Market Overview

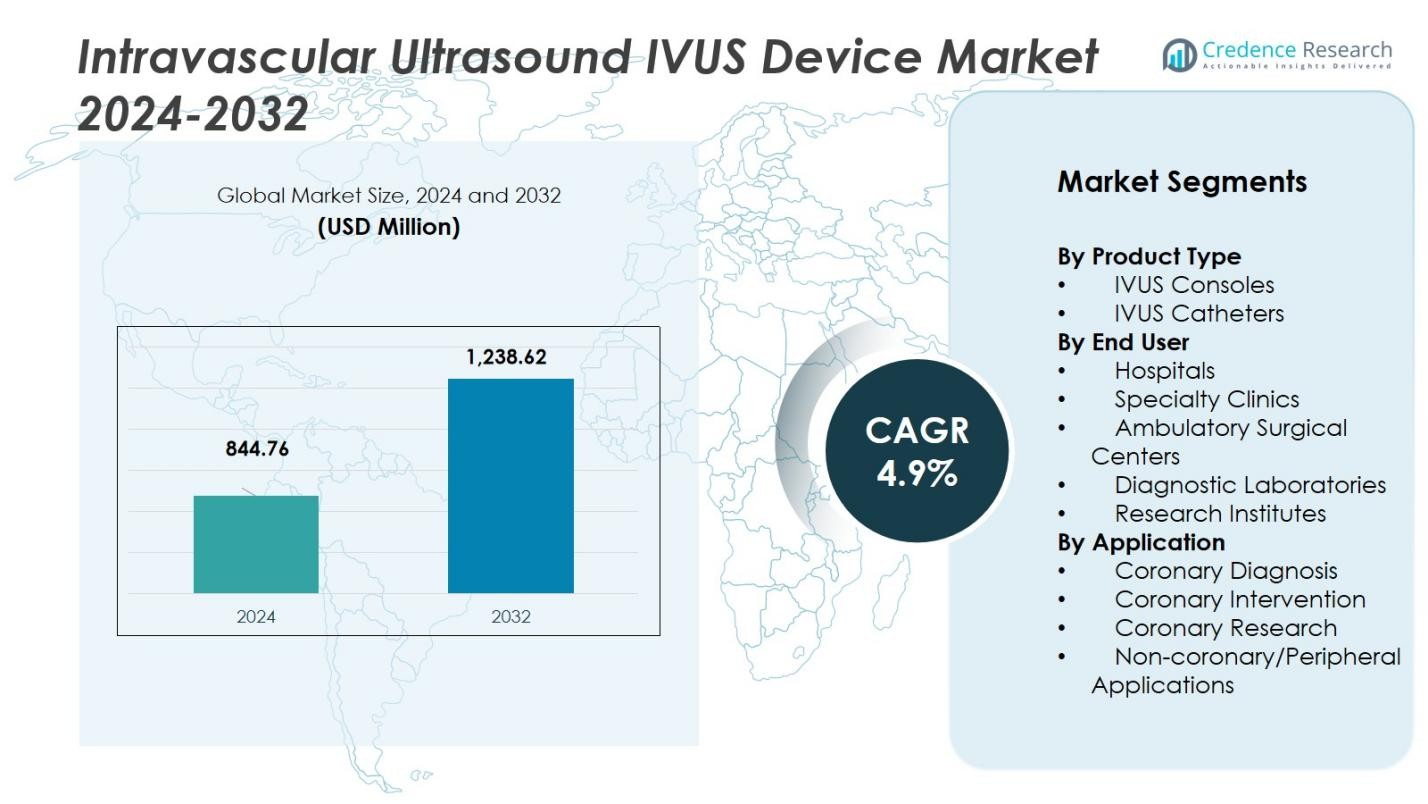

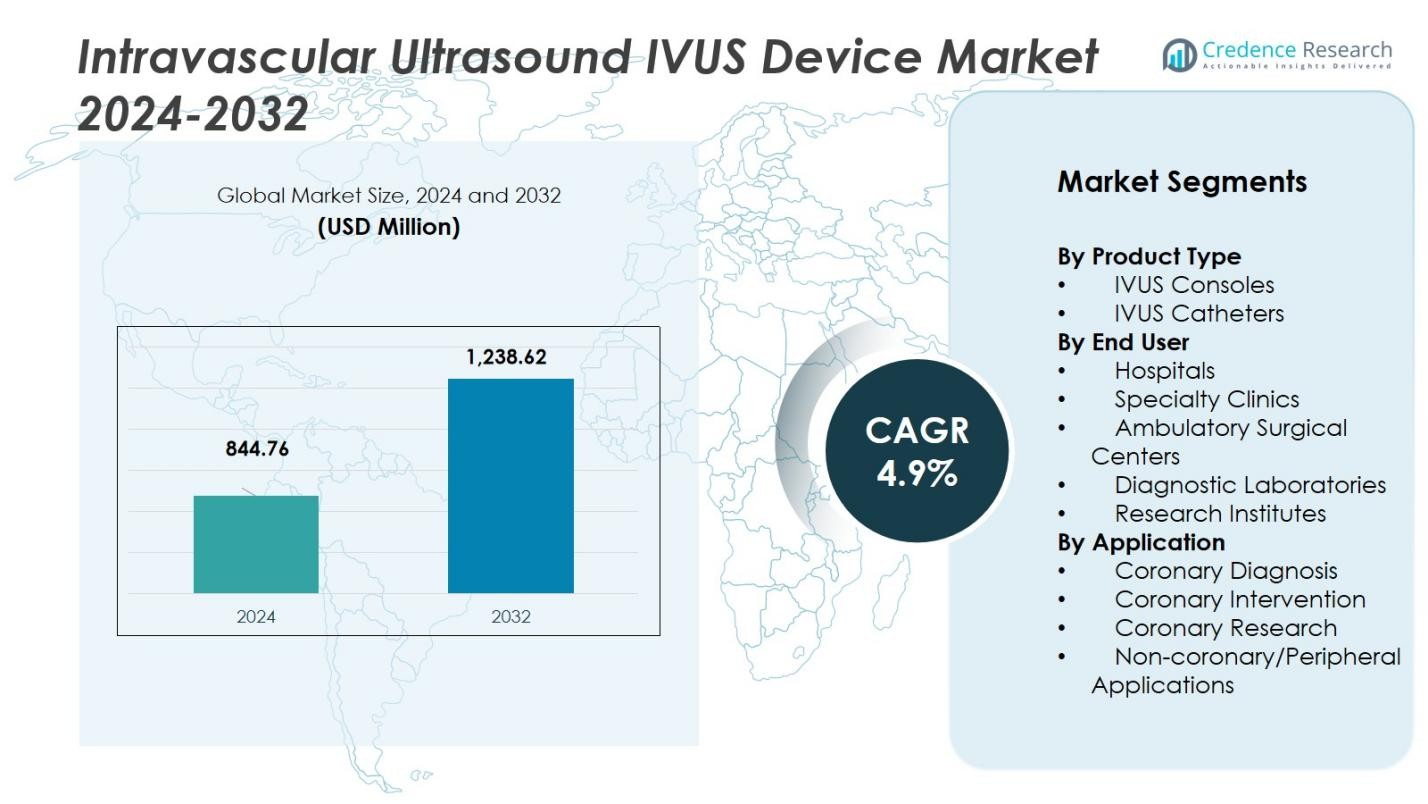

The Intravascular Ultrasound (IVUS) Device Market size was valued at USD 844.76 million in 2024 and is anticipated to reach USD 1,238.62 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravascular Ultrasound (IVUS) Device Market Size 2024 |

USD 844.76 Million |

| Intravascular Ultrasound (IVUS) Device Market , CAGR |

4.9% |

| Intravascular Ultrasound (IVUS) Device Market Size 2032 |

USD 1,238.62 Million |

The Intravascular Ultrasound (IVUS) Device Market is shaped by several prominent players, including Conavi Medical, Medtronic, OptiMed Medical Devices, Siemens Healthineers, GE Healthcare, Avinger Inc., Abbott Laboratories, Terumo Corporation, Infraredx Inc., and Philips Healthcare. These companies drive innovation through advancements in catheter technology, imaging resolution, and AI-enabled diagnostic support. Their strategic focus on expanding clinical applications and strengthening global distribution enhances market penetration. Regionally, North America leads the IVUS device market with 38% share, supported by advanced healthcare infrastructure, high adoption of image-guided cardiovascular procedures, and strong investment in interventional cardiology technologies.

Market Insights

- The Intravascular Ultrasound (IVUS) Device Market was valued at USD 844.76 million in 2024 and is projected to reach USD 1,238.62 million by 2032, growing at a CAGR of 4.9%.

