Market Overview

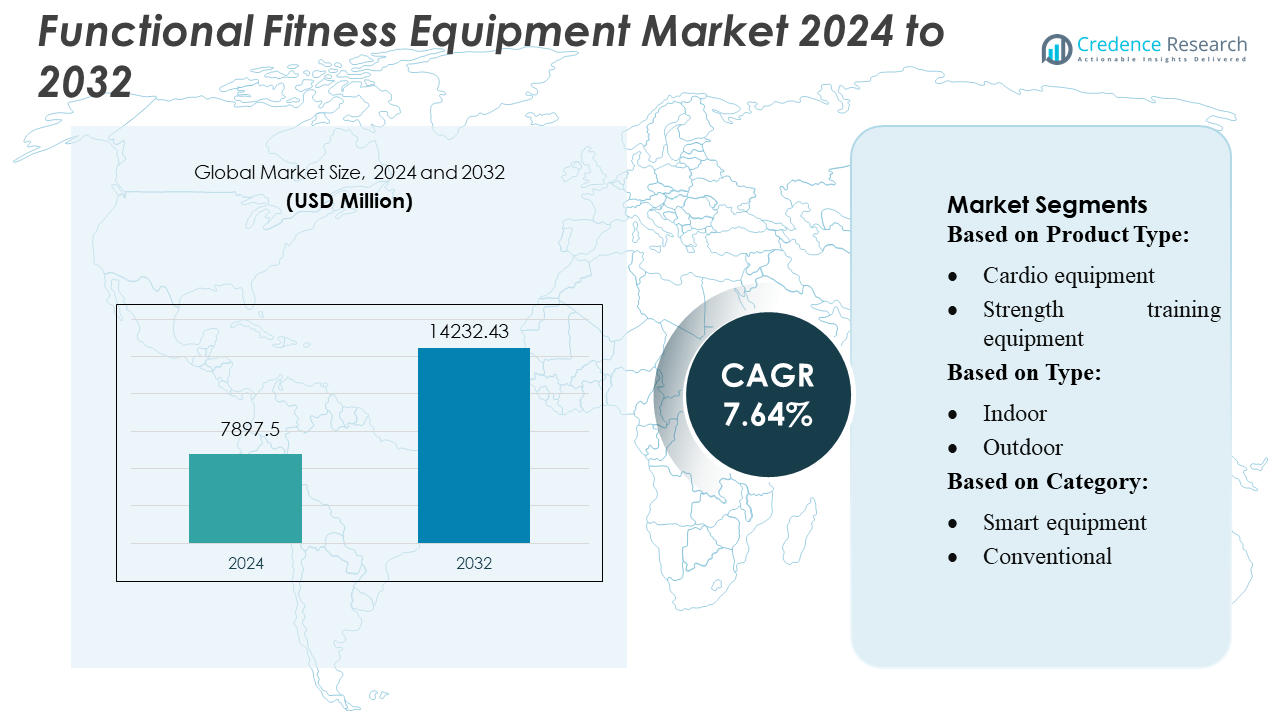

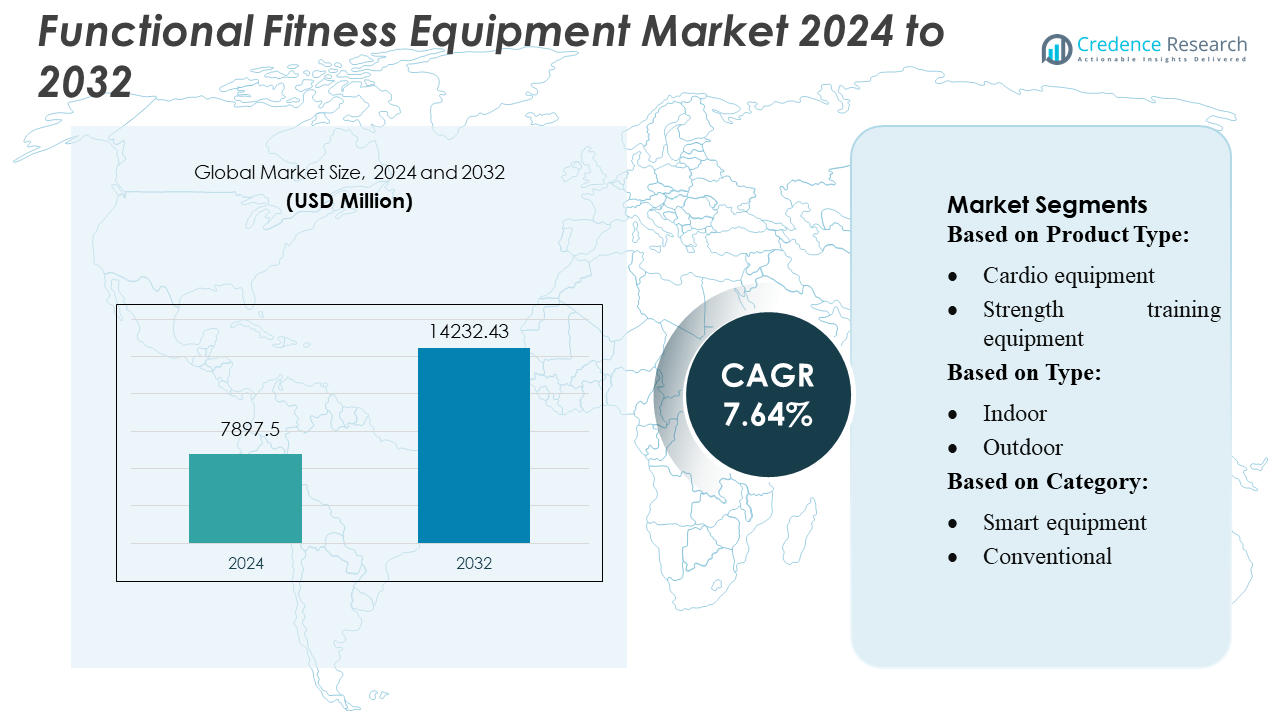

Functional Fitness Equipment Market size was valued USD 7897.5 million in 2024 and is anticipated to reach USD 14232.43 million by 2032, at a CAGR of 7.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Fitness Equipment Market Size 2024 |

USD 7897.5 Million |

| Functional Fitness Equipment Market, CAGR |

14.80% |

| Functional Fitness Equipment Market Size 2032 |

USD 14232.43 Million |

The Functional Fitness Equipment Market is shaped by strong competition among leading players such as Technogym, Life Fitness, Johnson Health Tech, Icon Health & Fitness, Peloton, Precor, True Fitness, Anta Sports, and Shandong EM Health Industry Group, each expanding their portfolios through smart, connected, and multifunctional training solutions. These companies focus on product innovation, digital integration, and strategic distribution to strengthen global presence across commercial, home, and boutique fitness segments. North America remains the leading region, holding approximately 35% of the market share, supported by mature fitness infrastructure, high consumer spending, and rapid adoption of technology-enabled training systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Functional Fitness Equipment Market was valued at USD 7,897.5 million in 2024 and is projected to reach USD 14,232.43 million by 2032, registering a CAGR of 7.64% during the forecast period.

- Market growth is driven by rising adoption of functional, strength, and mobility-focused training across gyms, boutique studios, and home fitness spaces, supported by increasing demand for smart, connected, and AI-assisted workout systems.

- Key trends include rapid digital integration, expansion of compact multifunctional equipment, and growing consumer preference for performance tracking, personalized coaching, and eco-friendly product designs.

- Competitive intensity remains high as major companies enhance innovation, diversify product portfolios, and strengthen distribution networks, with strength training equipment holding the largest share among product segments.

- Regionally, North America leads with 35% market share, followed by Europe and Asia-Pacific, driven by mature fitness ecosystems, strong consumer spending, and growing investments in functional training zones across commercial and residential settings.

Market Segmentation Analysis:

By Product Type

The functional fitness equipment market remains dominated by strength training equipment, which accounts for over 35% of total segment share due to its extensive use across commercial gyms, boutique fitness studios, and rehabilitation centers. Demand grows as consumers prioritize muscle conditioning and metabolic training, driving investments in free weights, racks, and cable systems. Cardio equipment follows closely, supported by the rising adoption of high-intensity interval training (HIIT). Functional training tools such as kettlebells, battle ropes, and medicine balls continue to expand as users seek dynamic, full-body workout solutions.

