Market Overview

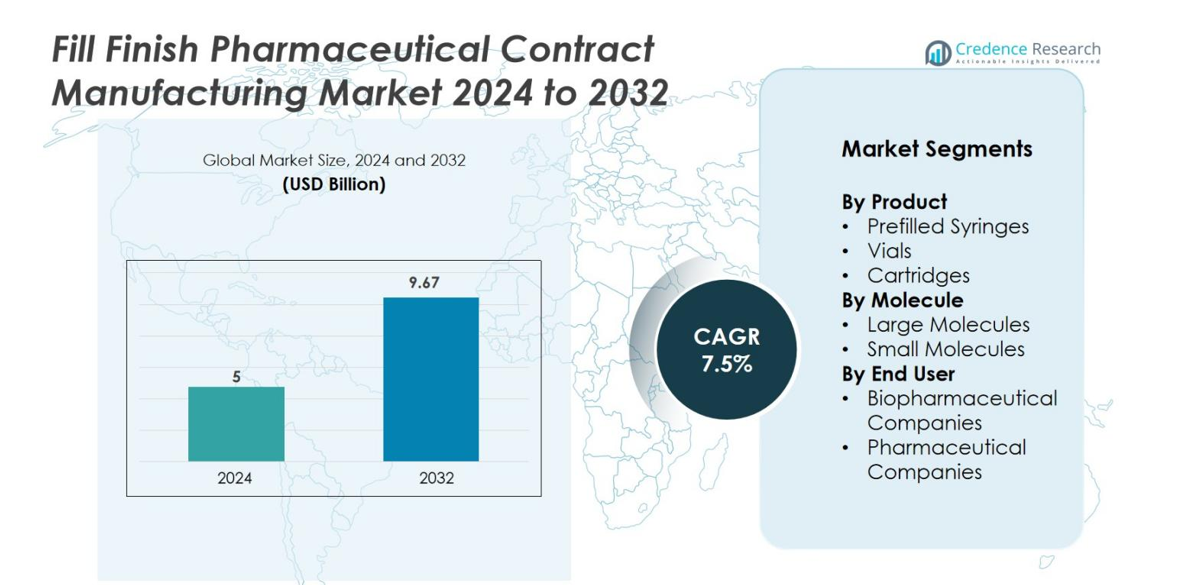

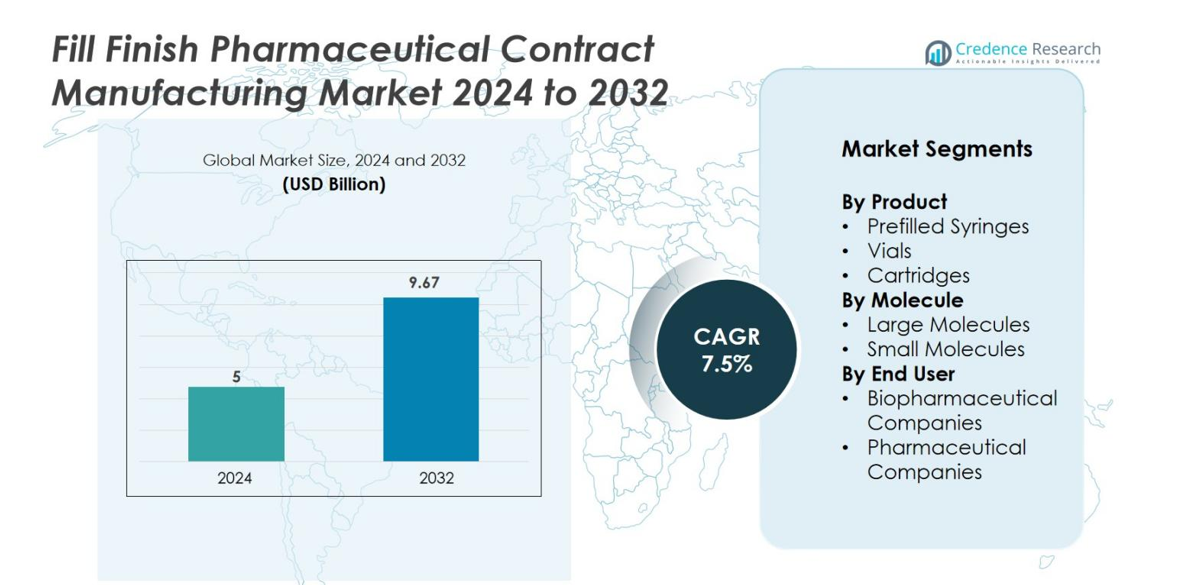

The Fill-Finish Pharmaceutical Contract Manufacturing market size was valued at USD 5 billion in 2024 and is anticipated to reach USD 9.67 billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fill Finish Pharmaceutical Contract Manufacturing Market Size 2024 |

USD 5 billion |

| Fill Finish Pharmaceutical Contract Manufacturing Market, CAGR |

7.5% |

| Fill Finish Pharmaceutical Contract Manufacturing Market Size 2032 |

USD 9.67 billion |

The Fill-Finish Pharmaceutical Contract Manufacturing market is driven by the strong presence of leading global CMOs that offer advanced sterile production capabilities and large-scale capacity. Key players include Thermo Fisher Scientific Inc., Catalent Inc., Baxter, Recipharm AB, Sartorius AG, Eurofins Scientific, Boehringer Ingelheim International GmbH, Symbiosis Pharmaceutical Services, MabPlex International, and Societal CDMO. These companies specialize in high-precision aseptic processing, automated fill-finish systems, and support for both biologics and small-molecule injectables. Regionally, North America leads the market with approximately 38–40% share, driven by its advanced biopharmaceutical ecosystem, followed by Europe with around 30–32% due to its strong regulatory environment and established contract manufacturing infrastructure.

Market Insights

- The fill-finish pharmaceutical contract manufacturing market was valued at USD 5 billion in 2024 and is projected to reach USD 9.67 billion by 2032, expanding at a CAGR of 7.5% during the forecast period.

- Market growth is driven by rising demand for biologics, injectable therapies, and sterile manufacturing outsourcing, as companies seek specialized capabilities, cost efficiency, and faster commercialization support.

- Key trends include increasing adoption of automation, isolator technology, flexible single-use systems, and growing preference for advanced packaging formats such as prefilled syringes and cartridges, with vials holding the largest product share at about 53%.