- Market growth is driven by rising cardiovascular disease prevalence, increasing adoption of minimally invasive interventions, and strong demand for IVUS catheters, which hold 62% of the product-type segment.

- Emerging trends include rapid integration of hybrid imaging platforms, AI-enhanced image interpretation, and expanding use of IVUS in peripheral vascular procedures.

- Major players such as Medtronic, Abbott, Philips Healthcare, Terumo, and Siemens Healthineers strengthen their market position through technological innovation and product portfolio expansion.

- Regionally, North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 23%, reflecting differences in healthcare infrastructure, regulatory support, and adoption of advanced interventional imaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

IVUS catheters accounted for the largest share of approximately 62% of the product-type segment in 2024, driven by their high utilization rate in coronary interventions and rapid adoption of advanced imaging catheters that offer superior resolution and ease of integration with modern angiography systems. Their recurring-use nature supports strong revenue growth compared to consoles, which hold a smaller share due to longer replacement cycles. Increasing preference for minimally invasive diagnostics and growing demand for real-time vessel assessment continue to reinforce catheter dominance in the IVUS device market.

- For instance, Philips introduced the IntraSight mobile platform in 2024, which enables seamless integration of its IVUS catheters like the Eagle Eye Platinum for precise coronary assessments, helping hospitals achieve greater workflow efficiency and adoption of advanced imaging.

By End User

Hospitals dominated the end-user segment with an estimated 56% market share, supported by their capacity to perform complex cardiovascular procedures and availability of advanced imaging platforms. Hospitals also lead in adopting IVUS technology for both routine and high-risk interventions due to skilled personnel and reimbursement support. Specialty clinics and ambulatory surgical centers are expanding their share, but hospital-based catheterization labs remain the primary centers for IVUS use. Rising incidence of coronary artery disease and increased integration of IVUS into clinical guidelines further strengthen the segment’s growth trajectory.

- For instance, Volcano Corp.’s s5i IVUS system is installed in major hospital cath labs such as Columbia Presbyterian in New York and Scripps Clinic in La Jolla, demonstrating hospitals’ adoption of customizable IVUS solutions tailored to complex clinical workflows.

By Application

Coronary intervention represented the largest application segment with roughly 58% market share, fueled by its central role in guiding stent placement, optimizing treatment outcomes, and reducing restenosis risks. IVUS is increasingly recommended for percutaneous coronary intervention due to its ability to accurately assess lesion morphology and stent expansion. Coronary diagnosis and research segments are growing steadily, supported by clinical adoption in pre-treatment evaluation and new cardiovascular studies. Non-coronary/peripheral applications are emerging but remain smaller due to slower uptake in peripheral vascular procedures and limited reimbursement in several regions.

Key Growth Drivers

Rising Burden of Cardiovascular Diseases

The growing global prevalence of coronary artery disease and peripheral vascular disorders continues to drive demand for IVUS systems due to their ability to provide precise intravascular imaging and guide complex interventions. As aging populations increase and lifestyle-related risk factors become more common, clinicians are increasingly adopting IVUS to improve diagnostic accuracy and optimize procedural outcomes. This rising disease burden also accelerates hospital investments in advanced imaging technologies, strengthening the adoption of IVUS devices across both developed and emerging healthcare markets.

- For instance, the World Health Organization reported that cardiovascular diseases accounted for an estimated 19.8 million deaths globally in 2022, with ischemic heart disease as a primary cause, underscoring the rising disease burden fueling demand for advanced imaging technologies.

Increasing Adoption of Image-Guided Interventions

Expansion of minimally invasive cardiovascular procedures has fueled the demand for IVUS devices, as they provide real-time visualization of vessel morphology and stent placement. Clinical evidence supporting improved outcomes and reduced restenosis with IVUS-guided interventions is accelerating its integration into routine practice. Growing recommendations in professional guidelines and reimbursement improvements in several regions further boost adoption. As interventional cardiology moves toward precision-based treatment planning, IVUS remains a critical tool to enhance accuracy, safety, and overall clinical efficiency.

- For instance, the MUSIC study demonstrated that IVUS-guided stent implantation achieving complete apposition and symmetric expansion significantly lowered 6-month restenosis rates, highlighting the importance of optimal stent deployment in reducing complications.

Technological Advancements in IVUS Systems

Continuous innovation in catheter design, imaging consoles, and high-resolution transducer technology is significantly contributing to market growth. Modern IVUS systems offer enhanced image clarity, faster processing, and improved compatibility with digital catheterization laboratories, enabling more accurate assessment of plaque characteristics and vessel dimensions. Integration of artificial intelligence and automated quantification tools is also improving workflow efficiency. These advancements not only enhance diagnostic confidence but also attract broader usage among clinicians seeking reliable imaging solutions for increasingly complex cardiovascular interventions.

Key Trends & Opportunities

Growing Integration of IVUS with Hybrid Imaging Platforms

A major market trend is the increasing integration of IVUS with other advanced imaging modalities such as OCT and angiography to support comprehensive intravascular assessment. Hybrid imaging platforms improve procedural outcomes by offering complementary structural and morphological insights. This trend presents significant opportunities for manufacturers to develop multimodal systems with enhanced interoperability. As clinical practices shift toward more precise and data-driven interventions, hybrid IVUS technologies are positioned to gain strong traction across high-volume cardiac centers and specialized vascular care facilities.

- For instance, companies like CONAVI and TERUMO have developed hybrid IVUS-OCT catheter systems that provide synergistic, coregistered images, combining IVUS’s deep tissue penetration with OCT’s high-resolution surface detail, enabling precise evaluation of coronary artery disease.

Expansion in Emerging Markets and Peripheral Applications

Emerging economies present strong opportunities for IVUS expansion due to rising investments in healthcare infrastructure and growing awareness of cardiovascular imaging benefits. As catheterization labs increase in number and training programs expand, adoption of IVUS is expected to accelerate. Additionally, peripheral vascular interventions are gaining attention as clinicians explore IVUS for non-coronary applications such as peripheral artery disease assessment. Improved reimbursement frameworks and broader clinical evidence supporting IVUS efficacy in these procedures will unlock new avenues for market penetration and long-term growth.

- For instance, in India, government initiatives and private investments have led to the expansion of catheterization labs and cardiology training programs, accelerating IVUS usage in major hospitals like Apollo Hospitals and Fortis Healthcare.

Key Challenges

High Cost of IVUS Systems and Procedures

The substantial cost associated with IVUS consoles, catheters, and procedural use poses a significant barrier to adoption, particularly in cost-sensitive markets. Hospitals face budget limitations, and reimbursement inconsistencies further restrict utilization. Smaller facilities and ambulatory centers often prioritize alternative imaging methods due to affordability constraints. Additionally, ongoing maintenance and training requirements add to the overall expenditure. These financial challenges limit widespread adoption despite strong clinical benefits, especially in regions with underdeveloped healthcare funding structures.

Shortage of Skilled Professionals and Procedural Complexity

Effective use of IVUS requires specialized training and expertise to interpret intravascular images accurately and integrate findings into interventional planning. A shortage of trained interventional cardiologists and imaging technicians limits the technology’s penetration in certain regions. The learning curve associated with IVUS operation and analysis can also deter adoption in high-volume settings that prioritize speed and workflow efficiency. Without adequate training programs and standardization efforts, the market faces continued barriers to broader clinical utilization and procedural integration.

Regional Analysis

North America

North America held the largest share of the IVUS device market in 2024, accounting for 38% due to its advanced healthcare infrastructure, high adoption of image-guided cardiovascular interventions, and strong reimbursement support. The region benefits from widespread availability of catheterization labs and rapid integration of technologically advanced IVUS systems into interventional cardiology practices. Growth is further supported by a high prevalence of coronary artery disease and increasing clinical preference for intravascular imaging to enhance procedural accuracy. Continuous R&D investments and strong presence of leading medical device manufacturers reinforce North America’s dominant market position.

Europe

Europe captured 27% of the market, driven by rising demand for minimally invasive cardiovascular procedures and growing acceptance of IVUS-guided interventions in clinical guidelines. Countries such as Germany, the U.K., and France lead adoption due to well-established healthcare systems and increasing focus on precision-based treatment strategies. The region also benefits from ongoing investments in digital catheterization laboratories and expanding clinical research activities. Efforts to improve reimbursement coverage and growing awareness among cardiologists regarding the diagnostic and procedural value of IVUS continue to support steady market expansion across European healthcare facilities.

Asia-Pacific

The Asia-Pacific region accounted for 23% of the IVUS device market, supported by rapid healthcare modernization, rising cardiovascular disease incidence, and increasing investments in advanced imaging technologies. China, Japan, and India are driving growth due to expanding hospital infrastructures and greater adoption of intravascular imaging in urban cardiac centers. Government initiatives to strengthen cardiovascular care and a growing number of interventional cardiology training programs further enhance market penetration. As catheterization labs continue to increase and patient volumes rise, Asia-Pacific is expected to experience the fastest growth in IVUS utilization over the forecast period.

Latin America

Latin America represented 7% of the market, with growth driven by expanding access to cardiovascular diagnostic services and rising demand for advanced imaging tools in major economies such as Brazil and Mexico. Although adoption remains lower than in developed regions, ongoing improvements in healthcare infrastructure and growing investment in interventional cardiology are supporting IVUS uptake. Increased awareness of the clinical benefits of IVUS in optimizing coronary interventions and gradual improvements in reimbursement policies are contributing to regional market expansion. However, cost constraints and uneven access to specialized facilities continue to limit broader adoption.

Middle East & Africa

The Middle East & Africa region held 5% of the IVUS device market, supported by increasing investments in tertiary healthcare facilities and growing focus on managing rising cardiovascular disease burdens. Wealthier Gulf countries, including Saudi Arabia and the UAE, lead adoption due to ongoing hospital modernization and rising utilization of advanced intravascular imaging technologies. In contrast, many African nations face limited access to specialized cardiovascular centers, slowing widespread uptake. Nonetheless, expanding medical tourism, improving clinical training programs, and rising procurement of modern catheterization technologies are gradually contributing to market growth across the region.

Market Segmentations:

By Product Type

- IVUS Consoles

- IVUS Catheters

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Research Institutes

By Application

- Coronary Diagnosis

- Coronary Intervention

- Coronary Research

- Non-coronary/Peripheral Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Intravascular Ultrasound (IVUS) Device Market features major players such as Conavi Medical, Medtronic, OptiMed Medical Devices, Siemens Healthineers, GE Healthcare, Avinger Inc., Abbott Laboratories, Terumo Corporation, Infraredx Inc., and Philips Healthcare. These companies compete through continuous innovation in catheter design, imaging resolution, artificial intelligence–enabled analytics, and integration with hybrid imaging systems. Market leaders focus on expanding clinical applicability by developing advanced IVUS platforms that enhance diagnostic accuracy and procedural outcomes. Strategic initiatives, including mergers, partnerships with cardiac centers, and geographic expansion, strengthen their global presence. Many players emphasize product portfolio diversification, offering both consoles and high-performance catheters tailored for coronary and peripheral applications. Additionally, growing investments in clinical research and trials support evidence-based adoption, while improved training programs enhance physician proficiency. Competition is further shaped by pricing strategies and efforts to secure favorable reimbursement, positioning top manufacturers to capture emerging opportunities across rapidly developing healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- On March 3 2025, Boston Scientific Corporation announced its agreement to acquire SoniVie Ltd., which developed the TIVUS™ Intravascular Ultrasound System aimed at denervation-based vascular therapy.

- In April 2024, Provisio Medical announced the FDA clearance of its Provisio IVUS System, introducing Sonic Lumen Tomography technology that delivers automated, real-time lumen measurements for vascular specialists.

- In May 2024, SonoVascular entered a strategic partnership with Lantheus Holdings, Inc., integrating microbubble technology with the SonoThrombectomy System to advance treatment options for venous thromboembolism.

- In October 2023, Evident Vascular launched with USD 35 million in funding, aiming to accelerate development of its AI-enhanced IVUS technology for improved intravascular imaging and clinical decision support.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as cardiovascular disease prevalence rises globally.

- Adoption of IVUS-guided interventions will increase as clinical guidelines emphasize precision imaging.

- Technological advancements will enhance image clarity, device miniaturization, and workflow automation.

- AI-enabled analytics will strengthen real-time interpretation and improve clinical decision-making.

- Hybrid systems combining IVUS with OCT and angiography will gain greater clinical acceptance.

- Emerging markets will experience faster growth due to improving healthcare infrastructure.

- Peripheral vascular applications will expand as awareness of non-coronary benefits increases.

- Training programs and digital education tools will boost procedural proficiency among clinicians.

- Reimbursement improvements in several countries will support broader clinical adoption.

- Competitive differentiation will intensify as manufacturers invest in innovation and strategic collaborations.