Market Overview

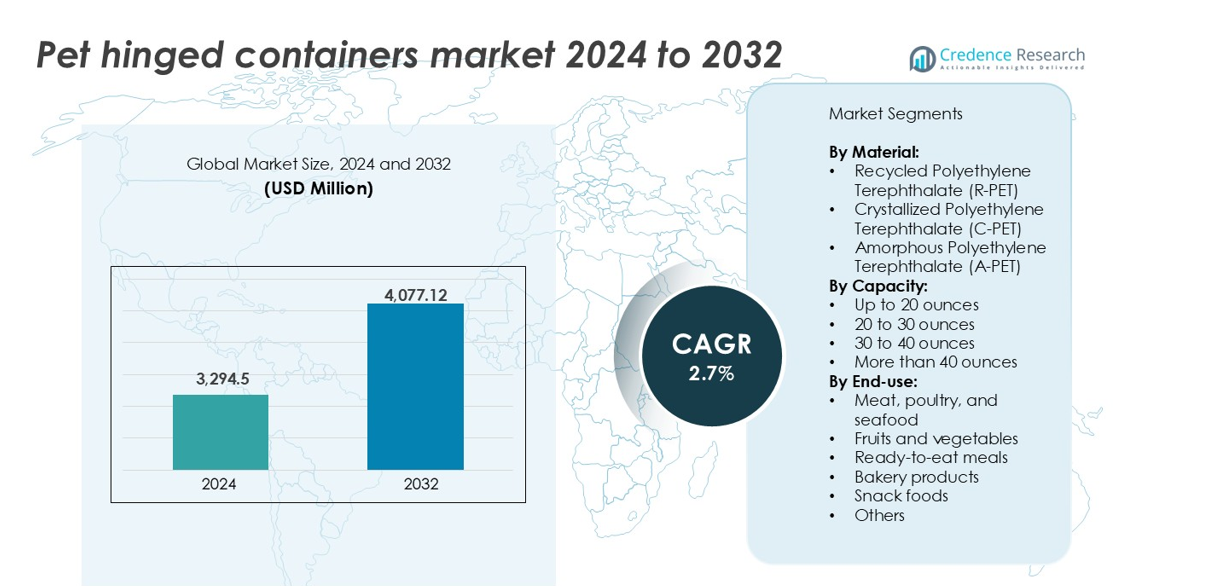

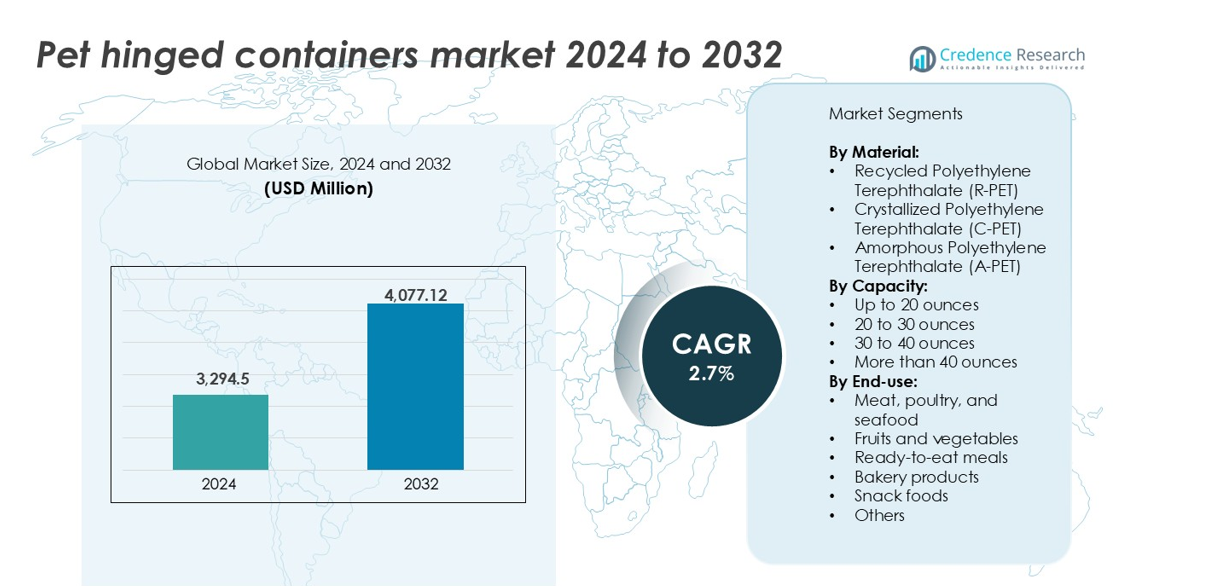

The Pet Hinged Containers Market was valued at USD 3,294.5 million in 2024 and is anticipated to reach USD 4,077.12 million by 2032, growing at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PET Hinged Containers Market Size 2024 |

USD 3,294.5 million |

| PET Hinged Containers Market, CAGR |

2.7% |

| PET Hinged Containers Market Size 2032 |

USD 4,077.12 million |

Top players in the PET hinged containers market include Amcor Limited, Berry Global Group, Inc., Sonoco Products Company, and Silgan Holdings Inc., all of which maintain robust portfolios across food packaging. These companies dominate through high-volume production, global supply networks, and investments in R&D for recyclable and microwave-safe containers. Placon Corporation, Anchor Packaging Inc., and Pactiv LLC compete actively in North America with strong distribution in retail and foodservice. Europe and North America collectively account for over 59% of global market share, driven by advanced recycling infrastructure, high consumption of packaged foods, and strict regulatory standards promoting R-PET usage.

Market Insights

- The PET Hinged Containers Market was valued at USD 3,294.5 million in 2024 and is projected to reach USD 4,077.12 million by 2032, growing at a CAGR of 2.7% during the forecast period.

- Growth is fueled by rising demand for recyclable packaging, especially R-PET, driven by sustainability goals and regulations targeting single-use plastics.

- A key trend includes rising use of microwave-safe C-PET containers, addressing the growing popularity of ready meals and reheatable food packaging.

- Major players like Amcor, Berry Global, Sonoco, and Silgan dominate the landscape through large-scale production, product innovation, and strategic sustainability efforts.

- North America leads the market with a 32% share, followed by Europe at 27% and Asia-Pacific at 24%. The up to 20 ounces segment holds the highest capacity share, while meat, poultry, and seafood lead end-use applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The PET hinged containers market is segmented into R-PET, C-PET, and A-PET. Among