Market Overview

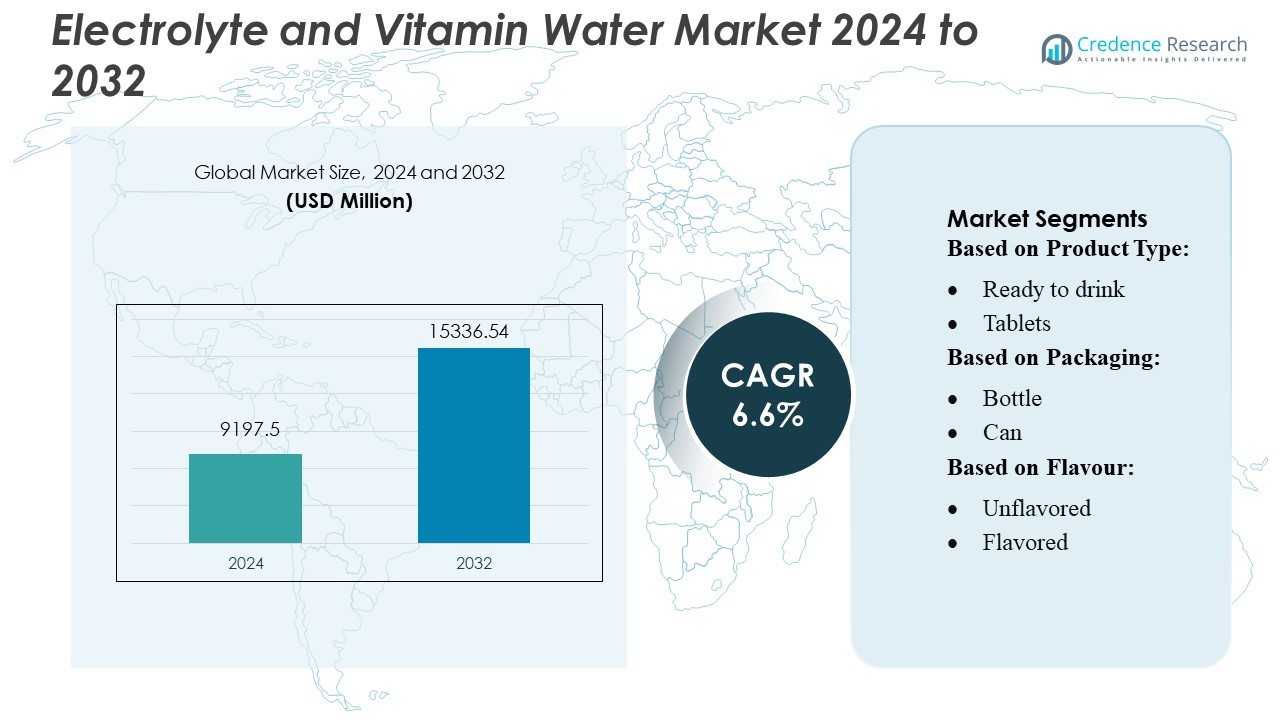

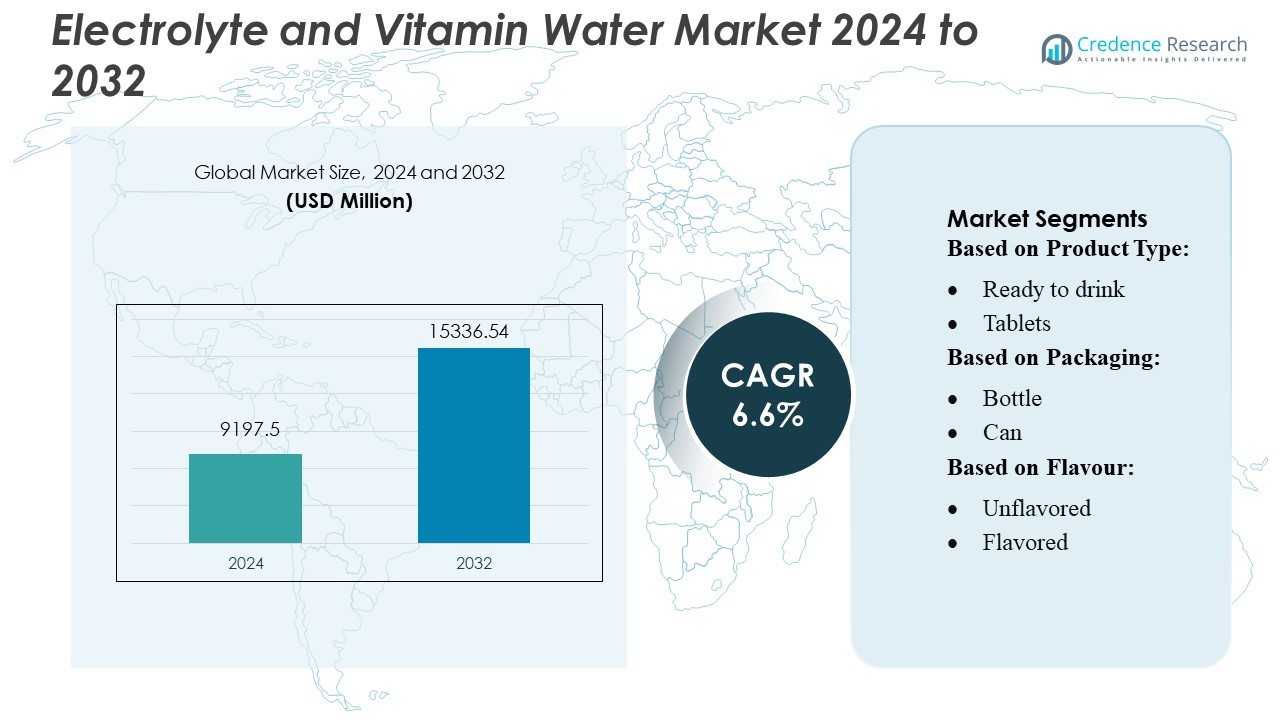

Electrolyte and Vitamin Water Market size was valued USD 9197.5 million in 2024 and is anticipated to reach USD 15336.54 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrolyte and Vitamin Water Market Size 2024 |

USD 9197.5 Million |

| Electrolyte and Vitamin Water Market, CAGR |

6.6% |

| Electrolyte and Vitamin Water Market Size 2032 |

USD 15336.54 Million |

The Electrolyte and Vitamin Water Market include National Beverage Corp, Evian (DANONE), Poland Spring (Primo Water Corporation), Voss (Voss of Norway ASA), Dasani (The Coca-Cola Company), Gerolsteiner (Gerolsteiner Brunnen GmbH & Co. KG), Perrier (Nestlé), Fiji Water (FIJI Water Company LLC), Nongfu Spring (Nongfu Spring Co., Ltd.), and Aquafina (PepsiCo), each strengthening their portfolios through clean-label formulations, natural mineral profiles, and expanded distribution strategies. Asia-Pacific leads the global market with approximately 30% market share, driven by rapid urbanization, rising disposable incomes, and growing adoption of functional hydration products across fitness, lifestyle, and youth-oriented consumer groups.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electrolyte and Vitamin Water Market was valued at USD 9,197.5 million in 2024 and is projected to reach USD 15,336.54 million by 2032, growing at a CAGR of 6.6%, reflecting strong global demand for functional hydration.

- Market drivers include rising health consciousness, growing preference for low-calorie and clean-label hydration, and increasing adoption among fitness-focused consumers seeking mineral-enriched and vitamin-infused beverages.

- Key trends center on zero-sugar formulations, natural mineral sourcing, sustainable packaging, and rapid expansion through e-commerce and convenience retail, supported by innovation from leading brands strengthening premium product lines.

- Competitive activity intensifies as global and regional players enhance distribution networks and diversify portfolios, while market restraints include fluctuating raw material costs, sustainability compliance pressures, and rising competition from flavored water and sports drinks.

- Asia-Pacific leads with 30% regional share, while ready-to-drink formats hold the dominant segment share due to widespread availability and strong consumer preference for convenient hydration solutions.

Market Segmentation Analysis:

By Product Type

Ready-to-drink (RTD) formulations dominate the electrolyte and vitamin water market, accounting for around 65% market share, supported by strong consumer preference for convenience, immediate hydration, and portability. RTD products benefit from extensive retail penetration and frequent innovation in functional ingredients. Tablets follow as the second-largest segment, driven by rising demand for customizable electrolyte concentration and lower per-serving cost. Powder formats gain traction among athletes and cost-conscious consumers, while the “Others” category, including concentrates and functional shots, expands gradually through niche positioning in performance and recovery applications.

- For instance, Danone’s Evian brand introduced evian+, a 330 ml sparkling RTD can that boosts magnesium content to 50 mg per can and zinc to 1.1 mg, targeting cognitive function.

