Market Overview

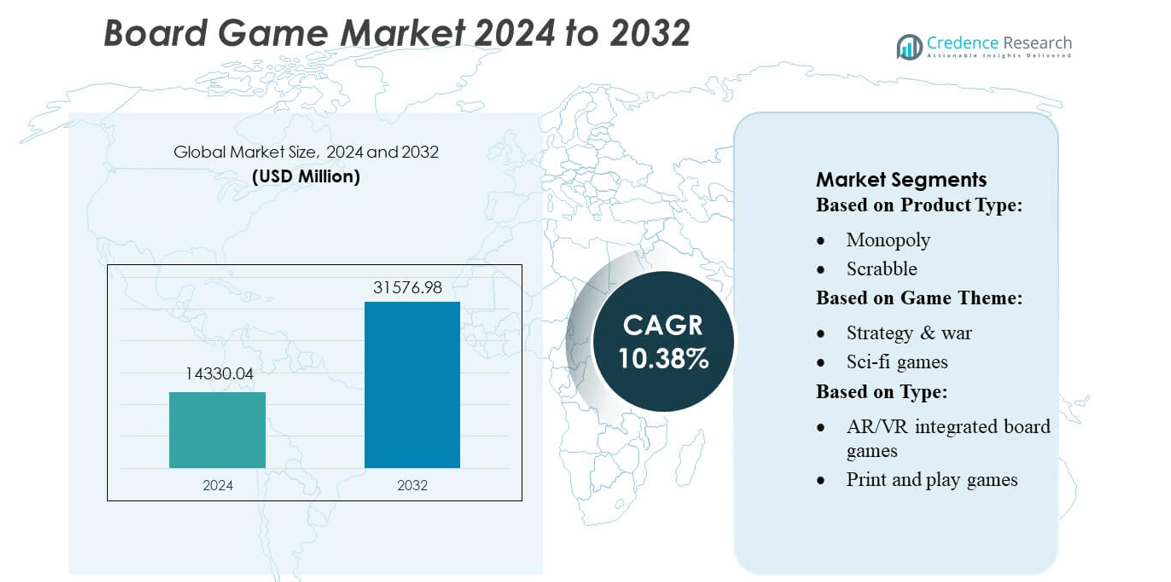

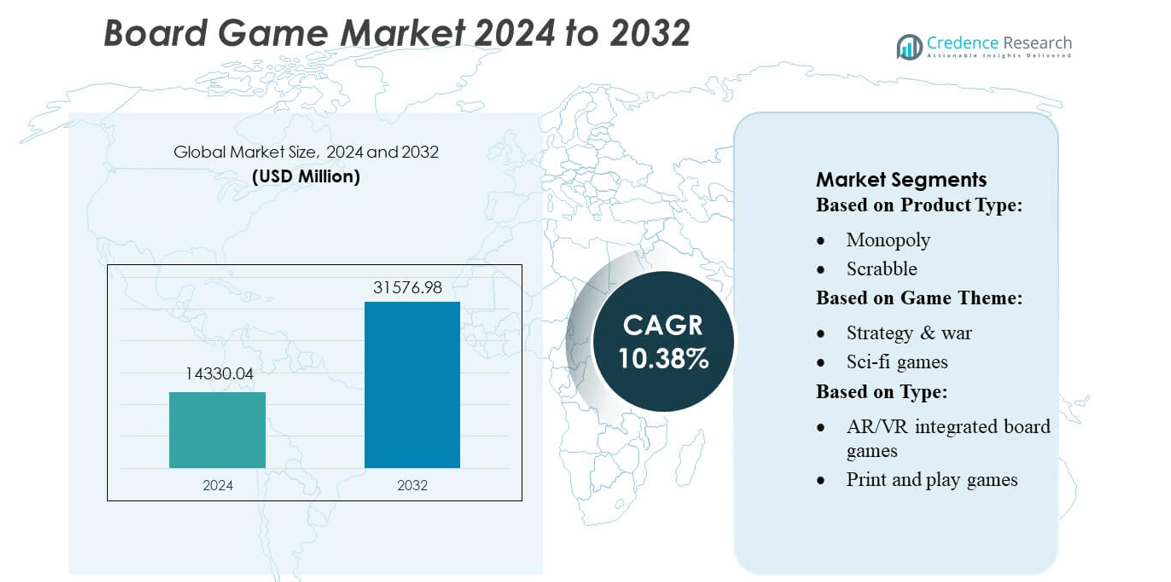

Board Game Market size was valued USD 14330.04 million in 2024 and is anticipated to reach USD 31576.98 million by 2032, at a CAGR of 10.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Board Game Market Size 2024 |

USD 14330.04 million |

| Board Game Market, CAGR |

10.38% |

| Board Game Market Size 2032 |

USD 31576.98 million |

The global board game market is dominated by major players such as Hasbro, Mattel, Asmodee, Ravensburger, and Spin Master, each leveraging strong brand portfolios in family, strategy, and licensed games. Hasbro leads in classic titles, Mattel excels in party and card games, while Asmodee captures the strategy and hobby segment through its acquisitions. Ravensburger commands attention in puzzle and family games, and Spin Master grows via innovation and licensing. Geographically, North America is the leading region, holding approximately 38.8 % of the global market.

