Market Overview

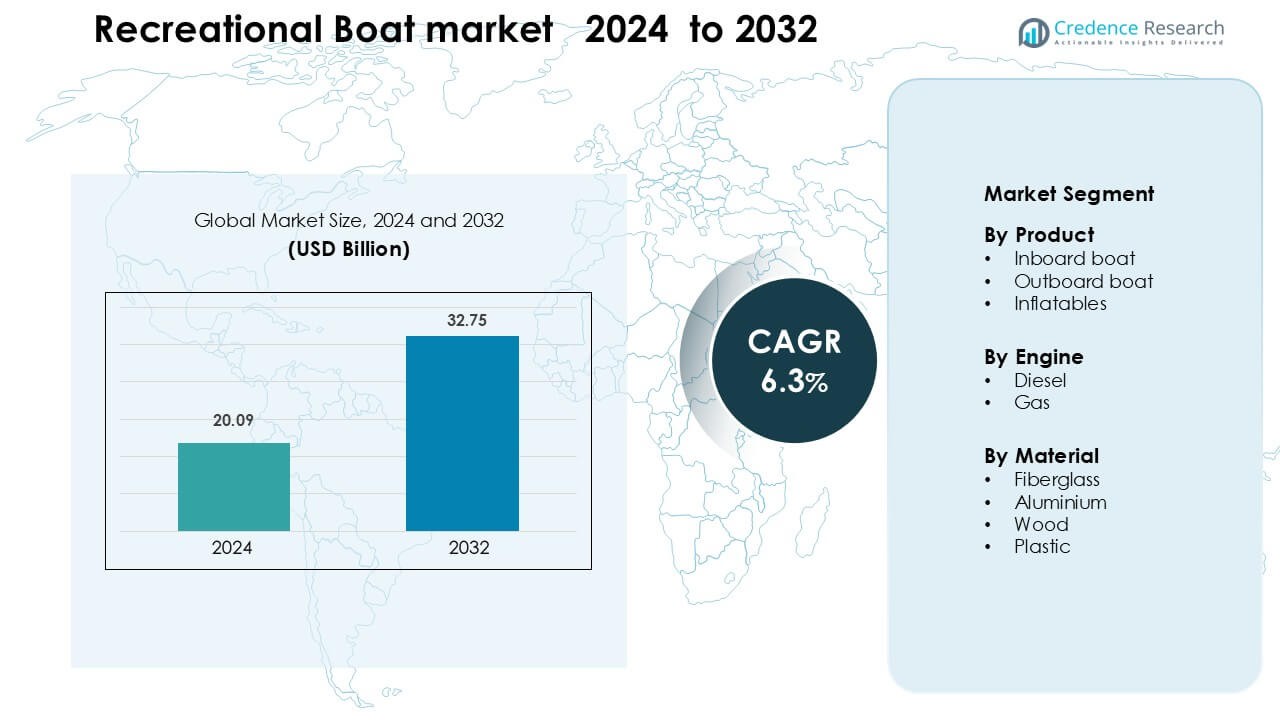

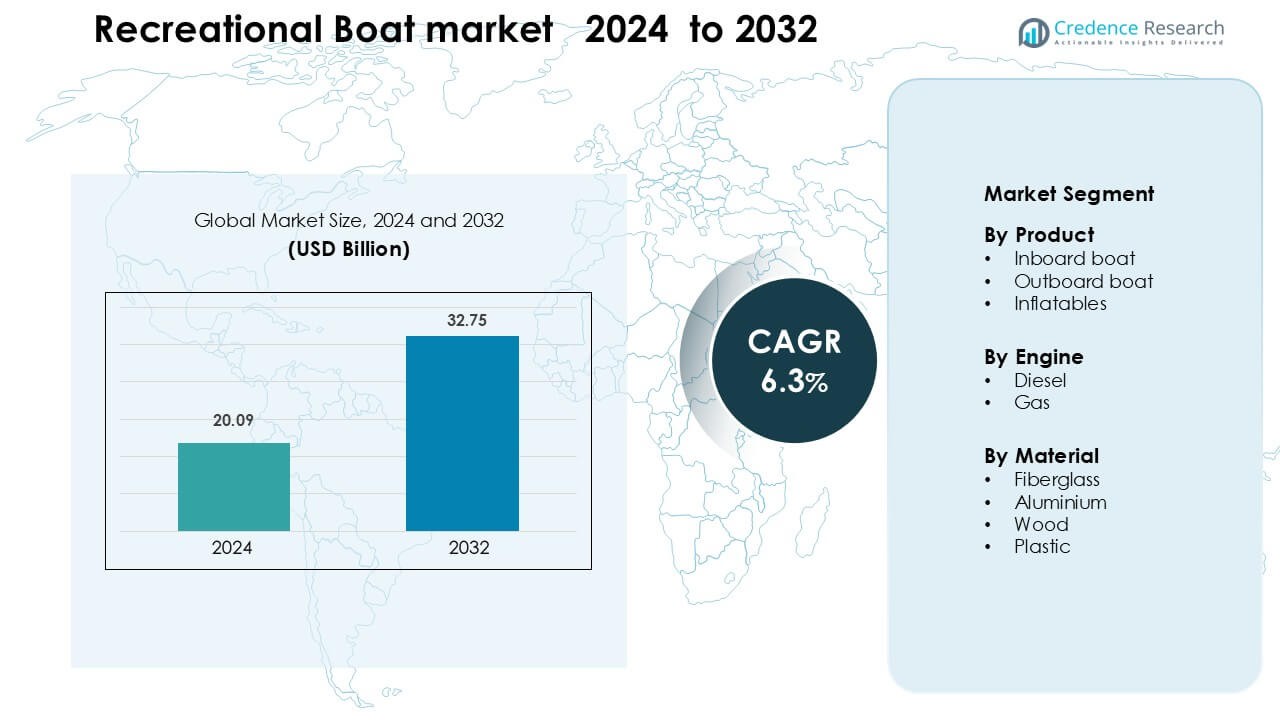

Recreational Boat market was valued at USD 20.09 billion in 2024 and is anticipated to reach USD 32.75 billion by 2032, growing at a CAGR of 6.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recreational Boat Market Size 2024 |

USD 20.09 Billion |

| Recreational Boat Market, CAGR |

6.3 % |

| Recreational Boat Market Size 2032 |

USD 32.75 Billion |

The recreational boat market is shaped by leading companies such as Fountain Powerboats, Inc., Bavaria Yachtbau GmbH, Ferretti S.P.A., Bombardier Recreational Products (BRP) Inc., Chaparral Boats, Inc., Avon Marine, Azimut Benetti Group, Baja Marine, Farr Yacht Design, Ltd., and Brunswick Corporation. These manufacturers compete through advanced hull designs, high-performance engines, and expanding product portfolios across outboard, inboard, and luxury yacht categories. North America remained the leading region in 2024 with about 46% share, supported by strong consumer spending, mature marina networks, and high participation in boating activities. This regional dominance continues to drive global demand and technological innovation in recreational boats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Recreational Boat market was valued at USD 20.09 billion in 2024 and is anticipated to reach USD 32.75 billion by 2032, growing at a CAGR of 6.3 % during the forecast period.

- Rising demand for leisure boating, strong interest in outboard boats holding 58% share, and higher spending on premium watercraft drive steady sales.

- Key trends include rapid adoption of electric propulsion, smart navigation systems, and lightweight composite materials that improve efficiency and reduce operating costs.

- Competitive activity strengthens as major players expand portfolios, upgrade engine technology, and introduce customizable models to meet varied buyer preferences across global markets.

- North America led the market with 46% share, followed by Europe at 28%, while fiberglass remained the dominant material with 64% share, reinforcing strong regional and segment-level momentum worldwide.

Market Segmentation Analysis:

By Product

In 2024, outboard boats held the dominant share at about 58% due to strong demand for versatile designs, easier maintenance, and better fuel efficiency. Buyers in fishing, leisure cruising, and water sports favored outboard models because manufacturers offered compact engines, higher horsepower options, and improved noise reduction. Inboard boats kept steady use in luxury cruising and wake sports, while inflatables grew in portable recreation and rental fleets. Rising interest in accessible marine recreation continued to push outboard units as the preferred product choice.

