Market Overview:

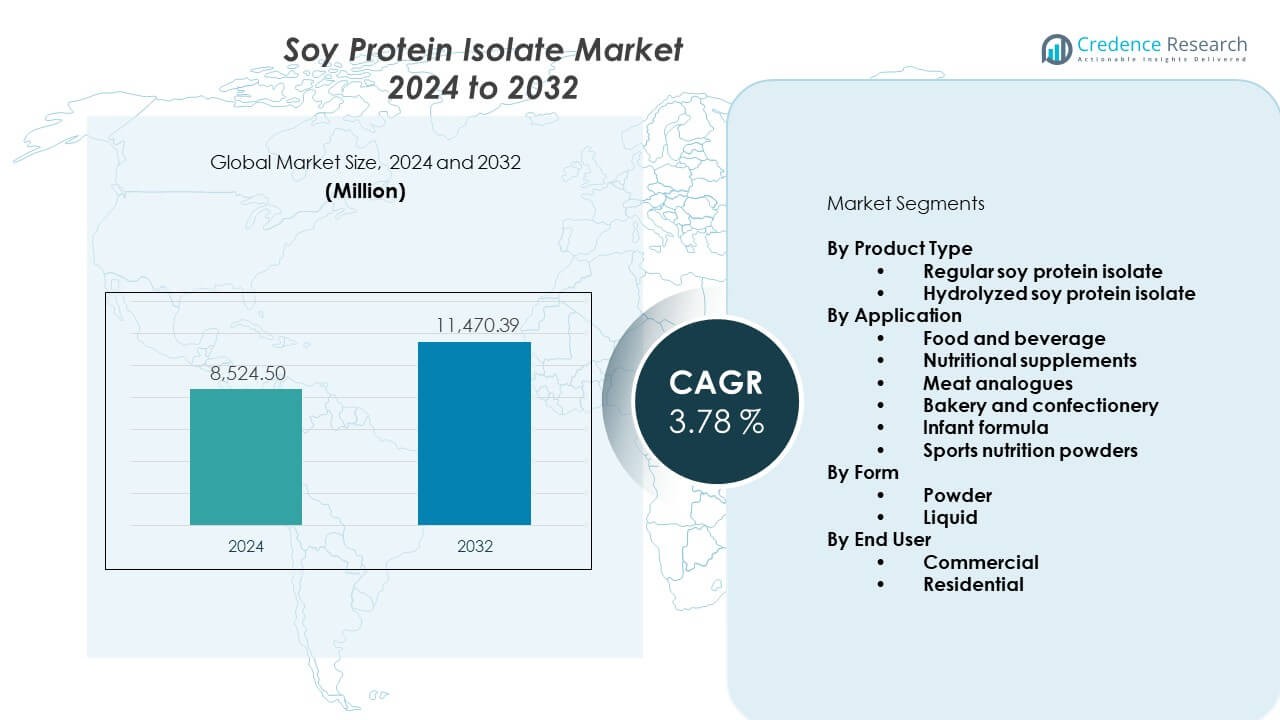

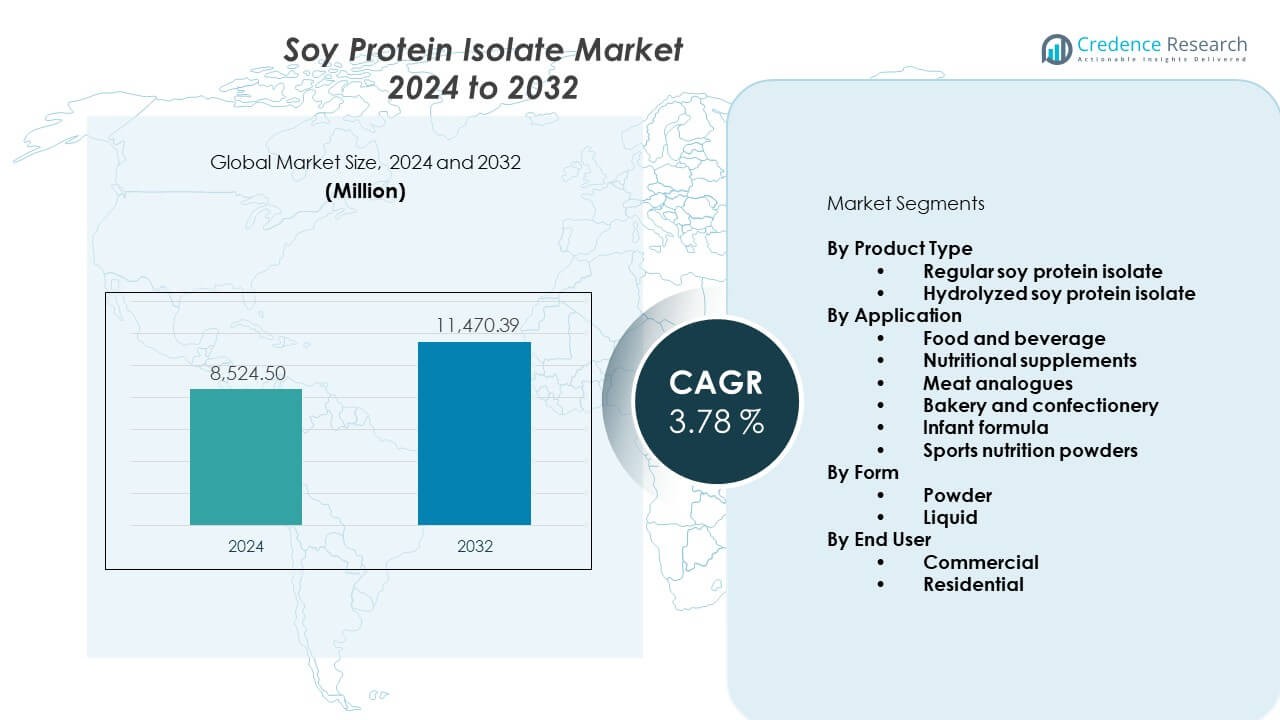

The Soy protein isolate market is projected to grow from USD 8,524.5 million in 2024 to an estimated USD 11,470.39 million by 2032, with a compound annual growth rate (CAGR) of 3.78% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soy protein isolate market Size 2024 |

USD 8,524.5 Million |

| Soy protein isolate market, CAGR |

3.78% |

| Soy protein isolate market Size 2032 |

USD 11,470.39 Million |

Growing demand for plant-based protein drives strong adoption across key industries. Food and beverage producers use soy protein isolate to enhance protein density and functional performance. Sports nutrition brands highlight its amino acid profile to attract active consumers. Manufacturers improve extraction methods to reduce off-notes. Clean-label trends shape product development across snacks and beverages. Rising lactose intolerance cases increase interest in dairy alternatives. Global health awareness pushes preference for sustainable protein options. This trend strengthens the commercial position of soy protein isolate and supports wider market penetration.

North America leads due to strong demand for plant-based foods and mature production ecosystems. Europe follows with higher adoption of vegan diets and clean-label ingredients. Asia-Pacific emerges as the fastest-growing region due to rising consumer awareness, protein deficiency concerns, and rapid expansion of local processing facilities. China and India gain traction as food manufacturers integrate plant-based proteins into mainstream categories. Latin America expands due to wider soy cultivation and improving food technology capabilities. The Middle East and Africa show steady uptake driven by dietary diversification and interest in affordable protein sources.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The soy protein isolate market is valued at USD 8,524.5 million in 2024 and is projected to reach USD 11,470.39 million by 2032, growing at a 78% CAGR during the forecast period.