these, Recycled Polyethylene Terephthalate (R-PET) holds the largest market share. Its dominance is driven by rising demand for sustainable and eco-friendly packaging. R-PET aligns with circular economy goals and supports brand sustainability commitments. It offers clarity, durability, and cost efficiency. Food-grade R-PET is increasingly accepted for packaging fresh and processed foods. Regulatory pushes for recycled content usage further support its growth. Manufacturers invest in closed-loop recycling systems to ensure material availability and quality consistency.

- For instance, Amcor uses over 218,000 metric tons of post-consumer recycled (PCR) plastic annually including substantial volumes of food-grade R-PET across its global operations in North America, Europe, and Asia.

By Capacity

PET hinged containers with a capacity up to 20 ounces lead the market in terms of volume share. This segment serves fast-moving food applications such as cut fruits, deli items, snacks, and bakery portions. The dominance stems from growing demand for single-serve and grab-and-go products in retail and foodservice. Small-capacity containers offer better portion control, convenience, and reduced food waste. They also enhance visual appeal on shelves and reduce shipping costs. Increasing urban consumption patterns and quick-service models further drive the preference for compact packaging formats.

- For instance, Inline Plastics introduced its Safe-T-Fresh® Grab & Go line with tamper-evident, clear PET containers under 16 oz, specifically designed for refrigerated food-to-go displays in retail chains.

By End-Use

Among end-use categories, meat, poultry, and seafood represent the dominant segment in the PET hinged containers market. These products require secure, leak-resistant packaging with strong visibility and shelf appeal. PET containers meet hygiene and safety standards while preserving freshness. Retailers favor them for their stackability and compatibility with cold-chain storage. Rising consumption of packaged protein and fresh cuts boosts volume demand. In parallel, ready-to-eat meals are a fast-growing segment, supported by urban lifestyles and demand for microwave-safe packaging that reduces preparation time.

