Market Overview

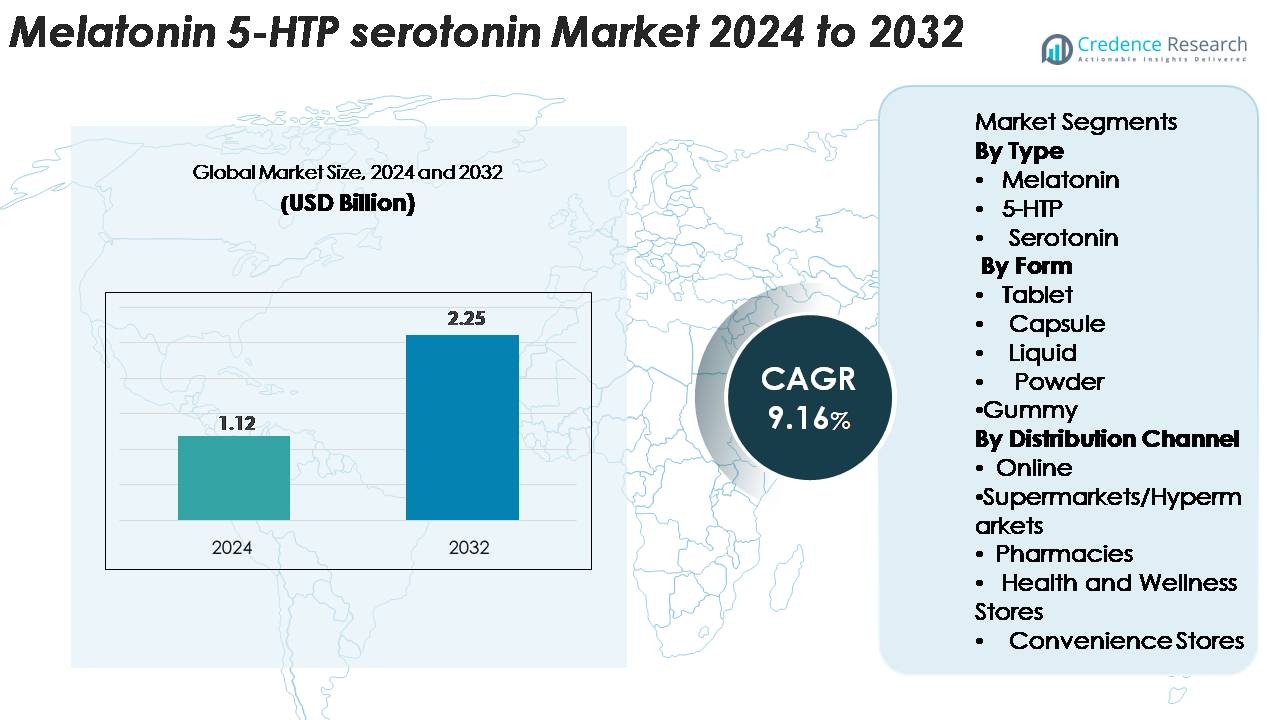

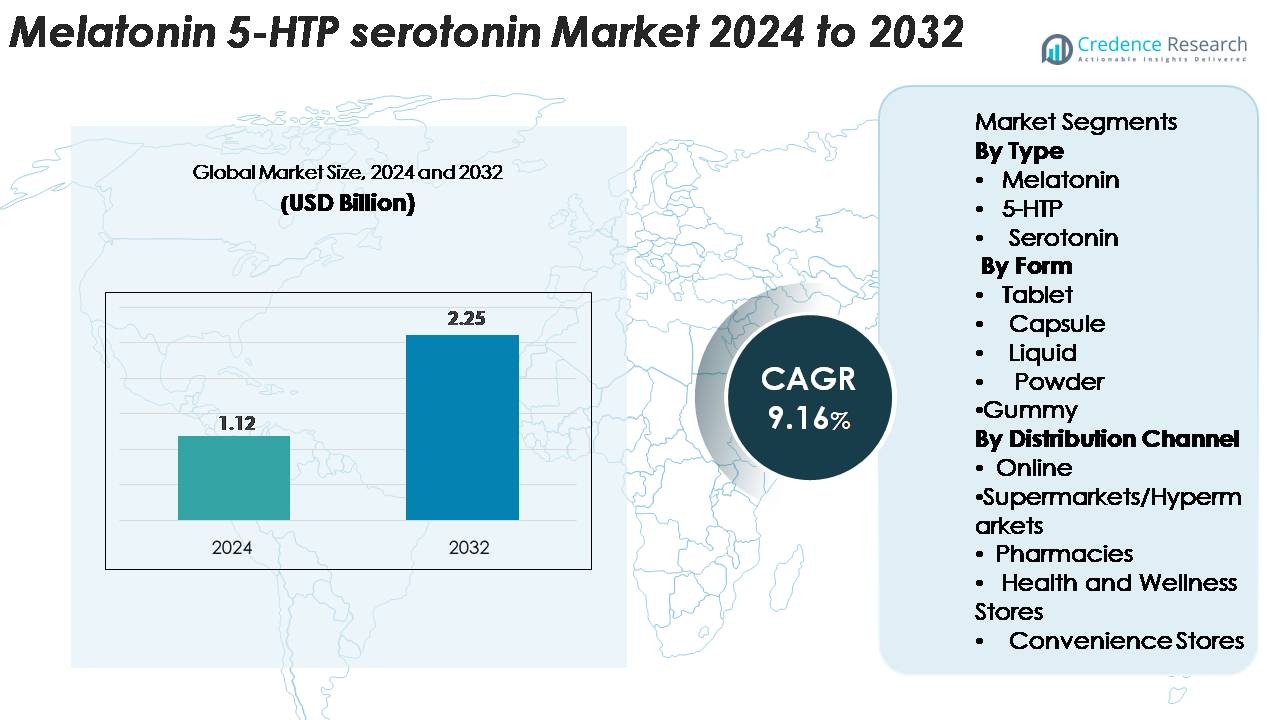

The global Melatonin 5-HTP Serotonin market was valued at USD 1.12 billion in 2024 and is projected to reach USD 2.25 billion by 2032, expanding at a CAGR of 9.16% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Melatonin 5-HTP Serotonin market Size 2024 |

USD 1.12 Billion |

| Melatonin 5-HTP Serotonin market , CAGR |

9.16% |

| Melatonin 5-HTP Serotonin market Size 2032 |

USD 2.25 Billion |

The Melatonin–5-HTP–Serotonin market is shaped by leading nutraceutical and dietary supplement manufacturers that emphasize high-quality formulations, clean-label ingredients, and expanding global distribution networks. Key players include major OTC wellness brands, specialized mood-support supplement companies, and firms offering advanced sleep-health solutions across tablets, capsules, liquids, and gummies. North America remains the dominant region with 38% market share, driven by strong consumer awareness and extensive retail penetration. Europe follows with 27%, supported by stringent quality standards and high adoption of natural sleep aids, while Asia–Pacific accounts for 24%, emerging as the fastest-growing market due to rising lifestyle-related sleep and stress issues.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Melatonin 5-HTP–Serotonin market was valued at USD 1.12 billion in 2024 and is projected to reach USD 2.25 billion by 2032, expanding at a CAGR of 9.16% during the forecast period.

- Market growth is driven by rising cases of sleep disorders, stress-related conditions, and increasing adoption of preventive wellness supplements, with melatonin holding the largest 48% share among type segments.

- Key trends include strong demand for clean-label, vegan, and plant-based formulations, along with rapid growth in gummy formats and advanced delivery systems enhancing absorption and consumer convenience.

- Competition intensifies as global and regional supplement brands expand through e-commerce, pharmacies, and cross-border retail, while quality standardization and regulatory variability act as major restraints.

- Regionally, North America leads with 38% share, followed by Europe at 27% and Asia–Pacific at 24%, supported by growing awareness of natural sleep aids and widespread availability of OTC wellness products.