By Packaging

Bottles remain the dominant packaging format with approximately 70% market share, driven by their convenience, durability, and compatibility with on-the-go consumption. The segment also benefits from widespread availability across retail and food-service channels. Cans observe steady growth as brands adopt lightweight, recyclable aluminum packaging aligned with sustainability goals. Pouches gain attention for their lower material footprint and portability, appealing to outdoor and sports users. Overall, bottle packaging maintains its lead due to versatility, strong brand visibility, and acceptance across premium, mainstream, and functional hydration lines.

- For instance, Primo Brands is aggressively pushing circular design: their 5-gallon returnable bottles (used in home delivery) are reused after collection, and each 5-gallon bottle exchange is reported to “save the equivalent of 1,500 single-use 0.5-liter plastic bottles from landfills and oceans.

By Flavour

Flavored electrolyte and vitamin water leads the category with nearly 75% market share, driven by consumer preference for taste-enhanced hydration options featuring fruit-based, botanical, and functional flavor blends. Innovation in low-sugar and natural flavor systems continues to reinforce segment dominance. Unflavored products maintain a niche but stable presence, supported by consumers seeking clean-label, additive-free hydration or those using electrolyte products for medical or high-performance needs. Despite this, flavored variants sustain faster adoption due to wider portfolio diversity, stronger marketing appeal, and alignment with lifestyle-driven hydration trends.

Key Growth Drivers

1. Rising Demand for Functional Hydration

The market grows steadily as consumers increasingly prioritize hydration products that deliver functional benefits beyond basic water intake. Rising participation in sports, fitness activities, and endurance training accelerates demand for electrolyte-rich beverages that support energy balance and recovery. Urban lifestyle stress and heat exposure also push consumers toward fortified hydration solutions suitable for daily use. Additionally, expanding adoption of clean-label formulations with natural electrolytes and vitamins strengthens product appeal among health-conscious buyers, boosting consistent category expansion across both developed and emerging markets.

- For instance, Voss offers VOSS+ Aquamin®, an enhanced water formulation containing 74 trace minerals and electrolytes, sustainably sourced from the coastal waters of Iceland.

2. Expansion of Convenience-Driven Consumption

Convenience continues to drive significant market growth, with ready-to-drink electrolyte and vitamin water gaining strong preference among busy consumers seeking portable and immediate hydration. Increasing retail penetration through supermarkets, hypermarkets, and convenience stores enhances product accessibility. The rise of e-commerce platforms further accelerates availability, allowing brands to offer multi-pack formats and subscription-based replenishment. These convenience factors, combined with growing on-the-go consumption among working professionals, commuters, and students, strengthen overall market demand and encourage manufacturers to expand packaging formats and flavor assortments.

- For instance, Dasani relaunched its 20-oz, 1 L, and 1.5 L bottles in 100% recycled PET (rPET) as of 2022, excluding caps and labels, which substantially reduces reliance on virgin plastic.

3. Innovation in Low-Sugar and Clean-Label Formulations

Growing consumer vigilance around sugar intake encourages manufacturers to innovate with low-sugar, zero-sugar, and natural sweetener–based electrolyte drinks. Brands increasingly incorporate plant-derived minerals, natural flavors, and vitamin blends to meet expectations for clean-label hydration. Advances in electrolyte stabilization and natural flavor systems further improve product performance without compromising taste. This shift aligns with broader health and wellness trends, enabling companies to target premium, specialized, and lifestyle segments. As awareness of metabolic health and weight management rises, clean-label innovation becomes a core driver of market expansion.

Key Trends & Opportunities

1. Growth of Personalized and Performance-Specific Hydration

A rising trend in personalized nutrition creates opportunities for customized electrolyte and vitamin formulations tailored to activity level, sweat rate, or specific performance goals. Brands increasingly offer segmented lines for endurance athletes, high-intensity trainers, and general wellness consumers. Digital fitness platforms and wearable technologies further enable personalized hydration insights, encouraging demand for targeted electrolyte blends. This trend positions the market for premiumization as consumers seek higher-value, science-backed hydration solutions aligned with individual biological needs and performance requirements.

- For instance, Gerolsteiner’s “Ursprung” spring water—launched is uniquely mineralized: it contains 4,441 mg of total dissolved minerals per liter, including 3,144 mg of hydrogen carbonate, 590 mg of calcium, and 167 mg of magnesium.