- For instance, Peloton Interactive Inc. enhances the cardio category with hardware such as the Peloton Bike+, which integrates a 23.8-inch rotating HD touchscreen and digitally controlled resistance offering up to 100 micro-adjustment levels, enabling precise performance tracking during functional and interval-based workouts.

By Type

The indoor segment leads the market with more than 70% share, driven by strong adoption in fitness clubs, home gyms, corporate wellness centers, and rehabilitation facilities. Indoor installations benefit from controlled environments, higher equipment longevity, and integration with digital workout platforms. Growth accelerates as consumers shift toward at-home training supported by compact, multifunctional equipment. Outdoor functional fitness equipment gains traction in parks, recreational zones, and community fitness spaces due to rising public wellness initiatives, but remains comparatively smaller because of weather-related maintenance and limited installation flexibility.

- For instance, the Life Fitness PowerMill Climber integrates the SureStep System Technology with a 4.0 HP motor and delivers speeds spanning 12–185 steps per minute, while its step platform covers 205 square inches for secure footing.

By Category

The conventional equipment segment holds the dominant position with approximately 60% market share, supported by its affordability, durability, and widespread use across commercial and residential settings. Conventional systems remain preferred in high-traffic gyms requiring robust, low-maintenance solutions. However, the smart equipment segment is the fastest-growing, propelled by increasing integration of AI-enabled coaching, performance analytics, and app-based workout tracking. Smart functional equipment also benefits from the expansion of connected home gyms, where users demand personalized training, real-time feedback, and seamless device interoperability.

Key Growth Drivers

1. Rising Adoption of Functional and High-Intensity Training

The growing preference for functional fitness and high-intensity training significantly drives market expansion as consumers seek workouts that improve strength, mobility, and core stability. Fitness clubs increasingly integrate functional zones with specialized equipment such as kettlebells, battle ropes, suspension trainers, and sandbags. The trend is fueled by demand for dynamic, full-body routines suited for weight management, athletic conditioning, and rehabilitation. The surge in boutique studios specializing in CrossFit, calisthenics, and metabolic conditioning further accelerates equipment demand across commercial and residential spaces.

- For instance, iFit-enabled NordicTrack Commercial S22i Studio Cycle offers incline and decline adjustment from −10% to +20%, a 22-inch HD touchscreen, and digitally controlled resistance up to 1,000 watts, enabling fully immersive, terrain-simulating rides.

2. Expansion of Home Fitness and Personalized Training

Home fitness adoption continues to accelerate, driven by rising health awareness, remote working patterns, and the convenience of personalized training experiences. Consumers invest in compact and multifunctional functional fitness equipment that fits limited spaces while offering diverse workout options. The integration of digital coaching, guided programs, and mobile-based tracking enhances user engagement, encouraging long-term usage. Equipment manufacturers capitalize on this shift by offering modular systems, smart sensors, and connected platforms, which enhance product value and attract tech-savvy home fitness users globally.

- For instance, NordicTrack X24 Smart Treadmill (also referred to as the Commercial X24 or X24i) features a large, 24-inch Full-Color Capacitive HD Touchscreen that is capable of both tilting and pivoting for on- and off-equipment workouts.

3. Increasing Integration of Smart and Connected Equipment

The integration of smart technology into functional fitness equipment remains a strong growth driver, enabling users to track performance metrics such as form, repetitions, heart rate, and progress. AI-enabled coaching systems and real-time analytics improve training efficiency and reduce injury risks, appealing to both beginners and advanced athletes. Commercial gyms adopt connected equipment to deliver personalized member experiences, optimize equipment usage, and strengthen retention. The shift toward data-driven training experiences boosts demand for smart functional equipment across home gyms, boutique studios, and rehabilitation facilities.

Key Trends & Opportunities

1. Growth of Boutique Functional Training Studios

Boutique studios specializing in functional fitness, CrossFit, mobility training, and small-group workouts present a strong opportunity for market growth. These studios prioritize high-performance equipment, customized workout zones, and instructor-led immersive experiences. This trend is fueled by consumer demand for specialized, community-driven training environments that offer faster results and greater engagement. As memberships rise globally, studio operators increasingly invest in durable, space-efficient functional training equipment, creating consistent demand across premium urban fitness centers and suburban wellness hubs.