Market Segmentation Analysis:

By Type

Melatonin dominates the market, accounting for over 48% share, driven by its widespread use in sleep regulation, circadian rhythm management, and stress-related disorders. Its high consumer acceptance, strong clinical validation, and broad OTC availability reinforce its leadership. 5-HTP follows as a rapidly expanding sub-segment due to rising interest in mood enhancement and natural serotonin support. Serotonin supplements remain a smaller niche category, primarily used in targeted neurological wellness products. Overall, demand is propelled by growing sleep disorders, stress-related conditions, and increasing preference for plant-derived neuro-support ingredients.

- For instance, Nature’s Bounty manufactures its melatonin supplements within a quality framework that includes rigorous laboratory testing on each batch to verify potency, purity, and ingredient integrity, ensuring consistent delivery of the labeled melatonin dose per serving.

By Form

Tablets hold the leading position with around 40% market share, supported by ease of dosing, long shelf life, and cost-efficient mass production. Capsules closely follow, benefiting from better bioavailability profiles and consumer acceptance for combination formulations containing melatonin and 5-HTP blends. Liquid forms gain traction among consumers seeking faster absorption, while powders cater to personalized nutrition formats. Gummies represent one of the fastest-growing sub-segments due to convenience and flavor-driven adoption, especially among younger consumers and those preferring chewable wellness supplements.

- For instance, Nature’s Bounty’s Quick-Dissolve melatonin tablet delivers exactly 10 mg of melatonin per serving and is engineered to dissolve under the tongue in about 30 seconds using Mannitol + Crospovidone matrix technology.

By Distribution Channel

Online channels dominate the market with over 45% share, driven by strong demand for subscription-based wellness products, easy access to global brands, and increasing consumer preference for digital purchasing of dietary supplements. Pharmacies remain a key distribution avenue due to high trust levels and professional guidance for sleep and mood-support products. Supermarkets and hypermarkets maintain steady visibility through mainstream OTC wellness shelves. Health and wellness stores attract consumers seeking specialized or premium formulations, while convenience stores contribute to impulse and travel-oriented supplement purchases.

Key Growth Drivers

Rising Prevalence of Sleep Disorders and Stress-Related Conditions

The growing global burden of sleep disorders, anxiety, and chronic stress serves as a major driver for the Melatonin–5-HTP–Serotonin market. Increasing exposure to screen time, irregular work schedules, and lifestyle disruptions are intensifying sleep-related complications across age groups. Melatonin remains the preferred intervention due to its natural hormone-based mechanism and minimal side effects, supporting its high adoption among consumers seeking non-prescription solutions. Meanwhile, 5-HTP supplements are gaining acceptance for mood stabilization and serotonin support, especially among adults experiencing burnout and emotional fatigue. The expanding awareness of sleep hygiene and mental wellness—coupled with rising health consciousness—further strengthens market demand. Health professionals increasingly recommend melatonin and 5-HTP as adjuncts to sleep therapies, which reinforces credibility and adoption. Additionally, the penetration of digital health platforms and teleconsultation services accelerates access to information and products, ultimately amplifying consumer reliance on natural mood and sleep-support supplements.

- For instance, NOW Foods’ Sleep Regimen 3-in-1 includes 50 mg of 5-HTP and 3 mg of melatonin per capsule, manufactured in facilities that conduct over 400 quality-control tests to validate ingredient accuracy.

Expansion of Preventive Healthcare and Self-Care Consumption Patterns

A strong global shift toward preventive healthcare is fueling demand for natural supplements like melatonin, 5-HTP, and serotonin-enhancing formulations. Consumers increasingly prioritize self-management of sleep, mood, and stress, preferring natural options over pharmaceutical interventions. The shift from treatment-based care to proactive wellness purchasing has led to accelerated adoption of supplements that support cognitive balance, emotional well-being, and relaxation. Retailers and brands are responding with product innovations such as fast-dissolving tablets, dual-action blends, enhanced bioavailability formats, and clean-label formulations. This consumer movement is further strengthened by the rise of personalized nutrition, subscription wellness kits, and DTC brands offering tailored sleep and relaxation products. The expanding influence of wellness influencers and accessible scientific communication on social platforms encourages informed self-care decisions. As healthcare systems globally promote lifestyle-based management for sleep and mood disorders, the preventive wellness mindset continues to elevate the demand for natural neuro-support supplements.

