reached USD 2,389.63 million in 2024 and will grow at a 4.1% CAGR through 2032, driven by rising demand in industrial and regulated sectors.

- Growing contamination control needs support strong adoption, led by polyethylene materials holding a 62% segment share, while chemicals remain the top end-use segment with a 41% share.

- Trends highlight rising use of specialty anti-static and barrier-grade liners, along with sustainability-driven demand for recyclable and lightweight designs across global industries.

- Competition intensifies as key players invest in high-performance materials, automated production, and customized liner solutions to meet strict hygiene and safety standards.

- Regionally, North America leads with a 33% share, followed by Europe at 28%, Asia Pacific at 27%, Latin America at 7%, and Middle East & Africa at 5%, reflecting varied industrial growth and regulatory maturity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Polyethylene leads the material segment with a 62% share due to strong puncture resistance and wide chemical compatibility. LDPE and HDPE liners support high-volume use in chemicals, food, and pharmaceutical settings, which increases their adoption. Polypropylene and PVC follow as preferred options for heat-resistant and solvent-heavy environments. Specialty materials gain traction as industries demand anti-static, conductive, and barrier-grade liners for safer and cleaner handling. Growth in regulated sectors drives steady investment in advanced polymer formulations.

- For instance, a large chemical packager like CDF Group supplies drum & pail liners made of HDPE that resist leaks and contamination, with liner thickness options ranging from 4 mil up to 30 mil.

By Drum Type

Steel drums dominate this segment with a 48% share because industries rely on these drums for hazardous and high-strength material storage. Drum liners used with steel drums improve contamination control and streamline cleaning cycles, which supports higher usage rates. Plastic drums hold a rising share due to expanding use in food, beverage, and light-chemical applications. Fiber and composite drums see steady growth as companies shift toward lighter and more sustainable packaging options. Demand rises as end users seek flexible liner options across drum categories.

- For instance, manufacturers of UN-certified steel drums (typical 200-litre / 55-gallon size) state the drums are robust enough for repeated reuse with liners, avoiding corrosion when aggressive chemicals are stored.

By End-Use Industry

The chemical industry holds the highest share at 41%, driven by strict safety rules and rising demand for contamination-free transport. Drum liners help chemical processors reduce cleaning time and manage corrosive materials with better efficiency. Food and beverage producers increase adoption as they focus on hygiene and allergen control. Pharmaceutical companies also rely on liners for cleanroom-ready handling and regulated waste disposal. Oil and lubricant manufacturers use liners to prevent residue buildup and extend drum life, which supports steady segment growth.

Key Growth Drivers

Rising Demand for Contamination Control

Industries increase the use of drum liners to maintain stricter hygiene and material purity. Chemical, food, and pharmaceutical plants adopt liners to prevent cross-contamination and reduce cleaning cycles. This shift supports safer handling of powders, liquids, and hazardous substances. Many companies use liners to meet regulatory standards and improve operational efficiency. Growing demand for clean storage and transport conditions drives strong adoption across high-risk sectors.

- For instance, CDF Corporation reports that its Form-Fit and Air-Assist liners handle high viscosities, which supports safer filling of sticky materials in pharma environments. The Air-Assist feature is specifically designed to improve evacuation of these products compared to gravity flow or other systems.

Expansion of Chemical and Industrial Manufacturing

Growth in chemical output and industrial materials boosts demand for durable and compliant drum liners. Manufacturers rely on liners to protect drums from corrosive substances and extend drum lifespan. Rising production volumes in coatings, adhesives, additives, and specialty chemicals strengthen market use. Expansion of industrial supply chains increases the need for safe packaging and waste-handling solutions. This trend positions drum liners as a cost-effective containment tool.

- For instance, Anduro Manufacturing provides multi-layer polyethylene liners that offer significant tensile strength. These liners are designed for durability and strength, enabling longer service periods during repeated drum use.

