Market Overview

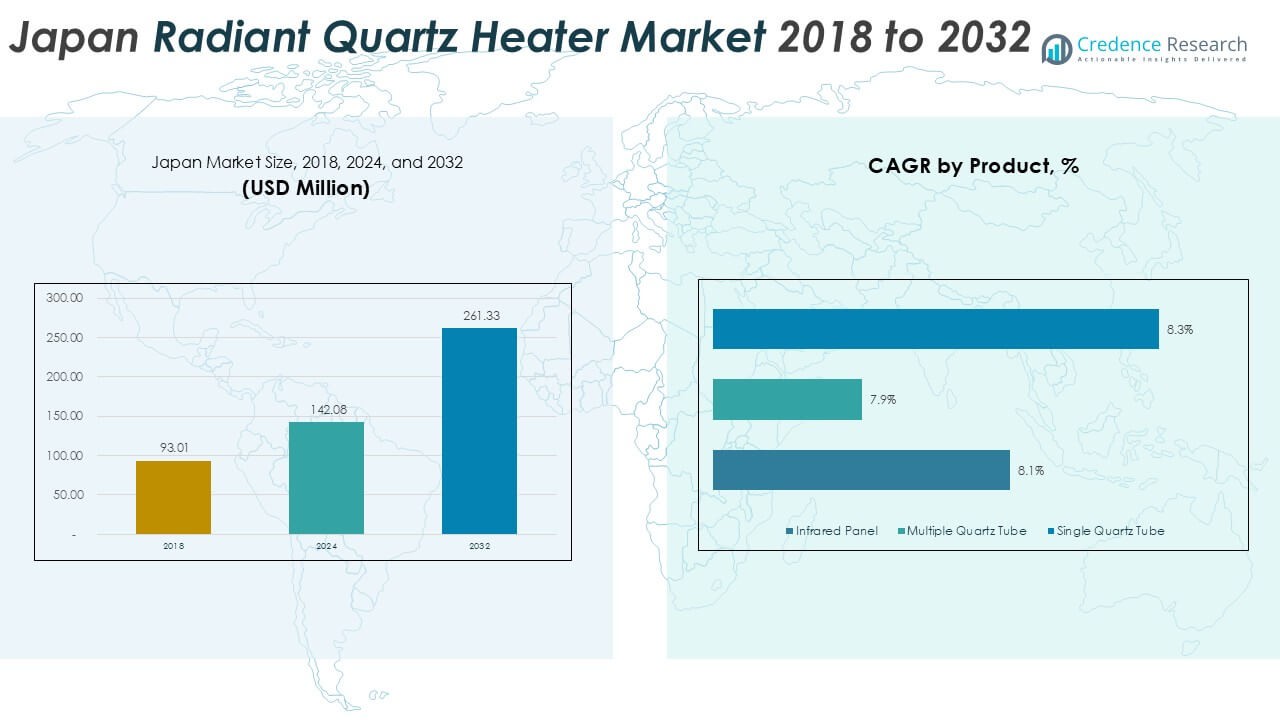

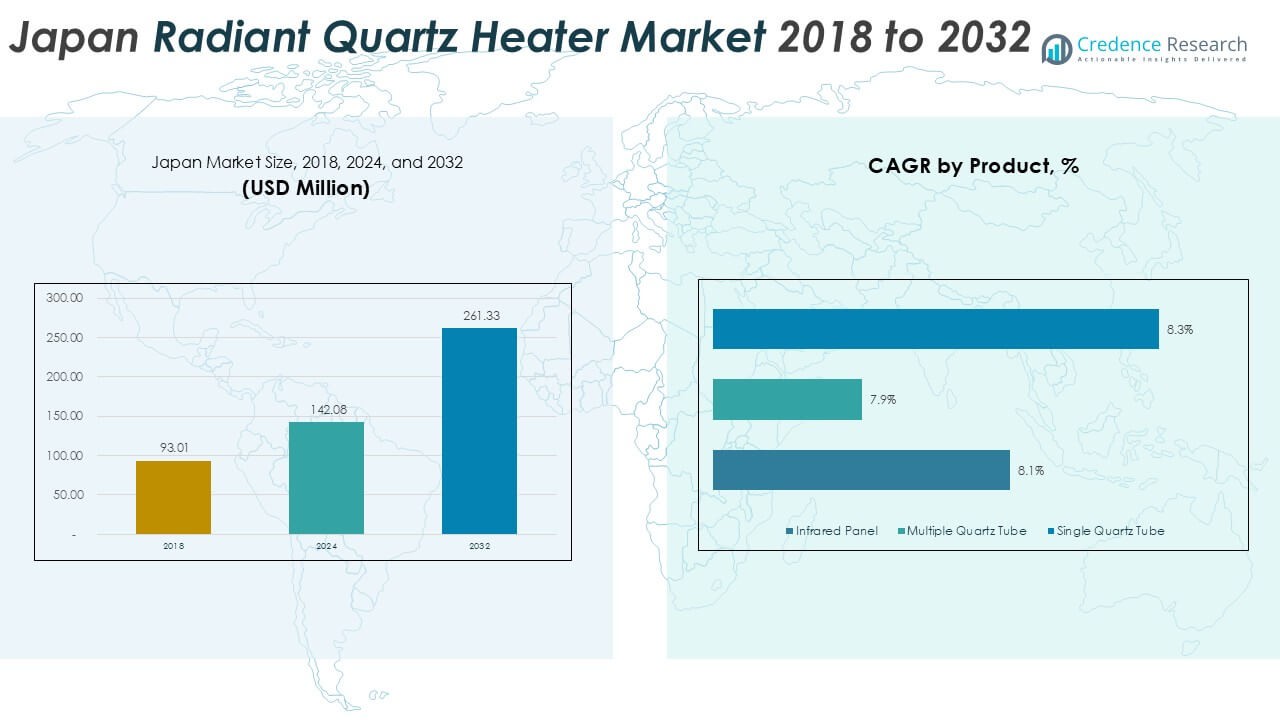

Japan Radiant Quartz Heater market size was valued at USD 93.01 million in 2018 to USD 142.08 million in 2024 and is anticipated to reach USD 261.33 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Radiant Quartz Heater Market Size 2024 |

USD 142.08 Million |

| Japan Radiant Quartz Heater Market, CAGR |

7.9% |

| Japan Radiant Quartz Heater Market Size 2032 |

USD 261.33 Million |

The Japan radiant quartz heater market features a mix of global and regional manufacturers competing on safety, efficiency, and product design. Key players include Elektraa Corp, Convectronics, Tempco Electric Heater Corporation, Döbeln Elektrowärme GmbH, Lasko Products, TPI Corporation, MISUMI Corporation, Duraflame, SPACE-RAY, and Sawhney Industries. These companies focus on compact, portable heaters suited for urban households and light commercial use. Strong offline retail presence supports brand visibility and seasonal sales. Regionally, the Kanto region leads the market with approximately 38% share, driven by high population density, apartment living, and higher purchasing power. Kansai follows as the second-largest regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Japan radiant quartz heater market reached USD 142.08 million in 2024 and is projected to grow at a 7.9% CAGR through 2032, driven by steady residential replacement demand.

- Energy efficiency and instant heating remain key drivers, with multiple quartz tube heaters holding about 42% segment share due to faster heat output and suitability for larger rooms.

- Design-focused, compact, and safety-enhanced models represent a strong trend, while the 1000–1500-watt segment leads with nearly 46% share, balancing comfort and electricity costs.

- The market shows moderate competition, with domestic and global players competing on safety certifications, retail reach, and mid-range pricing, while offline channels dominate with around 61% share.

