Market Overview

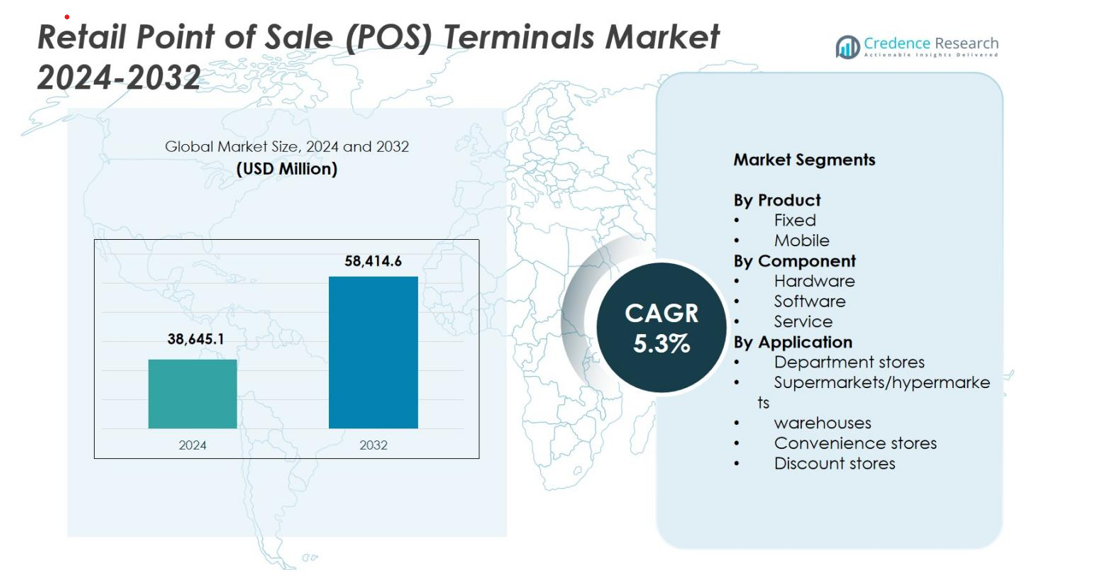

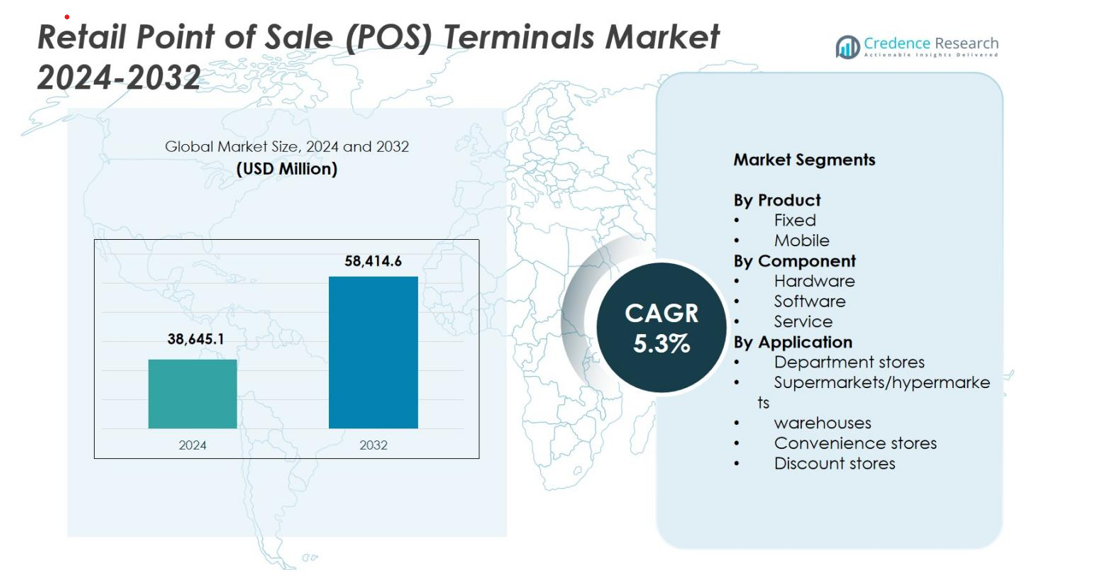

Retail Point of Sale (POS) Terminals market size was valued at USD 38,645.1 million in 2024 and is anticipated to reach USD 58,414.6 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retail Point of Sale (POS) Terminals Market Size 2024 |