- Competition intensifies as major players—Thermo Fisher Scientific, Catalent, Recipharm, Baxter, and Eurofins Scientific—expand capacity, enhance aseptic capabilities, and pursue strategic partnerships to strengthen service portfolios.

- Regionally, North America leads with around 38–40% share, followed by Europe at 30–32%, while Asia-Pacific grows rapidly with 22–24%, supported by expanding biologics manufacturing and cost-effective contract services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

In the product segment of the fill-finish pharmaceutical contract manufacturing market, the vials sub-segment holds the dominant position with a share of 53.4% in 2024. This leadership is driven by the versatility and widespread adoption of vials for both large-molecule and small-molecule injectable formulations, particularly in biologics and vaccines. Contract manufacturers continue to expand high-capacity vial fill-finish lines, supported by stringent sterility requirements and growing demand for scalable packaging formats, which collectively reinforce the strong market position of vial-based fill-finish operations.

- For instance, Syntegon Technology GmbH has installed more than 1,500 vial-filling and closing machines globally to support large-scale production of critical injectable therapies.

By Molecule

Under the molecule classification, the large molecules sub-segment dominates with 67% market share in 2024. This prominence reflects the rapid expansion of biologics, monoclonal antibodies and other complex therapies that require advanced fill-finish capabilities. Growth is further supported by rising chronic disease prevalence, an increasing number of biologic approvals, and the shift toward outsourcing to specialized contract manufacturers. These providers offer sophisticated sterile processing, containment and quality assurance systems, enabling efficient production of large-molecule therapeutics and sustaining their dominant share.

