Market Overview

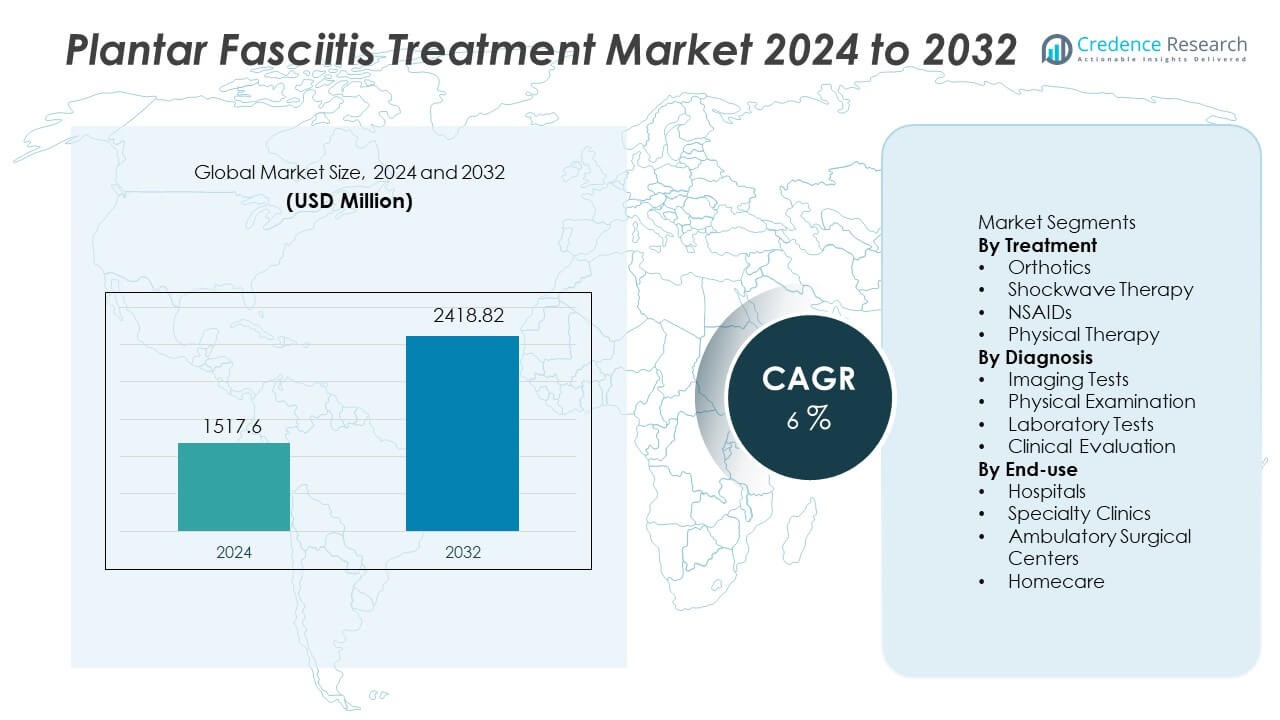

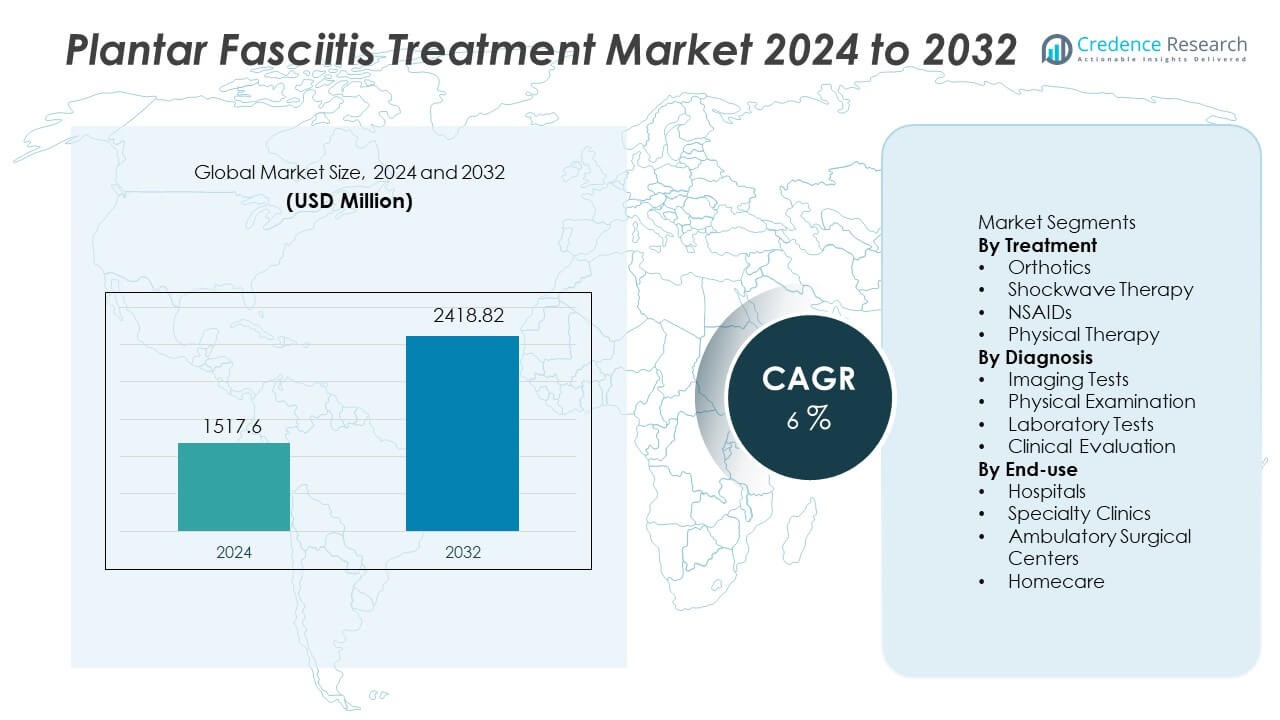

The Plantar Fasciitis Treatment Market was valued at USD 1,517.6 million in 2024 and is expected to reach USD 2,418.82 million by 2032, registering a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plantar Fasciitis Treatment Market Size 2024 |

USD 1,517.6 Million |

| Plantar Fasciitis Treatment Market, CAGR |

6% |

| Plantar Fasciitis Treatment Market Size 2032 |

USD 2,418.82 Million |

Bayer, Pfizer, Sanofi, GlaxoSmithKline, Stride Rite, DJO Global, Bauerfeind, Reckitt Benckiser, Foot Levelers, and Orthofeet are key companies in the Plantar Fasciitis Treatment market and continue to expand non-invasive solutions including orthotics, physiotherapy support, and shockwave systems. These players strengthen product portfolios with ergonomic footwear, compression solutions, and pain-relief formulations to support faster recovery and sustained mobility. North America remains the dominant region with a 34% share due to higher diagnosis rates, active sports populations, and wider access to podiatry services across clinical and homecare channels.

Market Insights

Market Insights

- The Plantar Fasciitis Treatment market reached USD 1,517.6 million in 2024 and is expected to reach USD 2,418.82 million by 2032 at a CAGR of 6.

- Rising incidence of heel pain, obesity, and sports injuries drives treatment adoption, while orthotics hold a 42% share due to strong clinical preference and non-invasive pain relief.

- Key trends include advanced imaging support, custom orthotics, home-based physiotherapy, and telehealth guidance that helps patients manage pain and stretching routines remotely.

- Competition grows as Bayer, Pfizer, Sanofi, and other companies expand non-invasive care with shockwave devices, ergonomic footwear, and improved pain-relief solutions targeting chronic cases.

