1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Research Methodology

1.3.1. Phase I – Secondary Research

1.3.2. Phase II – Data Modelling

1.3.2.1. Company Share Analysis Model

1.3.2.2. Revenue Based Modelling

1.3.3. Phase III – Primary Research

1.3.4. Research Limitations

1.3.5. Assumptions

1.4. Market Introduction

1.5. Market Research Scope

2. Executive Summary

2.1. Market Snapshot: Saudi Arabia Data Center Market

2.2. Saudi Arabia Data Center Market, By Type

2.3. Saudi Arabia Data Center Market, By IT Infrastructure

2.4. Saudi Arabia Data Center Market, By End User

2.5. Saudi Arabia Data Center Market, By Region

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Saudi Arabia Data Center Market Value, 2017-2030, (US$ Mn)

3.1.2. Y-o-Y Growth Trend Analysis

3.2. Market Dynamics

3.2.1. Market Drivers

3.2.1.1. Driver 1

3.2.1.2. Driver 2

3.2.1.3. Driver 3

3.2.2. Market Restraints

3.2.2.1. Restraint 1

3.2.2.2. Restraint 2

3.2.3. Market Opportunities

3.2.3.1. Opportunity 1

3.2.3.2. Opportunity 2

3.2.4. Major Industry Challenges

3.2.4.1. Challenge 1

3.2.4.2. Challenge 2

3.3. Growth and Development Patterns

3.4. Investment Feasibility Analysis

3.5. Market Opportunity Analysis

3.5.1. Type

3.5.2. IT Infrastructure

3.5.3. End User

3.5.4. Geography

4. Premium Insights

4.1. STAR (Situation, Task, Action, Results) Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers/Consumers

4.2.3. Bargaining Power of Suppliers

4.2.4. Threat of Substitute Types

4.2.5. Intensity of Competitive Rivalry

4.3. Key Market Trends

4.3.1. Demand Side Trends

4.3.2. Supply Side Trends

4.4. Value Chain Analysis

4.5. Type Analysis

4.6. Analysis and Recommendations

4.7. Marketing Strategy Analysis

4.7.1. Direct Marketing

4.7.2. Indirect Marketing

4.7.3. Marketing Channel Development Trend

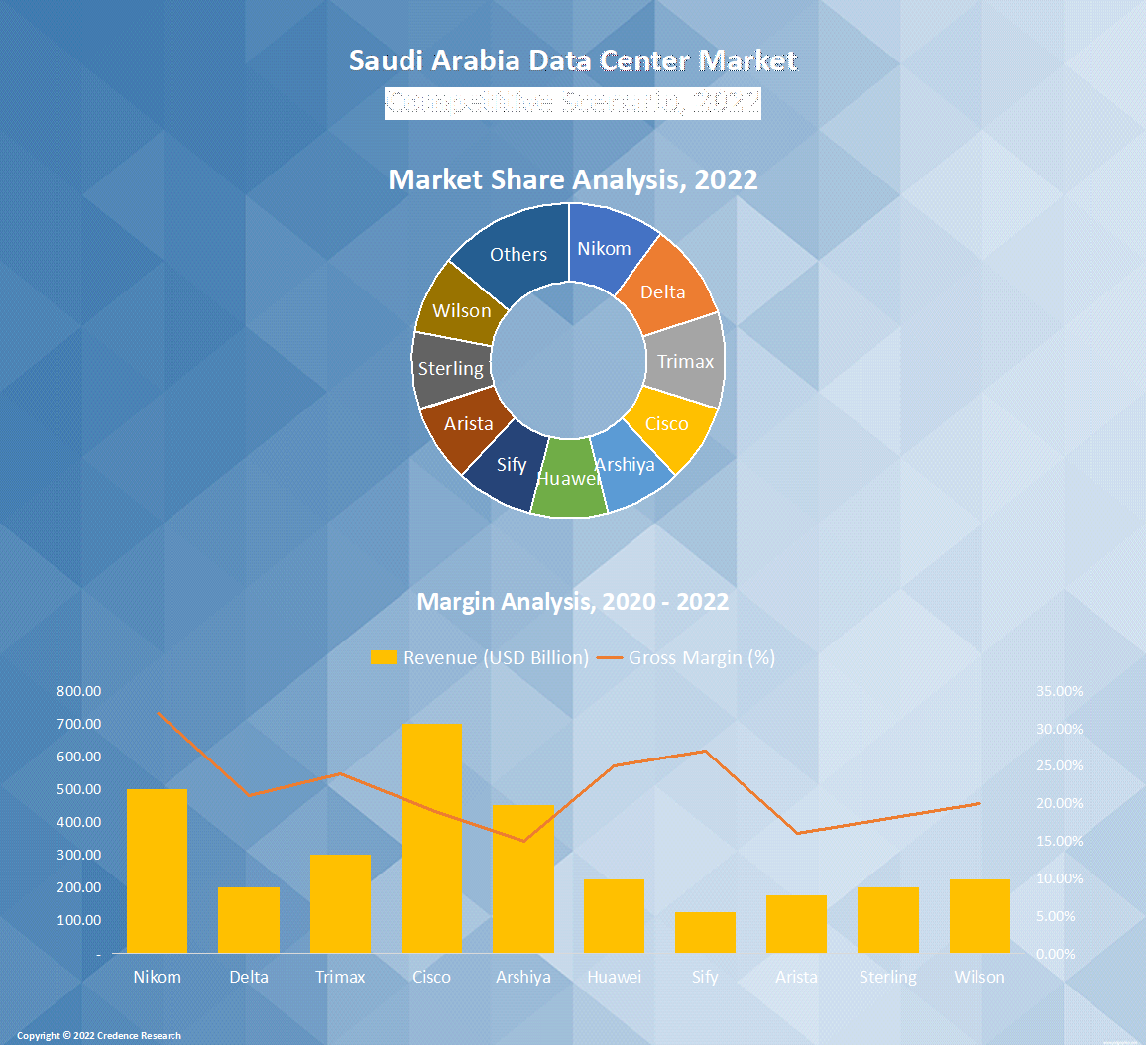

5. Market Positioning of Key Players, 2022

5.1. Company market share of key players, 2022

5.2. Competitive Benchmarking

5.3. Market Positioning of Key Vendors

5.4. Geographical Presence Analysis

5.5. Major Strategies Adopted by Key Players

5.5.1. Key Strategies Analysis

5.5.2. Mergers and Acquisitions

5.5.3. Partnerships

5.5.4. Product Launch

5.5.5. Geographical Expansion

5.5.6. Others

6. Economic Impact Analysis

6.1. Recession Impact

6.1.1. Saudi Arabia

6.2. Ukraine-Russia War Impact

