Market Overview:

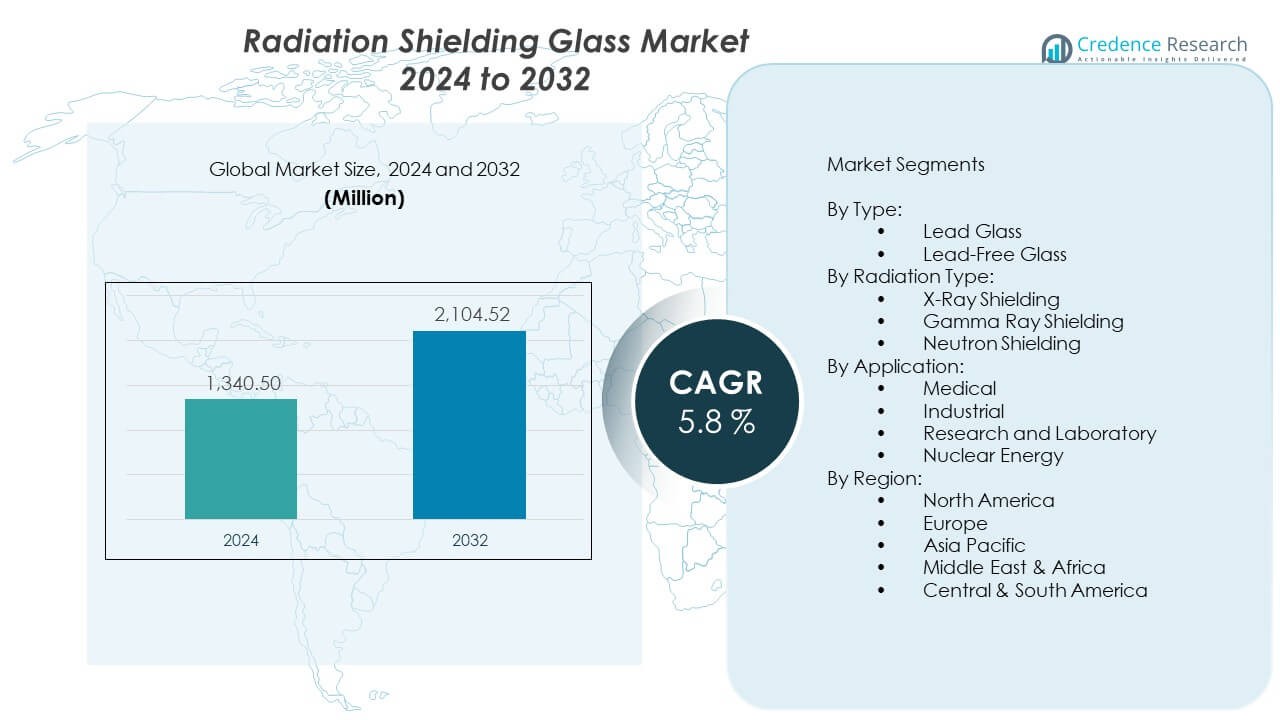

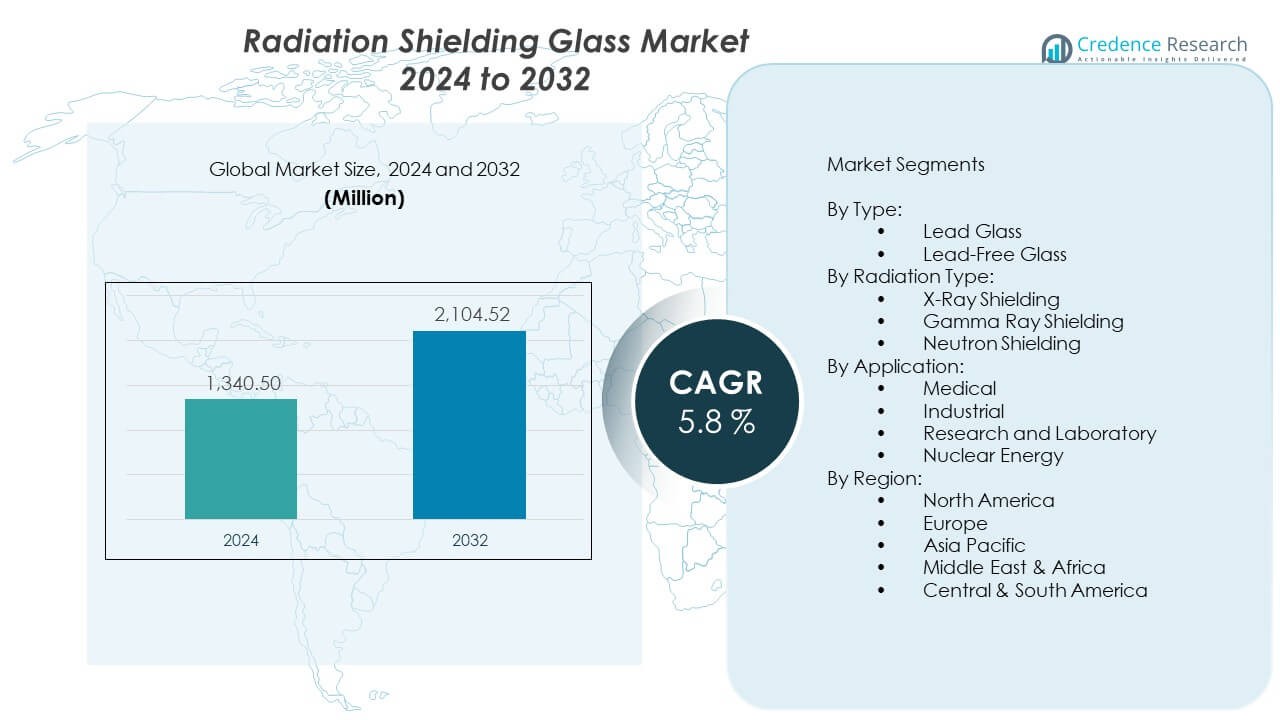

The Radiation Shielding Glass Market is projected to grow from USD 1340.5 million in 2024 to an estimated USD 2104.52 million by 2032, with a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Radiation Shielding Glass Market Size 2024 |

USD 1340.5 Million |

| Radiation Shielding Glass Market, CAGR |

5.8% |

| Radiation Shielding Glass Market Size 2032 |

USD 2104.52 Million |

Demand grows due to rising diagnostic imaging volumes across healthcare systems. Hospitals install more CT, PET, and X-ray units to support higher screening needs. Manufacturers supply advanced glass compositions to improve clarity and durability. Buyers choose high-lead and lead-free options to match stricter safety norms. Research labs expand adoption for particle studies and nuclear testing. Radiation protection rules drive upgrades across older medical sites. Vendors introduce cleaner glass formulations to support better visibility. Steady investments across medical infrastructure strengthen long-term demand.

North America leads due to strong imaging capacity and wide hospital networks. Europe maintains a solid position because of strict radiation safety laws. Asia Pacific shows the fastest rise as healthcare systems add more diagnostic centers. China, India, and Japan expand screening programs to meet rising patient loads. The Middle East invests in new specialty hospitals that require protective glass installations. Latin America and Africa gain momentum from gradual upgrades in public medical facilities. Growing