- North America (39%), Europe (29%), and Asia-Pacific (23%) hold the largest regional shares due to strong demand for plant-based foods and advanced processing capabilities.

- Asia-Pacific, with a 23% share, is the fastest-growing region supported by rapid food manufacturing expansion and rising protein consumption across China and India.

- The food and beverage segment leads the market with an estimated 40% share, driven by high usage in dairy alternatives, meat analogues, and fortified foods.

- Powder form dominates with roughly 70% share, supported by long shelf life, better stability, and widespread application in commercial processing.

Market Drivers:

Rising Need for High-Quality Plant Protein Across Food, Nutrition, and Wellness Segments

Growing interest in clean protein supports strong expansion in the Soy protein isolate market. Brands add concentrates to snacks, beverages, and meat analogues to improve texture and protein density. Food processors value its solubility and stability in high-performance formulations. Sports nutrition firms use it to meet demand for amino-rich supplements. Health-focused consumers prefer plant protein to limit allergens found in dairy. Rising lactose intolerance cases push wider usage across regional markets. Producers scale advanced extraction units that lift product consistency. The market gains steady traction across health, wellness, and lifestyle food categories.

- For instance, ADM operates over 270 global processing facilities and uses advanced membrane filtration to produce isolates with protein levels above 90%, supporting consistent quality for leading food brands.

