Market Overview:

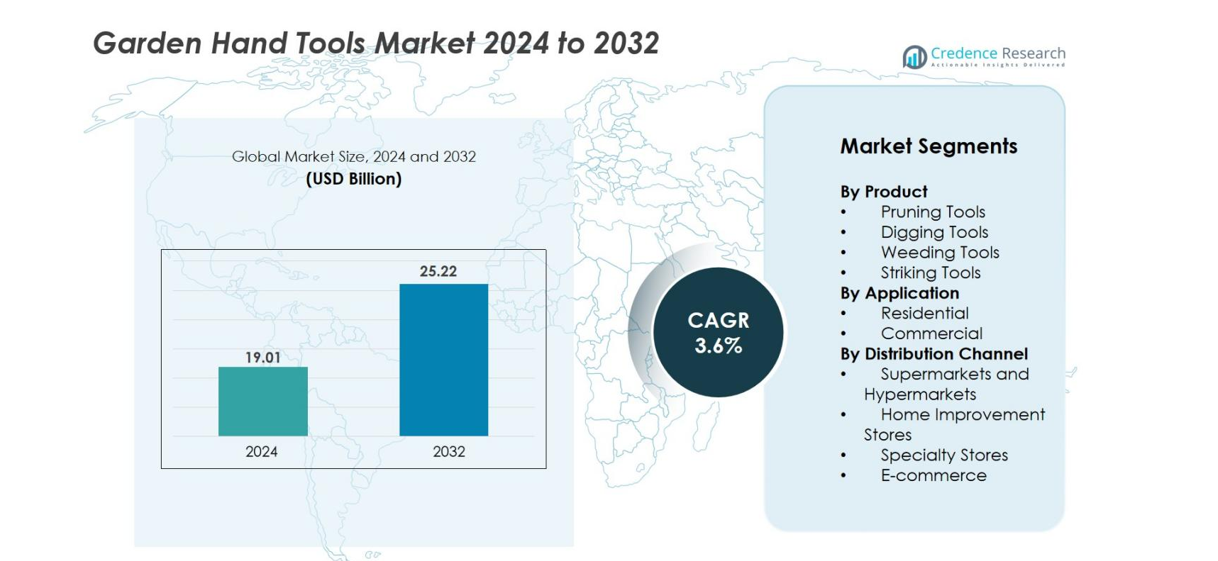

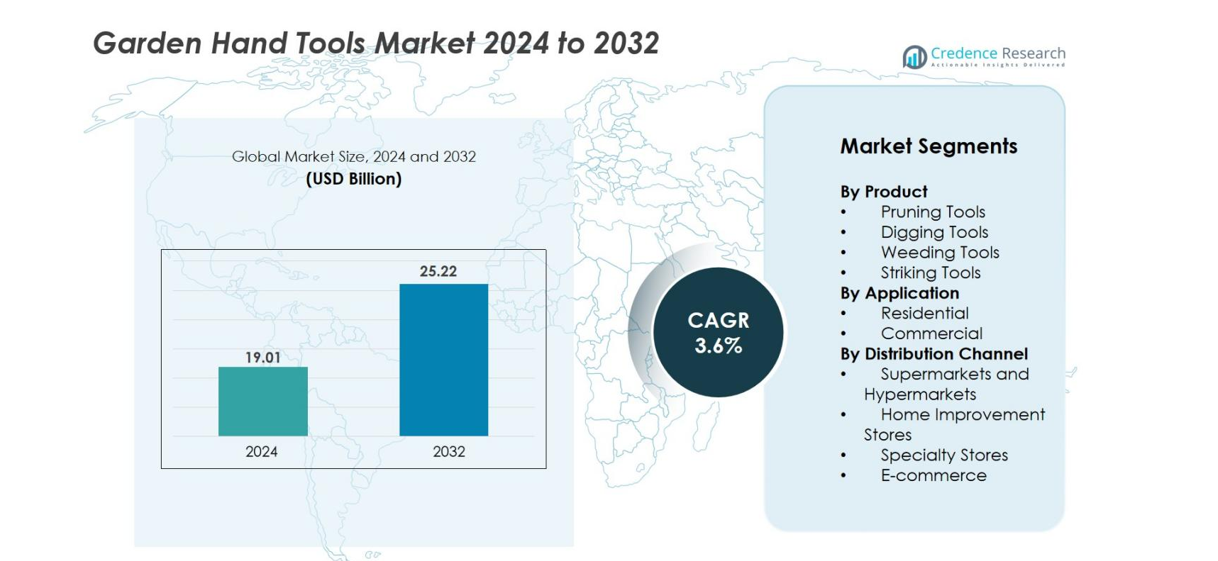

Garden Hand Tool Market size was valued at USD 19.01 Billion in 2024 and is anticipated to reach USD 25.22 Billion by 2032, growing at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Garden Hand Tools Market Size 2024 |

USD 19.01 Billion |

| Garden Hand Tools Market, CAGR |

3.6% |

| Garden Hand Tools Market Size 2032 |

USD 25.22 Billion |

Garden Hand Tool Market is driven by a diverse group of established manufacturers that continue to shape product innovation and global penetration. Key players such as Fiskars Corporation, Stanley Black & Decker, FELCO SA, The Husqvarna Group, Spear & Jackson, Corona Tools, Burgon & Ball, A.M. Leonard, Inc., Ames Companies Inc., and Wolf-Garten USA strengthen the market through advanced ergonomics, durable materials, and extensive retail networks. North America leads the market with a 32.4% share, supported by strong DIY gardening trends and premium tool adoption, followed by Europe with 28.7%, driven by its mature gardening culture and high demand for eco-friendly, precision-engineered tools.

Market Insights

- The Garden Hand Tool Market was valued at USD 19.01 Billion in 2024 and is projected to reach USD 25.22 Billion by 2032, registering a CAGR of 3.6% during the forecast period.

- Demand is driven by rising home gardening, DIY landscaping, and expanding commercial horticulture, with pruning tools leading the product segment with a 34.7% share due to their essential role in plant maintenance.

- Key trends include increasing adoption of eco-friendly materials, ergonomic tool designs, and growing consumer preference for premium, long-lasting tools that enhance comfort and efficiency.

- The market features strong participation from leading players such as Fiskars, Stanley Black & Decker, FELCO, Husqvarna, and Corona Tools, with competition centered on durability, innovation, and retail penetration.

