Market Overview:

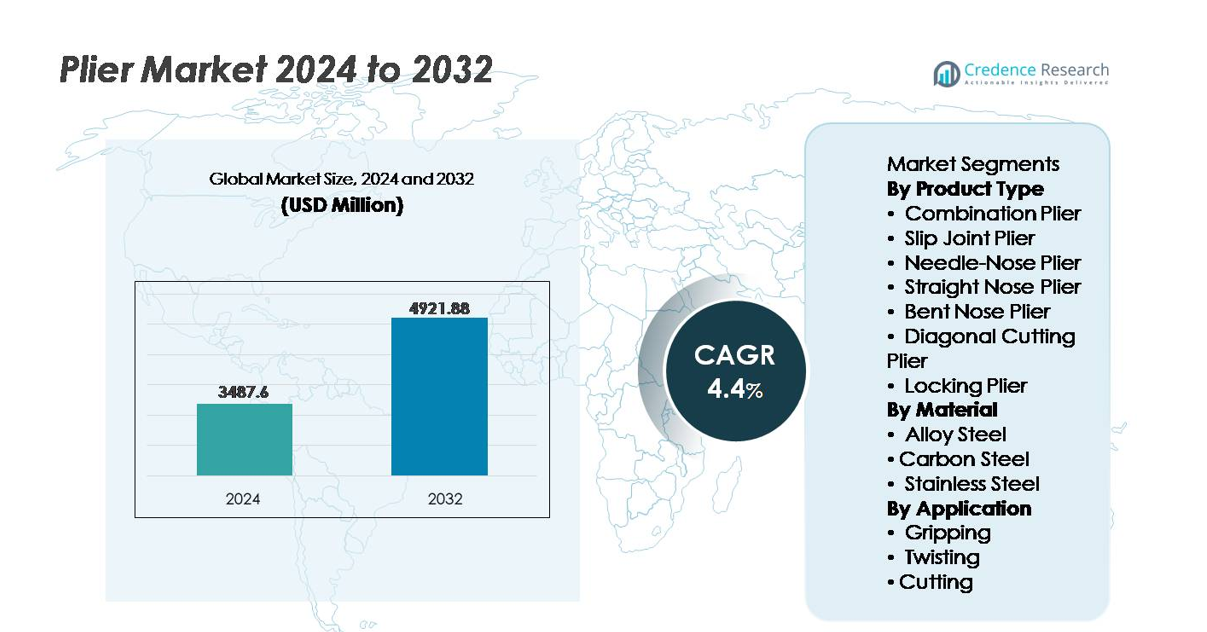

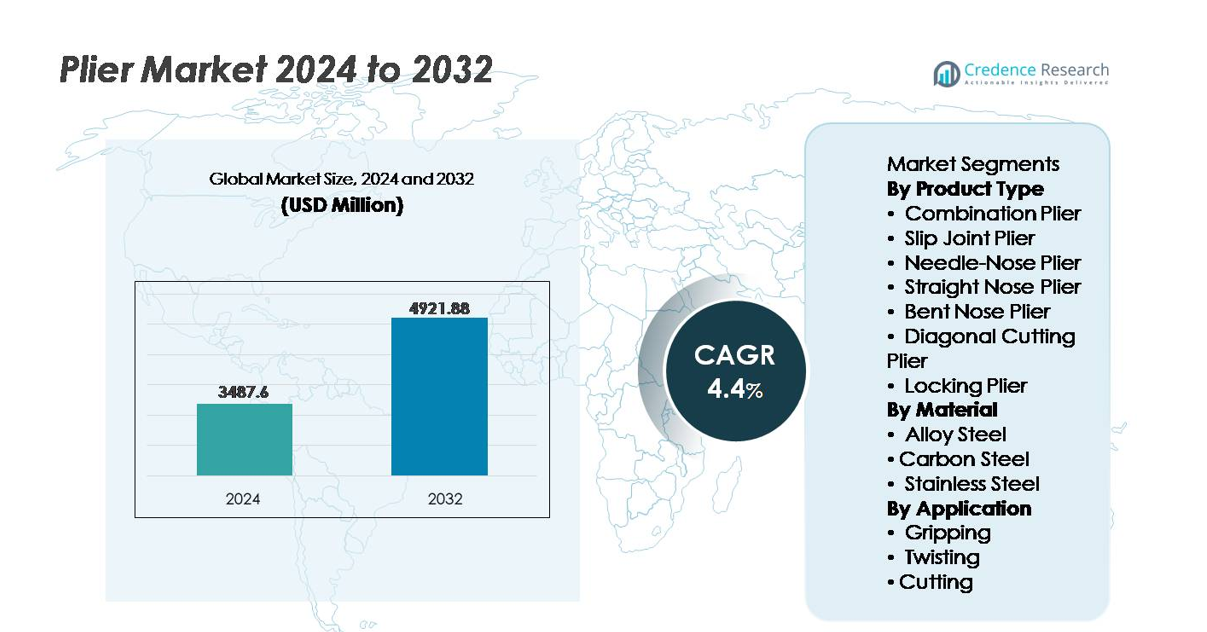

The global plier market was valued at USD 3,487.6 million in 2024 and is projected to reach USD 4,921.88 million by 2032, expanding at a CAGR of 4.4% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plier Market By Product Size 2024 |

USD 3,487.6 million |

| Plier Market By Product, CAGR |

4.4% |

| Plier Market By Product Size 2032 |

USD 4,921.88 million |

The plier market is shaped by competitive participation from established tool manufacturers and specialized brands, including Snap-on, Park Tool, Knipex Tools, CHISEN Tools, Akar Tools, Rennsteig Werkzeuge, Klein Tools, MARUTO HASEGAWA KOSAKUJO, Apex Tool Group, and Lisle Corp. These companies compete through innovations in ergonomic design, precision engineering, alloy strength enhancement, and industry-specific tool configurations serving automotive, electrical, construction, and maintenance sectors. Asia Pacific leads the global market with approximately 36% share, driven by large-scale industrialization, infrastructure expansion, and manufacturing output, followed by North America and Europe, where demand centers on professional-grade and compliance-certified pliers for specialized applications.

Market Insights:

- The global plier market was valued at USD 3,487.6 million in 2024 and is projected to reach USD 4,921.88 million by 2032, expanding at a CAGR of 4.4% during the forecast period.

- Increasing construction, automotive repair, and industrial servicing activities act as primary market drivers, supported by the rising adoption of insulated and high-tensile pliers for electrical safety, equipment maintenance, and precision operations.

- Key market trends include the shift toward ergonomic and lightweight composite pliers, multifunctional tool designs, and growing demand for micro-cutting and ESD-safe tools in electronics and EV component assembly.

- Competitive pressures from low-cost manufacturers and counterfeit tool circulation restrain pricing and brand reliability, while OEM quality standards require continuous innovation in material strength and safety compliance.