USD 38,645.1 million |

| Retail Point of Sale (POS) Terminals Market , CAGR |

5.3% |

| Retail Point of Sale (POS) Terminals Market Size 2032 |

USD 58,414.6 million |

Retail Point of Sale (POS) Terminals Market is shaped by a strong group of global and regional players, including Shopify Inc., Square, PayPal Zettle, Lightspeed, Clover, SumUp, NCR Corporation, Aptos, Cegid Group, and Ctac NV, all driving advancements in digital payment capabilities, mobile POS adoption, and cloud-based retail management. These companies focus on enhancing transaction speed, security, and omnichannel integration to support evolving retail demands. In 2024, North America led the market with a 34.2% share, supported by rapid digital payment adoption and strong presence of key technology providers, followed by Asia-Pacific with 28.9%, driven by expanding retail infrastructure and cashless initiatives.

Market Insights

- Retail Point of Sale (POS) Terminals Market was valued at USD 38,645.1 million in 2024 and is projected to grow at a CAGR of 5.3% through 2032.

- Market growth is driven by rising adoption of omnichannel retailing, increasing demand for contactless payments, and strong integration of POS systems with inventory, loyalty, and data analytics platforms.

- Key trends include rapid uptake of cloud-based and mobile POS solutions, expansion of AI- and IoT-enabled terminals, and modernization of checkout systems across supermarkets, convenience stores, and specialty retail formats.

- Leading players such as Shopify Inc., Square, PayPal Zettle, Lightspeed, Clover, SumUp, NCR Corporation, Aptos, Cegid Group, and Ctac NV continue to innovate, with fixed POS holding a 62.4% share as the dominant product segment.

- Regionally, North America leads with a 34.2% share, followed by Asia-Pacific at 28.9%, Europe at 26.8%, Latin America at 6.5%, and MEA at 3.6%, reflecting strong global retail digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The Retail Point of Sale (POS) Terminals Market is segmented into fixed and mobile POS systems, with fixed POS dominating the market in 2024 with a 62.4% share. This leadership is driven by strong adoption across supermarkets, hypermarkets, and large retail chains that require stable, high-capacity transaction systems with robust peripheral integration. Fixed POS terminals offer enhanced security, advanced inventory management, and consistent performance during peak hours. Mobile POS is expanding quickly due to rising demand for queue-busting solutions and flexible checkout experiences across convenience stores and specialty retail environments.

- For Instance, NCR Voyix’s “Emerald POS” platform is used by major grocery retailers such as Northgate González Market.

By Component

Within the component segment, the market includes hardware, software, and services, with hardware accounting for the largest share in 2024 at 47.8%. Growth is supported by continuous terminal upgrades, rising deployment of contactless payment devices, and the shift toward EMV-compliant systems. Retailers prioritize durable, high-performance hardware to support omnichannel operations and faster checkout workflows. Software adoption is accelerating with cloud-based POS, AI-driven analytics, and real-time data insights, while service offerings gain traction as retailers seek integration, maintenance, and managed support solutions.

- For instance, NCR Voyix introduced its latest self-checkout and POS hardware enhancements in 2024, adding upgraded scanners and touchscreens to improve transaction speed and reliability across high-traffic retail outlets.

By Application

The application segment covers department stores, supermarkets/hypermarkets, warehouses, convenience stores, and discount stores, with supermarkets/hypermarkets leading at 38.6% share in 2024. This dominance stems from high transaction volumes, multi-lane checkout needs, and demand for integrated POS solutions supporting inventory tracking, loyalty programs, and dynamic pricing. Department stores increasingly implement advanced POS for unified omnichannel experiences, while convenience and discount stores adopt compact or mobile POS systems for speed and space efficiency. Warehouses rely on rugged POS terminals to optimize billing, inventory handling, and logistics workflows.

