Market Overview

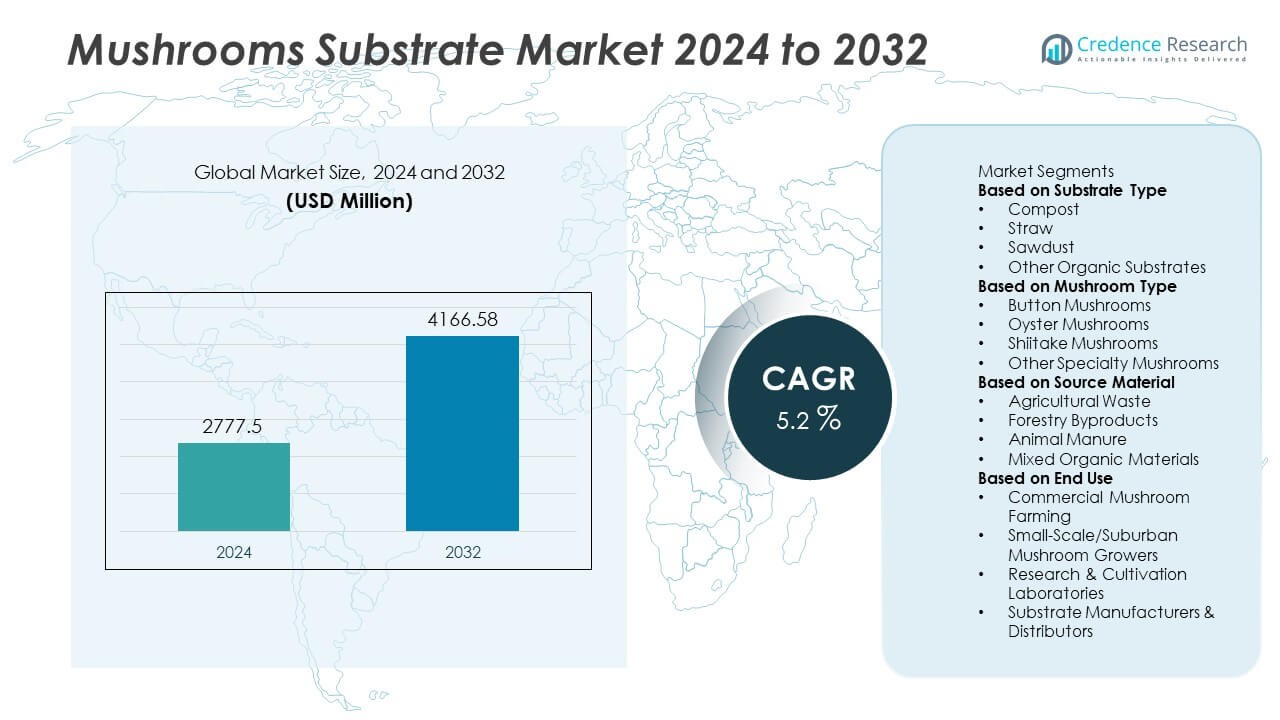

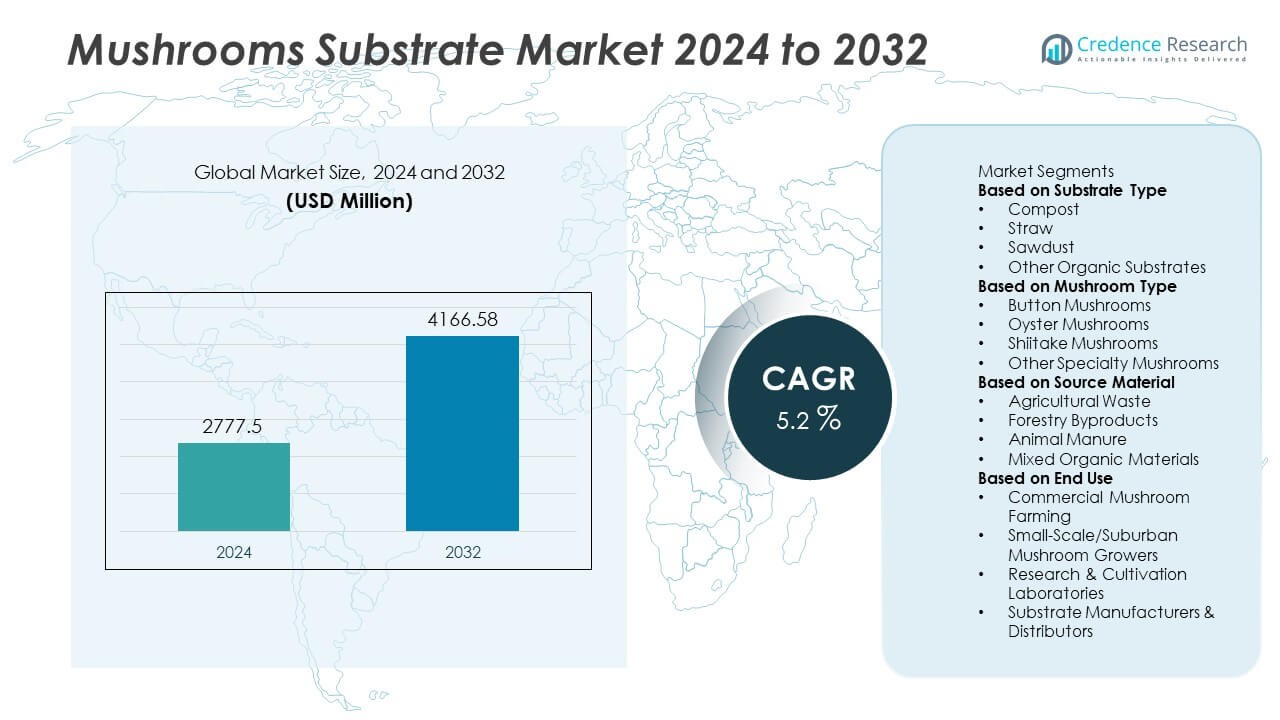

The Mushrooms Substrate Market reached USD 2,777.5 million in 2024 and is projected to grow to USD 4,166.58 million by 2032, recording a 5.2% CAGR over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mushrooms Substrate Market Size 2024 |

USD 2,777.5 Million |

| Mushrooms Substrate Market, CAGR |

5.2% |

| Mushrooms Substrate Market Size 2032 |

USD 4,166.58 Million |

The Mushrooms Substrate market includes leading participants such as Italspawn, Mushroom Substrate Solutions, Amycel Spawn, Mycelia BV, Hirano Mushroom LLC, Agrinoon (Fujian) Biological Co., Ltd, Highline Mushrooms, Aloha Medicinals, Phoratec Mushroom Supplies, and Sylvan Inc. These companies focus on compost, straw, and sawdust substrate formulations to improve yield efficiency, mycelium colonization speed, and contamination control for button, oyster, shiitake, and other specialty mushrooms. Product innovation continues in sterilized ready-to-use substrate blocks and enriched blends supporting medicinal mushroom cultivation. North America leads the market with a 34% share, followed by Europe with 28%, supported by expanding commercial mushroom operations, controlled-environment farming, and strong integration of agricultural and forestry byproduct substrates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mushrooms Substrate market reached USD 2,777.5 million in 2024 and is projected to reach USD 4,166.58 million by 2032, registering a 5.2% CAGR during the forecast period.

