Market Overview

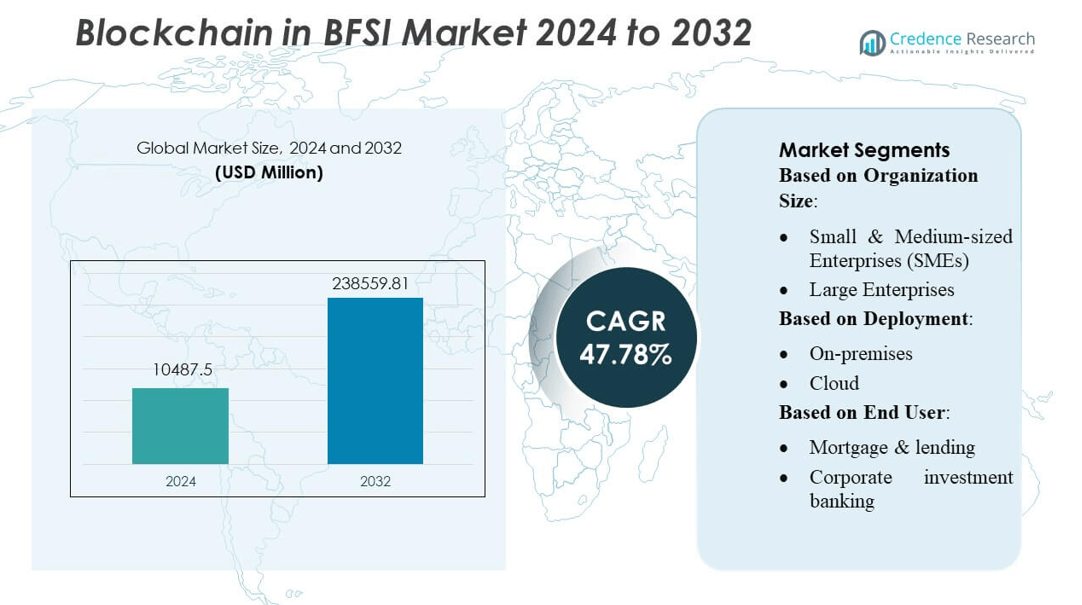

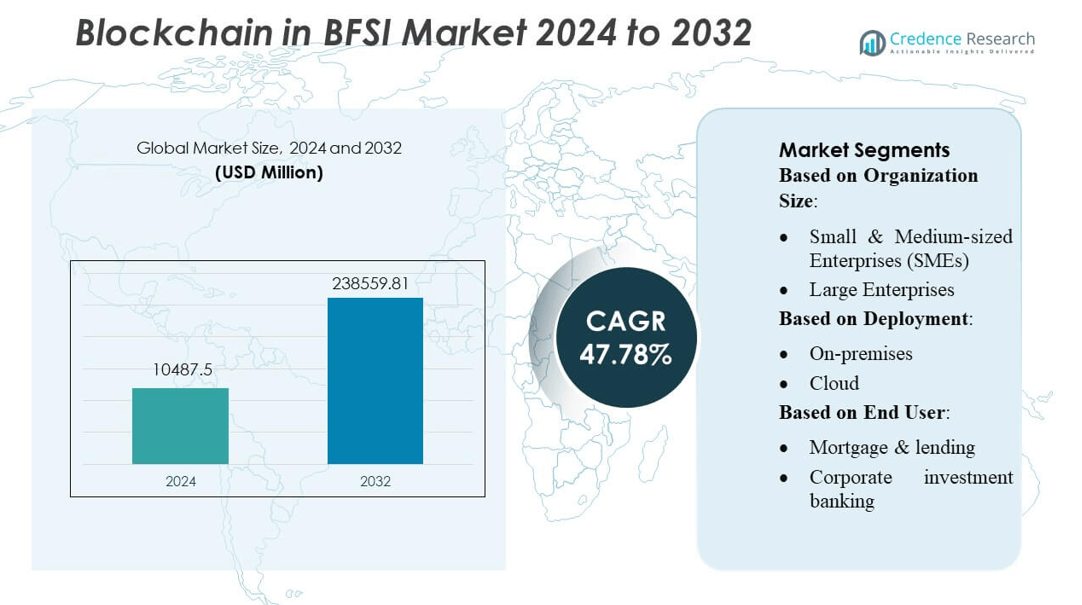

Blockchain in BFSI Market size was valued USD 10487.5 million in 2024 and is anticipated to reach USD 238559.81 million by 2032, at a CAGR of 47.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blockchain in BFSI Market Size 2024 |