- For instance, Technogym SkillRun Unity 5000 treadmill features a motorized slat-belt running surface measuring 173 × 55 cm, supports a maximum user weight of 220 kg, and delivers resistance up to 1,700 watts at 10 km/h via patented Multidrive Technology — enabling both running and sled-push training in one unit.

2. Expansion of Corporate and Community Wellness Initiatives

Corporate offices, community recreation centers, and public wellness parks increasingly adopt functional fitness equipment to promote health and reduce lifestyle-related diseases. Organizations invest in compact, multi-user equipment that supports mobility, strength, and full-body training. Municipal authorities also expand outdoor functional fitness zones to increase public access to wellness infrastructure. This trend creates opportunities for durable, weather-resistant, and low-maintenance equipment solutions tailored for non-commercial, high-footfall environments. As governments amplify preventive healthcare initiatives, the market benefits from a steady rise in institutional-level demand.

- For instance, SM-1000 Functional Trainer provides dual adjustable arms with 270° rotating pulley housings and 23 vertical position settings (numbered 1–23) for versatile multi-plane motion, ideal for shared workout zones.

3. Rising Demand for Eco-Friendly and Sustainable Equipment

Sustainability has become a key market opportunity as consumers and gyms prefer equipment made from recycled, low-impact, and durable materials. Manufacturers increasingly invest in eco-friendly design approaches such as carbon-neutral steel production, biodegradable grips, and energy-efficient manufacturing processes. This trend aligns with global ESG goals and supports gyms that market themselves as environmentally responsible. The demand for long-lasting, low-waste products also positions sustainable equipment as a premium category, attracting both corporate buyers and home users prioritizing eco-conscious fitness solutions.

Key Challenges

1. High Cost of Advanced and Smart Functional Equipment

The adoption of smart and connected functional fitness equipment is restricted by high purchase and maintenance costs, particularly for small gyms, community centers, and price-sensitive home users. AI-enabled systems, integrated sensors, and digital coaching platforms elevate product pricing, limiting accessibility in emerging economies. Additionally, subscription-based digital content and software updates add ongoing expenses. These factors create a barrier to mass adoption, slowing the transition from conventional to smart functional equipment across both commercial and residential sectors.

2. Space Constraints and Limited Infrastructure in Urban Areas

Urban gyms and residential spaces often face layout limitations that restrict the installation of full functional training zones or large multifunctional racks. Home users in compact apartments struggle to accommodate bulky or multi-station equipment, reducing market penetration for premium systems. Commercial facilities also balance space allocation among strength, cardio, and functional zones, limiting investment in new equipment. Manufacturers must address this challenge through modular, foldable, and space-efficient designs that enable full-body training without requiring large dedicated functional areas.

Regional Analysis

North America

North America leads the functional fitness equipment market with over 35% share, driven by strong penetration of commercial gyms, boutique studios, and advanced home fitness setups. Growth accelerates as consumers adopt functional and high-intensity training supported by well-established fitness culture. Corporate wellness programs and rehabilitation centers also increase demand for multifunctional strength and mobility equipment. The U.S. remains the primary revenue contributor due to high disposable incomes, rapid uptake of smart training systems, and strong brand presence. Manufacturers benefit from mature distribution networks and heightened interest in connected, AI-enabled fitness solutions.

Europe

Europe holds around 28% of the global market, supported by rising health awareness, expansion of boutique fitness concepts, and government-backed physical activity programs. Countries such as Germany, the U.K., and France drive demand as gyms invest in functional training zones to attract performance-focused members. Home fitness adoption continues to grow, particularly in urban areas where compact multifunctional tools appeal to consumers with limited space. The region also sees increasing interest in eco-friendly equipment, aligning with sustainability-focused regulations. Rehabilitation centers and physiotherapy clinics further boost uptake of balance, mobility, and flexibility-oriented functional tools.

Asia-Pacific

Asia-Pacific represents over 24% of the market and stands as the fastest-growing region, driven by expanding urban populations, rising income levels, and rapid gym network development. China, India, and Southeast Asia lead demand as younger consumers adopt strength, functional, and high-intensity training. The home fitness trend accelerates post-pandemic, increasing sales of compact resistance systems, suspension trainers, and kettlebells. Government initiatives promoting active lifestyles and the growth of premium fitness chains bolster commercial investments. Increasing interest in sports performance training and digital-enabled fitness ecosystems further supports strong regional market expansion.