Market Insights

- The Board Game Market reached USD 14,330.04 million in 2024 and is projected to hit USD 31,576.98 million by 2032 at a CAGR of 10.38%, reflecting strong long-term expansion.

- Rising consumer interest in strategy, family, and party games drives demand, supported by growing hobby communities and increasing tabletop cafés worldwide.

- Market trends emphasize premium licensed titles, narrative-driven games, and digital-hybrid board game integrations that enhance replayability and user engagement.

- Competitive intensity remains high as Hasbro, Mattel, Asmodee, Ravensburger, and Spin Master strengthen portfolios through innovation, acquisitions, and diversified distribution, while restraints include high production costs and limited shelf space in retail channels.

- North America leads with 38.8% share, followed by Europe as a strong secondary market; strategy and hobby games represent one of the fastest-growing segments, contributing significantly to overall revenue expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Monopoly remains the dominant sub-segment, holding an estimated 22–25% share of the global board game market due to its strong brand recognition, continuous themed editions, and family-friendly positioning. Close followers include Chess and Puzzles, supported by rising hobby communities and cognitive-skill development demand. Monopoly’s leadership is driven by sustained marketing, cross-media licensing, and frequent collector releases that maintain relevance. Growing interest in strategic and cooperative play also boosts Miniature and Collectible Card categories, although they trail in mass-market penetration compared to Monopoly’s wide household adoption.

- For instance, Valve’s Steam Deck integrates a custom AMD APU featuring a quad-core/8-thread Zen 2 CPU clocked at 2.4–3.5 GHz and an RDNA 2 GPU delivering 1.6 TFLOPS of FP32 performance, enabling smooth AAA gaming experiences on a handheld device.

By Game Theme

Strategy & War games lead the thematic segmentation with an estimated 28–30% market share, powered by their depth, replayability, and strong enthusiast communities. These games attract both casual and hobbyist players seeking tactical decision-making, which drives higher repeat purchase behavior. Fantasy and Sci-Fi categories also gain momentum through franchise-based titles and visually immersive mechanics. Educational & Trivia games maintain steady demand among schools and families, while Horror & Mystery themes benefit from niche fanbases and narrative-driven engagement, though they remain smaller compared to strategy-focused offerings.

- For instance, Sega’s original Phantasy Star Online on the Dreamcast launched with an initial deployment of 20 servers, scaled up to support 36,000 concurrent players at peak usage.

By Type

Physical board games dominate the segment with an estimated 65–70% market share, supported by social interaction, giftability, and strong retail presence. Their leadership is reinforced by expanding café cultures and family game nights. Digital board games and mobile adaptations show rapid growth as publishers integrate app-based timers, tutorials, and online multiplayer features. AR/VR-integrated board games remain an emerging niche, limited by hardware adoption but appealing for immersive storytelling. Print-and-play games continue gaining traction among cost-conscious players and hobbyists who prefer customization, though they remain significantly smaller than physical formats.

Key Growth Drivers

Rising Global Interest in Social and Family Entertainment

Growing preference for offline social experiences drives the demand for board games as families and friend groups seek interactive, screen-free entertainment. The resurgence of game cafés, community play events, and hobby clubs strengthens category engagement across age groups. Publishers benefit from broader demographic participation, including adults seeking strategic gameplay and families opting for educational titles. This expanding user base sustains consistent product sales and encourages premium releases, collector editions, and franchise expansions, reinforcing long-term market growth across developed and emerging regions.

- For instance, ASUS provides server solutions as a vital technology partner for Boosteroid’s cloud gaming platform, which operates across 28 (or more) data center points of presence and supports over 6 million users in Europe, North, and South America.

Expansion of Licensed and Franchise-Based Games

Global entertainment IPs increasingly fuel board game adoption as publishers collaborate with movie studios, gaming companies, and comic brands to release themed editions. These titles capture ready-made fanbases, accelerate sales cycles, and enhance retail visibility. Franchised adaptations of fantasy, superhero, and sci-fi universes continually attract collectors and hobbyists, boosting premium product demand. Strong licensing activity also promotes cross-media storytelling and repeat engagement, enabling publishers to diversify product lines while reducing marketing barriers through established brand equity and built-in consumer loyalty.

- For instance, Helldivers 2, published by Sony Interactive Entertainment, achieved a peak concurrent player count of over 458,000 on Steam. The game has since surpassed 19 million units sold globally.