Shift Toward Cost-Efficient Handling and Disposal

Companies adopt drum liners to cut labor costs linked to drum cleaning and maintenance. Liners reduce downtime and allow faster drum turnover in busy facilities. Businesses also use liners to lower waste-processing expenses by minimizing residue buildup. The focus on operational efficiency increases demand across automotive, oil, and general manufacturing sectors. This driver supports strong market growth as firms prioritize streamlined material handling.

Key Trends & Opportunities

Growing Use of Specialty and High-Performance Materials

Demand rises for anti-static, conductive, and barrier-grade drum liners in sensitive environments. Electronics, chemicals, and pharmaceutical companies use these high-performance products to manage static risks and improve product purity. Advances in polymer engineering offer stronger resistance to solvents and temperature changes. This trend creates new opportunities for manufacturers to supply specialized solutions. Expansion of high-value industries boosts uptake of premium liner technologies.

- For instance, Berry Global produces packaging solutions, such as specific multilayer polypropylene bottles designed for hot filling applications, that offer reliability during warm filling processes. The general expansion of high-value industries boosts the uptake of premium liner and packaging technologies.

Increasing Adoption of Sustainable and Lightweight Options

Sustainability initiatives push companies to shift from heavy drums to lighter and recyclable packaging. This change raises demand for eco-friendly liners that reduce drum wear and waste. Bio-based and recycled polymer liners gain traction as firms target lower carbon footprints. Adoption grows in food, beverage, and consumer goods supply chains that prioritize green compliance. This trend presents opportunities for suppliers offering certified sustainable materials.

- For instance, Welton Rubber Company manufactures various durable rubber products and conducts rigorous testing, which generally contributes to product longevity and potentially less waste.

Key Challenges

Volatility in Polymer and Raw Material Prices

Fluctuating costs of polyethylene, polypropylene, and specialty resins create pricing pressure for manufacturers. Raw material instability affects profit margins and disrupts production planning. Many producers struggle to maintain consistent pricing for large industrial clients. Supply chain delays in resin availability further challenge delivery commitments. This issue forces manufacturers to adopt flexible sourcing and cost-management strategies.

Growing Focus on Waste Reduction and Recycling Compliance

Tighter rules on plastic waste management challenge market growth, especially in regions with strict disposal policies. Companies must meet rising recycling and reporting requirements, which increases operational costs. Drum liner producers face pressure to design recyclable or reusable solutions. Industrial users also seek ways to minimize single-use plastics without compromising safety. These constraints demand innovation in material design and end-of-life management.

Regional Analysis

North America

North America leads the Drum Liner market with a 33% share, driven by strong demand across chemicals, pharmaceuticals, and food processing industries. Strict regulatory standards support wider adoption of liners that improve containment and reduce contamination risks. Manufacturers in the region invest in high-performance materials and anti-static designs to meet advanced safety needs. The growth of industrial automation also increases the use of liners to reduce cleaning and labor costs. Expanding hazardous waste management activities further strengthens regional requirements for durable and compliant drum liners.

Europe

Europe holds a 28% share, supported by mature chemical production, regulated food systems, and rising pharmaceutical output. The region prioritizes sustainability, which drives demand for recyclable and lightweight drum liners. Companies adopt high-grade liners to comply with strict environmental and hygiene norms. Growth in specialty chemicals and clean manufacturing increases the need for contamination-free handling. Investment in advanced waste management processes boosts liner use across industrial sites. Strong distribution networks and consistent quality standards keep Europe a stable and innovation-focused market.

Asia Pacific

Asia Pacific captures a 27% share, fueled by rapid expansion in chemicals, manufacturing, and food processing. China, India, and Southeast Asia increase adoption as industries scale production and require safer material handling. Growing export activities heighten the need for contamination-resistant liners that support global compliance. Rising pharmaceutical investment strengthens demand for sterile-grade and anti-static liners. The region also benefits from large polymer production, which supports competitive pricing. Industrial growth and urbanization continue to drive strong market momentum.

