Market overview

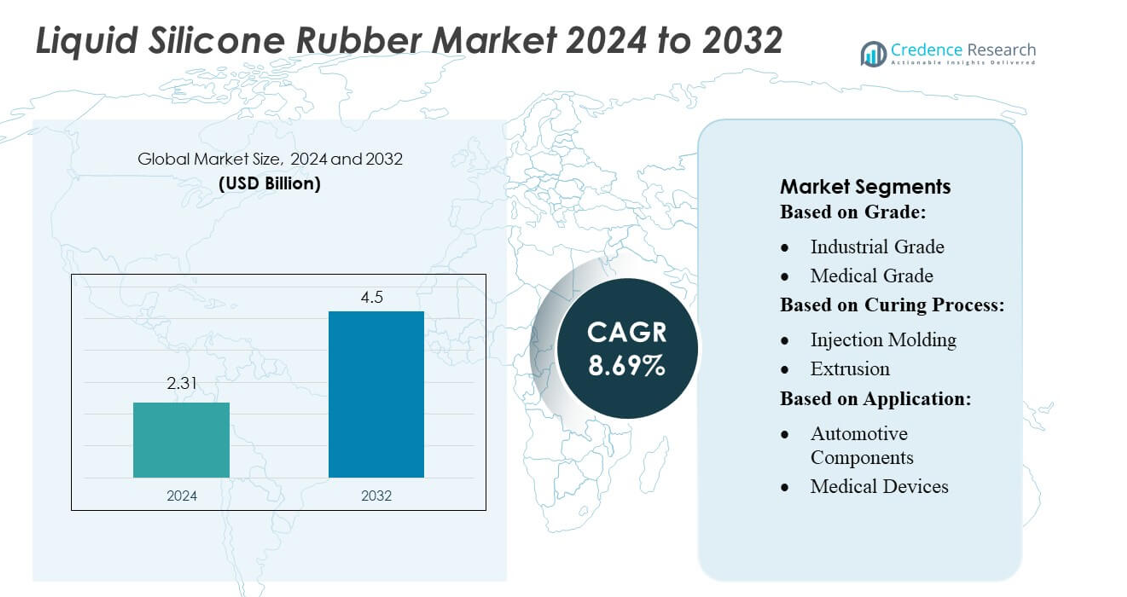

Liquid Silicone Rubber Market size was valued USD 2.31 billion in 2024 and is anticipated to reach USD 4.5 billion by 2032, at a CAGR of 8.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Silicone Rubber Market Size 2024 |

USD 2.31 billion |

| Liquid Silicone Rubber Market, CAGR |

8.69% |

| Liquid Silicone Rubber Market Size 2032 |

USD 4.5 billion |

The Liquid Silicone Rubber Market is supported by a diverse group of global manufacturers that focus on producing high-purity formulations, precision-molded components, and application-specific LSR grades for medical, automotive, electronics, and industrial sectors. These companies strengthen competitiveness through advanced injection molding technologies, material innovations, and expanded manufacturing footprints across high-growth regions. Asia-Pacific leads the global market with approximately 38% share, driven by large-scale electronics production, rapid industrialization, and strong demand from automotive and medical device manufacturing hubs. Continuous investment in automated LSR processing and rising consumption of high-performance elastomer components reinforce the region’s long-term dominance.

Market Insights

- The Liquid Silicone Rubber Market was valued at USD 2.31 billion in 2024 and is projected to reach USD 4.5 billion by 2032, expanding at a CAGR of 8.69%, reflecting strong demand across medical, automotive, electronics, and industrial applications.

- Market growth is driven by rising adoption of medical-grade LSR for biocompatible devices, increasing EV-related component production, and expanding use of high-precision LSR parts in wearable electronics and industrial automation.

- Advancements in automated injection molding, ultra-pure formulations, and micro-molding technologies continue shaping key market trends, supporting larger production volumes and improved design flexibility.

- Competitive intensity increases as manufacturers invest in new material grades, regional manufacturing expansions, and customized LSR solutions, although high production costs and equipment investments remain key restraints.

- Asia-Pacific leads with 38% share, supported by strong electronics and automotive manufacturing, while the medical devices segment maintains the largest application share due to stringent performance and purity requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The Liquid Silicone Rubber Market by grade is led by Industrial Grade, holding over 55% share, driven by its broad use in automotive seals, electronics insulation, kitchenware, and industrial components requiring high thermal stability and durability. Medical Grade remains a fast-growing segment due to rising demand for biocompatible materials in implants and wearable sensors, while Food Grade finds niche adoption in baking molds and dispensing components. Continuous formulation improvements, compliance with regulatory standards, and rising precision molding needs reinforce the dominance of Industrial Grade across diversified manufacturing environments.

