Market Overview

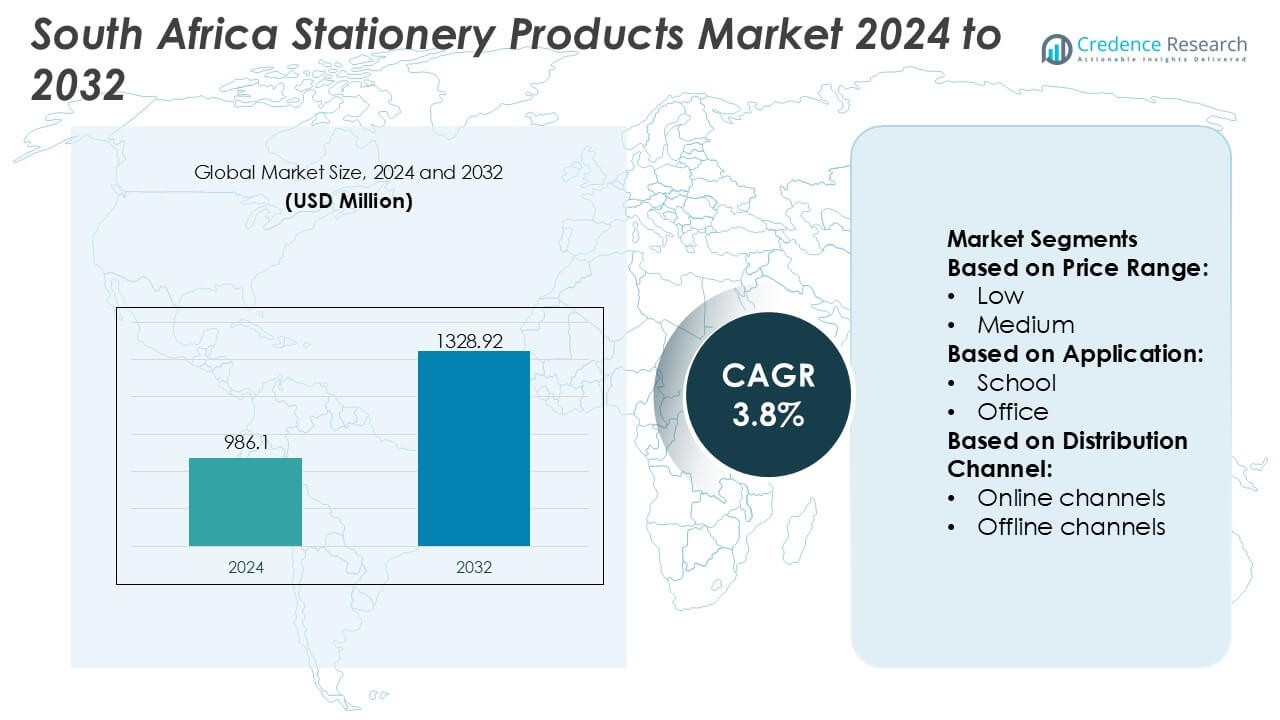

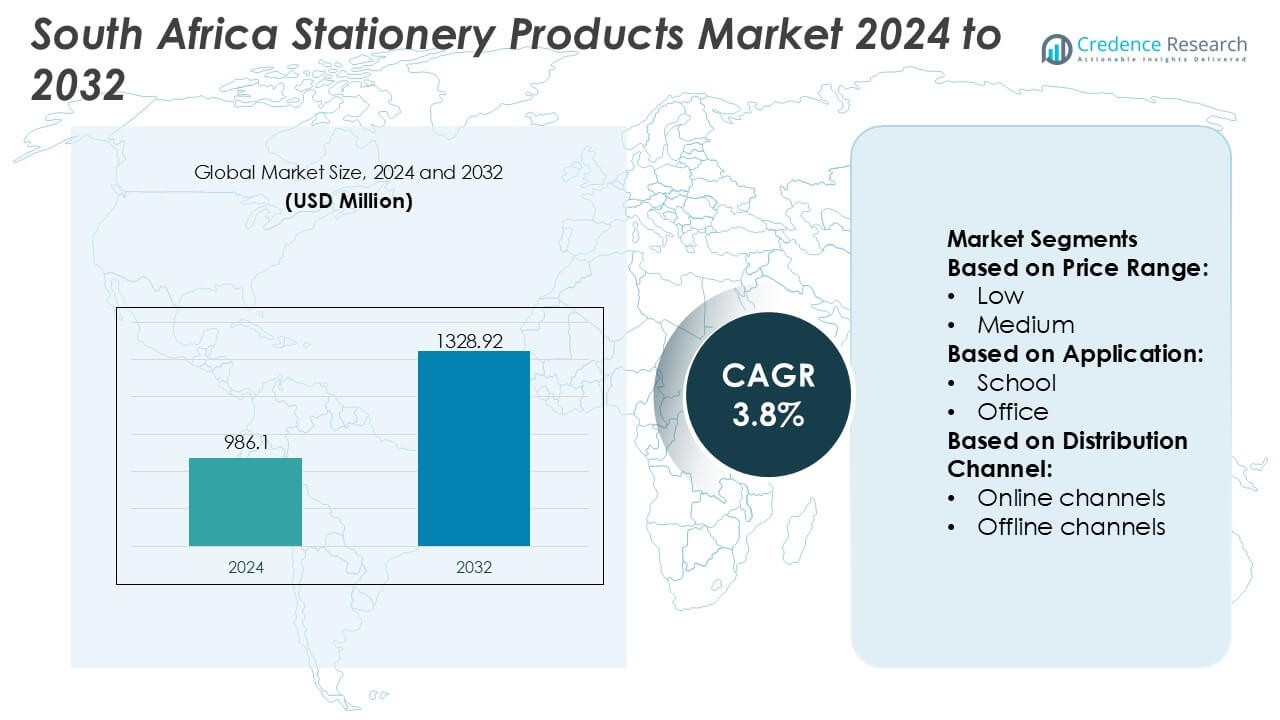

South Africa Stationery Products Market size was valued USD 986.1 million in 2024 and is anticipated to reach USD 1328.92 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa Stationery Products Market Size 2024 |

USD 986.1 Million |

| South Africa Stationery Products Market, CAGR |

3.8% |

| South Africa Stationery Products Market Size 2032 |

USD 1328.92 Million |

The South Africa Stationery Products Market is shaped by a competitive mix of global brands, regional distributors, and emerging local manufacturers that strengthen market performance through diversified product lines, broad retail penetration, and targeted institutional supply programs. Companies compete across writing tools, notebooks, art materials, and office stationery, focusing on affordability, durability, and sustainable product innovation to meet evolving consumer needs. Gauteng remains the leading region with an exact 38% market share, supported by its dense concentration of schools, universities, and corporate offices, along with strong retail infrastructure and high purchasing power that consistently drives stationery demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 986.1 million in 2024 and is projected to hit USD 1328.92 million by 2032 at a CAGR of 3.8%, reflecting steady long-term demand.

- Strong growth drivers include expanding school enrollment, rising SME procurement needs, and increasing adoption of affordable and sustainable stationery across writing tools, notebooks, and art materials.

- Key trends highlight the shift toward eco-friendly products, premium creative stationery, and rapid expansion of e-commerce, which enhances accessibility across urban and suburban regions.

- Competitive dynamics intensify as global and regional players diversify portfolios, strengthen retail partnerships, and focus on value-driven innovation to meet consumer expectations.

- Regional analysis confirms Gauteng as the leading market with 38% share, while core segments such as writing instruments and notebooks dominate national consumption due to recurring academic and office demand.

Market Segmentation Analysis:

By Price Range

The low-price range segment holds the dominant position with an estimated 52–54% share, supported by strong demand for affordable notebooks, pens, and scholastic supplies across public schools and cost-sensitive households. This segment benefits from South Africa’s large student population, government textbook and stationery procurement programs, and expanding availability of low-cost imported products. Medium-priced stationery grows steadily as consumers shift toward better durability and design, while the high-price segment remains niche, driven by premium corporate gifting and branded professional stationery.

- For instance, Crayola, LLC enhanced the cost-efficiency and volume output of its school-supply portfolio after expanding its manufacturing lines in Easton, Pennsylvania, where the company produces more than 3 billion crayons and 700 million markers annually, enabling higher-volume distribution partnerships with emerging markets.