Key Growth Drivers

Rising Demand for Sustainable and Recyclable Packaging Materials

The PET hinged containers market is seeing strong growth due to increasing demand for eco-friendly and recyclable packaging. Brands and manufacturers are under pressure to reduce plastic waste and improve environmental impact. Recycled Polyethylene Terephthalate (R-PET) offers a reliable solution with clear sustainability benefits. R-PET packaging uses less energy during production and supports closed-loop recycling systems. Many foodservice and retail companies are switching to R-PET containers to meet sustainability targets and comply with tightening regulations on single-use plastics. Consumers also prefer packaging made from recycled content, boosting its market penetration. With governments enforcing mandates on recycled content inclusion, the use of R-PET in hinged containers is projected to grow rapidly. Large players are expanding their in-house recycling and reprocessing capabilities to ensure material supply. This shift toward circular packaging models continues to drive adoption across multiple food categories.

- For instance, Berry Global processed over 100,000 metric tons of R-PET in 2023 across its packaging divisions, supporting its target to use 30% circular plastics by 2030.

Expansion of Ready-to-Eat and Takeaway Food Culture

The global surge in demand for ready-to-eat meals and takeaway food has significantly contributed to the growth of PET hinged containers. These containers offer lightweight, durable, and tamper-evident solutions suited for hot and cold food storage. Foodservice outlets, cloud kitchens, and meal delivery services increasingly use PET hinged containers for product visibility and secure sealing. Rising urbanization, dual-income households, and fast-paced lifestyles fuel demand for convenient packaging options. PET containers also meet microwave compatibility and leak-proof criteria, which are vital in modern food distribution. The packaging format supports various portion sizes, allowing vendors to serve full meals, snacks, and salads. Retailers use PET hinged containers to enhance food presentation while maintaining hygiene standards. As food delivery apps and takeout channels continue to expand, the market for portion-controlled, tamper-resistant packaging sees consistent growth, making this a key driver for long-term demand.

- For instance, Sabert Corporation, a global leader in sustainable food packaging with annual revenues exceeding $800 million, is a primary supplier for QSR chains and grocers.

Growth of Organized Retail and Cold Chain Infrastructure

Rising investments in modern retail and cold chain logistics support demand for high-performance food packaging such as PET hinged containers. Supermarkets, hypermarkets, and convenience stores prefer transparent packaging that enhances product visibility and shelf appeal. PET containers offer strength and resistance to moisture, making them ideal for chilled and frozen food sections. Growth in the retail footprint of fresh and ready-to-eat products across developed and developing markets directly benefits PET packaging. Organized retail chains rely on standardized, stackable packaging formats to streamline inventory handling and presentation. Improved cold chain logistics reduce spoilage and expand the shelf life of perishable items, enabling broader distribution of protein, dairy, and produce in PET containers. This infrastructure upgrade, especially in Asia-Pacific and Latin America, accelerates the adoption of PET hinged containers across meat, seafood, fruits, and prepared foods, driving consistent volume demand.

Key Trends & Opportunities

Shift Toward High-Performance, Microwave-Safe PET Solutions

A key trend shaping the PET hinged containers market is the increasing preference for microwave-safe and oven-compatible variants. Crystallized PET (C-PET) is gaining traction due to its ability to withstand high temperatures, making it ideal for reheatable food trays and meal kits. With growing consumer demand for convenience, reheatable packaging plays a critical role in food delivery and retail. Foodservice operators and retailers look for packaging that combines heat resistance, clarity, and recyclability. C-PET containers offer those features and support hot-fill applications as well. This trend presents an opportunity for packaging suppliers to innovate material blends that retain performance while enhancing sustainability. As ready meals and home delivery options expand, the need for heat-stable containers will continue rising. Manufacturers investing in C-PET processing capabilities and proprietary designs are well-positioned to capitalize on this trend and differentiate their offerings.

- For instance, Faerch’s C-PET trays withstand temperatures up to 220°C and are used in over 500 million ready-meal packs annually across Europe.