- Regionally, Asia Pacific holds 36% share as the largest market, followed by North America at 32% and Europe at 27%; by product type, Combination pliers represent the dominant segment due to multipurpose usage across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The plier market by product type is led by Combination pliers, constituting the dominant sub-segment due to their multipurpose utility in gripping, bending, and wire cutting for household, automotive, and industrial use. Their adaptability eliminates the need for multiple hand tools, driving widespread adoption among electricians, mechanics, and DIY users. Meanwhile, diagonal cutting pliers find strong demand in electronics and cable installation, where precision edge cutting is essential. Locking pliers are gaining momentum in metal fabrication and heavy-duty repair due to their ability to firmly clamp objects for hands-free operation. Specialty variants including crimping and end-cutting pliers address niche applications across manufacturing and construction.

- For instance, IRWIN Vise-Grip locking pliers feature an adjusting screw that controls jaw opening and clamping pressure for a stable hold in demanding repair tasks.

By Material

Alloy steel represents the dominant sub-segment in the material category, driven by its superior hardness, tensile strength, and durability, making it suitable for high-load industrial applications. Manufacturers favor alloy steel for its resistance to wear and deformation, extending product life cycles for professional tools. Carbon steel remains relevant in cost-sensitive markets and general-purpose utilities, while stainless steel pliers attract users demanding anti-corrosion performance in marine, chemical, and outdoor environments. Composite and hybrid materials are emerging for lightweight ergonomic tools, especially in precision electronics work and user fatigue reduction initiatives in repetitive tasks.

- For instance, Knipex manufactures its heavy-duty diagonal cutters from forged, oil-hardened chrome-vanadium heavy-duty steel with precision cutting edges that are additionally induction-hardened to achieve a cutting edge hardness of approximately 64 HRC, enabling reliable severing of piano wire up to a 2.5 mm diameter (on a 200mm model).