- For instance, Nature’s Bounty has advanced its clean-label development by producing melatonin quick-dissolve tablets using a sublingual matrix engineered to dissolve in 30 seconds, delivering a precise 10 mg dose for rapid nighttime use.

Increased Product Accessibility Through E-Commerce and Omnichannel Distribution

Enhanced product accessibility via online retail and omnichannel distribution significantly drives market expansion. E-commerce platforms offer a vast assortment of melatonin, 5-HTP, and serotonin supplements, enabling consumers to compare product attributes, formulations, certifications, and reviews. Subscription-based delivery models for sleep and mood-support supplements are gaining substantial traction, ensuring long-term customer retention and predictable purchasing patterns. The availability of international brands through online marketplaces has broadened consumer choice, while regulatory improvements in supplement categorization have streamlined cross-border sales. Pharmacies, health stores, and supermarkets continue to complement digital channels, enhancing overall product visibility. Retailers increasingly stock functional gummies, quick-release capsules, and blended sleep-support formulas due to rising consumer demand. Furthermore, promotional bundling, digital advertisements, and AI-driven recommendation engines help steer consumers toward specific wellness categories, thereby elevating sales volumes. The omnichannel ecosystem ultimately ensures consistent product availability and strengthens market penetration across diverse demographics.

Key Trends & Opportunities

Growth of Clean-Label, Vegan, and Plant-Based Supplement Formulations

A major trend shaping the market is the surge in clean-label and vegan supplement preferences. Consumers increasingly seek formulations free from artificial additives, allergens, and synthetic excipients, driving manufacturers to adopt botanical sources and natural stabilizers for melatonin and serotonin-support blends. Plant-based capsules, organic extracts, and sustainably sourced ingredients are gaining prominence, aligning with broader sustainability and ethical consumption movements. This trend opens new opportunities for brands to differentiate through certifications such as non-GMO, organic, or allergen-free. Companies are also innovating with plant-fermented melatonin and naturally derived 5-HTP extracted from Griffonia simplicifolia seeds. As regulatory bodies emphasize transparency in labeling and ingredient disclosure, clean-label products deliver a competitive advantage. This premium wellness trend appeals particularly to millennials and Gen Z consumers, enabling brands to expand into high-value functional nutrition segments and develop specialized formulations for sleep optimization and emotional balance.

- For instance, Garden of Life formulates its mykind Organics sleep range using fully vegan, USDA-certified organic ingredients, and each batch undergoes more than 300 residue and identity tests in accordance with NSF standards.

Rising Popularity of Functional Gummies and Advanced Delivery Technologies

Functional gummies represent one of the fastest-growing opportunities in the melatonin, 5-HTP, and serotonin supplement landscape. Their taste appeal, ease of consumption, and suitability for daily routines have made them especially popular among younger consumers, first-time supplement users, and individuals seeking convenient nighttime routines. Brands are leveraging this trend by introducing sugar-free, vegan, and multi-benefit gummy formulations featuring complementary ingredients such as L-theanine, chamomile, and magnesium. Beyond gummies, advanced delivery systems—including sustained-release capsules, nanoemulsion liquids, and fast-dissolving strips—are creating new product possibilities. These technologies enhance bioavailability, responsiveness, and overall consumer experience. As consumers increasingly demand faster onset of action for sleep aids and mood-balancing supplements, adoption of innovative delivery mechanisms continues to accelerate. This trend offers significant opportunities for premiumization, product differentiation, and market expansion into professional-grade and clinical nutrition channels.

- For instance, OLLY Sleep Gummies deliver 3 mg of melatonin per two-gummy serving, combined with 100 mg of L-theanine and botanical extracts such as chamomile and lemon balm, formulated in NSF-certified facilities. Brands are also introducing vegan and sugar-free versions to expand accessibility.