6.2.1. Saudi Arabia

6.3. COVID-19 Impact Analysis

6.3.1. Saudi Arabia

7. Saudi Arabia Data Center Market, By Type

7.1. Saudi Arabia Data Center Market Overview, by Type

7.1.1. Saudi Arabia Data Center Market Revenue Share, By Type, 2022 Vs 2030 (in %)

7.2. Corporate Data Centers

7.2.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

7.3. Web Hosting Data Centers

7.3.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

8. Saudi Arabia Data Center Market, By IT Infrastructure

8.1. Saudi Arabia Data Center Market Overview, by IT Infrastructure

8.1.1. Saudi Arabia Data Center Market, By IT Infrastructure, 2022 vs 2030 (in %)

8.2. Servers

8.2.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

8.3. Storage

8.3.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

8.4. Enterprise Networking

8.4.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

8.5. Others

8.5.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9. Saudi Arabia Data Center Market, by End User, 2017-2030 (US$ Mn)

9.1. Saudi Arabia Data Center Market Overview, by End User

9.1.1. Saudi Arabia Data Center Market, By End User, 2022 vs 2030 (in%)

9.2. BFSI

9.2.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.3. Telecom & IT

9.3.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.4. Media & Entertainment

9.4.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.5. E-Commerce

9.5.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.6. Government

9.6.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.7. Healthcare

9.7.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

9.8. Others

9.8.1. Saudi Arabia Data Center Market, By Region, 2017-2030 (US$ Mn)

10. Saudi Arabia Data Center Market, By Region

10.1. Saudi Arabia Data Center Market Overview, by Region

10.1.1. Saudi Arabia Data Center Market, By Region, 2022 vs 2030 (in%)

10.2. Type

10.2.1. Saudi Arabia Data Center Market, By Type, 2017-2030 (US$ Mn)

10.3. IT Infrastructure

10.3.1. Saudi Arabia Data Center Market, By IT Infrastructure, 2017-2030 (US$ Mn)

10.4. End User

10.4.1. Saudi Arabia Data Center Market, By End User, 2017-2030 (US$ Mn)

11. Saudi Arabia Data Center Market Analysis

11.1. Saudi Arabia Data Center Market, by Type, 2017-2030(US$ Mn)

11.1.1. Overview

11.1.2. SRC Analysis

11.2. Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2030(US$ Mn)

