Market Overview:

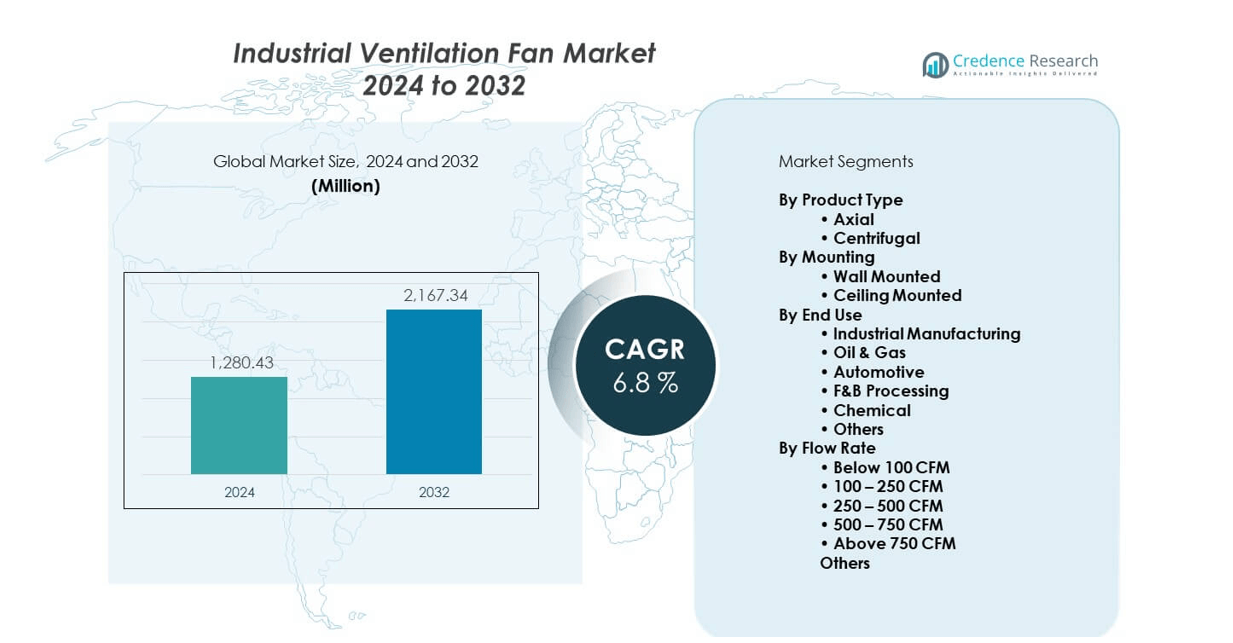

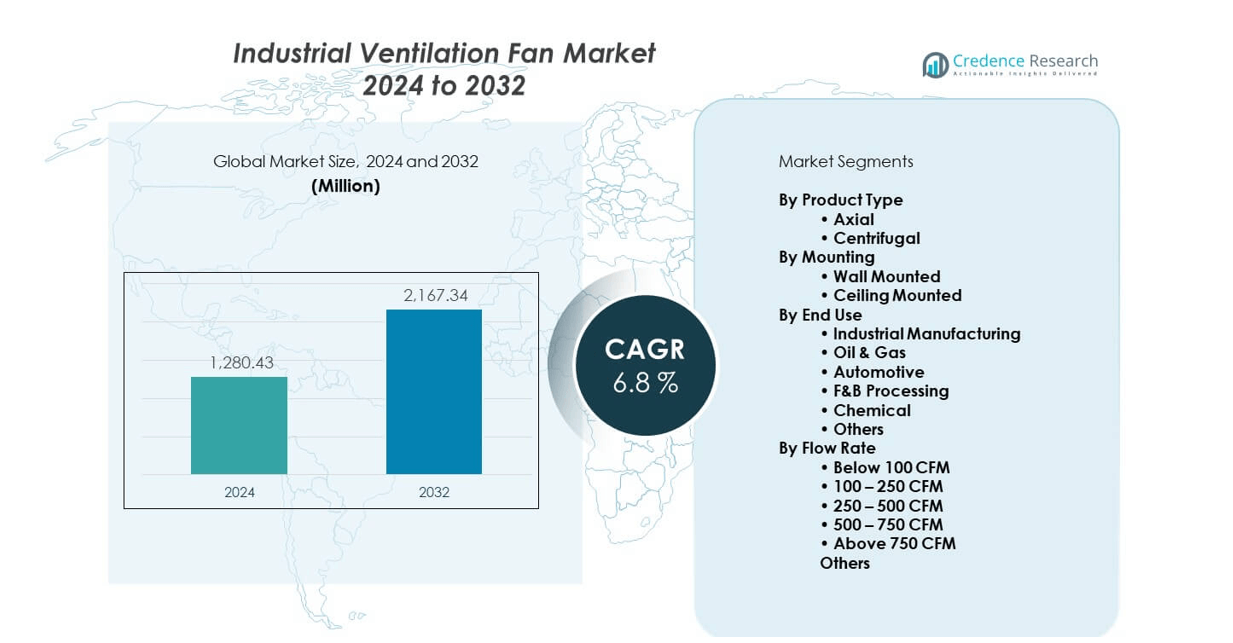

The Industrial ventilation fan market is projected to grow from USD 1280.43 million in 2024 to USD 2167.34 million by 2032, reflecting a CAGR of 6.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Ventilation Fan Market Size 2024 |

USD 1280.43 million |

| Industrial Ventilation Fan Market, CAGR |

6.8% |

| Industrial Ventilation Fan Market Size 2032 |

USD 2167.34 million |

Stricter emission standards drive adoption of advanced ventilation solutions. Manufacturers deploy smart control systems that balance airflow and energy use. Rising automation pushes plants to maintain stable temperatures for sensitive equipment. Industries such as chemicals, automotive, and metals invest in durable fans to manage hazardous air conditions. Innovation in low-noise and high-volume fans supports wider industrial use.

North America leads with strong industrial safety rules and early adoption of advanced ventilation technologies. Europe follows due to strict workplace standards and heavy manufacturing activity. Asia Pacific emerges as the fastest-growing region, driven by rapid factory expansion in China, India, and Southeast Asia. Latin America and the Middle East show steady progress as industrial zones expand and governments enforce cleaner air requirements for workers and production units.

Market Insights:

- The Industrial ventilation fan market reached USD 1280.43 million in 2024 and is projected to hit USD 2167.34 million by 2032, growing at a 8% CAGR led by rising industrial safety and ventilation upgrades.

- Asia Pacific (38%), North America (27%), and Europe (24%) hold the top regional shares due to strong manufacturing activity, strict safety norms, and widespread ventilation modernization across industrial facilities.

- Asia Pacific remains the fastest-growing region (38%), driven by rapid factory expansion, stricter air-quality regulations, and high adoption of energy-efficient ventilation systems.

- Axial fans lead the product segment with an estimated 62% share, supported by strong demand for high-airflow solutions across large production halls and temperature-sensitive industrial zones.