- Regionally, North America dominates with 32.4%, followed by Europe at 28.7%, while Asia-Pacific remains the fastest-growing region with a 24.1% share, supported by rising urban gardening and increasing retail accessibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The Garden Hand Tool Market by product is led by pruning tools, which hold the dominant share of 34.7% in 2024, driven by increasing demand for precision cutting, plant health maintenance, and the rising popularity of home gardening. Pruning tools including shears, loppers, and secateurs are widely used for trimming shrubs, fruit trees, and ornamental plants, making them essential for both casual and professional gardeners. Advancements in ergonomic designs, lightweight materials, and non-slip grips further support adoption. Meanwhile, digging and weeding tools continue to grow steadily as landscaping and horticulture activities expand across residential and commercial spaces.

- For instance, Fiskars introduced its PowerGear2 pruning shears featuring patented gear technology that delivers up to 3× more cutting power, supported by lab-tested durability of 50,000 cutting cycles.

By Application

The residential segment dominates the Garden Hand Tool Market with a 58.4% share in 2024, primarily fueled by growing consumer interest in DIY gardening, backyard landscaping, and home-based horticulture. Increased awareness of sustainable living, kitchen gardening, and outdoor wellness trends contribute to higher demand for hand tools used in pruning, planting, and soil maintenance. Commercial usage—including landscaping services, municipal gardening, and horticulture contractors—continues to expand, supported by infrastructure development and rising investments in public green spaces, but remains smaller in comparison to the rapidly growing residential user base.

