Market Overview

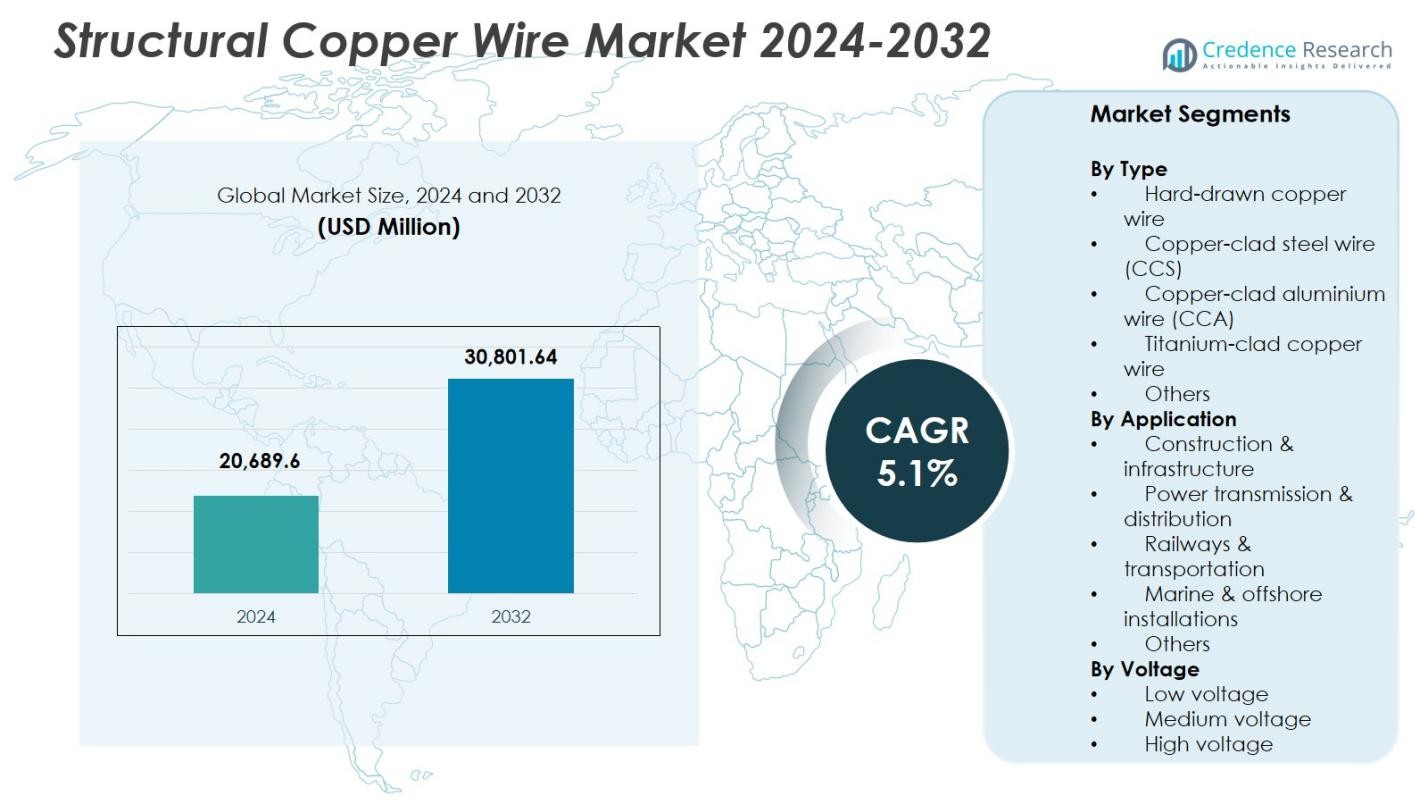

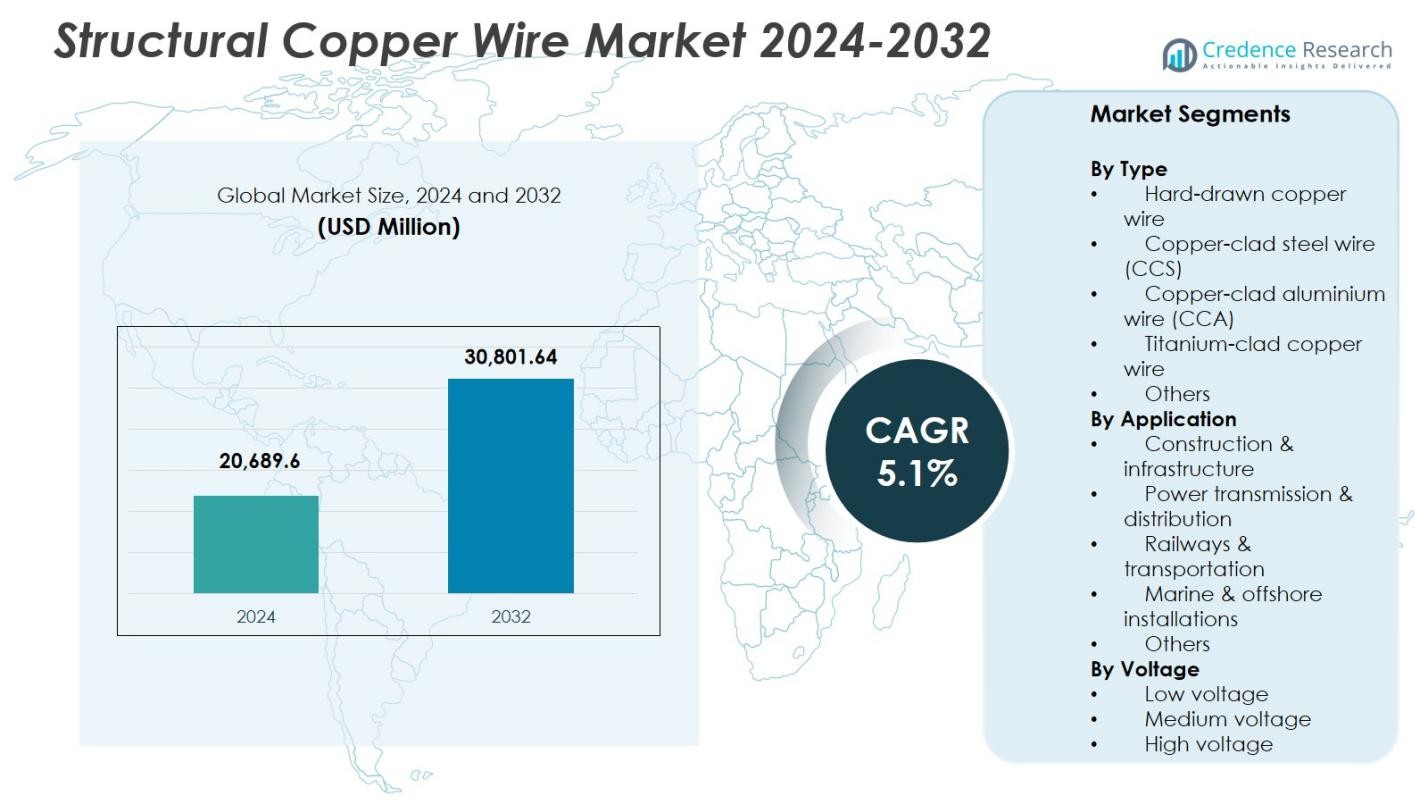

Structural Copper Wire Market size was valued at USD 20,689.6 million in 2024 and is anticipated to reach USD 30,801.64 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Structural Copper Wire Market Size 2024 |

USD 20,689.6 Million |

| Structural Copper Wire Market, CAGR |

5.1% |

| Structural Copper Wire Market Size 2032 |

USD 30,801.64 Million |

Structural Copper Wire Market features leading players such as Southwire, Prysmian Group, Nexans, General Cable, LS Cable & System, Superior Essex, Sumitomo Electric, Hitachi Cable, Okonite, and Rea Magnet Wire, all contributing to advancements in high-conductivity and durable wiring solutions for construction, power distribution, and transportation sectors. These companies strengthen their presence through technological upgrades, product innovation, and expanded manufacturing capacities. Regionally, Asia-Pacific leads the market with a 38.6% share, driven by rapid urbanization, large-scale infrastructure development, and extensive grid expansion across China, India, and Southeast Asia, reinforcing its dominance in global copper wire demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Structural Copper Wire Market was valued at USD 20,689.6 million in 2024 and will grow at a CAGR of 5.1% through 2032.

- Strong market drivers include rising construction and infrastructure expansion, with the construction & infrastructure segment holding a 38.7% share supported by increasing electrification needs.