- Strong growth in commercial mushroom farming drives substrate demand, with compost leading the substrate type segment at 42% share, driven by high suitability for button and oyster mushroom production and consistent yield outcomes.

- Trends include rising adoption of ready-to-use sterilized substrate blocks, substrate enrichment for medicinal mushrooms, and expanding use of agricultural and forestry waste supporting circular farming practices.

- The market remains competitive with innovation in substrate sterilization, pathogen control, and distribution networks, while contamination risks, raw material variability, and production cost sensitivity continue to challenge small and emerging growers.

- North America holds 34%, Europe 28%, Asia Pacific 24%, Latin America 8%, and Middle East & Africa 6% of the market share, supported by strong adoption of compost, sawdust, and straw substrate formulations across commercial and decentralized mushroom cultivation.

Market Segmentation Analysis:

By Substrate Type:

Compost dominates the Mushrooms Substrate market with a 42% share, driven by high suitability for button, oyster, and portobello mushroom cultivation. Compost provides balanced nutrients, promotes stable mycelium growth, and supports higher yield consistency across commercial production systems. Straw substrate follows, mainly used in oyster and specialty mushroom farming due to accessibility and cost advantages. Sawdust plays a key role in shiitake and wood-based mushroom varieties, supporting dense fruiting bodies and improved shelf life. Other organic substrates, including coffee grounds and coco coir blends, gain attention from small-scale and urban growers focused on circular waste utilization.

- For instance, Mycelia NV produces high-quality mycelium spawn and mother cultures, which professional growers then use to inoculate a variety of substrates (such as sawdust or agricultural waste). This inoculum supports standardized shiitake strain performance, enabling the customer to grow mushrooms or create mycomaterials.

By Mushroom Type:

Button mushrooms lead the segment with a 48% market share, supported by strong global consumption and well-established commercial cultivation practices. These mushrooms rely heavily on compost-based substrates, enabling high-volume production and uniform crop cycles. Oyster mushrooms are the next major category, benefiting from rapid growth cycles and rising dietary demand. Shiitake mushrooms show steady expansion, supported by sawdust and wood-enriched substrate adoption for premium and medicinal markets. Other specialty mushrooms, including reishi, maitake, and lion’s mane, gain traction as functional food demand increases and substrate formulations evolve to enhance bioactive compound development.

- For instance, Sylvan is an important U.S. producer of fresh mushrooms and operates U.S. spawn production facilities in Pennsylvania and Nevada, as well as international plants. The company houses an extensive collection of over 600 strains from more than 50 mushroom species in its laboratories.

By Source Material:

Agricultural waste sources hold a 44% share, driven by large-scale use of straw, corn cobs, bran, and other crop residues in substrate mixing. This material supports sustainable production and reduces input costs for mushroom farms of varying sizes. Forestry byproducts, including sawdust and wood chips, remain essential for shiitake and wood-loving mushroom species, supporting dense and nutrient-rich substrate development. Animal manure blends enhance microbial diversity and compost efficiency, strengthening substrate performance in button mushroom farming. Mixed organic materials, including composted blends with coffee grounds, paper waste, and horticultural residues, gain interest in urban and small-scale mushroom operations focused on circular nutrient systems.

Key Growth Drivers

Rising Commercial Mushroom Cultivation Demand

Commercial mushroom farming expands globally due to growing consumption of button, oyster, and shiitake varieties. Substrate suppliers benefit as farms seek high-yield formulations that support faster colonization and stable crop cycles. Large producers adopt compost, straw, and enriched sawdust substrates to improve output and consistency across climate-controlled cultivation units. Rising interest in protein-rich, low-fat mushroom products supports farm investments in optimized substrate blends. Government-supported agricultural diversification programs and training for mushroom growers further accelerate substrate market growth. The driver remains strong as food processors and retail chains increase sourcing of fresh and processed mushrooms.

- For instance, Highline Mushrooms utilizes advanced technology and climate control in its facilities, including a “Farm of the Future” in Leamington, to ensure consistent and high-quality organic mushroom production. The company focuses on efficiency, with mushrooms going from farm to shelf in 24 hours.

Increasing Use of Agricultural and Forestry Waste

The growing focus on circular bioeconomy practices drives substrate production from crop residues, sawdust, and manure. These materials create cost-effective substrate mixes while reducing environmental waste and improving farm sustainability. Producers use straw, corn cobs, rice husk, and wood byproducts to support the nutritional needs of different mushroom species. This approach lowers substrate input expenses and enables year-round cultivation. Adoption grows as mushroom farming becomes a preferred income source for rural communities and small growers. Regulatory encouragement for organic cultivation strengthens this driver by supporting waste-to-resource applications in agriculture.

- For instance, the Fujian Kaisheng Biomass Power Plant uses rice husk and other agricultural residues as fuel to generate electricity, with a total nameplate capacity of 24 MW.

Rising Demand for Functional and Medicinal Mushrooms

Consumer interest in immune-boosting and nutritionally dense mushrooms supports substrate innovation for premium species such as shiitake, lion’s mane, and reishi. These mushrooms require enriched sawdust and wood-based substrate blends for higher bioactive compound levels. Functional mushroom supplements, extracts, and powders expand demand for controlled substrate formulations with traceable input quality. Health-conscious consumers and nutraceutical brands drive farms to adopt substrate solutions that improve yield potency. The growing global focus on natural wellness ingredients positions medicinal mushroom cultivation as a key growth contributor for the substrate market.

Key Trends & Opportunities

Growth of Ready-to-Use and Sterilized Substrate Blocks

Ready-to-use substrate blocks gain popularity among commercial and small-scale growers due to their convenience and reduced contamination risk. Sterilized and pre-inoculated substrate products enable faster colonization, higher yield reliability, and efficient handling for beginners and experienced farmers. The trend aligns with the rise of indoor and vertical mushroom farms that use controlled substrate formats to standardize output. Online distribution creates strong opportunities for substrate suppliers targeting hobby growers and urban farming communities. The opportunity strengthens as demand for subscription-based and pre-prepared substrate kits increases across major markets.

- For instance, Aloha Medicinals operates facilities involved in the production of mushroom products, utilizing equipment as part of its manufacturing process.

Expansion of Organic and Sustainable Mushroom Production

Growing demand for organic-certified mushrooms encourages substrate producers to offer chemical-free, traceable input sources. Organic farming trends support substrate blending from plant residues, sawdust, and livestock compost without synthetic additives. Sustainable substrates align with consumer expectations for eco-friendly, low-carbon cultivation systems. Certifications create new opportunities for suppliers to serve premium food, wellness, and export markets. The trend offers long-term growth potential as restaurants, retailers, and nutraceutical manufacturers increase sourcing of sustainably grown mushroom ingredients.

- For instance, Agrinoon Biological produces mushroom substrate and spawn and manages organic waste for agricultural use, contributing to the circular economy within the farming industry.

Key Challenges

Contamination Risks and Quality Control Issues

Substrate quality is critical for successful colonization, and contamination risks remain a major challenge. Poor sterilization, improper moisture control, and pathogen presence can cause complete crop loss. Small and medium-scale growers face difficulty achieving consistent substrate performance without advanced processing equipment. Contamination also increases farm production costs and reduces supply reliability for commercial buyers. Ensuring substrate purity requires reliable sourcing, testing, and standardized manufacturing methods, which may raise product prices. Suppliers must focus on hygiene control and technical support to overcome this challenge.

Supply Chain Limitations and Raw Material Variability

Substrate production depends on the availability of agricultural and forestry byproducts, which vary seasonally and geographically. Limited access to straw, manure, and quality sawdust may disrupt mixing ratios and performance consistency. Transportation costs increase for bulk substrate materials due to weight and handling requirements. Suppliers must adjust formulations to maintain nutrient balance despite input variability. These constraints challenge scale-up of substrate manufacturing in regions with limited biomass processing infrastructure. Developing decentralized substrate production and local sourcing networks is essential to reduce risk and stabilize market growth.

Regional Analysis

North America

North America holds a 34% market share driven by growth in commercial mushroom farming and adoption of controlled-environment agriculture. The United States leads substrate demand for button and oyster mushroom production, supported by compost and straw-based blends. Rising interest in functional mushroom varieties, including lion’s mane and maitake, encourages use of enriched sawdust substrates. Local substrate manufacturers benefit from steady availability of agricultural residues and forestry byproducts. The region also sees increased adoption of ready-to-use sterilized substrate blocks among small and urban growers. Strong distribution networks and investment in sustainable farming practices reinforce long-term market growth.

Europe

Europe accounts for a 28% market share, supported by established mushroom cultivation in the Netherlands, Poland, Spain, Italy, and France. Compost and manure-based substrates dominate due to strong button mushroom production. Oyster and specialty mushroom growers use straw and mixed organic materials, aligning with organic certification programs. Sustainability regulations encourage substrate producers to source crop and forestry waste responsibly. Demand for gourmet and medicinal mushrooms increases substrate innovation across small and mid-sized farms. Growth continues as retailers expand offerings of organic and locally grown mushroom products in fresh and processed formats.

Asia Pacific

Asia Pacific holds a 24% market share, driven by large-scale mushroom production in China, India, Japan, and South Korea. Sawdust and agricultural waste substrates support high consumption of shiitake and oyster mushrooms across foodservice and retail channels. Expanding adoption of integrated farming and circular biomass practices strengthens substrate availability. Regional growers focus on improving yield, shelf life, and contamination control through sterilized substrate blocks. Population growth and rising protein demand increase mushroom farming investments, particularly in India and Southeast Asia. Strong government support for agri-business and export-oriented cultivation enhances market expansion.

Latin America

Latin America represents an 8% market share, supported by increasing mushroom production in Brazil, Mexico, Argentina, and Chile. Substrate adoption grows as farms utilize abundant agricultural residues, including sugarcane bagasse, coffee waste, and straw. Oyster mushroom cultivation expands due to low entry cost and strong nutritional positioning among health-conscious consumers. Urban farming and small-scale production contribute to rising demand for ready-to-use substrate kits. Regional supply chains strengthen as agricultural cooperatives incorporate mushroom production into diversified income programs. Ongoing improvements in cold-chain logistics support broader retail distribution of fresh mushrooms.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, driven by growing interest in climate-controlled mushroom farming. Substrate suppliers target markets in the United Arab Emirates, Saudi Arabia, South Africa, and Kenya, where controlled-environment agriculture expands to improve food security. Compost and straw-based substrates support button and oyster mushroom production, while premium sawdust blends serve emerging specialty mushroom growers. Limited substrate raw material availability increases reliance on imported or commercially processed mixes. Regional governments encourage sustainable farming and resource efficiency, supporting long-term substrate market opportunities.

Market Segmentations:

By Substrate Type

- Compost

- Straw

- Sawdust

- Other Organic Substrates

By Mushroom Type

- Button Mushrooms

- Oyster Mushrooms

- Shiitake Mushrooms

- Other Specialty Mushrooms

By Source Material

- Agricultural Waste

- Forestry Byproducts

- Animal Manure

- Mixed Organic Materials

By End Use

- Commercial Mushroom Farming

- Small-Scale/Suburban Mushroom Growers

- Research & Cultivation Laboratories

- Substrate Manufacturers & Distributors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mushrooms Substrate market features key players such as Italspawn, Mushroom Substrate Solutions, Amycel Spawn, Mycelia BV, Hirano Mushroom LLC, Agrinoon (Fujian) Biological Co., Ltd, Highline Mushrooms, Aloha Medicinals, Phoratec Mushroom Supplies, and Sylvan Inc. These companies focus on improving substrate formulations that enhance colonization rates, yield consistency, and contamination resistance for button, oyster, shiitake, and specialty mushrooms. Producers expand their presence through collaborations with commercial mushroom farms and controlled-environment cultivation operators. Many focus on compost, straw, and sawdust blends, while some introduce sterilized, ready-to-use substrate blocks for small growers and urban farming markets. Innovation centers on optimizing organic waste utilization and maintaining high substrate microbial quality. Companies pursue supply chain reliability by securing agricultural and forestry residue sources, while geographic expansion targets high-growth markets in Asia Pacific and North America. Growing interest in medicinal and functional mushrooms also supports R&D in enriched substrate formulations.

Key Player Analysis

- Italspawn

- Mushroom Substrate Solutions

- Amycel Spawn

- Mycelia BV

- Hirano Mushroom LLC

- Agrinoon (Fujian) Biological Co., Ltd

- Highline Mushrooms

- Aloha Medicinals

- Phoratec Mushroom Supplies

- Sylvan Inc.

Recent Developments

- In April 2025, Sylvan received a direct investment from Novo Holdings, while KKR remained the majority shareholder, to scale up production capacity, upgrade R&D infrastructure, and deepen substrate/spawn development in Asia.

- In March 2025, Sylvan Inc. began construction of a new R&D facility adjacent to its spawn plant in Huai’an, China, focused on breeding, molecular biology and substrate-formulation research.

- In May 2024, Highline Mushrooms held its Gardener Appreciation Day event at its Crossfield, Alberta, site. During the event, the company distributed free spent-mushroom substrate to local gardeners, demonstrating a substrate by-product reuse initiative.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Substrate Type, Mushroom Type, Source Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Commercial mushroom farming will expand, increasing demand for high-yield substrate blends.

- Ready-to-use sterilized substrate blocks will gain wider adoption among urban and small growers.

- Agricultural and forestry waste utilization will strengthen circular and sustainable substrate production.

- Substrate enrichment will grow to support medicinal and functional mushroom cultivation.

- Automation and laboratory-grade sterilization techniques will improve substrate consistency and contamination control.

- Online distribution and subscription-based substrate supply models will expand market reach.

- Regional manufacturing facilities will increase to reduce substrate transport costs and improve availability.

- Technological research will enhance substrate nutrient balance for higher colonization rates.

- Partnerships between substrate suppliers and commercial mushroom farms will accelerate product development.

- Government support for agri-innovation and alternative farming will boost long-term substrate market growth.