- For instance, Gardena introduced its “smart Irrigation Control” unit which can manage up to six 24 V irrigation valves via Bluetooth connectivity in a single garden installation.

By Distribution Channel

Among distribution channels, home improvement stores lead the market with a 39.2% share in 2024, driven by their extensive product assortments, hands-on tool demonstrations, and strong brand visibility. Retailers such as hardware chains and garden centers provide consumers with expert guidance and immediate product availability, boosting sales of pruning, digging, and striking tools. E-commerce is rapidly gaining traction due to convenience, competitive pricing, and access to a wider range of specialty gardening tools. Supermarkets, hypermarkets, and specialty stores remain important channels, but home improvement outlets continue to dominate due to their superior customer engagement and product variety.

Key Growth Drivers

Rising Adoption of Home Gardening and Landscaping Activities

The growing popularity of home gardening has become a major driver for the Garden Hand Tool market, supported by increased consumer focus on wellness, outdoor living, and sustainable home practices. Households are investing in gardens, balconies, and small green spaces for food cultivation, aesthetics, and relaxation. This shift drives strong demand for pruning tools, digging equipment, and ergonomic hand tools that enhance comfort and precision. The expansion of suburban housing and rising participation in lawn care contribute to wider tool adoption. Social media gardening trends, DIY cultivation tutorials, and community gardening movements further support the need for quality tools as consumers pursue healthier, home-grown living.

- For instance, Husqvarna Group, through its Gardena division (which focuses on residential watering products, garden hand tools and smart garden systems) reported net sales of SEK 13,610 million in 2022 for that division.

Expansion of Landscaping and Commercial Horticulture Services

The growth of professional landscaping, municipal gardening, and commercial horticulture services significantly boosts demand for garden hand tools. Urban infrastructure development, beautification initiatives, and public park maintenance require durable pruning, weeding, and striking tools for ongoing upkeep. Governments promoting urban green cover, biodiversity enhancement, and sustainable city planning are increasing tool usage across commercial entities. Landscaping services for residential communities, hospitality facilities, and corporate campuses further stimulate adoption. Professional service providers prefer heavy-duty, high-performance tools, encouraging manufacturers to innovate with advanced materials and ergonomic features tailored to high-frequency use.

- For instance, Andreas Stihl AG & Co. KG (STIHL) reports that its manufacturing network on four continents has already produced more than 15,000,000 units at its China site alone

Technological Advancements and Ergonomic Product Innovation

Innovation in design, materials, and ergonomics continues to reshape the Garden Hand Tool market. Manufacturers are using lightweight alloys, reinforced steel, anti-rust finishes, and shock-absorbing handles to improve durability and user comfort. Ergonomically designed tools that reduce hand strain and enhance grip stability appeal to both casual gardeners and professionals. Advanced cutting mechanisms, multifunctional components, and adjustable designs help users achieve greater precision and productivity. Increased awareness of safety and the need to minimize physical fatigue fuel interest in improved hand tool technologies. As consumers seek reliable and comfortable tools, innovation remains essential to market expansion.

Key Trends & Opportunities

Surge in Eco-Friendly and Sustainable Tool Manufacturing

A strong shift toward sustainable materials and environmentally conscious production is emerging in the Garden Hand Tool market. Consumers are increasingly choosing tools made from recyclable metals, responsibly sourced wood, and biodegradable or minimal packaging. Manufacturers are adopting natural fiber composites, eco-safe coatings, and circular product design practices to reduce environmental impact. This trend aligns with global sustainability movements, green home initiatives, and growing ecological awareness among hobbyists and professionals. It also presents opportunities for brands to introduce certified eco-friendly product lines, carbon-neutral manufacturing practices, and long-lasting sustainable alternatives that appeal to environmentally conscious buyers.