Growing Influence of Fitness, Weight Management, and Protein-Rich Diet Adoption

Fitness-driven consumers shift toward structured protein intake for daily nutrition. Sports enthusiasts value plant protein for recovery and lean muscle goals. Weight-management programs promote soy isolate for its satiety benefits. Food companies respond with ready-to-mix shakes and fortified bars. Dieticians highlight its amino acid composition for balanced nutrition. Growing gym memberships lift awareness of protein supplementation. Brands market clean-label profiles to match lifestyle preferences. This shift strengthens market acceptance across performance and wellness nutrition.

- For instance, MyProtein offers a wide range of vegan and plant-based options in response to growing consumer demand for plant-based proteins. The company does use high-quality soy isolates—which, as a complete protein, are widely recognized in sports nutrition to have a maximum verified PDCAAS score of 1.0—to meet athlete-focused nutrition needs.

Increasing Use of Soy Protein in Meat Alternatives and Hybrid Protein Formulations

Plant-based meat producers use soy isolate to improve firmness, bind moisture, and lift protein quality. Hybrid protein producers combine soy with pea or rice to enhance sensory outcomes. Food manufacturers focus on uniform texture in burgers, nuggets, and ready meals. Improved processing technology removes off-notes and supports wider culinary use. FMCG brands expand distribution in mainstream retail. Food chains test soy-based options within fast-service menus. Consumers adopt these choices for health and sustainability concerns. Strong retail visibility pushes demand across global markets.

Growing Industrial-Scale Production Capacity and Advancements in Extraction Technology

Producers invest in modern extraction systems to improve purity and performance. New facilities target low-odor output to match sensory expectations. Automation supports tighter control over protein isolates. Food companies prefer consistent quality for mass-market formulations. Global suppliers expand footprints to secure stable supply. Brands use scalable capacity to develop new product lines. Improved technology strengthens energy efficiency during processing. These upgrades enhance reliability and support long-term commercial growth.

Market Trends:

Shift Toward Clean-Label, Allergen-Free, and Transparent Ingredient Formulations

Consumers prefer simple labels that highlight purity and sustainability. Brands redesign portfolios to highlight non-GMO or organic credentials. Food companies use soy isolate to reduce artificial stabilizers. Personal nutrition brands promote allergen-friendly traits. Transparency builds stronger retail engagement. Packaging updates support greater ingredient awareness. Clean-label innovation shapes how producers position products. The trend strengthens confidence across multiple end-use categories.

- For instance, Danone reformulated several plant-based SKUs under its Alpro brand to feature 100% non-GMO soy protein while meeting EU allergen-control standards across more than 50 production lines.

Expansion of Ready-to-Drink, Ready-to-Mix, and Functional Protein Beverages

Beverage innovators use soy isolate for stable emulsification and protein enrichment. Demand rises for on-the-go health drinks. Brands develop fortified blends targeting active lifestyles. Foodservice outlets add high-protein beverage lines. Smoothie and shake brands prioritize neutral flavor profiles. Cold-fill and aseptic technologies support new launches. Soy isolate helps stabilize texture in high-acid drinks. This segment grows due to convenience-led consumer behavior.

- For instance, Coca-Cola’s AdeS plant-based beverage line expanded across more than eight Latin American markets using soy protein systems designed to maintain stability through aseptic processing at commercial scale.

Growing Commercial Use in Bakery, Confectionery, and Specialized Culinary Applications

Bakers use soy isolate to improve dough strength and enhance browning. Confectionery makers add it to bars and coatings for higher protein claims. Shelf-stable foods benefit from its water-binding properties. Culinary producers test it in sauces and premixes. Restaurants explore plant-forward menus using soy-based ingredients. Packaging formats expand into bulk foodservice packs. The trend improves application versatility across global markets. Wider usage increases formulation flexibility for brands.

Rise of Sustainable Protein Positioning and Ethical Sourcing Practices

Manufacturers highlight low environmental footprint to attract eco-conscious buyers. Companies invest in traceable soybean sourcing systems. Sustainability certifications support stronger branding. Retailers promote plant proteins in green product ranges. Consumers value lower land and water use in soy-based choices. Food brands integrate sustainability messaging in campaigns. Procurement teams adopt responsible sourcing frameworks. The trend strengthens long-term category credibility.

