Market Overview

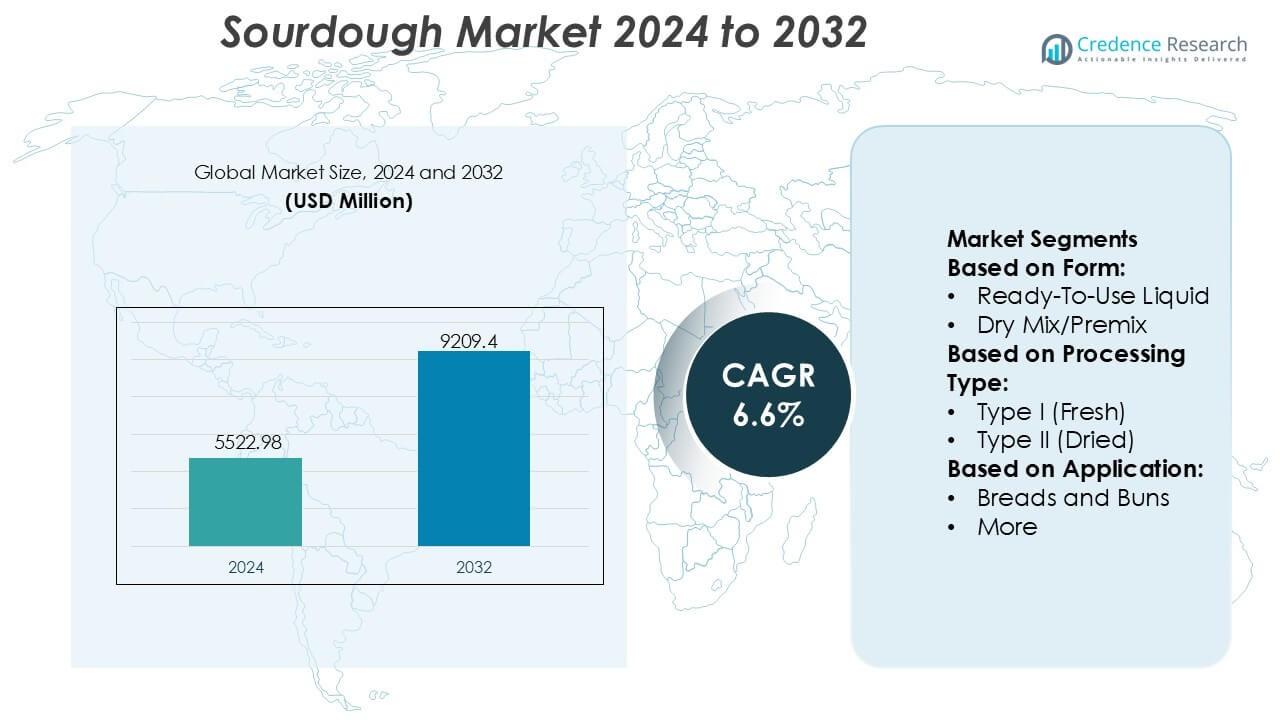

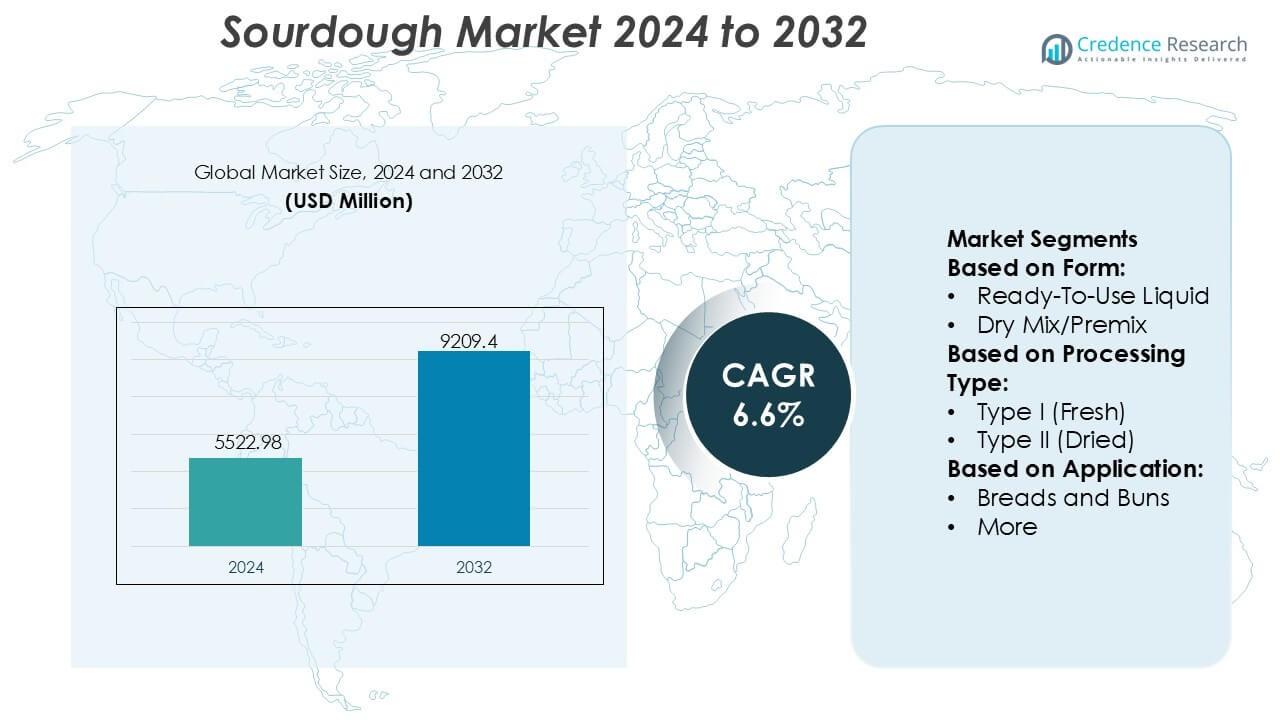

Sourdough Market size was valued USD 5522.98 million in 2024 and is anticipated to reach USD 9209.4 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sourdough Market Size 2024 |

USD 5522.98 Million |

| Sourdough Market, CAGR |

6.6% |

| Sourdough Market Size 2032 |

USD 9209.4 Million |

The sourdough market features a mix of global fermentation specialists, industrial bakeries, and artisanal producers that collectively shape product innovation, quality consistency, and large-scale commercialization. Leading companies strengthen market growth through investments in controlled fermentation systems, ready-to-use starter cultures, and expanded premium bread portfolios that align with clean-label demand. Europe remains the dominant regional market with an exact 38% share, supported by strong artisanal traditions, mature bakery infrastructure, and deep consumer preference for naturally fermented bread varieties. The region’s emphasis on long-fermentation quality, flavor authenticity, and advanced production capabilities continues to reinforce its competitive leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sourdough Market was valued at USD 5522.98 million in 2024 and is projected to reach USD 9209.4 million by 2032, reflecting a 6.6% CAGR.

- Strong market growth is driven by rising clean-label demand, increased preference for natural fermentation, and expanding adoption of ready-to-use starter cultures across industrial bakeries.

- Trends highlight the rapid premiumization of breads, with artisanal and long-fermented formats gaining traction and shaping competitive differentiation through flavor depth, texture, and nutritional appeal.

- Competitive activity intensifies as producers invest in controlled fermentation technologies and diversified sourdough-based product lines, while smaller artisanal brands elevate market authenticity.

- Europe leads with an exact 38% share, driven by established bakery traditions, while the breads segment holds the dominant application share due to high consumption frequency and strong preference for naturally fermented bakery products.

Market Segmentation Analysis:

By Form

The ready-to-use liquid form dominates the sourdough market with an estimated 54–56% share, driven by rising adoption among commercial bakeries seeking consistent fermentation performance and reduced preparation time. Its active microbial stability, ease of dosing, and suitability for large-scale automated dough systems strengthen its leadership. Dry mix or premix formats expand steadily due to longer shelf life and cost-efficient transport, attracting small bakeries and home bakers; however, their lower microbial activity compared with liquid cultures limits penetration in artisanal and industrial applications that require robust flavor development and controlled acidity.

- For instance, Gold Coast Baking Company in Southern California, not the Queensland company). That site claims 1 million units daily to over 14,000 locations 500,000+ pounds of flour a week and delivery to 14K+ locations.