- Flow rate units above 750 CFM hold nearly 40% share, driven by heavy manufacturing, automotive, and chemical facilities that require continuous high-volume ventilation for safe operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need For Effective Airflow Systems In Hazardous And High-Heat Industrial Environments

Rising demand for safer workspaces strengthens adoption of advanced ventilation systems. Companies deploy high-volume fans to control fumes, dust, and heat. Factories in chemicals and metals sectors upgrade airflow systems to support strict safety rules. The Industrial ventilation fan market gains steady traction from these upgrades. High-temperature operations need constant airflow to protect equipment and workers. Firms explore energy-efficient models to cut operational costs. Smart monitoring helps maintain stable airflow levels across production zones. It supports higher productivity by keeping indoor conditions stable.

- For instance, specific models within the Systemair AXC axial fan series, such as the AXCBF, can handle continuous operation in high-heat zones up to 200°C by having the motor outside the airflow. The wider AXC range can process air volumes up to 500,000 m³/h, supporting diverse industrial applications where high-temperature operations need constant airflow to protect equipment and workers.

Increasing Regulatory Pressure To Improve Indoor Air Quality And Worker Health Protection

Governments enforce tighter norms on industrial emissions and ventilation standards. Companies respond by adopting compliant fan systems with better filtration features. Firms enhance airflow to reduce exposure to hazardous airborne particles. The Industrial ventilation fan market benefits from steady enforcement of workplace safety norms. Ventilation upgrades reduce downtime linked to poor air quality. Focus on worker health creates long-term demand for robust systems. Certification requirements drive factories to replace outdated equipment. It encourages companies to adopt standardized airflow solutions across multiple sites.

