Market Overview

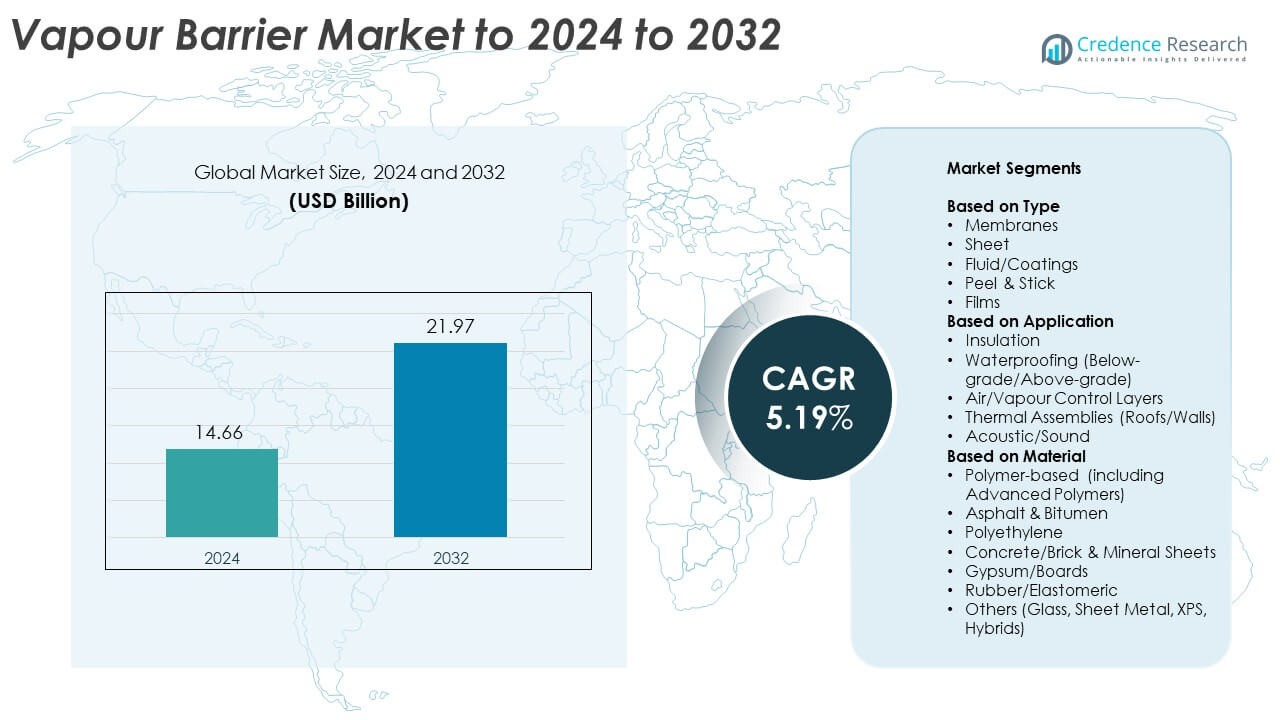

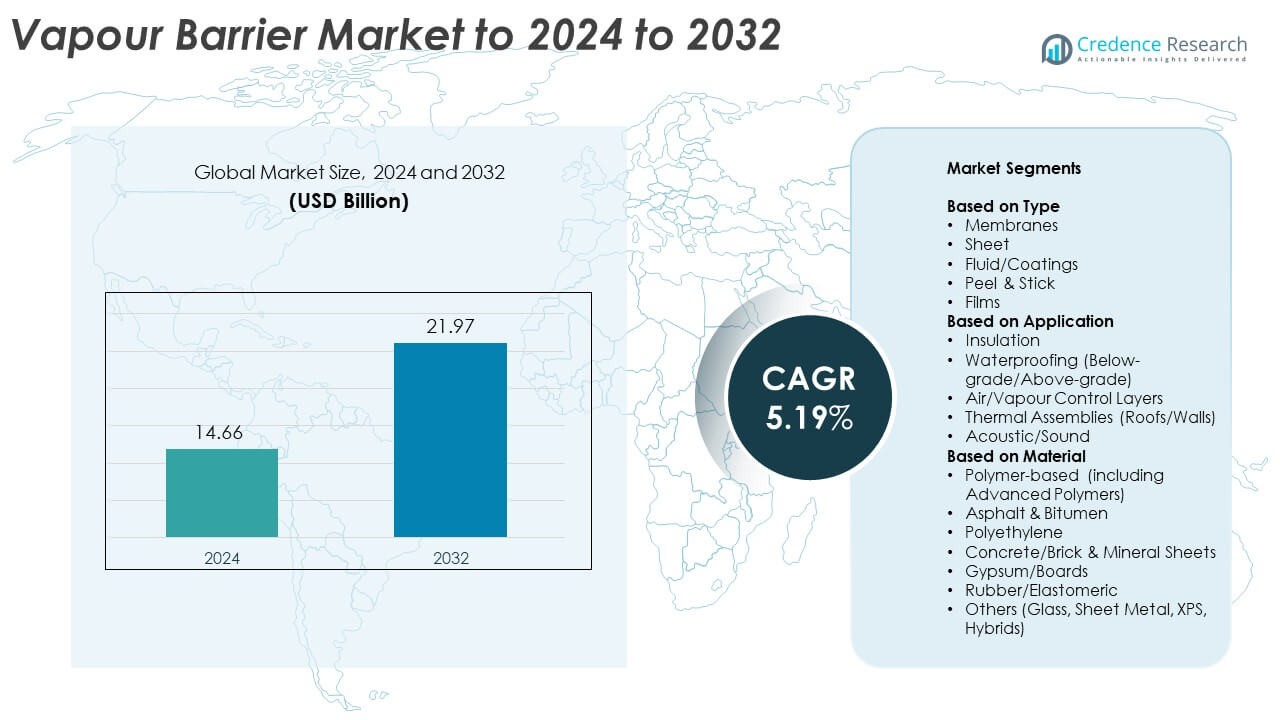

Vapour Barrier Market size was valued at USD 14.66 billion in 2024 and is anticipated to reach USD 21.97 billion by 2032, at a CAGR of 5.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vapour Barrier Market Size 2024 |

USD 14.66 Billion |

| Vapour Barrier Market, CAGR |

5.19% |

| Vapour Barrier Market Size 2032 |

USD 21.97 Billion |

The vapour barrier market includes major players that focus on advanced membranes, durable coatings, and high-performance polymer solutions to meet rising global construction standards. These companies compete through stronger product portfolios, wider distribution, and innovations that improve moisture protection in residential, commercial, and industrial buildings. North America leads the global market with around 34% share in 2024, supported by strict energy-efficiency rules and high adoption of modern insulation systems. Europe follows with nearly 28% share due to strong sustainability targets, while Asia Pacific accounts for about 24% as rapid urban development and large construction pipelines drive strong demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The vapour barrier market was valued at USD 14.66 billion in 2024 and is projected to reach USD 21.97 billion by 2032, growing at a CAGR of 5.19%.

- Strong demand from insulation applications, holding about 42% share, drives market growth as builders aim to reduce moisture damage and improve energy efficiency.

- Sustainable and high-performance polymer membranes emerge as key trends, supported by rising adoption in modular, commercial, and high-humidity construction projects.

- Competition intensifies as global manufacturers expand portfolios toward advanced coatings, multilayer membranes, and low-emission materials to meet evolving construction codes.