- Key trends highlight growing adoption of copper-clad aluminium and copper-clad steel wires, along with heightened demand from renewable energy and offshore installations requiring corrosion-resistant copper wiring.

- Major players such as Southwire, Prysmian Group, Nexans, LS Cable & System, Superior Essex, and Sumitomo Electric strengthen market presence through technological advancements and capacity expansion.

- Asia-Pacific leads regional demand with a 38.6% share, followed by North America at 29.4% and Europe at 26.7%, while the low-voltage segment dominates overall consumption with a 52.4% market share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

The Structural Copper Wire Market by type is dominated by hard-drawn copper wire, holding 46.3% market share in 2024 due to its high tensile strength, excellent conductivity, and suitability for demanding structural and electrical applications. Copper-clad steel (CCS) and copper-clad aluminium (CCA) wires follow, driven by their lightweight properties and cost-effectiveness for large infrastructure projects. Titanium-clad copper wire is gaining traction in corrosive environments, particularly in offshore installations. Growing demand for durable wiring solutions in construction, grid upgrades, and renewable energy systems continues to strengthen the leadership of hard-drawn copper wire across global markets.

- For instance, Southwire supplies hard-drawn copper grooved contact wire for transit systems, delivering high tensile strength up to 435 MPa in diameters like 3.67 mm for overhead power applications.

By Application:

Within applications, construction and infrastructure represent the leading segment with a 38.7% market share, driven by rapid urban development, smart city projects, and the rising need for high-quality electrical wiring in commercial and residential buildings. Power transmission and distribution remains a strong contributor due to grid modernization and electrification initiatives. Railways and transportation benefit from long-term investments in metro rail and high-speed connectivity. Marine and offshore installations show steady adoption owing to corrosion-resistant copper solutions. The dominance of the construction segment is reinforced by continuous building expansions and strict electrical performance standards.

- For instance, KEC International and Hindalco Industries developed India’s first Copper-Silver contact wire with Delhi Metro Rail Corporation in 2025, engineered for high-speed operations and thermal resistance to reduce maintenance.

By Voltage:

By voltage category, the low-voltage segment leads with a 52.4% market share, supported by widespread use in residential wiring, commercial buildings, lighting circuits, and low-capacity power distribution. Medium-voltage copper wire demand is propelled by industrial expansions and substation upgrades, while high-voltage applications contribute significantly to long-distance transmission and renewable energy integration. The low-voltage segment maintains its leadership due to high consumption volumes, safety compliance requirements, and growing renovation activities across developed and developing regions, ensuring sustained demand for reliable and efficient copper wiring solutions.

Key Growth Drivers

Rapid Expansion of Construction and Infrastructure Projects

The Structural Copper Wire Market experiences strong growth driven by large-scale construction and infrastructure developments across urban, commercial, and industrial sectors. Increasing investment in smart cities, high-rise buildings, and public utilities boosts the demand for durable, high-conductivity copper wiring. Copper’s superior mechanical strength and fire resistance make it a preferred material for structural applications requiring long-term reliability. Government-led modernization efforts in roads, metros, airports, and housing further accelerate installations, ensuring a sustained rise in copper wire consumption across global infrastructure networks.

- For instance, in New York City, copper wiring is a core component of the subway system upgrades, providing durable, high-conductivity connections that support safe and efficient mass transit operations.

Grid Modernization and Electrification Initiatives

Global efforts to upgrade outdated power grids and accelerate electrification significantly propel the market, as copper wire remains essential for efficient energy distribution. Expanding renewable energy projects, including solar and wind, require robust transmission lines with high conductivity and thermal performance. Countries transitioning to clean energy systems are investing heavily in medium- and high-voltage networks, directly increasing demand for structural copper wire. Additionally, rising load demands from industrialization and digital infrastructure expansion drive utilities to reinforce grid stability, strengthening long-term market growth.

- For instance, Tucson Electric Power deployed 104 miles of copper cable, including AWG #10 metal-clad, #2, and 4/0 cables, in its 4.6-MW Springerville Generating Station solar array, connecting 72,000 panels across 44 acres while a buried copper grounding grid protects against frequent lightning strikes.

Advancements in Transportation and Industrial Applications

Modernization of railways, metro systems, and mass transportation networks drives heightened usage of structural copper wiring due to its unmatched reliability and electrical efficiency. Industrial automation, robotics, and advanced manufacturing facilities also depend on copper-based wiring to support high-performance equipment. Growth in electric mobility infrastructure, including charging stations, enhances the need for high-strength copper conductors. As emerging markets scale industrial production and transportation upgrades, copper wire manufacturers benefit from rising procurement across sectors requiring long-lasting, corrosion-resistant electrical solutions.