2. Sustainable Packaging and Eco-Friendly Formulations

Sustainability emerges as a critical opportunity as consumers demand products with reduced environmental impact. Brands increasingly adopt recyclable aluminum cans, lightweight bottles, and plant-based or biodegradable packaging materials. Concentrated powders and tablets further reduce plastic waste and transportation emissions, appealing to environmentally conscious buyers. Clean sourcing of minerals, natural flavors, and vitamins supports eco-friendly product positioning. As regulatory pressures intensify and corporate sustainability goals expand, environmentally responsible manufacturing and packaging approaches create a strong competitive advantage in the market.

- For instance, Perrier has committed to ensuring its plastic overwraps incorporate 50% recycled materials, a goal that is part of its parent company Nestlé’s wider sustainability ambitions and target for its bottles to be made with 50% recycled PET by 2025.

3. Expansion into Emerging Markets and Heat-Stress Regions

Rapid urbanization and rising temperatures in regions across Asia, Africa, and Latin America create strong opportunities for hydration products designed to address heat stress and fluid loss. Increasing middle-class income and broader awareness of hydration health amplify adoption. Localized flavor development and cost-effective packaging formats help brands penetrate high-volume markets. Governments and health organizations promoting hydration awareness during extreme heat events further support demand expansion. These conditions offer long-term growth potential for manufacturers willing to tailor products to climatic and cultural preferences.

Key Challenges

1. High Competition and Pricing Pressure

The market faces intense competitive pressure from global beverage players, private labels, and emerging functional drink brands. Price-sensitive consumers often shift toward economical substitutes such as powders and generic electrolyte mixes, challenging premium positioning. Retailers increasingly promote private-label offerings, intensifying margin compression. Frequent promotional activity and discounting strategies further erode profitability for established manufacturers. To remain competitive, brands must differentiate through innovation, cleaner formulations, and targeted marketing, while navigating rising production and ingredient costs that complicate pricing strategies.

2. Regulatory Constraints and Ingredient Compliance

Regulatory requirements surrounding nutrient fortification, claims, sweeteners, and additives create significant challenges for electrolyte and vitamin water manufacturers. Varying regional standards complicate product formulation and global distribution. Restrictions on health claims, sugar content regulations, and evolving labeling rules require frequent reformulation and compliance updates. Delays in approvals for new ingredients or functional claims may impede innovation timelines. Manufacturers must invest in rigorous quality control, documentation, and regulatory expertise to mitigate compliance risks and maintain product integrity across diverse markets.

Regional Analysis

North America

North America holds a dominant position in the Electrolyte and Vitamin Water Market, capturing around 35% of global share, driven by high consumer inclination toward functional beverages and strong retail penetration. Brands leverage advanced formulation technologies, such as enhanced mineral absorption and clean-label electrolytes, to appeal to health-conscious buyers. The United States leads the region with aggressive product diversification across zero-sugar, plant-based, and performance-hydration lines. Growth is further strengthened by expanding distribution through convenience stores, fitness chains, and e-commerce platforms. Increasing adoption among athletes and lifestyle consumers continues to support steady market expansion across the region.

Europe

Europe accounts for approximately 25% of the global market share, supported by rising preferences for low-calorie hydration products and regulatory push toward clean, functional ingredients. The region benefits from strong uptake in Western Europe, where consumers actively shift from carbonated soft drinks to fortified hydration alternatives. Manufacturers focus on natural mineral content, reduced artificial additives, and sustainable packaging to meet evolving demand. Growing participation in sports, wellness activities, and urban mobility trends sustains consumption across key markets such as Germany, the U.K., and France. Retailers also promote private-label offerings, further strengthening product accessibility across Europe.

Asia-Pacific

Asia-Pacific commands around 30% of global market share and represents the fastest-growing region due to rapid urbanization, rising disposable incomes, and expanding awareness of functional hydration. Countries such as China, Japan, India, and South Korea drive demand through increasing gym memberships, active lifestyles, and hot climate conditions that elevate hydration needs. Manufacturers introduce localized flavors, natural ingredients, and affordable smaller pack sizes to broaden reach. Strong growth in modern retail, online delivery platforms, and convenience stores accelerates widespread product availability. Regional players also benefit from youth-driven consumption patterns and aggressive promotional activities.

