Market Overview

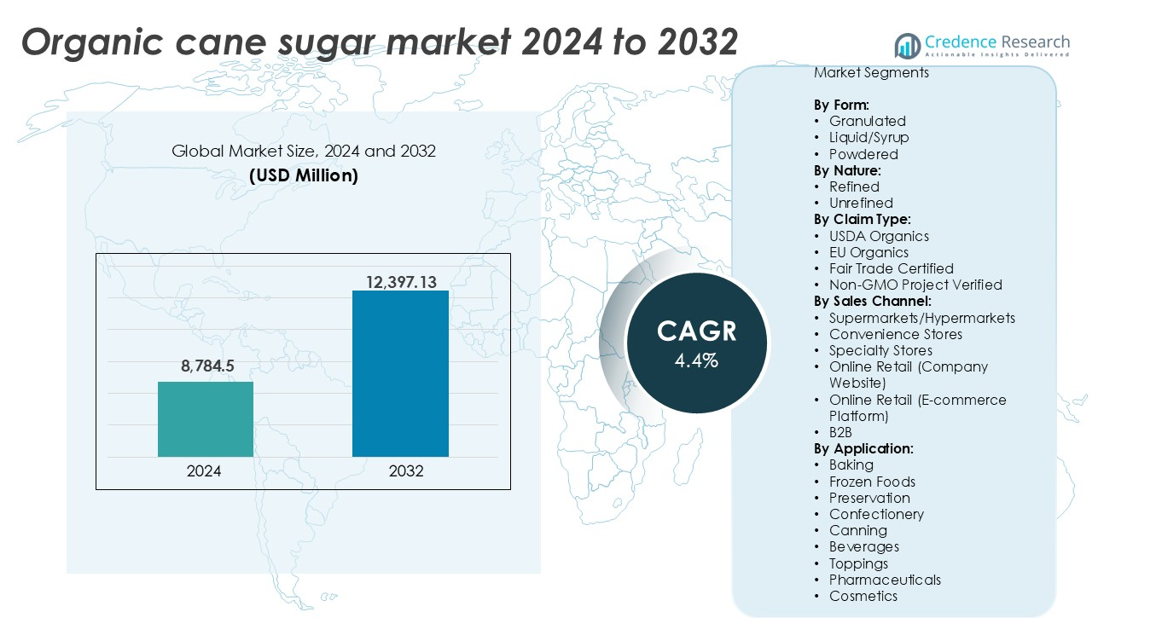

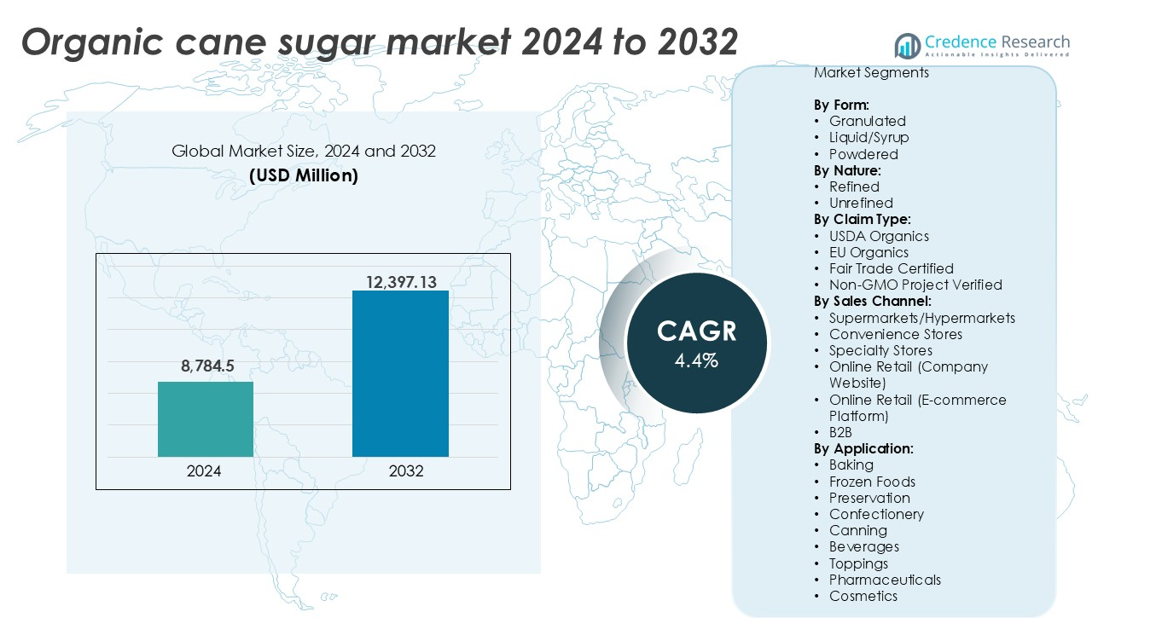

The Organic Cane Sugar Market was valued at USD 8,784.5 million in 2024 and is anticipated to reach USD 12,397.13 million by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organic Cane Sugar Market Size 2024 |

USD 8,784.5 million |

| Organic Cane Sugar Market, CAGR |

4.4% |

| Organic Cane Sugar Market Size 2032 |

USD 12,397.13 million |

Top players in the organic cane sugar market include ASR GROUP, Wholesome Sweeteners, Inc., Louis Dreyfus Company, ORGANICWAY FOOD INGREDIENTS INC., and Global Organics, Ltd. These companies lead through certified supply chains, global sourcing networks, and strong retail or B2B partnerships. ASR GROUP and Wholesome Sweeteners, Inc. hold significant volume share due to wide product portfolios and established contracts with food manufacturers. North America dominates the global market with a 35% share, driven by high organic food consumption, advanced retail infrastructure, and strong regulatory support. Europe follows closely with 28% share, supported by stringent organic standards and growing demand for ethical, traceable ingredients. Both regions provide a stable consumer base for certified organic cane sugar, helping global leaders maintain steady sales growth.

Market Insights

- The Organic Cane Sugar Market was valued at USD 8,784.5 million in 2024 and is projected to reach USD 12,397.13 million by 2032, growing at a CAGR of 4.4%.

- Rising demand for clean-label and chemical-free sweeteners in food and beverage industries is driving steady market growth.

- Granulated form holds the highest share among all product forms due to its widespread use in processed foods, bakery, and beverages.