Key Trends & Opportunities

Rising Adoption of Lightweight and Hybrid Copper-Clad Materials

A prominent trend shaping the market is the growing adoption of copper-clad aluminium (CCA) and copper-clad steel (CCS) wires, which offer cost advantages without compromising conductivity for specific applications. These lightweight alternatives reduce installation costs and improve energy efficiency, particularly in telecommunication lines, railways, and large structural projects. Manufacturers are focusing on advanced cladding technologies to enhance durability and corrosion resistance. This shift creates new opportunities for product diversification, enabling companies to cater to markets demanding a balance between performance and material economics.

- For instance, General Clad supplies CCS wire for overhead catenary systems in railways, leveraging its higher conductivity than plain steel for reliable train power supply and mechanical strength for longer spans between supports.

Increasing Demand from Renewable and Offshore Energy Installations

The expansion of offshore wind farms, solar parks, and marine energy systems generates strong opportunities for corrosion-resistant structural copper wire solutions. Copper’s high conductivity and resistance to harsh environmental conditions make it essential for subsea cabling and offshore substations. Growing global commitments to carbon-neutral energy infrastructure drive investments in long-distance transmission projects, where copper wires ensure minimal energy loss. As renewable installations move to deeper marine locations and higher capacities, advanced copper-based wiring solutions become crucial for reliability and operational efficiency.

- For instance, Tucson Electric Power’s 4.6-MW photovoltaic solar farm incorporated over 100 miles of AWG 4/0 bare copper grounding cable, forming an exothermically welded grid buried under the perimeter and arrays to protect against lightning strikes.

Key Challenges

Volatility in Copper Prices and Rising Material Costs

Fluctuating global copper prices remain a major challenge, directly impacting production costs and profit margins for wire manufacturers. Market volatility is influenced by mining supply disruptions, geopolitical tensions, and fluctuating demand from construction and electronics sectors. Higher raw material costs can delay large-scale infrastructure and industrial projects, leading buyers to explore lower-cost alternatives such as CCA or CCS. Manufacturers must strengthen supply chain resilience and adopt forward-pricing strategies to manage instability while maintaining competitive product offerings.

Competition from Alternative Conductive Materials

The market faces increasing pressure from alternative materials such as aluminium and advanced composite conductors, which offer cost savings and lighter weight for specific applications. While copper provides superior conductivity and strength, aluminium’s lower price and ease of installation attract certain utility and construction projects. Technological advancements in aluminium alloys continue to enhance performance, challenging copper’s dominance in medium- and low-voltage applications. This shift compels manufacturers to innovate with higher-efficiency copper products and value-added features to defend market share.

Regional Analysis

North America

North America holds a 29.4% market share in the Structural Copper Wire Market, driven by extensive investments in grid modernization, urban infrastructure upgrades, and the expansion of renewable energy projects. The United States leads demand due to large-scale construction activity, industrial automation, and the rapid electrification of transport systems. Canada contributes significantly through hydropower transmission and mining sector developments that require high-performance copper wiring. Strong regulatory emphasis on energy efficiency and fire-safe electrical systems continues to stimulate copper wire consumption across commercial, residential, and industrial applications.

Europe

Europe accounts for a 26.7% market share, supported by aggressive decarbonization initiatives, smart grid development, and retrofitting of older buildings with high-efficiency wiring systems. Germany, France, and the U.K. dominate regional demand due to robust industrial output and renewable energy penetration, including offshore wind installations. The region’s stringent electrical safety norms strengthen the adoption of high-conductivity copper wiring. Ongoing railway electrification, sustainable construction practices, and cross-border transmission interconnections further accelerate market growth, positioning Europe as a key contributor to structural copper wire demand over the forecast period.

Asia-Pacific

Asia-Pacific leads the global market with a 38.6% share, driven by rapid urbanization, expanding construction activity, and massive power infrastructure development across China, India, Japan, and Southeast Asia. Government-led electrification programs and industrial expansion significantly increase demand for low- and medium-voltage copper wiring. The region’s strong manufacturing base enhances consumption in electronics, transportation, and renewable energy installations. Growing offshore wind investments in China and Japan further boost high-voltage copper wire requirements. APAC’s dominance is reinforced by high population density, economic growth, and sustained infrastructural investments.