Key Growth Drivers

Growing Adoption of Omnichannel Retailing

The accelerating shift toward omnichannel retailing stands as a major growth driver for the Retail Point of Sale (POS) Terminals Market. Retailers are increasingly integrating physical and digital sales channels to deliver seamless shopping experiences, and POS systems serve as the technological backbone enabling unified commerce. Modern POS terminals support real-time inventory updates, cross-channel payments, click-and-collect services, and synchronized customer data across online platforms and in-store operations. As retailers prioritize personalization, faster checkout, and integrated loyalty programs, demand rises for advanced POS solutions equipped with analytics and cloud connectivity. The rising adoption of mobile POS systems further enhances flexibility and improves customer service, especially in high-traffic environments. This convergence of operational efficiency and experiential retail significantly propels market expansion.

- For Instance, Shopify POS continues to be rolled out as a unified-commerce backbone to tie together online and offline sales. In 2024-2025 Shopify has enhanced functionality that allows retailers to sync inventory, customer data, checkout, and returns across channels so whether a customer shops online or in-store, their cart, loyalty profile, and purchase history follow them.

Rising Demand for Contactless and Digital Payment Solutions

The growing preference for contactless and digital payments continues to fuel strong adoption of modern POS terminals globally. Consumers increasingly expect fast, secure, and touch-free payment experiences driven by the proliferation of mobile wallets, NFC-enabled cards, and QR-based transactions. Retailers respond by upgrading to advanced POS systems capable of processing diverse digital payment modes while ensuring compliance with global security standards like EMV and PCI-DSS. The pandemic accelerated behavioral shifts toward touchless transactions, making digital payments a long-term norm in retail. Financial inclusion initiatives, regulatory pushes toward cashless economies, and digital transformation programs across developing regions further stimulate POS deployment. As businesses seek fraud reduction, higher transaction speed, and improved customer trust, the demand for secure, multi-functional POS terminals continues to grow.

- For instance, Visa reported in 2024 that over 70% of all face-to-face transactions in its global network were contactless, reinforcing the need for terminals that support tap-to-pay.

Increasing Need for Data-Driven Retail Operations

The rising emphasis on data-driven decision-making significantly boosts the adoption of advanced POS terminals. Retailers use POS data as a critical intelligence source to analyze purchasing behaviors, optimize inventory levels, identify peak hours, and design targeted promotional strategies. Modern POS systems equipped with AI and cloud analytics provide real-time insights that enhance merchandising accuracy, reduce stockouts, and improve operational efficiency. The integration of POS with CRM, ERP, and supply chain systems further strengthens data visibility across the value chain. As competition intensifies, retailers increasingly rely on analytics-enabled POS platforms to deliver personalized customer experiences and streamline workforce management. This shift toward intelligent retail ecosystems drives robust demand for next-generation POS terminals capable of continuous data processing and actionable insights.

Key Trends & Opportunities

Rapid Shift Toward Cloud-Based and Mobile POS Solutions

A major trend reshaping the Retail POS Terminals Market is the accelerating adoption of cloud-based and mobile POS platforms. Cloud POS systems enable remote access, automatic updates, centralized data management, and seamless integration with e-commerce platforms, making them ideal for multi-store operations. Retailers benefit from lower upfront costs, subscription-based pricing, and enhanced scalability. Meanwhile, mobile POS solutions unlock opportunities for more flexible store layouts, line-busting workflows, and personalized customer interactions directly on the sales floor. These systems facilitate faster onboarding, simplified maintenance, and easier connectivity with third-party applications such as loyalty programs and inventory tools. As retailers seek agility and operational efficiency in an evolving digital landscape, cloud and mobile POS represent significant growth avenues.

- For instance, Shopify expanded its cloud-based POS capabilities in 2024, enabling retailers to unify online and in-store carts, returns, and inventory through a single cloud dashboard.