- North America leads the market with a 35% share, followed by Europe at 28% and Asia-Pacific at 22%, driven by both consumption and export growth.

- High production costs, limited organic farmland, and strict certification requirements restrain supply chain scalability in price-sensitive markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Granulated organic cane sugar holds the largest share in the form segment, accounting for over 55% of the global market. Its high adoption across bakery, beverages, and packaged foods supports dominant demand. Food processors prefer granulated sugar for ease of handling, consistent texture, and extended shelf life. The powdered form follows, driven by its usage in confectionery and instant mixes. Liquid/syrup form remains niche, yet its use in health drinks and organic syrups is expanding. Granulated sugar’s compatibility with diverse recipes keeps it the preferred form across retail and industrial applications.

- For instance, Wholesome Sweeteners produces over 70,000 metric tons of granulated organic cane sugar annually, supplying major food brands and retailers in North America.

By Nature

Refined organic cane sugar dominates the nature segment with nearly 65% market share. It finds strong demand from processed food and beverage manufacturers that require uniform sweetness and appearance. Refined variants offer greater consistency and fewer impurities, making them suitable for commercial-scale use. Unrefined sugar, while smaller in share, is gaining popularity in clean-label and natural food categories. The refined segment benefits from scalability, color control, and broader regulatory acceptance across export markets, which continues to strengthen its position in mainstream food applications.