11.2.1. Overview

11.2.2. SRC Analysis

11.3. Saudi Arabia Data Center Market, by End User, 2017-2030(US$ Mn)

11.3.1. Overview

11.3.2. SRC Analysis

12. Company Profiles

12.1. Nikom IT Infrastructure Private Limited

12.1.1. Company Overview

12.1.2. Products/Services Portfolio

12.1.3. Geographical Presence

12.1.4. Financial Summary

12.1.4.1. Market Revenue and Net Profit (2019-2022)

12.1.4.2. Business Segment Revenue Analysis

12.1.4.3. Geographical Revenue Analysis

12.2. Delta Group

12.3. Trimax IT Infrastructure & Services Limited

12.4. Cisco India

12.5. Arshiya Limited

12.6. Huawei

12.7. Sify Technologies

12.8. Arista

12.9. Sterling & Wilson

List of Figures

FIG. 1 Saudi Arabia Data Center Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Saudi Arabia Data Center Market Segmentation

FIG. 4 Saudi Arabia Data Center Market, by Type, 2022 (US$ Mn)

FIG. 5 Saudi Arabia Data Center Market, by IT Infrastructure, 2022 (US$ Mn)

FIG. 6 Saudi Arabia Data Center Market, by End User, 2022 (US$ Mn)

FIG. 7 Saudi Arabia Data Center Market, by Geography, 2022 (US$ Mn)

FIG. 8 Attractive Investment Proposition, by Type, 2022

FIG. 9 Attractive Investment Proposition, by IT Infrastructure, 2022

FIG. 10 Attractive Investment Proposition, by End User, 2022

FIG. 11 Attractive Investment Proposition, by Geography, 2022

FIG. 12 Saudi Arabia Data Center Market Value Contribution, By Type, 2022 & 2030 (Value %)

FIG. 13 Saudi Arabia Data Center Market, by Corporate Data Centers, Value, 2017-2030 (US$ Mn)

FIG. 14 Saudi Arabia Data Center Market, by Web Hosting Data Centers, Value, 2017-2030 (US$ Mn)

FIG. 15 Saudi Arabia Data Center Market Value Contribution, By IT Infrastructure, 2022 & 2030 (Value %)

FIG. 16 Saudi Arabia Data Center Market, by Servers, Value, 2017-2030 (US$ Mn)

FIG. 17 Saudi Arabia Data Center Market, by Storage, 2017-2030 (US$ Mn)

FIG. 18 Saudi Arabia Data Center Market, by Enterprise Networking, Value, 2017-2030 (US$ Mn)

FIG. 19 Saudi Arabia Data Center Market, by Others, 2017-2030 (US$ Mn)

FIG. 20 Saudi Arabia Data Center Market Value Contribution, By End User, 2022 & 2030 (Value %)

FIG. 21 Saudi Arabia Data Center Market, by BFSI, Value, 2017-2030 (US$ Mn)

FIG. 22 Saudi Arabia Data Center Market, by Telecom & IT, 2017-2030 (US$ Mn)

FIG. 23 Saudi Arabia Data Center Market, by Media & Entertainment, Value, 2017-2030 (US$ Mn)

FIG. 24 Saudi Arabia Data Center Market, by E-Commerce& IT, 2017-2030 (US$ Mn)

FIG. 25 Saudi Arabia Data Center Market, by Government, Value, 2017-2030 (US$ Mn)

FIG. 26 Saudi Arabia Data Center Market, by Healthcare& IT, 2017-2030 (US$ Mn)

FIG. 27 Saudi Arabia Data Center Market, by Others, Value, 2017-2030 (US$ Mn)

List of Tables

TABLE 1 Market Snapshot: Saudi Arabia Data Center Market

TABLE 2 Saudi Arabia Data Center Market: Market Drivers Impact Analysis

TABLE 3 Saudi Arabia Data Center Market: Market Restraints Impact Analysis

TABLE 4 Saudi Arabia Data Center Market, by Competitive Benchmarking, 2022

TABLE 5 Saudi Arabia Data Center Market, by Geographical Presence Analysis, 2022

TABLE 6 Saudi Arabia Data Center Market, by Key Strategies Analysis, 2022

TABLE 7 Saudi Arabia Data Center Market, by Corporate Data Centers, By Region, 2017-2022 (US$ Mn)

TABLE 8 Saudi Arabia Data Center Market, by Corporate Data Centers, By Region, 2023-2030 (US$ Mn)

TABLE 9 Saudi Arabia Data Center Market, by Web Hosting Data Centers, By Region, 2017-2022 (US$ Mn)

TABLE 10 Saudi Arabia Data Center Market, by Web Hosting Data Centers, By Region, 2023-2030 (US$ Mn)