By Processing Type

Type I (fresh sourdough) remains the dominant processing category with a 51–53% share, supported by its continuous fermentation method that yields superior aroma, improved crust characteristics, and enhanced digestibility attributes highly valued in premium and artisanal bread production. Type II (dried) sourdough gains traction in packaged bakery segments due to convenient handling, long storage stability, and reduced microbial variability. Emerging Type III and other hybrid processing innovations strengthen diversification, but their adoption remains comparatively lower as manufacturers continue to prioritize the authenticity and sensory depth associated with Type I systems.

- For instance, Josey Baker Bread documents that its sourdough process utilizes a daily-refreshed, highly hydrated 100% whole grain rye starter and a long fermentation time.

By Application

Breads and buns represent the leading application segment with a commanding 62–64% share, driven by expanding consumer preference for natural leavening, improved shelf life, and enhanced nutritional profiles such as better digestibility and reduced glycemic response. Industrial bakeries integrate sourdough to differentiate mainstream bread lines and meet clean-label expectations. Other applications including crackers, pizza bases, pancakes, and specialty baked goods grow steadily as foodservice operators and packaged goods manufacturers upgrade flavor complexity and texture. Yet, the strong functional performance and broad consumption frequency of breads ensure their continued dominance across global markets.

Key Growth Drivers

Rising Consumer Demand for Clean-Label and Natural Fermentation

Growing preference for minimally processed foods strengthens demand for sourdough due to its natural fermentation process, absence of chemical additives, and enhanced digestibility. Consumers increasingly recognize sourdough’s nutritional benefits, including improved mineral bioavailability and reduced gluten intensity, which drives adoption across premium and mainstream bakery categories. Brands leverage clean-label positioning to differentiate product portfolios and strengthen customer retention. Expanding awareness through retail, foodservice, and digital platforms reinforces market momentum and encourages manufacturers to scale production capabilities and diversify formulations.

- For instance, Puratos committed to preserving sourdough biodiversity. The Institute houses a proprietary library containing 153 distinct sourdough cultures and analytical capacity for over 1,500 isolated strains, enabling systematic study of fermentation behaviours, digestive effects, shelf-life, flavour development, and nutritional outcomes.

Expansion of Artisanal and Premium Bakery Products

The rise of artisanal bakeries and specialty bread formats significantly boosts sourdough adoption, as producers prioritize authentic flavor, crust quality, and long fermentation profiles that appeal to premium-focused consumers. Growth in gourmet retail channels and upscale cafés strengthens demand for handcrafted sourdough varieties. Industrial bakeries integrate artisanal-inspired techniques to replicate premium attributes at scale, widening product reach. Globalization of European bread culture further accelerates market expansion, encouraging suppliers to invest in active cultures, advanced fermentation control, and innovative liquid starter systems.

- For instance, Alpha Baking replaced 22 diesel trucks with propane-powered step vans (Class 4) to reduce greenhouse gas emissions according to a study by Argonne National Laboratory under the U.S. Department of Energy’s Clean Cities program.

Increased Industrial Utilization for Shelf-Life and Texture Enhancement

Manufacturers increasingly adopt sourdough as a functional ingredient to improve dough rheology, enhance product softness, and extend shelf stability without artificial preservatives. Its ability to reduce staling, improve crumb structure, and enhance flavor continuity supports strong usage in packaged breads, buns, and frozen bakery goods. Industrial bakeries integrate controlled sourdough fermentation systems to optimize production consistency and lower wastage. Demand strengthens across both mature and emerging markets, driven by consumer expectations for high-quality baked products with longer-lasting freshness.

Key Trends & Opportunities

Growth in Hybrid and Specialty Sourdough Innovations

Manufacturers invest in hybrid sourdough formulations—combining traditional fermentation with enzymes, specialty grains, and nutritional boosters—to meet evolving dietary preferences. Rising interest in high-fiber, gluten-reduced, and protein-enriched bakery goods creates opportunities for differentiated product development. Innovations such as quinoa, rye, spelt, and ancient-grain sourdoughs improve flavor diversity and broaden premium offerings. Expanded R&D capabilities enable companies to commercialize stable liquid and dried cultures tailored for specific dough systems, supporting deeper penetration in both commercial and home-baking segments.