- For instance, Florida Crystals supplies USDA-certified organic cane sugar to global food processors from its South Florida facilities, where it manages approximately 190,000 acres of land. As the first domestic producer of Regenerative Organic Certified® sugar, the company contributes to the ASR Group’s global refining capacity of over 6 million metric tons annually.

By Claim Type

USDA Organics leads the claim type segment, contributing to over 40% of global market value. Strong regulatory standards and consumer trust in USDA labeling drive this dominance. EU Organics follows, supported by rising organic food demand across European countries. Fair Trade Certified sugar is also gaining ground, especially among socially conscious brands. Non-GMO Project Verified claims appeal to niche health-focused buyers but represent a smaller share. Overall, USDA Organics holds its lead due to global recognition, retailer preference, and stronger marketing support in North America and beyond.

Key Growth Drivers

Rising Demand for Clean-Label and Organic Ingredients

Consumers increasingly prefer natural, minimally processed sweeteners, driving strong interest in organic cane sugar. Health-conscious buyers seek clean-label products free from synthetic additives, preservatives, and chemicals. Organic cane sugar aligns well with these preferences due to its chemical-free cultivation and production processes. Food and beverage manufacturers are reformulating product lines to meet organic certification standards, creating sustained demand. This shift is evident in bakery, snacks, beverages, and packaged food sectors, where organic sugar replaces conventional options. Growing awareness of food sourcing and health impacts further supports long-term growth. Regulatory support and organic food marketing campaigns across developed markets add to momentum.

- For instance, General Mills committed to sourcing 100% certified organic sugar for its Annie’s brand by 2024, replacing all conventional sweeteners across its snack and cereal categories.

Expanding Global Organic Food and Beverage Industry

The expanding organic food industry globally is a major driver for the organic cane sugar market. Major economies such as the U.S., Germany, and France are witnessing increased organic product sales across supermarkets and online platforms. Organic cane sugar remains a core ingredient across multiple food applications, including dairy, cereals, beverages, sauces, and baby food. The growing number of certified organic brands and private labels has increased bulk procurement of organic cane sugar. Emerging markets like India and Brazil are also contributing to growth, both as consumers and producers. With improved distribution channels, enhanced supply chain transparency, and certification compliance, organic food manufacturers continue to increase organic sugar usage.

- For instance, ALDI SÜD sources organic sugar primarily from beets and cane for its private-label lines (such as Nur Nur Natur and Specially Selected) across more than 4,400 stores in Europe. The retailer leverages international procurement departments based in Salzburg and Mülheim to manage high-volume supply chains and ensure consistent organic standards across its markets in Germany, the UK, Ireland, Italy, Switzerland, Austria, and Hungary.

Supportive Regulations and Certifications Enhancing Market Confidence

Regulatory frameworks and certifications play a critical role in building trust among buyers and enhancing product credibility. Certifications like USDA Organics, EU Organics, and Fair Trade Certified ensure strict compliance with sustainability and food safety norms. These marks serve as proof of ethical sourcing, environmental responsibility, and chemical-free production. Retailers and large food brands rely on such certifications to differentiate products and capture health-conscious consumers. The standardized certification processes have enabled consistent exports and imports across regulated markets, supporting the global trade of organic cane sugar. Government subsidies and incentives for organic farming in countries like the U.S., India, and EU nations further strengthen production and distribution networks.

Key Trends & Opportunities

Growth in Premium and Ethical Food Products

Premiumization of food products is gaining pace, with consumers seeking high-quality, ethically sourced ingredients. Organic cane sugar fits into premium food categories due to its sustainable farming practices and traceable supply chains. The trend toward “better-for-you” foods and sustainable sourcing is pushing brands to integrate Fair Trade and Non-GMO Verified claims. Ethical consumerism, especially among millennials and Gen Z, has increased demand for products that support fair labor and eco-friendly farming. This creates opportunities for producers to align their offerings with evolving buyer values and gain loyalty in premium grocery and e-commerce channels.