- For instance, Fiskars Group developed its Solid™ Hoe and Solid™ Trowel garden hand-tools with 65% recycled plastic (reinforced with fiberglass) in their components.

Growing Demand for Premium and Ergonomic Hand Tools

Premium, high-performance hand tools are gaining momentum as gardening evolves into a lifestyle-driven activity. Consumers are prioritizing tools with advanced features such as cushioned handles, high-strength blades, lightweight metals, and improved grip ergonomics. This trend supports the rise of specialized tools for plant-specific pruning, soil conditioning, and root care. Manufacturers are capitalizing by offering upgraded tool sets, durability-focused designs, and enhanced accessories. As gardening becomes more skill-intensive and personalized, demand continues to shift toward high-quality, precision-engineered tools that deliver long-term value and superior ease of use.

- For instance, Fiskars integrates its patented PowerGear™ mechanism into pruning tools, a system tested to deliver up to 3× cutting efficiency relative to standard mechanisms, backed by engineering data from its product validation labs.

Key Challenges

Availability of Low-Cost Counterfeit and Substandard Tools

The presence of counterfeit and low-quality garden hand tools creates a significant challenge for established brands. These products mimic the appearance of premium tools but lack durability, safety compliance, and reliable materials, resulting in frequent breakage and poor user experience. Their low prices attract budget-conscious consumers, especially in emerging markets, making it difficult for authentic brands to maintain market share. The influx of unregulated imports and non-certified products further disrupts organized retail channels. Manufacturers must address brand protection, consumer awareness, and product differentiation to counter the impact of inferior alternatives.

Seasonal Demand Fluctuations and Weather-Driven Uncertainty

Seasonality significantly influences the Garden Hand Tool market, with peak demand during warmer months and a sharp decline during winter. Unexpected weather events—such as excessive rainfall, droughts, or prolonged cold—can delay gardening schedules and disrupt tool sales. Climate change has increased volatility, affecting both residential gardening behavior and commercial landscaping operations. Retailers and manufacturers struggle to forecast inventory and production accurately due to irregular buying patterns. These fluctuations create challenges in maintaining stable revenue streams, efficient supply chains, and consistent production planning throughout the year.

Regional Analysis

North America

North America holds the largest share of 32.4% in the Garden Hand Tool Market, driven by the strong culture of home gardening, DIY landscaping, and extensive residential lawn maintenance. The region benefits from high consumer spending on premium, ergonomic tools and strong retail penetration through home improvement chains. Growth is further supported by urban landscaping projects and rising interest in sustainable gardening. The U.S. leads the regional market with widespread adoption of pruning, digging, and weeding tools across both residential and commercial applications. Increasing suburban housing developments continue to sustain long-term market demand.

Europe

Europe accounts for 28.7% of the market, supported by a well-established gardening culture, high adoption of eco-friendly tools, and expanding outdoor living trends. Countries such as Germany, the U.K., France, and the Netherlands exhibit strong interest in premium, ergonomically designed tools for home and community gardening. Government initiatives promoting green cities, biodiversity, and public landscaping further fuel market growth. The presence of leading tool manufacturers and specialized retail channels strengthens regional accessibility. Europe’s rising focus on sustainable materials and low-impact gardening practices continues to influence product preference, driving steady demand across both residential and commercial segments.

Asia-Pacific

Asia-Pacific holds a 24.1% share of the global market and remains the fastest-growing region due to rapid urbanization, expanding residential construction, and increasing adoption of home gardening across China, India, Japan, and Australia. Rising disposable incomes and lifestyle shifts toward wellness and outdoor activities support demand for pruning, weeding, and digging tools. Government programs promoting urban green spaces and horticulture development also contribute to market expansion. E-commerce-driven accessibility and growing acceptance of ergonomic, high-quality tools accelerate adoption. As gardening gains popularity among younger consumers, Asia-Pacific continues to emerge as a key growth engine for manufacturers.