- For instance, Greenheck’s Vari-Green motor technology reduces energy consumption by up to 80% compared with traditional motors, enabling compliance with stringent IAQ standards. The Industrial ventilation fan market benefits from steady enforcement of workplace safety norms.

Rising Automation Levels And Need For Temperature Stability In Modern Production Facilities

Automation expands across manufacturing zones and creates need for stable temperatures. Robotics and precision tools work best under controlled conditions. Companies deploy high-efficiency fans to maintain steady airflow around sensitive machinery. The Industrial ventilation fan market grows as automation spreads into new industries. Heat buildup from automated lines increases the need for reliable ventilation. Smart sensors guide airflow adjustments in real time. Firms use connected controls to track fan performance. It supports better energy planning and reduces mechanical failures.

Growing Focus On Energy Efficiency And Adoption Of Low-Noise, High-Performance Ventilation Solutions

Rising energy bills push industries to choose efficient ventilation technologies. Companies focus on fans that deliver strong airflow with lower power use. Engineers design new blades and motors that reduce friction losses. The Industrial ventilation fan market shifts toward premium, quiet systems for long shifts. Low-noise fans help maintain worker comfort in dense production spaces. Motor upgrades extend the lifespan of ventilation systems. Firms adopt energy-monitoring tools to improve cost control. It increases demand for long-term, reliable airflow solutions.

Market Trends:

Wider Deployment Of Smart Ventilation Controls And Remote Monitoring Platforms In Industrial Plants

Factories integrate IoT platforms to track airflow in real time. Connected systems help operators optimize fan performance. Predictive tools alert teams before a failure occurs. The Industrial ventilation fan market shifts toward integrated control ecosystems. Remote access supports maintenance planning in large facilities. Plants reduce manual inspections through automated diagnostics. Controls allow flexible airflow adjustments for each zone. It helps industries manage energy and safety conditions with precision.

- For instance, ABB Ability™ digital monitoring allows fan diagnostics with real-time vibration and motor load data, cutting unplanned downtime by up to 40% in industrial plants. The Industrial ventilation fan market shifts toward integrated control ecosystems. Remote access supports maintenance planning in large facilities.

Shift Toward Modular Ventilation Designs That Support Fast Installation And Scalable Capacity Expansion

Companies adopt modular fans that fit changing production layouts. These systems reduce downtime during installation or upgrades. The Industrial ventilation fan market sees interest in units that allow quick reconfiguration. Manufacturers prefer plug-and-play designs for growing factories. Modular setups support multi-stage ventilation planning. Plants expand capacity without structural changes. Flexible frames support integration with ducts or standalone units. It improves planning for seasonal or project-based airflow needs.

- For instance, FläktGroup’s modular eQ-air handling units support tool-less component replacement, enabling installation time reductions of up to 30% in expanding plants. Manufacturers prefer plug-and-play designs for growing factories. Modular setups support multi-stage ventilation planning.

Rapid Adoption Of High-Durability Materials And Corrosion-Resistant Components For Harsh Industrial Zones

Heavy industries need fan systems that withstand exposure to chemicals and moisture. Engineers design blades with reinforced composites. The Industrial ventilation fan market supports facilities with long operating cycles. Plants in mining, pulp, and marine sectors prefer corrosion-resistant motors. Durable materials reduce replacement frequency. Stronger casings enhance vibration stability in high-load areas. Firms extend maintenance intervals with rugged parts. It builds long-term trust in premium ventilation brands.

Increasing Integration Of Ventilation With Energy-Recovery And Environmental Management Systems

Industries pair ventilation with systems that reclaim waste heat. Plants reduce total energy consumption through recovered airflow. The Industrial ventilation fan market aligns with environmental targets across regions. Energy-recovery systems improve sustainability ratings. Integrated setups help firms meet green certification needs. Companies monitor environmental metrics through unified dashboards. Ventilation becomes part of broader sustainability planning. It enhances the long-term value of airflow investments.

Market Challenges Analysis:

High Upfront Costs And Energy Consumption Issues That Slow Adoption In Cost-Sensitive Industries

Purchasing advanced ventilation units requires significant capital for small factories. Energy use increases operational costs during long work shifts. The Industrial ventilation fan market faces resistance from sectors with strict budgets. Firms delay upgrades when older equipment remains functional. Limited financial incentives reduce interest in premium fans. Some regions lack awareness of long-term savings from efficient units. Slow modernization in traditional industries limits technology adoption. It creates uneven growth across global markets.