Potential for Personalized Sleep and Mood Support Solutions

Growing interest in personalized wellness is unlocking new pathways for targeted sleep and mood supplements. Advances in biomarker mapping, wearable sleep trackers, and AI-driven health assessments enable consumers to identify their specific hormone levels, circadian rhythm disruptions, and mood-related patterns. This creates demand for tailored supplements that combine melatonin, 5-HTP, serotonin precursors, and synergistic botanical extracts in optimized ratios. Brands offering personalized subscription kits, data-based sleep improvement programs, and adaptive formulations stand to benefit from this emerging trend. As personalization gains traction, opportunities expand in both the premium consumer segment and corporate wellness programs. The integration of digital diagnostics with nutraceutical solutions positions the industry toward hybrid models that combine technology with natural mood and sleep support interventions.

Key Challenges

Regulatory Variability and Quality Assurance Concerns

Regulatory inconsistency across regions poses a key challenge for the Melatonin–5-HTP–Serotonin market. While melatonin is sold as an OTC supplement in several countries, it remains regulated as a prescription drug in certain jurisdictions, creating barriers to uniform global distribution. Furthermore, quality inconsistencies, adulteration risks, and inadequate standardization in raw materials affect product reliability, particularly in low-cost brands. Differences in permissible dosage limits, labeling requirements, and health claims can restrict marketing strategies and increase compliance costs. Manufacturers must invest in stringent testing protocols, validated supply chains, and third-party certifications to maintain consumer trust. As regulatory bodies intensify scrutiny over dietary supplements, ensuring transparency and product integrity becomes crucial. The challenge lies in balancing rapid innovation with adherence to complex, evolving compliance frameworks across multiple global markets.

Consumer Misuse, Overdependence, and Awareness Gaps

Although demand for sleep and mood-support supplements is rising, consumer misuse and overdependence present notable challenges. Many individuals self-prescribe melatonin and 5-HTP without proper dosage knowledge, leading to inconsistent results, tolerance issues, or ineffective long-term outcomes. Misconceptions about serotonin supplements and their role in mood regulation can contribute to improper use or unrealistic expectations. Additionally, a portion of the population remains skeptical about the long-term benefits or safety profiles of natural sleep aids, slowing adoption in certain markets. Educating consumers on appropriate dosing, proper timing, and evidence-backed benefits is essential. Brands and healthcare professionals must work together to provide clearer guidance and improve awareness regarding responsible use. Strengthening consumer education and offering clinically validated formulations will help mitigate risks and support sustainable market growth.

Regional Analysis

North America

North America leads the global Melatonin–5-HTP–Serotonin market with around 38% share, driven by high consumer awareness of sleep health, strong adoption of nutraceuticals, and widespread availability of OTC supplements. The U.S. dominates regional consumption due to a rising incidence of sleep disorders linked to stress, digital lifestyles, and shift-based work patterns. Well-established e-commerce platforms, premium wellness brands, and favorable regulatory guidelines further strengthen market penetration. Growing integration of melatonin and 5-HTP into personalized wellness programs and clinical recommendations continues to support steady regional growth.

Europe

Europe accounts for approximately 27% of the market, supported by strong demand for natural sleep aids, clean-label supplements, and plant-based mood-support formulations. Germany, the U.K., France, and Italy represent major consumer hubs, benefitting from high healthcare awareness and increased acceptance of preventive wellness products. Regulatory standardization under EFSA ensures quality compliance, which enhances consumer trust in serotonin-boosting and sleep-support supplements. The expanding aging population, rising stress-related disorders, and increasing retail availability across pharmacies and specialty wellness stores drive further growth across the region.

Asia–Pacific

Asia–Pacific holds around 24% market share, emerging as one of the fastest-growing regions due to rising urbanization, lifestyle-induced sleep disturbances, and growing disposable incomes. China, Japan, South Korea, and India exhibit strong momentum as consumers increasingly adopt natural sleep and mood-support supplements. Expanding e-commerce ecosystems, growing health awareness, and rapid penetration of international nutraceutical brands fuel demand. The region’s large young population, coupled with high digital engagement, accelerates the uptake of melatonin gummies, capsules, and 5-HTP blends, contributing to sustained long-term growth.