Latin America

Latin America captures 8.3% of the Garden Hand Tool Market, supported by growing landscaping activities, rising home gardening interest, and increased municipal investment in urban beautification projects. Brazil, Mexico, and Argentina represent the major contributors due to expanding residential construction and horticulture practices. The region’s warm climate encourages continuous outdoor gardening, boosting year-round tool usage. However, the market is influenced by price-sensitive consumers, leading to higher demand for affordable yet durable tools. Growth in retail infrastructure and the penetration of home improvement stores and online platforms continue to strengthen tool availability across the region.

Middle East & Africa

The Middle East & Africa region holds a 6.5% market share, with growth driven by rising landscaping projects, expanding real estate developments, and increasing investments in public green spaces. Urban centers such as the UAE, Saudi Arabia, and South Africa are key contributors due to government-led sustainability initiatives and beautification programs. While residential gardening is comparatively limited, the commercial landscaping sector drives strong demand for pruning and digging tools. Climate conditions necessitate durable, weather-resistant tools. Improving retail distribution and growing awareness of outdoor gardening trends continue to support gradual market expansion across the region.

Market Segmentations

By Product

- Pruning Tools

- Digging Tools

- Weeding Tools

- Striking Tools

By Application

By Distribution Channel

- Supermarkets and Hypermarkets

- Home Improvement Stores

- Specialty Stores

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Garden Hand Tool Market is characterized by a strong mix of global manufacturers, specialized tool companies, and emerging brands focusing on innovation and durability. Key players such as Fiskars Corporation, Stanley Black & Decker, FELCO SA, The Husqvarna Group, Spear & Jackson, Corona Tools, Burgon & Ball, A.M. Leonard, Inc., Ames Companies Inc., and Wolf-Garten USA maintain a robust presence through extensive product portfolios, ergonomic designs, and advanced material technologies. These companies compete on quality, comfort, and performance, offering premium tools suited for both residential gardeners and commercial landscapers. Many manufacturers are increasingly investing in sustainable materials, lightweight alloys, and shock-absorbing handles to differentiate their products. Strategic partnerships with retailers, strengthened online distribution, and expansion into emerging markets further support their growth. As consumer demand for durable, user-friendly, and eco-conscious tools rises, competition continues to intensify across product categories and sales channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corona Tools

- A.M. Leonard, Inc.

- Spear & Jackson

- The Husqvarna Group

- Fiskars Corporation

- Burgon & Ball

- FELCO SA

- Wolf-Garten USA

- Stanley Black & Decker, Inc.

- Ames Companies Inc.

Recent Developments

- In October 2025, Stanley Black & Decker’s brands DEWALT, Cub Cadet and Hustler debuted new outdoor/hand-held solutions for professionals at the Equip Expo event.

- In 2025, Gardena introduced new components and enhanced features for its established GARDENA smart system, which integrates with home automation technologies and uses app-controlled irrigation and data to manage gardens efficiently

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as home gardening and DIY landscaping continue to gain popularity worldwide.

- Demand for ergonomic, lightweight, and user-friendly tools will rise as consumers prioritize comfort and ease of use.

- Technological advancements in materials and design will lead to more durable, long-lasting, and precision-focused hand tools.

- Sustainability will shape product development, with manufacturers increasing the use of recyclable metals and eco-friendly components.

- E-commerce will expand as a preferred distribution channel, offering wider tool variety and competitive pricing.

- Professional landscaping and municipal horticulture services will continue driving commercial tool demand.

- Premium gardening tools will see higher adoption as hobbyists invest in performance-enhanced and specialized products.

- Climate change will influence tool usage trends, encouraging demand for weather-resistant and adaptive tool designs.

- Manufacturers will strengthen global footprints through partnerships, retail expansion, and product line diversification.

- Asia-Pacific will emerge as a key growth hub due to urban development, rising incomes, and increasing gardening participation.