Maintenance Complexity And Lack Of Skilled Technicians In Heavy Industrial Clusters

Large plants need regular inspection of motors, blades, and ducts. Skilled labor shortages increase downtime during maintenance cycles. The Industrial ventilation fan market faces challenges when technicians lack training. Plants replace components late due to limited workforce capacity. Complex installations increase repair difficulty. Harsh industrial environments accelerate wear on parts. Firms struggle to maintain consistent airflow across shifts. It creates performance instability in older or poorly serviced systems.

Market Opportunities:

Rising Demand For Smart, Automated, And Energy-Efficient Ventilation Systems Across Expanding Industrial Hubs

Factories invest in efficient airflow systems to improve safety and productivity. Automation increases the need for controlled ventilation around machinery. The Industrial ventilation fan market gains openings in sectors shift toward digital operations. Energy-efficient motors attract cost-focused manufacturers. Smart controls support predictive insights for airflow planning. Firms upgrade old systems to reduce electricity use. Expanding industrial parks need scalable airflow designs. It strengthens demand for advanced ventilation technologies.

Growing Shift Toward Green Manufacturing Practices And Sustainable Facility Certifications

Companies pursue cleaner production methods and eco-friendly systems. Green certifications encourage adoption of low-power ventilation. The Industrial ventilation fan market aligns with sustainability goals across global factories. Firms choose high-durability fans to reduce waste. Integration with energy-recovery systems improves plant efficiency. Environmental rules support long-term investment in improved airflow. Industries seek low-noise, high-capacity fans for modern layouts. It creates steady opportunities for innovative products.

Market Segmentation Analysis:

By Product Type

Axial fans dominate large industrial spaces that need high airflow and efficient circulation. They support ventilation in factories with open layouts and continuous heat generation. Centrifugal fans serve operations that need stronger pressure control and directed airflow. These units perform well in harsh or enclosed environments. The Industrial ventilation fan market benefits from demand across both types. It grows as plants upgrade to efficient and durable fan technologies.

- For instance, EBM-PAPST’s backward-curved centrifugal fans generate static pressures above 1,000 Pa, making them ideal for confined industrial zones. The Industrial ventilation fan market benefits from demand across both types. It grows as plants upgrade to efficient and durable fan technologies.

By Mounting

Wall-mounted fans support targeted ventilation in production rooms, loading bays, and confined work areas. These units help maintain stable airflow near equipment and worker zones. Ceiling-mounted fans handle broad-area coverage in large industrial halls. They support uniform air distribution across assembly lines and storage zones. Each mounting type serves unique structural requirements. It allows factories to optimize ventilation layouts based on floor space and workflow needs.

- For instance, Airmaster’s industrial wall fans typically deliver up to 6,100 CFM, supporting localized cooling in heavy workshops. Ceiling-mounted fans, such as the 70-inch or 80-inch models which can produce over 6,000 CFM, handle broad-area coverage in large industrial halls.

By End Use

Industrial manufacturing leads adoption due to constant heat, dust, and fume control needs. Oil and gas facilities need robust fans that handle hazardous air environments. Automotive plants use controlled airflow for paint booths and testing chambers. F&B processing relies on clean ventilation to support hygiene standards. Chemical facilities depend on corrosion-resistant systems that manage harsh vapors. Other industries adopt mixed fan solutions for routine ventilation tasks. It reflects broad applicability across critical sectors.

By Flow Rate

Lower ranges below 100 CFM and 100–250 CFM serve compact rooms, machinery zones, and inspection areas. Mid-level 250–500 CFM and 500–750 CFM units support standard workshop spaces with moderate airflow needs. Above 750 CFM systems operate in large production halls or high-heat environments. These fans deliver strong air movement for intensive industrial tasks. Each flow rate segment caters to specific operational pressures and ventilation loads. It highlights varied performance demands across facility types.

Segmentation:

By Product Type

By Mounting

- Wall Mounted

- Ceiling Mounted

By End Use

- Industrial Manufacturing

- Oil & Gas

- Automotive

- F&B Processing

- Chemical

- Others

By Flow Rate

- Below 100 CFM

- 100 – 250 CFM

- 250 – 500 CFM

- 500 – 750 CFM

- Above 750 CFM

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the industrial ventilation fan market at 38%, supported by rapid manufacturing expansion across China, India, and Southeast Asia. Strong investment in automotive, electronics, and chemical production increases demand for high-capacity airflow systems. Governments enforce stricter worker-safety rules, which pushes industries to upgrade ventilation equipment. The region benefits from large-scale industrial zones that require continuous airflow control. The industrial ventilation fan market grows steadily here due to strong infrastructure and factory modernization. It strengthens further as companies adopt energy-efficient fans to reduce operating costs. Local manufacturers also support regional adoption with competitive pricing and wide product availability.