By Application

Cutting stands as the leading application sub-segment, propelled by the increasing volume of electrical wiring, cable installation, and metal trimming tasks in infrastructure upgrades and industrial automation. Precision cutting pliers cater to electronics, aerospace, and medical device assembly, where clean cuts and minimal material deformation are critical. Gripping applications continue to exhibit strong adoption in automotive repairs, assembly lines, and maintenance operations. Twisting applications support construction, wiring, and fence installation but remain secondary to cutting due to specialization needs. Demand is increasingly shaped by ergonomic design, improved leverage mechanics, and insulated handles for electrical safety.

Key Growth Drivers:

Expanding Infrastructure Development and Construction Activities

Rapid expansion in global infrastructure spanning transportation networks, commercial structures, and urban redevelopment continues to drive demand for durable and multifunctional pliers used across wiring, plumbing, metalwork, and installation tasks. Government-backed initiatives in road modernization, housing, renewable energy deployment, and smart city projects create consistent procurement cycles for hand tools. Contractors and technicians increasingly prioritize high-tensile pliers with enhanced leverage mechanics and anti-slip grip surfaces to improve work efficiency, reduce fatigue, and support safety compliance. Additionally, growth in modular construction and pre-engineered building components necessitates precise cutting, bending, and fastening tools, positioning pliers as a core requirement in assembly activities. Emerging markets in Asia, Africa, and South America are particularly significant demand pools, fueled by urban population growth, rising disposable incomes, and an expanding skilled labor force entering mechanical and construction trades.

- For instance, Fujiya’s industrial plier models used in Southeast Asian construction projects are built with cutting edge hardness values up to 60–62 HRC and deliver cutting performance suitable for 2.6 mm diameter steel wire commonly used in scaffold and rebar fixing.

Rising DIY Culture, Repair Services, and Home Improvement

The surge of do-it-yourself (DIY) culture, supported by online tutorials, digital tool retailing, and increasing consumer preference for cost-saving self-maintenance, has elevated plier adoption in home repair, furniture assembly, electrical fixes, and hobby crafting. Retail-ready tool kits containing combination, needle-nose, and diagonal pliers increasingly target homeowners, students, and small workshop users. The growth of appliance repair services, bicycle maintenance, automotive refurbishing, and hardware refurbishment further stimulates usage frequency and replacement cycles. Companies offering ergonomic designs, lighter materials, and multifunctional mechanisms benefit from positive consumer sentiment toward user-friendly and compact tools. Seasonal home improvement spending and influencer-driven tool demonstrations enhance brand reach while professional-grade features trickle down into consumer-grade models. This behavioral shift transforms hand tools from utilitarian instruments into personalized household utility essentials and hobby-enabling accessories.

- For instance, Klein Tools’ Journeyman-series pliersincorporate dual-material handles with molded elastomer gripping surfaces designed to reduce slippage and user strain during continuous use, while maintaining heavy-duty cutting capacity for materials including ACSR cable, screws, nails, and most hardened wire.

Growth in Electronics, Renewable Energy, and Industrial Automation

Demand for precision-engineered pliers is rising across electronics assembly, electric vehicle production, battery manufacturing, and solar panel installation sectors that require fine gripping, terminal crimping, edge trimming, and micro-cutting capabilities. The proliferation of wiring harnesses, tiny circuit components, and insulation-sensitive materials compels manufacturers to offer pliers with reduced jaw tolerance, higher cutting accuracy, and anti-static properties. As industrial automation advances, maintenance teams require insulated and torque-supportive tools suitable for live-line operations and robotic equipment servicing. Renewable energy installations especially rooftop photovoltaic systems drive adoption of crimping, twisting, and cable-cutting tools optimized for high-voltage continuity and corrosion resistance. The convergence of electrification and automation positions pliers as irreplaceable tools in preventive maintenance strategies, safety compliance programs, and precision-driven manufacturing floors.

Key Trends & Opportunities:

Technological Integration in Hand Tools

A major trend shaping the plier market involves integration of advanced mechanisms and smart features to improve operational efficiency, comfort, and reliability. Ergonomic grips with vibration-dampening materials, heat-resistant handle coatings, and biomechanical leverage systems reduce strain and enable prolonged use in industrial settings. Opportunities emerge in smart tool innovation, where embedded sensors measure force application, count usage cycles, or alert technicians during calibration-sensitive tasks. Quick-change jaw systems and modular attachments provide multipurpose flexibility that reduces inventory needs. Manufacturers exploring anti-corrosion nano-coatings, induction-hardened jaws, and hybrid alloy composites position themselves strongly as precision, safety, and product life cycle become dominant purchasing criteria.