- North America leads with about 34% share, followed by Europe at 28% and Asia Pacific at 24%, while membranes dominate by type with nearly 38% share due to their reliability and broad application scope.

Market Segmentation Analysis:

By Type

Membranes lead this segment with about 38% share in 2024 due to strong durability, flexible installation, and higher resistance against moisture diffusion across residential and commercial structures. Builders prefer membrane-based barriers because these rolls suit both large wall assemblies and foundation systems with fewer joints, which reduces leakage risks. Sheet products and fluid coatings grow at a steady pace as retrofitting work increases, while peel and stick formats gain traction in fast-installation projects. Films expand mainly in industrial settings where lightweight layers help manage controlled environments.

- For instance, 3M confirms that its 3M Air and Vapour Barrier 3015 has a water vapor transmission permeance of 0.26 perms, when tested under ASTM E96 (Procedure B, water method).

By Application

Insulation dominates this segment with nearly 42% share in 2024 as moisture-regulated insulation systems reduce mold risks and maintain energy efficiency in walls, roofs, and HVAC assemblies. Demand rises because temperature swings and humidity fluctuations impact building envelopes, pushing contractors to integrate vapour barriers directly with insulation layers. Waterproofing expands across infrastructure and below-grade projects, while air and vapour control layers gain adoption under tighter energy-efficiency codes. Thermal assemblies and acoustic systems grow through higher adoption in commercial facilities.

- For instance, Owens Corning FOAMULAR 250 records permeance of 1.5 perm in ASTM E96 testing.