Latin America

Latin America captures a 3.8% market share, supported by increasing investments in infrastructure modernization, residential construction, and energy distribution networks. Brazil and Mexico lead regional demand due to industrial expansion, electricity grid upgrades, and urban housing developments. Copper wire adoption is rising in transportation, mining operations, and small-scale renewable energy projects across Chile and Colombia. Despite economic fluctuations, government initiatives to strengthen power reliability and expand rural electrification continue to support market growth, creating steady opportunities for copper wire manufacturers across the region.

Middle East & Africa

The Middle East & Africa region holds a 4.5% market share, fueled by ongoing infrastructure megaprojects, commercial real estate development, and expansion of power transmission networks. Gulf countries such as Saudi Arabia and the UAE drive demand through smart city development and energy diversification programs. In Africa, population growth and electrification efforts stimulate consumption of low-voltage copper wire. Additionally, investments in rail and industrial facilities across South Africa and Egypt contribute to market expansion. The region’s rising focus on reliable, durable electrical systems strengthens copper wire deployment across key applications.

Market Segmentations:

By Type

- Hard-drawn copper wire

- Copper-clad steel wire (CCS)

- Copper-clad aluminium wire (CCA)

- Titanium-clad copper wire

- Others

By Application

- Construction & infrastructure

- Power transmission & distribution

- Railways & transportation

- Marine & offshore installations

- Others

By Voltage

- Low voltage

- Medium voltage

- High voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Structural Copper Wire Market features leading players such as Southwire, Prysmian Group, Nexans, General Cable, LS Cable & System, Rea Magnet Wire, Superior Essex, Sumitomo Electric, Hitachi Cable, and Okonite, all shaping industry performance through extensive product portfolios and global supply capabilities. These companies focus on high-conductivity, corrosion-resistant, and durable copper wire solutions designed for construction, power distribution, transportation, and offshore applications. Strategic investments in advanced manufacturing technologies, continuous annealing processes, and sustainable material engineering enhance product reliability and cost efficiency. Leading manufacturers increasingly pursue mergers, capacity expansions, and regional partnerships to strengthen distribution networks and secure long-term contracts with utilities and infrastructure developers. Rising demand for hybrid copper-clad materials encourages innovation in lightweight designs, while the transition toward renewable energy and smart grid upgrades drives companies to develop high-performance wires capable of supporting modern electrical loads. This dynamic environment fosters ongoing technological advancement and competitive differentiation.

Key Player Analysis

- Nexans (France)

- Superior Essex (USA)

- Sumitomo Electric (Japan)

- Okonite (USA)

- Hitachi Cable (Japan)

- Southwire (USA)

- LS Cable & System (South Korea)

- Prysmian Group (Italy)

- Rea Magnet Wire (USA)

- General Cable (USA)

Recent Developments

- In February 2025, Mirae Asset Global Investments made a $200 million investment in Essex Solutions, the magnet wire business formed from Superior Essex’s buyout of Essex Furukawa Magnet Wire.

- In November 2025, JTL Industries Limited expanded its non-ferrous portfolio with a Continuous Cast (CC) Copper product targeting EV and renewable energy sectors.

- In July 2025, Taihan Cable & Solution acquired offshore cable installation specialist OceanC&I, enhancing its turnkey capabilities for structural copper wire applications in submarine cables across the full value chain from design to maintenance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global construction and infrastructure projects continue to expand.

- Grid modernization and renewable energy integration will increase demand for high-performance copper wiring.

- Adoption of copper-clad aluminium and copper-clad steel wires will rise as industries seek lightweight and cost-efficient alternatives.

- Electrification of transportation networks, including metros and railways, will strengthen copper wire consumption.

- Offshore wind and marine installations will boost demand for corrosion-resistant structural copper wire solutions.

- Advancements in manufacturing technologies will enhance conductor strength, durability, and efficiency.

- Industrial automation and smart factory expansion will drive higher usage of copper wiring in industrial equipment.

- Emerging economies will experience accelerated demand due to urbanization and electrification programs.

- Sustainability initiatives will push manufacturers to develop eco-efficient and recyclable copper wire products.

- Strategic mergers and capacity expansions will reshape global supply chains and enhance market competitiveness.

Market Segmentation Analysis:

Market Segmentation Analysis: