Market Overview

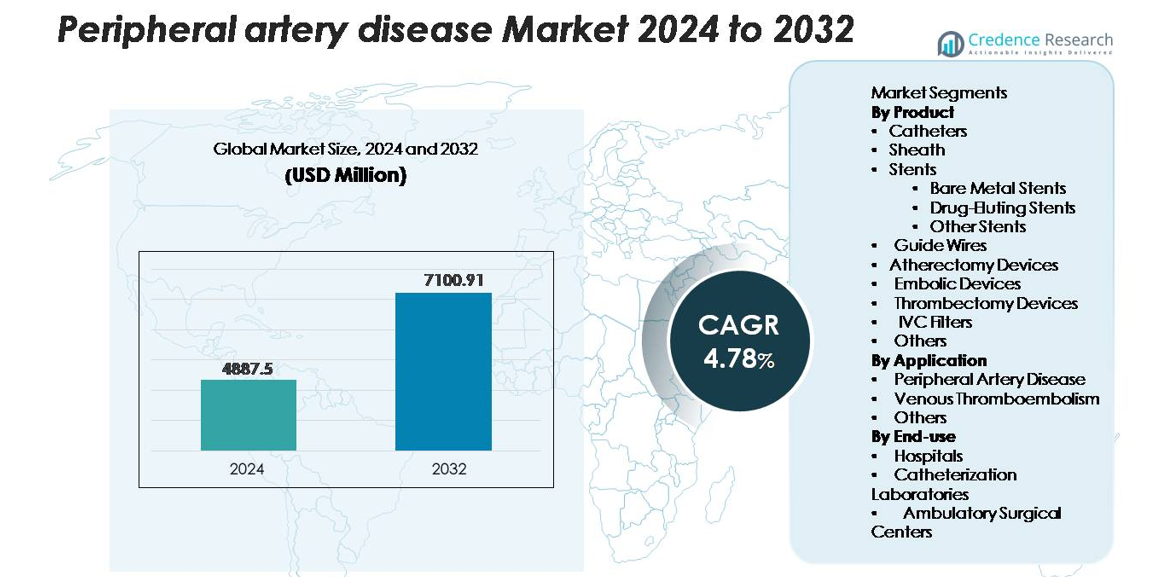

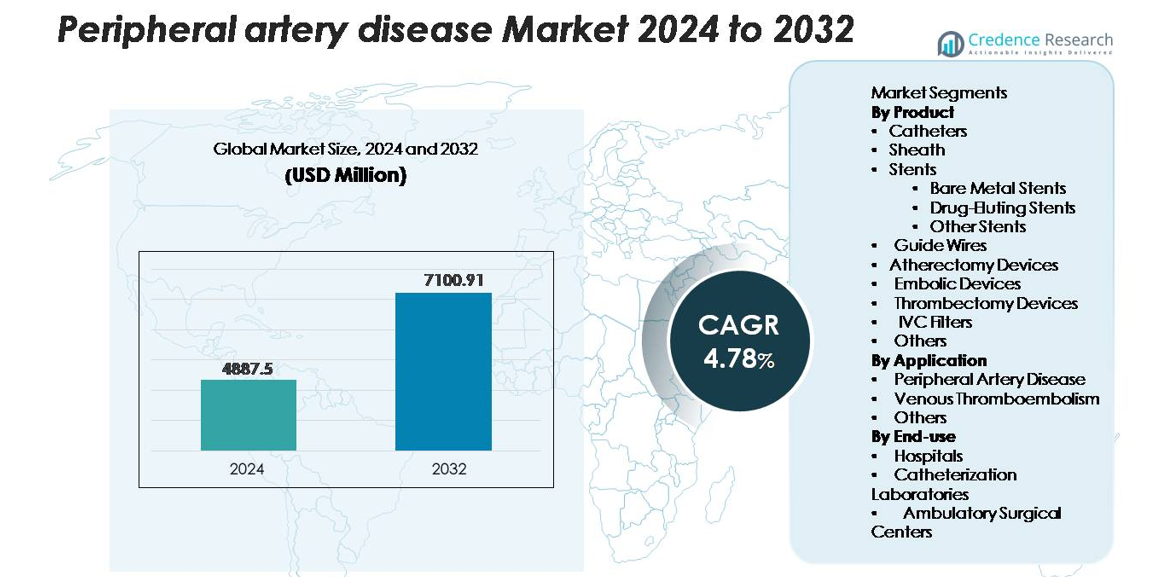

The global peripheral artery disease (PAD) market was valued at USD 4,887.5 million in 2024 and is projected to reach USD 7,100.91 million by 2032, expanding at a CAGR of 4.78% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Peripheral Artery Disease Market Size 2024 |

USD 4,887.5 million |

| Peripheral Artery Disease Market, CAGR |

4.78% |

| Peripheral Artery Disease Market Size 2032 |

USD 7,100.91 million |

The peripheral artery disease market is shaped by a concentrated group of global leaders, including Medtronic, Abbott, Boston Scientific, BD, Cook Medical, Terumo Corporation, and Cardinal Health, each strengthening their position through advanced stent platforms, atherectomy systems, and image-guided endovascular solutions. These companies focus on expanding minimally invasive therapeutic portfolios and enhancing clinical outcomes through continuous R&D investment. North America remains the leading region, commanding approximately 38% of the global market, supported by robust vascular care infrastructure, high procedural volumes, and strong reimbursement frameworks. Europe and Asia-Pacific follow as major contributors with rapidly expanding adoption of next-generation PAD treatment technologies.

Market Insights

- The global peripheral artery disease market was valued at USD 4,887.5 million in 2024 and is projected to reach USD 7,100.91 million by 2032, registering a CAGR of 4.78% during the forecast period.

- Market growth is primarily driven by the rising global burden of atherosclerosis, diabetes, and hypertension, alongside increasing adoption of minimally invasive endovascular interventions such as angioplasty, drug-eluting stents, and atherectomy procedures.

- Key trends include accelerating demand for drug-coated technologies, expansion of outpatient vascular interventions, and rapid integration of AI-enabled diagnostics and intravascular imaging for precision treatment planning.

- Competitive activity intensifies as major players expand portfolios in stents, atherectomy devices, and thrombectomy systems, with stents emerging as the dominant product segment holding over 34% share, supported by sustained innovation in drug-elution and thin-strut platforms.

- Regionally, North America leads with approximately 38% market share, followed by Europe at 28%, Asia-Pacific at 22%, while Latin America and the Middle East & Africa collectively contribute the remaining share, shaped by varying levels of infrastructure development and access to advanced vascular care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

In the peripheral artery disease market, stents remain the dominant product category, accounting for over 34% of total product revenue, driven by rising adoption of minimally invasive revascularization procedures. Within this segment, drug-eluting stents (DES) lead due to their superior restenosis prevention and long-term patency outcomes, while bare-metal stents maintain relevance in patients requiring shorter dual antiplatelet therapy durations. Atherectomy and thrombectomy devices continue gaining traction as adjunctive tools for complex plaque removal, whereas catheters, sheaths, guide wires, and embolic protection devices support the growing procedural volume across interventional settings.

- For instance, Abbott’s Hi-Torque Pilot™ 200 guide wire offers a tip load of 4.1 g and superb torque transmission for navigating chronic total occlusions (CTOs).

By Application:

Peripheral artery disease (PAD) represents the largest application segment, contributing nearly 68% of overall market share, supported by the high global prevalence of atherosclerosis and increased screening among aging populations. Advances in endovascular treatment protocols, including stenting, atherectomy, and image-guided interventions, further accelerate demand. Venous thromboembolism constitutes a secondary but steadily expanding segment, propelled by rising incidence of deep vein thrombosis and pulmonary embolism. The “Others” category encompasses device utilization in vascular trauma and postoperative clot management, reflecting the broadening procedural scope of modern vascular therapies.

- For instance, Medtronic’s IN.PACT Admiral drug-coated balloon demonstrated an 82.2% primary patency rate at 12 months in femoropopliteal lesions in its pivotal randomized controlled trial (with a Kaplan-Meier estimate of 89.8% at 360 days), reinforcing the effectiveness of modern PAD therapies.

By End-use:

Hospitals dominate the end-use landscape with over 55% market share, primarily due to their advanced infrastructure, higher patient inflow, and availability of multidisciplinary vascular care. Complex PAD cases, high-risk interventions, and emergency thrombectomy procedures are predominantly managed in hospital-based vascular units. Catheterization laboratories rank as the fastest-growing segment owing to the proliferation of specialized interventional suites that enable quicker, image-guided procedures with reduced hospital stays. Ambulatory surgical centers are steadily expanding adoption as reimbursement models shift toward outpatient vascular interventions, supported by the growing preference for same-day, minimally invasive care.

Key Growth Drivers

Rising Global Burden of Atherosclerosis and Aging Population

The growing prevalence of atherosclerosis, diabetes, hypertension, and obesity significantly heightens the incidence of peripheral artery disease, driving sustained demand for advanced treatment devices and vascular interventions. Aging demographics further accelerate disease burden, as individuals over 65 face markedly higher risks of plaque buildup, limb ischemia, and mobility complications. Healthcare systems worldwide are expanding screening programs, incorporating ankle–brachial index testing and duplex ultrasound evaluations to enable earlier PAD detection. This earlier identification translates into rising procedural volumes, particularly for endovascular angioplasty, stenting, and atherectomy. Public health initiatives promoting cardiovascular risk management also complement market expansion by increasing patient awareness and encouraging timely clinical intervention.

- For instance, Medtronic’s IN.PACT Admiral clinical program demonstrated durable outcomes in complex PAD, treating mean lesion lengths of 12.1 cm with a 99.1% device-success rate across more than 1,500 evaluated patients.

Rapid Advancement in Minimally Invasive Endovascular Treatment Technologies

Accelerating technological progress in minimally invasive vascular devices is a key driver for market growth, particularly as endovascular procedures increasingly replace open surgical interventions. Drug-eluting stents, drug-coated balloons, advanced guide wires, and rotational atherectomy systems are enabling more predictable procedural outcomes and improved long-term patency rates. Manufacturers continue to introduce devices optimized for complex lesions, below-the-knee interventions, and total occlusions, thereby expanding the treatable patient pool. Image-guided navigation technologies and intravascular imaging platforms enhance procedural precision, supporting higher adoption among interventional radiologists and vascular surgeons. Collectively, these innovations strengthen clinician confidence, reduce recovery times, and expand access to outpatient PAD treatment pathways.

- For instance, Boston Scientific’s Jetstream™ rotational atherectomy system operates at rotational speeds of approximately 70,000 to 73,000 rpm, enabling effective plaque removal in mixed-morphology lesions; similarly, Abbott’s Xience Skypoint™ DES features an 81-µm strut thickness that improves crossability in calcified vessels.

Increased Healthcare Investments and Expansion of Specialized Vascular Care Infrastructure

Growing investments in vascular care facilities, catheterization labs, and ambulatory surgical centers support the expansion of PAD treatment capacity across developed and emerging regions. Hospitals and healthcare providers continue to upgrade interventional suites, procure advanced imaging modalities, and integrate hybrid operating rooms to manage high-risk and complex vascular cases. Favorable reimbursement frameworks for angioplasty, stenting, and thrombectomy further encourage procedural growth. Additionally, public-private partnerships and national cardiovascular health programs are helping scale diagnostic and treatment capabilities in underserved regions. Training initiatives aimed at expanding the skilled interventional workforce also facilitate broader adoption of modern PAD treatment protocols, collectively strengthening market penetration.

Key Trends & Opportunities

Growing Adoption of Drug-Coated Balloons and Next-Generation Stent Platforms

A major trend shaping the market is the rapid shift toward drug-coated balloons (DCBs) and next-generation stent platforms designed to enhance long-term patency without relying solely on permanent implants. DCBs are particularly gaining traction in small-vessel and below-the-knee interventions where restenosis risk is high. Meanwhile, bioresorbable scaffolds, ultra-thin strut stents, and polymer-free drug-elution technologies are broadening therapeutic options for patients with challenging vascular anatomies. These advancements create significant opportunities for device manufacturers to differentiate through improved deliverability, lower restenosis rates, and enhanced clinical outcomes. The trend aligns strongly with clinician preference for technologies that reduce repeat interventions.

- For instance, Medtronic’s IN. PACT™ Admiral DCB demonstrated a late lumen loss of approximately 0.39 mm at 12 months in femoropopliteal lesions, which was significantly superior to plain balloon angioplasty (approximately 1.03 mm).

Expansion of Outpatient and Office-Based Endovascular Procedures

The increasing shift from inpatient to outpatient and office-based vascular interventions is creating new growth avenues across developed markets. Advancements in imaging, device miniaturization, and low-contrast techniques enable many PAD procedures to be performed safely in ambulatory settings. This trend reduces hospitalization costs, shortens recovery times, and expands treatment access, particularly for elderly and comorbid patients. Office-based labs (OBLs) and ambulatory surgical centers are rapidly adopting atherectomy devices, stents, and thrombectomy systems, supported by favorable reimbursement structures. Manufacturers are capitalizing on this shift by designing compact, portable, and workflow-efficient devices tailored for lower-acuity settings.

- For instance, Philips’ Azurion platform demonstrated a 17% reduction in procedure time and a 28% faster patient preparation-to-incision interval in the St. Antonius Hospital study, based on more than 1,500 real-world interventional cases.

Integration of AI-Enabled Diagnostics and Remote Vascular Monitoring

AI-driven diagnostic tools, automated imaging interpretation systems, and remote monitoring solutions are emerging as high-impact opportunities in the PAD landscape. Machine learning algorithms enhance the accuracy of vascular imaging, enable earlier plaque detection, and support personalized treatment planning. Wearable sensors and mobile health platforms provide continuous monitoring of limb perfusion and mobility parameters, facilitating proactive intervention before symptom escalation. Healthcare providers benefit from improved patient adherence, reduced follow-up burden, and enhanced long-term outcome tracking. As digital health adoption accelerates, AI-enabled solutions are expected to play a pivotal role in expanding preventive care and optimizing treatment pathways.

Key Challenges

High Risk of Restenosis and Limited Long-Term Efficacy in Complex Lesions

Despite advancements in stents, balloons, and atherectomy devices, restenosis remains a persistent clinical challenge, especially in long lesions, calcified arteries, and below-the-knee segments. Complex anatomical variations, comorbidities such as diabetes, and resistance to conventional drug-eluting therapies often impair long-term vessel patency. Repeat interventions significantly increase patient burden and healthcare costs, limiting overall treatment success. Limited clinical evidence for certain device classes in complex PAD further constrains adoption. Manufacturers must continue to innovate to overcome durability limitations, enhance drug-delivery technologies, and support rigorous clinical studies to strengthen physician confidence.

Cost Constraints and Unequal Access to Advanced Endovascular Treatments

High procedure costs, particularly for advanced stents, atherectomy devices, and thrombectomy systems, pose a significant barrier in low- and middle-income regions. Limited reimbursement coverage and out-of-pocket expenditure models restrict patient access to modern PAD therapies. Many healthcare systems lack specialized vascular centers, trained interventional specialists, and advanced imaging modalities necessary for high-quality endovascular care. These disparities lead to delayed diagnosis, lower treatment uptake, and higher rates of limb-threatening ischemia. Bridging the access gap requires coordinated efforts across manufacturers, policymakers, and healthcare providers to improve affordability, training, and infrastructure availability

Regional Analysis

North America

North America holds the largest share of the peripheral artery disease market at approximately 38%, supported by high disease prevalence, advanced cardiovascular care infrastructure, and strong adoption of minimally invasive endovascular procedures. The United States drives regional dominance due to robust reimbursement frameworks, large interventional radiology networks, and significant investments in drug-eluting stents, atherectomy systems, and image-guided vascular technologies. Growth is further accelerated by clinical guidelines promoting early PAD screening and the expanding footprint of hybrid operating rooms. Ongoing R&D activities and rapid uptake of next-generation endovascular devices continue to reinforce the region’s leadership position.

Europe

Europe accounts for around 28% of the global market, underpinned by high awareness of atherosclerotic diseases and well-established vascular care infrastructure across Germany, the U.K., France, and Italy. The region benefits from structured clinical pathways, widespread use of duplex ultrasound screening, and strong adoption of minimally invasive angioplasty and stenting procedures. Favorable reimbursement in Western Europe and growing investment in ambulatory vascular care settings support procedural expansion. Eastern European countries are recording steady growth as healthcare modernization programs increase access to advanced PAD interventions. Rising elderly populations further reinforce long-term device demand across the region.

Asia-Pacific

The Asia-Pacific region holds approximately 22% of the market and is the fastest-growing geography due to escalating prevalence of diabetes, hypertension, and smoking-related vascular disorders. China, Japan, India, and South Korea are major growth engines, driven by expanding hospital networks, increasing catheterization lab installations, and improving availability of modern endovascular devices. Government-led cardiovascular screening initiatives and improved healthcare expenditure enable earlier PAD diagnosis and intervention. Rising demand for cost-effective stents, guide wires, and atherectomy systems is expanding the treatment landscape. The region’s large patient pool and rapid infrastructure upgrades position Asia-Pacific for sustained long-term expansion.

Latin America

Latin America captures around 7% of the global market, influenced by rising PAD incidence associated with obesity, diabetes, and cardiovascular risk factors. Brazil and Mexico lead adoption due to improving access to catheterization laboratories and growing availability of drug-eluting stents and thrombectomy devices. However, limited reimbursement coverage and disparities in healthcare infrastructure restrict broader penetration of advanced endovascular technologies. Increasing physician training programs and public awareness campaigns are gradually expanding patient inflow. As private healthcare providers invest in modern vascular suites, the region is expected to experience steady but moderate growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the market, constrained by limited access to advanced vascular care and low early-detection rates. Growth is concentrated in Gulf countries such as Saudi Arabia, the UAE, and Qatar, where investments in tertiary hospitals and hybrid operating rooms are rising. The burden of diabetes and peripheral vascular complications remains high, driving increasing demand for angioplasty, stenting, and atherectomy procedures. In Africa, restricted healthcare infrastructure limits adoption, but international collaborations and gradual expansion of interventional cardiology centers are beginning to support incremental market growth.

Market Segmentations:

By Product

- Catheters

- Sheath

- Stents

- Bare Metal Stents

- Drug-Eluting Stents

- Other Stents

- Guide Wires

- Atherectomy Devices

- Embolic Devices

- Thrombectomy Devices

- IVC Filters

- Others

By Application

- Peripheral Artery Disease

- Venous Thromboembolism

- Others

By End-use

- Hospitals

- Catheterization Laboratories

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The peripheral artery disease market features a competitive landscape dominated by global leaders specializing in endovascular therapies, vascular imaging, and minimally invasive device innovations. Major companies including Medtronic, Abbott, Boston Scientific, Philips, Cook Medical, Terumo, Becton Dickinson, Cardinal Health, and AngioDynamics drive market advancement through continuous product upgrades, expanded clinical evidence, and strategic portfolio diversification. These players compete on deliverability, long-term patency outcomes, and compatibility with advanced imaging platforms. Drug-eluting stents, atherectomy systems, thrombectomy devices, and drug-coated balloons remain central to competitive differentiation, with companies accelerating R&D to target complex lesions and below-the-knee disease. Partnerships with hospitals, catheterization labs, and ambulatory surgical centers strengthen distribution reach, while regulatory approvals in North America, Europe, and Asia-Pacific enhance global penetration. Emerging firms are increasingly focusing on bioresorbable technologies and AI-enabled vascular guidance systems, intensifying innovation-driven competition. Overall, technological leadership, clinical performance, and global commercialization capabilities remain the key competitive levers shaping this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Teleflex Incorporated the company completed its acquisition of BIOTRONIK’s Vascular Intervention business for €760 million, adding products for peripheral interventions like the Passeo-18 Lux Peripheral Drug-Coated Balloon Catheter to strengthen its PAD market presence.

- In January 2025, Boston Scientific Corporation the firm agreed to acquire Bolt Medical, Inc., anticipated to close in the first half of 2025, enhancing its vascular intervention capabilities.

- In March 2024, Becton, Dickinson and Company (BD) launched the AGILITY clinical study to evaluate the safety and effectiveness of its Vascular Covered Stent for treating peripheral artery disease (PAD), conducted across the U.S., Europe, Australia, and New Zealand

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see accelerated adoption of minimally invasive endovascular procedures across hospital and outpatient settings.

- Drug-coated balloons, polymer-free stents, and next-generation atherectomy systems will gain broader clinical acceptance.

- AI-enabled vascular imaging and decision-support tools will streamline diagnosis and improve treatment precision.

- The expansion of outpatient labs and ambulatory surgical centers will increase procedure volumes globally.

- Remote monitoring tools and wearable technologies will support earlier intervention and improved patient follow-up.

- Manufacturers will intensify innovation in devices tailored for complex and below-the-knee lesions.

- Growing physician training programs in emerging markets will expand access to advanced PAD treatments.

- Reimbursement reforms in developing regions will strengthen adoption of interventional PAD therapies.

- Partnerships between medtech companies and healthcare systems will drive integrated vascular care models.

- Rising global awareness campaigns will improve early diagnosis rates and expand the eligible patient pool.