By Material

Polymer-based materials hold the dominant share of about 45% in 2024 due to strong vapor-diffusion resistance, long service life, and compatibility with modern construction systems. Polyethylene follows with steady demand in residential housing because the material offers low cost and simple installation. Asphalt and bitumen barriers grow in heavy infrastructure projects where rugged performance is needed. Concrete, mineral sheets, gypsum boards, and elastomeric products serve niche uses across fire-rated walls, industrial facilities, and high-moisture zones, supported by rising building safety and sustainability requirements.

Key Growth Drivers

Rising Energy-Efficiency Construction Standards

Global building codes push developers to use stronger vapour control systems that cut heat loss and reduce moisture risks. Contractors choose vapour barriers to keep insulation dry and maintain stable indoor climates in homes and offices. The shift toward green buildings increases adoption across both new builds and renovation work. Demand grows further as countries enforce stricter rules for energy savings and long-term building health.

- For instance, pro clima INTELLO PLUS varies sd from 0.25 to over 25 metres.

Expansion of Residential and Commercial Construction

Urban growth boosts demand for durable moisture-control layers across walls, roofs, and foundations. Homebuyers expect structures that resist mold and improve comfort, which increases vapour barrier use in insulation assemblies. Commercial projects use advanced barriers to protect HVAC systems and reduce water damage concerns. Steady construction spending in emerging markets strengthens long-term market growth.

- For instance, Kingspan Kooltherm K108 cavity boards achieve thermal conductivity as low as 0.019 W/mK.

Growth of High-Performance Materials

Manufacturers launch stronger polymer-based films and membranes that offer better moisture resistance and long service life. Builders trust these advanced materials because they support modern designs and complex climate zones. Adoption rises in industrial and cold-storage buildings where moisture protection is critical. The move toward smart and high-performance envelopes continues to shape demand.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Materials

Green materials gain traction as developers target eco-friendly building certifications. Companies invest in recyclable polymers and low-VOC coatings to meet sustainability goals. This shift creates new opportunities for brands that offer cleaner products suited for energy-efficient projects. Demand rises in regions supporting carbon-reduction programs.

- For instance, CertainTeed MemBrain measures 1 perm or less dry and above 10 perms wet.

Growing Adoption in Prefabricated and Modular Construction

Modular builders use vapour barriers to speed production and maintain quality across factory-built units. Growth of prefab homes and commercial pods increases demand for lightweight films and membranes. Improved consistency and reduced waste open new opportunities for suppliers that can deliver ready-to-apply barrier solutions. This trend expands across North America, Europe, and Asia.

- For instance, ROCKWOOL states stone wool fibres withstand temperatures above 1000 degrees Celsius without melting.

Rising Use in High-Moisture and Cold-Climate Projects

Infrastructure in humid or freezing zones depends on reliable moisture control. Hospitals, data centers, and cold-storage sites use advanced vapour barriers to protect sensitive systems. Growth in these high-risk applications creates new revenue streams for premium barrier materials. Regions with extreme climates show strong long-term potential.

Key Challenges

Complex Installation and Skilled Labour Needs

Improper installation reduces barrier performance and creates moisture problems. Many regions lack trained workers who can apply membranes, films, or coatings correctly. Builders face delays when labour shortages slow project timelines. Training programs and clearer guidelines are needed to fix this gap.

Volatile Prices of Raw Materials

Costs shift often due to changing prices of polymers, bitumen, and chemical additives. These swings affect profit margins for manufacturers and raise project costs for contractors. Buyers hesitate when prices rise sharply, which slows demand. Stable raw-material supply remains a major challenge for the market.

Regional Analysis

North America

North America leads the vapour barrier market with about 34% share in 2024 due to strong adoption of energy-efficient construction standards and widespread use in residential and commercial insulation assemblies. The region’s colder climates increase the need for moisture-control systems across roofs, walls, and HVAC structures. Modern building codes encourage contractors to integrate high-performance polymer membranes that support long-term durability. Growth also comes from renovation projects in the US and Canada, where older buildings require upgraded moisture-barrier layers to reduce mold risks and improve energy savings.

Europe

Europe holds nearly 28% share in 2024, driven by strict environmental rules and advanced thermal-efficiency requirements across both residential and non-residential structures. Countries such as Germany, France, and the UK invest heavily in sustainable building practices that demand reliable vapour-control layers. Renovation of aging housing stock boosts uptake of polyethylene films and bitumen-based sheets. The region’s focus on passive-house designs and low-carbon buildings supports demand for premium membranes. Cold and temperate climates across Northern and Central Europe further strengthen the need for moisture-resistant building envelopes.