North America

North America accounts for 27% of the global share, driven by advanced industrial safety standards and high adoption of smart ventilation systems. Strong demand comes from oil and gas, F&B processing, and heavy manufacturing. Companies invest in automated ventilation platforms that support real-time airflow control. The industrial ventilation fan market grows across the U.S. as factories replace older fans with high-efficiency units. Energy regulations encourage the use of low-power motors and optimized blade designs. The region’s strong focus on worker safety and indoor air quality fuels ongoing upgrades. It maintains steady growth supported by mature industrial infrastructure.

Europe, Latin America, and Middle East & Africa

Europe holds 24% of the market due to strict workplace compliance rules and strong chemical, automotive, and industrial manufacturing bases. The industrial ventilation fan market benefits from sustainability policies that push factories toward efficient systems. Latin America accounts for 6%, with growth supported by expanding industrial clusters in Brazil and Mexico. Middle East & Africa hold 5%, driven by oil and gas activities and new industrial parks. European facilities prefer advanced, corrosion-resistant systems for long operating cycles. Latin America and MEA adopt ventilation technologies at a moderate pace due to budget constraints. It continues to grow in these regions as governments strengthen industrial safety norms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Marut Air

- Twin City Fan

- CB&I

- Greenheck Fan Corporation

- Systemair AB

- BarkerBille A/S

- POLLRICH GmbH

- Blauberg Motoren

- SPX Technologies

- Kruger Ventilation

- Ferrari Asia Ventilation

- EBARA CORPORATION

- Halifax Fan Ltd

- Paul’s Fan Company

- Mainstream Fluid & Air LLC

- EBM-PAPST

- Johnson Controls International Plc

- FlaktGroup Holding GmbH

- Witt & Sohn AG

- Airmaster Fan Co.

Competitive Analysis:

The Industrial ventilation fan market features strong competition among global and regional manufacturers that target high-demand industrial zones. Market leaders focus on energy-efficient designs, corrosion-resistant materials, and smart control systems to strengthen product value. Companies expand portfolios with advanced axial and centrifugal models that support heavy-duty environments. Mid-tier players compete through pricing, compact designs, and sector-specific solutions. It maintains steady growth as firms pursue automation-ready ventilation systems. Strong R&D pipelines help companies meet rising safety and compliance needs. Partnerships with industrial facilities support adoption of reliable airflow technologies. Competitive intensity remains high due to continuous upgrades in manufacturing standards.

Recent Developments:

- In August 2025, Systemair AB completed the acquisition of NADI Airtechnics Ltd., a leading manufacturer of industrial fans in India. This acquisition strengthens Systemair’s presence in the industrial segment and brings a complementary product range, particularly targeting infrastructure and railway project applications in India as well as potential expansion in Europe and the US. The deal reflects Systemair’s strategy for geographic expansion and technological enhancement of its industrial fan offerings.

- In April 2025, Greenheck Fan Corporation launched a new line of rooftop units (Model RT) designed for mixed-air applications. The new model focuses on optimizing indoor comfort with features like inverter scroll compressors for precise cooling and energy efficiency. Additionally, in August 2025, Greenheck expanded its RTU product line to include the Model RT-40, which offers advanced packaged cooling options suitable for industrial and commercial environments. Greenheck is also continuing a multi-year campus development in Knoxville, Tennessee, to improve regional manufacturing capabilities, with a groundbreaking taking place in May 2025.

Report Coverage:

The research report offers an in-depth analysis based on By Product Type and By Mounting. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for smart ventilation controls will shape product upgrades.

- Energy-efficient motors will gain preference across industrial zones.

- Automation-ready ventilation systems will support expanding factories.

- Corrosion-resistant materials will see higher adoption in harsh sectors.

- Modular ventilation units will scale rapidly in flexible production layouts.

- Predictive maintenance tools will enhance equipment reliability.

- Stronger safety rules will increase replacement of old ventilation units.

- Ventilation-integrated environmental systems will grow across green facilities.

- High-flow systems will expand in heavy manufacturing hubs.

- Digital monitoring platforms will define future airflow optimization.