TABLE 11 Saudi Arabia Data Center Market, by Servers, By Region, 2017-2022 (US$ Mn)

TABLE 12 Saudi Arabia Data Center Market, by Servers, By Region, 2023-2030 (US$ Mn)

TABLE 13 Saudi Arabia Data Center Market, by Storage, By Region, 2017-2022 (US$ Mn)

TABLE 14 Saudi Arabia Data Center Market, by Storage, By Region, 2023-2030 (US$ Mn)

TABLE 15 Saudi Arabia Data Center Market, by Enterprise Networking, By Region, 2017-2022 (US$ Mn)

TABLE 16 Saudi Arabia Data Center Market, by Enterprise Networking, By Region, 2023-2030 (US$ Mn)

TABLE 17 Saudi Arabia Data Center Market, by Others, By Region, 2017-2022 (US$ Mn)

TABLE 18 Saudi Arabia Data Center Market, by Others, By Region, 2023-2030 (US$ Mn)

TABLE 19 Saudi Arabia Data Center Market, by BFSI, By Region, 2017-2022 (US$ Mn)

TABLE 20 Saudi Arabia Data Center Market, by BFSI, By Region, 2023-2030 (US$ Mn)

TABLE 21 Saudi Arabia Data Center Market, by Telecom & ITs, By Region, 2017-2022 (US$ Mn)

TABLE 22 Saudi Arabia Data Center Market, by Telecom & ITs, By Region, 2023-2030 (US$ Mn)

TABLE 23 Saudi Arabia Data Center Market, by Media & Entertainment, By Region, 2017-2022 (US$ Mn)

TABLE 24 Saudi Arabia Data Center Market, by Media & Entertainment, By Region, 2023-2030 (US$ Mn)

TABLE 25 Saudi Arabia Data Center Market, by E-Commerce, By Region, 2017-2022 (US$ Mn)

TABLE 26 Saudi Arabia Data Center Market, by E-Commerce, By Region, 2023-2030 (US$ Mn)

TABLE 27 Saudi Arabia Data Center Market, by Government, By Region, 2017-2022 (US$ Mn)

TABLE 28 Saudi Arabia Data Center Market, by Government, By Region, 2023-2030 (US$ Mn)

TABLE 29 Saudi Arabia Data Center Market, by Healthcare, By Region, 2017-2022 (US$ Mn)

TABLE 30 Saudi Arabia Data Center Market, by Healthcare, By Region, 2023-2030 (US$ Mn)

TABLE 31 Saudi Arabia Data Center Market, by Others, By Region, 2017-2022 (US$ Mn)

TABLE 32 Saudi Arabia Data Center Market, by Others, By Region, 2023-2030 (US$ Mn)

TABLE 33

TABLE 34 Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 35 Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 36 Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 37 Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 38 Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 39 Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 40 Saudi Arabia Data Center Market, by Region, 2017-2022 (US$ Mn)

TABLE 41 Saudi Arabia Data Center Market, by Region, 2023-2030 (US$ Mn)

TABLE 42 Asia Pacific Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 43 Asia Pacific Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 44 Asia Pacific Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 45 Asia Pacific Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 46 Asia Pacific Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 47 Asia Pacific Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 48 China Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 49 China Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 50 China Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 51 China Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 52 China Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 53 China Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 54 Japan Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 55 Japan Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 56 Japan Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 57 Japan Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 58 Japan Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 59 Japan Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 60 India Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 61 India Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 62 India Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 63 India Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 64 India Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 65 India Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 66 South Korea Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 67 South Korea Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 68 South Korea Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 69 South Korea Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 70 South Korea Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 71 South Korea Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 72 South-East Asia Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 73 South-East Asia Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 74 South-East Asia Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 75 South-East Asia Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 76 South-East Asia Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 77 South-East Asia Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)

TABLE 78 Rest of Asia Pacific Saudi Arabia Data Center Market, by Type, 2017-2022 (US$ Mn)

TABLE 79 Rest of Asia Pacific Saudi Arabia Data Center Market, by Type, 2023-2030 (US$ Mn)

TABLE 80 Rest of Asia Pacific Saudi Arabia Data Center Market, by IT Infrastructure, 2017-2022 (US$ Mn)

TABLE 81 Rest of Asia Pacific Saudi Arabia Data Center Market, by IT Infrastructure, 2023-2030 (US$ Mn)

TABLE 82 Rest of Asia Pacific Saudi Arabia Data Center Market, by End User, 2017-2022 (US$ Mn)

TABLE 83 Rest of Asia Pacific Saudi Arabia Data Center Market, by End User, 2023-2030 (US$ Mn)