- For instance, Truckee Sourdough produces on average 10,000 loaves per day and offers a diverse range of sourdough loaves, rolls, and sliced breads for both commercial consumption and wholesale clients in the region.

Expansion of Sourdough Applications Beyond Bread

Sourdough’s versatility fosters new growth opportunities across pizza bases, crackers, tortillas, pastries, and snack formats. Foodservice operators leverage sourdough to elevate texture and flavor while meeting rising demand for craft-style offerings. Packaged food companies introduce sourdough-based convenience formats that appeal to health-conscious and premium-oriented consumers. The increasing popularity of global fusion bakery items supports category diversification, motivating manufacturers to enhance fermentation technologies and supply high-performance cultures customized for varied applications.

- For instance, Sunrise Medical designs, manufactures, and distributes both manual and powered wheelchairs globally. The company has manufacturing sites in 10 countries and sells its products in over 130 countries.

Key Challenges

High Production Costs and Long Fermentation Requirements

Sourdough manufacturing involves extended fermentation, climate-controlled environments, and continuous starter maintenance, leading to higher operational costs than conventional yeast-based baking. Industrial producers face challenges in balancing artisanal quality with throughput efficiency, especially when scaling long-fermentation protocols. Smaller bakeries often struggle with resource-intensive handling of active cultures, limiting product variety and production volumes. These factors create barriers for cost-sensitive markets and slow adoption in regions where quick-process bakery methods dominate.

Variability in Fermentation Performance and Quality Consistency

Sourdough’s microbial complexity introduces variability in acidity, aroma, and dough performance, posing operational challenges for large-scale bakeries seeking uniform output. Fluctuations in temperature, hydration levels, and starter activity increase risk of batch inconsistencies, impacting shelf-life and final product texture. Producers invest in standardized dried or liquid cultures to reduce variability, yet such solutions may still fall short of replicating authentic nuances. This performance unpredictability restricts rapid automation and complicates integration into highly mechanized bakery lines.

Regional Analysis

North America

North America holds an estimated 32–34% share of the sourdough market, driven by strong consumer interest in artisanal bakery products, clean-label formulations, and premium bread varieties. Large commercial bakeries upgrade fermentation systems to meet rising demand for natural leavening and improved texture in packaged breads and buns. Growth in foodservice channels, including cafés and gourmet bakeries, reinforces consumption across urban markets. The region benefits from advanced production infrastructure, widespread retail penetration, and growing adoption of ready-to-use sourdough cultures that support consistent quality and large-scale manufacturing efficiency.

Europe

Europe leads the global sourdough market with a commanding 38–40% share, supported by deep-rooted bread traditions, strong artisanal culture, and high acceptance of naturally fermented products. Countries such as Germany, Italy, France, and the Nordics drive robust consumption due to preference for dense, flavorful, and long-fermented bread varieties. Established bakery chains and industrial manufacturers incorporate sourdough to enhance shelf life and meet clean-label standards. Extensive R&D, mature bakery ecosystems, and diversified product portfolios reinforce Europe’s dominant position, while rising export activities strengthen its influence across global bakery supply chains.

Asia-Pacific

Asia-Pacific accounts for roughly 18–20% share, emerging as the fastest-growing region due to rising Western-style bakery adoption, rapid urbanization, and expanding café culture. Consumers increasingly favor premium bread formats featuring soft texture and mild sour notes, encouraging manufacturers to adapt sourdough technologies to regional taste profiles. Growing retail bakery chains in China, Japan, South Korea, and Southeast Asia accelerate market penetration. Investment in automated bakery lines and localized starter culture production supports scalability, while the strong e-commerce ecosystem broadens access to sourdough-based mixes, artisanal loaves, and ready-to-bake products.

Latin America

Latin America captures an estimated 6–7% share, supported by steady growth in bakery modernization and rising interest in natural fermentation techniques. Countries such as Brazil, Mexico, and Argentina increasingly incorporate sourdough into premium bread lines to enhance flavor and product differentiation. Expanding supermarket bakeries and café chains accelerate adoption, particularly in metropolitan areas. Challenges around production cost and access to specialized cultures persist, yet rising consumer awareness of sourdough’s nutritional and sensory benefits encourages manufacturers to invest in scalable fermentation solutions and value-added bakery innovations.