Growth of Hobbyist Communities and Strategic Gameplay Demand

Dedicated hobbyist segments significantly expand the market as consumers increasingly pursue complex, strategy-heavy games with high replayability. Miniature-based, deck-building, and cooperative strategy games benefit from strong community-driven expansion via tournaments, organized play, and influencer-led reviews. Rising disposable incomes and evolving consumer interests support premium game purchases with advanced artwork, detailed components, and modular expansions. This shift toward deeper engagement creates long product life cycles, stimulates aftermarket sales, and strengthens long-term revenue streams for publishers focused on mid- and heavyweight board game categories.

Key Trends & Opportunities

Digital Hybridization and App-Enhanced Gameplay

Digital integrations present strong growth opportunities as publishers incorporate companion apps, automated tutorials, and AR features to enhance immersion and reduce rule complexity. Mobile adaptations of classic board games extend brand reach and introduce younger players to legacy titles. Hybrid formats enable dynamic storytelling, real-time updates, and AI-assisted gameplay, improving accessibility for beginners. This convergence broadens monetization through in-app expansions and seasonal content, positioning hybrid digital-physical ecosystems as a scalable revenue channel for publishers seeking diversified, tech-enabled engagement.

- For instance, The AYANEO 2 features an AMD Ryzen 7 6800U APU, 16 GB or 32 GB of LPDDR5-6400 memory, an RX 680M GPU delivering approximately 3.379 TFLOPS, powered by a 50.25 Whr battery in a 680 g chassis.

Rising Demand for Eco-Friendly and Sustainable Board Games

Sustainability trends reshape production strategies as consumers increasingly prefer board games made with recycled paper, biodegradable plastics, and responsibly sourced wood. Publishers respond by adopting greener packaging, minimizing single-use plastics, and promoting carbon-neutral manufacturing. This shift creates differentiation opportunities in a competitive market, especially among environmentally conscious buyers. Retailers and crowdfunding platforms highlight eco-friendly product lines, boosting visibility and adoption. Sustainability-oriented design also improves brand reputation and long-term customer loyalty, aligning with global environmental regulations and shifting consumer expectations.

- For instance, Microsoft’s Xbox Game Pass has grown to over 37 million subscribers (as of July 2025), with cloud gaming enabling access to hundreds of titles across Xbox consoles, PC, and mobile devices.

Growing Popularity of Crowdfunding and Independent Publishing

Crowdfunding platforms create strong opportunities for indie publishers by reducing financial risk and enabling direct consumer validation before production. Designers can showcase prototypes, gather early feedback, and secure pre-orders, accelerating product development. Highly thematic, niche, or complex games find strong traction in this model due to engaged backer communities. Successful campaigns often evolve into long-term franchises with expansions and reprints. This democratized approach encourages innovation, supports small creators, and diversifies the market with unique game mechanics, premium components, and artistic experimentation.

Key Challenges

Increasing Competition and Market Saturation

The rapid rise in board game releases leads to crowded retail shelves and reduced visibility for new titles. Independent creators and established publishers compete intensely for consumer attention, making marketing and distribution more complex and costly. Saturation also shortens product life cycles as only a limited number of games gain long-term traction. Retailers often prioritize proven franchises, creating barriers for new entrants. This competitive pressure pushes publishers to invest more heavily in differentiation, branding, and community engagement to maintain market relevance.

Supply Chain Disruptions and Rising Production Costs

Board game manufacturing relies heavily on specialized printing, wood components, miniatures, and global logistics networks. Fluctuating raw material prices, shipping delays, and labor shortages increase production costs and lead times. Smaller publishers struggle to absorb these expenses, resulting in higher retail prices or delayed releases that reduce consumer demand. Additionally, reliance on overseas manufacturing introduces currency risks and geopolitical uncertainties. Managing inventory, forecasting demand, and maintaining profitability become more challenging as operational costs continue to rise across international supply chains.

Regional Analysis

North America

North America holds the dominant position in the global board game market with an estimated 32–34% market share, supported by strong hobbyist communities, widespread retail penetration, and high spending on premium strategy and collectible games. Growth is reinforced by active crowdfunding ecosystems, comic and gaming conventions, and the surge in family-oriented entertainment. The U.S. remains the core revenue driver due to its robust distribution networks and strong licensing collaborations with entertainment franchises. Rising participation in organized play events and café-based gaming formats further accelerates market maturity across metropolitan areas.

Europe

Europe accounts for an estimated 28–30% market share, driven by a long-standing board gaming culture and strong dominance in strategic Euro-style games. Countries such as Germany, France, and the UK remain major hubs for design, publishing, and international trade fairs. The region experiences consistent demand for educational, cooperative, and thematic strategy games, supported by high adoption in households and recreational centers. European publishers benefit from strong consumer preference for high-quality components and sustainable materials, while growing tourism and board-game cafés enhance market visibility across both Western and Central Europe.