- Regionally, Kanto leads with about 38% share, followed by Kansai at roughly 24%, while Kyushu and Hokkaido–Tohoku together account for nearly 21%, reflecting climate and housing differences.

Market Segmentation Analysis:

By Product

The Japan radiant quartz heater market shows clear product-level segmentation. Multiple quartz tube heaters dominate, holding about 42% market share. Strong demand comes from higher heat output and faster warm-up. These heaters suit larger rooms and semi-commercial spaces. Consumers prefer consistent radiant coverage during cold seasons. Infrared panel heaters follow, driven by slim design and wall-mount options. Single quartz tube models serve budget buyers and small rooms. However, limited heating range restricts wider adoption. Product innovation and safety improvements continue supporting demand across all product categories.

- For instance, CORONA Co., Ltd.’s quartz space heater uses three quartz heating tubes, operates at 1,500 watts, and reaches usable heat output in under 20 seconds, supporting living rooms and retail spaces.

By Wattage Segment

The 1000–1500-watt segment leads the market with nearly 46% share. This range balances energy use and heating efficiency. Japanese households favor moderate power for apartments and compact homes. The segment supports stable indoor comfort without high electricity bills. Below 1000-watt units attract price-sensitive users and spot heating needs. Above 1500-watt models serve large rooms and commercial settings. However, higher energy costs limit adoption. Energy-saving regulations and consumer awareness strongly support mid-range wattage demand.

- For instance, Dainichi , Ltd.’s electric ceramic fan heater (e.g., the Dainichi EF-P1200H-W model) operates at 1,200 watts (on ‘high’ mode) and includes multiple heat levels. This type of electric heater is rated for smaller rooms, such as approximately 6 tatami mats in a wooden house or 8 tatami mats in a concrete house (with insulation).

By Distribution Channel

Offline channels remain dominant, accounting for around 61% market share. Electronics stores allow product inspection and safety assurance. Japanese consumers value in-store guidance for heating appliances. Seasonal promotions and bundled offers also support offline sales. Online channels grow steadily due to convenience and wider product access. E-commerce platforms attract younger buyers and urban users. Competitive pricing and home delivery support online growth. However, trust in physical retail keeps offline channels strong. Omnichannel strategies increasingly shape purchasing behavior.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating

Energy efficiency remains a primary growth driver in Japan’s radiant quartz heater market. Consumers face high electricity costs and strict energy awareness. Radiant quartz heaters convert power directly into heat. This process reduces wasted energy. Many households prefer localized heating over whole-room systems. Quartz heaters support zone-based heating needs. Compact apartments benefit from targeted warmth. Manufacturers improve reflector design and quartz materials. These upgrades enhance heat output efficiency. Government focus on energy conservation supports adoption. Retailers promote efficiency ratings during winter sales. Energy-conscious consumers favor mid-wattage quartz models. This driver supports steady replacement demand. Long product lifespans also reinforce value perception.

- For instance, CORONA Co., Ltd.’s electric quartz heater operates at 1,200 watts, reaches usable heat output in under 15 seconds, and is specified for rooms up to 8 tatami mats, supporting efficient zone heating.

Aging Population and Indoor Comfort Needs

Japan’s aging population strongly supports heater demand. Elderly residents spend more time indoors. They require safe and reliable heating. Radiant quartz heaters provide instant warmth. Fast heating reduces cold exposure risks. Many models include tip-over and overheat protection. Lightweight designs allow easy relocation. Seniors prefer simple controls and quiet operation. Quartz heaters meet these preferences well. Healthcare guidance stresses maintaining warm indoor environments. This advice increases seasonal purchases. Assisted living facilities also adopt portable heaters. Demand rises during colder months. Demographic trends ensure long-term market stability.

- For instance, a common generic quartz heater might weigh around 1.6 to 2.9 kilograms, operate with settings up to 1,000 watts (e.g., 400W/800W or 500W/1000W options), and include standard safety features like an automatic tip-over shutoff switch and overheat protection, supporting safe indoor use.