awareness of workplace protection supports broader global adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market grows from USD 1340.5 million in 2024 to USD 2104.52 million by 2032, expanding at a 8% CAGR, driven by rising imaging installations and safety upgrades.

- North America holds ~35% due to strong imaging capacity, Europe has ~28% based on strict compliance standards, and Asia Pacific captures ~30% supported by rapid healthcare expansion.

- Asia Pacific is the fastest-growing region with nearly 30% share, driven by rising diagnostic centers, nuclear research growth, and broader public-facility upgrades.

- Lead glass accounts for the largest share due to high attenuation strength and wide use in medical rooms.

- Medical applications dominate the market with the highest share, supported by heavy CT, PET, and X-ray installation volumes across global hospitals.

Market Drivers:

Growing Demand for Advanced Medical Imaging Infrastructure

Healthcare systems expand diagnostic capacity to meet rising patient needs. Hospitals install new CT, PET, and X-ray units that require protective partitions. The Radiation shielding glass market gains steady traction from these capacity upgrades. Buyers choose high-performance glass to maintain visibility during imaging procedures. Strict safety rules drive faster replacement of outdated shielding setups. Manufacturers supply improved compositions that support higher transmission clarity. Research centers widen adoption due to more radiation-based experiments. Strong investment across public and private hospitals sustains long-term demand.