USD 10487.5 million |

| Blockchain in BFSI Market, CAGR |

47.78% |

| Blockchain in BFSI Market Size 2032 |

USD 238559.81 million |

The Blockchain in BFSI market is shaped by strong participation from major global technology providers and large financial institutions that continue to expand enterprise-grade blockchain capabilities across payments, lending, compliance, and trade finance. These players focus on scalable distributed ledger platforms, advanced security frameworks, and interoperable network architectures that support high-volume financial operations. Strategic partnerships with fintech firms and broader adoption of cloud-enabled blockchain services further strengthen competitive positioning. North America leads the market with approximately 38–40% share, driven by early regulatory support, rapid digital transformation among banks, and sustained investment in blockchain-based financial infrastructure.

Market Insights

- The Blockchain in BFSI Market was valued at USD 10,487.5 million in 2024 and is projected to reach USD 238,559.81 million by 2032, expanding at a CAGR of 47.78%, driven by rapid digitalization and growing demand for secure, transparent financial systems.

- Market growth is strongly supported by rising adoption of blockchain for payments, lending, compliance automation, and trade finance, with increasing deployment across both cloud and on-premises environments.

- Key trends include expanding enterprise-grade blockchain platforms, growing smart contract integration, and intensified collaboration between banks, fintechs, and cloud providers.

- Competitive intensity increases as technology vendors and financial institutions enhance security, scalability, and interoperability; however, regulatory uncertainty and high integration costs remain major restraints.

- Regionally, North America leads with 38–40% share, while Asia-Pacific emerges as the fastest-growing region; segment-wise, large enterprises dominate with over 60% share, supported by higher investment capacity and advanced digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Organization Size

Large enterprises dominate the blockchain in BFSI market, accounting for an estimated 62–65% share, driven by their higher technology budgets and strong focus on advanced security architectures. These institutions adopt blockchain to enhance fraud mitigation, accelerate KYC/AML verification, and streamline cross-border settlements. Their existing digital transformation frameworks support large-scale blockchain integration across multi-node networks. SMEs exhibit rising adoption due to cost-efficient blockchain-as-a-service (BaaS) models; however, limited in-house expertise and infrastructure constraints keep their contribution lower compared to large banking groups.

- For instance, Ping An Insurance leverages its blockchain network with over 44,000 nodes, and has achieved throughput of 50,000 transactions per second, enabling secure, high-volume operations across its multi-node financial and trade-finance ecosystem.

By Deployment

Cloud deployment leads the segment with an estimated 58–60% market share, supported by scalable infrastructure, faster implementation cycles, and lower upfront capital requirements. BFSI institutions increasingly adopt cloud-based blockchain platforms to enable real-time data sharing, API-driven integrations, and flexible regulatory compliance updates. Cloud vendors also offer robust encryption and identity management tools, which accelerate adoption among regional banks and fintechs. On-premises deployment remains preferred for highly sensitive workflows in major banks, but high maintenance costs and longer deployment timelines limit its broader market share.

- For instance, Axoni’s Veris network, powered by its AxCore ledger, synchronizes millions of equity swap trades, and in production supports real-time reconciliation across 15 major financial institutions, dramatically reducing mismatch risk.

By End User

Banking represents the dominant end-user segment, holding approximately 55–57% market share, fueled by high-volume use cases such as real-time payments, digital identity management, and trade finance automation. Banks leverage blockchain to reduce settlement delays, prevent operational fraud, and improve auditability across distributed systems. Mortgage and lending institutions adopt blockchain for smart contract–based loan processing, while corporate investment banks explore decentralized clearing and tokenized assets. Credit unions and community banks show steady adoption due to consortium-based solutions, but their market share remains smaller compared to large commercial banks.

