Market Overview:

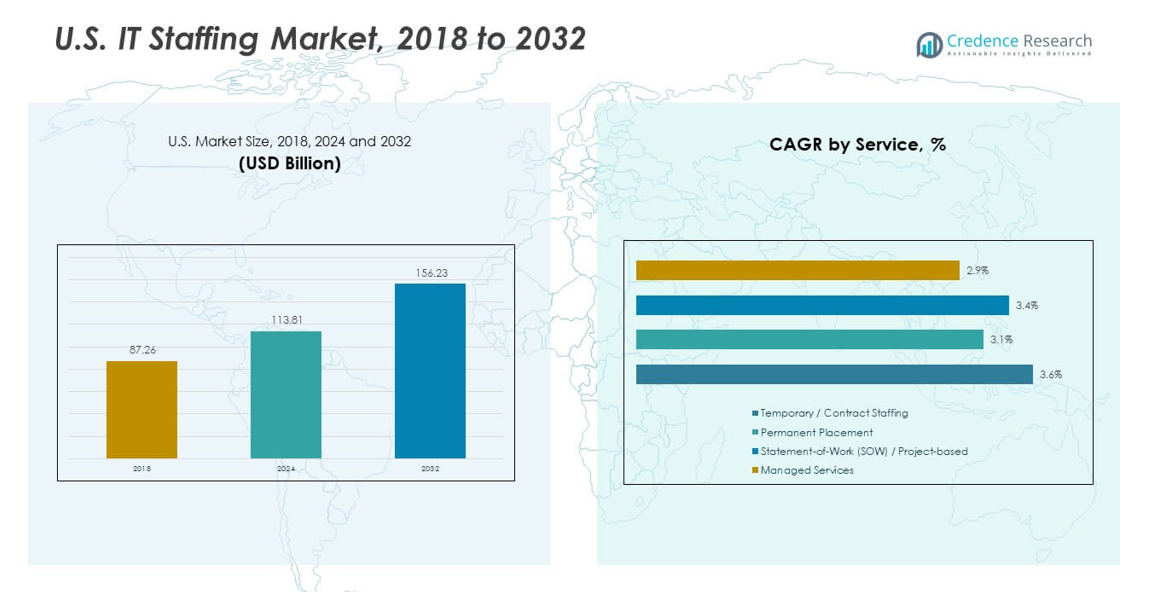

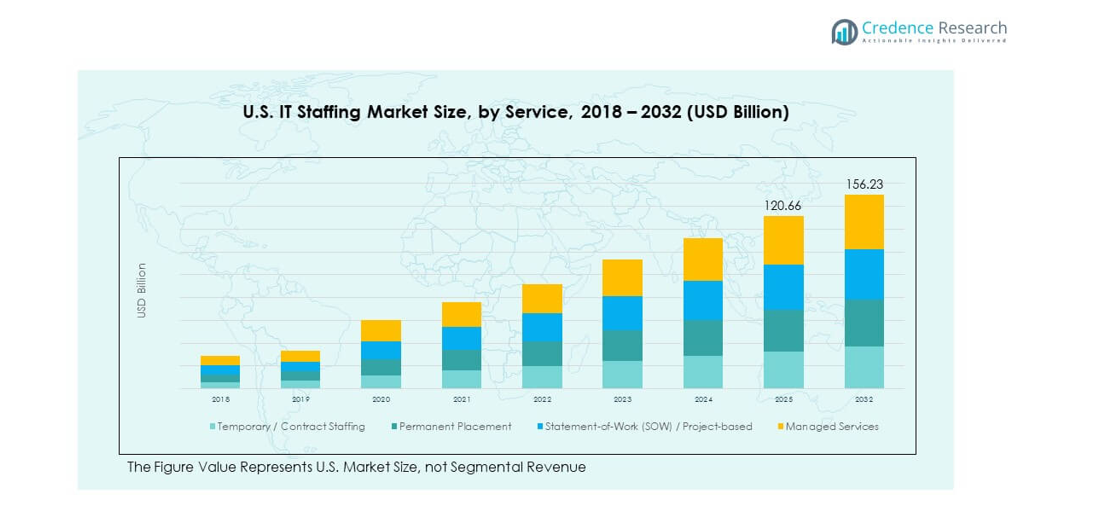

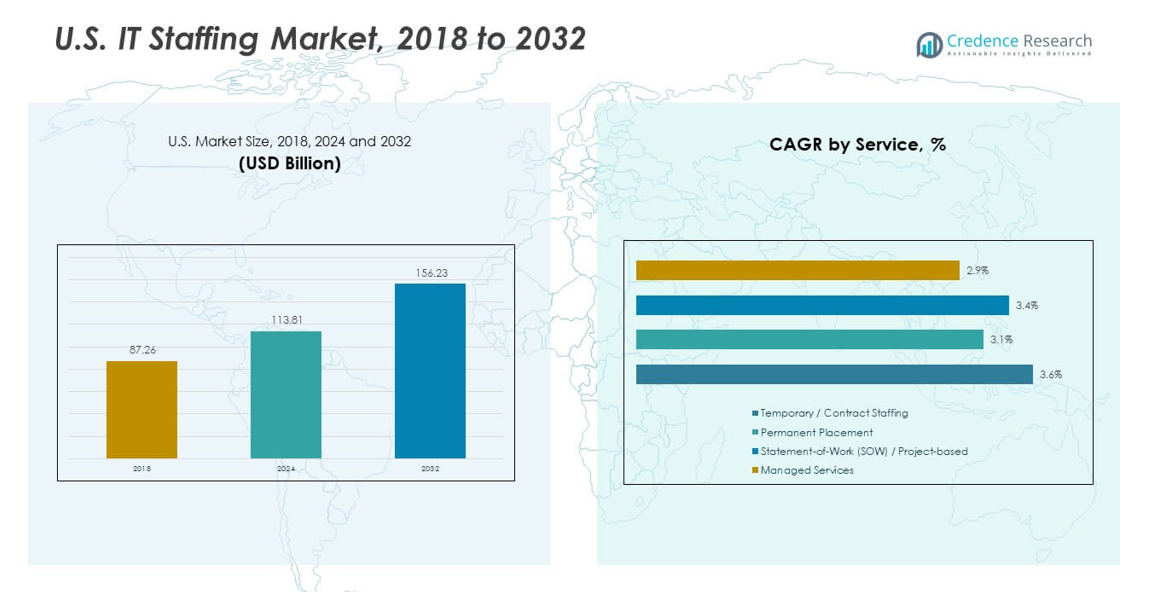

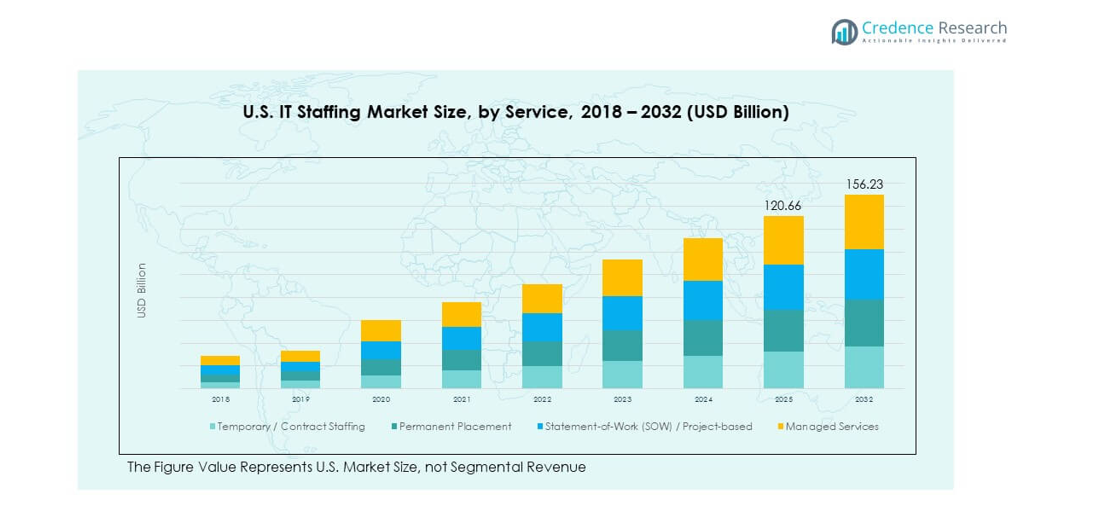

The U.S. IT Staffing Market size was valued at USD 87.26 billion in 2018, grew to USD 113.81 billion in 2024, and is anticipated to reach USD 156.23 billion by 2032, at a CAGR of 3.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. IT Staffing Market Size 2024 |