- For instance, Corning supplied heavy-shielding glass for the UK National Nuclear Laboratory’s Windscale project, including radiation-blocking windows weighing 7 tons each, verified through NNL’s published deployment updates.

Rising Compliance Pressure from Radiation Safety Regulations

Governments update radiation protection norms to create safer clinical zones. Facilities adopt certified shielding materials to meet inspection standards. The Radiation shielding glass market benefits from tighter rule enforcement worldwide. Medical planners design treatment rooms with improved viewing windows for operators. Vendors introduce cleaner and stronger formulations to meet regulatory tests. Buyers prefer high-lead or lead-free grades depending on safety targets. Older hospitals strengthen compliance through full-scale shielding upgrades. Rising awareness among technicians supports further adoption.

- For instance, SCHOTT’s RD 30 and RD 50 radiation shielding glass lines are certified under international standards, with SCHOTT confirming attenuation performance of up to 5.2 mm Pb equivalence in published product specifications used across hospital refurbishments.

Growing Expansion of Nuclear Research and Industrial Testing

Research institutions widen use of radiation systems for scientific studies. Nuclear labs integrate shielded viewing areas to manage exposure levels. The Radiation shielding glass market grows due to rising experimental workloads. Industrial NDT sites install advanced windows for equipment monitoring. Defense and energy units add more protective enclosures for inspection rooms. Buyers demand glass variants that handle higher energy exposure ranges. Producers refine material strength to support rugged operating cycles. Growing interest in radiation-based testing reinforces market momentum.

Increasing Preference for Improved Visibility and Operator Comfort

Imaging teams choose clearer viewing windows to enhance precision. Buyers appreciate glass that reduces distortion in high-energy environments. The Radiation shielding glass market sees growth from facilities seeking better workflow. Designers integrate larger windows to support smooth equipment control. Manufacturers upgrade optical purity for complex imaging settings. Technicians value materials that sustain clarity under continuous load. Hospitals prefer coatings that improve scratch and impact resistance. Cleaner visibility supports safer and faster diagnostic operations.

Market Trends:

Shift Toward Lead-Free Shielding Materials Across Healthcare Sites

Hospitals evaluate eco-friendly alternatives to traditional high-lead glass. Buyers prefer safer compositions to reduce disposal concerns. The Radiation shielding glass market expands through rising demand for green materials. Vendors invest in lead-free formulas that maintain high attenuation. Regulatory bodies promote safer products for sensitive environments. Manufacturers highlight long-term stability that supports heavy imaging cycles. Customers adopt these grades to meet broader sustainability goals. Cleaner material choices gain fast acceptance in modern clinics.

- For instance, Nippon Electric Glass (NEG) confirmed its LF-Series lead-free radiation shielding glass delivers up to 0.5–1.0 mm Pb equivalence using barium-based compositions, as validated through its technical documentation and certified attenuation tests.

Integration of Smart Manufacturing in Radiation Glass Production

Producers automate production lines to raise consistency. Digital controls help maintain precise thickness and density levels. The Radiation shielding glass market benefits from improved efficiency across factories. Automated systems limit defects that affect optical quality. Vendors adopt robotics to reduce handling errors. Buyers receive more uniform products that support strict shielding needs. Data-driven processes quicken product development cycles. Modern manufacturing strengthens supplier competitiveness across regions.

Growing Use of Large-Format Viewing Panels in Hybrid Rooms

Hospitals redesign imaging zones to support multifunctional workflows. Hybrid operating rooms require wider viewing areas for surgical teams. The Radiation shielding glass market gains traction from this layout shift. Buyers prefer large panels that improve visibility for multiple operators. Vendors engineer reinforced frames to hold oversized formats. Teams value uninterrupted views during complex procedures. Better visibility improves coordination among clinicians. Wider windows support smoother cross-functional imaging tasks.

Expansion of Custom-Engineered Glass for Specialized Applications

Buyers request tailored designs to match room geometry and energy loads. Vendors produce customized thickness levels for high-energy imaging rooms. The Radiation shielding glass market advances due to greater customization needs. Research labs order unique panel sizes for specialized equipment bays. Industrial NDT units prefer glass that supports rugged workflows. Designers integrate coatings that limit glare and surface wear. Engineers value materials tested for extreme use conditions. Custom solutions strengthen long-term supplier relationships.