- North America leads regional demand with a 34% share, followed by Europe at 30% and Asia Pacific at 26%, while hospitals hold a 49% share by end-use due to wider diagnostic and rehabilitation capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Treatment

Orthotics hold a 42% share of the treatment segment and remain the leading option for managing heel pain linked with plantar fascia strain. Orthotic inserts support arch alignment and reduce plantar load during walking. Physical therapy also grows through stretching plans and gait correction. NSAIDs provide short-term pain control for active patients. Shockwave therapy attracts interest due to tissue healing benefits and shorter recovery time. Orthotics remain dominant because they are non-invasive, low-risk, and widely recommended by clinicians. Rising participation in sports and growing obesity levels continue to drive orthotic adoption in both clinical and home settings.

- For instance, DJO Global developed radial shockwave devices delivering up to 5 bar pressure and 21 Hz frequency for chronic heel pain treatment in outpatient centers.

By Diagnosis

Imaging tests account for a 46% share of diagnosis due to strong reliance on ultrasound, X-ray, and MRI for severe or persistent heel pain. Imaging helps rule out fractures and confirm plantar fascia inflammation when symptoms continue. Physical examination remains important for first assessment in outpatient settings. Clinical evaluation covers gait study and pressure points for treatment planning. Laboratory tests support differential diagnosis in complex cases. Growth in advanced ultrasound improves early detection and reduces unnecessary referrals. Rising sports injuries and aging populations support wider use of imaging in specialty clinics and hospital departments.

- For instance, Philips Healthcare launched AI-based ultrasound tools that rapidly process data to enhance soft-tissue imaging in sports medicine.

By End-use

Hospitals hold a 49% share of the end-use segment and lead due to higher patient inflow and stronger diagnostic capacity. Hospitals offer access to imaging, rehabilitation, and pain management teams under one setting. Specialty clinics expand through focused podiatry care and rapid appointments. Ambulatory surgical centers handle advanced procedures for chronic cases. Homecare increases as patients use orthotics, night splints, and guided exercises. Hospitals remain dominant due to availability of multidisciplinary expertise and post-treatment monitoring. Rising outpatient visits for foot pain and increasing awareness of early intervention continue to support hospital demand across major regions.

Key Growth Drivers

Rising Incidence of Foot Injuries and Chronic Heel Pain

Growing cases of heel pain due to long working hours, obesity, and athletic activity fuel treatment demand. Many adults develop plantar fascia inflammation linked with poor footwear and high-impact movement. Rising sports participation and fitness routines increase strain on the foot arch. Earlier diagnosis and wider physician awareness also expand treatment volume in primary care and orthopedic settings. Digital health tools help patients track pain history, supporting continuous care. More patients seek early intervention to avoid prolonged pain episodes.

- For instance, Orthofeet uses advanced cushioning and an ergonomic sole along with premium orthotic insoles that feature anatomical arch support and multiple cushioning layers to provide soft, supportive relief of foot and heel pain, working wonders for comfort and alignment.

Growing Geriatric Population with Musculoskeletal Disorders

Aging populations face higher risk of chronic foot conditions because softer tissues cannot absorb repetitive load. Osteoarthritis and reduced muscle function cause foot alignment issues, raising heel pain risk. Physicians prefer orthotic management as a non-invasive option for older patients. Improved homecare and supportive devices enable older adults to manage discomfort at home. Rising chronic disease burden, especially diabetes, also increases foot complication risks. Increasing healthcare spending in developed regions strengthens adoption of supportive therapies.

- For instance, Eli Lilly and Company offers prescription solutions for diabetic neuropathy with a daily dosing regimen, reducing foot discomfort linked with nerve damage and improving patient quality of life.

Shift Toward Non-Invasive and Cost-Effective Treatments

Healthcare providers recommend less invasive methods to avoid surgical procedures and reduce complication risk. Orthotics and physical therapy serve as first-line treatment options for most patients. Shockwave technology expands due to faster recovery, fewer side effects, and strong physician acceptance. Reimbursement improvements support early non-invasive treatment in some regions. Direct-to-consumer channels expand access to supportive footwear and inserts. Growing clinical evidence for non-invasive recovery encourages wider adoption across outpatient settings.