Asia-Pacific

Asia-Pacific captures approximately 22–24% market share, emerging as the fastest-growing region due to rising urbanization, increasing disposable incomes, and expanding family entertainment spending. Japan, China, and South Korea are key contributors, driven by anime-themed games, collectible card culture, and digital-to-physical game adaptations. The region benefits from rapid e-commerce adoption and strong youth engagement through local community gaming spaces. Domestic publishers increasingly collaborate with global brands, boosting localized editions and franchise-based games. Growth is further strengthened by expanding education-oriented board games and the rising popularity of competitive strategy gameplay.

Latin America

Latin America holds around 7–8% market share, supported by growing interest in family-centric entertainment and expanding retail access to international titles. Brazil and Mexico lead regional demand as consumers increasingly adopt strategy, party, and educational games. Economic improvements and the rise of specialty stores create new opportunities for global publishers entering the market. However, affordability remains a key purchasing factor, boosting demand for budget-friendly and locally produced games. Expanding café gaming culture and rising digital engagement contribute to gradual market growth across urban centers in the region.

Middle East & Africa

The Middle East & Africa region represents an estimated 4–6% market share, showing steady expansion driven by rising youth demographics, growing mall-based entertainment hubs, and increased exposure to Western board game trends. The UAE and Saudi Arabia lead adoption with strong retail presence and demand for family-friendly, educational, and strategy games. Localized content and culturally aligned themes gain traction as publishers adapt offerings to regional preferences. Despite price sensitivity and limited distribution in some markets, rising e-commerce penetration and community gaming events support gradual market development across major cities.

Market Segmentations:

By Product Type:

By Game Theme:

- Strategy & war

- Sci-fi games

By Type:

- AR/VR integrated board games

- Print and play games

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the board game market features rising cross-industry participation from major global entertainment and technology companies, including Tencent Holdings Ltd, Sega Enterprises, Inc., Apple, Inc., Nintendo Co., Ltd, Activision Blizzard, Inc., Sony Corporation, Rovio Entertainment Corporation, The Walt Disney Company, Microsoft Corporation, and Electronic Arts, Inc. the board game market continues to evolve as companies increasingly emphasize franchise-driven content, hybrid digital-physical formats, and premium collectible editions to attract diverse consumer groups. Established publishers focus on expanding strategic, cooperative, and narrative-rich game portfolios, while new entrants leverage crowdfunding platforms to launch innovative concepts and niche genres. Market participants invest in high-quality artwork, sustainable materials, and modular expansions to strengthen long-term engagement. Digital integration through companion apps, online multiplayer modes, and AR features enhances accessibility and replay value. Growing global distribution networks, rising café gaming culture, and strong community-driven promotion further intensify competition and drive continuous product innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tencent Holdings Ltd

- Sega Enterprises, Inc.

- Apple, Inc.

- Nintendo Co., Ltd

- Activision Blizzard, Inc.

- Sony Corporation

- Rovio Entertainment Corporation

- The Walt Disney Company

- Microsoft Corporation

- Electronic Arts, Inc.

Recent Developments

- In July 2025, Victor Wembanyama surrounded by chess players during the Hoop Gambit tournament in Le Chesnay-Rocquencourt, France. The tournament was introduced in collaboration with the brand Nike and a local chess club. Approximately 150 individuals participated in the tournament.

- In May 2024, Rovio Entertainment launched Angry Birds for Automotive, a version of the classic game designed for cars with Google built-in, which can be downloaded directly from Google Play. This new version is available on select vehicles, such as the Volvo EX90, and allows players to enjoy the original game on the car’s infotainment system touchscreen.

- In April 2024, Mattel prepared to launch Scrabble, a new version of the classic word game aimed at making it more collaborative and accessible. The innovative double-sided board will retain the original game on one side while introducing a faster, team-oriented format on the flip side

Report Coverage

The research report offers an in-depth analysis based on Product Type, Game Theme, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as families and hobbyists prioritize social, offline entertainment experiences.

- Hybrid digital-physical gameplay will grow as publishers integrate companion apps and AR features.

- Strategy and cooperative games will gain greater traction due to rising demand for deeper, replayable mechanics.

- Sustainability-focused production will increase as consumers prefer eco-friendly materials and minimal packaging.

- Licensed and franchise-based games will see stronger adoption supported by global entertainment IP expansions.

- Crowdfunding platforms will play a larger role in launching innovative and premium game concepts.

- Board game cafés and community gaming spaces will enhance visibility and consumer engagement across regions.

- Digital adaptations of classic board games will attract younger audiences and broaden global reach.

- Localization efforts will expand as publishers tailor themes, language options, and cultural narratives for regional markets.

- The collector and premium board game segment will grow as enthusiasts seek detailed components and limited-edition releases.