- For instance, the CDMO Catalent, Inc. reported delivering over 70 billion doses across its biologics manufacturing and fill/finish services and managing ~1,400 active development programmes globally.

By End-User

Within the end-user category, biopharmaceutical companies represent the leading sub-segment, accounting for 55.3% of market revenue in 2024. Their dominance is driven by the extensive reliance on outsourced fill-finish services for biologics, cell-based therapies and personalized medicines. These companies increasingly partner with contract manufacturers to access flexible capacity, specialized sterile handling and regulatory-compliant environments. The need to accelerate time-to-market and reduce operational costs further strengthens the preference for outsourcing, ensuring that biopharmaceutical companies remain the primary users of fill-finish contract manufacturing services.

Key Growth Drivers

Rising Demand for Biologics and Injectable Therapies

The increasing adoption of biologics, monoclonal antibodies, and vaccines is significantly boosting demand for fill-finish contract manufacturing. Injectable therapies require strict sterility, precision filling, and advanced containment technologies, prompting companies to rely on specialized CMOs. Growth in chronic diseases and personalized medicine further drives the need for high-quality injectable production. As biologics pipelines expand, manufacturers seek external partners with sophisticated aseptic capabilities, solid quality systems, and scalable capacity, making biologics demand a major industry growth catalyst.

- For instance, Grand River Aseptic Manufacturing (GRAM) partnered with Johnson & Johnson to provide fill-finish services for their COVID-19 vaccine candidate, aiming to produce 100 million doses for the U.S. government.

Increased Outsourcing to Reduce Costs and Enhance Efficiency

Pharmaceutical and biopharmaceutical companies are rapidly outsourcing fill-finish operations to reduce capital expenditure and accelerate development timelines. Establishing aseptic facilities requires substantial investment in equipment, compliance, and skilled labor, making outsourcing an attractive alternative. CMOs provide flexible capacity, validated processes, and regulatory expertise, enabling faster scale-up and improved operational efficiency. Small biotech firms, in particular, rely heavily on CMOs due to limited in-house capabilities. This shift toward outsourcing continues to strengthen market expansion.

- For instance, Grand River Aseptic Manufacturing (GRAM) expanded its footprint by adding a 61,500 square-foot fill/finish facility in 2020 (tripling its production space to over 100,000 sq ft) to support client outsourcing of injectable drug manufacturing.

Technological Advancements and Capacity Expansion

Continuous advancements in automation, robotics, isolator systems, and digital process monitoring are enhancing precision and sterility in fill-finish manufacturing. CMOs are expanding production capacity, upgrading legacy lines, and adopting modern equipment to support growing demand for sterile injectable products. These improvements enable greater batch flexibility, accuracy, and quality assurance. As global demand for vaccines and biologics increases, investment in advanced technology and larger facilities supports higher throughput, making innovation and capacity growth major industry drivers.

Key Trends & Opportunities

Adoption of Flexible and Single-Use Technologies

The shift toward flexible and single-use technologies is transforming fill-finish operations by enabling faster changeovers, reduced cleaning requirements, and lower contamination risks. Single-use systems suit multi-product facilities managing diverse biologics and small-batch runs. Their use supports agility in clinical manufacturing and personalized medicine. CMOs adopting modular, flexible platforms can handle vials, syringes, and cartridges with ease, improving turnaround times and operational efficiency. This trend presents strong opportunities for providers offering adaptable, contamination-controlled fill-finish solutions.