Market Challenges Analysis:

High Production Costs and Limited Availability of Specialized Inputs

Producers face heavy expenses due to strict material purity requirements. High-lead and lead-free blends need refined processing steps. The Radiation shielding glass market experiences pressure as suppliers manage rising input costs. Manufacturers struggle to balance optical clarity with strong shielding levels. Complex melting and cooling cycles increase energy consumption. Buyers encounter higher prices during major facility upgrades. Limited global suppliers reduce price flexibility. Financial constraints slow adoption in developing regions.

Complex Installation Requirements and Limited Skilled Technicians

Radiation rooms need precise fitting to maintain full protection. Installers must align glass panels with supporting shielding layers. The Radiation shielding glass market sees challenges where trained teams remain scarce. Errors in installation reduce shielding quality and safety. Large-format panels demand special handling equipment. Hospitals face longer project timelines due to limited expertise. Remote regions depend on outsourced technicians, which raises cost. Maintenance teams require ongoing training to manage advanced materials.

Market Opportunities:

Growing Modernization of Imaging Facilities Across Emerging Regions

Developing countries expand diagnostic infrastructure to meet rising clinical demand. Hospitals invest in new rooms that require high-quality shielding panels. The Radiation shielding glass market gains growth opportunities from these upgrades. Vendors supply cost-effective options to support expanding networks. Governments promote safer imaging spaces through stronger compliance rules. Buyers adopt larger windows to improve workflow and team coordination. Facility expansion programs create demand for new material variants. Wider modernization efforts support steady long-term adoption.

Rising Global Interest in High-Purity and Smart-Coated Glass

Buyers request coatings that improve clarity and durability under constant use. Vendors introduce advanced surface treatments that limit scratches and glare. The Radiation shielding glass market benefits from rising interest in next-generation materials. Research labs prefer clearer glass to support precision tasks. Hospitals seek products that deliver better operator comfort. Producers invest in coatings that improve optical performance in difficult environments. Demand grows for glass that supports strong resistance to chemical exposure. New innovations enable wider adoption across specialized settings.

Market Segmentation Analysis:

By Type

Lead glass dominates use across medical and industrial settings due to strong attenuation capacity and stable optical clarity. Many hospitals prefer high-lead grades for imaging rooms with frequent exposure cycles. Lead-free glass gains traction among facilities seeking safer handling and eco-friendly options. Vendors introduce advanced formulations to match strength targets without compromising visibility. Buyers evaluate long-term maintenance needs before selecting materials. Research labs adopt lead-free types to limit contamination risks. The Radiation shielding glass market benefits from rising interest in durable and compliant material variants. Global demand shifts toward cleaner and more efficient glass solutions.

- For instance, Ray-Bar Engineering confirms its X-Ray Lead Glass maintains certified attenuation ratings up to 3.7 mm Pb equivalence in a single pane, supported by independent testing and published compliance documentation used in medical and industrial installations. Ray-Bar also offers multi-layer laminated glass for higher-energy applications, with equivalencies up to 38.1 mm (1.5 inches) or 2 inches Pb.

By Radiation Type

X-ray shielding glass remains the largest segment due to extensive diagnostic imaging usage. Hospitals install multiple windows across CT, fluoroscopy, and radiography units. Gamma ray shielding glass supports nuclear medicine and high-energy applications. Industrial NDT sites rely on these grades to secure inspection rooms. Neutron shielding solutions serve specialized research and nuclear testing facilities. Buyers select specific compositions based on energy levels and exposure frequency. Vendors expand portfolios to meet varied protection requirements. Strong application diversity supports stable growth across global markets.

- For instance, boron-enriched glass panels are known to be effective neutron-shielding materials containing substantial amounts of boron oxide (B₂O₃) for applications in high-energy neutron environments such as nuclear laboratories.

By Application

Medical applications lead demand due to rising imaging volumes and radiation safety norms. Facilities upgrade windows to improve technician visibility and operator comfort. Industrial users deploy shielding glass for inspection and quality-control zones. Research and laboratory environments adopt advanced materials to support precision studies. Nuclear energy plants install specialized panels for high-risk control rooms. Buyers prioritize clarity, stability, and regulatory compliance across each setting. Vendors design tailored solutions for heavy-duty performance. The Radiation shielding glass market gains consistent support from wide end-use adoption.