By Application

The school segment leads the South Africa stationery products market with an estimated 58–60% share, driven by continuous academic enrollment, curriculum-linked supply requirements, and recurring annual demand for exercise books, writing instruments, and art materials. Government-funded education initiatives and NGO-supported learning programs further reinforce volume growth. Office applications recover gradually with hybrid working models and rising SME activity, while home-use stationery expands due to hobby crafting, home-schooling trends, and personal organization products gaining popularity.

- For instance, Mitsubishi Pencil Co., Ltd. is a globally established manufacturer of writing instruments, founded and today employs approximately 2,800–2,955 people across 11 production facilities worldwide.

By Distribution Channel

Offline channels dominate with an estimated 62–64% market share, supported by widespread preference for physical verification of products and strong penetration of supermarkets, bookstores, and independent school-supply retailers. Established chains benefit from bulk purchasing by institutions and promotional campaigns aligned with back-to-school seasons. Online channels grow at a faster pace as e-commerce adoption rises, driven by convenience, price comparison features, and expanded digital assortments from major retailers and marketplace platforms, particularly in urban centers.

Key Growth Drivers

- Expanding Education Sector and Enrollment Growth

Rising school enrollment, curriculum modernization, and ongoing investment in basic education strongly accelerate stationery consumption across South Africa. Government-led initiatives to improve access to learning materials boost demand for notebooks, pens, art supplies, and organizational tools. The growing adoption of blended learning models also supports purchases of supplementary stationery for home use. Increasing participation in tertiary education broadens the customer base further, while private schools and tutoring centers create consistent procurement cycles. This structural expansion reinforces steady, long-term growth in the stationery market.

- For instance, ACCO Brands currently manufactures about 40% of its products in company-owned facilities in the countries where it operates; the remaining ~60% are sourced from lower-cost countries (primarily in Asia).

- Growth of Small Businesses and Corporate Procurement Needs

The proliferation of SMEs, remote-work setups, and expanding office infrastructure strengthens demand for essential stationery such as files, notepads, printing supplies, and desk accessories. Businesses increasingly prioritize cost-effective yet durable stationery solutions to support administrative and operational workflows. Procurement activities within corporate offices, call centers, and professional services firms sustain consistent order volumes. Rising entrepreneurship, co-working spaces, and informal business expansion further amplify demand, particularly for affordable bulk stationery. This commercial uptake significantly contributes to the market’s overall volume growth.

- For instance, Canon Inc. enhanced commercial print-supply reliability through its latest toner production upgrades at the Toride Plant, where the company operates high-precision polymerized-toner manufacturing lines capable of producing particles with an average diameter of 5–7 micrometers technology Canon validates as improving image sharpness and reducing fusing energy consumption by more than 10 kilowatt-hours per million printed pages, according to Canon’s proprietary EA-Eco toner process documentation.

- Rising Preference for Affordable and Locally Produced Stationery

Consumers increasingly prefer competitively priced, locally manufactured stationery due to budget-sensitive purchasing behavior and higher trust in domestic brands. Local producers benefit from shorter supply chains, reduced import dependency, and improved pricing flexibility, enabling them to meet demand efficiently. Government incentives supporting small manufacturing units further enhance product availability and diversification. The affordability-driven trend encourages wider adoption of essential stationery products across school, office, and home use. This shift toward value-oriented buying strengthens the role of domestic manufacturers in market expansion.

Key Trends & Opportunities

- Increasing Demand for Eco-Friendly and Sustainable Stationery

Growing environmental awareness accelerates demand for recycled notebooks, biodegradable pens, sustainable paper products, and plastic-free packaging solutions. Schools and corporates actively integrate sustainability criteria into procurement policies, creating opportunities for brands offering green-certified stationery. Local manufacturers invest in eco-materials and waste-reduction processes to differentiate in a competitive market. Retailers expand shelf space for environmentally responsible products as consumers seek low-impact alternatives. This trend creates strong opportunities for innovation and premium product positioning aligned with South Africa’s sustainability goals.

- For instance, Faber-Castell AG supports large-scale sustainable production through its managed forestry operations in Brazil, where the company cultivates approximately 10,000 hectares of pine forests used exclusively for pencil-wood supply, enabling traceable and renewable raw-material sourcing.