Key Trends and Opportunities

Growing Use of Advanced Imaging and Ultrasound Diagnosis

Clinicians use ultrasound and MRI for precise detection of plantar fascia inflammation and heel spurs. Early imaging helps rule out fractures and supports targeted treatment planning. Advanced diagnostic tools enhance outcomes and reduce unnecessary surgery. Digital imaging improves follow-up monitoring and helps track inflammation over time. Sports medicine centers adopt imaging to support return-to-activity decisions. Hospitals expand radiology services for musculoskeletal cases across developed regions, enabling wider medical coverage for heel pain.

- For instance, modern MRI systems include sequences that visualize inflammatory edema and changes in the plantar fascia with high soft-tissue contrast. These sequences offer excellent detail and contrast resolution for distinguishing various tissues, making MRI a powerful tool for evaluating soft tissue and bone abnormalities in the heel and assisting in diagnosing conditions like plantar fasciitis.

Rising Demand for Custom Orthotics and Telehealth Support

Custom orthotic inserts become more common for arch support and gait correction. Retail and online platforms increase access to tailored orthotic solutions. Telehealth platforms connect patients with physical therapy guidance and pain monitoring at home. Home-based recovery and exercise programs lower treatment cost. Clinics introduce remote follow-up for stretching routines and night splint use. Digital consultation strengthens adherence and supports long-term foot correction for high-risk groups.

- For instance, Bayer collaborates on digital programs that support chronic disease management, such as for diabetes and cardiovascular risk, through the collection of patient-reported outcomes using mobile logs, which can reinforce adherence during home therapy.

Key Challenges

Limited Long-Term Relief in Some Patients

Some patients experience recurring heel pain even after standard treatment. Biomechanical issues vary by patient and need ongoing correction plans. Poor adherence to exercises reduces treatment outcomes. Chronic pain cases may require multiple therapies, raising cost burden. Lack of early consultation delays treatment, leading to severe inflammation. Variation in treatment results increases reliance on long-term physician supervision.

Variable Access to Advanced Care in Low-Income Settings

Limited insurance coverage makes advanced therapy less accessible in developing countries. High device prices restrict access to shockwave equipment and imaging services. Lack of trained specialists reduces treatment quality in rural regions. Patients rely on basic pain medication rather than structured treatment plans. Uneven healthcare spending slows technology adoption. These challenges create treatment gaps across low-income populations and underserved communities.

Regional Analysis

North America

North America holds a 34% share of the Plantar Fasciitis Treatment market supported by strong diagnosis rates and high adoption of orthotics and shockwave therapy in clinical settings. The United States leads due to active sports populations and high prevalence of obesity-linked heel pain. Hospitals and specialty clinics invest in advanced imaging and early physiotherapy programs. Growing insurance coverage for musculoskeletal treatment supports wider access. Canada expands adoption through podiatry services and sports rehabilitation centers. Increasing awareness of early intervention and rising foot injuries continue to drive future demand across outpatient settings.

Europe

Europe accounts for a 30% share driven by increased foot injury incidence, musculoskeletal disorders, and a growing geriatric base. Germany, the United Kingdom, and France lead due to strong reimbursement for physiotherapy and advanced imaging. Healthcare systems promote non-invasive treatment options before surgical procedures. Sport-related foot conditions continue to surge with rising participation in outdoor activities. Hospitals and orthopedic clinics expand rehabilitation services and custom orthotic offerings. Investments in early diagnosis and podiatry care support market expansion. Rising chronic disorders and lifestyle-related foot injuries drive sustained demand in European countries.