- For instance, Suzuki DF350 outboard delivers 350 hp (257.4 k) from a 4.39 L V6 engine, using a contra-rotating dual-propeller system to reduce vibration and improve thrust efficiency.

By Engine

Gas engines led this segment in 2024 with nearly 71% share due to lower upfront cost, simple maintenance needs, and broad availability across recreational boat categories. Many users selected gas-powered systems for day cruising and watersports where quick acceleration and lighter weight offered clear benefits. Diesel engines held a smaller but stable base in larger boats needing longer range and stronger torque. Growth in high-performance gas engines with cleaner combustion supported wider adoption across mid-sized recreational craft.

- For instance, Mercury Racing 450R gasoline outboard delivers 450 hp from a 4.6-liter V8 platform and weighs 689 lb, achieving a wide operating range of 5800–6400 rpm., which supports high-performance acceleration for mid-sized recreational boats.

By Material

Fiberglass dominated the material segment in 2024 with around 64% share because the material provides strong durability, corrosion resistance, and flexible molding for complex hull shapes. Boat manufacturers relied on fiberglass to reduce maintenance demands and improve long-term performance for family cruisers, sport boats, and fishing craft. Aluminum gained traction in rugged utility and coastal models, while wood and plastic served niche designs or entry-level buyers. The shift toward lightweight and low-maintenance construction continued to reinforce fiberglass as the preferred material in the recreational boat market.

Key Growth Drivers

Growing Demand for Leisure Marine Activities

Rising participation in water-based recreation remains a key growth driver for the recreational boat market. Families, hobbyists, and adventure travelers continue to increase spending on boating, fishing, water sports, and coastal tourism. Higher disposable incomes in North America and Europe support strong purchases of mid-range and premium vessels, while emerging markets witness rising interest in entry-level models. Consumer preference for outdoor leisure after the pandemic has sustained demand across marinas and rental fleets. Tourism operators also expand boating services, which boosts fleet renewals. The growth of marina infrastructure, along with wider access to boating clubs and shared ownership programs, encourages new users to enter the market. Together, these factors strengthen long-term demand for recreational boats.

- For instance, Freedom Boat Club, one of the world’s largest boat-sharing networks, recorded over 600,000member boating trips in 2024 across more than 400 locations.

Technological Advancements in Boat Design and Engines

Technical improvements in hull design, propulsion systems, and onboard electronics significantly enhance market growth. Manufacturers adopt advanced composite materials to improve durability, reduce weight, and increase fuel efficiency. The rise of digital dashboards, smart navigation systems, and integrated telematics boosts user experience and safety. Hybrid and electric propulsion gain attention as buyers seek low-noise, low-maintenance alternatives that support eco-friendly boating. High-performance outboard engines with better torque and optimized fuel burn drive upgrades across popular segments. Automated docking, joystick controls, and predictive maintenance tools further strengthen the appeal of modern boats. These innovations attract both new and experienced buyers and support the shift toward technologically advanced recreational vessels.

- For instance, Resin infusion is an advanced composite manufacturing method that uses a vacuum to pull resin into a dry-fiber mold, which creates a lighter, stronger, and more consistent part compared to older hand-layup methods.

Expansion of Boat Sharing, Rentals, and Marine Tourism

The growth of rental platforms, peer-to-peer boat sharing, and guided marine tours accelerates demand for recreational boats. Many users now prefer flexible access models instead of full ownership, reducing cost barriers for beginners. Rental fleets expand in coastal regions, lakeside destinations, and tourism hubs where demand for short-duration boating rises. Operators regularly replace older boats with newer, more efficient models, supporting consistent sales. Government programs promoting water recreation and tourism development further strengthen infrastructure around marinas and waterways. Smooth booking apps, subscription plans, and club memberships attract younger demographics. This shift toward shared and rental-based boating creates sustained opportunities for manufacturers and service providers.

Key Trend & Opportunity

Shift Toward Electric and Hybrid Propulsion

The recreational boat market observes a strong shift toward cleaner propulsion systems as users and regulators emphasize lower emissions and quieter operation. Electric and hybrid systems gain wider adoption in small and mid-sized boats where short-range coastal travel is common. Manufacturers develop high-density battery packs, efficient power trains, and regenerative technologies that extend range and reduce operating costs. Charging infrastructure expands in marinas, supported by government incentives. Growing awareness of environmental impacts strengthens interest in sustainable boating. This trend also supports innovation in lightweight materials, hull optimization, and smart energy management systems.