Growth of Compact Urban Housing

Urban housing patterns shape heating demand in Japan. Apartments dominate major cities. Limited space restricts large heating systems. Radiant quartz heaters fit compact living areas. Slim designs support easy storage. Portable models suit flexible room usage. Renters prefer non-installed heating solutions. Quartz heaters require no permanent setup. This convenience drives strong urban adoption. Real estate developers also favor portable appliances. Seasonal mobility adds further appeal. Manufacturers target urban consumers with space-saving designs. This driver aligns with long-term urbanization trends. Compact living continues supporting market growth.

Key Trends & Opportunities

Expansion of Smart and Safety-Enhanced Features

Smart features create new growth opportunities. Consumers value better control over heating use. Timers and thermostats improve energy management. Remote-control functions add convenience. Some models support smart plugs for automation. Safety remains a critical focus area. Advanced sensors prevent overheating incidents. Child-lock functions attract family households. Japanese buyers prioritize product reliability. Feature-rich models support premium pricing. Retailers upsell smart-enabled heaters during peak seasons. Manufacturers differentiate through safety certifications. This trend supports higher margins. Smart integration will expand steadily.

- For instance, CORONA Co., Ltd.’s electric quartz heater includes a 24-hour programmable timer, operates at 1,200 watts, and features automatic overheat shutoff with tip-over detection, enhancing safety for indoor use.

Design-Focused and Aesthetic Products

Product design plays a growing role in purchasing decisions. Consumers prefer heaters that match interiors. Minimalist styles suit modern Japanese homes. Neutral colors and slim profiles gain traction. Infrared panels attract design-conscious buyers. Hospitality and office spaces demand discreet heating. Visual appeal supports premium positioning. Retail displays highlight form and finish. Manufacturers invest in industrial design. Design-led models target urban professionals. This trend opens opportunities in premium retail channels. Aesthetic differentiation strengthens brand identity.

- For instance, Aladdin (Sengoku Aladdin) offers a graphite toaster oven (model AET-GS13C) with a body width of 350 mm, depth of 295 mm, and operating power of 1,270 watts, designed to blend with modern living spaces.

Growth of Online Sales Channels

Online channels show steady expansion. E-commerce platforms offer wide product selection. Consumers compare features and prices easily. Home delivery supports urban convenience. Seasonal discounts drive online purchases. Younger buyers favor digital channels. Detailed product reviews build trust. However, safety concerns limit full shift online. Brands improve digital content and certifications. Hybrid online-offline strategies gain traction. This trend supports broader market reach. Online growth enhances brand visibility nationwide.

Key Challenges

High Electricity Costs and Usage Sensitivity

Electricity pricing remains a major challenge. Japan has relatively high power costs. Consumers monitor appliance energy use closely. High-wattage heaters face adoption resistance. Long operating hours raise cost concerns. This issue limits demand for large-capacity models. Price-sensitive households delay replacements. Manufacturers must emphasize efficiency benefits. Clear labeling helps address concerns. Energy-saving claims require credibility. This challenge pressures pricing strategies. Brands balance performance with consumption limits. Cost sensitivity may slow premium segment growth.

Competition from Alternative Heating Technologies

Radiant quartz heaters face strong competition. Heat pumps and ceramic heaters gain popularity. Air conditioners with heating modes remain widespread. Oil heaters attract traditional users. Each alternative offers distinct advantages. Consumers compare long-term operating costs. Some alternatives provide whole-room heating. Quartz heaters focus on localized warmth. This positioning limits certain use cases. Manufacturers must clearly communicate benefits. Product education becomes essential. Competitive pressure affects pricing and margins. Differentiation remains critical for growth.