Segmentation:

By Type:

- Lead Glass

- Lead-Free Glass

By Radiation Type:

- X-Ray Shielding

- Gamma Ray Shielding

- Neutron Shielding

By Application:

- Medical

- Industrial

- Research and Laboratory

- Nuclear Energy

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Central & South America

Key Countries:

- United States

- China

- Germany

- Japan

- France

- India

- South Korea

- Brazil

Regional Analysis:

North America

North America holds the leading share of the Radiation shielding glass market with nearly 35% due to its strong medical imaging base and large hospital networks. Facilities upgrade shielding installations to meet strict safety norms. The United States drives most demand through high diagnostic volumes and expanding nuclear medicine use. Vendors secure long-term contracts with major healthcare groups. Research centers increase adoption to support particle studies and scientific testing. It gains sustained momentum from advanced manufacturing capabilities across the region. Strong regulatory enforcement supports consistent replacement cycles.

Europe

Europe accounts for about 28% of global share due to strong compliance frameworks and well-established imaging infrastructure. Germany, France, and the U.K. remain key contributors due to high adoption of advanced diagnostic systems. Hospitals invest in modern shielding windows to maintain visibility and meet radiation protection standards. Industrial NDT facilities create steady demand for specialized glass grades. Research institutes rely on precision shielding for controlled experiments. The Radiation shielding glass market benefits from Europe’s strong focus on safety-driven modernization. Cross-border healthcare investments strengthen regional procurement.

Asia Pacific

Asia Pacific captures nearly 30% of the global share and ranks as the fastest-growing region. Hospitals expand imaging capacity to support rising patient loads across China, India, and Japan. Governments fund upgrades across public facilities to meet radiation safety norms. Nuclear energy and research segments widen the requirement for high-attenuation glass. Industrial inspection sites increase adoption across manufacturing hubs. Buyers prefer cost-effective variants that match expanding infrastructure needs. The Radiation shielding glass market sees strong growth in APAC due to rapid healthcare expansion and rising investments in specialized laboratories.

Key Player Analysis:

- British Glass

- Corning Incorporated

- Schott AG

- Nippon Electric Glass Co., Ltd.

- Ray-Bar Engineering Corporation

- Raybloc Ltd.

- Lead Glass Pro.

- MAVIG GmbH

- MidlandLead

- AGC Inc.

- Pilkington Group Limited

- Isolite Corporation

- Glaswerke Haller GmbH

- Nuclear Lead Co., Inc.

- Radiation Protection Products, Inc.

- Electric Glass Building Materials Co., Ltd.

- H V Skan Ltd.

- Wolf X-Ray

Competitive Analysis:

The Radiation shielding glass market features strong competition among global manufacturers focused on advanced formulations and optical clarity. Vendors differentiate through high-lead, lead-free, and large-format panel designs. Established companies secure long-term supply contracts with hospitals and research labs. Producers invest in better melting and finishing processes to improve visibility and durability. Dealers expand distribution networks to reach fast-growing regions. New entrants target niche applications such as nuclear research and industrial NDT. It gains momentum from rising compliance needs and continuous facility upgrades. Competitive pressure drives ongoing innovation across product lines.

Recent Developments:

- Ray-Bar Engineering Corporation launched an upgraded line of ultra-clear lead (x-ray) shielding glass panels with improved optical clarity and performance in early 2025.

- In 2025, Corning Incorporated made significant advancements in the radiation shielding glass market with its heavy shielding glass products, exemplified by the 7-ton radiation-blocking windows deployed at the United Kingdom National Nuclear Laboratory (UKNNL) Windscale facility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise as hospitals expand diagnostic imaging capacity and upgrade shielding systems.

- Lead-free materials will gain adoption driven by safety goals and environmental regulations.

- Nuclear research labs will widen investments in high-performance shielding windows.

- Large-format panels will see higher demand in hybrid operating and advanced procedure rooms.

- Industrial NDT sites will adopt clearer and more durable glass compositions.

- Vendors will increase automation to improve consistency and reduce production defects.

- Custom-engineered glass solutions will expand for complex facility layouts.

- APAC regions will maintain strong growth due to rapid medical infrastructure expansion.

- Regulatory tightening will influence procurement standards across major markets.

- Product innovation will center on visibility, coating durability, and radiation resistance.