Latin America

Latin America accounts for around 7% of market share, with growth supported by increasing participation in functional training, CrossFit, and community fitness programs. Brazil and Mexico dominate demand due to expanding gym chains and rising health consciousness among urban populations. Budget-friendly and durable functional equipment, such as medicine balls, resistance tubes, and power bags, gains traction across commercial and home settings. Economic constraints limit adoption of high-cost smart equipment, but local manufacturers benefit from demand for versatile and space-efficient training tools. Government-led wellness campaigns also contribute to gradual market expansion.

Middle East & Africa

The Middle East & Africa holds approximately 6% of market share, driven by rapid fitness infrastructure development in the Gulf nations and increasing investments in premium gyms, sports clubs, and hotel fitness centers. The UAE and Saudi Arabia lead the region as consumers embrace functional training to support weight management and lifestyle improvements. Demand grows for durable outdoor functional equipment used in community fitness parks and recreational spaces. However, budget limitations in parts of Africa restrain premium equipment adoption. Despite this, rising youth fitness participation and government wellness initiatives create long-term growth opportunities.

Market Segmentations:

By Product Type:

- Cardio equipment

- Strength training equipment

By Type:

By Category:

- Smart equipment

- Conventional

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Functional Fitness Equipment Market features leading players such as Peloton Interactive Inc., Life Fitness (KPS Capital), Shandong EM Health Industry Group Co., Ltd., Icon Health & Fitness, Technogym S.P.A., Anta Sports Products Limited, True Fitness Technology, Inc., Johnson Health Tech, and Precor Incorporated. the Functional Fitness Equipment Market is characterized by strong innovation, rapid digital integration, and continuous product differentiation as companies compete to capture both commercial and residential demand. Manufacturers increasingly focus on developing multifunctional, space-efficient equipment that supports strength, mobility, balance, and high-intensity training. The market also shows a clear shift toward smart, connected systems that offer performance tracking, AI-guided workouts, and seamless integration with mobile fitness apps. Companies enhance competitiveness through strategic partnerships, expanded global distribution networks, and investments in sustainable materials and energy-efficient manufacturing. Growing demand from boutique studios, corporate wellness programs, and rehabilitation centers further intensifies competition across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Peloton Interactive Inc.

- Life Fitness (KPS Capital)

- Shandong EM Health Industry Group Co., Ltd.

- Icon Health & Fitness

- Technogym S.P.A.

- Anta Sports Products Limited

- True Fitness Technology, Inc.

- Johnson Health Tech

- Precor Incorporated

- Johnson Health Tech. Co., Ltd.

Recent Developments

- In October 2025, Technogym offers cutting-edge solutions like its Connected Dumbbells: adjustable dumbbells with an ergonomic design, equipped with a quick with internal sensors that analyze movement patterns and monitor exercise performance.

- In April 2025, Gymleco unveiled innovative piece of equipment merges two staple chest exercises – incline press and chest flyes – into one compact and biomechanically optimized machine that combines incline press and chest flyes. Designed for maximum muscle activation and space efficiency, it’s an ideal addition for modern gyms.

- In October 2024, Precor partnered with Dimension 6 Fitness to distribute Nike Strength equipment in North America. This collaboration expands Precor’s offerings to include Nike-branded Functional Strength training equipment for gyms and fitness facilities that carry the Nike brand.

- In September 2024, iFIT made a significant showcasing its new lineup of smart fitness products. This launch included new hardware, a redesigned operating system, the interactive AI Coach (beta) configuration, and new outdoor content.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as consumers prioritize functional training for strength, mobility, and overall wellness.

- Adoption of smart, connected equipment will rise as users seek real-time analytics and personalized coaching.

- Home fitness demand will remain strong, supported by compact, multifunctional product designs.

- Commercial gyms will increase investments in functional zones to enhance member engagement and retention.

- Boutique studios specializing in functional and performance training will drive higher equipment replacement cycles.

- Sustainable, eco-friendly equipment materials will gain traction as manufacturers align with global ESG standards.

- Rehabilitation centers will increasingly integrate functional tools to support injury recovery and mobility training.

- Outdoor functional fitness installations will grow as cities promote community wellness programs.

- AI-driven training platforms will influence equipment development and user experience optimization.

- Global distribution networks will expand as brands target emerging markets with rising fitness participation.