Middle East & Africa

The Middle East & Africa region holds 4–5% share, with growth driven by expanding artisanal bakery formats, rising tourism, and increasing demand for premium bread products in urban centers. Countries in the Gulf Cooperation Council (GCC) invest in high-quality bakery infrastructure and import sourdough cultures to support upscale retail and foodservice offerings. Adoption remains moderate due to limited local fermentation expertise and price sensitivity, yet interest in health-focused bakery items and European-style breads strengthens momentum. Growing retail diversification and improved cold-chain logistics gradually enhance SOURDOUGH penetration across key markets.

Market Segmentations:

By Form:

- Ready-To-Use Liquid

- Dry Mix/Premix

By Processing Type:

- Type I (Fresh)

- Type II (Dried)

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sourdough market features including Bread SRSLY, Lallemand, Gold Coast Bakeries (Queensland) Pty Ltd, Josey Baker Bread, Puratos, Morabito Baking Co. Inc., Riverside Sourdough, Alpha Baking Company, Inc., Boudin Bakery, and Truckee Sourdough Company. the sourdough market reflects a blend of artisanal craftsmanship and advanced industrial capabilities, with companies focusing on innovation in fermentation science, product consistency, and clean-label formulations. Leading producers invest in controlled starter culture development, long-fermentation technologies, and scalable liquid and dried sourdough solutions to support both premium and mass-market bakery applications. Artisanal and specialty bakeries enhance competition by emphasizing unique flavor profiles, extended fermentation, and high-quality ingredients that appeal to health-conscious consumers. Industrial bakeries expand sourdough integration across packaged breads, buns, and frozen bakery formats, reinforcing market penetration. Continuous R&D, capacity expansion, and strategic retail partnerships strengthen overall competitiveness and accelerate global adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bread SRSLY

- Lallemand

- Gold Coast Bakeries (Queensland) Pty Ltd

- Josey Baker Bread

- Puratos

- Morabito Baking Co. Inc.

- Riverside Sourdough

- Alpha Baking Company, Inc.

- Boudin Bakery

- Truckee Sourdough Company

Recent Developments

- In October 2024, Lallemand Inc. acquired Singapore’s CerealTech Pte Ltd, integrating it into Lallemand Baking Solutions (LBS) but keeping CerealTech’s Singapore operations, branding, and commercial teams intact for regional growth and a broader portfolio, as confirmed by sources like Milling Middle East & Africa and Baking Business.

- In June 2024, Nutraj launched the “NutrajSnackrite Daily Nutrition Pack,” a convenient trail mix offering with individual pouches and a reusable tiffin, designed to promote healthy snacking habits with premium nuts and dried fruits, available across online and physical stores in India.

- In May 2024, Bakels Group unveiled Fermdor Active a concentrated powder that lets bakers easily create premium artisan breads with the authentic, full-bodied taste and aroma of traditional sourdoughs, using just flour, salt, water, and a 4% dosage of the improver for consistent, high-quality results with less complexity. Developed by Bakels’ experts, it’s a cost-effective solution for consistent quality and convenience in artisan baking.

- In May 2024, Puratos Group launched Sapore Lavida, Belgium’s inaugural fully traceable active sourdough, Crafted solely from 100% whole wheat flour obtained through regenerative agriculture practices, Sapore Lavida is poised to empower bakers across.

Report Coverage

The research report offers an in-depth analysis based on Form, Processing Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as clean-label bakery demand accelerates and consumers prioritize natural fermentation.

- Industrial bakeries will increase adoption of standardized sourdough cultures to improve consistency and shelf-life performance.

- Artisanal and premium bread formats will gain more visibility across retail channels, boosting product diversification.

- Hybrid sourdough formulations using ancient grains and functional ingredients will strengthen innovation pipelines.

- Foodservice operators will broaden sourdough-based menu offerings to meet rising preference for premium textures and flavors.

- Ready-to-use liquid and dried starters will see wider global penetration due to operational efficiency benefits.

- E-commerce growth will enhance access to specialty sourdough products, mixes, and home-baking kits.

- Manufacturers will invest in automation to optimize long-fermentation processes and reduce production variability.

- Health-focused consumers will drive demand for sourdough products with improved digestibility and nutritional attributes.

- Regional bakeries will collaborate with fermentation technology providers to upgrade sourdough quality and production capacity.