Latin America

Latin America represents around 7% of the global market, supported by increasing consumer interest in stress relief, mental wellness, and sleep-support supplements. Brazil, Mexico, and Argentina show expanding demand as urban lifestyles heighten sleep-related issues. Growing pharmacy retail networks, improved supplement accessibility, and rising adoption of U.S. and European nutraceutical brands contribute to market expansion. Although regulatory variations pose challenges, consumer acceptance of natural mood-support formulations such as 5-HTP and melatonin continues to rise, driven by increased awareness of preventive health practices.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 4% share, with growth driven by rising health consciousness, expanding pharmaceutical distribution, and increasing awareness of sleep-related wellness. The UAE, Saudi Arabia, and South Africa represent key markets, supported by growing expatriate populations and strong penetration of international supplement brands. Retail pharmacies and emerging e-commerce platforms enhance accessibility of melatonin and serotonin-support products. Although regulatory barriers and limited local manufacturing moderate growth, rising stress levels, lifestyle changes, and improved consumer education support steady demand across the region.

Market Segmentations:

By Type

- Melatonin

- 5-HTP

- Serotonin

By Form

- Tablet

- Capsule

- Liquid

- Powder

- Gummy

By Distribution Channel

- Online

- Supermarkets/Hypermarkets

- Pharmacies

- Health and Wellness Stores

- Convenience Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Melatonin–5-HTP–Serotonin market is characterized by a mix of established nutraceutical brands, specialized sleep-health companies, and rapidly emerging clean-label supplement manufacturers. Leading players compete through product innovation, diversified formulations, and strong omnichannel distribution strategies spanning e-commerce, pharmacies, and health stores. Companies increasingly focus on developing high-purity melatonin, plant-derived 5-HTP from Griffonia simplicifolia, and enhanced serotonin-support blends fortified with botanical co-ingredients. Innovations such as sustained-release tablets, sugar-free gummies, and bioavailability-optimized liquid drops are widely adopted to strengthen differentiation. Strategic partnerships with contract manufacturers, investments in clinical validation, and expansion into premium wellness segments further shape competitive positioning. Branding, certification standards, and transparent labeling remain central to maintaining consumer trust, while regulatory variations across regions drive companies to maintain stringent quality control and compliance frameworks. Overall, the market remains moderately fragmented, with rising demand enabling both global and regional players to scale steadily.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Garden of Life

- Swanson Health Products

- Herbalife

- NutraBlast

- Natures Bounty

- Life Extension

- Kirkland Signature

- NOW Foods

- Jarrow Formulas

- GNC Holdings

- Solgar

Recent Developments

- In April 2025, Herbalife India launched Sleep Enhance™ with saffron extract, formulated to improve sleep quality and mood ahead of bedtime.

- In June 2023, Nature’s Bounty introduced Sleep3 Gummies, featuring L-theanine plus quick-release and time-release melatonin in a single gummy format.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural sleep and mood-support supplements will continue to rise as stress and sleep disorders increase globally.

- Melatonin will maintain its dominance, while 5-HTP blends gain traction for mood stabilization and serotonin enhancement.

- Clean-label, vegan, and plant-derived formulations will shape product development across major brands.

- Gummy supplements and fast-absorbing liquid formats will experience strong consumer adoption.

- Personalized sleep solutions combining digital tracking and tailored supplement plans will become more mainstream.

- Regulatory clarity and quality standardization will influence market expansion and brand positioning.

- E-commerce and subscription-based wellness kits will strengthen recurring consumer purchases.

- Innovation in sustained-release and high-bioavailability delivery systems will improve product performance.

- Emerging markets in Asia–Pacific and Latin America will offer high-growth opportunities for global brands.

- Partnerships between nutraceutical firms and clinical researchers will enhance credibility and product differentiation.