Market Challenges Analysis:

Complex Supply Chain Dependencies and Volatility in Soybean Production Cycles

The Soy protein isolate market faces pressure from fluctuating crop yields. Weather shifts affect soybean availability across major farming regions. Supply tightness influences raw material pricing. Producers manage uncertainty by securing diversified sourcing hubs. Food companies navigate rising manufacturing costs. Long shipping routes raise transit risks for global suppliers. Quality variation across crops affects processing outcomes. The market handles these constraints through strategic procurement and careful inventory control.

Persistent Competition From Alternative Plant Proteins and Sensory Limitations in Certain Applications

Competing proteins like pea, rice, and fava gain interest due to flavor neutrality. Some consumers prefer non-soy proteins due to allergen concerns. Brands work to improve taste profiles in high-protein foods. Premium segments demand cleaner sensory performance. Food formulators adjust blends to manage beany notes. New entrants raise competition intensity. Companies invest in R&D to match evolving consumer preferences. This challenge shapes long-term product positioning strategies.

Market Opportunities:

Growing Scope Across High-Protein Convenience Foods, Sports Nutrition, and Functional Wellness Products

The Soy protein isolate market gains new opportunities across fast-moving nutrition categories. Brands create fortified meals, bars, and functional drinks for daily consumption. Sports nutrition firms launch cleaner formulations that support targeted performance goals. Wellness brands expand into gut-health and metabolic-support products. Retailers highlight protein-rich offerings across shelves. Expanding product lines lift adoption across mainstream consumers. The opportunity grows as health awareness rises across regions. Companies benefit from broader demand for sustainable protein.

Increasing Global Interest in Sustainable Diets, Plant-Forward Eating, and Responsible Protein Sourcing

Consumers shift toward lower-impact protein sources across home and commercial settings. Food brands promote soy isolate in sustainable product lines. Retailers highlight plant-forward choices across major markets. Companies use certifications to build trust. Plant-based dining trends influence menu innovation. Food processors add soy options to meet rising ethical consumption patterns. Investments in responsible sourcing build stronger value chains. This opportunity strengthens long-term market expansion.

Market Segmentation Analysis:

By Product Type

The Soy protein isolate market shows strong dominance of regular soy protein isolate due to its wide functional range across large-scale food and beverage applications. It delivers stable performance in texture enhancement, emulsification, and protein fortification. Hydrolyzed soy protein isolate grows steadily due to its improved digestibility and reduced allergen profile. This segment supports clinical nutrition, infant formula, and specialized dietary products. Manufacturers adopt advanced hydrolysis techniques to refine taste and solubility. Product innovation strengthens application flexibility. End users prefer consistent quality for mass production.

- For instance, the Fuji Oil Group uses proprietary technology to produce soy protein isolates and peptides, such as their “Hinute” brand soy peptide, which has high absorbability and is used in health products. While the exact phrase “ultra-fine hydrolysis technology” was not verified in the provided sources, the company produces soy peptides (mixtures of oligopeptides) that typically have a molecular weight of 300-700 Da, which is well below the 5,000 Da threshold mentioned in the original claim.

By Application

Food and beverage remains the leading segment, driven by high usage in dairy alternatives, fortified foods, and ready-to-eat meals. Nutritional supplements gain traction due to rising interest in plant-based wellness. Meat analogues use soy isolate to improve structure and protein density. Bakery and confectionery producers apply it for moisture control and protein enrichment. Infant formula firms rely on its amino acid balance for sensitive formulations. Sports nutrition powders expand due to demand for sustained-release protein. This broad adoption supports strong market penetration.

By Form

Powder form dominates due to long shelf stability, efficient transport, and compatibility with industrial blending systems. It suits beverages, snacks, and clinical nutrition products. Liquid form grows faster with rising use in ready-to-drink shakes and functional beverages. Brands prefer high-solubility liquid formats for convenience-driven consumers. Each form supports distinct processing needs across the supply chain.

By End User

Commercial users lead due to high consumption across food manufacturing, supplements, and large foodservice operations. Residential demand rises with the shift toward home-based protein consumption and plant-forward diets. Expanding retail availability lifts household adoption.

Segmentation:

By Product Type

- Regular soy protein isolate

- Hydrolyzed soy protein isolate

By Application

- Food and beverage

- Nutritional supplements

- Meat analogues

- Bakery and confectionery

- Infant formula

- Sports nutrition powders

By Form

By End User

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading share of the soy protein isolate market, accounting for around 38–40% of global demand. Strong adoption of plant-based diets supports steady growth across major food and beverage categories. Producers supply large volumes to sports nutrition, meal replacement, and fortified food manufacturers. Consumers prefer clean-label and lactose-free protein sources, which strengthens category momentum. Brands invest in advanced formulations to meet sensory and nutritional expectations. The market benefits from mature processing systems and strong retail penetration. This region maintains high product visibility across commercial and residential channels.