- For instance, Silopren™ LSR 7000 series delivers faster cure rates and maintains mechanical stability at temperatures from –50°C to 200°C, enhancing throughput for automotive and electronics manufacturers.

By Curing Process

Injection Molding dominates the curing process segment with nearly 60% market share, supported by its high throughput, reduced cycle time, and suitability for complex geometries widely required in automotive, electronics, and medical applications. Extrusion continues expanding due to increasing output of hoses, tubes, and profiles, while Compression Molding remains relevant for low-volume industrial components. Emerging 3D Printing applications leverage LSR’s elasticity and heat resistance to support prototyping and customized device production. The dominance of Injection Molding is driven by automation compatibility and ability to maintain dimensional consistency at large production scales.

- For instance, WACKER’s ELASTOSIL® LR 5040 series, for example, enables faster cycle times through ultra-fast platinum-catalyzed curing and eliminates post-curing, which ensures high dimensional stability and low volatile content below 0.5% for precision micro-components.

By Application

Medical Devices represent the dominant application segment, accounting for around 35% market share, propelled by increasing use of hypoallergenic, sterilizable, and biocompatible LSR in catheters, valves, respiratory masks, and implantable components. Automotive Components follow closely as OEMs utilize LSR for gaskets, connectors, and vibration-dampening parts. Consumer Products gain steady adoption due to rising demand for durable kitchenware and wearable accessories. Electronics materials benefit from LSR’s dielectric properties, while industrial products and other categories expand gradually. The leadership of Medical Devices stems from stringent safety standards and growing global healthcare device consumption.

Key Growth Drivers

Rising Demand from Medical and Healthcare Applications

The Liquid Silicone Rubber Market benefits strongly from increasing adoption of biocompatible and hypoallergenic materials in medical devices. Manufacturers use LSR for catheters, seals, valves, respiratory masks, infant care products, and implantable components that require durability, sterilization compatibility, and high purity. Growing investment in minimally invasive procedures and wearable health monitoring devices boosts the demand for medical-grade LSR. Regulatory compliance with ISO 10993 and FDA standards further reinforces its penetration in clinical applications, making healthcare a consistent driver of long-term market expansion.

- For instance, Trelleborg facilities utilize cleanrooms that conform to ISO 14644-1 standards, including Class 100,000 (ISO 8) for production and Class 10,000 (ISO 7) for post-production processing like washing and double-bagging.

Expanding Use in Automotive and Electric Vehicle Components

Growing vehicle electrification and demand for high-performance sealing materials drive the adoption of LSR across automotive applications. Its temperature resistance, electrical insulation properties, and vibration-dampening capabilities make it essential for connectors, gaskets, sensors, battery components, and under-the-hood parts. Automakers prioritize LSR for components exposed to heat and harsh environments, while EV manufacturers increasingly require silicone-based materials to ensure thermal stability and long operational life. The shift toward advanced driver-assistance systems and higher electronic integration further strengthens the role of LSR in modern vehicle platforms.

- For instance, Elkem Silicones won the Ringier Technology Innovation Award for its BLUESIL™ LSR 3935 product. This product is designed for high-voltage EV connector sealing and offers Shore-A hardness from ShA 20 to ShA 60 while delivering long-term waterproofing, self-lubrication, and improved thermal stability.

Increased Adoption in Consumer Electronics and Industrial Applications

The market experiences significant growth due to rising demand for LSR in electronic encapsulation, keypads, wearables, and high-precision industrial components. LSR provides excellent dielectric strength, moisture resistance, and flexibility, making it ideal for protecting circuits and producing durable touch interfaces. Industrial automation expands the need for LSR parts resistant to chemicals and mechanical stress. Growth in smart devices, IoT hardware, and compact electronic housing supports broader application of LSR in precision-molded engineering components. Manufacturers also invest in automated molding technologies to enhance production reliability and reduce cycle times.

Key Trends & Opportunities

Advancements in LSR Injection Molding and Automation

A major trend shaping the market is the rapid advancement of automated LSR injection molding systems designed to improve throughput, accuracy, and material efficiency. Fully automated dosing, mixing, and molding units significantly reduce labor dependency, defects, and cycle times. This trend opens new opportunities for high-volume production of medical, automotive, and electronics components with complex geometries. Increasing integration of digital monitoring and closed-loop control enhances process stability, enabling consistent quality assurance. These advancements encourage manufacturers to scale operations and meet growing demand for high-precision LSR parts.