Regional Analysis

Kanto Region

The Kanto region leads the Japan radiant quartz heater market with about 38% share. High population density drives strong residential demand. Tokyo apartments favor compact and portable heating solutions. Consumers prefer quick heating for short winter periods. Quartz heaters suit localized warmth needs well. Office spaces and retail outlets also support demand. Higher disposable income supports premium models. Safety-certified products gain faster acceptance. Offline electronics stores dominate regional sales. Online purchases grow among younger households. Seasonal promotions strongly influence buying patterns. Kanto remains the core revenue center.

Kansai Region

Kansai accounts for nearly 24% market share. Osaka and Kyoto drive steady urban demand. Many homes use supplemental heating during colder months. Radiant quartz heaters serve spot heating needs efficiently. Consumers favor mid-wattage models for energy control. Compact housing supports portable heater adoption. Traditional retail channels remain influential. Price sensitivity is slightly higher than Kanto. Energy efficiency messaging strongly impacts purchase decisions. Hotels and small offices add commercial demand. Stable winter temperatures support consistent seasonal sales.

Chubu Region

Chubu holds around 17% market share. The region combines urban and industrial demand. Nagoya drives residential consumption. Manufacturing hubs support light commercial usage. Cold winters increase heater penetration. Households prefer durable and mid-priced models. Energy-efficient quartz heaters suit regional needs. Offline sales dominate due to strong retail presence. Online channels grow in suburban areas. Consumers focus on reliability and safety features. Replacement demand supports steady growth. Regional climate conditions sustain winter sales volumes.

Kyushu Region

Kyushu represents about 11% market share. Milder winters limit overall heating demand. Consumers mainly use heaters for short durations. Radiant quartz heaters suit occasional use patterns. Lower wattage models dominate regional sales. Price sensitivity remains high among households. Compact and portable designs perform well. Offline retail continues to lead distribution. Online channels expand slowly. Energy cost awareness shapes buying decisions. Seasonal demand peaks remain shorter. Growth stays moderate compared to northern regions.

Hokkaido and Tohoku Region

Hokkaido and Tohoku account for roughly 10% market share. Colder climates drive strong heating needs. However, central heating systems dominate homes. Quartz heaters serve supplemental and spot heating roles. Consumers value fast heat output. High-wattage models see better acceptance here. Safety and durability remain key priorities. Commercial spaces use portable heaters widely. Offline channels dominate due to trust factors. Online adoption remains limited. Seasonal demand intensity remains high during winter months.

Market Segmentations:

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu Region

- Hokkaido and Tohoku Region

Competitive Landscape

The Japan radiant quartz heater market shows a moderately fragmented competitive landscape. Domestic and international manufacturers compete on product safety, energy efficiency, and design quality. Established players leverage strong retail networks and seasonal promotions. Japanese consumers favor brands with proven reliability and safety certifications. Companies focus on compact, portable models suited for urban homes. Product differentiation centers on wattage options and heating speed. Mid-range pricing dominates competitive positioning. Global brands bring standardized designs, while local players adapt to regional preferences. Offline channels remain critical for brand visibility. Online platforms support wider reach and price comparison. Innovation in safety features strengthens brand trust. Competitive intensity increases during winter seasons.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Elektraa Corp

- Convectronics

- Tempco Electric Heater Corporation

- Döbeln Elektrowärme GmbH

- Lasko Products, LLC

- TPI Corporation

- MISUMI Corporation

- Duraflame, Inc.

- SPACE-RAY

- Sawhney Industries

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow steadily due to urban apartment living and compact housing.

- Energy-efficient quartz heaters will gain stronger consumer preference.

- Mid-wattage models will remain the most widely adopted products.

- Safety-certified heaters will see higher acceptance across households.

- Design-focused and slim-profile models will support premium demand.

- Online sales will expand alongside strong offline retail presence.

- Seasonal replacement demand will continue driving market stability.

- Aging population needs will support long-term residential usage.

- Manufacturers will invest more in smart and safety features.

- Regional demand differences will remain shaped by climate conditions.