Latin America

Latin America holds close to 6% market share, supported by rising interest in healthier beverage categories and gradual lifestyle transitions across urban populations. Brazil and Mexico lead regional consumption, with increasing awareness of electrolyte balance and hydration benefits, especially among sports enthusiasts and outdoor labor groups. Brands prioritize affordability, tropical flavors, and functional claims to cater to cost-sensitive consumers. Expansion of convenience retail formats and sports nutrition channels strengthens product accessibility. Although the market faces price sensitivity, growing fitness culture and wider penetration of international brands support steady demand within key urban clusters.

Middle East & Africa

The Middle East & Africa region captures around 4% of the global market, driven by hot climatic conditions that heighten hydration needs and rising consumer interest in functional beverages. Growth is centered in the UAE, Saudi Arabia, and South Africa, where retail modernization and premium beverage trends are expanding. Manufacturers introduce mineral-rich, low-sugar, and flavor-enhanced electrolyte waters tailored to regional preferences. Increased participation in sports events, outdoor activities, and health-focused lifestyles supports higher adoption. While market penetration remains developing, improving distribution networks and growing awareness of hydration benefits continue to enhance regional demand.

Market Segmentations:

By Product Type:

By Packaging:

By Flavor:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrolyte and Vitamin Water Market include National Beverage Corp, Evian (DANONE), Poland Spring (Primo Water Corporation), Voss (Voss of Norway ASA), Dasani (The Coca-Cola Company), Gerolsteiner (Gerolsteiner Brunnen GmbH & Co. KG), Perrier (Nestlé), Fiji Water (FIJI Water Company LLC), Nongfu Spring (Nongfu Spring Co., Ltd.), and Aquafina (PepsiCo). The Electrolyte and Vitamin Water Market remains highly active, with companies intensifying efforts to differentiate through advanced hydration technologies, clean-label formulations, and functional enhancements such as added minerals, vitamins, and natural electrolytes. Manufacturers emphasize zero-sugar and low-calorie variants to appeal to health-conscious consumers while investing in sustainable packaging solutions, including recycled PET and lightweight bottle designs. Brands expand their presence through multichannel distribution across supermarkets, fitness centers, and digital commerce, supported by targeted marketing campaigns aimed at sports, lifestyle, and wellness segments. Continuous innovation in flavors, performance-boosting ingredients, and eco-friendly bottling practices fuels competition, driving firms to enhance product quality and strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- National Beverage Corp

- Evian (DANONE)

- Poland Spring (Primo Water Corporation)

- Voss (Voss of Norway ASA)

- Dasani (The Coca-Cola Company)

- Gerolsteiner (Gerolsteiner Brunnen GmbH & Co. KG)

- Perrier (Nestlé)

- Fiji Water (FIJI Water Company LLC)

- Nongfu Spring (Nongfu Spring Co., Ltd.)

- Aquafina (PepsiCo)

Recent Developments

- In August 2025, ORSL ZERO Mango Electrolyte Drink, made with real mango pulp and zero added sugar, expands electrolyte and hydration portfolio to meet Indian consumers’ evolving needs.

- In September 2024, Waterloo Sparkling Water launched a new Pomegranate Açaí flavor and brought back their seasonal Spiced Apple flavor. Both beverages are calorie-free, sugar-free, and made with non-GMO natural flavors.

- In August 2024, Flow Beverage Corp. announced the launch of Flow Sparkling Mineral Spring Water. The product comes in 300ml aluminum bottles made with 70% recycled material, offering four varieties.

- In May 2024, Marvelle Healthcare launched Rhythm Water in India, a premium natural mineral water sourced from the Himalayas. The brand offered two varieties and is focused on a 20-year filtration process to ensure purity and mineral retention.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging, Flavour and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth as consumers increasingly prioritize functional hydration over traditional sugary beverages.

- Brands will expand zero-sugar, clean-label, and naturally sourced electrolyte formulations to meet evolving health preferences.

- Product innovation will intensify, with companies introducing enhanced mineral blends, vitamin-enriched variants, and performance-oriented hydration solutions.

- E-commerce and quick-commerce platforms will play a larger role in product accessibility, especially in urban markets.

- Sustainable packaging initiatives will accelerate as companies adopt recycled materials and lightweight bottle designs.

- Localization of flavors and region-specific formulations will increase to capture diverse consumer tastes.

- Sports nutrition and fitness segments will continue to drive premiumization in electrolyte beverages.

- Smart marketing strategies using influencers, digital campaigns, and experiential promotions will shape brand visibility.

- Expansion into emerging markets will rise as awareness of hydration benefits continues to grow.

- Competition will intensify as global and regional brands enhance distribution networks and diversify product portfolios.