- For instance, Snap-on has piloted digital torque-tracking grips that log up to 5,000 application cycles and communicate usage logs via Bluetooth to maintenance management platforms.

Growth of Sustainable Manufacturing and Recyclable Materials

Sustainability is transitioning from preference to necessity as regulatory pressure and corporate carbon accounting reshape tool manufacturing. Companies adopting recycled steel input, water-efficient heat-treatment processes, and low-resin handle designs gain reputational and procurement advantages. Opportunities lie in producing recyclable plier components, offering refurbishment systems, and enabling extended-service warranty programs that reduce environmental waste. Consumer-facing brands targeting eco-conscious buyers emphasize transparency in material sourcing, energy consumption, and factory emissions. Government incentives for cleaner manufacturing and the rising circular economy allow toolmakers to differentiate through sustainability certifications, green-compliance labeling, and localized production strategies that minimize transport emissions and supply chain risks.

- For instance, “Wiha’s Germany-based production facility utilizes renewable energy to support carbon-reduced manufacturing and enable energy-use disclosure against emissions reporting frameworks.”

Key Challenges:

Price Pressure and Competition from Low-Cost Manufacturers

The market faces intense pricing competition driven by low-cost production hubs offering inexpensive pliers in standard configurations, often targeting mass retail and small repair markets. High-quality manufacturers struggle to balance advanced material costs, compliance testing, and workforce training with competitive price positioning. The commoditization of general-purpose hand tools limits differentiation and compresses margins for legacy brands relying on traditional distribution channels. Counterfeit tools pose additional risks by undermining brand equity and exposing end users to equipment failure or workplace injury. Navigating this challenge requires strategic focus on value-added features, certification-backed quality assurance, and premium segmentation.

Skilled Workforce Shortages and Safety Compliance Constraints

The global shortage of trained technicians, electricians, and maintenance specialists restricts tool demand in industrial and construction sectors where pliers are standard operational tools. New workers require safety-certified insulated pliers and task-specific designs, yet training lags behind the pace of electrification and automation expansion. Regulatory compliance for protective hand tools increases manufacturing and documentation costs, particularly in industries governed by strict electrical and mechanical safety standards. Failure to meet these standards can result in certification penalties and lost contract opportunities. Addressing this challenge demands investment in user education, safety design innovation, and collaboration with vocational training institutes to stimulate tool literacy.

Regional Analysis:

North America

North America holds approximately 32% of the global plier market share, supported by its well-established construction, automotive repair, and industrial maintenance sectors. High adoption of insulated, ergonomic, and precision pliers among certified electricians and technicians drives consistent purchase cycles. Government incentives for renewable energy installation and EV infrastructure enhance demand for cutting, crimping, and terminal pliers. The region also benefits from a strong DIY culture and pervasive home improvement spending. Manufacturers leverage opportunities in lightweight composite tools and safety-compliant designs aligned with OSHA standards, widening the market for professional-grade and consumer-grade hand tools.

Europe

Europe captures nearly 27% of the plier market, driven by stringent workplace safety regulations and rising dependence on energy-efficient and electrically powered equipment. Industrial retrofitting in Germany, the UK, and France stimulates demand for precision and corrosion-resistant pliers, especially in aerospace, rail, and mechanical engineering applications. The region’s sustainability mandate encourages manufacturers to adopt recyclable materials and circular manufacturing practices. Growth in offshore wind projects and maritime operations further supports stainless-steel and anti-corrosion tool adoption. The dominance of professional users and preference for quality-certified tools contribute to steady market pricing and premium brand positioning.

Asia Pacific

Asia Pacific accounts for the largest share at approximately 36%, driven by large-scale infrastructure development, industrial automation, electronics manufacturing, and expanding labor-intensive industries. China and India serve as major production and consumption hubs with rising domestic brands and export capabilities. Rapid urbanization fuels construction and utilities maintenance demand, while the booming electronics sector boosts requirements for micro-cutting, ESD-safe, and precision pliers. Price competitiveness and expansion of retailer and e-commerce channels help widen market penetration. Government-backed training programs to expand technical trades further stimulate tool consumption across commercial and residential applications.