Integration of AI, IoT, and Advanced Analytics in POS Systems

The market is witnessing strong opportunities driven by the integration of AI, IoT, and advanced analytics into POS systems. AI-powered POS enhances demand forecasting, automates product recommendations, and strengthens fraud detection through real-time anomaly monitoring. IoT-enabled devices connect POS with sensors, smart shelves, and inventory systems to improve operational visibility and streamline stock management. Retailers increasingly adopt POS systems that capture behavioral data, enabling personalized promotions and dynamic pricing strategies. With advanced analytics, businesses gain deeper insights into purchase patterns, store performance, and operational bottlenecks. As retail environments become more automated and connected, opportunities expand for vendors offering intelligent, interoperable, and analytics-driven POS ecosystems.

- For instance, Walmart’s AI- and computer-vision–based inventory and shelf-analytics systems, expanded in 2024, integrate with in-store POS data to optimize replenishment and reduce stockouts.

Key Challenges

High Implementation and Upgrade Costs

One of the major challenges in the Retail POS Terminals Market is the substantial cost associated with installation, integration, and upgrades. Retailers, especially small and medium-sized businesses, often face financial constraints when adopting modern POS systems that require new hardware, software subscriptions, and staff training. Transitioning from legacy systems to cloud-based or digitally advanced POS involves compatibility issues, security compliance, and potential downtime during deployment. Continuous technological advancements further require periodic upgrades, adding to long-term operational expenses. These financial and logistical burdens can slow adoption rates and deter smaller retailers from fully leveraging advanced POS capabilities, despite their long-term benefits.

Cybersecurity Risks and Data Privacy Concerns

Cybersecurity remains a significant challenge as POS terminals increasingly connect to cloud platforms, digital payment systems, and interconnected retail networks. POS systems are vulnerable to malware attacks, data breaches, and payment card fraud, prompting retailers to invest heavily in advanced security frameworks. Ensuring compliance with PCI-DSS, EMV standards, and local data protection regulations adds complexity and cost. With rising threats targeting retail environments, even a single breach can result in financial losses, reputational damage, and regulatory penalties. Maintaining end-to-end encryption, multi-factor authentication, and continuous security monitoring becomes essential, yet demanding, for retailers operating large or distributed POS networks.

Regional Analysis

North America

North America dominated the Retail Point of Sale (POS) Terminals Market in 2024 with a 34.2% share, driven by rapid technology adoption, high penetration of digital payment systems, and strong investments in omnichannel retail infrastructure. Major retailers continue deploying advanced POS hardware and cloud-based platforms to enhance transaction speed, improve inventory visibility, and support contactless payments. The presence of leading solution providers and frequent system upgrades further strengthen regional growth. Rising demand for mobile POS solutions in specialty stores, quick-service restaurants, and convenience outlets contributes significantly to market expansion across the U.S. and Canada.

Europe

Europe held a 26.8% share of the Retail POS Terminals Market in 2024, supported by widespread adoption of EMV-compliant systems, expansion of cashless payment ecosystems, and strong regulatory emphasis on secure transaction technologies. Retailers across Germany, the U.K., France, and Nordic countries increasingly integrate cloud-based POS and mobility solutions to improve operational efficiency and enhance checkout experiences. Growth is also driven by rising e-commerce penetration and omnichannel strategies that require seamless POS integration. Modernization of legacy retail formats, along with continued demand for digital wallets and contactless payments, fuels further market development across the region.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with a 28.9% share in 2024, propelled by rapid retail expansion, rising consumer adoption of digital payments, and government-led cashless economy initiatives. China, India, Japan, and Southeast Asian markets are investing heavily in POS modernization to support high transaction volumes and dynamic retail formats. Mobile POS deployment is particularly strong due to cost efficiency and flexibility. The booming e-commerce sector and increased integration of AI- and cloud-driven POS platforms further accelerate growth. Expanding supermarkets, convenience chains, and small retail businesses continue to drive significant demand across the region.