Key Growth Drivers

Rising Demand for Secure and Transparent Financial Transactions

The BFSI sector increasingly adopts blockchain to strengthen transactional security, minimize fraud, and ensure tamper-proof data sharing across distributed participants. Financial institutions leverage decentralized ledgers to eliminate reconciliation delays and improve auditability in high-volume processes such as clearing, settlements, and payments. Growing cyber threats and stringent regulatory expectations accelerate the shift toward permissioned blockchain frameworks. The need for trusted, real-time verification drives banks, insurers, and fintechs to embed blockchain into identity management, KYC/AML workflows, and cross-border transactions, positioning security enhancement as a core industry growth catalyst.

- For instance, Santander issued a 20 million bond directly on the Ethereum blockchain, tokenizing both the principal and quarterly coupon payments in smart contracts, enabling fully on-chain delivery-versus-payment and reducing intermediaries.

Expansion of Digital Payments and Cross-Border Remittances

Rapid growth in digital payments and global remittance flows increases demand for blockchain-enabled payment rails offering faster settlement and lower transaction costs. Financial institutions adopt distributed ledger technology to bypass multi-layer intermediaries, reducing settlement cycles from days to minutes. Blockchain also supports automated compliance checks and reduces operational overhead in foreign exchange and correspondent banking networks. As digital wallets and real-time payment infrastructure scale worldwide, blockchain platforms enable frictionless interoperability and transparency, reinforcing their appeal for both domestic and international transaction ecosystems.

- For instance, Digital Asset deployed its Daml Canton privacy-enabled ledger in the U.S. Treasury Collateral Network Pilot. This pilot involved operating 14 Canton nodes and connecting four different types of cross-application transaction workflows across 15 market participants.

Rising Integration of Smart Contracts in Lending and Trade Finance

Smart contract adoption accelerates blockchain deployment in lending, supply chain finance, and trade finance operations. Automated, self-executing contracts reduce manual intervention, lower processing errors, and shorten loan approval timelines. In trade finance, smart contracts streamline documentation, digitize letters of credit, and enhance cargo visibility across port authorities and logistics partners. Financial institutions benefit from reduced operational complexity and improved trust among counterparties. The ability of smart contracts to automate multi-party agreements positions blockchain as a critical enabler of efficiency in complex BFSI workflows.

Key Trends & Opportunities

Growth of Blockchain-as-a-Service (BaaS) and Consortium-Based Platforms

The increasing availability of BaaS offerings from cloud providers and fintech vendors creates new adoption opportunities for banks and credit unions with limited internal resources. These platforms offer pre-configured networks, identity modules, and compliance tools, reducing setup costs and accelerating pilot-to-production timelines. Industry consortiums, particularly in payments, trade finance, and insurance, enable shared infrastructure across competing institutions, allowing cost pooling and interoperability. As regulatory sandboxes support collaborative blockchain experimentation, BaaS and consortium models emerge as major scalability and commercialization trends.

- For instance, Microsoft supports enterprise blockchain workloads through Azure Confidential Ledger, built on the Confidential Consortium Framework (CCF), which processes commitments with sub-10-millisecond write latency while operating inside hardware-based trusted execution environments (TEEs) using Intel SGX.

Tokenization of Financial Assets and New Digital Asset Classes

The BFSI industry observes a growing shift toward tokenization of securities, loans, commodities, and alternative assets. Blockchain enables fractional ownership, improved liquidity, and automated lifecycle management of tokenized instruments. Banks and investment firms explore digital asset custodial services, programmable securities, and blockchain-based secondary markets. Regulatory clarity around digital assets in several economies further accelerates pilot programs for tokenized bonds and real-world asset (RWA) platforms. This trend creates new revenue streams and reshapes capital markets through more inclusive and efficient investment workflows.

- For instance, Tata Consultancy Services (TCS) has advanced tokenized asset infrastructure through its Quartz Smart Solutions, which processed over 120 million corporate action messages in live deployments and supports end-to-end token issuance, fractionalization, and smart-contract–based lifecycle automation.