- Rapid Growth of Online Stationery Retail and Digital Ordering Platforms

E-commerce adoption expands rapidly as consumers increasingly prefer doorstep delivery, broader product variety, and competitive pricing. Online marketplaces and direct-to-consumer brands accelerate accessibility across urban and peri-urban regions. Digital procurement tools for schools and offices further streamline bulk ordering, reducing operational costs and improving inventory planning. Subscription-based stationery kits and curated bundles gain traction among students and remote professionals. This shift toward digital shopping provides strong growth potential for brands investing in online visibility, logistics partnerships, and efficient fulfillment systems.

- For instance, Dixon Ticonderoga Company through its parent F.I.L.A. Group supports online distribution with large-scale manufacturing capacity, as F.I.L.A.’s global facilities produce more than 3,000,000,000 pencils and colored pencils annually, ensuring consistent supply availability for high-volume e-commerce channels.

- Premiumization Through Designer, Personalized, and Niche Products

Rising interest in premium stationery, including customized planners, artistic pens, and branded notebooks, creates new value-driven opportunities. Urban consumers increasingly view stationery as a lifestyle accessory, driving demand for aesthetic, durable, and specialized items. Independent designers and boutique brands expand offerings in journaling, creative arts, and productivity tools. Retailers leverage personalization trends to offer engraved pens, bespoke covers, and curated stationery sets. The premium segment enables higher margins and allows brands to differentiate in a market still dominated by value-oriented products.

Key Challenges

- Strong Competition from Digital Tools and Paperless Workflows

Digital learning platforms, electronic note-taking apps, and paperless office systems increasingly reduce reliance on traditional stationery. Schools adopting tablets and hybrid digital education models create long-term substitution risks for notebooks, pens, and printing paper. In offices, cloud-based documentation and workflow automation limit demand for conventional office supplies. As digital adoption accelerates, stationery brands must innovate, reposition value offerings, or diversify into hybrid learning accessories to remain competitive. This challenge continues to pressure volume growth in higher-penetration urban markets.

- Price Sensitivity and Supply Chain Cost Pressures

High price sensitivity among consumers restricts premium product uptake and pressures manufacturers to maintain low-cost offerings. Currency fluctuations and import-related costs for paper, ink, and raw materials further impact pricing stability. Retailers face challenges maintaining inventory affordability while managing shipping and distribution expenses. Intense competition from low-cost imported stationery intensifies margin pressures for local producers. These cost dynamics require efficient sourcing strategies, optimized manufacturing processes, and stronger distribution planning to safeguard profitability in a highly price-competitive market.

Regional Analysis

North America

North America holds a 28% share driven by strong institutional procurement from schools, colleges, and corporate offices. High per-capita spending, early adoption of premium stationery, and strong penetration of digital retail channels reinforce market strength. The U.S. remains the primary demand center, supported by diverse product innovation in eco-friendly, personalized, and professional stationery categories. Growth in remote work and hybrid learning sustains demand for planners, notebooks, and writing tools. Retailers benefit from advanced supply chain networks that ensure consistent product availability, allowing North America to maintain a stable and mature market position.

Europe

Europe leads the global stationery market with a 30% share, supported by strong educational infrastructure, high literacy rates, and a long-standing preference for quality writing and office materials. Demand is boosted by established corporate sectors, government procurement programs, and widespread adoption of sustainable stationery. Countries such as Germany, France, and the UK drive innovation in recyclable paper, refillable pens, and premium artistic supplies. Europe’s regulatory focus on environmental compliance accelerates the shift toward eco-certified products. The combination of cultural affinity for writing tools and mature retail networks upholds Europe’s dominant position.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a 34% share, driven by expanding student populations, rapid urbanization, and large-scale consumption of affordable stationery in China, India, Japan, and Southeast Asia. Rising education investments and growing middle-class spending strengthen recurring demand across school, office, and creative stationery categories. Manufacturers benefit from large production capacities and competitive pricing, enabling strong domestic and export supply. E-commerce penetration accelerates accessibility, particularly in tier-2 and tier-3 cities. Asia-Pacific’s combination of scale, manufacturing advantage, and demographic momentum positions it as the global growth engine for stationery products.