Latin America

Latin America accounted for a 6.5% share of the market in 2024, with growth driven by improving payment infrastructure, rising smartphone penetration, and increasing use of digital wallets. Brazil and Mexico lead regional adoption as retailers digitize operations and upgrade outdated POS systems to support electronic payments and compliance requirements. Mobile POS adoption is accelerating among small and mid-sized retailers due to affordability and ease of use. Economic reforms, financial inclusion initiatives, and modernization of retail formats contribute to steady market expansion, despite challenges related to security concerns and uneven digital infrastructure across the region.

Middle East & Africa (MEA)

The Middle East & Africa region held a 3.6% share in 2024, supported by the rise of modern retail formats, government initiatives promoting cashless transactions, and growing adoption of e-commerce. The UAE, Saudi Arabia, and South Africa are key contributors, investing in advanced POS systems to meet increasing consumer demand for digital payments and seamless checkout experiences. Mobile POS solutions are gaining traction among SMEs due to low installation costs and improved flexibility. Despite infrastructural challenges in parts of Africa, ongoing retail sector modernization and expanding fintech ecosystems continue to unlock growth opportunities across MEA.

Market Segmentations

By Product

By Component

- Hardware

- Software

- Service

By Application

- Department stores

- Supermarkets/hypermarkets

- warehouses

- Convenience stores

- Discount stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Retail Point of Sale (POS) Terminals Market features a diverse and dynamic competitive landscape, shaped by global technology providers, payment solution companies, and emerging cloud-based POS vendors. Key players such as Shopify Inc., Square, PayPal Zettle, Lightspeed, Clover, SumUp, NCR Corporation, Aptos, Cegid Group, and Ctac NV drive innovation through advanced payment technologies, mobile POS adoption, and integrated omnichannel capabilities. These companies focus on enhancing user experience, improving transaction security, and delivering scalable cloud-based platforms tailored for retailers of all sizes. Strategic partnerships, product upgrades, and geographic expansion remain central to strengthening market presence. Vendors increasingly invest in AI-enabled analytics, contactless payment support, and seamless integration with retail management systems to differentiate their offerings. As competition intensifies, providers prioritize flexible pricing models and subscription-based solutions to attract small and medium-sized enterprises, while large retailers seek robust, enterprise-grade POS ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cegid Group

- PayPal Zettle

- Aptos (Goldman Sachs Merchant Banking Division)

- Square

- Ctac NV

- Lightspeed

- NCR Corporation

- SumUp

- Clover

- Shopify Inc.

Recent Developments

- In December 2025, PAX Technology formed a strategic partnership with Wink to add multimodal biometric authentication (face, palm, or voice ID) to PAX’s Android payment terminals aiming to deliver faster, hands-free, more secure checkouts.

- In November 2025, ToneTag launched RetailPOD 3.0, an AI-enabled payment acceptance terminal designed to “talk, transact, and sell,” signalling a reimagined POS experience for retail stores.

- In August 2025, PAX Global (parent of PAX Technology) announced that its Australian RKI-service obtained PCI PIN certification strengthening its payment-security offerings and value-added services in the Asia-Pacific POS market

Report Coverage

The research report offers an in-depth analysis based on Product, Component, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady adoption of cloud-based and mobile POS platforms across global retail environments.

- Integration of AI and analytics will strengthen real-time decision-making and personalized customer engagement.

- Contactless and digital payment adoption will continue accelerating, driving upgrades to advanced POS systems.

- Retailers will increasingly replace legacy infrastructure with unified omnichannel POS ecosystems.

- Mobile POS solutions will expand rapidly in convenience stores, quick-service restaurants, and small retail formats.

- Enhanced cybersecurity frameworks will become essential as digital transactions and data volumes increase.

- POS vendors will focus on modular, scalable, and subscription-based deployment models.

- IoT and connected retail technologies will enhance automation, inventory tracking, and operational visibility.

- Developing regions will witness strong growth due to rising digitalization and expanding organized retail.

- Strategic partnerships between payment providers and POS vendors will reshape market innovation and competitiveness.