Latin America

Latin America accounts for a 7% share, driven by expanding chemical, mining, and food industries. Companies adopt drum liners to improve hygiene and reduce drum maintenance costs in high-volume operations. Brazil and Mexico lead demand due to rising industrial output and stronger export logistics. Adoption grows as regional firms upgrade handling systems to meet global quality standards. Increasing regulatory focus on waste reduction also boosts the use of liners that support safer disposal. Market growth strengthens as manufacturers introduce durable and cost-efficient solutions.

Middle East & Africa

Middle East & Africa hold a 5% share, supported by strong demand from oil, lubricants, and industrial chemicals. Refineries and petrochemical plants use drum liners to manage hazardous materials and reduce contamination risks. Rising food processing activities encourage adoption of hygienic and compliant liner solutions. Infrastructure growth in Gulf countries boosts demand for efficient packaging and material handling products. However, limited local manufacturing creates reliance on imports, influencing pricing trends. Continued industrial diversification supports steady long-term growth for drum liners in the region.

Market Segmentations:

By Material Type

- Polyethylene (LDPE, HDPE)

- Polypropylene

- PVC

- Specialty Materials (anti-static, conductive, barrier-grade)

By Drum Type

- Steel Drums

- Plastic Drums

- Fiber Drums

- Specialty/Composite Drums

By End-Use Industry

- Chemicals

- Food & Beverages

- Pharmaceuticals

- Oil & Lubricants

By Capacity

- Below 30 Gallons

- 30–55 Gallons

- Above 55 Gallons

- Custom Capacities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as Berry Global, C.L. Smith, International Plastics Inc., Multi-Pack Solutions, Anduro Manufacturing, Jokasafe, Polypak Packaging, Terdex, Dana Poly Inc., and Welton Rubber Company, all of which strengthen their market presence through material innovation and expanded distribution networks. Manufacturers focus on high-performance polyethylene liners, specialty anti-static grades, and custom-fit solutions that support demanding chemical, pharmaceutical, and food applications. Many companies invest in automated production lines to improve output consistency and reduce lead times. Sustainability also shapes competition as producers introduce recyclable and bio-based materials to meet rising environmental expectations. Strategic partnerships with industrial clients help suppliers deliver tailored liner designs with enhanced durability and regulatory compliance. Growing emphasis on contamination control and safe material handling keeps competition active, with players prioritizing product reliability, certification standards, and cost-efficient manufacturing practices to maintain long-term advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global

- L. Smith

- International Plastics Inc.

- Multi-Pack Solutions

- Anduro Manufacturing

- Jokasafe

- Polypak Packaging

- Terdex

- Dana Poly Inc.

- Welton Rubber Company

Recent Developments

- In February 2024, Berry Global and Glatfelter Corporation announced a definitive agreement for a tax-free spin-off and merger. Berry spun off its Health, Hygiene, and Specialties Global Nonwovens and Films business, which then merged with Glatfelter.

- In April 2023, Greif, a global leader in industrial packaging products and services, completed an acquisition that increased its ownership stake in Centurion Container LLC. Greif became the majority owner, expanding its existing minority investment to a controlling interest in the business.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Drum Type, End-Use Industry, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance polyethylene liners will rise as industries tighten hygiene standards.

- Specialty anti-static and barrier-grade liners will gain traction in chemical and pharmaceutical handling.

- Automation in production will help manufacturers improve consistency and reduce delivery times.

- Sustainable and recyclable liner materials will see stronger adoption due to rising environmental rules.

- Customized liner designs will expand as clients seek better fit, durability, and contamination control.

- Growth in pharmaceutical and food processing sectors will create steady demand for sterile-grade liners.

- Digital tracking and quality monitoring tools will improve product traceability across supply chains.

- Expansion of industrial output in Asia Pacific will drive higher liner consumption.

- Companies will invest more in advanced polymers to meet stricter performance and safety norms.

- Global trade growth will support wider use of drum liners for secure and compliant material transport.