- For instance, Merck Millipore’s Mobius® single-use final-fill assemblies demonstrated a reduction in campaign fill time from 36 hours to 12 hours, while achieving fill speeds of 10,000 units per hour in their single-use configuration

Expanding Demand for Advanced Packaging and Lyophilization

Demand for prefilled syringes, cartridges, and freeze-dried products is growing as biologics increasingly require enhanced stability and patient-friendly delivery formats. CMOs are expanding lyophilization capacity and investing in controlled nucleation and automated loading systems to improve quality and consistency. Advanced packaging formats support accurate dosing and safety, driving their adoption. As regulatory expectations evolve and drug pipelines diversify, opportunities rise for CMOs offering specialized packaging, serialization, and robust lyophilization services.

- For instance, Lyophilization Services of New England (LSNE), now part of PCI Pharma Services, operates 18 commercial-scale lyophilizers across its facilities and recently added a 30 m² large-scale lyophilizer, enabling significantly higher batch throughput for biologics and high-value injectables.

Key Challenges

High Capital Requirements and Technical Complexity

Fill-finish manufacturing requires significant investment in sterile equipment, isolators, cleanrooms, and automation systems. Maintaining aseptic compliance also demands ongoing validation, monitoring, and skilled staff, creating high operational costs. Biologics and complex injectables add further technical challenges, requiring advanced containment and strict environmental controls. Smaller CMOs often struggle to meet these demands, limiting industry participation. These high financial and technical barriers remain a major challenge for scaling and sustaining fill-finish capabilities.

Supply Chain Vulnerabilities and Capacity Limitations

Supply chain disruptions involving sterile components, single-use systems, and packaging materials pose ongoing challenges for fill-finish manufacturers. Limited availability of critical items can delay production and raise costs. Simultaneously, demand for injectable biologics often exceeds global fill-finish capacity, leading to long lead times and resource constraints. Smaller companies may struggle to secure manufacturing slots within high-demand CMOs. Managing capacity allocation and reducing dependency on fragile supply networks remain key industry obstacles.

Regional Analysis

North America

North America holds the largest share of the fill-finish pharmaceutical contract manufacturing market, accounting for 40% of global revenue. The region benefits from strong biologics pipelines, advanced manufacturing infrastructure, and the presence of leading CMOs with high-capacity sterile facilities. Increased outsourcing by major biopharmaceutical companies, combined with strict regulatory standards that encourage high-quality fill-finish processes, supports sustained growth. Rising demand for injectable therapies, continued investment in automation, and expansion of vaccine production capabilities further strengthen North America’s dominant regional position.

Europe

Europe represents 32% of the global fill-finish pharmaceutical contract manufacturing market, driven by its robust pharmaceutical base, strong regulatory framework, and extensive network of contract manufacturers. Countries such as Germany, Switzerland, and the UK are major hubs for sterile injectable production and biologics development. The region’s emphasis on high-quality aseptic standards and technological innovation supports continued growth. Increased demand for biologics, biosimilars, and advanced delivery formats also contributes to market expansion. Ongoing capacity upgrades and strategic partnerships with global drug developers reinforce Europe’s significant regional share.

Asia-Pacific

Asia-Pacific holds 24% of the market and is the fastest-growing region due to rising pharmaceutical production, expanding biologics manufacturing, and increasing outsourcing from Western companies seeking cost-effective solutions. China, India, South Korea, and Singapore are emerging hubs for sterile fill-finish services, supported by rapid facility modernization and government incentives. Growing demand for vaccines, biosimilars, and injectable generics drives capacity expansion. The region’s improving regulatory environment, skilled workforce, and competitive pricing continue to attract major global players, positioning Asia-Pacific as a rapidly expanding contributor to market growth.

Latin America

Latin America accounts for 5% of the global fill-finish pharmaceutical contract manufacturing market. While smaller in scale, the region is experiencing steady growth driven by expanding healthcare investments, rising demand for injectable drugs, and improved pharmaceutical manufacturing capabilities. Brazil and Mexico lead the market with growing contract manufacturing activities and increasing partnerships with global firms. Upgrades in sterile processing infrastructure and a shift toward outsourcing among local drug manufacturers support regional development. However, regulatory variations and limited high-end capabilities continue to moderate overall market expansion.