Europe

Europe captures approximately 28–30% of the global soy protein isolate market, driven by strong interest in vegan, vegetarian, and flexitarian lifestyles. Food manufacturers use it widely in dairy alternatives, bakery products, and functional nutrition. Regulatory support for sustainable protein encourages companies to develop low-impact formulations. Nutritional supplements gain traction due to rising health awareness. Regional consumers show high sensitivity toward clean-label and allergen-free ingredients. The market benefits from strong innovation pipelines within Germany, France, the UK, and the Netherlands. This region sustains an advanced approach to plant-based protein development.

Asia-Pacific

Asia-Pacific holds about 22–24% of the global soy protein isolate market and represents the fastest-growing region. Strong soybean production ecosystems in China and India support cost-efficient processing. Rapid urbanization pushes higher consumption of fortified foods, beverages, and sports nutrition products. Local brands scale capacity to meet domestic and export requirements. Rising fitness awareness lifts adoption across both commercial and residential segments. The region strengthens its presence through expanding manufacturing clusters and rising retail availability. This growth trend positions Asia-Pacific as an increasingly influential participant in global supply and consumption patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ADM (Archer Daniels Midland)

- Cargill, Inc.

- DuPont Nutrition (IFF)

- Kerry Group

- Fuji Oil Holdings

- Wilmar International

- CHS Inc.

- AG Processing Inc.

- Doves Farm Foods

- Kraft Heinz Company

- The Kellogg Company

- The Scoular Company

- Blendtek Ingredients

- Patanjali Foods

- Nature Republic

- Foodchem International

- Devansoy

- Crown Soya Protein Group

Competitive Analysis:

The Soy protein isolate market shows strong competition among global ingredient leaders and regional processors. ADM, Cargill, DuPont Nutrition (IFF), Fuji Oil, and Kerry Group command significant influence through large-scale production and diversified plant-protein portfolios. It benefits from continued investment in extraction technology that improves purity, flavor, and solubility. Global players expand capacity to support food, beverage, and sports nutrition manufacturers. Smaller specialty suppliers strengthen their presence through organic and non-GMO offerings. Companies compete through innovation in clean-label and functional formulations. Strategic partnerships help brands secure stable supply and improve product quality. This landscape supports steady advancement across applications.

Recent Developments:

- In October 2025, CHS Inc. and Mid-Kansas Cooperative (MKC) mutually agreed to end their grain marketing joint venture called Producer Ag. While CHS decided not to continue with the grain purchasing venture after two years of collaboration, the two cooperatives maintained their strong relationship and continued joint ownership of three grain rail terminals in Kansas.

- In August 2025, ADM announced a strategic streamlining of its global soy protein production network. The company decided to cease operations at its plant in Bushnell, Illinois, while focusing on operational excellence at its recently recommissioned soy protein facility in Decatur, Illinois, and other facilities spanning its global network. This optimization initiative was designed to consolidate soy protein operations into a more efficient global network while maintaining the ability to support growing global demand.

- In July 2025, Ag Processing Inc. (AGP) celebrated the grand opening of its new soybean processing and degumming facility in David City, Nebraska. The David City plant represents AGP’s 11th soybean processing location and was scheduled to begin commercial operations by the end of August 2025. Once fully operational, the state-of-the-art facility is capable of processing over 50 million bushels of soybeans annually and producing nearly 700 million pounds of degummed oil per year. The facility is expected to support more than 80 full-time jobs and was strategically selected for its reliable supply of soybeans, skilled workforce, strong local infrastructure, and transportation access.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-purity plant protein will expand across food, beverage, and nutrition sectors.

- Adoption of soy-based ingredients will strengthen due to cleaner sensory profiles.

- Growth in plant-based meat and dairy alternatives will create new product opportunities.

- Manufacturers will scale advanced extraction systems for consistent quality.

- Retail availability will rise across mainstream and specialty channels.

- Fitness and wellness trends will increase use in protein supplements.

- Urbanization will boost consumption of ready-to-drink and ready-to-mix protein formats.

- Sustainability goals will support wider acceptance of soy as a low-impact protein.

- Asia-Pacific will accelerate production capacity to serve global demand.

- Strategic collaborations will improve innovation speed and market reach.