Integration of Blockchain with AI and Cloud for Enhanced Automation

Financial institutions increasingly integrate blockchain with AI-driven analytics and cloud-native architectures to enhance risk scoring, identity verification, and compliance monitoring. AI models leverage distributed datasets for anomaly detection and behavioral fraud analysis, while cloud platforms provide elastic compute capabilities for complex multi-node networks. This convergence enables real-time decision-making in credit underwriting, insurance claims, and payments screening. The combined use of AI, blockchain, and cloud technologies enhances scalability and supports development of intelligent, autonomous financial workflows.

Key Challenges

Regulatory Uncertainty and Compliance Complexity

Despite rising adoption, blockchain in BFSI faces fragmented regulatory frameworks across jurisdictions, slowing enterprise-scale deployments. Variations in data privacy rules, digital asset classifications, and cross-border data transfer requirements pose significant compliance challenges. Financial institutions must ensure traceability and auditability without compromising the decentralization benefits of blockchain networks. The absence of unified standards for interoperability, governance, and validation mechanisms creates adoption hesitancy. Ongoing regulatory evolution requires institutions to allocate additional resources for legal assessment, risk management, and regulatory alignment.

Integration Barriers and High Implementation Costs

Legacy infrastructure in banks and insurance companies often lacks compatibility with modern blockchain frameworks, resulting in complex and costly integration efforts. Establishing secure nodes, validating network protocols, and building interoperable APIs require significant technical expertise. Many institutions face challenges in scaling pilot projects to enterprise-wide solutions due to performance limitations, latency issues, and insufficient developer skillsets. Upfront investments in infrastructure, security audits, and training restrain adoption, particularly among smaller institutions with limited technology budgets. These integration hurdles remain a major challenge for widespread blockchain deployment.

Regional Analysis

North America

North America leads the Blockchain in BFSI market with an estimated 38–40% share, supported by strong adoption across major banks, insurance providers, and fintech platforms. The U.S. drives growth through extensive implementation in cross-border payments, digital identity management, and fraud analytics. Financial institutions actively integrate blockchain with AI and cloud ecosystems to enhance operational transparency and regulatory compliance. Robust venture capital funding, an established fintech ecosystem, and early regulatory guidance further accelerate enterprise-grade adoption. Canada contributes to market expansion through consortium-based initiatives and pilot programs in trade finance and digital asset infrastructure.

Europe

Europe holds an estimated 26–28% market share, driven by increasing blockchain deployment across retail banking, trade finance, and open banking frameworks. The region benefits from strong regulatory support, including the Markets in Crypto-Assets (MiCA) framework, which encourages compliant digital asset and distributed ledger innovations. Financial institutions in the U.K., Germany, and Switzerland lead implementation of tokenized securities, cross-border settlements, and KYC/AML automation. Collaborative consortiums and EU-funded blockchain initiatives enhance interoperability across institutions. Growing demand for real-time payments, transparent lending processes, and secure data-sharing solutions sustains the region’s steady market growth.

Asia-Pacific

Asia-Pacific records rapid expansion and captures approximately 23–25% market share, driven by large-scale digital transformation programs in China, India, Singapore, and Japan. Regional banks deploy blockchain to streamline remittances, trade finance, and digital onboarding, particularly across high-volume cross-border corridors. Governments support adoption through blockchain-ready regulatory sandboxes and national digital identity frameworks. The region’s strong fintech ecosystem accelerates innovations in decentralized payments and tokenized financial assets. Growing smartphone penetration and digital banking adoption further boost market expansion, positioning Asia-Pacific as the fastest-growing region in blockchain-enabled BFSI applications.