- For instance, Vision Marine’s E-Motion 180E electric outboard delivers 180 hp with a 650-V powertrain and dual lithium-ion battery packs rated at 60 kWh, enabling cruising ranges of up to 70–90 km depending on speed.

Rising Demand for Smart, Connected Boats

Connected technologies create major opportunities in the recreational boat market. Boaters increasingly prefer vessels equipped with digital displays, GPS-linked systems, remote diagnostics, and onboard sensors for safety and convenience. Telematics allow real-time engine monitoring, route optimization, and maintenance alerts, reducing downtime for owners and rental operators. Integration of entertainment systems, wireless controls, and advanced navigation enhances the boating experience. Smart features help differentiate premium models and improve resale value. As digital adoption rises, manufacturers collaborate with software firms to offer advanced connectivity suites, positioning smart boats as a key growth opportunity.

- For instance, Garmin’s OneHelm integration ecosystem supports coordination of over 20 onboard systems including lighting, stabilization, and HVAC through a single digital interface.

Growth in Luxury and Customized Recreational Boats

Demand for premium vessels grows as high-income buyers seek personalized designs, larger cabins, and comfort-focused features. Luxury cruising, yacht tourism, and high-end fishing expeditions push builders to offer bespoke interiors, advanced stabilization systems, and superior safety enhancements. Customization extends to upholstery, electronics, deck layout, and performance upgrades. This segment attracts strong interest in regions with wealthy coastal communities and expanding marine tourism. The shift toward tailored experiences enhances innovation in materials, design, and craftsmanship, creating long-term opportunities in the high-value segment of the recreational boat market.

Key Challenge

High Ownership and Maintenance Costs

The recreational boat market faces a major barrier in the form of high purchase, storage, and maintenance expenses. Buyers often need to invest in docking fees, insurance, winterization, and regular servicing, increasing long-term costs. These financial burdens limit adoption among middle-income groups and reduce repeat purchases. Fuel price volatility adds further pressure, especially for larger or high-performance models. Cost concerns also affect rental operators and tourism firms, who must manage high fleet upkeep expenses. This challenge slows market penetration and encourages many potential users to choose rental or shared options instead of ownership.

Environmental Regulations and Emission Compliance (Challenge)

Strict regulations on marine emissions and environmental protection create hurdles for manufacturers and users. Authorities in major boating regions enforce limits on exhaust pollutants, noise levels, and fuel spills, requiring companies to redesign hulls, engines, and fuel systems. Compliance increases production costs and slows the launch of new models. Older boats face restrictions in sensitive waterways, reducing resale value and usage. Users also face higher costs for eco-friendly fuels and compliant equipment. While regulations improve sustainability, they create significant operational and financial challenges for the recreational boat market.

Regional Analysis

North America

North America held the largest share of about 46% in the recreational boat market in 2024, supported by strong demand in the U.S. and Canada. High participation in leisure boating, advanced marina infrastructure, and widespread ownership of outboard and inboard boats drive regional dominance. Buyers favor technologically equipped models with high-performance engines, contributing to steady product upgrades. Boat clubs, rental platforms, and tourism operators further boost sales. Government focus on water recreation safety and environmental standards strengthens industry stability. Overall, strong consumer spending and mature marine culture keep North America the leading regional market.

Europe

Europe accounted for nearly 28% share in 2024 due to established boating traditions across Italy, France, Germany, the U.K., and Nordic countries. Demand rises for sailing boats, luxury cruisers, and eco-friendly electric vessels driven by strict emission norms. Marinas along the Mediterranean and Baltic coasts continue to attract high boating traffic. Growth in charter services and coastal tourism supports consistent fleet renewal. Buyers prefer fiberglass and aluminum builds due to durability and low maintenance. Advancements in engine efficiency and connected features reinforce Europe’s strong position in global recreational boating.