Latin America

Latin America accounts for 5% of the global market, driven by steady stationery consumption in Brazil, Mexico, Argentina, and Chile. Seasonal back-to-school demand significantly influences revenue patterns, while expanding public-education programs strengthen notebook and writing tool sales. Economic variability encourages consumers to prioritize value-priced stationery, driving growth in local manufacturing and private-label offerings. Urban centers show rising demand for premium and imported products, particularly within office and art categories. Strengthening e-commerce channels improve penetration across remote areas. Although growth is moderate, ongoing educational development supports stable long-term demand.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, shaped by rising investments in education infrastructure and increasing urbanization. Gulf countries such as the UAE and Saudi Arabia generate strong demand for premium office stationery, while African markets prioritize essential and budget-friendly products. Growth is supported by expanding private schools and corporate sectors. However, supply chain inefficiencies and price sensitivity limit premium adoption in several African economies. E-commerce expansion improves product accessibility, particularly in urban corridors. As educational reforms advance, demand is expected to rise steadily across the region.

Market Segmentations:

By Price Range:

By Application:

By Distribution Channel:

- Online channels

- Offline channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the South Africa Stationery Products Market players such as Crayola, LLC; Kokuyo Co., Ltd.; BIC Group; Herlitz PBS AG; Mitsubishi Pencil Co., Ltd.; ACCO Brands Corporation; Canon Inc.; Faber-Castell AG; Dixon Ticonderoga Company; and Adveo Group International SA. the South Africa Stationery Products Market features a dynamic mix of global brands, regional suppliers, and emerging local manufacturers competing across school, office, and creative stationery segments. Companies strengthen market positioning through product diversification, cost-efficient manufacturing, and expanded retail partnerships. Growing emphasis on sustainable materials, ergonomic designs, and value-oriented pricing shapes competition as consumers increasingly prioritize affordability and environmental responsibility. Retail chains and e-commerce platforms intensify rivalry by offering broader assortments and promotional pricing, while institutional procurement from schools, corporates, and government departments reinforces long-term contracts. Continuous innovation in writing tools, art supplies, and organizational products supports differentiation in an otherwise price-sensitive and highly fragmented market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crayola, LLC

- Kokuyo Co., Ltd.

- BIC Group

- Herlitz PBS AG

- Mitsubishi Pencil Co., Ltd.

- ACCO Brands Corporation

- Canon Inc.

- Faber-Castell AG

- Dixon Ticonderoga Company

- Adveo Group International SA

Recent Developments

- In July 2025, China’s Deli Group launched “The Best Mate in Africa” event in Johannesburg, South Africa, to mark its expansion, showcasing over 1,250 products like pens, notebooks, and art supplies, transitioning to a localized South African subsidiary to deepen market presence, reports PR Newswire and The Malaysian Reserve.

- In November 2024, Swan Mill Group, a U.K. manufacturer, acquired The Gifted Stationery Co. to boost its presence in the stationery market, with Gifted’s owner, Nigel Parr, staying on to run it as a standalone brand within the group, leveraging its complementary products like diaries, calendars, and the “Hey Hugo” children’s line for growth.

- In May 2024, bioQ launched the world’s first 100% biodegradable pen, the NOTE pen, in India around featuring non-toxic ink, recycled paper refills, and exteriors in bamboo, paper, or metal to combat plastic waste from billions of discarded pens. Founded by Saurabh H. Mehta, this innovation offers a plastic-free alternative, using materials like newspaper and natural fibers for a truly eco-friendly writing solution.

Report Coverage

The research report offers an in-depth analysis based on Price Range, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience steady demand growth driven by expanding school enrollment and ongoing education-sector investments.

- Rising SME activity and hybrid work arrangements will continue to support consistent procurement of office stationery.

- Eco-friendly and recyclable stationery products will gain stronger market acceptance as sustainability preferences intensify.

- E-commerce platforms will capture a larger share of stationery sales through wider product access and competitive pricing.

- Local manufacturers are likely to strengthen their presence by offering cost-effective alternatives to imported products.

- Premium stationery and personalized items will expand gradually in urban centers with higher disposable incomes.

- Retailers will increasingly adopt data-driven inventory strategies to improve availability during seasonal demand peaks.

- Government supply programs and public-school distribution initiatives will continue to shape procurement cycles.

- Digital learning tools may slow growth in certain traditional stationery categories but create opportunities in hybrid-use accessories.

- Market competition will intensify as global and regional brands enhance distribution partnerships and product innovation.