- For instance, Shin-Etsu’s FE-201-U series (hardness ShA 25-80) and FE-301-U series (hardness ShA 40-80) demonstrate superior oil resistance under high heat, which is a critical performance characteristic for fluorosilicone rubber (FSR) applications.

Growing Opportunity in Wearable Devices and Soft Robotics

Rising consumer adoption of smart wearables, flexible sensors, and soft robotic systems creates strong opportunities for LSR materials due to their elasticity, skin compatibility, and long-term durability. Companies develop ultra-soft LSR formulations for skin-contact applications such as fitness trackers, therapeutic patches, and continuous monitoring devices. Soft robotics manufacturers increasingly use LSR to produce grippers, actuators, and cushioning components that require biomechanical flexibility. The convergence of medical-grade silicone, electronics miniaturization, and human-machine interaction is accelerating material innovations across both consumer and industrial domains.

- For instance, Avantor’s NuSil™ MED-6015 is a low consistency medical-grade silicone elastomer suitable for applications such as encapsulation and injection molded parts, which has a typical hardness of 50 Shore A and an elongation of 100%.

Expansion of 3D Printing Technologies for Customized LSR Components

The development of additive manufacturing technologies capable of processing Liquid Silicone Rubber presents a notable emerging opportunity. Advanced 3D printers enable manufacturers to create customized, low-volume, and complex elastomeric components that are difficult to achieve through traditional molding. Industries such as healthcare, electronics, and prototyping benefit from rapid design iterations and personalized geometries. This trend supports the growth of patient-specific medical implants, wearable interface components, and engineering prototypes. As LSR-compatible printing systems become more affordable, demand for customized silicone products is expected to accelerate.

Key Challenges

High Production Costs and Need for Advanced Processing Equipment

A major challenge for the Liquid Silicone Rubber Market is the high capital investment required for advanced injection molding machines, precision dosing systems, and automated production setups. LSR processing demands specialized equipment and tight control over temperature, curing, and material mixing, which raises operational costs for manufacturers. The initial investment becomes a constraint for small-scale producers and limits adoption in cost-sensitive applications. Material costs also remain relatively high compared to conventional elastomers, affecting price competitiveness and slowing adoption in low-margin product categories.

Technical Limitations in Processing Complex Multimaterial and Hybrid Components

Despite its versatility, LSR faces challenges in applications that require strong bonding with dissimilar materials such as certain plastics or metals. Achieving reliable adhesion often demands surface treatments, primers, or specialized co-molding techniques, increasing production complexity. Some hybrid components require compatibility with high-temperature processes that may degrade silicone properties. These limitations constrain the integration of LSR in advanced electronic assemblies and structural automotive parts. The development of improved adhesion technologies and multimaterial processing capabilities remains essential to broaden LSR’s usability in emerging high-performance applications.

Regional Analysis

North America

North America holds around 32% share of the Liquid Silicone Rubber Market, driven by strong adoption of LSR in medical devices, automotive systems, and high-performance electronics. The U.S. leads consumption due to its advanced healthcare manufacturing ecosystem, strict regulatory standards, and high demand for biocompatible components. Automotive suppliers increasingly use LSR for connectors, gaskets, and thermal-resistant parts, while consumer electronics manufacturers integrate LSR for keypad assemblies and encapsulation. Continuous innovation in injection molding and rising investment in medical wearables strengthen the region’s growth momentum, supporting consistent long-term demand for premium LSR formulations.

Europe

Europe accounts for roughly 28% share, supported by strong industrial automation, mature automotive production, and stringent safety regulations across medical and electronics sectors. Germany, France, and Italy dominate LSR consumption, especially in high-precision molded components for electric vehicles, medical consumables, and electronic encapsulation. Increased focus on sustainable manufacturing and compliance with REACH and ISO standards reinforces the adoption of high-purity LSR grades. Demand rises further as European OEMs integrate LSR into EV battery systems, charging connectors, and sensors. Continuous advancements in material science and strong R&D capabilities maintain Europe’s competitive position in the market.