USD 113.81 billion |

| U.S. IT Staffing Market, CAGR |

3.76% |

| U.S. IT Staffing Market Size 2032 |

USD 156.23 billion |

Strong drivers shape growth for the U.S. IT Staffing Market. Companies increase hiring to support cloud shifts, cybersecurity programs, and fast software rollout cycles. Many employers rely on staffing partners to fill shortages in AI engineering, data analytics, DevOps, and full-stack development. Hybrid work expands access to nationwide talent pools and improves placement speed. Demand rises across healthcare, banking, and retail due to steady tech upgrades. Faster project execution strengthens the need for flexible staffing formats. Agencies gain relevance through niche recruitment capabilities.

Regional dynamics show concentrated demand across major U.S. hubs for the U.S. IT Staffing Market. States with strong enterprise footprints lead due to mature digital ecosystems and deep tech labor supply. Emerging regions grow faster as remote hiring removes geographic limits and supports distributed teams. Secondary cities gain appeal with lower costs and rising start-up activity. Coastal hubs maintain leadership due to innovation clusters and advanced technology adoption. Expanding regional tech programs continue to shape hiring landscapes nationwide.

Market Insights:

- The U.S. IT Staffing Market was valued at USD 87.26 billion in 2018, reached USD 113.81 billion in 2024, and is projected to hit USD 156.23 billion by 2032, reflecting a steady CAGR of 3.76% driven by ongoing digital transformation and rising enterprise technology adoption.

- The Northeast holds 32%, the South holds 28%, and the Midwest holds 24%, dominating the market due to dense enterprise clusters, strong BFSI and healthcare demand, and rapid digital upgrades across telecom, retail, and manufacturing ecosystems.

- The West region holds 16% and stands out as the fastest-growing zone, supported by deep technology ecosystems, cloud-native companies, and strong demand for AI, cybersecurity, and DevOps specialists across innovation-driven industries.

- Temporary/Contract Staffing leads the service mix with an estimated 38–40% share, supported by high demand for flexible project execution and rapid deployment talent.

- Managed Services accounts for roughly 22–24% share, driven by enterprises that outsource complex digital operations and seek bundled support for cloud, automation, and cybersecurity functions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Advanced Digital Systems

The U.S. IT Staffing Market gains strong momentum from rapid digital upgrades across enterprises. Firms expand cloud workloads to support secure and flexible operations. Leaders invest in automation programs that streamline core functions. Recruiters face higher demand for roles linked to AI, DevOps, and data engineering. Many companies prefer contract hiring to manage project speed. Hybrid work models widen the search pool for national talent. It strengthens staffing workflows in sectors that rely on digital growth.

- For instance, Capital One migrated fully from on-premise data centers to the cloud, retiring 8 data centers and enabling its technology team of over 11,000 employees to build cloud-based applications.

Growing Demand for Cybersecurity and Risk Management Talent

Cyber threats drive urgent hiring cycles for critical security skills across large enterprises. Many firms enhance their defense posture to meet regulatory rules and internal risk goals. Recruiters source talent for threat analysis, network defense, and incident response. Demand rises for specialists who understand cloud security frameworks. Staff shortages push employers to rely on staffing partners for quick sourcing. Contract formats support teams during peak risk cycles. The U.S. IT Staffing Market benefits from steady need for secure digital operations.

- For instance, the need for cloud-security specialists surged after companies like Capital One moved core operations to cloud platforms, where data encryption and secure access became critical.

Expansion of Industry-Specific Technology Requirements

Sector-focused modernisation drives unique demand patterns across healthcare, retail, and finance. Each sector needs tech workers with domain knowledge and system expertise. Recruiters match firms with talent that supports platform integration and workflow upgrades. Many employers seek workers who understand regulatory frameworks in sensitive industries. Digital payments, EHR platforms, and logistics systems expand hiring cycles. It encourages recruiters to build niche vertical practices. Sector diversity strengthens long-term staffing activity.