- For instance, Wholesome Sweeteners was the first U.S. brand to launch Fair Trade Certified and Non-GMO Project Verified organic cane sugar, supplying over 150 million pounds of ethically sourced sweeteners annually.

Expansion of B2B and Online Retail Channels

E-commerce and B2B trade expansion are reshaping access to organic cane sugar, especially in urban and export-driven markets. Online platforms enable small and medium enterprises to purchase bulk organic sugar with verified certifications. Direct-to-consumer organic brands use company websites and e-commerce platforms to distribute organic goods more widely. B2B channels offer manufacturers a chance to source certified organic cane sugar from global suppliers efficiently. With improved cold chains, tracking systems, and cross-border logistics, suppliers can now target niche industrial users and enter new regional markets more effectively.

Key Challenges

High Cost of Organic Production and Certification

The cost of producing and certifying organic cane sugar remains significantly higher than conventional sugar. Organic farming requires more labor, strict control of pest management, and longer cultivation cycles. Certification processes involve detailed inspections, documentation, and annual renewals, which burden small farmers and cooperatives. These high costs limit scalability, especially in price-sensitive markets where affordability is critical. Limited access to certified land and farming inputs further raises production costs. The resulting higher retail prices can deter mass-market adoption, particularly in developing regions with limited consumer purchasing power.

Supply Chain Complexity and Limited Availability

Organic cane sugar supply chains face complexity due to restricted cultivation areas, seasonal yield variability, and dependence on certification bodies. Limited availability of organic farmland and certified processing facilities narrows sourcing flexibility. Adverse weather, pests, or soil depletion can reduce yield, causing supply disruptions. Import-export regulations, documentation errors, and certification mismatches can slow shipments, impacting B2B operations. This fragmented supply network makes it difficult for food companies to maintain consistent ingredient sourcing. Ensuring traceability and quality control throughout the chain remains a challenge, especially when scaling operations across multiple geographies.

Regional Analysis

North America

North America holds the largest share in the global organic cane sugar market, accounting for over 35% of total revenue. The U.S. drives most of the demand due to high consumption of organic food and strong retailer presence. Large food manufacturers prefer USDA-certified sugar to meet clean-label and non-GMO product standards. Consumer preference for natural and sustainable sweeteners fuels steady growth. Increased availability across supermarkets and health-focused e-commerce channels strengthens distribution. Canada also contributes with growing awareness of organic ingredients. Regulatory backing and premium product launches continue to support market expansion across the region.

Europe

Europe accounts for around 28% of the global organic cane sugar market, with Germany, France, and the U.K. leading regional demand. EU Organics certification drives consumer confidence and ensures strict production standards. The market benefits from strong government support for organic farming and sustainability regulations. Retailers across Europe promote fair trade and ethically sourced ingredients, further boosting sales. Increasing demand for organic confectionery, bakery, and beverage products strengthens B2B uptake. Growth remains steady across Western Europe, while Eastern Europe sees rising awareness. The region’s mature organic food ecosystem ensures stable demand and consistent product innovation.

Asia-Pacific

Asia-Pacific holds approximately 22% market share and shows the fastest growth in the organic cane sugar market. India and Thailand are key producers, while Japan, China, and South Korea show rising consumption. Regional expansion is supported by increasing health awareness, urbanization, and organic product availability. Government support for organic farming and rising disposable income boost both supply and demand. India’s export potential grows as domestic organic production expands. Rising online retail penetration and natural food trends drive market visibility. The region’s dual role as a producer and consumer base offers strong long-term opportunities.

Latin America

Latin America holds around 10% of the global market, supported by countries like Brazil and Paraguay with strong organic cane production. The region benefits from favorable climate, low production costs, and export-oriented agriculture. Brazil remains a top global supplier of organic cane sugar, serving North America and Europe. Domestic demand is limited but growing, driven by urban health trends. Certification infrastructure is improving, enabling more producers to access global markets. The region’s growth potential lies in expanding processing capacity and improving traceability. Fair trade practices and cooperative farming models also support market sustainability.