Latin America

Latin America accounts for roughly 6–7% of the market, driven by rising demand for secure digital payment infrastructure and transparent financial processes. Banks and fintechs adopt blockchain to reduce reliance on intermediaries in remittances, which remain a major revenue flow across Brazil, Mexico, and Colombia. Regulatory agencies increasingly support pilot programs focused on identity verification and anti-fraud solutions. Economic volatility and high levels of financial exclusion encourage deployment of blockchain-based credit scoring and micro-lending platforms. Growing collaboration between traditional banks and fintech innovators continues to strengthen the regional adoption landscape.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–5% market share, supported by increasing government-led digital transformation initiatives and banking modernization programs. Financial institutions in the UAE and Saudi Arabia deploy blockchain for cross-border settlements, trade finance, and digital identity authentication. Regional central banks explore blockchain for interbank payments and real-time regulatory reporting. In Africa, adoption grows through fintech-driven solutions for remittances, microfinance, and secure digital wallets. While overall penetration remains lower than other regions, accelerating investment and supportive policy frameworks are expected to strengthen long-term blockchain integration.

Market Segmentations:

By Organization Size:

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

By Deployment:

By End User:

- Mortgage & lending

- Corporate investment banking

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Blockchain in BFSI market features a diverse mix of global technology leaders and financial innovators, including Ping An Insurance (Group) Company of China, Ltd., Axoni (SCHVEY, INC.), Accenture plc, Santander Bank, N.A., Digital Asset Holdings, LLC, Microsoft Corporation, Tata Consultancy Services (TCS), Unicsoft, Cognizant Technology Solutions Corp., and International Business Machines Corporation (IBM). the Blockchain in BFSI market continues to evolve rapidly as technology providers, financial institutions, and fintech platforms accelerate investments in decentralized solutions to enhance transparency, security, and operational efficiency. Vendors increasingly differentiate themselves through advancements in smart contract automation, scalable distributed ledger architectures, and cloud-integrated blockchain frameworks that support high-volume financial operations. Partnerships and consortium-based networks play a crucial role in expanding interoperability across payments, trade finance, lending, and identity verification ecosystems. Market competition intensifies as organizations focus on regulatory compliance readiness, data privacy, and real-time transaction processing. Additionally, the rising adoption of digital assets and tokenization solutions drives further innovation, prompting service providers to deliver more robust, enterprise-grade blockchain platforms tailored to the complex needs of BFSI stakeholders.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, German private bank Metzler partnered with Swiss AI startup Unique to integrate AI tools for improving productivity and modernizing internal processes. The partnership focuses on streamlining workflows by using AI to automate tasks like CRM entries, summarizing meetings, and gathering information, which allows relationship managers to spend more time with clients.

- In May 2024, Infosys, Tata Consulting Services, Tech Mahindra, and Wipro, all the IT companies, are winning the digital transformation deals in banking, financial services, and Insurance) industry. The organizations see the potential opportunities in core banking,

- In March 2024, Mahindra & Mahindra Financial Services Limited (MMFSL), part of the Mahindra Group, collaborated with the Manipal Academy of BFSI to launch the “Prarambh” program, a specialized business training initiative aimed exclusively at women candidates.

- In March 2024, Reserve Bank of India introduced the omnibus framework for identifying self-regulatory organizations (SROs) for its authorized entities like NBFCs, banks, and housing financing companies

Report Coverage

The research report offers an in-depth analysis based on Organization Size, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience accelerated adoption as banks expand blockchain use in payments, settlements, and compliance workflows.

- Financial institutions will increasingly integrate blockchain with AI and cloud platforms to enhance automation and risk management.

- Tokenization of assets will grow rapidly, enabling more efficient trading, custody, and fractional ownership models.

- Cross-border remittance networks will shift toward blockchain rails to reduce settlement time and eliminate intermediary costs.

- Smart contract deployment will streamline lending, insurance claims, and trade finance operations.

- Consortium-based blockchain networks will gain traction as institutions prioritize interoperability and shared infrastructure.

- Regulatory clarity will improve, encouraging wider enterprise-scale implementation across global BFSI markets.

- Digital identity verification systems will increasingly use blockchain to strengthen fraud prevention and KYC/AML compliance.

- Blockchain-as-a-service offerings will expand, enabling smaller institutions to adopt decentralized solutions more easily.

- Continuous cybersecurity advancements will position blockchain as a core technology for secure financial data exchange.