Asia Pacific

Asia Pacific captured roughly 18% share in 2024, with rapid growth supported by rising disposable incomes and expanding marine tourism in China, Japan, South Korea, Australia, and Southeast Asia. Coastal destinations promote boating activities, driving higher demand for outboard boats and inflatables. Governments invest in marina development, coastal safety, and tourism infrastructure, encouraging broader adoption. Increasing interest in water sports and family cruising accelerates market expansion. Manufacturers also focus on affordable models suited for first-time buyers. Asia Pacific remains the fastest-growing region due to its expanding recreational boating culture.

Latin America

Latin America held around 5% share in 2024, influenced by boating activities in Brazil, Mexico, Argentina, and Caribbean coastal markets. Growing tourism, fishing, and leisure boating support moderate demand for outboard and fiberglass models. Rising interest in rental fleets at beach resorts also boosts sales. Economic fluctuations and import costs restrict broader ownership, but stable tourism zones maintain steady consumption. Manufacturers target mid-range and compact designs suited for warm coastal waters. Continued investment in marinas and waterfront recreation spaces helps strengthen the regional market outlook.

Middle East & Africa

The Middle East & Africa region represented nearly 3% share in 2024, supported by luxury boating culture in the UAE, Saudi Arabia, and South Africa. High-income buyers show strong interest in premium inboard boats and yachts, while rental and charter services expand along major waterfronts. Tourism development in Dubai, Cape Town, and Red Sea resorts drives additional demand. Limited marina coverage and high ownership costs slow mass adoption, but niche luxury segments remain strong. Rising coastal recreation projects and waterfront infrastructure continue to create selective growth opportunities.

Market Segmentations

By Product

- Inboard boat

- Outboard boat

- Inflatables

By Engine

By Material

- Fiberglass

- Aluminium

- Wood

- Plastic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The recreational boat market features a competitive landscape shaped by global manufacturers offering diverse product portfolios across outboard boats, inboard cruisers, sailboats, inflatables, and luxury yachts. Key players such as Fountain Powerboats, Inc., Bavaria Yachtbau GmbH, Ferretti S.P.A., Bombardier Recreational Products (BRP) Inc., Chaparral Boats, Inc., Avon Marine, Azimut Benetti Group, Baja Marine, Farr Yacht Design, Ltd., and Brunswick Corporation focus on product innovation, advanced propulsion systems, and enhanced onboard technologies to strengthen market presence. Companies invest heavily in lightweight materials, connected navigation systems, and fuel-efficient engines to differentiate offerings. Many leading brands expand production facilities, upgrade dealer networks, and engage in strategic partnerships to improve regional reach. The shift toward electric and hybrid propulsion encourages established players to broaden sustainable product lines. Customization, premium finishes, and performance upgrades remain important competitive factors as buyers seek tailored and high-value boating experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fountain Powerboats, Inc.

- Bavaria Yachtbau GmbH

- Ferretti S.P.A.

- Bombardier Recreational Products (BRP) Inc.

- Chaparral Boats, Inc.

- Avon Marine

- Azimut Benetti Group

- Baja Marine

- Farr Yacht Design, Ltd.

- Brunswick Corporation

Recent Developments

- In September 2025, Ferretti Group launched a new official dealer partnership: MennYacht GG Poland (with Gazda Group) to serve the Polish market for Ferretti Yachts, Pershing and Itama brands.

- In February 2024, Fountain Powerboats, Inc. introduced its 43 SCX center-console model (19,500-lb, quad Mercury Racing 500R outboards) at the Miami International Boat Show.

Report Coverage

The research report offers an in-depth analysis based on Product, Engine, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for leisure boating will rise as outdoor recreational activities gain wider interest.

- Electric and hybrid propulsion systems will see strong adoption across small and mid-sized boats.

- Smart dashboards and connected navigation tools will become standard in new models.

- Manufacturers will expand the use of lightweight composite materials to improve efficiency.

- Rental fleets and boat-sharing platforms will grow as users prefer flexible access over ownership.

- Premium and customized yachts will attract high-income buyers seeking tailored experiences.

- Marina infrastructure development will accelerate in emerging coastal regions.

- Environmental regulations will push companies toward cleaner engines and low-emission designs.

- Digital service platforms will enhance maintenance, route planning, and safety management.

- Global competition will intensify as brands innovate to capture expanding recreational boating demand.