Latin America

Latin America represents close to 3% of global market share, with demand emerging from oil and gas maintenance, automotive repair, and housing projects across Brazil, Mexico, and Argentina. Economic cycles influence professional construction expenditure, yet steady informal repair and refurbishment markets maintain baseline tool consumption. Increasing investments in industrial safety and technical workforce development enhance preference for certified and insulated pliers. Growing e-commerce delivery capabilities and partnerships with regional distributors improve access to advanced tool variants. Affordability remains a key purchasing determinant, creating opportunity for mid-tier but durable plier offerings.

Middle East & Africa

The Middle East & Africa region holds approximately 2% market share, supported by ongoing investments in energy, petrochemical complexes, and urban infrastructure particularly in the UAE, Saudi Arabia, and South Africa. Harsh climatic conditions drive demand for corrosion-resistant and heat-resistant pliers suitable for outdoor and heavy-duty environments. Gradual expansion of renewable energy, power grid modernization, and utility maintenance sustains professional tool procurement. However, import dependency and pricing sensitivities pose barriers to premium tool penetration. Capacity-building initiatives and government-funded vocational institutes may improve skilled usage and future adoption of higher-specification pliers.

Market Segmentations:

By Product Type

- Combination Plier

- Slip Joint Plier

- Needle-Nose Plier

- Straight Nose Plier

- Bent Nose Plier

- Diagonal Cutting Plier

- Locking Plier

By Material

- Alloy Steel

- Carbon Steel

- Stainless Steel

By Application

- Gripping

- Twisting

- Cutting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The plier market features a highly competitive landscape characterized by a mix of global tool brands, regional manufacturers, and cost-driven market entrants targeting mass retail and industrial procurement channels. Leading companies differentiate through advanced materials, ergonomic mechanics, induction-hardened cutting edges, and insulated designs compliant with electrical safety standards. Premium players emphasize product reliability, longer lifecycle tools, and brand-backed warranties to maintain positioning among professional users. Meanwhile, mid-tier manufacturers leverage scalable production and regional distribution advantages to compete on price and utility. Customization for industry-specific applications such as micro-cutting pliers for electronics and corrosion-resistant models for marine use creates niche opportunities. E-commerce and direct-to-consumer models improve visibility and price transparency, intensifying competition, while counterfeit tools challenge brand reputation and end-user safety. Continuous innovation in lightweight composites, sustainability-focused manufacturing, and multifunctional designs remains central to competitive differentiation in both professional and DIY segments.Top of FormBottom of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Snap-on

- Park Tool

- Knipex Tools

- CHISEN Tools

- Akar Tools

- Rennsteig Werkzeuge

- Klein Tools

- MARUTO HASEGAWA KOSAKUJO

- Apex Tool Group

- Lisle Corp

Recent Developments:

- In 2025, Knipex rolled out a new, limited-edition Holiday TwinGrip pliers model (product code 82 01 200 S02, 8-inch/200 mm) as part of its new-products lineup. This model features a special black finish and bronze lettering.

- In 2025, Knipex expanded the availability of its Cobra® ES extra-slim water-pump pliers to new sizes (including 180 mm and a redesigned 250 mm), aiming to offer more flexibility for tight installation spaces.

Report Coverage:

The research report offers an in-depth analysis based on Product type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for pliers will strengthen as infrastructure expansion and industrial maintenance activities continue to grow globally.

- Manufacturers will increasingly adopt lightweight and ergonomic designs to enhance user comfort and reduce fatigue in professional applications.

- Precision and micro-cutting pliers will gain traction with the rise of electronics, EV manufacturing, and advanced assembly operations.

- Smart hand tools with force measurement and wear-tracking features may emerge to support productivity and safety monitoring.

- Sustainability initiatives will drive greater use of recyclable materials and environmentally efficient manufacturing processes.

- Insulated and safety-certified pliers will see rising adoption due to stricter electrical safety regulations.

- Customization and modular jaw systems will support multi-functionality and reduce tool inventory requirements for end users.

- E-commerce expansion will improve product accessibility and strengthen competitive pricing dynamics.

- Premium brands will focus on anti-corrosion coatings and extended-life cutting surfaces to differentiate performance.

- Growth in skilled-trade training programs will increase professional tool purchasing across developing markets.