Asia-Pacific

Asia-Pacific leads the Liquid Silicone Rubber Market with about 38% share, driven by rapid industrialization, expanding automotive manufacturing, and large-scale electronics production across China, Japan, South Korea, and India. The region benefits from high-volume LSR molding operations supporting consumer products, wearable devices, and electrical components. Strong demand for medical-grade LSR grows with rising healthcare investments and increased production of disposable devices. Cost-efficient manufacturing ecosystems and growing EV adoption accelerate market expansion. Local players invest in automated LSR injection systems to meet OEM quality requirements, reinforcing Asia-Pacific’s role as the fastest-growing and most dominant global market.

Latin America

Latin America holds an estimated 7% share, with gradual growth supported by increasing demand for automotive sealing systems, healthcare devices, and industrial components across Brazil, Mexico, and Argentina. Regional manufacturers are adopting LSR for high-temperature gaskets, electrical insulation parts, and consumer product applications as industries modernize production lines. Healthcare expenditure increases the use of medical-grade LSR in respiratory equipment and diagnostic accessories. Although adoption is slower compared to developed markets, expanding electronics assembly and rising vehicle production present steady opportunities. Investments in local molding capabilities are improving supply chain reliability and supporting long-term market development.

Middle East & Africa

The Middle East & Africa represent about 5% share, characterized by growing industrial manufacturing, expanding medical device imports, and rising investment in infrastructure and consumer goods. The UAE, Saudi Arabia, and South Africa lead adoption as manufacturers incorporate LSR in electrical insulation, industrial seals, and consumer product applications. Healthcare modernization drives increased use of biocompatible silicone materials for hospital equipment and diagnostic components. While production capacity remains limited, rising demand for high-durability materials in harsh environments and an expanding electronics assembly ecosystem contribute to continuous but moderate market growth across the region.

Market Segmentations:

By Grade:

- Industrial Grade

- Medical Grade

By Curing Process:

- Injection Molding

- Extrusion

By Application:

- Automotive Components

- Medical Devices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Liquid Silicone Rubber Market features a competitive environment led by global manufacturers such as Stockwell Elastomerics, Momentive Performance Materials, Wacker Chemie AG, Trelleborg AB, Wynca Tinyo Silicone Co. Ltd, Elkem ASA, SIMTEC Silicone Parts, LLC, Shin-Etsu Chemical Co. Ltd, Avantor Inc., and Dow. The Liquid Silicone Rubber Market is shaped by continuous advancements in material science, precision molding technologies, and application-specific product development. Manufacturers focus on producing high-purity, high-consistency LSR grades optimized for medical devices, automotive components, and electronics encapsulation, where durability, biocompatibility, and thermal stability are essential. Competition intensifies as companies invest in automated injection molding, multi-cavity tooling, and real-time process control systems to enhance throughput and dimensional accuracy. The market also sees rising innovation in ultra-soft formulations for wearable devices and low-viscosity grades for micro-molding applications. Sustainability initiatives, such as energy-efficient curing processes and reduced-waste production, further influence strategic differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Alcon launched Precision7, a 1-week silicone hydrogel replacement contact lens containing a new technology that provides up to 16 hours of comfort and accurate vision in both sphere and toric designs.

- In September 2024, Shin-Etsu Chemical Co., Ltd. introduced its new product, the ST-OR Type heat-shrinkable silicone rubber tubing for busbar protection.

- In July 2024, Trelleborg Group, through its Sealing Solutions division, completed its acquisition of the Baron Group, an Australian-Chinese manufacturer of advanced precision silicone components

Report Coverage

The research report offers an in-depth analysis based on Grade, Curing Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as medical-grade LSR gains wider adoption in advanced therapeutic and diagnostic devices.

- Demand for high-performance LSR will rise with growing production of electric vehicles and next-generation automotive electronics.

- Manufacturers will invest more in automated injection molding systems to improve efficiency and reduce production variability.

- Use of LSR in wearable electronics and soft robotics will accelerate due to rising need for flexible and skin-safe materials.

- The market will benefit from increasing development of ultra-pure and low-volatile formulations for sensitive healthcare applications.

- Additive manufacturing of LSR components will grow as 3D printing technologies become more precise and commercially viable.

- Electronics manufacturers will adopt LSR more widely for encapsulation and insulation of miniaturized components.

- Sustainability-driven production methods will expand as companies optimize curing processes and reduce material waste.

- Integration of LSR in consumer products will increase due to its durability, heat resistance, and design flexibility.

- Global suppliers will expand capacity in Asia-Pacific to address rising demand from industrial and electronics sectors.