Shift Toward Project-Based and Agile Delivery Models

Project delivery cycles grow shorter due to rapid transformation targets. Many firms adopt agile methods that require flexible staffing setups. Recruiters fill temporary and contract roles that support sprint-based tasks. Teams need developers, testers, and architects for short deployment windows. The U.S. IT Staffing Market reflects rising dependence on adaptable workforce structures. Employers value speed in mobilizing teams for tech upgrades. Agile adoption improves placement frequency for staffing partners.

Market Trends:

Rise of Remote and Distributed Workforce Models

Remote work expands talent access for firms seeking high-skill IT roles nationwide. Many employers hire workers outside major tech hubs to reduce cost pressure. Recruiters source talent across multiple states to meet skill targets. Remote onboarding tools support faster placement cycles. Distributed teams gain importance for firms scaling AI and cloud operations. The U.S. IT Staffing Market adapts to broader hiring zones. It supports greater inclusivity across varied talent pools.

- For instance, a Microsoft Research study analyzing remote onboarding during the pandemic surveyed 267 new developers who were onboarded virtually and found they faced challenges regarding social connectedness, communication, and collaboration, but the majority still felt welcomed and moderately connected to their teams.

Increasing Use of Skill-Based Assessments and Digital Screening

Hiring teams rely on structured tests to verify candidate skill strength. Recruiters deploy tools that assess coding ability and system knowledge. Automated screening improves shortlisting accuracy for complex roles. Firms prefer evidence-based evaluation during heavy competition for niche expertise. Digital assessments reduce time spent on manual filtering. It supports better alignment between job needs and candidate strength. The U.S. IT Staffing Market gains transparency in skill evaluation.

- For instance, The Adecco Group partnered with Bullhorn Recruitment Cloud and deployed AI-powered screening tools to improve job matching and reduce time-to-fill. The platform scaled from 1,300 to over 23,000 recruiters globally in recent years.

Growth of AI-Integrated Recruitment Platforms

AI tools improve resume parsing and match accuracy across large databases. Many staffing firms invest in advanced algorithms to cut sourcing time. Predictive tools guide recruiters toward candidates with higher placement success. Automated systems streamline communication between candidates and hiring managers. AI insights support workforce planning for enterprise clients. It raises efficiency across large staffing workflows. The U.S. IT Staffing Market shifts toward data-driven recruitment.

Expansion of Diversity, Equity, and Inclusion Technology

DEI goals guide many corporate hiring strategies across the country. Firms adopt platforms that reduce bias during screening and shortlisting. Recruiters offer inclusive hiring programs to meet client expectations. Technology identifies talent from varied backgrounds and skill groups. Employers strengthen brand value through inclusive workforce initiatives. It pushes staffing agencies to expand training around equitable hiring. The U.S. IT Staffing Market benefits from structured DEI frameworks.

Market Challenges Analysis:

Widening Skill Gaps Across High-Demand Technology Roles

Skill shortages impact hiring cycles across cloud, AI, and cybersecurity functions. Many firms struggle to locate workers with deep technical knowledge. Recruiters face pressure to meet project deadlines during heavy demand. Training timelines create slow placement for complex roles. Employers compete for limited talent across leading cities. Salary pressure rises due to intense competition for niche profiles. It challenges the U.S. IT Staffing Market during peak digital expansion.

Rising Competition From In-House Talent Pipelines and Automation

Some enterprises build internal academy programs that reduce reliance on recruiters. Teams train workers for cloud and automation tasks within controlled setups. Automated screening tools limit agency involvement in early hiring stages. Firms adopt internal referral programs to improve retention. Recruiters must differentiate value through niche expertise and faster sourcing. Pricing pressure increases when clients push for leaner staffing budgets. It limits growth potential across competitive staffing networks.

Market Opportunities:

Expanding Demand for AI, Automation, and Cloud Transformation Talent

AI expansion creates wide opportunities for staffing firms serving tech-centric employers. Many companies accelerate automation programs that require engineers and architects. Cloud migration drives continuous need for certified specialists. Recruiters gain advantage by building deep networks in emerging skill clusters. Firms adopt flexible hiring structures to support fast deployments. It positions the U.S. IT Staffing Market for strong engagement in enterprise projects.

Growing Role of Talent Outsourcing Among Mid-Sized Enterprises

Mid-sized firms turn to staffing partners for full project support. Many businesses lack internal teams that can manage complex tech upgrades. Recruiters offer end-to-end solutions that meet skill and workflow needs. Outsourcing reduces hiring risk for firms with limited HR capacity. Hybrid work widens access to talent across remote regions. It supports higher adoption of structured staffing programs in the U.S. IT Staffing Market.

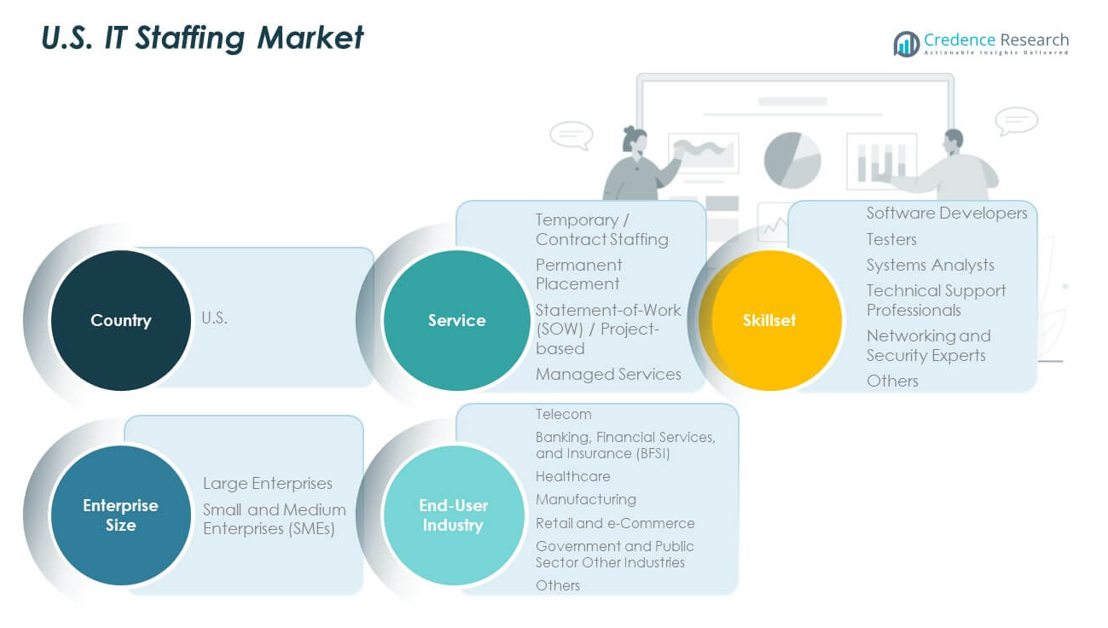

Market Segmentation Analysis:

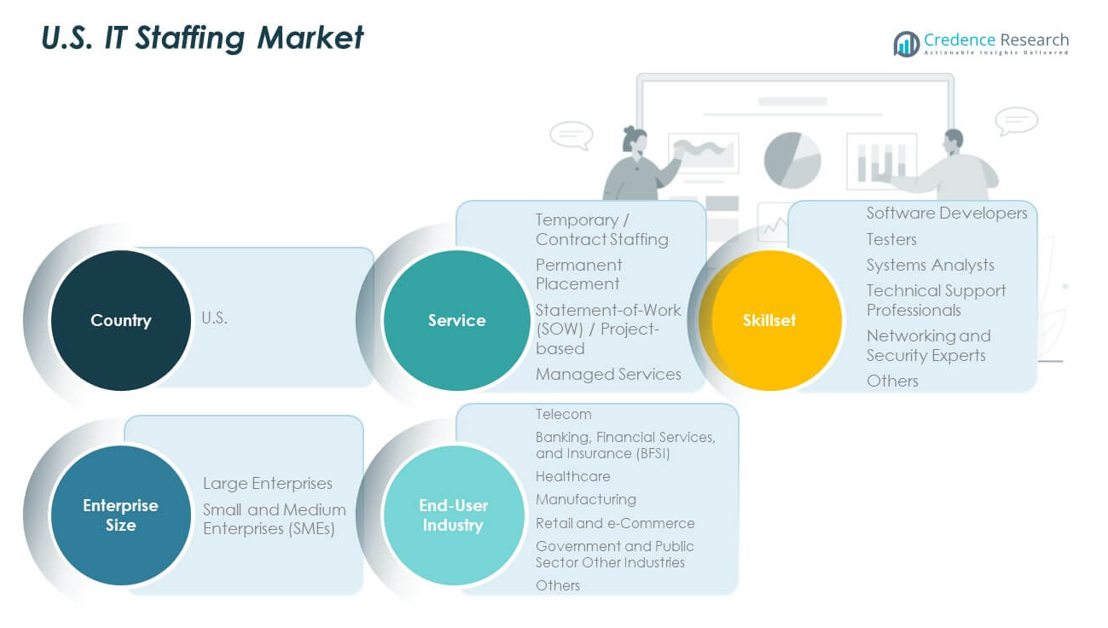

By Service Segment

The U.S. IT Staffing Market expands through strong demand across temporary and contract staffing due to flexible project models and shorter deployment cycles. Permanent placement supports firms that build long-term capability in high-skill roles. SOW and project-based hiring gains traction across enterprises that need defined delivery structures. Managed services attracts firms that seek full operational support for complex workloads. Each service type strengthens workforce readiness for evolving digital needs. It supports steady activity across diverse enterprise functions.

By Skillset Segment

Software developers lead demand due to continuous platform upgrades and new application pipelines. Testers maintain relevance across quality assurance cycles in regulated sectors. Systems analysts support integration work across hybrid architectures. Technical support professionals remain vital for daily service continuity. Networking and security experts gain priority due to rising cyber risks. Other niche roles emerge across AI, cloud, and DevOps functions. It reflects broad skill diversity across enterprise technology goals.

- For instance, Capital One migrated all on-premises data-center applications to cloud platforms, enabling its 11,000-member technology team to collaborate on 2,000 cloud-native applications—this migration demanded large developer and DevOps intake.

By Enterprise Size

Large enterprises drive strong hiring due to multi-layer digital programs and global system rollouts. SMEs adopt staffing support to manage limited in-house resources. Demand grows for contract formats that reduce hiring friction. Staffing partners help SMEs navigate talent shortages in emerging technologies. It strengthens adoption across both segments.

By End-User Industry

Telecom leads due to network modernization efforts. BFSI strengthens demand for secure platforms and digital transactions. Healthcare expands hiring for system integration and patient-centric platforms. Retail and e-commerce scale digital channels that need continuous tech support. Government programs adopt IT staff for modernization. It reflects broad multi-industry reliance on skilled workers.

Segmentation:

By Service Segment

- Temporary / Contract Staffing

- Permanent Placement

- Statement-of-Work (SOW) / Project-based

- Managed Services

By Skillset Segment

- Software Developers

- Testers

- Systems Analysts

- Technical Support Professionals

- Networking and Security Experts

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User Industry

- Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and e-Commerce

- Government and Public Sector Other Industries

- Others

Country-wise Analysis

- United States (single-country market)

Regional Analysis:

Northeast Region

The U.S. IT Staffing Market records strong activity in the Northeast, which holds an estimated 32% share driven by dense enterprise clusters and steady tech investments. Financial institutions in New York and insurance groups across the region create high demand for cybersecurity and data-focused roles. Healthcare networks expand digital workflows that lift hiring for integration specialists. Boston strengthens regional momentum through its biotech and software innovation hubs. Staffing firms serve clients that require rapid scaling for regulated digital systems. It benefits from deep talent density and strong academic pipelines.

Midwest and South Region

The Midwest secures nearly 24% share supported by manufacturing digitalization and expanding healthcare technology needs. Firms in major cities adopt hybrid work models that widen access to skilled workers. The South leads with an estimated 28% share due to fast growth across telecom, retail, and financial service ecosystems. Tech hubs across Texas and Georgia continue to expand project-based hiring for cloud and automation programs. Enterprises rely on staffing partners to meet rising demand for network security and full-stack development roles. It gains traction across regions that prioritize cost efficiency and digital expansion.