Rising Use of Smart Packaging Features in Food Display

The PET hinged containers market is witnessing early adoption of smart packaging elements to improve safety and visibility. Transparent packaging that includes tamper-evident seals, resealable closures, and printed QR codes is becoming more common. These features boost consumer confidence, especially in online and self-service formats. Brands are using packaging as a tool to communicate freshness, origin, and nutritional details. Retailers value PET containers for their ability to display contents clearly, supporting impulse buys and reducing product handling. With digital integration rising, some companies explore interactive packaging that links to freshness tracking or promotional content. These innovations enhance user experience and brand differentiation. PET hinged containers that combine visual clarity with secure closure and digital access are gaining favor in high-volume retail. Suppliers offering such solutions create added value and open new growth opportunities in both premium and mass-market food segments.

Key Challenges

Volatility in Raw Material Supply and Pricing

The PET hinged containers market remains vulnerable to fluctuations in raw material prices, especially virgin and recycled PET resin. Supply chain disruptions, energy costs, and changes in recycling rates can affect material availability and pricing. PET resin prices often react to changes in crude oil markets and shifts in regional demand-supply dynamics. When R-PET supply tightens due to low collection or contamination, packaging manufacturers face cost pressures. Small- and mid-size converters struggle to manage input cost volatility without passing price hikes to customers. This can reduce margins and create uncertainty in contract pricing. While many brands push for more recycled content, inconsistent feedstock availability limits scalability. Establishing stable recycling infrastructure and long-term procurement contracts is key to reducing this risk. Until then, market players will face supply unpredictability and competitive price pressures.

Growing Regulatory Pressure on Single-Use Plastics

Regulatory constraints on single-use plastics pose a challenge for PET hinged container adoption, especially in regions with strict plastic bans or levies. Governments across Europe, parts of Asia, and North America are implementing rules to restrict or tax disposable plastic packaging. Although PET is recyclable, it is often included in single-use categories, creating compliance burdens for foodservice and packaging suppliers. Inadequate recycling infrastructure further complicates the regulatory environment. Companies must invest in labeling, sorting, and material innovation to meet extended producer responsibility (EPR) requirements. These compliance efforts increase costs and slow down product rollouts. Misalignment between recyclability claims and actual recycling rates also affects consumer trust. To mitigate this challenge, suppliers must strengthen collaboration with local waste management, adopt certified sustainable materials, and support clear labeling for proper disposal.

Regional Analysis

North America

North America accounts for the largest share in the PET hinged containers market, contributing over 32% of the global revenue in 2024. The region benefits from strong demand for packaged foods, takeaway meals, and ready-to-eat items. High adoption of sustainable packaging, particularly R-PET, supports market penetration. U.S.-based retailers and foodservice brands actively invest in recyclable and tamper-evident packaging formats. Widespread cold chain infrastructure and organized retail presence drive volume growth. Canada’s focus on reducing single-use plastics also encourages material innovation. Rising consumption of salads, fruits, and deli products in transparent containers continues to sustain regional demand.

Europe

Europe holds approximately 27% market share in the PET hinged containers market, driven by strict sustainability regulations and advanced recycling systems. Countries like Germany, France, and the U.K. lead the shift to R-PET packaging across retail and foodservice sectors. Demand is high for microwave-safe, resealable containers used for ready meals, bakery items, and cold cuts. The EU’s circular economy policies fuel investments in closed-loop packaging systems. Premium food retailers adopt clear, recyclable packaging for visual appeal and compliance. Innovation in smart labeling and compostable alternatives adds competitive pressure but also boosts the overall packaging quality in the region.

Asia-Pacific

Asia-Pacific represents around 24% of the global PET hinged containers market and is the fastest-growing region. Rapid urbanization, expanding organized retail, and growing middle-class consumption drive demand for hygienic and portable packaging. Countries like China, India, Japan, and South Korea show increasing adoption of PET containers across fresh produce, meats, and snack segments. E-commerce and food delivery services boost demand for leak-proof, clear-lid containers. Rising sustainability awareness supports gradual growth in R-PET usage. Government support for domestic recycling infrastructure and food safety regulations further stimulates demand for PET hinged packaging, especially in metro and Tier 1 urban centers.