Middle East & Africa

The Middle East & Africa region holds 4% of the fill-finish pharmaceutical contract manufacturing market, with growth supported by strengthening healthcare systems and rising investment in local pharmaceutical production. Countries such as Saudi Arabia, the UAE, and South Africa are increasing focus on sterile manufacturing to reduce dependency on imports. Demand for vaccines and essential injectable therapies continues to rise, prompting gradual expansion of fill-finish capabilities. Despite ongoing improvements, market growth is moderated by limited technological infrastructure and reliance on external CMOs for complex biologics and specialty injectables.

Market Segmentations

By Product

- Prefilled Syringes

- Vials

- Cartridges

By Molecule

- Large Molecules

- Small Molecules

By End User

- Biopharmaceutical Companies

- Pharmaceutical Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fill-finish pharmaceutical contract manufacturing market is characterized by the presence of global CMOs with extensive sterile manufacturing capabilities and a growing number of regional specialists expanding their service portfolios. Leading companies such as Thermo Fisher Scientific Inc., Catalent Inc., Baxter, Recipharm AB, Sartorius AG, Eurofins Scientific, Boehringer Ingelheim International GmbH, Symbiosis Pharmaceutical Services, MabPlex International, and Societal CDMO play a prominent role in shaping market dynamics. These players compete through investments in high-throughput fill-finish lines, advanced isolator technology, and automation to ensure sterility and scalability for complex biologics and injectable therapies. Strategic collaborations, capacity expansions, and acquisitions are frequently employed to strengthen geographic presence and enhance technical capabilities. As demand for biologics, vaccines, and specialized delivery formats increases, competition intensifies around quality compliance, turnaround times, and the ability to support both clinical and commercial manufacturing needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eurofins Scientific

- MabPlex International Co. Ltd.

- Baxter

- Symbiosis Pharmaceutical Services Ltd

- Sartorius AG

- Recipharm AB

- Catalent, Inc (acquired by Novo Holdings A/S)

- Boehringer Ingelheim International GmbH

- Societal CDMO (Recro Pharma, Inc)

- Thermo Fisher Scientific Inc.

Recent Developments

- In October 2025, Jubilant HollisterStier LLC (a subsidiary of Jubilant Pharmova Limited) launched its third sterile fill-&-finish line at its Spokane (Washington, US) facility, adding approximately 50% additional capacity and integrating advanced isolator technology for complex injectable products.

- In November 2024, Lonza announced the completion of its first GMP batch at the Portsmouth facility, advancing capacity for small- to mid-scale mammalian biologics and strengthening support for diverse molecule types.

- In May 2024, Eurofins CDMO Alphora Inc. announced a three-fold expansion of its Drug Product Analytical Services Laboratory in Mississauga, Canada, significantly enhancing its analytical and development capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Molecule, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as demand for biologics, vaccines, and injectable therapies rises globally.

- Outsourcing of sterile fill-finish operations will increase as pharmaceutical companies prioritize cost efficiency and faster time-to-market.

- Automation, robotics, and isolator-based technologies will become standard across advanced fill-finish facilities.

- Single-use and flexible manufacturing systems will gain wider adoption to support multi-product, small-batch, and personalized therapy production.

- Lyophilization capacity will expand to meet growing stability requirements for complex biologic formulations.

- Prefilled syringes and advanced delivery formats will see strong uptake, reshaping packaging preferences.

- Contract manufacturers will invest heavily in capacity expansion to address global shortages in sterile manufacturing.

- Regulatory expectations for sterility, traceability, and contamination control will continue to tighten.

- Strategic partnerships between biopharma companies and CMOs will grow to secure long-term production capacity.

- Asia-Pacific will emerge as a critical growth engine due to expanding biologics manufacturing and competitive service offerings.