Asia Pacific

Asia Pacific accounts for about 24% share in 2024 and shows the fastest growth due to rapid urban development and rising investments in large-scale residential and commercial projects. China, India, Japan, and Southeast Asian countries increase the use of vapour barriers to protect insulation in high-humidity and high-rainfall zones. Expanding industrial and cold-storage facilities also drive demand for polymer-based films and coatings. Government programs promoting energy-efficient buildings and modern construction methods create strong opportunities for global and regional manufacturers in the emerging economies across the region.

Latin America

Latin America holds roughly 8% share in 2024, supported by rising construction activity in Brazil, Mexico, Chile, and Colombia. Warmer climates and higher humidity levels push developers to adopt vapour barriers to prevent mold growth and maintain indoor comfort. Increasing investment in commercial buildings, retail centers, and hospitality projects strengthens demand for polyethylene sheets and fluid-applied coatings. Growth remains steady as governments improve building standards and encourage moisture-management systems in new housing plans. Adoption continues to rise as developers prioritize structural durability and long-term asset performance.

Middle East & Africa

Middle East and Africa represent about 6% share in 2024, with demand driven by expanding infrastructure and commercial development across the Gulf countries and parts of Africa. Hot climates create temperature-driven condensation issues that increase the need for vapour-control membranes in HVAC-intensive buildings. Waterproofing and below-grade applications grow in large urban projects. Rising construction in Saudi Arabia, the UAE, South Africa, and Nigeria supports steady uptake of advanced polymer and bitumen barriers. The push toward energy-efficient buildings and smart urban development boosts long-term market potential.

Market Segmentations:

By Type

- Membranes

- Sheet

- Fluid/Coatings

- Peel & Stick

- Films

By Application

- Insulation

- Waterproofing (Below-grade/Above-grade)

- Air/Vapour Control Layers

- Thermal Assemblies (Roofs/Walls)

- Acoustic/Sound

By Material

- Polymer-based (including Advanced Polymers)

- Asphalt & Bitumen

- Polyethylene

- Concrete/Brick & Mineral Sheets

- Gypsum/Boards

- Rubber/Elastomeric

- Others (Glass, Sheet Metal, XPS, Hybrids)

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The vapour barrier market features major players such as Carlisle Companies Inc., Saint-Gobain, BASF SE, Owens Corning, Kingspan Group, Henry Company, Knauf Insulation, W. R. Meadows Inc., Firestone Building Products, and Soprema Group. The competitive landscape reflects strong investment in advanced polymer membranes, high-performance coatings, and multi-layer barrier systems designed for modern building envelopes. Companies focus on improving moisture resistance, installation efficiency, and long-term durability to meet rising energy-efficiency standards across global construction markets. Product portfolios expand toward sustainable and low-emission materials as green-building rules grow stronger. Firms also strengthen distribution networks to support faster supply in residential, commercial, and industrial projects. Continuous innovation in high-humidity and cold-climate applications helps manufacturers secure long-term market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Carlisle Companies Inc.

- Saint-Gobain (including GCP Applied Technologies)

- BASF SE

- Owens Corning

- Kingspan Group

- Henry Company

- Knauf Insulation

- W. R. Meadows Inc.

- Firestone Building Products (Elevate, a Holcim brand)

- Soprema Group

Recent Developments

- In 2025, Kingspan promoted Aquazone, a high‑performance polyethylene membrane for inverted roofs that combines high water vapour permeability with resistance to water ingress, helping reduce insulation thickness while controlling moisture in roof build‑ups.

- In 2024, Soprema introduced SOPRASEAL STICK AVB AT as a new primerless, self‑adhesive air and vapour barrier membrane for walls, promoted a technical webinar as its latest solution in the SOPRASEAL air/vapour barrier range for above‑grade wall applications.

- In 2024, Owens Corning launched the PINKWRAP® portfolio of weather-resistant barrier products designed to protect homes against wind, rain, and snow while delivering UV resistance.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as construction codes demand stronger moisture-control systems.

- Advanced polymer membranes will gain wider use in modern building envelopes.

- Energy-efficient housing will push higher adoption of integrated vapour and insulation layers.

- Renovation activity will create strong demand for replacement barriers in aging structures.

- Prefabricated and modular buildings will boost use of ready-to-apply vapour solutions.

- Cold-climate and high-humidity regions will expand investment in moisture-resistant materials.

- Smart building technologies will support development of adaptive vapour-control products.

- Sustainable and recyclable barrier materials will gain market traction.

- Industrial and cold-storage facilities will drive growth for high-performance barriers.

- Manufacturers will expand capacity as global infrastructure spending rises.