Middle East & Africa (MEA)

MEA accounts for a smaller share, close to 5%, in the global organic cane sugar market but shows emerging demand. The United Arab Emirates and South Africa lead regional consumption due to rising demand for health-oriented food products. Imports dominate supply, with limited local organic sugarcane cultivation. Growth is supported by increasing availability of premium food products in retail and hospitality sectors. Rising awareness of clean-label ingredients and dietary health concerns is shaping market trends. The region depends on strong supply chain networks and retail partnerships to ensure product availability across key cities.

Market Segmentations:

By Form:

- Granulated

- Liquid/Syrup

- Powdered

By Nature:

By Claim Type:

- USDA Organics

- EU Organics

- Fair Trade Certified

- Non-GMO Project Verified

By Sales Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail (Company Website)

- Online Retail (E-commerce Platform)

- B2B

By Application:

- Baking

- Frozen Foods

- Preservation

- Confectionery

- Canning

- Beverages

- Toppings

- Pharmaceuticals

- Cosmetics

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the organic cane sugar market features a mix of global producers, regional suppliers, and specialized organic ingredient firms. Leading players such as ASR GROUP, Wholesome Sweeteners, Inc., and Louis Dreyfus Company maintain strong positions through vertically integrated operations and broad distribution networks. Companies like ORGANICWAY FOOD INGREDIENTS INC. and Gillco Ingredients focus on supplying certified organic inputs to food manufacturers and health-focused brands. U.S.-based players, including Indiana Sugars and US Sweeteners, support domestic demand with established sourcing partnerships. Firms like Global Organics, Ltd. and DO IT ORGANIC cater to niche markets with specialty formulations and clean-label solutions. Most competitors emphasize USDA or EU organic certifications, non-GMO compliance, and sustainable sourcing practices to build brand credibility. Strategic alliances, bulk supply contracts, and e-commerce integration remain key growth enablers. As demand for traceable, ethically sourced ingredients rises, market leaders invest in digital traceability tools, quality control, and origin-based marketing to strengthen their competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2023, Just Date natural sweeteners announced the launch of organic date sugar nationwide in Sprouts Farmers Market stores. The product, made from organic, non-GMO dates, caters to health-conscious consumers seeking natural sweeteners. The nationwide availability reflects the increasing demand for alternative sugars and highlights the brand’s commitment to providing quality organic products.

- In July 2023, Nordzucker, one of the leading sugar manufacturers through its brand SweetFamily, introduced locally sourced brown organic sugar, expanding its product range. As per the company, this offering aligns with consumer demand for natural and sustainable ingredients. The brown organic sugar is produced in Germany, emphasizing traceability and environmental responsibility while meeting the quality standards of organic certification.

- In 2023, Wholesome launched Turbinado Sugar and Regenerative Organic certified cane in collaboration with Whole Foods Market.

- In 2023, Germany-based Nordzucker introduced Brown Organic Sugar to meet growing consumer demand for organic products.

Report Coverage

The research report offers an in-depth analysis based on Form, Nature, Claim Type, Sales Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic cane sugar will grow as consumers shift toward clean-label and natural ingredients.

- Food manufacturers will increase usage in bakery, beverage, and packaged food categories.

- Organic farming practices will expand, improving supply stability in developing regions.

- Certifications like USDA Organics and Fair Trade will gain more importance in purchase decisions.

- Online retail and B2B e-commerce platforms will boost product visibility and access.

- Asia-Pacific will emerge as a key production and export hub for organic cane sugar.

- Technological improvements in processing will enhance product consistency and shelf life.

- Strategic partnerships among producers and retailers will improve global distribution networks.

- Increased investment in traceability and digital sourcing tools will build consumer trust.

- High costs and supply chain challenges will continue to limit adoption in some price-sensitive markets.