West Region

The West holds roughly 16% share, driven by strong activity in technology-focused states. Silicon Valley accelerates hiring cycles for software developers, AI engineers, and DevOps specialists. Cloud-native companies support sustained demand for specialized contractors who manage large-scale deployments. Entertainment, gaming, and e-commerce industries add depth to regional staffing needs. Remote work policies broaden candidate pools across surrounding states that feed talent into western hubs. The U.S. IT Staffing Market strengthens its presence in the region through continuous innovation demand and evolving digital programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. IT Staffing Market shows strong competition driven by firms that scale operations across major industry clusters. Large players expand service depth to support digital transformation programs in healthcare, finance, telecom, and retail. Recruiters strengthen networks around cloud, cybersecurity, and AI roles to meet rising talent shortages. Mid-sized agencies compete through niche expertise and faster placement cycles. Technology-driven platforms improve sourcing efficiency and screening accuracy. Pricing pressure pushes firms to optimize delivery models while protecting service quality. It maintains a dynamic landscape shaped by evolving skill needs and aggressive capability expansion.

Recent Developments:

- In November 2025, ASGN and Salesforce announced a 360-degree partnership to deliver AI solutions across enterprise platforms. This multi-year partnership integrates Salesforce’s Agentforce to drive automation and promote AI-driven advancements within ASGN’s digital engineering and client service sectors. This strategic collaboration underscores Salesforce’s growing influence in facilitating enterprise-level AI adoption, as Agentforce is utilized to revamp essential workflows and expedite value realization for both commercial and governmental clients. The partnership announcement aligns with the broader IT staffing industry’s shift toward AI-driven solutions and intelligent workforce management.

- In November 2025, TEKsystems Global Services was officially named a Snowflake Intelligence Launch Partner. TEKsystems Global Services earned this official launch partner status as a Snowflake Elite Partner by delivering a comprehensive set of initiatives that underscored their commitment to driving innovation and enabling customers to unlock the full potential of Snowflake Intelligence. Snowflake Intelligence is a generative AI-powered business intelligence tool that allows users to get actionable answers from their data by asking questions in plain language. By combining TEKsystems’ deep industry expertise with the secure, scalable foundation of the Snowflake Data Cloud and Snowflake Intelligence, the company will further empower customers to deploy intelligent agents that drive real-time decisions and unlock transformational business value.

- In October 2025, Insight signed a definitive agreement to acquire Sekuro, a global provider of end-to-end security, governance, and cybersecurity services. Insight Enterprises Australia Pty Limited announced this acquisition to significantly expand Insight’s cybersecurity capabilities in the Asia Pacific region (APAC). Sekuro specializes in designing, building, securing, and optimizing public, private, and hybrid cloud platforms to help businesses secure their networks and applications. With businesses in APAC recording a 38% year-on-year rise in data breaches in 2024, this acquisition positions Insight to better meet the growing demand for comprehensive security solutions. The completion of this acquisition was expected in early November 2025.

- In September 2025, the Adecco Group and Microsoft renewed their strategic collaboration through a six-year agreement to drive the future of workforce management and digital transformation. This renewed partnership spans a comprehensive suite of Microsoft technologies, including Azure cloud services, Microsoft 365 enterprise solutions, Microsoft Security and Compliance, and a global rollout of Microsoft Dynamics 365 as the Group’s unified platform for finance and procurement. The renewed agreement reinforces the Adecco Group’s commitment to being at the forefront of digital transformation in the HR industry—not just adapting to the future of work but actively shaping it.

Report Coverage:

The research report offers an in-depth analysis based on service segments, skillset segments, enterprise size, end-user industries, and country-level dynamics. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for cloud-focused talent is expected to rise as enterprises expand digital systems.

- Cybersecurity hiring should strengthen due to increasing threat exposure across major industries.

- AI and automation skillsets will become mainstream drivers of recruitment activity.

- Hybrid work structures may widen access to skilled workers across secondary talent hubs.

- Staffing firms are likely to invest more in AI-driven sourcing and assessment tools.

- Contract staffing could gain traction in sectors with rapid project cycles.

- Managed services may expand as firms outsource complex digital operations.

- Industry-specific hiring will grow across healthcare, BFSI, and telecom ecosystems.

- Upskilling initiatives may improve alignment between job needs and talent supply.

- Market consolidation may increase as large firms acquire niche providers for capability depth.