Asia Pacific

Asia Pacific holds a 26% share backed by rising awareness of chronic foot conditions and increased adoption of supportive footwear and physiotherapy. China and India show higher patient volumes due to large populations and rising obesity trends. Sports injuries and aging demographics contribute to growing treatment demand. Hospitals improve orthopedic infrastructure and diagnostic capabilities to target heel pain early. Expansion of podiatry services and physiotherapy centers supports future growth. Medical tourism in countries such as India boosts access to cost-effective care. Rising health spending across urban areas strengthens regional market presence.

Latin America

Latin America holds a 6% share and grows as urban populations face increased lifestyle-related foot injuries and prolonged standing work conditions. Brazil and Mexico lead due to wider sports participation and active orthopedic care networks. Healthcare systems expand physiotherapy services and access to orthotics for musculoskeletal pain. Hospitals improve diagnostic capabilities with ultrasound and gait analysis modules. Public health programs create awareness of early foot care to avoid chronic disability. Growing private healthcare access also strengthens treatment adoption across regional cities. Rising fitness interest increases long-term demand for plantar fasciitis management.

Middle East and Africa

The Middle East and Africa represent a 4% share, supported by increasing recognition of musculoskeletal disorders linked with obesity, diabetes, and long standing working hours. Gulf countries expand access to orthopedics, physiotherapy, and diagnostic imaging in modern hospital networks. African markets show growing demand but remain limited due to low specialist availability. Import-based access to orthotics and shockwave equipment restricts adoption in some areas. Cross-border healthcare services and insurance expansion support higher treatment uptake. Rising sports participation among young populations helps increase awareness and long-term demand for heel pain treatment.

Market Segmentations:

By Treatment

- Orthotics

- Shockwave Therapy

- NSAIDs

- Physical Therapy

By Diagnosis

- Imaging Tests

- Physical Examination

- Laboratory Tests

- Clinical Evaluation

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Homecare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the market is Bayer, Pfizer, Sanofi, GlaxoSmithKline, Stride Rite, DJO Global, Bauerfeind, Reckitt Benckiser, Foot Levelers, and Orthofeet lead competition across the Plantar Fasciitis Treatment market. These companies offer products ranging from orthotics and oral pain relievers to advanced shockwave technologies targeting chronic heel pain. Vendors invest in custom orthotic solutions, night splints, and improved compression support to enhance pain relief and foot alignment. Medical device companies emphasize non-invasive recovery options that reduce long treatment cycles. Partnerships between orthopedic centers and therapy clinics also strengthen distribution channels. Major firms promote digital engagement and direct-to-consumer offerings to expand reach in homecare settings. Competition continues to increase as new brands introduce ergonomic footwear, smart insoles, and targeted physiotherapy tools for active and aging populations.

Key Player Analysis

- Bayer

- Pfizer

- Sanofi

- GlaxoSmithKline

- Stride Rite

- DJO Global

- Bauerfeind

- Reckitt Benckiser

- Foot Levelers

- Orthofeet

Recent Developments

- In November 2025, Pfizer Inc. was listed among key global players driving growth in the plantar fasciitis treatment market.

- In July 2025, Endo, Inc. shared that new plantar fasciitis-related presentations were featured at APMA’s annual meeting. This signals ongoing clinical and scientific engagement in pain-focused therapies.

- In August 2024, Enovis received a patent for an adjustable dorsal night splint. The design supports controlled plantar fascia stretching for heel pain care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment, Diagnosis, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Future demand will grow through non-invasive care such as orthotics and physiotherapy.

- Healthcare providers will adopt advanced shockwave devices for chronic heel pain.

- Digital assessment will support early diagnosis and remote physical therapy plans.

- Ergonomic footwear will expand for sports, work, and aging populations.

- Customized orthotic inserts will gain adoption through retail and online channels.

- Homecare kits will support stretching, night splints, and pain management.

- Medical tourism will offer cost-effective plantar fasciitis procedures in developing regions.

- Artificial intelligence tools will enhance gait analysis and treatment planning.

- Sports medicine clinics will focus on injury prevention and faster recovery models.

- Regional manufacturers will invest in localized orthotic production to reduce import dependence.

Market Insights

Market Insights