Latin America

Latin America holds a modest yet growing share of about 9% in the global PET hinged containers market. Brazil and Mexico are key markets, driven by growth in quick-service restaurants, supermarkets, and bakery chains. Demand for transparent, stackable packaging supports product display and freshness retention. PET containers are favored for cut fruits, sweets, and deli goods. Limited cold chain coverage in rural areas restricts broader penetration. However, rising adoption of packaged protein and snack foods fuels market expansion. Regulatory support for food-grade plastic packaging and increasing awareness of recyclable materials create room for regional manufacturers to scale.

Middle East & Africa (MEA)

The Middle East & Africa region contributes roughly 8% to the PET hinged containers market. Growth is supported by rising demand for packaged convenience foods, especially in the UAE, Saudi Arabia, and South Africa. Organized retail formats and food delivery platforms expand container usage across bakery, meat, and produce categories. Hot climate conditions require durable, leak-resistant packaging with temperature stability. Adoption of R-PET is still limited but gradually increasing with sustainability programs and food safety initiatives. Import dependency for PET resin and weak recycling infrastructure remain challenges. However, rising investment in local food packaging and retail chains supports steady market growth.

Market Segmentations:

By Material:

- Recycled Polyethylene Terephthalate (R-PET)

- Crystallized Polyethylene Terephthalate (C-PET)

- Amorphous Polyethylene Terephthalate (A-PET)

By Capacity:

- Up to 20 ounces

- 20 to 30 ounces

- 30 to 40 ounces

- More than 40 ounces

By End-use:

- Meat, poultry, and seafood

- Fruits and vegetables

- Ready-to-eat meals

- Bakery products

- Snack foods

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PET hinged containers market is highly competitive, with several global and regional players offering a wide range of packaging solutions. Key companies such as Amcor Limited, Berry Global Group, Inc., and Sonoco Products Company dominate the market with large-scale production, advanced R&D, and strong distribution networks. These leaders focus on sustainable packaging, particularly R-PET-based containers, to meet rising demand for recyclable solutions. Mid-sized players like Placon Corporation, Pactiv LLC, and Genpak LLC cater to niche applications, offering customization and quick delivery. Companies such as Sealed Air Corporation and Sabert Corporation emphasize innovation in microwave-safe and tamper-evident packaging. Strategic partnerships, regional expansions, and investments in recycling infrastructure are common across the landscape. Price competition and regulatory compliance push firms to enhance operational efficiency and adopt circular packaging practices. With sustainability and food safety as key priorities, competition intensifies around material sourcing, clarity, stackability, and food-contact safety certifications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Limited

- Berry Global Group, Inc.

- Sonoco Products Company

- Silgan Holdings Inc.

- Sealed Air Corporation

- Pactiv LLC

- Dart Container Corporation

- Placon Corporation

- Anchor Packaging Inc.

- Sabert Corporation

- Genpak, LLC

- D&W Fine Pack

- Linpac Packaging Ltd. (Klöckner Pentaplast)

Recent Developments

- In 2024, Sabert Corporation, headquartered in the United States, has launched its new Pulp Hinged Containers and Pulp Portion Cups. The expansion includes sustainable and compostable products. These new offerings aim to meet the needs of foodservice operators seeking eco-friendly packaging solutions.

- In April 2023, Tesco and Faerch launched a pioneering initiative to recycle used PET trays from European curbside waste into new packaging for its chilled ready meals, marking a significant step towards sustainability in the food packaging industry.

Report Coverage

The research report offers an in-depth analysis based on Material, Capacity, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for R-PET containers will rise as brands shift toward circular packaging systems.

- Microwave-safe and oven-compatible PET formats will gain popularity in ready meal applications.

- Smart packaging features like tamper-evident seals and QR codes will become more common.

- Food delivery and takeaway growth will continue driving small-capacity hinged container demand.

- Organized retail expansion in emerging economies will support wider adoption of PET packaging.

- Manufacturers will invest in recycling infrastructure to secure sustainable material supply.

- Regulatory push for minimum recycled content will reshape procurement and production strategies.

- Shelf-ready packaging with high clarity will remain essential for fresh food merchandising.

- Technological advances will improve PET heat resistance without compromising recyclability.

- Partnerships between packaging firms and food producers will increase to ensure compliance and innovation.